Post-Election Property Landscape: New Opportunities for Australian Investors

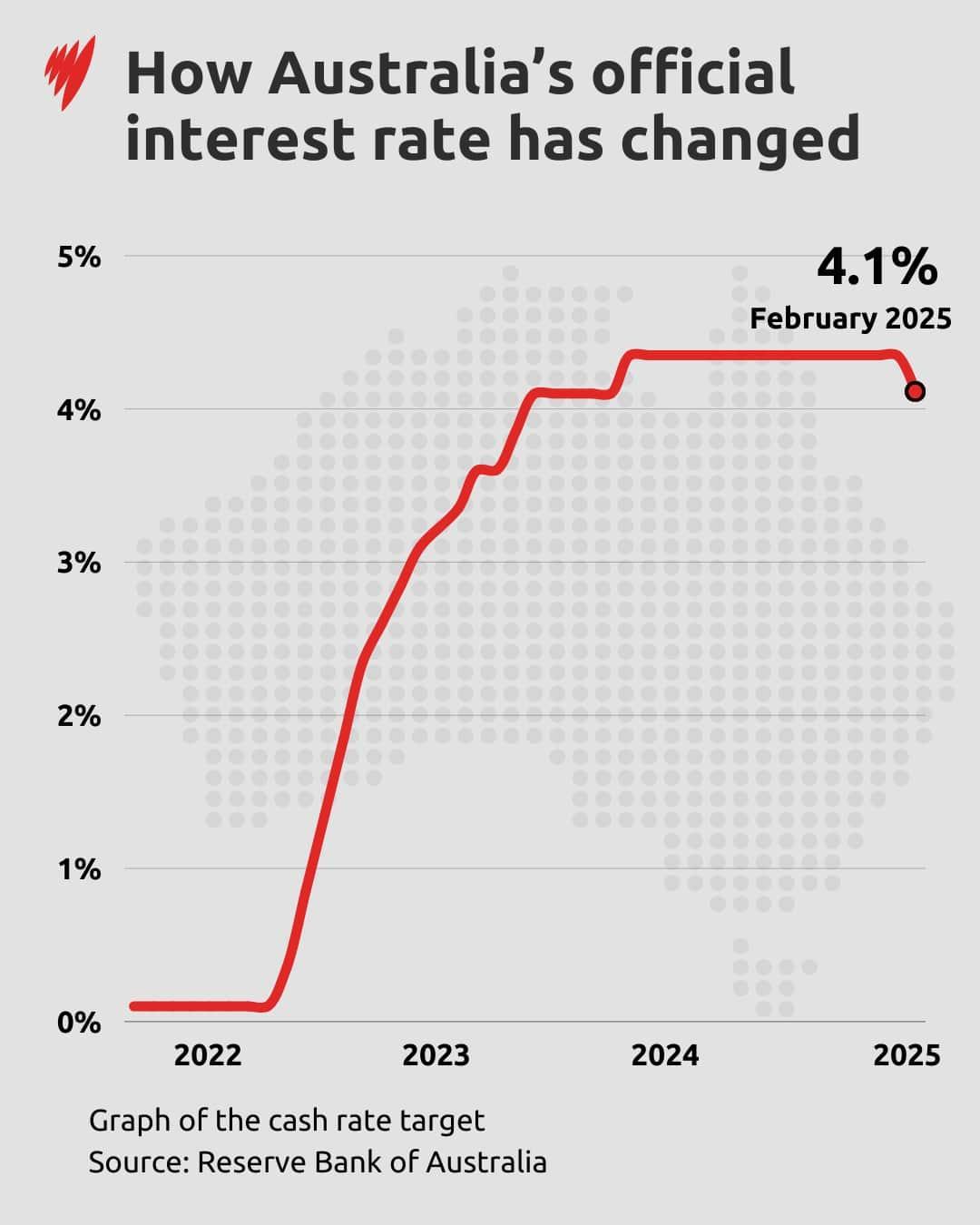

In the week following Labor’s decisive May 3, 2025, election victory, auction clearance rates in Melbourne surged to 74.4%—the highest in two years—while buyer inquiries spiked by 30% on Sunday alone, according to BresicWhitney CEO Thomas McGlynn. This immediate market response underscores the profound impact of political stability on investor confidence, particularly as the Reserve Bank of Australia prepares for a widely anticipated rate cut on May 20.

Yet, beneath the surface of this apparent optimism lies a more intricate dynamic. Supply constraints remain acute, with Western Sydney producing just 22.5% of its annual housing needs, a shortfall mirrored across other high-demand regions. Analysts predict that Labor’s expansive housing policies, including the Help to Buy program, could drive property prices up by 8-15%—but only after a lag period that may leave early movers at a distinct advantage.

This convergence of political clarity, fiscal policy shifts, and structural imbalances is reshaping Australia’s property market in ways that demand both urgency and strategic foresight.

Image source: sbs.com.au

Impact of Political Cycles on Real Estate

Political cycles exert a nuanced influence on real estate, particularly through the interplay of policy clarity and market sentiment. While elections often introduce short-term volatility, the immediate aftermath of a decisive result can catalyze rapid shifts in investor behavior. This phenomenon is especially pronounced in regions with constrained supply, where even minor policy adjustments can amplify price dynamics.

One critical mechanism is the reduction of transaction delays in response to political certainty. Research from Domain highlights that heightened policy uncertainty correlates with an 8.08% decline in property sales, yet this effect dissipates swiftly once electoral outcomes are resolved. For instance, following the 2019 federal election, market activity rebounded sharply as confidence in property stocks surged, underscoring the importance of clarity over prolonged ambiguity.

However, the practical application of this insight reveals complexities. Investors must navigate the lag between policy announcements and tangible impacts, such as housing supply initiatives. As property strategist Arjun Paliwal notes, “The window between policy clarity and market adjustment is where strategic opportunities lie.”

This dynamic underscores the need for a dual approach: leveraging immediate sentiment-driven opportunities while positioning for long-term structural shifts. By integrating these strategies, investors can mitigate risks and capitalize on the cyclical nature of political influence.

Key Policy Changes Affecting Investors

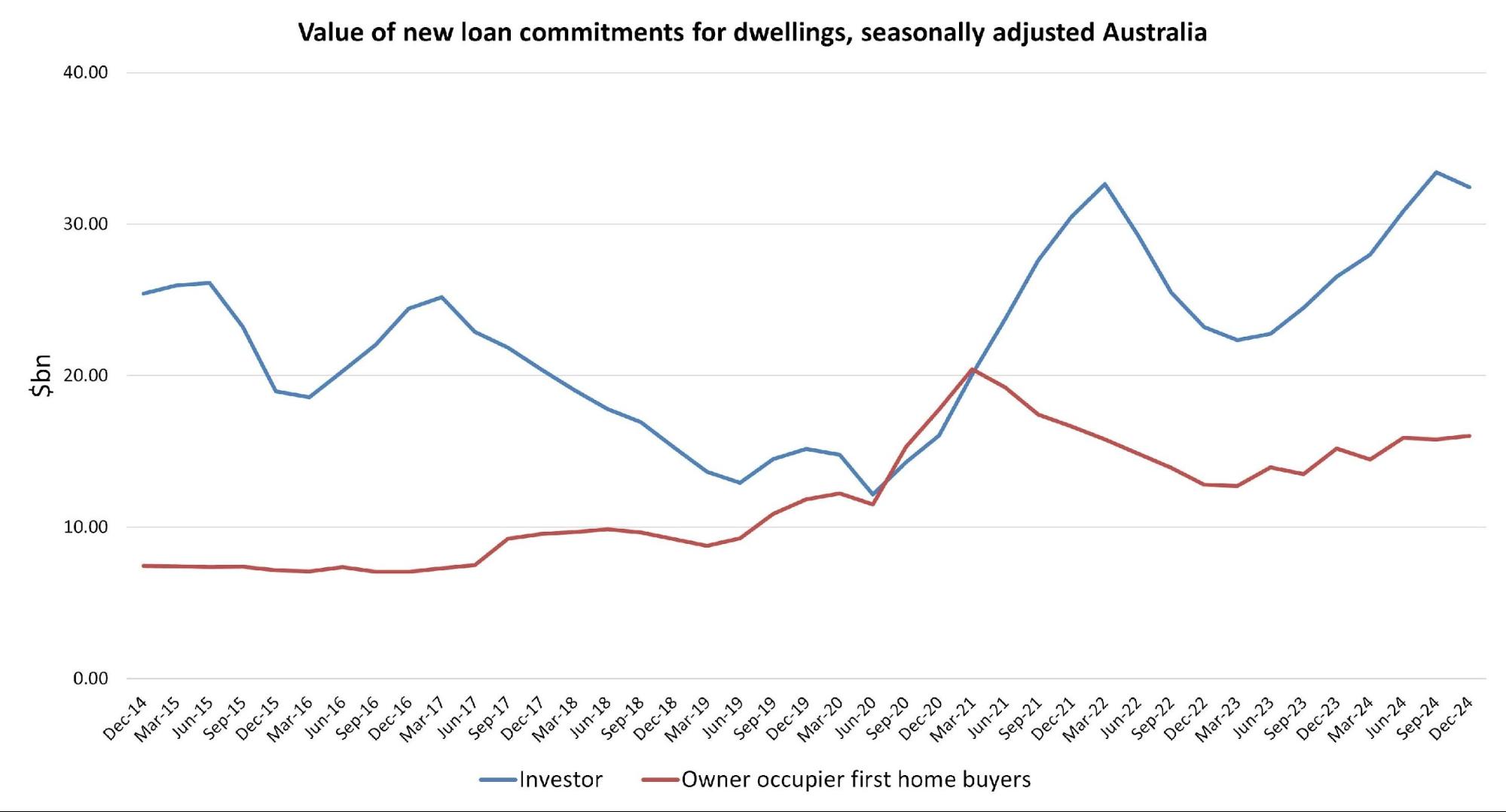

The introduction of the 5% deposit scheme and extended 40-year mortgage terms represents a transformative shift in property investment dynamics. While these policies are often celebrated for improving accessibility, their deeper implications for investors reveal a complex interplay of liquidity, risk, and long-term financial planning. By lowering entry barriers, these measures stimulate immediate demand, particularly in markets with constrained supply. However, the extended mortgage terms introduce a nuanced trade-off: reduced monthly repayments at the cost of significantly higher lifetime interest expenses.

A comparative analysis highlights the strengths and weaknesses of these approaches. The 5% deposit scheme accelerates market entry, enabling investors to leverage capital more effectively. Yet, it also amplifies competition in lower price brackets, potentially inflating property values. Conversely, the 40-year mortgage term offers cash-flow advantages but may deter investors focused on maximizing equity growth due to prolonged debt servicing.

Contextual factors, such as regional supply shortages and infrastructure development, further influence the effectiveness of these policies. For instance, areas with robust transport links and lifestyle appeal are likely to see heightened demand, intensifying price pressures.

“These policies reshape not just affordability but the entire investment calculus, requiring a recalibration of strategies to balance short-term liquidity with long-term returns.”

— Dr. Nicola Powell, Chief of Research, Domain

This evolving landscape underscores the need for investors to adopt adaptive strategies that align with both immediate opportunities and enduring financial objectives.

Analyzing Market Trends and Investor Sentiment

Investor sentiment in Australia’s post-election property market reveals a dynamic interplay between macroeconomic signals and localized market conditions. A striking example is the 74.4% auction clearance rate recorded in Melbourne, which underscores the immediate impact of political stability on buyer confidence. This surge, however, is not uniform across regions. In Western Sydney, where housing production meets only 22.5% of annual demand, constrained supply continues to amplify price pressures, creating a stark contrast to more balanced markets.

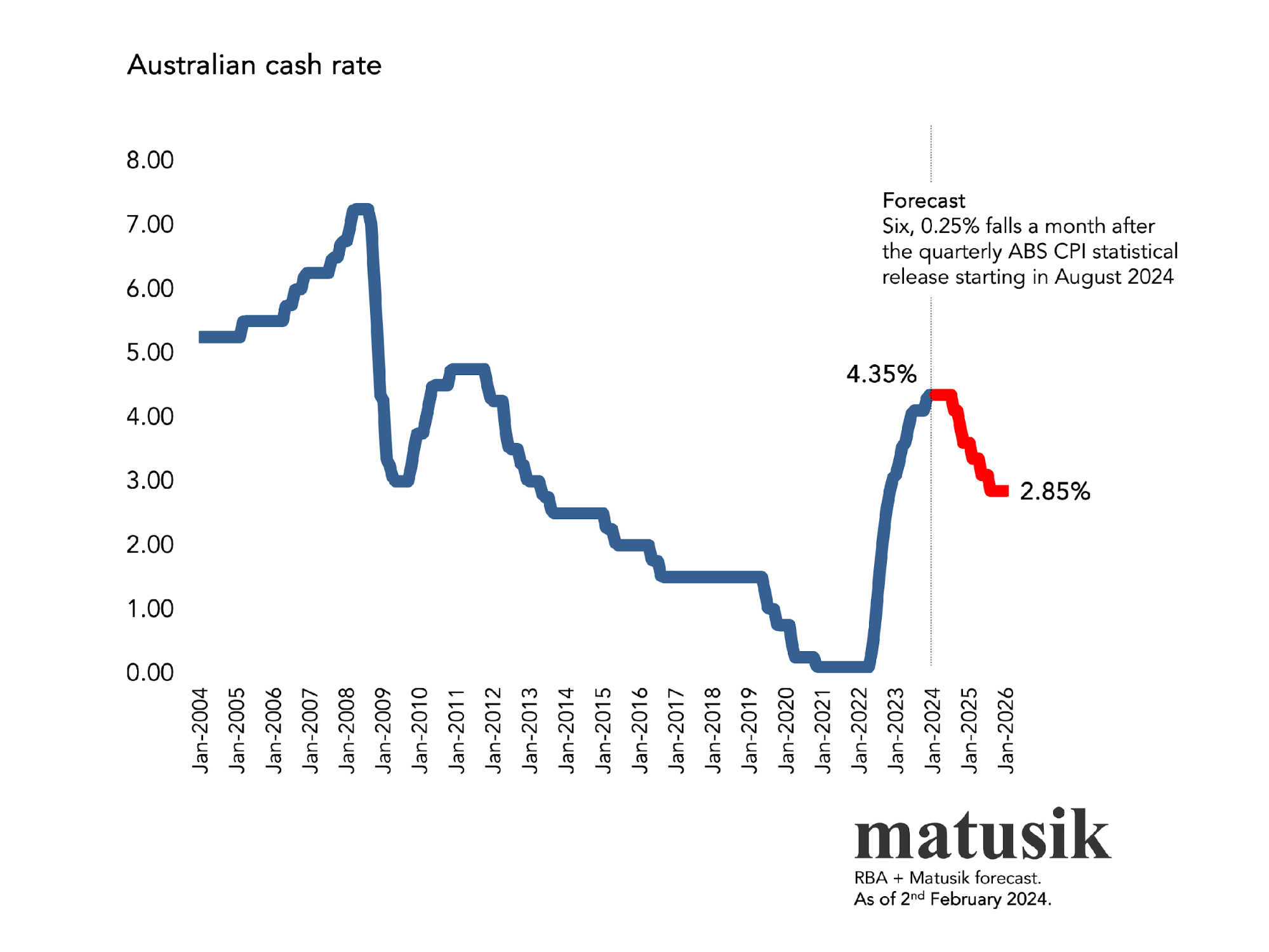

Quantitative shifts in interest rates further shape sentiment. The Reserve Bank of Australia’s anticipated rate cut on May 20 is expected to lower borrowing costs, with major lenders already offering variable rates below 5.75%. This preemptive adjustment has spurred urgency among investors, as reduced financing costs enhance purchasing power. However, the lag between rate cuts and their full economic impact highlights a critical window for strategic acquisitions.

Investor behavior mirrors a “domino effect,” where macroeconomic changes trigger localized responses. For instance, infrastructure upgrades in growth corridors often magnify demand, creating ripple effects that extend beyond immediate urban centers. This nuanced relationship between policy, sentiment, and regional dynamics demands a sophisticated, data-driven approach to property investment.

Image source: apimagazine.com.au

Regional Variations in Property Demand

Localized infrastructure development plays a pivotal role in shaping regional property demand, often overshadowing broader market trends. For instance, the Sunshine Coast in Queensland has experienced a surge in property interest following the completion of the $1.8 billion Bruce Highway upgrade. This project not only improved connectivity to Brisbane but also enhanced the region’s appeal for remote workers and lifestyle-driven buyers. Such targeted investments demonstrate how infrastructure can act as a catalyst for regional growth, creating pockets of high demand even in otherwise stable markets.

A critical factor influencing these variations is the disparity in how quickly regions respond to policy changes. Areas like Newcastle, with established transport links and economic diversification, tend to see immediate price escalations following government incentives. In contrast, emerging suburbs with underdeveloped amenities often experience delayed reactions, as buyers wait for tangible improvements. This lag creates opportunities for investors willing to adopt a long-term perspective, capitalizing on undervalued properties before demand peaks.

“Infrastructure projects are the linchpin of regional property growth, transforming accessibility into tangible value.”

— Dr. Nicola Powell, Chief of Research, Domain

However, this strategy is not without risks. Over-reliance on projected infrastructure benefits can lead to overvaluation if timelines or outcomes fall short. Investors must balance optimism with rigorous due diligence, ensuring that regional opportunities align with both current realities and future potential.

Interest Rate Movements and Investment Decisions

Interest rate movements fundamentally reshape the competitive landscape for property investors, particularly in supply-constrained markets. A reduction in rates, even by a fraction, can significantly enhance borrowing capacity, but the benefits are not evenly distributed. Regions with entrenched supply shortages, such as Western Sydney, experience amplified price pressures as increased purchasing power collides with limited availability.

The mechanics of this dynamic are rooted in the interplay between financing costs and market psychology. Lower rates reduce monthly repayment burdens, enabling buyers to stretch their budgets. However, this often triggers a surge in demand that outpaces supply, driving up property values. For instance, post-election rate adjustments in 2023 saw a 12% increase in median property prices in high-demand urban corridors, underscoring the disproportionate impact on constrained regions.

“Rate cuts are not just financial levers; they are psychological triggers that accelerate market activity,”

— Dr. Nicola Powell, Chief of Research, Domain

Yet, this environment presents risks. Investors who over-leverage during rate cuts may face challenges if rates rise again or if supply constraints persist, limiting long-term capital growth. To navigate these complexities, strategic timing and regional analysis are essential. By targeting undervalued areas poised for infrastructure upgrades, investors can mitigate risks while capitalizing on the liquidity advantages of lower rates.

Strategic Investment Opportunities

The post-election property landscape presents a rare alignment of political stability, fiscal incentives, and market liquidity, creating a fertile ground for strategic investments. According to CoreLogic, auction clearance rates in key urban centers have surged by over 20% since May 3, signaling heightened buyer activity. This momentum, coupled with the Reserve Bank of Australia’s anticipated rate cut on May 20, underscores a critical window for investors to secure properties before broader market adjustments drive prices higher.

One overlooked opportunity lies in leveraging policy-driven demand shifts. Labor’s expanded First Home Guarantee Scheme, set to launch in January 2026, is expected to inject thousands of new buyers into the market. Investors targeting properties within first-home buyer price brackets could capitalize on this influx, particularly in regions with robust infrastructure and limited supply. For example, areas like Brisbane’s outer suburbs, where median prices remain accessible, are poised for significant appreciation.

This environment demands precision. By combining data-driven regional analysis with an understanding of policy timing, investors can position themselves to maximize both short-term gains and long-term capital growth.

Image source: morningstar.com.au

Timing Market Entry for Maximum Returns

Strategic timing in property investment hinges on recognizing the subtle interplay between policy clarity and market inertia. Post-election periods, particularly those marked by decisive outcomes, create a unique environment where investor activity accelerates before the full impact of policy changes materializes. This brief window offers a tactical advantage for those who can act decisively.

One critical mechanism is the lag between policy announcements and their tangible effects on market dynamics. For instance, while Labor’s expanded First Home Guarantee Scheme is set to launch in January 2026, the immediate post-election phase provides a rare opportunity to secure properties before heightened demand inflates prices. Historical data from similar policy rollouts reveals that early movers often benefit from lower competition and more favorable valuations.

“The immediate aftermath of an election is a period of recalibration, where market sentiment shifts faster than pricing structures,”

— Dr. Nicola Powell, Chief of Research, Domain

However, this strategy is not without risks. Investors must account for regional disparities in supply constraints and infrastructure readiness, which can amplify or dampen price movements. By integrating predictive analytics with localized market insights, investors can navigate these complexities, ensuring that their timing aligns with both short-term opportunities and long-term growth trajectories.

Leveraging Policy-Driven Demand

The strategic exploitation of policy-driven demand requires a nuanced understanding of how fiscal measures interact with localized market dynamics. Labor’s housing policies, such as the expanded First Home Guarantee Scheme, create a predictable influx of first-time buyers. However, the real opportunity lies in identifying regions where these policies intersect with existing supply constraints, amplifying price growth potential.

A critical technique involves leveraging predictive analytics to assess the lag between policy announcements and market adjustments. For instance, investors can analyze metrics like building approval rates and infrastructure project timelines to pinpoint areas poised for rapid appreciation. This approach contrasts with reactive strategies, which often miss the initial surge in demand.

Contextual factors, such as zoning regulations and demographic shifts, further influence outcomes. For example, regions with restrictive planning laws may experience sharper price increases due to limited new supply. Conversely, areas with proactive development policies may see more gradual growth, offering long-term stability.

“Policy-driven demand is not just a market catalyst; it’s a signal for strategic positioning,”

— Dr. Nicola Powell, Chief of Research, Domain

By integrating these insights, investors can act preemptively, securing undervalued properties before broader market adjustments, thereby maximizing both short-term gains and sustained capital growth.

Challenges and Considerations for Investors

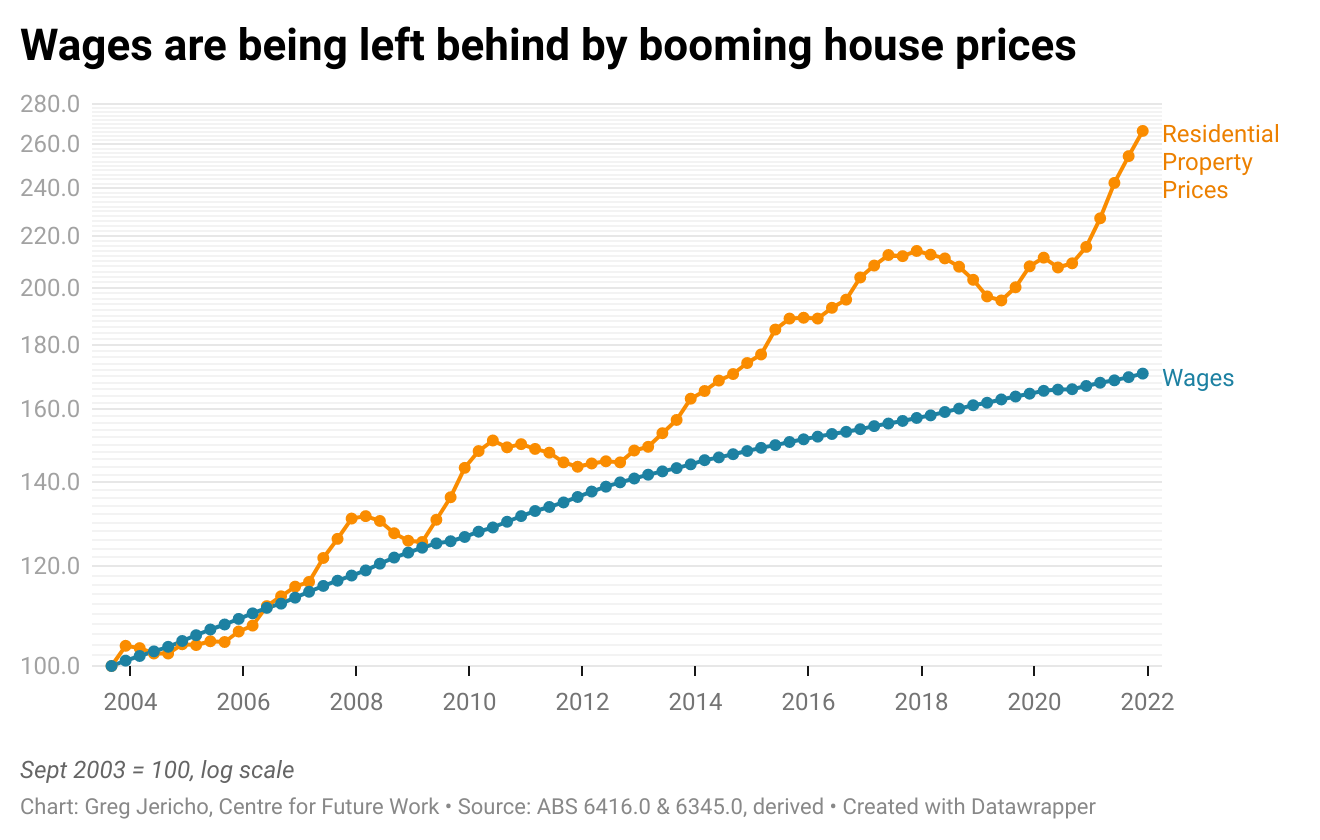

Investors navigating Australia’s post-election property market face a complex interplay of affordability constraints, supply shortages, and evolving financial products. With the median house price-to-income ratio at 8.2x in major cities, affordability remains a critical barrier, disproportionately affecting first-time buyers and renters. This imbalance, compounded by supply deficits—such as Western Sydney meeting only 22.5% of annual housing needs—intensifies competition and inflates prices.

Extended mortgage terms, while improving short-term cash flow, introduce long-term financial risks. For instance, a 40-year loan accrues significantly higher lifetime interest compared to a 30-year term, reducing overall profitability. Experts like Dr. Nicola Powell of Domain highlight the need for rigorous cost-benefit analysis to mitigate these risks.

Strategic investors must integrate predictive analytics and regional insights to identify undervalued opportunities, balancing immediate gains with sustainable growth trajectories.

Image source: futurework.org.au

Supply Constraints and Affordability Issues

Supply constraints in Australia’s property market are not merely a function of limited land or rising construction costs; they represent a systemic bottleneck exacerbated by regulatory inefficiencies and demographic pressures. In regions like Western Sydney, where housing production meets only a fraction of annual demand, these constraints amplify affordability challenges, creating a feedback loop of rising prices and reduced accessibility.

A critical yet underexplored dynamic is the interplay between supply shortages and policy-driven demand. For instance, initiatives like low-deposit schemes often stimulate buyer activity without addressing the underlying supply deficit, inadvertently driving prices higher. This phenomenon underscores the importance of aligning demand-side policies with robust supply-side interventions to achieve meaningful affordability improvements.

Comparative analysis reveals that regions with proactive planning frameworks, such as streamlined approval processes, tend to mitigate supply constraints more effectively. However, these approaches are not universally applicable; areas with entrenched zoning restrictions or high population growth face unique challenges that require tailored solutions.

“Supply constraints are not just economic barriers; they are structural inefficiencies that demand systemic reform,”

— Godfrey Dinh, CEO of Futurerent

Investors must adopt a granular approach, leveraging tools like predictive analytics to identify regions where infrastructure investments and policy shifts intersect with supply gaps. This strategy not only enhances decision-making but also mitigates risks associated with overvalued markets.

Long-Term Implications of Extended Mortgage Terms

Extended mortgage terms, such as the 40-year option, fundamentally alter the financial trajectory of property investments. While they reduce monthly repayments, enabling greater cash flow flexibility, the cumulative interest over the loan’s lifespan can significantly diminish overall returns. This trade-off is particularly pronounced in markets with moderate or stagnant property appreciation, where the extended repayment period may outpace equity growth.

A critical mechanism at play is the compounding effect of interest over time. For instance, a $400,000 loan at 4% interest over 40 years results in total repayments exceeding $800,000—nearly $115,000 more than a 30-year term. This disparity highlights the importance of evaluating long-term cost implications against short-term affordability benefits. Investors often underestimate this dynamic, focusing instead on immediate cash flow relief.

Contextual factors, such as regional price volatility and infrastructure development, further complicate the equation. In high-growth areas, extended terms may align with rising property values, offsetting interest costs. Conversely, in less dynamic markets, the financial burden can outweigh potential gains.

“Extended terms offer liquidity but demand a disciplined, long-term strategy to mitigate interest erosion,”

— Dr. Nicola Powell, Chief of Research, Domain

Investors must integrate predictive analytics and scenario modeling to assess whether extended terms align with their financial objectives, ensuring sustainable returns over decades.