Australia’s Housing Market Tug-of-War: Can Rate Cuts Outmuscle Trump’s Tariffs?

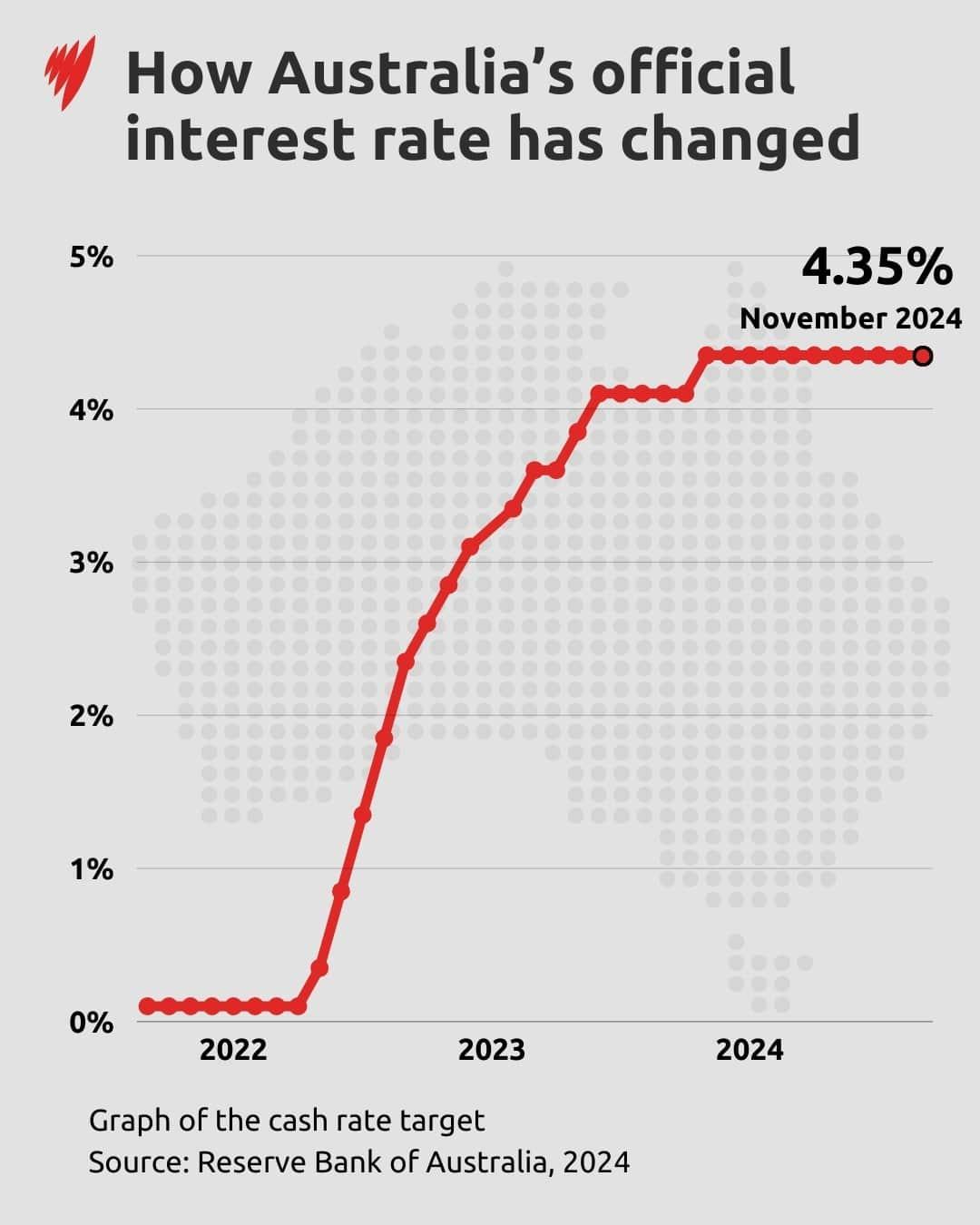

In April 2025, Australian house prices reached a record high, driven by a 0.5% interest rate cut from the Reserve Bank of Australia (RBA) just weeks earlier. Yet, this surge in property demand unfolds against a backdrop of economic turbulence—most notably, the imposition of a 10% tariff on Australian exports by the United States, with China facing an even steeper 104% rate. While rate cuts typically lower borrowing costs and stimulate housing markets, the ripple effects of these tariffs complicate the equation, influencing consumer confidence and construction costs in unexpected ways.

Tim Lawless, head of research at CoreLogic, notes that “interest rate cuts can boost borrowing capacity, but global trade disruptions often temper the optimism needed for large financial commitments.” This interplay is particularly stark in regions reliant on imported building materials, where tariffs inflate costs, potentially offsetting the benefits of cheaper mortgages.

The result is a housing market caught in a precarious balance—where monetary policy and international trade collide, reshaping the landscape for investors and first-home buyers alike.

Image source: sbs.com.au

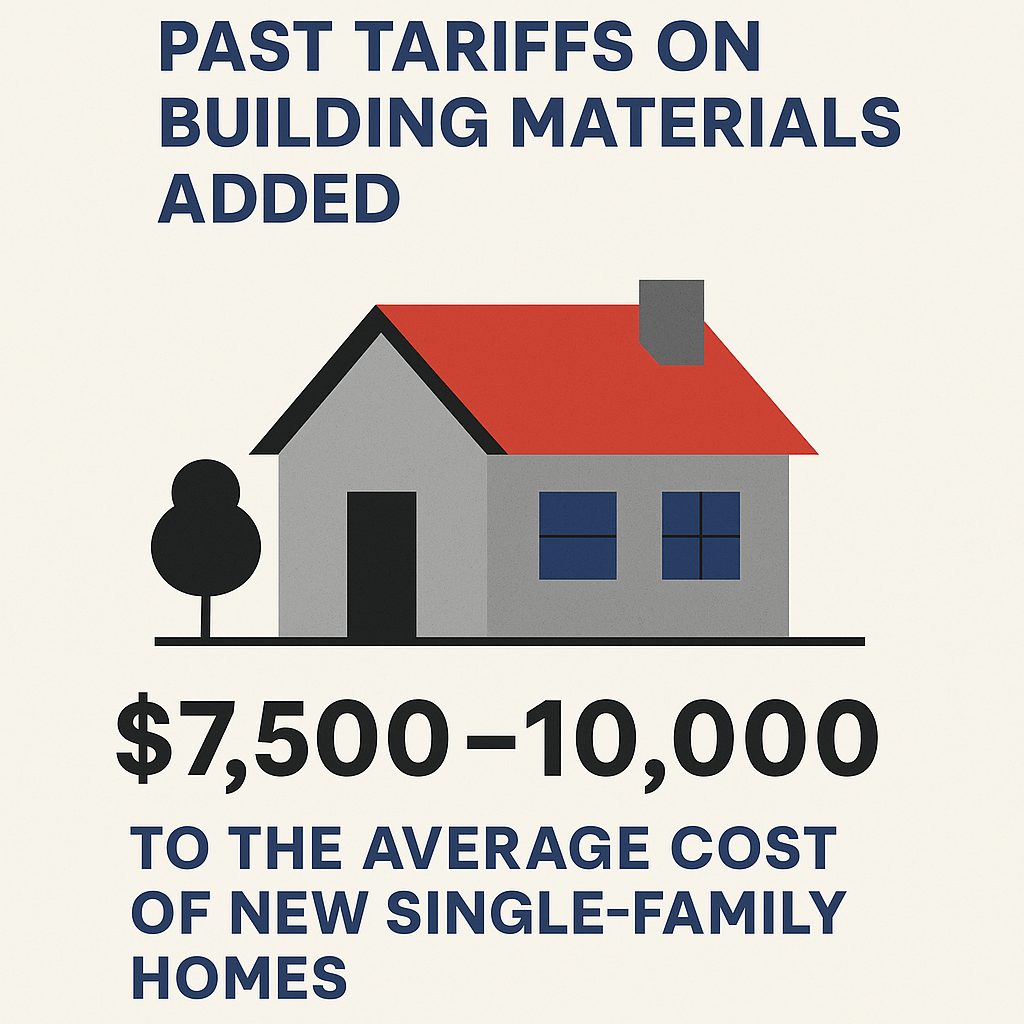

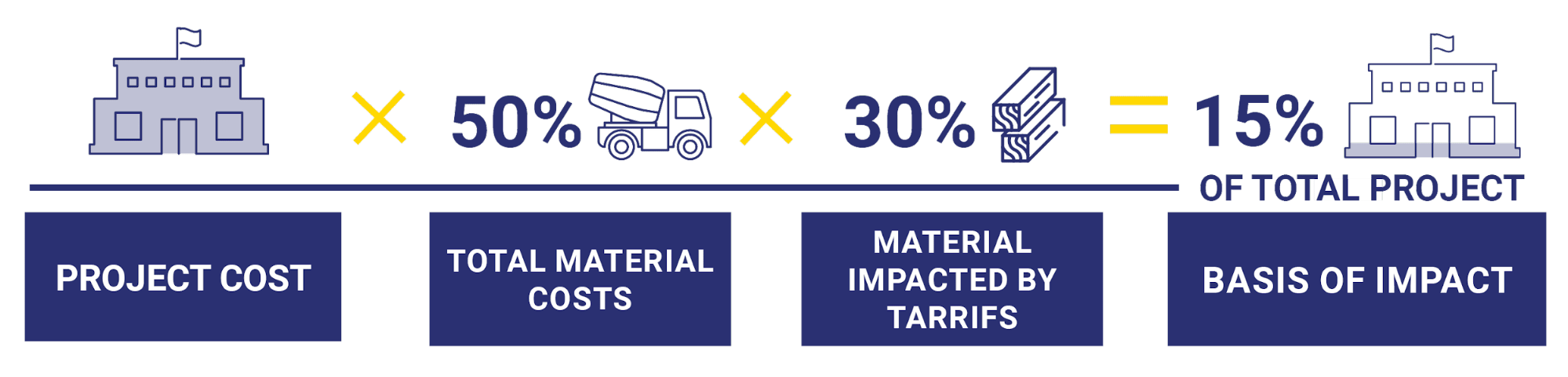

Understanding the Impact of Tariffs on Construction Costs

Tariffs on imported building materials exert a compounding effect on construction costs, extending beyond the immediate price increase. A 10% tariff, for instance, not only raises the cost of materials like steel and timber but also disrupts supply chains, leading to delays and logistical inefficiencies. These disruptions amplify costs for developers, who must navigate fluctuating timelines and resource availability, often resulting in project delays or cancellations.

The interplay between tariffs and financing conditions further complicates the landscape. While interest rate cuts reduce borrowing costs, they fail to offset the inflationary pressure tariffs impose on construction budgets. Developers face a dual challenge: balancing the benefits of cheaper loans against the unpredictability of material costs. This tension is particularly pronounced in urban centers like Sydney, where high demand for housing intensifies competition for limited resources.

“Higher material costs driven by tariffs often force developers to reassess project feasibility, particularly in markets already grappling with affordability issues.”

— Dr. Luke Hartigan, Economist, University of Sydney

A critical yet overlooked factor is the cascading impact on affordability. As developers pass increased costs to buyers, first-home purchasers are disproportionately affected, widening the gap between supply and demand. This dynamic underscores the need for targeted policy interventions to stabilize both construction and housing markets.

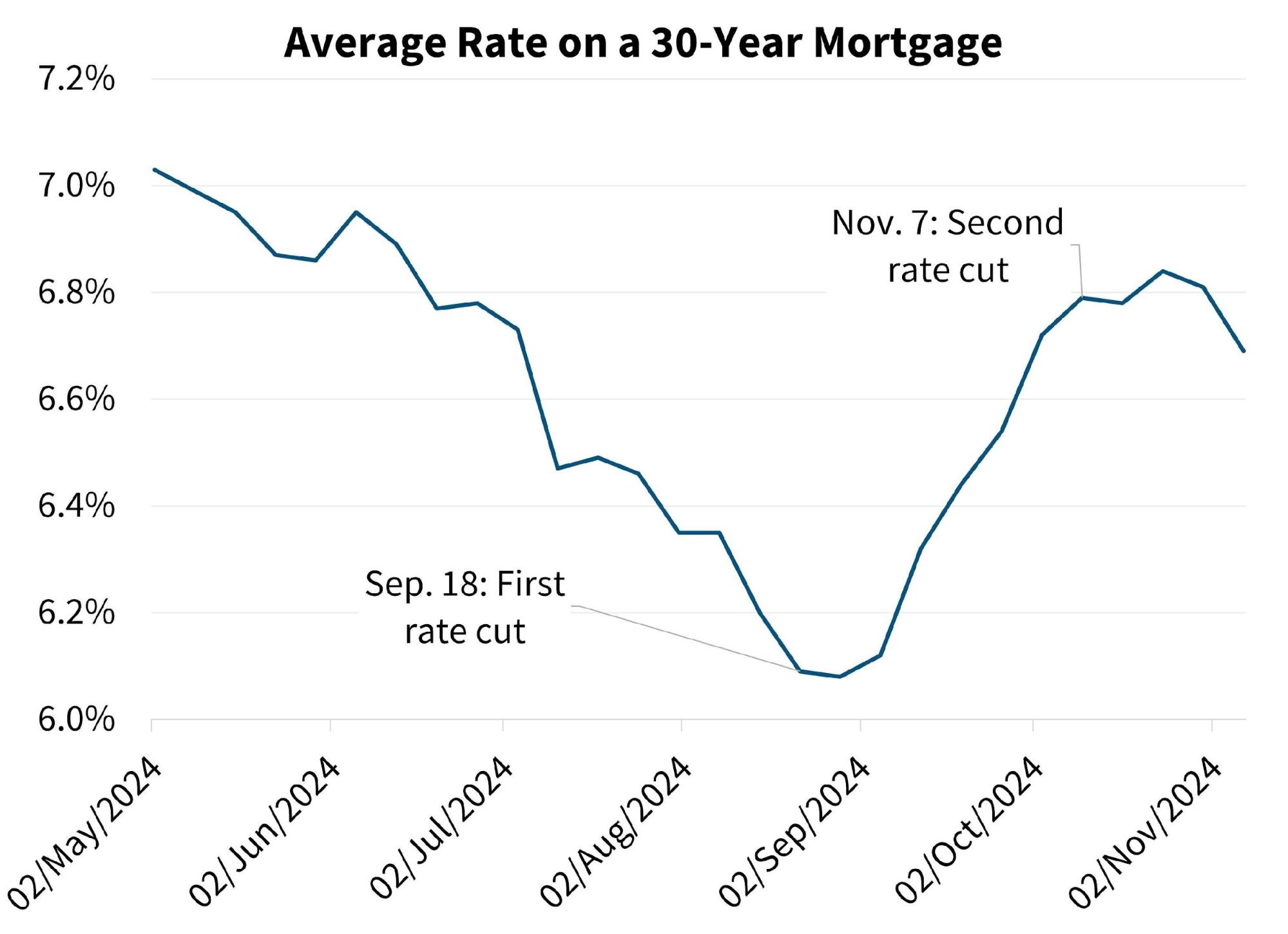

Role of Interest Rate Cuts in Stimulating Housing Demand

Interest rate cuts serve as a pivotal mechanism in reshaping housing demand by directly enhancing borrowing capacity and reducing financial strain on households. A reduction of 50 basis points, for instance, can significantly lower monthly mortgage repayments, effectively increasing disposable income and enabling broader market participation. This financial relief is particularly impactful in high-demand urban areas like Sydney, where affordability challenges are most acute.

The psychological dimension of rate cuts is equally critical. By fostering a perception of economic stability, they encourage hesitant buyers to transition from inquiry to commitment. This effect is amplified in markets already constrained by limited housing supply, where even marginal increases in buyer activity can drive competition and price growth.

However, the interplay between rate cuts and external pressures, such as tariffs, introduces complexities. While lower rates ease financing, they cannot fully counteract the inflationary impact of rising construction costs. Developers in Melbourne, for example, report that while rate cuts improve liquidity, the unpredictability of material expenses often necessitates recalibrated project budgets.

“Monetary policy’s influence on housing extends beyond affordability—it shapes market sentiment and confidence,” notes Dr. Luke Hartigan, Economist at the University of Sydney.

This nuanced dynamic underscores the dual role of rate cuts: as both a financial tool and a psychological catalyst in a volatile economic landscape.

Interplay Between Tariffs and Interest Rate Cuts

The interaction between tariffs and interest rate cuts reveals a complex economic dynamic that reshapes Australia’s housing market. Tariffs, such as the 10% imposed on Australian exports, introduce inflationary pressures by increasing the cost of imported construction materials like steel and timber. According to the Australian Bureau of Statistics, construction costs surged by 28% between 2019 and 2024, a trend exacerbated by these trade barriers. This inflation directly impacts developers’ profit margins, often forcing project delays or cancellations.

Conversely, interest rate cuts, such as the Reserve Bank of Australia’s recent 0.5% reduction, aim to counteract these pressures by lowering borrowing costs and improving liquidity. For instance, a 50-basis-point cut can reduce monthly mortgage repayments by approximately 5%, enabling broader market participation. However, this deflationary relief is insufficient to fully offset the unpredictability of material costs, particularly in urban centers like Sydney, where demand remains high.

This interplay creates a paradox: while rate cuts stimulate demand, tariffs constrain supply by inflating costs. The result is a market where affordability challenges persist, disproportionately affecting first-home buyers.

Image source: finmkt.io

Inflationary and Deflationary Pressures in the Housing Market

The simultaneous presence of inflationary and deflationary forces in Australia’s housing market creates a dynamic that challenges conventional economic models. Tariffs on imported construction materials, such as steel and timber, have driven up costs significantly, with some estimates indicating a 28% increase in material prices since 2019. This inflationary pressure directly impacts developers, who must navigate higher input costs, often leading to project delays or cancellations. These disruptions ripple through the market, constraining housing supply and amplifying affordability challenges.

On the deflationary side, interest rate cuts, such as the Reserve Bank of Australia’s recent 0.5% reduction, aim to stimulate demand by lowering borrowing costs. While this provides immediate relief to buyers—reducing monthly mortgage repayments by approximately 5%—it does not fully counteract the inflationary effects of tariffs. The mismatch between reduced financing costs and elevated construction expenses creates a fragmented market response, where demand increases but supply struggles to keep pace.

“The interplay between tariffs and rate cuts reveals a critical lag effect: while rate cuts can boost buyer activity, the inflationary impact of tariffs on construction costs delays the delivery of new housing stock,” notes Dr. Luke Hartigan, Economist at the University of Sydney.

This lag effect underscores the need for policymakers to address both demand-side and supply-side factors simultaneously, as focusing on one without the other risks perpetuating market volatility.

Regional Variations in Australia’s Housing Market

Australia’s housing market exhibits pronounced regional disparities in how tariffs and interest rate cuts interact. Urban centers like Sydney and Melbourne, heavily reliant on imported construction materials, face significant cost escalations due to tariffs. These pressures often neutralize the stimulative effects of lower borrowing costs, as developers struggle to maintain project feasibility amidst rising input expenses.

In contrast, regional markets such as Geelong and Newcastle demonstrate greater adaptability. Developers in these areas frequently source materials locally, reducing exposure to tariff-induced price volatility. This localized supply chain reliance not only stabilizes construction costs but also enables faster project timelines, allowing these regions to respond more dynamically to interest rate cuts.

“Regional markets often exhibit a surprising resilience,” notes Dr. Luke Hartigan, Economist at the University of Sydney. “Developers outside metropolitan hubs can mitigate supply chain issues by sourcing locally, which helps balance construction costs despite tariff challenges.”

However, this resilience is not without limitations. Regional areas may lack the infrastructure or workforce scale to capitalize fully on increased demand, creating bottlenecks in housing supply. This divergence underscores the need for region-specific policy interventions that address both supply chain vulnerabilities and demand-side pressures, ensuring balanced growth across Australia’s diverse housing landscape.

Global Economic Implications and Australia’s Position

The imposition of U.S. tariffs, particularly the 10% rate on Australian exports, has created a ripple effect that extends far beyond trade balances. These measures disrupt global supply chains, inflating costs for imported goods and materials critical to Australia’s construction sector. For instance, the Australian Bureau of Statistics reported a 28% rise in construction material costs between 2019 and 2024, a trend exacerbated by tariff-induced price volatility. This inflationary pressure not only constrains developers but also undermines the Reserve Bank of Australia’s (RBA) efforts to stabilize housing affordability through interest rate cuts.

A counterintuitive dynamic emerges when considering the Australian dollar’s depreciation, which has made local property more attractive to foreign investors. According to CoreLogic, international buyers accounted for a 12% increase in high-value property transactions in Sydney and Melbourne during the first quarter of 2025. However, this influx of foreign capital risks further inflating prices, exacerbating affordability challenges for domestic buyers.

This interplay highlights Australia’s precarious position: balancing global trade disruptions with domestic monetary policy requires precision. Missteps could amplify housing market volatility, underscoring the need for coordinated fiscal and trade strategies.

Image source: axiasinc.com

Repercussions of U.S. Tariffs on Global Trade

The cascading effects of U.S. tariffs extend beyond immediate cost increases, fundamentally altering global supply chain dynamics. A 10% tariff on Australian exports, for instance, not only raises prices but also disrupts the intricate logistics networks that underpin international trade. These disruptions manifest in delayed shipments, increased warehousing costs, and a shift in sourcing strategies, forcing businesses to adapt to a less predictable environment.

One critical mechanism at play is the reallocation of trade flows. As tariffs make certain imports less viable, countries like Australia must pivot to alternative markets or domestic production. However, domestic substitutes often lack the economies of scale and efficiency of global suppliers, leading to higher baseline costs. This shift is particularly pronounced in sectors like construction, where imported materials such as steel and timber are integral. The resulting price volatility complicates project planning and undermines the Reserve Bank of Australia’s (RBA) efforts to stabilize housing affordability through interest rate cuts.

“Tariffs inject a layer of uncertainty that disrupts not just pricing but the entire rhythm of supply chains,” notes Dr. Luke Hartigan, Economist at the University of Sydney.

This complexity underscores a critical insight: tariffs are not merely economic tools but systemic disruptors. Addressing their impact requires a dual focus on mitigating immediate cost pressures and fostering long-term supply chain resilience.

The Reserve Bank of Australia’s Balancing Act

The Reserve Bank of Australia (RBA) faces a unique challenge in reconciling the inflationary pressures of global tariffs with the deflationary intent of interest rate cuts. This balancing act is particularly critical in a housing market where construction costs, driven by tariffs on imported materials, directly influence affordability and supply dynamics. The RBA’s approach highlights the intricate interplay between monetary policy and external economic shocks, requiring precision to avoid exacerbating market volatility.

One key mechanism is the monetary transmission process, where rate cuts aim to lower borrowing costs and stimulate demand. However, tariffs disrupt this process by inflating input costs for developers, creating a lag in supply response. For instance, while a 0.5% rate cut can reduce mortgage repayments by approximately 5%, the concurrent rise in construction costs often offsets these gains, particularly in urban centers like Sydney.

“The RBA’s challenge lies in navigating conflicting forces—stimulating demand while mitigating cost-driven supply constraints,” explains Dr. Luke Hartigan, Economist at the University of Sydney.

This dynamic underscores the need for complementary fiscal measures, such as subsidies for local material production, to enhance the effectiveness of monetary policy. Without such interventions, the RBA’s efforts risk being undermined by external cost shocks, perpetuating affordability challenges.

Real-World Implications for Homeowners and Investors

The interplay between tariffs and interest rate cuts creates a dual-edged environment for homeowners and investors, where opportunities and risks coexist. For instance, a 0.5% interest rate cut can reduce annual mortgage repayments on a $1 million loan by approximately $7,600, according to CoreLogic. This financial relief enhances liquidity, enabling investors to expand portfolios and homeowners to refinance under more favorable terms. However, the inflationary impact of tariffs on construction materials, which have surged by 28% since 2019, complicates this dynamic by inflating property development costs.

A counterintuitive trend emerges in regional markets like Newcastle, where reliance on locally sourced materials shields developers from tariff-induced price volatility. This resilience contrasts sharply with urban centers like Sydney, where higher costs suppress new housing supply, intensifying competition and driving up prices.

Ultimately, this tug-of-war underscores the need for strategic foresight. Investors must weigh short-term gains from rate cuts against long-term risks tied to global trade disruptions, while homeowners face heightened affordability challenges amidst constrained supply.

Image source: fanniemae.com

Potential Housing Price Trends in Major Cities

In cities like Sydney and Melbourne, the interplay between interest rate cuts and tariff-induced cost pressures creates a complex dynamic shaping housing price trends. While rate cuts have enhanced borrowing capacity—saving homeowners with $1 million mortgages approximately $7,600 annually—this financial relief has intensified competition in these high-demand markets. However, the less visible but equally critical factor is the strain on new housing supply caused by rising construction costs. A 10% tariff on essential materials like steel and timber has significantly inflated project budgets, leading to delays and reduced developer activity.

This supply-side constraint is particularly pronounced in urban centers where demand consistently outpaces availability. Developers face a challenging environment where the benefits of lower borrowing costs are offset by unpredictable material expenses. According to Dr. Luke Hartigan, an economist at the University of Sydney, “Monetary policy provides short-term relief, but when material costs remain volatile, the long-term impact on supply—and thus housing prices—is less predictable.”

The result is a market where initial price rallies driven by increased buyer activity may be unsustainable. This underscores the importance of addressing both demand-side incentives and supply-side bottlenecks to ensure long-term market stability.

Impact of Economic Conditions on Housing Market Growth

Economic conditions exert a profound influence on housing market growth, particularly through their dual impact on demand and supply dynamics. While interest rate cuts can immediately enhance borrowing capacity, their effectiveness is often constrained by external economic shocks, such as tariffs. For instance, a 10% tariff on imported construction materials not only inflates costs but also disrupts supply chains, creating delays that ripple through the housing market. This interplay highlights a critical tension: monetary policy may stimulate demand, but without stable economic conditions, supply-side responses remain sluggish.

A key mechanism at play is the lag between financial relief for buyers and the materialization of new housing stock. Developers, facing elevated costs and uncertain timelines, often delay projects, undermining the short-term benefits of rate cuts. In Sydney, where housing supply is already constrained, this delay exacerbates affordability challenges.

“Economic stability is the cornerstone of effective monetary policy. Without it, rate cuts risk amplifying market volatility rather than fostering growth,” notes Dr. Luke Hartigan, Economist at the University of Sydney.

This dynamic underscores the need for integrated policy approaches that address both demand stimulation and supply stabilization, ensuring that economic interventions translate into sustainable market growth.

FAQ

How do Trump’s tariffs impact Australia’s housing market and construction costs?

Trump’s tariffs significantly influence Australia’s housing market by escalating construction costs and disrupting supply chains. With a 10% tariff on steel and aluminum imports, developers face higher material expenses, leading to project delays or cancellations. These increased costs ripple through the market, reducing housing supply and intensifying affordability challenges. Additionally, the tariffs’ broader economic impact, including inflationary pressures and weakened consumer confidence, further complicates market dynamics. This interplay between global trade policies and local construction challenges underscores the critical need for strategic interventions to mitigate the adverse effects on Australia’s housing sector and maintain market stability.

What role do Reserve Bank of Australia’s interest rate cuts play in countering tariff-induced inflation?

The Reserve Bank of Australia’s interest rate cuts aim to counter tariff-induced inflation by reducing borrowing costs and enhancing liquidity in the housing market. Lower rates increase purchasing power, enabling broader market participation despite rising construction expenses caused by tariffs. This monetary policy also fosters economic confidence, encouraging investment and mitigating the dampening effects of global trade disruptions. However, the effectiveness of rate cuts is limited when inflationary pressures from tariffs persist, particularly in urban centers where demand outpaces supply. Coordinated fiscal measures, alongside rate adjustments, are essential to address both affordability challenges and supply constraints in Australia’s housing market.

Why is the interplay between global trade policies and monetary policy critical for Australia’s housing affordability?

The interplay between global trade policies and monetary policy is critical for Australia’s housing affordability as it directly impacts both supply and demand dynamics. Tariffs on imported materials inflate construction costs, reducing housing supply and exacerbating affordability issues. Simultaneously, the Reserve Bank of Australia’s interest rate cuts aim to stimulate demand by lowering borrowing costs. However, this duality creates a paradox where increased demand clashes with constrained supply, driving prices higher. Addressing this requires a synchronized approach, combining monetary policy with trade and fiscal strategies, to stabilize costs, enhance supply chains, and ensure sustainable housing affordability across Australia.

What are the regional disparities in how tariffs and rate cuts affect housing markets across Australia?

Regional disparities in Australia’s housing markets arise from varying dependencies on imported materials and local economic conditions. Urban centers like Sydney and Melbourne, reliant on global supply chains, face heightened construction costs due to tariffs, limiting the effectiveness of interest rate cuts in boosting supply. Conversely, regional areas such as Newcastle and Geelong benefit from localized material sourcing, mitigating tariff impacts and enabling quicker responses to rate reductions. However, these regions often lack the infrastructure to fully capitalize on increased demand. Addressing these disparities requires tailored policies that balance supply chain resilience with equitable access to affordable housing nationwide.

How can policymakers balance the effects of tariffs and rate cuts to stabilize Australia’s housing market?

Policymakers can stabilize Australia’s housing market by integrating monetary, fiscal, and trade strategies to counteract the dual effects of tariffs and rate cuts. Subsidizing local production of construction materials can reduce reliance on imports, mitigating tariff-induced cost inflation. Simultaneously, targeted fiscal measures, such as grants for first-home buyers, can address affordability challenges exacerbated by rising prices. Complementing these efforts, the Reserve Bank of Australia’s interest rate cuts should be calibrated to stimulate demand without overheating the market. A coordinated approach ensures that both supply constraints and demand pressures are managed, fostering long-term stability and affordability in Australia’s housing sector.