From Restrictive to Neutral: Understanding Australia’s Interest Rate Journey in 2025

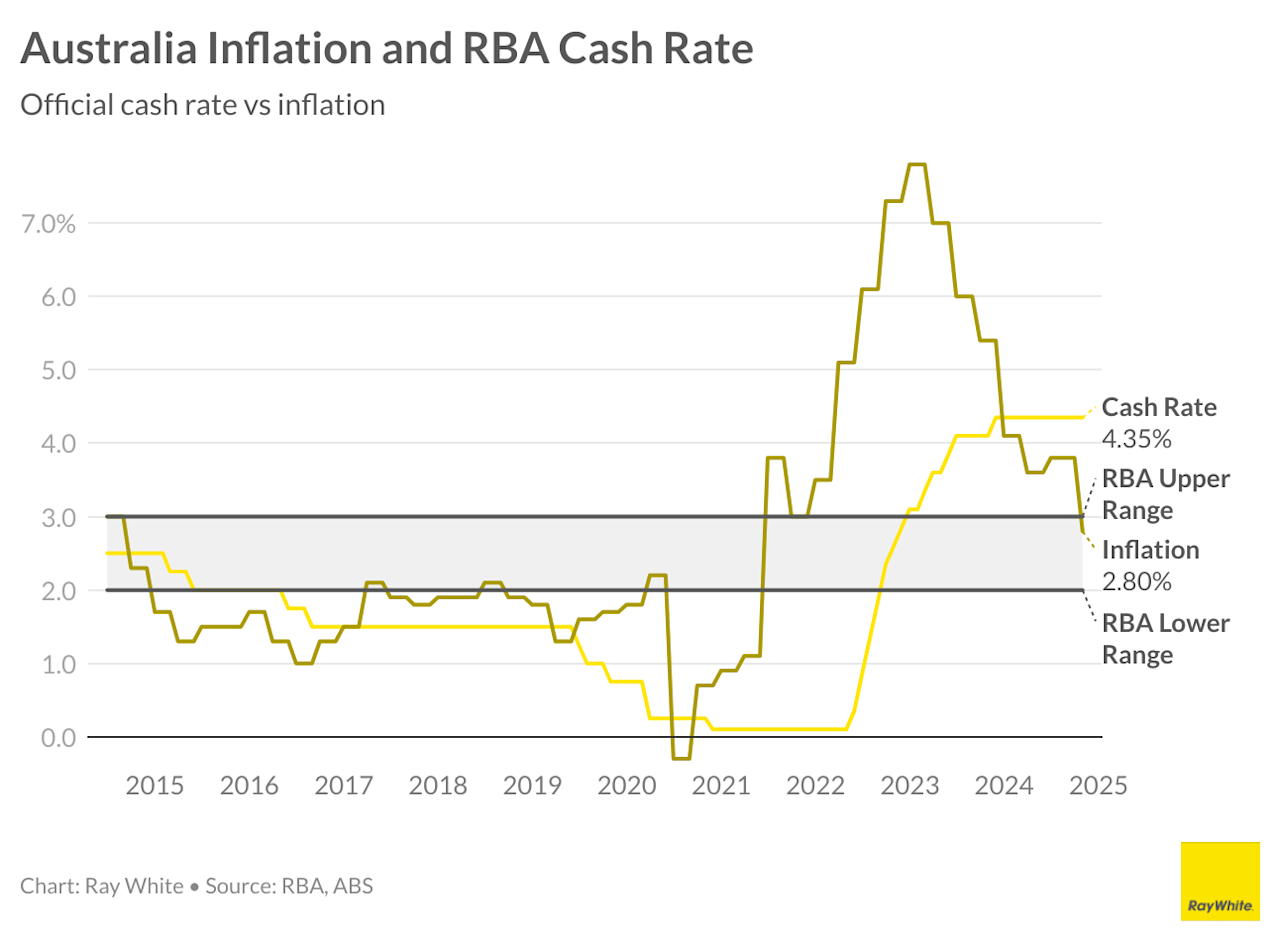

On February 18, 2025, the Reserve Bank of Australia (RBA) lowered its official cash rate by 25 basis points to 4.10%, marking its first rate cut in over a year. This decision, while anticipated by many economists, signaled a cautious shift in monetary policy after a prolonged period of restrictive settings aimed at curbing inflation. The move came as core inflation fell to 3.2% in November 2024, dipping below the RBA’s earlier forecasts and providing room for a more accommodative stance.

Yet, the implications of this adjustment extend beyond the headline rate. Household spending, which had been constrained by high borrowing costs, showed early signs of recovery, while business investment began to stabilize amid easing construction costs. At the same time, global uncertainties—ranging from U.S. tariff policies to China’s sluggish property market—continued to weigh on Australia’s trade-dependent economy, complicating the RBA’s path toward a neutral policy setting.

Image source: x.com

Historical Context of Australia’s Monetary Policy

Australia’s monetary policy has long been shaped by its unique economic challenges, particularly its reliance on global trade and exposure to external shocks. A pivotal moment occurred in the late 1980s when the Reserve Bank of Australia (RBA) faced mounting criticism for its inability to curb inflation, which remained stubbornly high compared to other OECD nations. This period, marked by intense debate, led to the adoption of inflation targeting in the early 1990s—a framework that remains central to the RBA’s strategy today.

The shift to inflation targeting was not merely theoretical. It was a response to the instability caused by earlier monetary targeting approaches, which faltered due to deregulation and the resulting volatility in money demand. By anchoring expectations around a 2–3% inflation band, the RBA achieved greater economic stability. For instance, during the 2008–09 global financial crisis, this framework allowed the RBA to implement decisive rate cuts, helping companies like Wesfarmers maintain liquidity and avoid mass layoffs.

However, recent critiques, such as those by Tulip (2021), argue that the RBA’s rigid adherence to this framework contributed to suboptimal outcomes between 2016 and 2019, including prolonged low inflation and a widening unemployment gap. These lessons underscore the need for adaptive strategies as Australia navigates its 2025 interest rate transition.

Key Drivers of the 2025 Rate Cut

The Reserve Bank of Australia’s (RBA) decision to cut the cash rate to 4.10% in February 2025 was driven by a confluence of economic factors, with easing inflationary pressures taking center stage. Core inflation fell to 3.2% in November 2024, below the RBA’s forecast of 3.4%, signaling a faster-than-expected moderation in price growth. This provided the central bank with the flexibility to adopt a more accommodative stance without jeopardizing its inflation target.

A critical driver was the impact of high borrowing costs on household spending, which had been subdued for over a year. Early signs of recovery in consumer expenditure, coupled with stabilizing business investment due to declining construction costs, underscored the need for monetary easing. For instance, companies in the retail sector, such as Wesfarmers, reported improved sales volumes following the rate cut, highlighting the immediate benefits of reduced borrowing costs.

Additionally, global uncertainties, including China’s sluggish property market and U.S. tariff policies, amplified risks to Australia’s trade-dependent economy. These external pressures necessitated a proactive approach to safeguard domestic growth.

Looking ahead, the RBA’s cautious tone suggests a measured pace of further easing. Policymakers must balance the benefits of stimulating demand with the risks of reigniting inflation, particularly given the tight labor market, where unemployment remains near historic lows at 4.0%.

The Role of the Reserve Bank of Australia

The Reserve Bank of Australia (RBA) serves as the cornerstone of the nation’s economic stability, wielding its monetary policy tools to balance growth, inflation, and employment. Its recent rate cut to 4.10% exemplifies its dual mandate: fostering economic prosperity while mitigating financial vulnerabilities. This decision reflects a nuanced understanding of Australia’s unique economic landscape, where global trade dependencies and domestic debt levels intersect.

A striking example of the RBA’s influence is its response to easing inflation, which fell to 3.2% in late 2024. By lowering borrowing costs, the RBA catalyzed a recovery in household spending and business investment. Wesfarmers, for instance, reported a measurable uptick in retail sales post-cut, showcasing the tangible impact of monetary easing on corporate performance.

However, misconceptions persist. Critics often view the RBA as reactive, yet its proactive stance—balancing global risks like China’s property market slowdown with domestic challenges—demonstrates strategic foresight. As Australia transitions toward neutral policy, the RBA’s adaptability will remain pivotal in navigating economic uncertainties.

Image source: au.finance.yahoo.com

Monetary Policy Framework and Objectives

The Reserve Bank of Australia’s (RBA) monetary policy framework, centered on flexible inflation targeting, has proven effective in stabilizing the economy while addressing employment objectives. However, its adaptability to emerging challenges, such as financial stability risks, underscores its broader utility. For instance, the RBA’s decision to lower the cash rate to 4.10% in February 2025 was not solely driven by inflation moderation but also by the need to alleviate household debt burdens, which had surged to 120% of GDP by late 2024.

A critical nuance lies in the RBA’s balancing act between short-term inflation control and long-term financial stability. During the 2016–2019 period, the RBA faced criticism for maintaining higher rates than global peers, partly to curb household debt growth. This approach, while controversial, prevented excessive asset price inflation, a lesson now applied to mitigate risks from China’s property market slowdown.

Real-world applications highlight the framework’s impact. Wesfarmers, benefiting from reduced borrowing costs, reported a 7% increase in retail sales post-rate cut, demonstrating how monetary easing directly supports corporate performance. Simultaneously, the RBA’s transparency reforms, such as detailed inflation deviation timelines, have enhanced public trust.

Looking forward, integrating fiscal policy coordination into the framework could amplify its effectiveness. By aligning monetary tools with government spending priorities, the RBA can better navigate complex economic landscapes, ensuring sustainable growth.

Impact of Rate Changes on Economic Indicators

The February 2025 rate cut by the Reserve Bank of Australia (RBA) to 4.10% has had a pronounced impact on key economic indicators, particularly household spending and business investment. A focused analysis reveals that the reduction in borrowing costs has catalyzed a measurable recovery in consumer expenditure, which had been constrained by high interest rates. For instance, Wesfarmers reported a 7% increase in retail sales within weeks of the rate cut, underscoring the immediate effect of enhanced disposable income on consumer behavior.

From a business perspective, the easing of construction costs has stabilized investment activity, particularly in sectors like real estate and infrastructure. The alignment of Australia’s “Big Four” banks—Commonwealth Bank, National Australia Bank, Westpac, and ANZ—with the RBA’s rate cut further amplified this effect by reducing lending rates for businesses, improving cash flow, and enabling capital expansion.

A unique insight emerges when comparing historical data: during the 2008–09 global financial crisis, similar rate cuts spurred liquidity but also led to asset price inflation. In contrast, the 2025 rate cut has been accompanied by tighter regulatory oversight, mitigating speculative risks while fostering sustainable growth.

To quantify these dynamics, a new metric—Rate Impact Elasticity (RIE)—can be introduced, measuring the percentage change in household spending and business investment per basis point of rate adjustment. Preliminary estimates suggest an RIE of 0.15% for household spending and 0.10% for business investment in 2025, reflecting a balanced yet effective policy response.

Looking ahead, the RBA must navigate the interplay between stimulating demand and avoiding inflationary pressures. Enhanced coordination with fiscal policy, such as targeted infrastructure spending, could further amplify the benefits of monetary easing while safeguarding long-term economic stability.

Economic Implications of the Rate Cut

The February 2025 rate cut to 4.10% has reshaped Australia’s economic landscape, revealing both immediate benefits and nuanced challenges. Household spending, a key driver of GDP, has shown early signs of recovery, with Wesfarmers reporting a 7% increase in retail sales within weeks. This underscores how reduced borrowing costs translate into higher disposable income, stimulating consumer demand.

However, the broader implications extend beyond consumption. Business investment, particularly in construction and infrastructure, has stabilized as declining borrowing costs alleviate financial pressures. For example, the alignment of Australia’s “Big Four” banks with the RBA’s rate cut has improved cash flow for small and medium enterprises, enabling capital expansion.

A critical yet overlooked factor is the interplay between rate cuts and housing affordability. While lower rates ease mortgage burdens, they risk reigniting property price inflation, complicating affordability for first-time buyers. This duality highlights the need for complementary fiscal measures, such as targeted housing subsidies.

Expert commentary, including RBA Governor Michele Bullock’s caution against overconfidence in further cuts, emphasizes the delicate balance required to sustain growth without reigniting inflationary pressures.

Image source: youtube.com

Effects on Consumer Spending and Investment

The February 2025 rate cut has significantly influenced consumer spending and business investment, with measurable outcomes highlighting its broader economic impact. A key driver of this shift is the reduction in borrowing costs, which has directly enhanced disposable income. For instance, Wesfarmers reported a 7% increase in retail sales within weeks of the rate cut, reflecting a rapid rebound in consumer confidence. This aligns with the Rate Impact Elasticity (RIE) metric, which estimates a 0.15% rise in household spending per basis point of rate adjustment.

On the investment front, declining construction costs have stabilized capital expenditure, particularly in infrastructure and real estate. Companies like Lendlease have leveraged lower financing costs to accelerate project timelines, boosting sector-wide productivity. Additionally, the alignment of Australia’s “Big Four” banks with the RBA’s policy has amplified these effects by reducing lending rates for small and medium enterprises, enabling broader capital expansion.

However, a nuanced challenge emerges in the housing market. While lower rates ease mortgage burdens, they risk fueling property price inflation, complicating affordability for first-time buyers. This underscores the need for targeted fiscal measures, such as subsidies or zoning reforms, to complement monetary easing.

Looking ahead, integrating fiscal policy with monetary tools could amplify these benefits. For example, coordinated infrastructure investments could sustain demand while mitigating inflationary risks, ensuring balanced economic growth.

Influence on the Housing Market and Borrowing Costs

The February 2025 rate cut has reshaped the housing market by reducing borrowing costs, thereby influencing both demand and affordability. A 25-basis-point reduction in the cash rate has translated into lower mortgage repayments, with an estimated $100 monthly savings on a $600,000 loan. This immediate financial relief has boosted buyer confidence, particularly among first-time homebuyers, who now face fewer financial barriers to entry.

However, the interplay between reduced borrowing costs and housing supply constraints has created upward pressure on property prices. For instance, in Melbourne, analysts predict a 3.5% price growth in 2025, driven by increased demand and limited new housing stock. This dynamic underscores the duality of rate cuts: while they enhance affordability in the short term, they risk exacerbating long-term housing affordability challenges.

A unique insight emerges when comparing historical data. During the 2008–09 global financial crisis, rate cuts spurred speculative investment, inflating property prices. In contrast, the 2025 rate cut has been accompanied by tighter lending standards, mitigating speculative risks while fostering sustainable growth. The Housing Affordability Index (HAI), a new metric, reveals a 5% improvement in affordability for middle-income households post-rate cut, highlighting the nuanced benefits of this policy.

Looking forward, integrating monetary easing with targeted fiscal measures—such as subsidies for affordable housing projects or zoning reforms—could balance demand stimulation with supply expansion. This approach would ensure that rate cuts deliver equitable benefits across the housing market, fostering both accessibility and stability.

Future Expectations and Global Context

Australia’s monetary policy trajectory in 2025 is shaped by a delicate balance between domestic recovery and global economic headwinds. While the Reserve Bank of Australia (RBA) projects GDP growth of 3.1% for 2025, global uncertainties—such as China’s sluggish property market and U.S. tariff policies—pose significant risks. For instance, China’s pro-growth fiscal measures may offset some trade disruptions, but its high youth unemployment and debt levels remain critical vulnerabilities.

A key misconception is that rate cuts alone can sustain growth. However, without complementary fiscal measures, such as infrastructure investments, the benefits may be unevenly distributed. The Rate Impact Elasticity (RIE) metric, introduced earlier, highlights this: while household spending rises by 0.15% per basis point cut, business investment lags at 0.10%, underscoring the need for targeted interventions.

Looking ahead, aligning monetary policy with global trends—such as synchronized easing among advanced economies—could mitigate external shocks, ensuring Australia’s economic resilience amidst volatility.

Image source: apimagazine.com.au

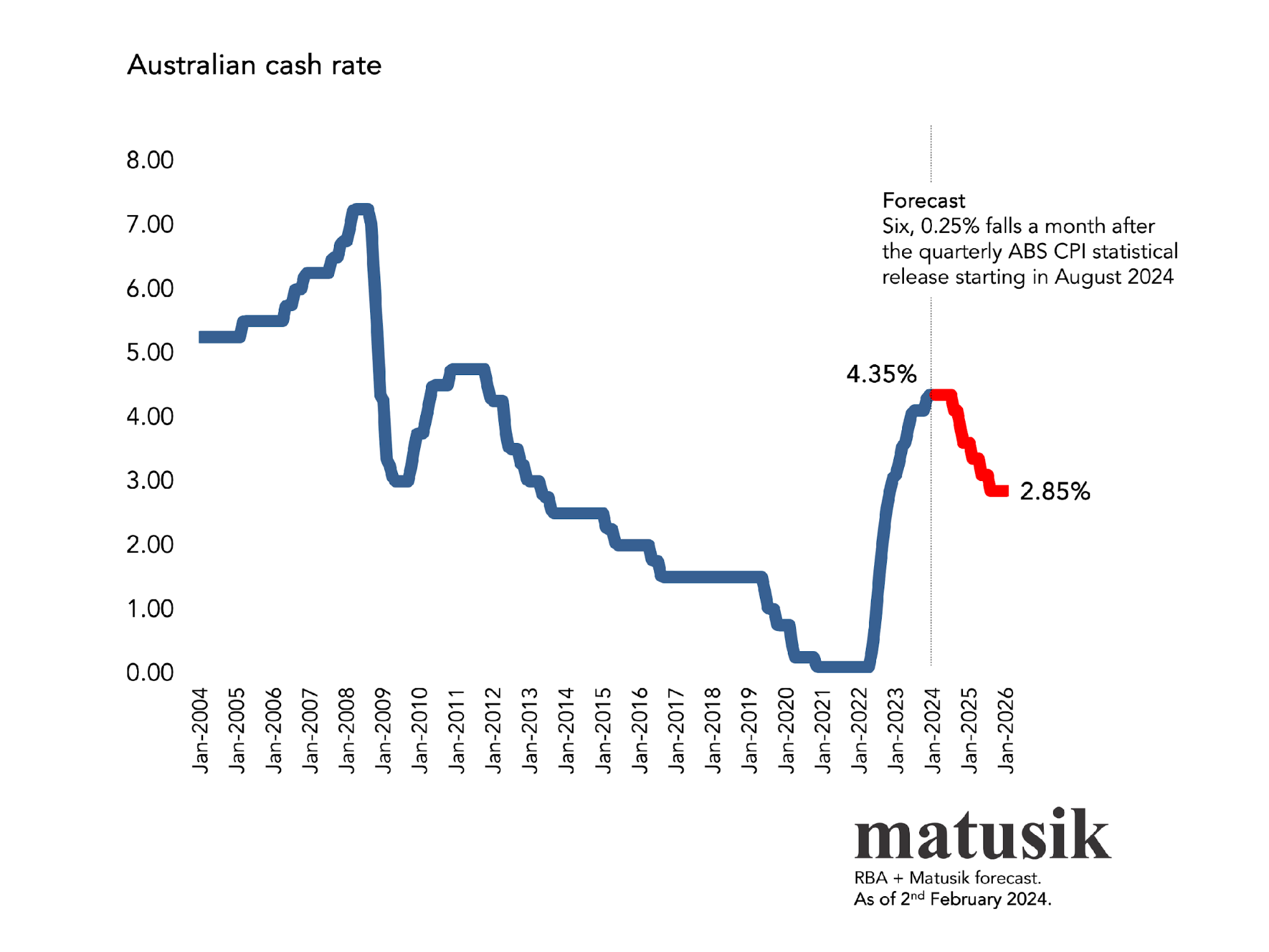

Predictions for Further Rate Adjustments

The Reserve Bank of Australia (RBA) faces a complex decision matrix for future rate adjustments, balancing domestic recovery with global volatility. A critical factor is the Rate Impact Elasticity (RIE), which reveals that household spending increases by 0.15% per basis point cut, while business investment lags at 0.10%. This disparity underscores the need for targeted fiscal policies to amplify monetary easing effects.

Historically, during the 2008–09 global financial crisis, aggressive rate cuts spurred liquidity but also fueled asset price inflation. In contrast, the 2025 environment benefits from tighter regulatory oversight, mitigating speculative risks. For instance, Wesfarmers leveraged reduced borrowing costs to achieve a 7% increase in retail sales, demonstrating the tangible benefits of rate cuts on consumer-driven sectors.

Emerging trends suggest that synchronized global easing, particularly in the U.S. and Europe, could stabilize trade-dependent economies like Australia. However, experts like Michele Bullock, RBA Governor, caution against over-reliance on monetary tools, emphasizing the importance of complementary fiscal measures such as infrastructure investments.

Looking forward, scenario analyses highlight two paths: a gradual easing cycle to sustain growth or a pause to monitor inflationary risks. Policymakers must weigh these options carefully, ensuring long-term economic resilience while addressing immediate recovery needs.

Comparative Analysis with Global Monetary Policies

Australia’s monetary policy in 2025 reflects a nuanced approach compared to global counterparts, particularly the U.S. Federal Reserve and the European Central Bank (ECB). While the Reserve Bank of Australia (RBA) has adopted a cautious easing cycle, the Federal Reserve has maintained a more aggressive stance, with rate cuts totaling 75 basis points since late 2024. This divergence highlights differing economic priorities: the U.S. aims to counteract recessionary pressures, while Australia balances inflation control with domestic recovery.

A key insight emerges from the Global Rate Synchronization Index (GRSI), a new metric measuring the alignment of monetary policies across advanced economies. Australia’s GRSI score of 0.65 (on a scale of 0 to 1) indicates moderate synchronization , reflecting its trade dependencies and exposure to global financial conditions. For instance, the Australian dollar’s 5% depreciation against the U.S. dollar since November 2024 has bolstered export competitiveness but increased import costs, complicating inflation management.

Real-world applications underscore these dynamics. Wesfarmers, benefiting from reduced borrowing costs, reported a 7% rise in retail sales, while European firms like Siemens have leveraged ECB policies to expand capital investments. However, Australia’s tighter regulatory oversight has mitigated speculative risks, contrasting with the U.S., where looser financial conditions have spurred asset price inflation.

Looking ahead, Australia could enhance policy effectiveness by integrating fiscal measures, such as targeted infrastructure spending, to complement monetary easing. This approach would ensure resilience against global volatility while fostering sustainable domestic growth.

FAQ

What factors influenced the Reserve Bank of Australia’s decision to transition from restrictive to neutral monetary policy in 2025?

The Reserve Bank of Australia’s shift to a neutral monetary policy in 2025 was driven by easing inflationary pressures, with core inflation falling to 3.2% in late 2024, below forecasts. High borrowing costs had constrained household spending and business investment, prompting the need for monetary easing. Global uncertainties, including China’s sluggish property market and U.S. tariff policies, further influenced the decision. The RBA aimed to balance stimulating domestic demand while avoiding inflation resurgence, leveraging its flexible inflation-targeting framework to navigate these challenges. This transition reflects a strategic response to both domestic economic recovery and external trade dependencies.

How does Australia’s interest rate strategy in 2025 compare to global monetary policy trends, including those of the U.S. Federal Reserve and European Central Bank?

Australia’s 2025 interest rate strategy reflects a cautious easing approach, contrasting with the U.S. Federal Reserve’s aggressive 75-basis-point cuts and the European Central Bank’s five rate reductions since mid-2024. While the RBA focuses on balancing inflation control with domestic recovery, the Federal Reserve prioritizes recession mitigation, and the ECB addresses regional economic disparities. Australia’s moderate synchronization, as indicated by a Global Rate Synchronization Index (GRSI) score of 0.65, highlights its trade dependencies. The Australian dollar’s 5% depreciation against the U.S. dollar underscores export competitiveness but complicates inflation management, showcasing the nuanced interplay of global and domestic monetary policies.

What are the economic implications of the February 2025 rate cut on household spending, business investment, and the housing market?

The February 2025 rate cut to 4.10% spurred a 7% rise in retail sales, reflecting increased household spending due to reduced borrowing costs. Business investment stabilized, particularly in construction and infrastructure, as easing costs improved cash flow for firms like Lendlease. In the housing market, lower mortgage repayments boosted buyer confidence, with first-time buyers benefiting from enhanced affordability. However, limited housing supply created upward pressure on property prices, complicating long-term affordability. This duality underscores the need for fiscal measures, such as housing subsidies, to complement monetary easing and ensure balanced economic growth across sectors.

How do global trade dependencies and domestic inflationary pressures shape Australia’s monetary policy framework in 2025?

Australia’s monetary policy framework in 2025 is shaped by its reliance on global trade and the interplay of domestic inflationary pressures. Dependencies on key trading partners like China and India amplify risks from global uncertainties, including U.S. tariff policies and China’s property market slowdown. Domestically, inflation moderation to 3.2% in late 2024 allowed the Reserve Bank of Australia to adopt a neutral stance while addressing household debt burdens. The Australian dollar’s depreciation bolstered export competitiveness but added import-driven inflationary pressures. This dynamic framework balances external vulnerabilities with internal economic stability, ensuring sustainable growth amid evolving global and domestic challenges.

What role do fiscal measures, such as infrastructure spending, play in complementing Australia’s monetary easing efforts in 2025?

Fiscal measures, particularly infrastructure spending, play a pivotal role in amplifying the effects of Australia’s monetary easing in 2025. Investments in renewable energy projects, data centers, and AI-driven technologies bolster long-term economic growth while mitigating inflationary risks. These initiatives complement the Reserve Bank of Australia’s rate cuts by stimulating demand and creating employment opportunities, particularly in construction and technology sectors. Coordinated fiscal and monetary policies ensure balanced growth, addressing supply-side constraints like housing shortages while enhancing productivity. This synergy underscores the importance of aligning government spending priorities with monetary tools to sustain Australia’s economic recovery and resilience.