The Australian Property Market In 2025: Buy, Hold, Or Sell?

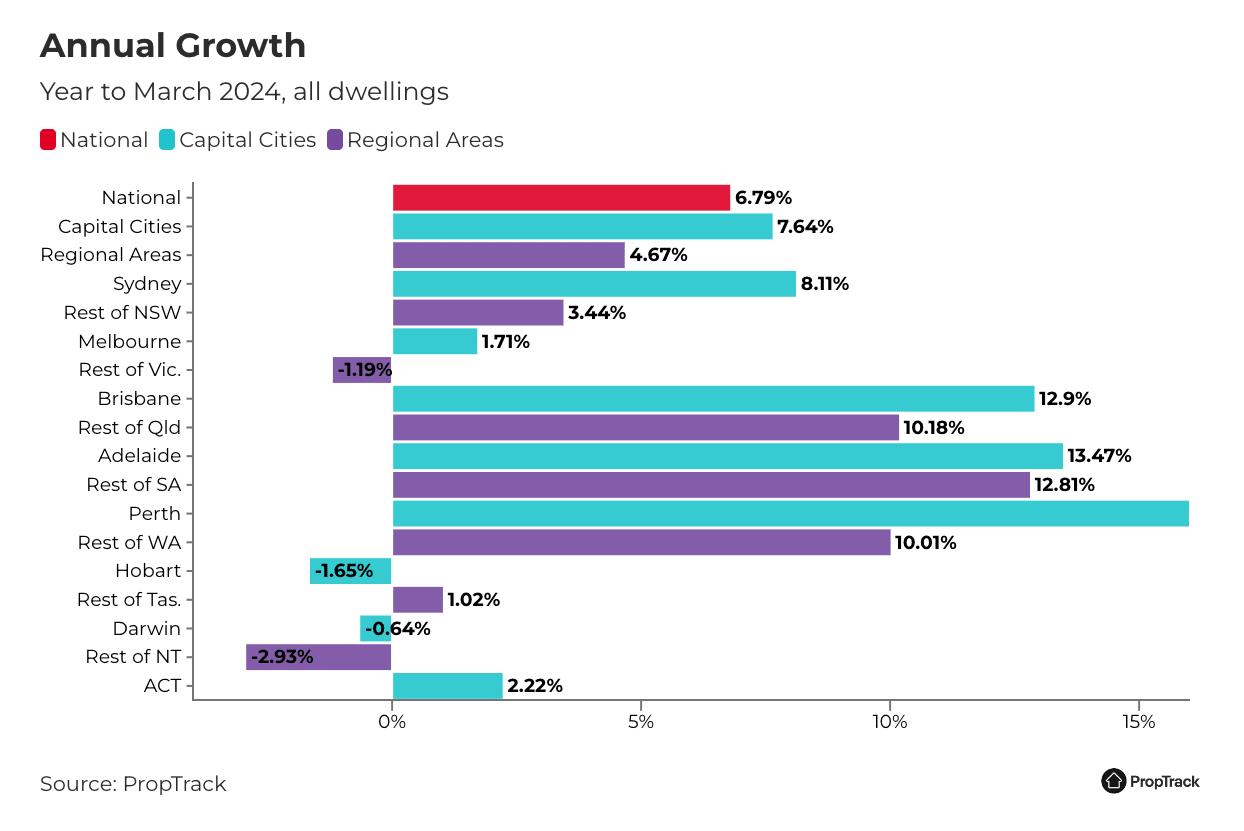

In 2025, Australia’s property market stands at a crossroads, where affordability pressures collide with unprecedented opportunities. Despite a record $11 trillion valuation in residential real estate as of late 2024, a paradox emerges: while urban centers like Sydney and Melbourne stabilize, regional markets such as Brisbane and Perth surge ahead, defying traditional investment hierarchies. This divergence raises a critical question—are we witnessing the twilight of metropolitan dominance, or the dawn of a decentralized property boom?

As interest rates edge downward and regional migration accelerates, the market’s pulse quickens, yet uncertainty looms. Will falling borrowing costs fuel a speculative frenzy, or will constrained supply temper price growth? Investors and homeowners alike must navigate this intricate landscape, balancing short-term gains against long-term resilience.

This article delves into the shifting dynamics of Australia’s property market, exploring whether 2025 is the year to buy, hold, or sell—and what these decisions reveal about the nation’s economic trajectory.

Contextual Overview and Relevance

The Australian property market in 2025 is uniquely shaped by the interplay of regional migration trends and evolving investment strategies. A critical yet underexplored factor is the role of infrastructure development in driving regional market growth. Cities like Brisbane and Perth, buoyed by government-backed projects such as the Inland Rail and renewable energy hubs, are not merely benefiting from population inflows but are also redefining the economic geography of the nation. These infrastructure investments enhance connectivity, reduce logistical costs and create employment hubs, making these regions increasingly attractive for both residential and commercial investments.

Conventional wisdom often prioritizes urban centers for their perceived stability, yet data from the Regional Movers Index reveals a 35.6% increase in migration to regional areas in late 2024. This shift challenges the long-held dominance of metropolitan markets, suggesting that affordability and lifestyle preferences are now equally critical drivers of demand.

For investors, this underscores the importance of aligning portfolios with infrastructure-led growth corridors. By targeting regions with planned developments, stakeholders can capitalize on long-term appreciation while mitigating risks associated with oversaturated urban markets. This recalibration signals a broader decentralization of economic opportunity, reshaping Australia’s property landscape.

Defining Key Concepts and Market Basics

A pivotal concept shaping the Australian property market in 2025 is the affordability threshold, which acts as a critical determinant of buyer behavior and market segmentation. This threshold, influenced by borrowing capacity, wage growth, and interest rates, has shifted significantly due to the Reserve Bank of Australia’s (RBA) cautious rate cuts, projected to reduce the cash rate by only 0.5% to 1% this year. While these reductions improve affordability marginally, they are insufficient to offset the broader challenges of stagnant wage growth and rising living costs.

One lesser-known factor amplifying affordability pressures is the hidden cost of delayed construction. Labor shortages and material price inflation have extended project timelines, increasing the final cost of new housing. This bottleneck not only exacerbates supply constraints but also inflates prices in secondary markets, where demand for existing properties surges.

Investors can leverage this dynamic by focusing on value-add opportunities in undercapitalized regions. For instance, targeting properties in areas with planned infrastructure upgrades can yield higher returns as these developments enhance local desirability. By integrating affordability metrics with regional growth indicators, stakeholders can craft resilient strategies that align with both short-term market conditions and long-term economic shifts.

Economic and Market Drivers

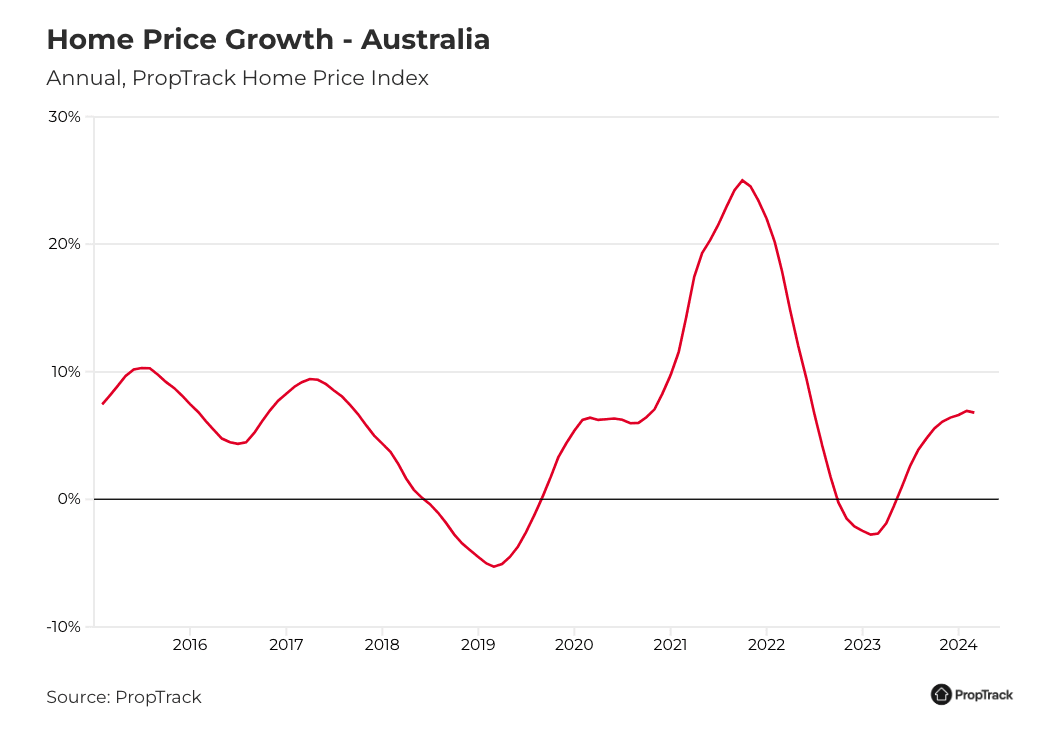

The Australian property market in 2025 is shaped by a confluence of economic forces, with interest rates, migration patterns, and infrastructure investment acting as primary drivers. While the Reserve Bank of Australia’s modest rate cuts (0.5% to 1%) have slightly eased borrowing costs , their impact is tempered by stagnant wage growth and persistent inflation. This creates a paradox where affordability improves marginally, yet purchasing power remains constrained.

A striking example is the surge in regional markets like Brisbane and Perth, where infrastructure projects such as the Inland Rail and renewable energy hubs have catalyzed economic activity. These developments not only attract population inflows but also create employment hubs, driving demand for both residential and commercial properties. In contrast, metropolitan markets like Sydney and Melbourne face saturation, with limited room for price growth.

An overlooked factor is the ripple effect of delayed construction. Prolonged timelines inflate costs, pushing buyers toward established properties in secondary markets. Investors can capitalize on this by targeting regions with robust infrastructure pipelines, aligning with long-term growth trends. This interplay of economic and market forces underscores the need for data-driven, region-specific strategies in 2025.

Image source: realestate.com.au

Influence of Interest Rates and Monetary Policy

Interest rates in 2025 are not merely a lever for borrowing costs but a barometer for broader economic sentiment. The Reserve Bank of Australia’s anticipated rate cuts, projected to lower the cash rate to 3.35% by year-end, signal a strategic pivot aimed at stimulating economic activity. However, the timing and magnitude of these cuts are critical. Delayed reductions could prolong affordability challenges, while aggressive cuts risk fueling speculative bubbles in already constrained markets.

A lesser-known dynamic is the psychological impact of rate movements. Even modest cuts can boost buyer confidence, creating a perception of improved affordability. This effect is particularly pronounced in regional markets like Adelaide and Hobart, where lower entry prices amplify the benefits of reduced borrowing costs. Conversely, in high-cost metropolitan areas, the same rate cuts may have a muted impact due to entrenched affordability ceilings.

Monetary policy also intersects with supply-side constraints. Prolonged high rates in 2024 curtailed new housing approvals, with only 160,000 dwellings approved against a target of 240,000. This shortfall exacerbates supply-demand imbalances, amplifying price pressures as rates decline.

For investors, aligning strategies with rate-sensitive markets—such as targeting regions with strong rental yields or undervalued growth corridors—offers a pathway to capitalize on these nuanced dynamics.

Supply-Demand Dynamics and Emerging Shifts

A critical yet underexplored aspect of supply-demand dynamics in 2025 is the impact of delayed construction timelines on secondary markets. Labor shortages and material cost inflation have extended project completion times, with annual housing completions projected to fall below 150,000 against a demand of 250,000. This shortfall has created a cascading effect, where buyers increasingly turn to established properties, driving up prices in secondary markets.

This phenomenon is particularly evident in regions like Newcastle and Geelong, where proximity to metropolitan hubs and planned infrastructure upgrades amplify their appeal. These areas are experiencing a surge in demand as affordability in primary urban centers like Sydney and Melbourne remains constrained. The ripple effect of this shift is reshaping traditional investment hierarchies, with secondary markets emerging as viable alternatives for both homeowners and investors.

A lesser-known factor influencing these dynamics is the hidden cost of underutilized land. Regulatory bottlenecks and zoning restrictions have left significant tracts of land undeveloped, further constraining supply. Addressing these inefficiencies through policy reforms could unlock new opportunities for development, alleviating pressure on existing housing stock.

For stakeholders, integrating regional growth indicators with supply-demand metrics offers a robust framework for decision-making. By targeting undervalued regions with strong infrastructure pipelines, investors can align with long-term market trends while mitigating risks associated with oversaturated urban markets.

Trends in Residential and Commercial Sectors

In 2025, the residential and commercial property sectors in Australia are diverging in performance, driven by distinct economic and demographic forces. The residential market, particularly in regional areas, continues to benefit from migration trends and infrastructure investments. For instance, Brisbane and Perth have seen a surge in demand due to projects like the Inland Rail and renewable energy hubs, which enhance connectivity and create employment opportunities . This has led to a 35.6% increase in regional migration, as reported in late 2024, reshaping housing demand patterns.

Conversely, the commercial sector faces a more complex landscape. While office spaces in metropolitan areas like Sydney and Melbourne struggle with high vacancy rates due to hybrid work models, industrial properties are thriving. The rise of e-commerce has driven demand for logistics hubs, with regions like Western Sydney and outer Melbourne emerging as hotspots for warehouse developments. This shift underscores the growing importance of supply chain efficiency in commercial real estate.

A common misconception is that regional growth benefits residential markets exclusively. However, commercial investments in these areas, such as co-working spaces and retail hubs, are also gaining traction. Investors can capitalize on this trend by targeting mixed-use developments in growth corridors, aligning with both residential and commercial demand trajectories.

Image source: realestate.com.au

Residential Patterns and Rental Market Outlook

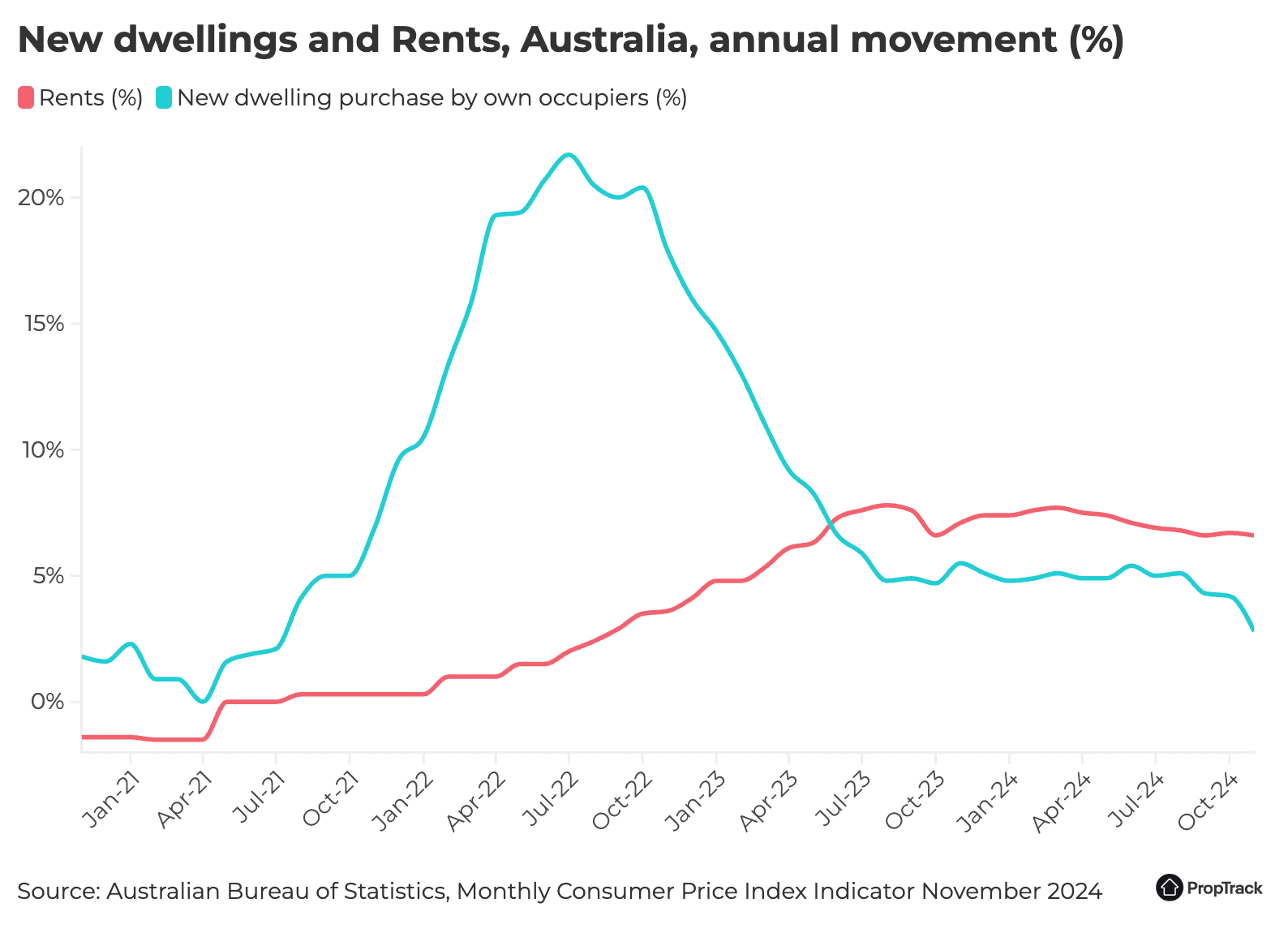

In 2025, the rental market is shaped by a confluence of demographic shifts and supply constraints, with regional areas experiencing the most pronounced effects. High migration levels, projected to exceed 500,000 annually, have intensified demand for rental properties, particularly in Brisbane, Perth, and Adelaide. These cities bolstered by infrastructure projects like renewable energy hubs, are witnessing rental yields surpassing 4.5% in key submarkets, making them attractive to investors seeking stable returns.

A lesser-known factor influencing rental patterns is the compression of household sizes. With more individuals opting for independent living, the demand for smaller, affordable units has surged. This trend is particularly evident in regions like Greater Adelaide, where vacancy rates remain critically low, driving moderate rent increases aligned with CPI. Shared living arrangements, such as co-living spaces, are also gaining traction as renters seek cost-effective solutions amidst affordability pressures.

Challenging conventional wisdom, the rental market’s tight conditions are not solely a result of supply shortages but also reflect delayed construction timelines and regulatory bottlenecks. Investors can leverage this dynamic by targeting regions with robust rental demand and aligning portfolios with emerging trends like co-living developments. This approach not only mitigates risks but also positions stakeholders to capitalize on evolving residential preferences and long-term market shifts.

Commercial Prospects and Sectoral Growth

A critical yet underexplored aspect of commercial real estate in 2025 is the emergence of mixed-use developments as a response to shifting economic and demographic trends. These projects, which integrate residential, retail, and industrial spaces, are gaining traction in regional hubs like Newcastle and Geelong. The appeal lies in their ability to diversify revenue streams while addressing localized demand for live-work-play environments. For instance, Newcastle’s proximity to Sydney and its growing logistics sector make it a prime candidate for such developments particularly as e-commerce continues to drive demand for last-mile delivery hubs.

One lesser-known driver of this trend is the synergy between infrastructure investments and commercial viability. Projects like the Inland Rail not only enhance connectivity but also reduce logistical costs, making regional areas more attractive for industrial and retail developments. This dynamic is particularly evident in Perth, where industrial rents are forecasted to grow by 2.2% to 3% annually, supported by demand from the resources sector.

Challenging conventional wisdom, the success of mixed-use developments hinges not solely on location but also on adaptive design strategies. Incorporating flexible spaces that can pivot between commercial and residential use mitigates risks associated with market volatility. Investors should prioritize regions with robust infrastructure pipelines and align with sectors like logistics and renewable energy to maximize returns.

Looking ahead, the integration of technology such as AI-driven asset management, will further enhance the efficiency and profitability of these developments, positioning them as a cornerstone of commercial growth in 2025 and beyond.

Regional Divergences and Investment Strategies

In 2025, regional property markets in Australia reveal stark divergences, driven by infrastructure investments, demographic shifts, and affordability pressures. For instance, Brisbane and Perth continue to outpace Sydney and Melbourne in growth, buoyed by projects like the Inland Rail and renewable energy hubs. These developments not only enhance connectivity but also create employment hubs, fostering sustained demand for residential and commercial properties. Brisbane’s northern suburbs. for example, have seen property values rise by over 8% year-on-year, reflecting the impact of these infrastructure upgrades.

A common misconception is that regional growth is uniform. However, areas like Hervey Bay in Queensland and Mount Barker in South Australia outperform due to their unique blend of affordability, lifestyle appeal, and proximity to economic centers. Conversely, regions lacking infrastructure pipelines or job creation initiatives risk stagnation, underscoring the importance of targeted investment strategies.

Investors should adopt a corridor-based approach, focusing on regions with planned infrastructure and strong rental yields. By aligning portfolios with these growth corridors, stakeholders can mitigate risks while capitalizing on long-term appreciation, reshaping traditional investment hierarchies.

Image source: realestate.com.au

Hotspot Analysis: Queensland, Western Australia, and Beyond

Queensland and Western Australia are emerging as pivotal hotspots in 2025, driven by a confluence of infrastructure investments, demographic shifts, and resource-driven economies. In Queensland, the Sunshine Coast Hinterland exemplifies a region where lifestyle appeal intersects with economic opportunity. Proximity to Brisbane and ongoing projects like the Bruce Highway upgrade have catalyzed property value increases of 6.5% year-on-year, while rental yields in key suburbs exceed 4.8%, attracting both investors and lifestyle-driven buyers.

Western Australia, particularly Perth’s outer suburbs, benefits from its alignment with the resources sector and renewable energy initiatives. Industrial zones near Kwinana are experiencing a surge in demand, with industrial rents forecasted to grow by 3% annually. This growth is underpinned by the state’s strategic focus on hydrogen energy hubs, which are expected to generate over 10,000 jobs by 2030, creating sustained housing demand.

A lesser-known factor is the spillover effect into secondary markets like Toowoomba and Bunbury, where affordability and infrastructure connectivity amplify their appeal. Investors should adopt a node-based strategy, targeting regions with multi-sector growth potential. By leveraging these dynamics, stakeholders can align with long-term trends while mitigating risks associated with oversaturated urban markets, positioning themselves for sustained returns in a rapidly evolving landscape.

Buy, Hold, or Sell Scenarios: Balancing Risks and Returns

A critical aspect of decision-making in 2025 revolves around timing market entry and exit in response to regional dynamics and macroeconomic shifts. For buyers, regions like Brisbane and Perth offer compelling opportunities due to infrastructure-led growth and rental yields exceeding 4.5% in key submarkets. However, the affordability threshold remains a decisive factor. Investors should prioritize properties in growth corridors with planned infrastructure upgrades, as these areas are likely to experience sustained appreciation. For instance, Brisbane’s northern suburbs have seen property values rise by over 8% year-on-year, signaling robust demand.

For those holding assets, the ripple effect of delayed construction timelines presents an opportunity to capitalize on rising secondary market prices. With annual housing completions projected to fall below 150,000 against a demand of 250,000, established properties in well-connected regions like Newcastle and Geelong are poised for continued value growth. Holding in these markets aligns with long-term resilience strategies, particularly as supply constraints persist.

Sellers, on the other hand, may find optimal conditions in oversaturated metropolitan markets like Sydney, where price stabilization limits future upside. By reallocating capital to undervalued regional hotspots, stakeholders can enhance portfolio diversification.

Actionable insight: adopt a dynamic portfolio strategy that integrates affordability metrics, infrastructure pipelines, and rental yield trends to balance risks and returns effectively, ensuring alignment with evolving market conditions.

FAQ

What are the key factors influencing the Australian property market in 2025?

Key factors shaping the Australian property market in 2025 include regional migration trends, infrastructure investments like the Inland Rail, modest interest rate cuts by the RBA, affordability thresholds, and delayed construction timelines. These elements collectively drive demand shifts, influence price growth, and redefine investment strategies across metropolitan and regional markets.

How do regional markets compare to metropolitan areas for investment opportunities in 2025?

Regional markets offer affordability strong rental yields and growth driven by infrastructure projects, but face risks tied to economic reliance on specific industries. Metropolitan areas provide long-term capital growth and stable tenant demand, though higher entry costs may limit short-term returns. Investment success depends on location, property type, and risk assessment.

What strategies should investors adopt when deciding to buy, hold, or sell in 2025?

Investors should focus on growth corridors with planned infrastructure, prioritize regions offering strong rental yields, and monitor affordability thresholds. Holding assets in secondary markets with rising demand ensures resilience while selling in oversaturated metropolitan areas allows capital reallocation to undervalued hotspots. A dynamic, data-driven portfolio strategy is essential.

How do infrastructure developments impact property values in Australia this year?

Infrastructure developments enhance connectivity, create employment hubs, and reduce logistical costs, driving demand in regions like Brisbane and Perth. Projects such as the Inland Rail and renewable energy hubs boost property values by attracting population inflows and fostering economic activity, making these areas prime targets for residential and commercial investments.

What are the risks and rewards of investing in secondary markets in 2025?

Secondary markets offer rewards like affordability, strong rental yields, and growth potential driven by infrastructure projects. However, risks include economic reliance on specific industries and limited diversification. Strategic investments in well-connected regions with robust infrastructure pipelines can mitigate risks while capitalizing on long-term appreciation and emerging demand trends.