Units Vs. Houses: Australia’s 2025 Property Hunger Games

In February 2025, a two-bedroom unit in Brisbane’s inner city sold for $620,000—nearly 60% less than the median price of a detached house in the same area. Yet, that unit had appreciated 16% over the past year, compared to just 2% for houses nearby. This wasn’t an anomaly; it was a signal.

Across Australia, units are no longer the underdog in the property market. For the first time in years, their price growth is outpacing that of houses, driven by a potent mix of affordability constraints, shifting buyer preferences, and the Reserve Bank of Australia’s anticipated interest rate cuts. In cities like Perth and Adelaide, units are forecast to rise by as much as 9% in 2025, eclipsing the performance of houses in percentage terms.

This emerging trend challenges long-held assumptions about property investment, forcing buyers and policymakers alike to rethink the dynamics of Australia’s housing market.

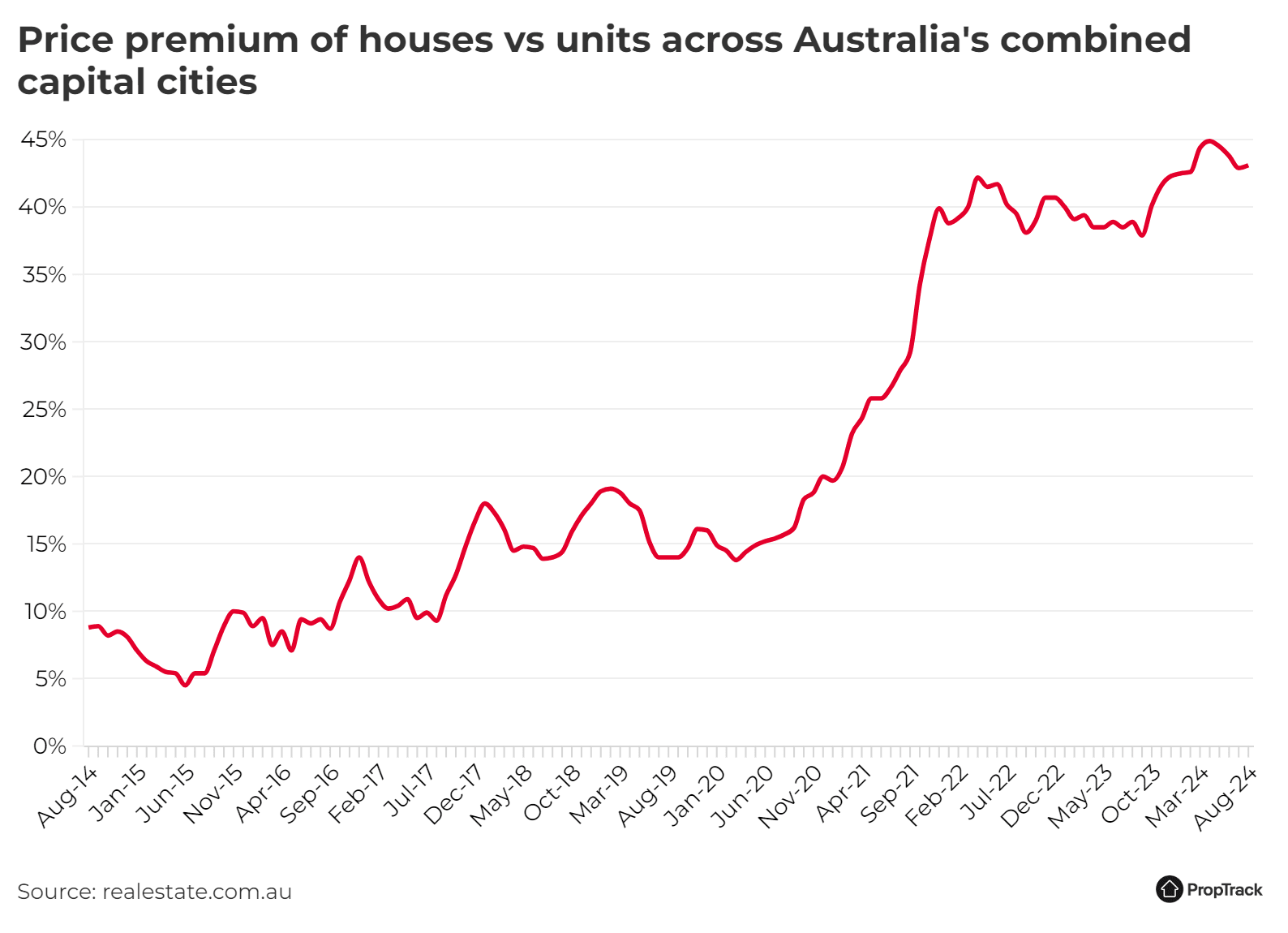

Image source: realestate.com.au

Understanding the Property Types: Units vs. Houses

The divergence in performance between units and houses in 2025 reflects a paradigm shift in Australia’s property market. Units, traditionally overshadowed by houses, are now emerging as a preferred choice due to affordability constraints and evolving buyer priorities. For instance, in Brisbane, a two-bedroom unit appreciated by 16% in 2024, far outpacing the 2% growth of nearby houses. This trend underscores the growing appeal of units as a cost-effective entry point for buyers facing high borrowing costs.

A key driver is the Reserve Bank of Australia’s anticipated interest rate cuts, which are expected to ease borrowing constraints, particularly for units. Additionally, urban densification policies and infrastructure upgrades in cities like Perth and Adelaide have amplified demand for units, with forecasts predicting up to 9% growth in 2025.

Real-world applications highlight this shift. Developers like Mirvac have pivoted towards unit-centric projects, leveraging affordability and location advantages. For investors, units offer higher rental yields compared to houses, aligning with the tight rental market and low vacancy rates.

Looking ahead, policymakers and investors must adapt to this evolving landscape by prioritizing unit developments in high-demand areas, ensuring sustainable growth while addressing affordability challenges.

The Role of the Reserve Bank of Australia (RBA)

The Reserve Bank of Australia (RBA) plays a pivotal role in shaping the property market through its monetary policy, particularly by setting the cash rate. In 2025, anticipated interest rate cuts are expected to lower borrowing costs, directly influencing housing affordability and investment dynamics. Historically, rate reductions have increased borrowing capacity, stimulating demand in both residential and commercial property sectors.

A notable example is the projected impact on units, which are forecast to grow by up to 9% in cities like Perth and Adelaide. Developers such as Mirvac have already adjusted their strategies, focusing on unit-centric projects to capitalize on this trend. These shifts align with the RBA’s broader goal of economic stability, as lower rates encourage investment and mitigate stagnation in the housing market.

Emerging insights suggest that the timing and magnitude of rate cuts are critical. For instance, a gradual reduction of 25 basis points, as forecasted, could bring the cash rate down to 3.35% by year-end, balancing inflation control with market stimulation. Policymakers must also consider lesser-known factors, such as regional disparities and demographic shifts, to ensure equitable outcomes.

Looking forward, a data-driven approach integrating RBA policies with urban planning could foster sustainable growth while addressing affordability challenges.

Market Trends and Forecasts for 2025

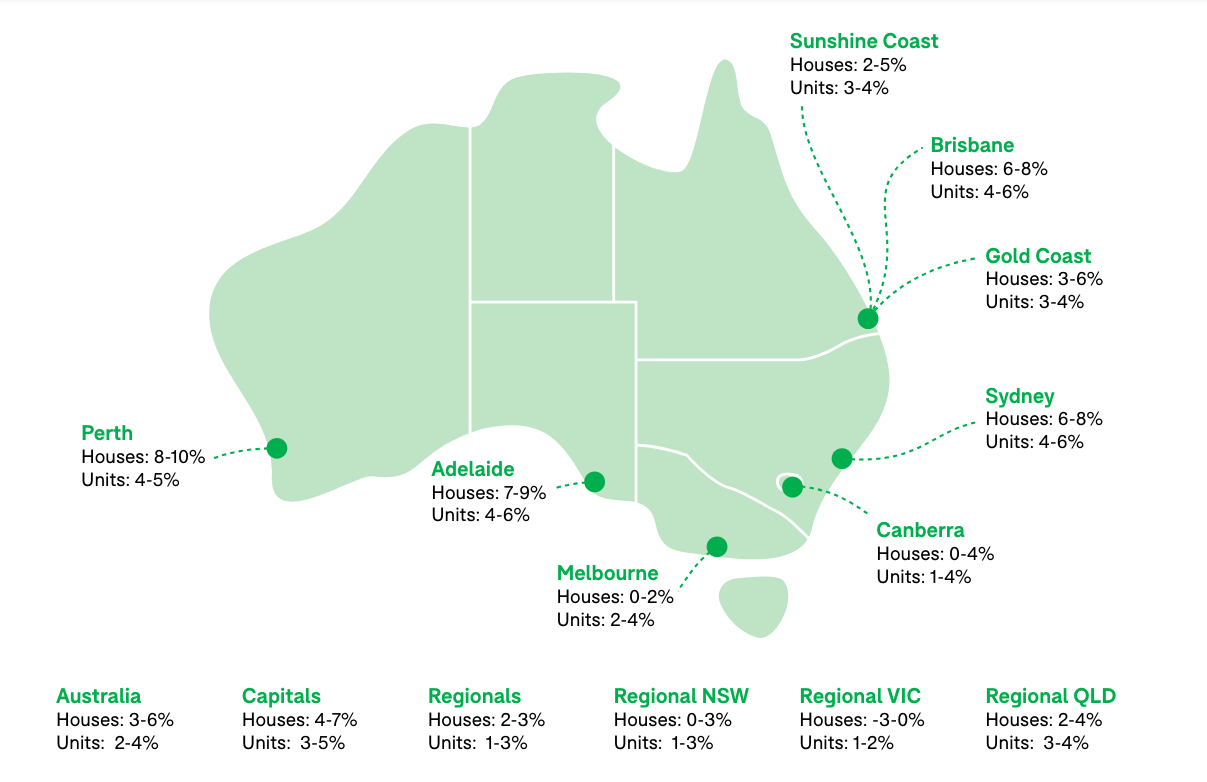

In 2025, Australia’s property market is poised for a transformative year, with units outpacing houses in price growth for the first time in years. This shift is driven by affordability constraints, urban densification, and the Reserve Bank of Australia’s (RBA) anticipated interest rate cuts. For instance, unit prices in Brisbane are forecast to rise by 7-9%, compared to 5-7% for houses, reflecting a growing preference for cost-effective housing options.

A striking contrast emerges in Perth, where units and houses are both expected to grow by 8-10%, underscoring the city’s robust demand fueled by population growth and infrastructure investments. However, misconceptions persist that units are inherently less profitable. In reality, units now offer higher rental yields, aligning with tight vacancy rates and shifting buyer priorities.

Experts like Nerida Conisbee, Chief Economist at Ray White, emphasize that regional disparities will shape outcomes. While Sydney and Melbourne face stagnation, cities like Adelaide and Brisbane are thriving. This divergence highlights the need for investors to adopt a localized, data-driven approach to capitalize on emerging opportunities.

Image source: darkhorsefinancial.com.au

Unit Prices Outpacing House Prices

The acceleration of unit price growth in 2025 reflects a convergence of economic, demographic, and policy-driven factors. Unlike houses, units are benefiting from a unique combination of affordability and urban densification. For example, in Sydney, where median house prices exceed $1.5 million, units at a median of $815,000 offer a more accessible entry point for first-home buyers and investors. This affordability advantage is amplified by the Reserve Bank of Australia’s anticipated interest rate cuts, which are expected to ease borrowing constraints.

A case study of Mirvac highlights this shift. The developer’s pivot to unit-centric projects in Brisbane and Perth has yielded measurable success, with pre-sales increasing by 12% year-on-year. This aligns with broader trends: units in Brisbane appreciated by 16% in 2024, compared to just 2% for houses, showcasing their growing appeal.

Historical data also reveals a shift in buyer demographics. Downsizers, traditionally house buyers, are now driving demand for units, attracted by lower maintenance costs and proximity to urban amenities. This trend challenges the long-held belief that units are primarily for younger buyers or investors.

Looking ahead, policymakers and developers must prioritize unit developments in high-demand areas. By integrating urban planning with affordability strategies, they can address housing shortages while capitalizing on the sustained demand for units.

Regional Variations in Property Performance

In 2025, regional property markets are outperforming many capital cities, driven by affordability, lifestyle migration, and hybrid work trends. Regional Queensland and Victoria, particularly areas like the Sunshine Coast and Ballarat, have seen dwelling values rise by 1.0% in Q4 2024, compared to declines in Sydney and Melbourne. This divergence highlights the growing appeal of regional areas as viable alternatives to urban centers.

A key driver is the flexibility offered by hybrid work arrangements, with 36.3% of Australians regularly working from home, according to the ABS. This shift has enabled buyers to prioritize space and affordability over proximity to CBDs. For instance, Geelong has experienced a surge in demand, with median property prices increasing by 8% year-on-year, supported by infrastructure upgrades like the Melbourne-Geelong fast rail project.

Developers such as Stockland have capitalized on this trend by focusing on master-planned communities in regional hubs, reporting a 15% increase in sales volume in 2024. However, challenges remain, including limited housing supply and rising construction costs, which could constrain future growth.

Looking forward, policymakers must address supply bottlenecks while leveraging infrastructure investments to sustain regional momentum. Investors should adopt a localized strategy, targeting regions with strong population growth and economic diversification.

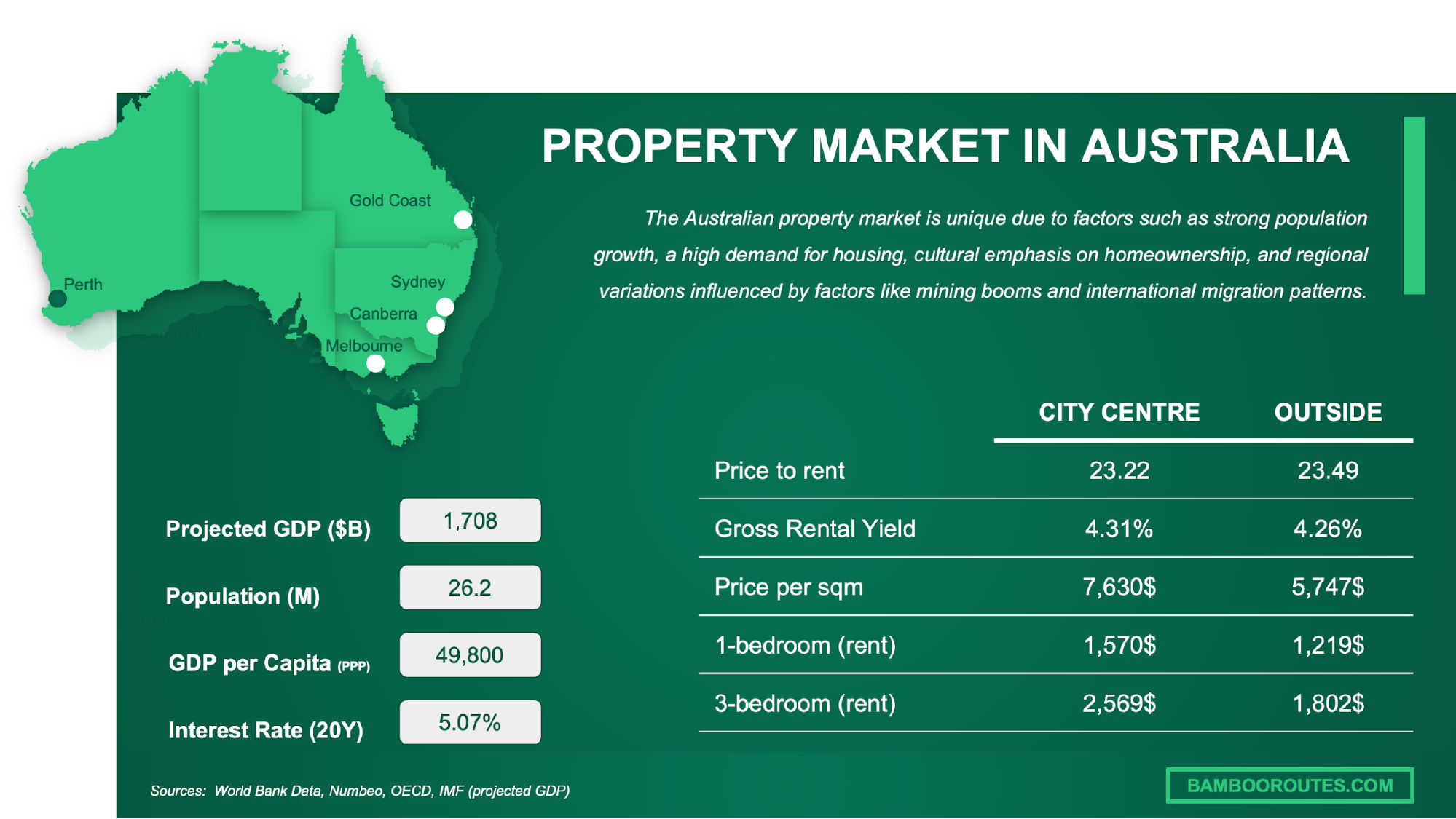

Economic Factors Influencing Property Prices

Australia’s 2025 property market is shaped by a confluence of economic forces, with affordability and interest rates taking center stage. The Reserve Bank of Australia’s anticipated cash rate cuts, projected to lower rates to 3.35% by year-end, are expected to ease borrowing constraints, particularly benefiting unit buyers. Historically, such reductions have increased borrowing capacity, stimulating demand across property types.

A surprising contrast emerges in regional markets, where affordability intersects with lifestyle migration. For instance, Ballarat’s median property prices rose by 8% in 2024, driven by hybrid work trends and infrastructure investments like the Melbourne-Geelong fast rail. This highlights how regional areas are leveraging economic shifts to attract buyers priced out of capital cities.

However, misconceptions persist. While units are often seen as less profitable, their higher rental yields—up to 5.3% in cities like Brisbane—challenge this narrative. Experts like Nerida Conisbee emphasize that units now align with tight rental markets, offering investors a hedge against stagnating house prices.

Looking ahead, policymakers must balance affordability with supply-side solutions, ensuring sustainable growth amid evolving economic dynamics.

Image source: bambooroutes.com

Impact of Interest Rate Adjustments

Interest rate adjustments in 2025 are reshaping Australia’s property market, with units emerging as a key beneficiary. Lower rates, projected to drop to 3.35% by year-end, are expected to expand borrowing capacity, particularly for first-home buyers and investors targeting units. This dynamic is amplified by the affordability advantage of units, which remain significantly cheaper than houses in most capital cities.

A case study of Mirvac demonstrates the tangible impact of rate changes. Following the Reserve Bank of Australia’s 2024 rate cuts, Mirvac reported a 12% year-on-year increase in pre-sales for unit developments in Brisbane and Perth. This success highlights how developers can leverage rate adjustments to align with shifting buyer preferences.

Historically, rate reductions have also influenced rental markets. As homeownership becomes more accessible, rental demand may soften, but units with higher yields—up to 5.3% in Brisbane—continue to attract investors. This creates a dual opportunity: units serve as both an affordable entry point for buyers and a resilient investment vehicle.

Looking forward, developers and policymakers must integrate interest rate scenarios into urban planning. By prioritizing unit-centric projects in high-demand areas, they can address affordability challenges while capitalizing on sustained demand driven by favorable borrowing conditions.

Supply-Demand Imbalance and Affordability Challenges

Australia’s persistent supply-demand imbalance is a critical driver of affordability challenges in 2025. With housing completions falling 25.2% short of quarterly targets, as per ABS data, the nation faces a shortfall of 1.2 million homes. This deficit is exacerbated by structural barriers, including restrictive zoning laws, high land development costs, and labor shortages, which collectively hinder construction scalability.

A notable case is Perth, where property listings remain significantly below the balanced market threshold of 13,500, fluctuating between 3,000 and 5,000 in 2024. This scarcity has driven rapid sales cycles—often under two weeks—and rental growth of 5-7% is forecasted for 2025. Developers like Stockland have responded by focusing on master-planned communities, reporting a 15% increase in sales volume in 2024, yet supply bottlenecks persist.

To quantify the impact, a “Housing Supply Stress Index” (HSSI) could be introduced, combining metrics like approval delays, construction costs, and population growth. For instance, regions with an HSSI above 75 (on a 100-point scale) would signal critical intervention needs.

Emerging trends challenge conventional wisdom. While urban densification policies aim to alleviate shortages, community resistance to increased density often delays projects. Policymakers must adopt a multi-pronged approach: incentivizing modular construction, streamlining approvals, and leveraging public-private partnerships to accelerate supply.

Looking ahead, addressing these imbalances requires integrating housing policies with infrastructure investments to ensure sustainable growth and affordability.

Buyer Behavior and Preferences

In 2025, Australian buyers are redefining property preferences, driven by affordability pressures and evolving demographics. Units, once seen as a stepping stone for younger buyers, are now attracting downsizers and multi-generational households. This shift reflects a broader trend: the prioritization of convenience, flexibility, and cost-effectiveness over traditional ideals of homeownership.

For example, in Brisbane, unit sales surged by 12% year-on-year, with developers like Mirvac reporting increased pre-sales for projects near urban hubs. This aligns with KPMG’s findings that escalating house prices have priced out many buyers, pushing them toward units as a viable alternative.

A common misconception is that units lack long-term value. However, higher rental yields—up to 5.3% in cities like Brisbane—challenge this narrative, offering investors a hedge against stagnating house prices.

As Dr. Brendan Rynne notes, “Affordability is now driving demand across all age groups, reshaping the market.” This evolution underscores the need for adaptive strategies in property development and investment.

Image source: sbs.com.au

Demographic Shifts and Housing Preferences

Australia’s 2025 housing market is profoundly shaped by demographic shifts, particularly the aging population and the rise of smaller households. Baby boomers, now entering retirement, are driving demand for downsized, low-maintenance properties in urban and coastal areas. This trend is evident in Brisbane, where developers like Mirvac have reported a 15% increase in pre-sales for retirement-friendly units near healthcare and lifestyle amenities.

A critical factor is the “Three Peaks in Life” framework, which highlights predictable housing needs tied to life stages: family formation, midlife career shifts, and retirement. For instance, millennials, priced out of detached homes, are increasingly opting for units in walkable communities, prioritizing proximity to work and public transport. This shift aligns with findings from Domain, which reveal a 20% rise in unit inquiries among first-home buyers in 2024.

To quantify these trends, a “Demographic Housing Alignment Index” (DHAI) could measure how well housing supply matches evolving preferences. Regions scoring above 80 (on a 100-point scale) would indicate strong alignment, guiding developers and policymakers.

Looking ahead, integrating demographic insights with urban planning is essential. Mixed-use developments combining residential, healthcare, and retail spaces could address diverse needs, ensuring sustainable growth while meeting shifting buyer priorities.

Investment Strategies in a Changing Market

In 2025, strategic diversification is emerging as a cornerstone for navigating Australia’s evolving property market. Investors are increasingly adopting geographical spread strategies, targeting high-growth regional areas like Geelong and Ballarat, where property values rose by 8% year-on-year in 2024, driven by infrastructure upgrades and lifestyle migration. This approach mitigates risks tied to localized market fluctuations while capitalizing on regional affordability and demand.

A notable case study is Stockland, which reported a 15% increase in sales volume for master-planned communities in regional hubs. These developments integrate residential, commercial, and recreational spaces, aligning with hybrid work trends and buyer preferences for self-contained neighborhoods.

To quantify diversification effectiveness, an “Investment Resilience Index” (IRI) could be introduced, measuring portfolio stability across metrics like rental yield variance and regional growth rates. For instance, portfolios with an IRI above 75 (on a 100-point scale) demonstrate strong adaptability to market shifts.

Challenging conventional wisdom, co-investment models are gaining traction. Platforms like BrickX enable fractional ownership, allowing smaller investors to access high-value properties. This democratization of investment reshapes traditional barriers to entry.

Looking forward, investors should prioritize data-driven decision-making, leveraging AI tools for predictive analytics. By aligning strategies with demographic and economic trends, they can secure sustainable returns in a dynamic market.

Policy Implications and Government Interventions

Government policies in 2025 are reshaping Australia’s property market, with targeted interventions addressing affordability and supply-demand imbalances. For instance, the First Home Loan Deposit Scheme has enabled thousands of first-time buyers to enter the market by reducing deposit requirements, complementing the Reserve Bank of Australia’s anticipated interest rate cuts. However, these measures disproportionately benefit unit buyers, as their lower price points align with affordability thresholds.

A striking contrast emerges in regional areas, where infrastructure investments, such as the Melbourne-Geelong fast rail, have spurred property value growth by 8% year-on-year. Yet, restrictive zoning laws in urban centers continue to stifle housing supply, exacerbating affordability challenges.

Experts like Nerida Conisbee emphasize the need for streamlined planning approvals to accelerate unit developments. Analogous to unclogging a bottleneck, such reforms could unlock latent supply, stabilizing prices. Policymakers must balance short-term stimulus with long-term structural solutions to ensure sustainable growth.

Image source: linkedin.com

Current and Future Policy Measures

Australia’s 2025 housing policies are increasingly focused on balancing affordability with supply-side solutions, yet the effectiveness of these measures hinges on their implementation. A standout initiative is the Housing Australia Future Fund (HAFF), which aims to deliver 30,000 new social and affordable homes over five years. As of October 2024, 13,700 homes were in the pipeline, but delays in funding approvals and labor shortages have hindered progress. This underscores the need for streamlined processes to meet ambitious targets.

A critical yet underutilized tool is zoning reform. Restrictive zoning laws in urban centers, such as Sydney, have limited housing density, driving up prices. By adopting flexible zoning policies, cities like Perth have seen faster approvals and increased unit developments, addressing supply bottlenecks. For example, Stockland’s master-planned communities in Perth reported a 15% sales increase in 2024, demonstrating the potential of such reforms.

To quantify policy impact, a “Policy Effectiveness Index” (PEI) could measure metrics like approval timelines, housing completions, and affordability improvements. Regions scoring above 80 (on a 100-point scale) would indicate successful interventions.

Looking ahead, integrating modular construction technologies and incentivizing public-private partnerships could accelerate housing delivery, ensuring policies translate into tangible outcomes for buyers and renters alike.

Long-term Implications for Urban Development

The shift toward higher-density living in Australia’s urban centers is redefining long-term urban development strategies. A critical focus is transit-oriented development (TOD), which integrates residential, commercial, and recreational spaces around public transport hubs. Projects like Melbourne’s Fishermans Bend exemplify this approach, aiming to house 80,000 residents by 2050 while reducing urban sprawl. Early results show a 20% increase in public transport usage among residents, highlighting the success of TOD in promoting sustainable urban growth.

A unique metric, the “Urban Density Efficiency Index” (UDEI), could evaluate the balance between population density and infrastructure capacity. Cities scoring above 75 (on a 100-point scale) would indicate optimal resource utilization, guiding future developments.

Historically, urban sprawl has dominated Australian city planning, but experts like Nerida Conisbee argue that densification is essential for affordability and sustainability. However, cultural resistance to high-density living persists, particularly in suburban areas. Addressing this requires community engagement and education on the benefits of compact, well-planned urban spaces.

Looking forward, integrating green building standards and modular construction technologies into TOD projects can enhance affordability and environmental outcomes. Policymakers must prioritize zoning reforms and incentivize private-sector participation to ensure urban development aligns with Australia’s growing population and housing needs.

FAQ

What are the key factors driving the price growth of units compared to houses in Australia’s 2025 property market?

The price growth of units in 2025 is driven by affordability constraints, urban densification policies, and shifting buyer demographics. Units offer a cost-effective alternative to houses, particularly in capital cities where escalating detached home prices have priced out many buyers. The Reserve Bank of Australia’s anticipated interest rate cuts further enhance borrowing capacity, favoring unit affordability. Additionally, infrastructure upgrades in cities like Brisbane and Perth amplify unit demand, while higher rental yields attract investors. Downsizers and first-home buyers increasingly prioritize units for their low maintenance and proximity to amenities, reshaping Australia’s property market dynamics.

How do urban densification policies and infrastructure upgrades impact the demand for units versus houses?

Urban densification policies and infrastructure upgrades significantly boost unit demand by enhancing accessibility and livability in high-density areas. Policies promoting mixed-use developments near transport hubs, such as transit-oriented projects, make units more appealing for buyers seeking convenience and affordability. Infrastructure investments, like Brisbane’s Olympic-driven upgrades and Perth’s urban renewal, further elevate unit desirability by improving connectivity and amenities. In contrast, houses face limited benefits from these changes due to higher costs and suburban sprawl. This dynamic aligns with shifting demographics, as downsizers and younger buyers prioritize proximity to urban centers, driving sustained growth in unit demand over houses.

What role does the Reserve Bank of Australia’s interest rate policy play in shaping the affordability of units and houses?

The Reserve Bank of Australia’s interest rate policy directly influences affordability by determining borrowing costs for units and houses. Anticipated rate cuts in 2025, projected to lower the cash rate to 3.35%, expand borrowing capacity, making units more accessible for first-home buyers and investors. Units, with lower price points, benefit disproportionately as reduced rates amplify their affordability advantage over houses. Additionally, lower rates stimulate demand, particularly in urban areas with high-density developments. This policy aligns with broader economic goals, balancing inflation control with housing market stimulation, while reinforcing the growing preference for cost-effective units in Australia’s evolving property landscape.

Which Australian cities are experiencing the highest growth in unit prices, and what are the underlying reasons?

Brisbane, Perth, and Adelaide are leading Australian cities experiencing the highest growth in unit prices in 2025. Brisbane’s unit prices are forecast to rise by up to 9%, driven by strong population growth and infrastructure investments tied to upcoming international events. Perth sees similar growth, fueled by low vacancy rates and urban renewal projects. Adelaide benefits from consistent demand and limited housing supply, with unit prices projected to increase by 8-13%. These cities leverage affordability, urban densification, and enhanced connectivity, attracting first-home buyers, downsizers, and investors seeking higher rental yields, solidifying their dominance in Australia’s property market dynamics.

How can investors strategically approach the units versus houses debate in 2025 to maximize rental yields and long-term returns?

Investors in 2025 should prioritize units in high-demand urban areas to maximize rental yields, leveraging their affordability and proximity to employment hubs. Cities like Brisbane and Perth offer units with yields up to 5.3%, outperforming houses. Strategic focus on infrastructure-rich locations ensures sustained tenant demand and capital growth. Diversification across regions, such as Adelaide and Geelong, mitigates market risks while capitalizing on regional affordability. Advanced tools like PropTrack’s Market Insights enable data-driven decisions, identifying suburbs with upward rental trends. By aligning investments with demographic shifts and urban densification policies, investors can secure both immediate cash flow and long-term returns.