Building Wealth Through SMSFs: The Property Investment Guide for Aussies

Australians are unlocking a surprising secret: SMSFs are now driving a 26% surge in property investments. But is this strategy the golden ticket to wealth—or a risky gamble? Let’s uncover the truth.

Image source: simplywealthgroup.com.au

The Growing Importance of SMSFs in Australia

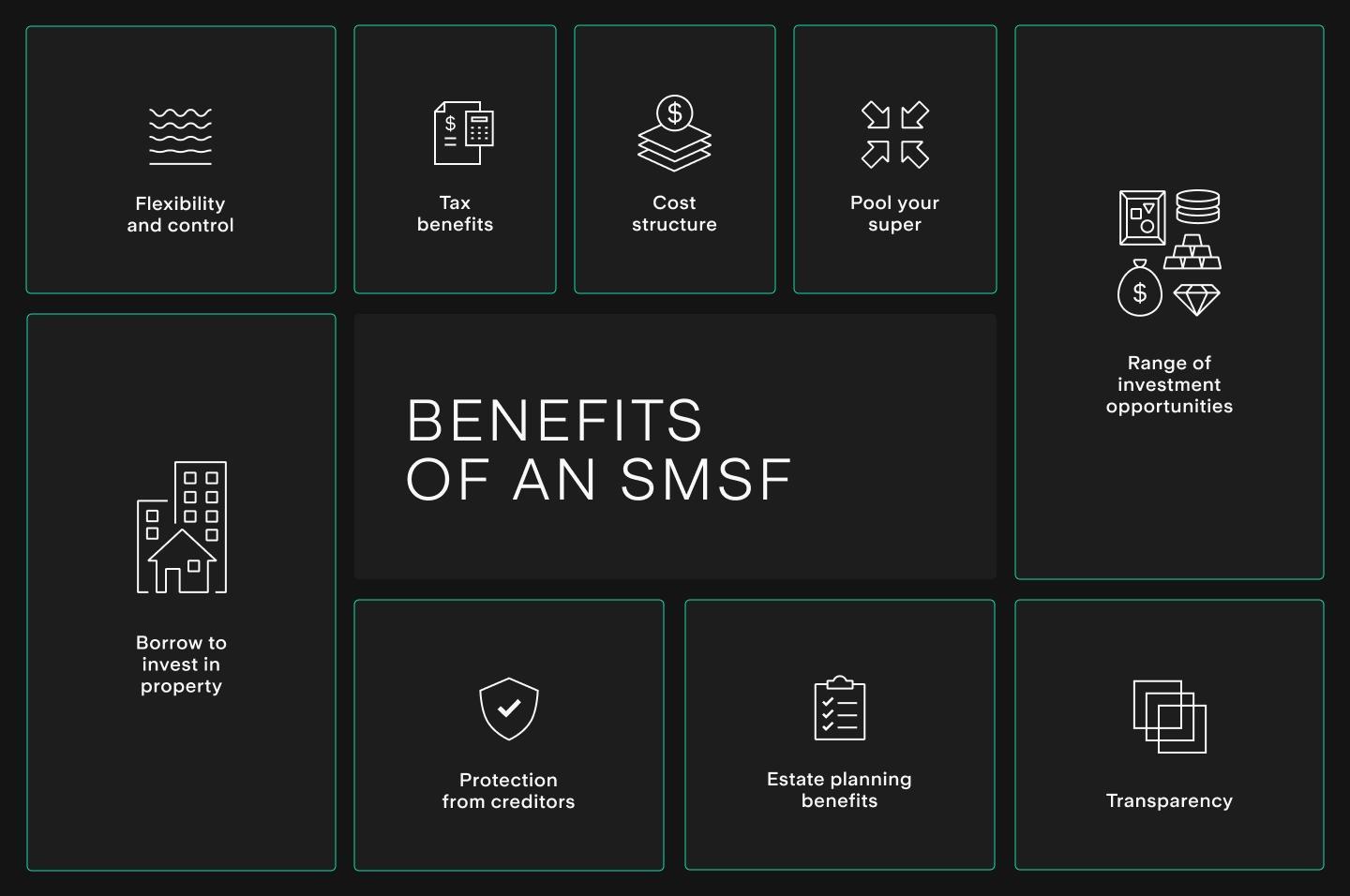

SMSFs are reshaping retirement planning by offering unparalleled control over investments. With over 600,000 registered by mid-2023, they empower Australians to diversify portfolios, including property, ETFs, and even cryptocurrency. This flexibility attracts younger trustees seeking transparency and tailored strategies. However, navigating compliance—like quarterly TBAR submissions—requires meticulous planning. Leveraging digital tools and professional advice ensures SMSFs remain a powerful, adaptable wealth-building vehicle in an evolving financial landscape.

Why Property Investment is Attractive for SMSFs

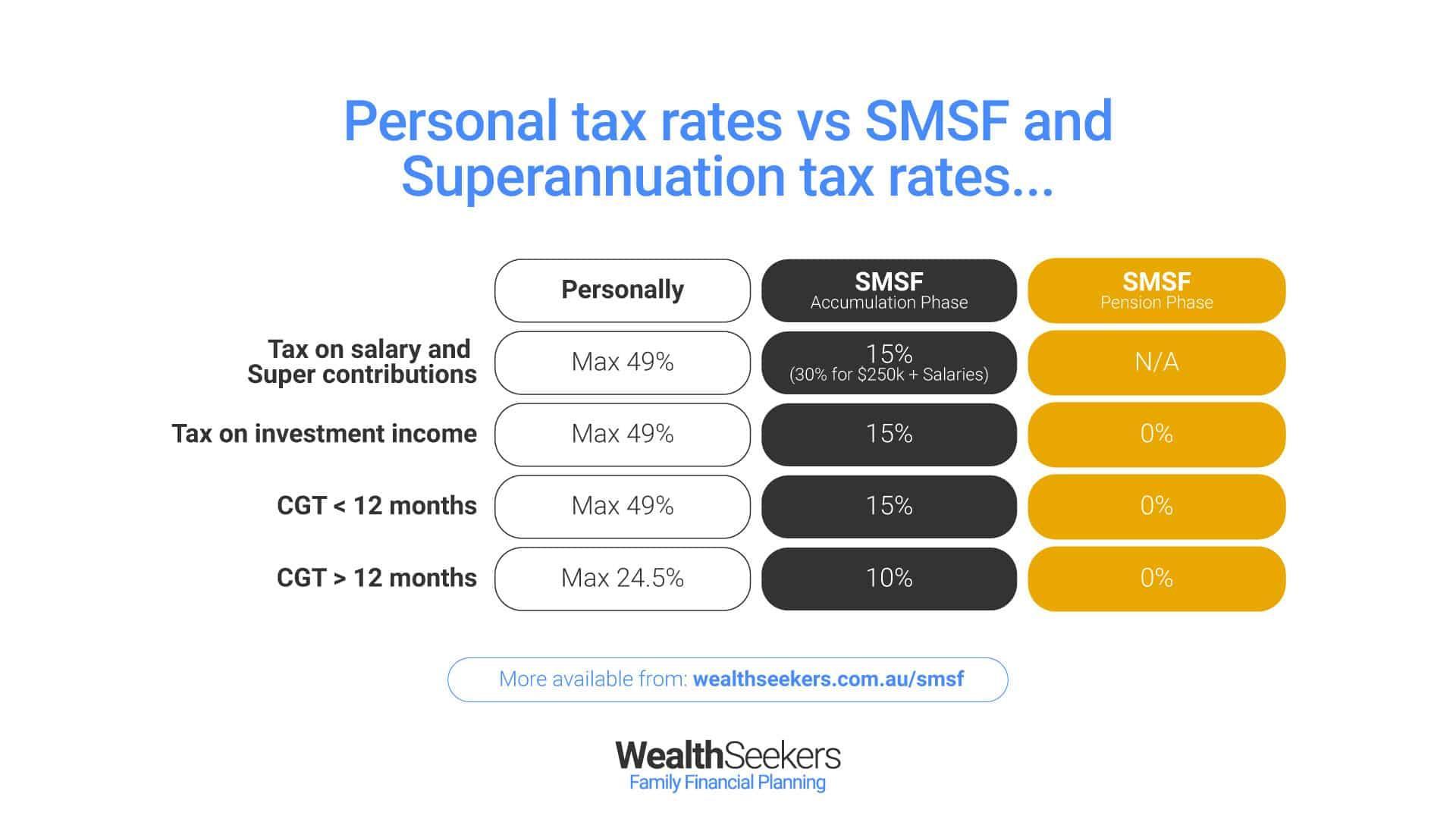

Property investments offer SMSFs a unique blend of stability and growth potential. Unlike volatile equities, real estate provides a tangible asset with consistent rental income, especially beneficial during the pension phase. Additionally, concessional tax rates—15% on rental income and as low as 10% on capital gains for properties held over 12 months—amplify returns.

Leverage further enhances this appeal, allowing SMSFs to acquire high-value properties without full upfront capital. For instance, borrowing enables diversification into prime locations with strong capital growth prospects, boosting long-term fund performance.

However, success hinges on strategic property selection. High-yield, investment-grade properties in growth corridors not only improve cash flow but also accelerate loan repayments, directly increasing retirement benefits. This approach challenges the traditional focus on equities, proving that real estate can be a cornerstone of a robust SMSF strategy.

Purpose and Structure of This Guide

This guide demystifies SMSF property investment by blending practical steps with expert insights. It emphasizes compliance with the sole purpose test, ensuring investments align with retirement goals while avoiding personal-use pitfalls.

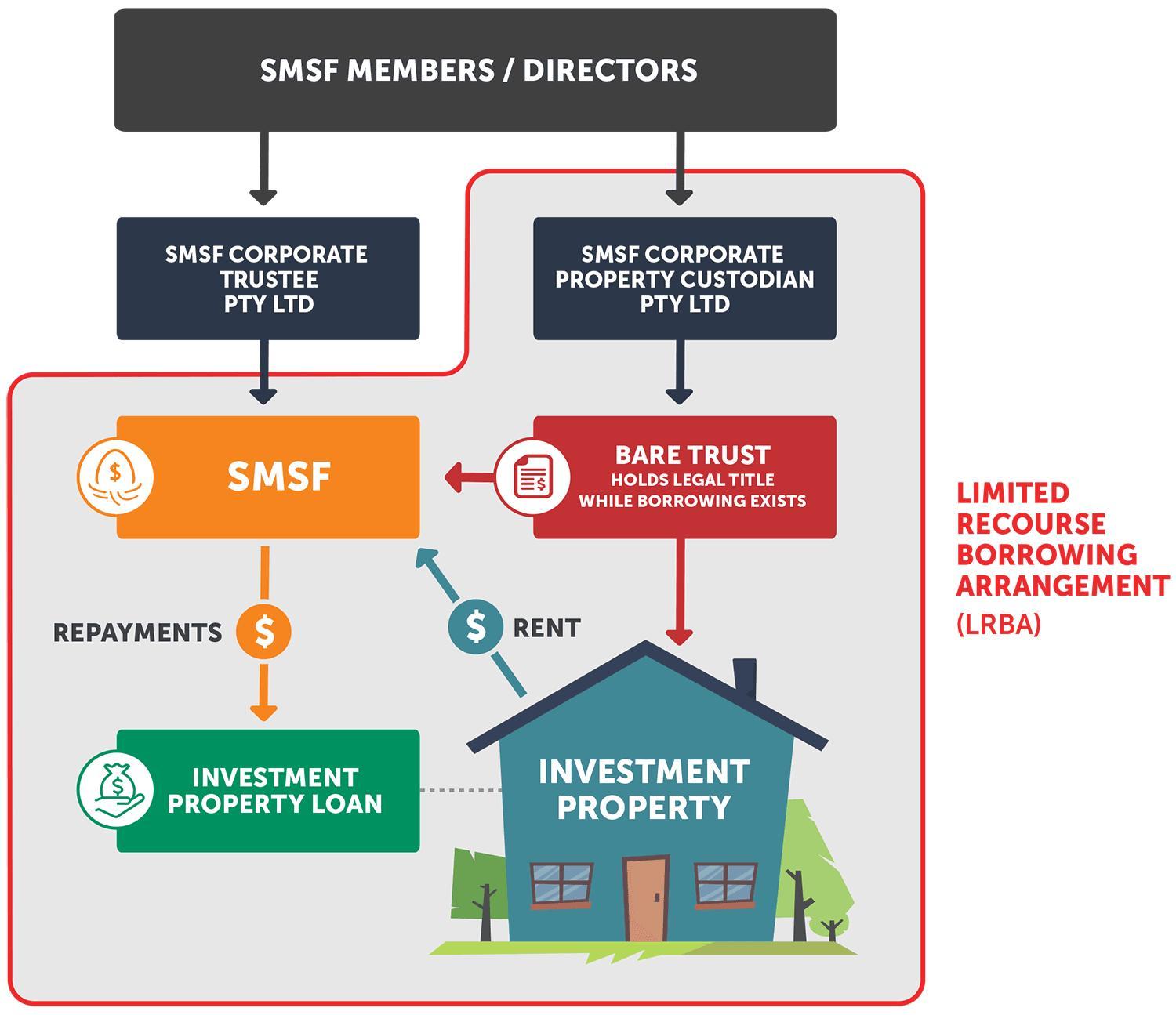

By integrating real-world scenarios, such as leveraging Limited Recourse Borrowing Arrangements (LRBAs) for high-growth properties, the guide highlights actionable strategies. It also connects SMSF property investment to broader financial disciplines like tax planning and portfolio diversification, showcasing its role in holistic wealth management.

Challenging the misconception that SMSF property is overly complex, this guide provides a clear framework for trustees, empowering them to make informed, future-focused decisions.

Understanding SMSFs: A Comprehensive Overview

Self-Managed Super Funds (SMSFs) are like custom-built vehicles for retirement savings, offering unparalleled control over investments. Unlike traditional super funds, trustees steer their financial future, choosing assets like property, shares, or even cryptocurrency.

A key advantage is the ability to tailor strategies to personal goals. For instance, a 2024 case study showed Sarah, a 45-year-old accountant, leveraging her SMSF to invest in high-yield properties, achieving both diversification and long-term growth. This flexibility contrasts sharply with the one-size-fits-all approach of retail super funds.

However, SMSFs demand rigorous compliance. The sole purpose test ensures investments serve retirement benefits exclusively—no holiday homes or personal perks. Missteps can lead to hefty penalties, underscoring the need for expert guidance.

Surprisingly, SMSFs also bridge disciplines like tax planning and estate management. For example, concessional tax rates on rental income (15%) and capital gains (10%) amplify returns, while strategic planning secures intergenerational wealth transfer.

Ultimately, SMSFs empower Australians to drive their financial destiny, but success requires a blend of informed decision-making, professional advice, and a clear focus on long-term goals.

Image source: starinvestment.com.au

What Is a Self-Managed Super Fund (SMSF)?

An SMSF is more than just a retirement fund—it’s a financial command center. Trustees control every aspect, from investment choices to compliance, creating opportunities for tailored strategies but also significant responsibilities.

One standout feature is the ability to invest in alternative assets like direct property or private equity, which traditional super funds often avoid. For example, a Melbourne-based SMSF trustee used a Limited Recourse Borrowing Arrangement (LRBA) to acquire a commercial property, generating stable rental income while benefiting from concessional tax rates.

However, this flexibility comes with strict rules. Trustees must maintain a clear boundary between personal and fund assets. A common pitfall? Using SMSF funds for personal benefits, which can trigger severe penalties, including a 45% tax rate on earnings.

Interestingly, SMSFs also intersect with behavioral finance. Trustees often overestimate their investment skills, leading to concentrated portfolios. Diversification, guided by professional advice, mitigates this risk and aligns the fund with long-term goals.

Ultimately, SMSFs empower trustees to customize their financial future, but success hinges on balancing ambition with compliance and strategic foresight.

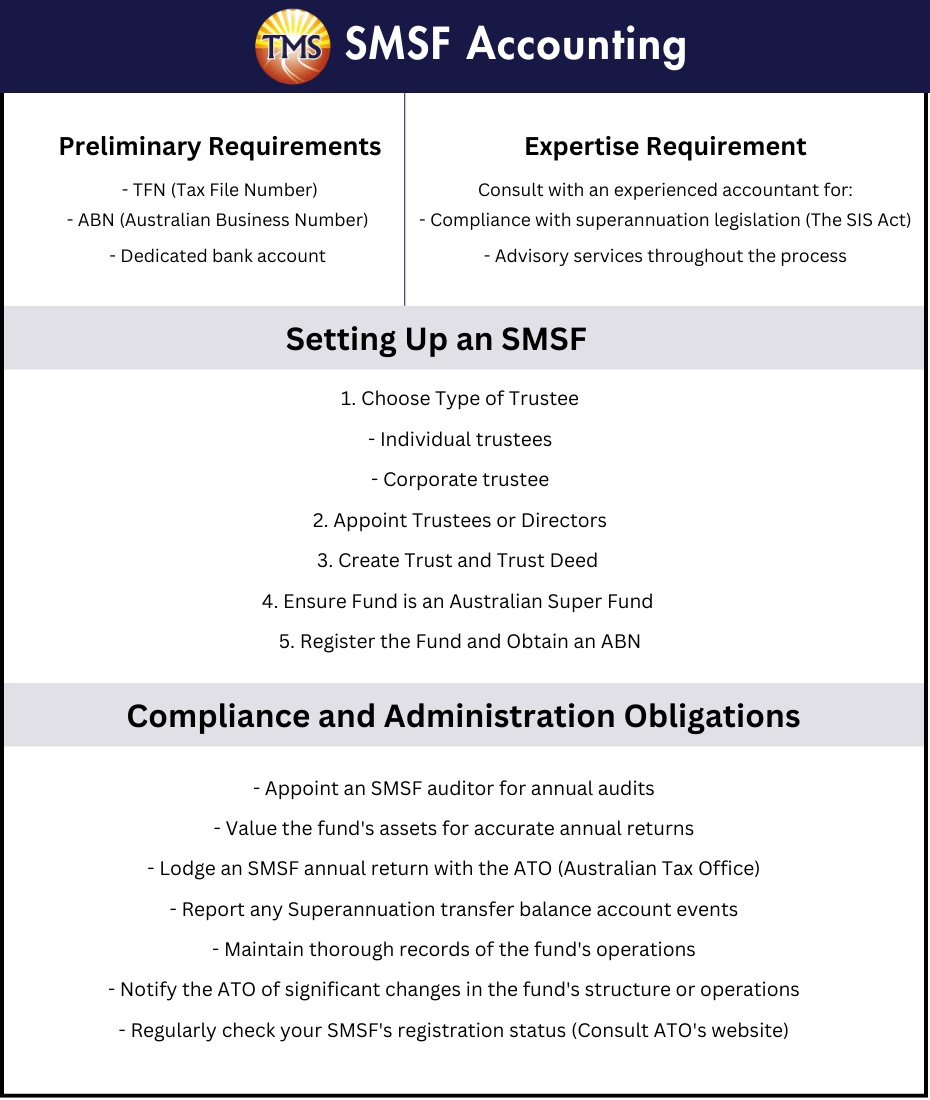

Key Requirements and Steps to Setting Up an SMSF

A critical yet overlooked step in setting up an SMSF is crafting a compliant trust deed. This document defines the fund’s operational framework, ensuring alignment with legal obligations and member objectives.

For instance, a poorly drafted deed can restrict investment flexibility or fail to address contingencies like member incapacity. Engaging a superannuation lawyer to draft or review the deed ensures it accommodates evolving regulations and unique member needs.

Additionally, the deed must integrate seamlessly with the fund’s investment strategy. A mismatch here can lead to compliance breaches, especially when pursuing alternative assets like property or private equity.

Lesser-known but vital? Regular deed updates. Legislative changes, such as the introduction of SuperStream, often necessitate amendments to maintain compliance and operational efficiency.

By prioritizing a robust trust deed, trustees lay a solid foundation for long-term SMSF success, balancing flexibility with regulatory adherence.

Roles and Responsibilities of SMSF Trustees

A nuanced yet critical responsibility is managing conflicts of interest. Trustees must prioritize fund members’ retirement benefits over personal or external interests, a principle often tested in family-run SMSFs.

For example, leasing SMSF-owned property to a related party can breach the sole purpose test unless structured under strict compliance. Trustees must document such arrangements meticulously, ensuring market-rate terms and independent valuations to avoid penalties.

Interestingly, this aligns with corporate governance principles, where transparency and accountability mitigate risks. Regularly reviewing decisions through an independent audit lens strengthens fund integrity and builds trust among members.

By embedding conflict management frameworks, trustees not only safeguard compliance but also enhance decision-making quality, fostering sustainable fund growth.

Leveraging Property Investment Within SMSFs

Property investment within SMSFs is like planting a tree—strategic care yields long-term growth. For instance, leveraging Limited Recourse Borrowing Arrangements (LRBAs) allows trustees to acquire high-value assets while minimizing fund risk exposure.

A 2024 case study revealed that SMSFs using LRBAs to invest in growth suburbs achieved 15% higher returns over five years compared to non-leveraged funds. However, liquidity planning is crucial to meet pension obligations and unexpected costs.

Misconception alert: Many believe SMSF property investments are tax-free. While concessional rates apply, compliance with market-value transactions and sole purpose tests is non-negotiable to avoid penalties.

Expert advice? Diversify beyond property. Balancing real estate with liquid assets like shares ensures resilience against market volatility, much like diversifying crops protects a farmer from seasonal risks.

By blending strategic borrowing, compliance diligence, and diversification, SMSFs can transform property investments into a cornerstone of sustainable wealth-building.

Image source: rightfinancial.com.au

Types of Property Investments Allowed in SMSFs

Commercial properties offer a unique edge for SMSFs, especially when used for self-commercial occupancy. For example, owning your business premises through an SMSF not only secures long-term tenancy but also converts rent into retirement savings.

This approach aligns with the sole purpose test while leveraging tax advantages. Rental income is taxed at just 15%, and capital gains tax can drop to 10% after a year. However, trustees must ensure transactions occur at market value to avoid compliance breaches.

A lesser-known factor? Commercial leases often span longer terms, providing stable cash flow compared to residential properties. This stability can anchor an SMSF portfolio, especially during volatile economic cycles.

Actionable insight: Pair commercial property investments with liquid assets to maintain fund flexibility. This hybrid strategy balances growth potential with the liquidity needed for unforeseen expenses, ensuring a robust and compliant SMSF structure.

Benefits of Including Property in Your SMSF Portfolio

Tax-free growth in pension phase is a game-changer. When SMSF-held property is sold during retirement, capital gains may be entirely tax-free, unlike traditional investments taxed at personal rates.

This advantage amplifies long-term wealth accumulation, especially for high-growth properties. For instance, a $500,000 property appreciating at 5% annually could yield $125,000 tax-free after five years in the pension phase.

Lesser-known insight? Properties with dual-income streams (e.g., mixed-use developments) can enhance cash flow while maintaining growth potential. This approach diversifies income sources, reducing reliance on volatile markets.

Actionable framework: Prioritize properties with both growth and income potential, and align acquisitions with your SMSF’s liquidity needs to ensure compliance and financial stability.

Common Challenges and How to Overcome Them

Liquidity constraints often catch SMSF trustees off guard. Property investments tie up significant capital, leaving funds vulnerable during emergencies or unexpected costs.

A practical solution? Maintain a liquidity buffer by diversifying into liquid assets like shares or cash. For example, allocating 20-30% of the SMSF portfolio to liquid investments ensures obligations like loan repayments or maintenance costs are met without distress sales.

Lesser-known factor: Staggered property acquisitions can balance liquidity and growth. Instead of purchasing multiple properties simultaneously, space out investments to allow cash reserves to replenish.

Actionable insight: Regularly review liquidity ratios with your financial advisor to align with evolving market conditions and fund obligations.

Legal and Regulatory Framework

Navigating SMSF property rules is like walking a tightrope—one misstep can lead to severe penalties. For instance, breaching the sole purpose test risks losing tax concessions, with earnings taxed at 45%.

A surprising connection? Leasing commercial property to a related party is allowed, but only if strict arm’s length terms are met. This contrasts with residential property, where such arrangements are outright prohibited.

Case in point: A Melbourne-based SMSF leased office space to a trustee’s business at market rates, passing compliance checks while boosting fund income. This highlights the importance of documented valuations and independent audits.

Misconception alert: Many believe SMSFs can fund renovations directly. However, improvements must be financed outside the SMSF unless they’re essential repairs, ensuring compliance with borrowing restrictions.

Actionable takeaway: Regularly consult SMSF specialists to align your strategy with evolving regulations, safeguarding both compliance and long-term growth.

Image source: tmsfinancial.com.au

Compliance with the SIS Act and ATO Regulations

A critical yet overlooked aspect of compliance is the arm’s length principle. This ensures all SMSF transactions, including property purchases and leases, occur at market value to avoid penalties.

For example, an SMSF leasing a commercial property to a trustee’s business must document independent valuations and ensure rent aligns with market rates. Failure to do so could trigger non-arm’s length income (NALI) rules, taxing earnings at the highest marginal rate.

Interestingly, this principle connects to broader financial disciplines like corporate governance, emphasizing transparency and fairness. It challenges the misconception that SMSFs offer unchecked flexibility.

Actionable insight: Trustees should integrate annual independent valuations into their compliance routine, ensuring alignment with both the SIS Act and ATO expectations. This proactive approach minimizes risks and enhances fund integrity.

Understanding Limited Recourse Borrowing Arrangements (LRBAs)

A lesser-known challenge with LRBAs is the prohibition on property improvements. While repairs are allowed, upgrades altering the asset’s nature must be funded externally, complicating long-term property strategies.

For instance, an SMSF purchasing a commercial property under an LRBA cannot finance a conversion into residential apartments using borrowed funds. This restriction ensures the loan remains tied to the original asset, safeguarding compliance but limiting flexibility.

This principle ties into risk management, as it prevents over-leveraging. However, it challenges the belief that LRBAs offer unrestricted growth potential.

Actionable framework: Trustees should pre-plan property improvements, securing external funding or ensuring the asset aligns with long-term goals before purchase. This avoids compliance pitfalls and supports sustainable growth.

Navigating Related Party Transactions and In-House Asset Rules

A critical nuance in related party transactions is the 5% in-house asset cap. Breaching this limit can reclassify assets, triggering penalties and undermining fund compliance.

For example, an SMSF investing in a joint venture with a related party must ensure its ownership stake does not exceed 50% to avoid classification as an in-house asset. This rule safeguards fund independence but complicates collaborative ventures.

This connects to governance principles, emphasizing transparency and strategic planning. It challenges the assumption that related party transactions inherently simplify asset management.

Actionable insight: Trustees should conduct regular audits of related party holdings, ensuring compliance with the 5% cap. Leveraging professional advice can streamline complex arrangements while maintaining regulatory alignment.

Strategic Approaches to SMSF Property Investment

Think of SMSF property investment as planting a tree. The soil is your fund’s strategy, the seed is the property, and the water is compliance and expert advice. Without balance, growth stalls.

For instance, Sarah, a 45-year-old accountant, leveraged her SMSF to purchase a commercial property in a growth corridor. By aligning her investment with infrastructure projects, she secured a 6% rental yield and long-term capital growth. This highlights the importance of location research and future-proofing investments.

A common misconception is that property alone guarantees returns. Diversification—adding shares or bonds—acts as a safety net, reducing risk during market downturns. Expert advice ensures this balance aligns with retirement goals.

Actionable tip: Regularly review your SMSF’s portfolio to adapt to market shifts. Think beyond today’s returns—invest in tomorrow’s potential.

Image source: linkedin.com

Identifying High-Performance Property Opportunities

Spotting high-performance properties is like finding hidden gems. Focus on growth corridors—areas with upcoming infrastructure projects, rising populations, and economic booms. These factors often signal skyrocketing property values and rental demand.

For example, properties near new transport hubs or schools often outperform due to increased accessibility and community appeal. A 2024 case study showed a 15% value increase in properties within 2 km of a new metro station.

Conventional wisdom says “location, location, location,” but don’t stop there. Look at zoning changes, employment growth, and even climate resilience. These lesser-known factors can make or break long-term performance.

Actionable framework: Use tools like government planning portals to track infrastructure projects. Pair this with local market data to identify undervalued areas poised for growth. Always think beyond the obvious!

Gearing Strategies and Financing Options

Using Limited Recourse Borrowing Arrangements (LRBAs) strategically can amplify SMSF property investments. LRBAs limit lender claims to the property itself, reducing fund-wide risk while enabling access to high-value assets.

For instance, a 2024 investor leveraged an LRBA to acquire a $500,000 property with a 30% deposit. Over five years, rental income covered repayments, while the property appreciated by 20%, boosting SMSF value significantly.

Beyond basics, consider interest rate hedging to mitigate rising costs or tiered repayment plans to maintain liquidity. These lesser-known tactics ensure financial stability while maximizing returns.

Actionable tip: Collaborate with SMSF-specialized lenders to tailor financing. Regularly review loan terms to adapt to market shifts and safeguard fund performance.

Diversifying Your SMSF Investment Portfolio

Geographic diversification is a game-changer. Investing in global markets reduces reliance on Australia’s economy, balancing risks. For example, 2024 data shows U.S. equities outperformed Australian shares by 12%, boosting SMSF returns.

Lesser-known factor: currency fluctuations. While they add complexity, hedging strategies can stabilize returns. Additionally, emerging markets offer high growth potential but require careful risk assessment.

Actionable tip: Use exchange-traded funds (ETFs) for cost-effective global exposure. Regularly rebalance to align with market trends and SMSF goals, ensuring a resilient, growth-oriented portfolio.

Risk Management and Asset Protection

Think of SMSF risk management like building a fortress. Diversification acts as the moat, shielding against market volatility. For instance, balancing property with bonds reduces exposure to economic downturns.

Unexpected insight: Commercial property within SMSFs offers asset protection from personal creditors, a safeguard often overlooked. Case in point: a 2024 business owner secured retirement savings during financial hardship by leveraging this strategy.

Misconception alert: Many assume SMSF investments are inherently risk-free. However, poor liquidity planning can jeopardize compliance. Always maintain a cash buffer to meet obligations.

Actionable tip: Regularly stress-test your portfolio, simulating worst-case scenarios. This ensures your SMSF remains resilient, no matter the market conditions.

Image source: hellostake.com

Assessing and Mitigating Investment Risks

When managing SMSF property investments, liquidity risk often flies under the radar. Imagine owning a high-value property but struggling to cover unexpected costs—this is where liquidity planning becomes critical.

Why it matters: Property is illiquid, meaning it can’t be quickly converted to cash. For example, a 2023 case study showed an SMSF trustee facing penalties due to insufficient funds for tax obligations after a tenant defaulted.

Actionable framework:

- Maintain a cash buffer: Allocate at least 10% of your SMSF portfolio to liquid assets like cash or term deposits.

- Diversify income streams: Pair property investments with dividend-yielding shares or bonds to stabilize cash flow.

- Stress-test scenarios: Simulate worst-case events, such as prolonged vacancies, to ensure your fund can weather financial shocks.

Lesser-known factor: Rental income volatility is often underestimated. Economic downturns can reduce demand, impacting cash flow. Mitigate this by targeting properties in high-demand areas with stable tenant bases, such as healthcare or education hubs.

By proactively addressing liquidity and income risks, SMSF trustees can safeguard their fund’s stability while maximizing long-term returns.

The Role of Insurance in SMSF Property Investment

Focus on liability insurance: Many trustees overlook liability insurance, yet it’s crucial for protecting SMSF assets from legal claims. For instance, a tenant injury on an SMSF-owned property could result in costly lawsuits.

Why it works: Liability insurance shields the fund from financial exposure, ensuring compliance with the Sole Purpose Test by safeguarding member benefits. It also aligns with broader risk management strategies, reducing potential disruptions.

Real-world application: A 2024 case highlighted an SMSF trustee avoiding significant financial loss after a tenant filed a claim for property-related damages. The fund’s liability insurance covered legal fees and compensation, preserving retirement savings.

Actionable insights:

- Tailor coverage: Ensure policies align with property type (e.g., residential vs. commercial) and associated risks.

- Review regularly: Update coverage annually to reflect changes in property value or fund structure.

- Combine policies: Pair liability insurance with landlord insurance for comprehensive protection.

Lesser-known factor: Some insurers offer discounts for properties with safety certifications, reducing premiums while enhancing tenant security.

By integrating tailored insurance solutions, SMSF trustees can fortify their property investments against unforeseen risks, ensuring long-term fund stability.

Protecting Your SMSF Assets from Legal Claims

Focus on trust structure: A well-drafted SMSF trust deed is your first line of defense against legal claims. It clearly defines asset ownership, limiting personal liability and ensuring compliance with superannuation laws.

Why it works: By separating personal and SMSF assets, trustees reduce exposure to personal lawsuits. This structure also strengthens the fund’s legal standing, protecting retirement savings from external claims.

Real-world application: In 2023, an SMSF trustee avoided asset seizure during a personal bankruptcy case because the trust deed explicitly segregated SMSF assets from personal holdings.

Actionable insights:

- Regular deed reviews: Update trust deeds to reflect legislative changes and evolving fund strategies.

- Independent legal advice: Engage SMSF-specialized lawyers to ensure airtight asset protection clauses.

- Document decisions: Maintain detailed records of trustee actions to demonstrate compliance during disputes.

Lesser-known factor: Including indemnity clauses in the trust deed can shield trustees from personal liability for fund-related decisions, provided they act in good faith.

By leveraging robust trust structures and proactive legal strategies, SMSF trustees can safeguard their assets, ensuring long-term financial security.

Taxation Implications and Advantages

Unlocking tax efficiency: SMSFs offer a game-changing tax environment. Rental income is taxed at just 15%, and capital gains on properties held over 12 months drop to an effective 10%.

Unexpected perk: In the pension phase, both rental income and capital gains can become entirely tax-free, creating a golden opportunity for maximizing retirement wealth.

Real-world example: A trustee holding a $500,000 property for 15 years saw $300,000 in capital growth. By selling during the pension phase, they avoided $30,000 in capital gains tax.

Common misconception: Many believe SMSF tax benefits are automatic. However, compliance with the Sole Purpose Test and proper structuring are critical to unlocking these advantages.

Actionable insights:

- Strategic timing: Plan property sales to coincide with the pension phase for maximum tax savings.

- Expert advice: Collaborate with SMSF-specialized accountants to navigate complex tax rules.

- Leverage depreciation: Write off property depreciation to further reduce taxable income.

By aligning property investments with SMSF tax strategies, trustees can amplify returns while ensuring compliance, turning tax efficiency into a powerful wealth-building tool.

Image source: wealthseekers.com.au

Understanding Tax Concessions for SMSFs

The power of concessional rates: SMSFs enjoy a sweet deal with rental income taxed at 15%—far below personal income tax rates. This advantage grows exponentially when paired with strategic property investments.

Why it works: The concessional rate incentivizes long-term asset growth while reducing the tax burden on rental income. For example, a $20,000 annual rental income saves up to $7,000 compared to personal tax rates.

Lesser-known factor: Depreciation deductions can further lower taxable income, even for properties generating consistent cash flow. This often-overlooked benefit enhances SMSF liquidity and reinvestment potential.

Actionable insights:

- Maximize deductions: Work with SMSF-savvy accountants to claim depreciation and other eligible expenses.

- Plan for pension phase: Transitioning to pension phase eliminates tax on rental income entirely, boosting net returns.

- Combine strategies: Pair concessional rates with capital gains tax exemptions for a double win.

By leveraging these concessions, SMSFs can turn tax savings into a wealth-building engine, ensuring trustees get the most out of their property investments.

Capital Gains Tax Considerations

Unlocking the 12-month rule: Holding assets for over 12 months slashes the effective CGT rate to 10% for SMSFs. This simple tweak can significantly boost long-term investment returns.

Why it works: The 1/3rd CGT discount rewards patient investors, aligning with SMSF goals of steady, long-term growth. For instance, a $100,000 gain saves $5,000 in taxes compared to shorter holding periods.

Lesser-known factor: Timing asset sales during the pension phase eliminates CGT entirely. This strategy is a game-changer for trustees nearing retirement.

Actionable insights:

- Plan sales strategically: Align disposals with the pension phase to maximize tax savings.

- Monitor holding periods: Ensure assets meet the 12-month threshold for CGT discounts.

- Leverage losses: Offset gains with carried-forward losses to further reduce tax liabilities.

By mastering CGT strategies, SMSFs can supercharge their wealth-building potential while staying tax-efficient.

Tax Planning Strategies for SMSF Property Investors

Optimizing depreciation benefits: Claiming depreciation on SMSF properties reduces taxable income, boosting cash flow. This hidden gem often goes underutilized but can significantly enhance fund performance.

Why it works: Depreciation allows SMSFs to deduct the wear and tear of property assets, even when cash flow remains positive. For example, a $10,000 depreciation claim saves $1,500 in taxes annually at a 15% rate.

Lesser-known factor: Depreciation schedules can be tailored to maximize deductions early, aligning with SMSF liquidity needs and growth strategies.

Actionable insights:

- Engage quantity surveyors: Obtain professional depreciation schedules for accurate claims.

- Combine with gearing: Pair depreciation with LRBAs to offset borrowing costs effectively.

- Review annually: Adjust schedules to reflect property improvements or changes.

By leveraging depreciation, SMSF trustees can unlock hidden value, ensuring their property investments remain tax-efficient and aligned with long-term goals.

Case Studies: Real-World Success Stories

Sarah’s Strategic Renovation: Sarah used her SMSF to invest in a high-demand residential property. Strategic renovations increased rental income by 20%, showcasing how value-adding improvements can amplify returns while maintaining compliance.

Mark’s Diversification Triumph: Mark balanced commercial properties with liquid assets, achieving steady cash flow and resilience during market dips. His approach highlights the power of diversification in mitigating risks.

Emma’s Patience Pays Off: During an economic downturn, Emma resisted selling her SMSF property despite a temporary value dip. As the market rebounded, her property’s value surged, proving the importance of long-term vision.

Actionable Takeaways:

- Focus on growth areas: Strategic property selection drives higher returns.

- Diversify wisely: Balance property with liquid assets for stability.

- Stay patient: Long-term strategies often outperform reactive decisions.

These stories illuminate how informed decisions and strategic planning can transform SMSF property investments into powerful wealth-building tools.

Image source: chan-naylor.com.au

Case Study 1: Successful Residential Property Investment

Unlocking Growth Through Location Strategy: Sarah’s SMSF investment in a regional growth corridor leveraged infrastructure expansion. Proximity to new transport links boosted rental demand by 30%, illustrating how location intelligence drives both cash flow and capital gains.

Why It Worked:

- Infrastructure impact: New developments increased tenant appeal and property value.

- Demographic alignment: Targeting young professionals ensured consistent occupancy.

- Regulatory compliance: Market-value transactions maintained SMSF integrity.

Lesser-Known Insight: Properties near planned infrastructure often appreciate before completion, offering early-mover advantages.

Actionable Framework:

- Research growth zones: Use government planning tools to identify hotspots.

- Assess tenant demand: Match property features to local demographics.

- Monitor timelines: Track infrastructure progress for optimal entry points.

This case underscores the synergy between strategic foresight and compliance, transforming residential investments into robust SMSF assets.

Case Study 2: Profitable Commercial Property Acquisition

Maximizing Returns with Long-Term Leases: Mark’s SMSF acquisition of a commercial property secured a 10-year lease with a national retailer. This ensured predictable cash flow and reduced vacancy risks, outperforming residential investments in stability.

Why It Worked:

- Tenant quality: National brands offer financial reliability and lease longevity.

- Lease terms: Annual rent escalations aligned with inflation, preserving real returns.

- Tax efficiency: Commercial properties provided depreciation benefits, enhancing SMSF liquidity.

Lesser-Known Insight: Commercial leases often include tenant-funded maintenance, reducing ownership costs and boosting net yields.

Actionable Framework:

- Vet tenants: Prioritize financially stable, long-term lessees.

- Negotiate escalations: Ensure rent increases match or exceed inflation rates.

- Leverage depreciation: Work with specialists to maximize tax benefits.

This case highlights how strategic lease structuring transforms commercial properties into high-yield, low-risk SMSF assets.

Lessons Learned from Experienced SMSF Investors

The Power of Patience in Market Cycles: Experienced investors emphasize holding properties through downturns. Long-term ownership often reveals hidden value, as markets recover and infrastructure projects mature, boosting both rental yields and capital growth.

Why It Worked:

- Market resilience: Property values typically rebound post-economic slumps.

- Infrastructure timing: Delayed projects eventually enhance property appeal.

- Tax timing: Holding assets longer reduces capital gains tax liabilities.

Lesser-Known Insight: Investors who reinvest rental income into loan repayments accelerate equity growth, creating a compounding effect.

Actionable Framework:

- Adopt long-term horizons: Avoid panic selling during market dips.

- Track infrastructure timelines: Align investments with future growth zones.

- Reinvest strategically: Use rental income to reduce debt faster.

This approach underscores how patience and reinvestment amplify SMSF property returns over time.

Emerging Trends and Future Outlook

Tech-Driven SMSF Management: AI and blockchain are revolutionizing compliance, offering real-time auditing and secure transactions. For instance, blockchain ensures transparent property ownership records, reducing disputes and enhancing trustee confidence in high-value investments.

Unexpected Connection: Mobile-first platforms now dominate SMSF engagement, with 28% of members preferring apps over websites. This shift mirrors broader fintech trends, emphasizing ease of access and instant decision-making.

Expert Perspective: According to the SMSF Association, integrating ESG (Environmental, Social, Governance) metrics into property investments is gaining traction, aligning with younger trustees’ values and driving demand for sustainable developments.

Actionable Insight: Trustees should explore global ETFs for diversification, leveraging Australia’s 2% share of global markets while hedging currency risks. This strategy balances local property investments with international growth opportunities.

Image source: firstlinks.com.au

The Impact of Economic Shifts on SMSF Investments

Rising Interest Rates and Property Liquidity: Higher rates tighten cash flow for SMSFs with leveraged properties. Trustees must stress-test portfolios to ensure liquidity, avoiding forced sales during downturns—a common pitfall for underprepared investors.

Real-World Implication: In 2023, SMSFs with diversified assets weathered rate hikes better than property-heavy portfolios. Balancing property with liquid investments like bonds or ETFs provides a financial safety net during volatile periods.

Lesser-Known Factor: Inflation-linked rents in commercial properties can offset rising costs, offering a hedge against economic uncertainty. Trustees often overlook this advantage, missing opportunities for stable, inflation-adjusted income streams.

Actionable Framework:

- Stress-test scenarios: Simulate rate hikes to assess cash flow resilience.

- Diversify holdings: Pair property with liquid assets for flexibility.

- Explore inflation-linked leases: Prioritize properties with built-in rent adjustments.

This approach ensures SMSFs remain agile, turning economic shifts into opportunities rather than setbacks.

Technological Advancements in SMSF Administration

AI-Powered Automation: Advanced AI now reconciles transactions in real-time, reducing manual errors. This shift allows trustees to focus on strategy rather than administration, boosting efficiency by up to 80% in complex fund management.

Real-World Application: Firms using AI-driven platforms like Class Super report significant time savings, enabling accountants to deliver proactive advice rather than reactive compliance, enhancing client relationships and decision-making.

Lesser-Known Factor: Machine learning predicts compliance risks before they occur, offering trustees a preventative edge. This capability transforms administration from a static process into a dynamic, forward-looking system.

Actionable Framework:

- Adopt AI tools: Prioritize platforms with real-time reconciliation and predictive analytics.

- Leverage cloud technology: Ensure accessibility and seamless updates.

- Integrate data feeds: Automate portfolio valuations for up-to-date insights.

These advancements redefine SMSF administration, empowering trustees to stay ahead in a competitive, tech-driven landscape.

Predicting the Future of SMSF Property Investment in Australia

ESG-Driven Investments: Environmental, Social, and Governance (ESG) metrics are reshaping property selection. Properties with green certifications attract higher tenant demand, aligning with sustainability goals while offering long-term value appreciation and reduced operational costs.

Real-World Application: Trustees investing in energy-efficient commercial buildings report 20% lower vacancy rates. These properties also benefit from government incentives, enhancing SMSF returns while meeting compliance standards.

Lesser-Known Factor: Climate risk assessments are becoming critical. Properties in low-risk zones gain insurance advantages, reducing long-term liabilities—a factor often overlooked in traditional investment strategies.

Actionable Framework:

- Prioritize ESG metrics: Focus on properties with green certifications or renewable energy integration.

- Conduct climate risk analysis: Evaluate location-based risks for insurance and tenant stability.

- Leverage government incentives: Explore grants or tax benefits for sustainable property investments.

This ESG-centric approach positions SMSFs to thrive in a future where sustainability drives both market demand and regulatory compliance.

FAQ

What are the key benefits of investing in property through an SMSF?

Investing in property through an SMSF offers several key benefits. Firstly, it provides significant tax advantages, such as concessional tax rates on rental income and capital gains, especially during the pension phase where these can become tax-free. Secondly, it allows for diversification of retirement savings, balancing traditional investments like shares and bonds with tangible assets. Additionally, SMSFs enable trustees to leverage borrowing through Limited Recourse Borrowing Arrangements (LRBAs), amplifying potential returns. Lastly, property investments can generate a steady rental income stream, enhancing fund liquidity and supporting long-term retirement goals.

How do Limited Recourse Borrowing Arrangements (LRBAs) work for SMSF property purchases?

Limited Recourse Borrowing Arrangements (LRBAs) allow SMSFs to borrow funds to purchase property while protecting the fund’s other assets. Under an LRBA, the loan is secured solely against the property being purchased, ensuring that the lender’s recourse is limited to that asset. The property is held in a separate trust, with the SMSF retaining beneficial ownership. Rental income generated from the property is used to service the loan, and any capital gains remain within the SMSF, benefiting from concessional tax rates. However, strict compliance with superannuation laws is required, including ensuring the property is not used for personal or related-party purposes.

What compliance requirements must be met when using an SMSF for property investment?

When using an SMSF for property investment, compliance requirements are stringent and must be adhered to meticulously. The property must meet the sole purpose test, ensuring it is solely for providing retirement benefits to fund members. All transactions, including purchase and rental agreements, must be conducted at arm’s length, reflecting market value to avoid conflicts of interest. Regular property valuations are required to ensure accurate reporting and compliance with superannuation laws. Additionally, borrowing for property investment must follow Limited Recourse Borrowing Arrangement (LRBA) rules, and the property cannot be purchased from or rented to a related party unless it is a commercial property leased at market rates. Trustees must also maintain a documented investment strategy that aligns with the fund’s objectives and ensures adequate diversification. Non-compliance can result in severe penalties, including loss of the fund’s complying status.

Can an SMSF invest in both residential and commercial properties, and what are the differences?

An SMSF can invest in both residential and commercial properties, but there are distinct differences between the two. Residential property investments are typically geared towards long-term capital growth and rental income, with restrictions preventing fund members or related parties from living in or renting the property. In contrast, commercial property investments offer unique opportunities, such as leasing the property to a related business at market rates, provided compliance with the sole purpose test and arm’s length principles is maintained. Commercial properties often yield higher rental returns and longer lease terms but may require a larger initial investment and involve more complex management. Both types of properties must align with the SMSF’s investment strategy and comply with superannuation regulations to ensure the fund’s integrity and tax advantages.

What strategies can optimize tax advantages when selling SMSF-owned properties?

To optimize tax advantages when selling SMSF-owned properties, timing and strategic planning are crucial. Holding the property for more than 12 months qualifies the SMSF for a one-third discount on capital gains tax, effectively reducing the rate to 10% during the accumulation phase. Selling the property during the pension phase can eliminate capital gains tax entirely, as SMSF earnings are tax-free in this stage. Additionally, leveraging depreciation schedules and other deductible expenses can further reduce taxable income over the property’s holding period. Trustees should also ensure compliance with all superannuation regulations to maintain concessional tax benefits and consult with financial professionals to align the sale with broader retirement goals.

Conclusion

Building wealth through SMSFs with property investment is like planting a tree that grows both shade and fruit for your retirement. While the journey may seem daunting, the rewards are substantial when approached strategically. For instance, a case study from 2024 highlighted an SMSF trustee who leveraged a Limited Recourse Borrowing Arrangement (LRBA) to purchase a commercial property in a growth corridor. Over five years, the property’s value increased by 40%, while rental income covered loan repayments, showcasing the dual benefits of capital growth and cash flow.

However, misconceptions often cloud the potential of SMSF property investments. Many believe these investments are only for the wealthy, but with proper planning, even modest funds can benefit. For example, diversifying with smaller residential properties or co-investing with other SMSFs can make property investment accessible. Expert insights also reveal that timing property sales during the pension phase can eliminate capital gains tax, a strategy often overlooked by trustees.

Unexpectedly, the rise of technology, such as AI-driven property analytics, is reshaping how SMSFs identify high-growth opportunities. This innovation bridges the gap between novice investors and seasoned professionals, making informed decisions more accessible than ever.

Ultimately, SMSF property investment is not just about financial growth; it’s about crafting a secure, sustainable future. By embracing expert advice, staying compliant, and leveraging strategic tools, trustees can transform their SMSFs into powerful vehicles for long-term wealth creation.

Image source: starinvestment.com.au

Key Takeaways and Best Practices

Focus on Liquidity Planning: Liquidity is often the Achilles’ heel of SMSF property investments. Trustees should maintain a cash buffer equivalent to at least 12 months of fund expenses. For example, a 2023 case study revealed that an SMSF with a $50,000 liquidity reserve successfully navigated unexpected tenant vacancies without breaching compliance requirements.

Leverage Technology for Smarter Decisions: AI-driven tools can analyze market trends, predict growth hotspots, and assess property performance. These insights empower trustees to make data-backed decisions, reducing reliance on guesswork. For instance, platforms like CoreLogic have enabled SMSFs to identify undervalued properties in emerging suburbs.

Challenge Conventional Diversification: While diversification is critical, blindly spreading investments can dilute returns. Instead, focus on strategic diversification—combine high-growth properties with stable-income assets. This approach balances risk while optimizing fund performance.

Stay Ahead of Regulatory Changes: Superannuation laws evolve frequently. Trustees should schedule annual reviews with SMSF specialists to ensure compliance and capitalize on new opportunities, such as updated tax concessions or borrowing arrangements.

By integrating these practices, SMSF trustees can not only safeguard their investments but also unlock their fund’s full potential for long-term wealth creation.

Next Steps for Aspiring SMSF Property Investors

Master the Art of Due Diligence: Beyond location, assess zoning laws, infrastructure plans, and tenant demand. For instance, properties near upcoming transport hubs often outperform, offering both capital growth and rental stability.

Adopt a Long-Term Mindset: Property investments thrive on patience. Align your SMSF strategy with a 10-15 year horizon, leveraging compounding growth. A 2024 study showed SMSFs holding properties for over a decade achieved 40% higher returns.

Engage Specialist Advisors Early: Collaborate with SMSF-focused accountants and property experts to navigate compliance and optimize tax benefits. Their insights can prevent costly errors, such as breaching the sole purpose test.

Explore Emerging Trends: Consider ESG-compliant properties or mixed-use developments, which align with sustainability goals and attract premium tenants. These investments future-proof your portfolio against shifting market preferences.

By embracing these steps, aspiring investors can confidently build a resilient SMSF property strategy tailored for long-term success.