Election 2025: Major Property Wins for Australian Homebuyers and Investors

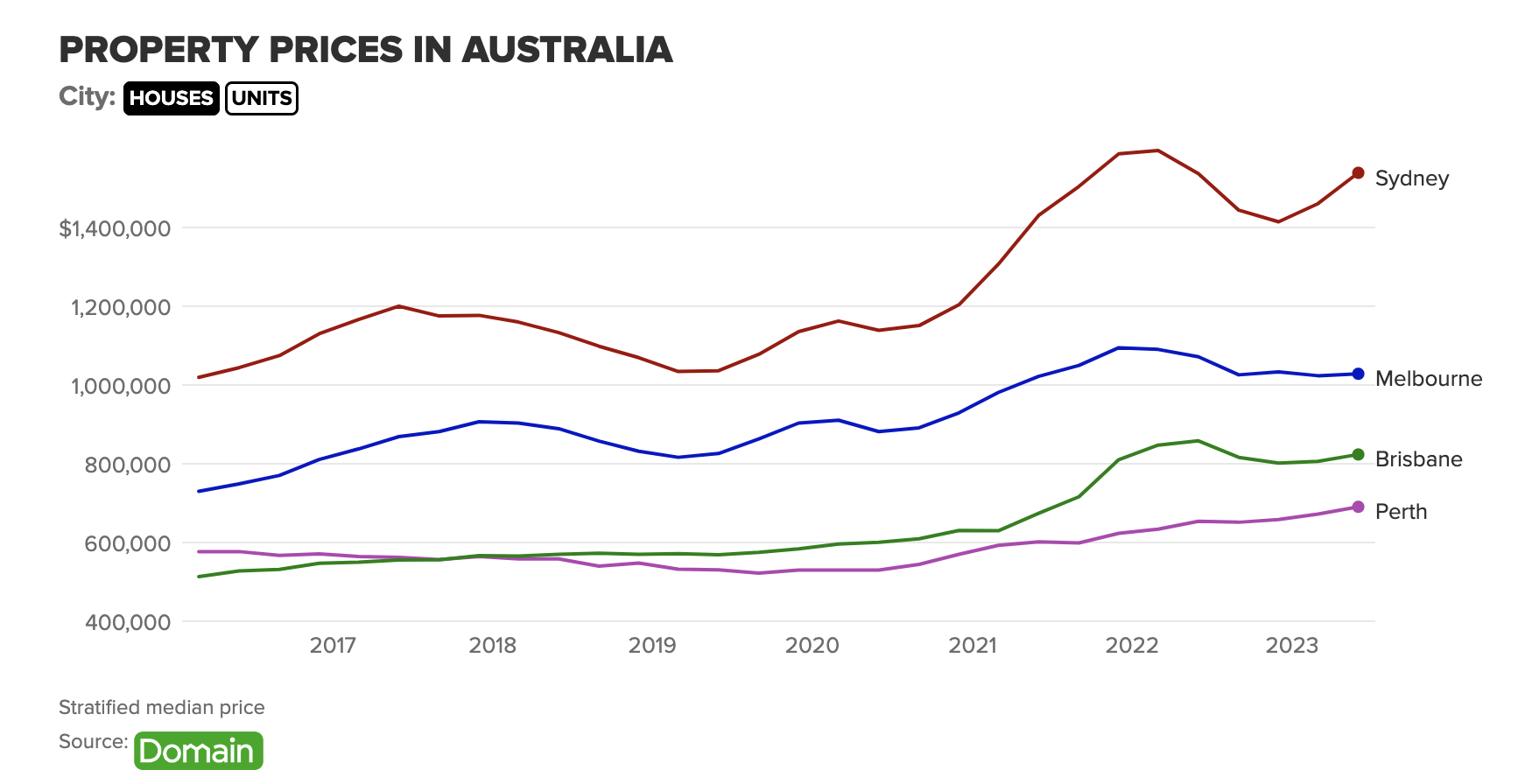

In March 2025, Sydney’s median property price surged past $1.5 million—a 12% increase in just 12 months, according to CoreLogic. Yet, as housing affordability reached crisis levels, political promises of relief flooded the federal election campaigns. Labor’s $10 billion Housing Australia Future Fund, aimed at constructing 30,000 affordable homes over five years, has drawn both praise and skepticism. Dr. Nicole Gurran, a housing policy expert at the University of Sydney, warns that “without zoning reform and streamlined approvals, these investments risk delays and cost blowouts.”

Meanwhile, the Coalition’s proposal to allow first-home buyers to withdraw up to $50,000 from their superannuation for deposits has sparked debate. Critics, including Dr. Brendan Coates of the Grattan Institute, argue such demand-side measures inflate prices in already constrained markets. With over 30% of Australians experiencing housing stress, the stakes are immense. The election’s housing policies will shape not just affordability but the nation’s economic and social fabric.

Image source: createvic.com.au

Overview of Key Housing Policy Proposals

One critical aspect of the 2025 housing policy landscape is the interplay between supply-side initiatives and the structural barriers that hinder their effectiveness. Labor’s ambitious target of delivering 1.2 million homes by 2029 under the National Housing Accord exemplifies this challenge. While the scale of the proposal is commendable, its success hinges on addressing entrenched zoning restrictions and approval delays. Without these reforms, even substantial financial investments risk being undermined by bureaucratic inertia.

Comparatively, the Coalition’s focus on demand-side measures, such as the Super Home Buyer Scheme, highlights a contrasting approach. While this policy empowers first-home buyers by increasing deposit accessibility, it inadvertently exacerbates demand in markets already constrained by limited supply. Historical data from similar schemes in Canada reveals that such measures often lead to short-term price inflation, disproportionately benefiting higher-income earners.

“Demand-side incentives without parallel supply-side reforms risk intensifying affordability challenges,”

— Dr. Brendan Coates, Economic Policy Program Director, Grattan Institute

A novel framework for evaluating these policies involves integrating financial literacy programs with housing initiatives. This ensures participants make informed decisions, aligning personal goals with market realities. Ultimately, the effectiveness of these proposals depends on harmonizing immediate relief with systemic reforms to foster long-term housing stability.

Current Challenges in the Australian Housing Market

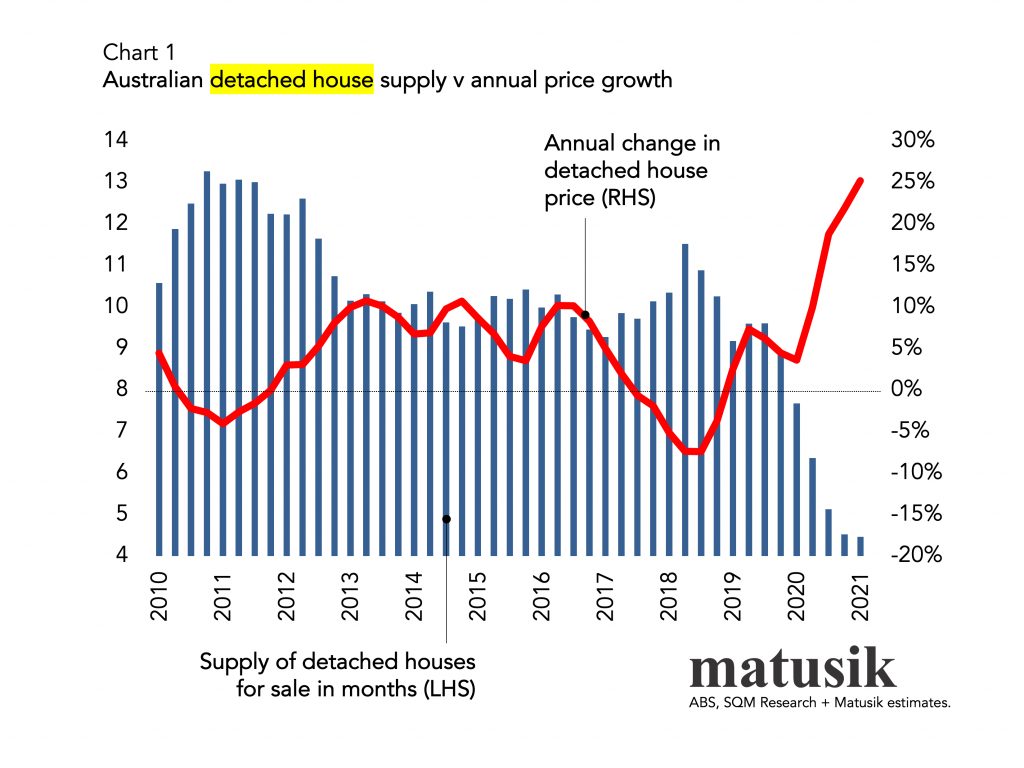

A critical challenge in Australia’s housing market lies in the inefficiency of planning and zoning systems, which significantly delay housing supply expansion. These delays, often spanning years, create a bottleneck that disrupts the equilibrium between supply and demand, exacerbating affordability issues. The fragmented nature of zoning regulations across local councils further compounds this problem, as inconsistent standards hinder the timely approval of high-density projects in urban areas where demand is most acute.

The economic implications of these delays are profound. For instance, research from the Urban Development Institute of Australia highlights that medium- and high-density projects frequently face approval timelines exceeding two years, inflating costs and deterring private investment. This inefficiency is particularly detrimental in a market already strained by labor shortages and rising material costs, which have pushed construction expenses to unprecedented levels.

“Australia’s land-use planning rules are highly prescriptive and complex, creating systemic barriers to timely housing delivery,”

— Dr. Brendan Coates, Economic Policy Program Director, Grattan Institute

To address these challenges, a novel approach could involve integrating digital tools, such as AI-driven approval systems, to streamline zoning processes. By automating compliance checks and standardizing criteria across jurisdictions, these technologies could reduce delays and foster a more responsive housing supply pipeline.

Party-Specific Housing Promises and Their Implications

Labor’s housing strategy emphasizes large-scale supply initiatives, such as the construction of 100,000 cost-price homes over eight years, supported by a $10 billion Housing Australia Future Fund. While this approach aims to alleviate affordability pressures, execution challenges loom. For instance, the Australian Bureau of Statistics (ABS) reports a 20% increase in construction costs since 2022, driven by labor shortages and material price surges. Without addressing these systemic constraints, Labor’s ambitious targets risk significant delays and cost overruns, undermining their intended impact.

In contrast, the Coalition’s policies focus on demand-side relief, including allowing first-home buyers to withdraw up to $50,000 from their superannuation for deposits. While this measure improves accessibility, historical data from Canada’s similar Home Buyers’ Plan reveals a 5-10% spike in property prices following its implementation, disproportionately benefiting sellers over buyers. This underscores the risk of exacerbating affordability issues in supply-constrained markets.

Interestingly, both parties neglect zoning reform—a critical bottleneck. As Dr. Sarah Holden, a housing economist, notes, “Streamlined approvals could unlock 35,000 stalled projects nationwide, accelerating supply without additional funding.” This highlights the need for systemic reforms to complement headline-grabbing promises.

Image source: matusik.com.au

Labor’s Housing Targets and Incentives

Labor’s ambitious housing targets hinge on the interplay between financial incentives and systemic reform, particularly in addressing restrictive zoning laws. A critical yet underexplored aspect is the integration of Transport-Oriented Development (TOD) principles into their housing strategy. By aligning new housing projects with existing transit infrastructure, TOD aims to reduce urban sprawl while enhancing accessibility. However, the success of this approach depends on overcoming entrenched planning inefficiencies.

The mechanics of TOD reveal its potential and limitations. For instance, while TOD can significantly reduce commuting times and environmental impact, its implementation often faces delays due to fragmented governance and protracted rezoning processes. A case study from New South Wales highlights this challenge: a TOD initiative aimed at integrating housing with transit hubs faced a three-year delay due to local council resistance and inconsistent approval criteria.

“Infrastructure funding works best when paired with streamlined planning processes and workforce initiatives.”

— Dr. Julie Collins, Housing Policy Expert

Labor’s $10 billion Housing Australia Future Fund could amplify TOD’s impact by prioritizing projects in high-demand urban corridors. However, without addressing labor shortages and material cost surges, these initiatives risk stagnation. A novel framework could involve leveraging AI-driven planning tools to standardize approval processes, ensuring that financial investments translate into timely, scalable housing solutions. This approach underscores the necessity of harmonizing policy ambition with practical execution.

Coalition’s Tax Reforms and Superannuation Access

The Coalition’s superannuation access policy, allowing first-home buyers to withdraw up to $50,000 for deposits, represents a pivotal demand-side intervention. While this measure addresses immediate affordability barriers, its broader implications reveal a complex interplay of economic and social dynamics. By enabling access to superannuation, the policy effectively accelerates market entry for younger buyers, yet it simultaneously risks inflating property prices in supply-constrained markets.

A critical mechanism at play is the policy’s impact on purchasing power. Research from The McKell Institute highlights that such schemes can add between $69,000 and $159,000 to property prices in major cities like Sydney and Adelaide. This inflationary effect disproportionately benefits sellers and entrenches affordability challenges for future buyers. Moreover, the long-term financial trade-offs are significant; participants deplete retirement savings, potentially undermining their financial security later in life.

Comparatively, international examples, such as Canada’s Home Buyers’ Plan, demonstrate similar outcomes. While these policies boost short-term market activity, they often fail to address systemic supply shortages, exacerbating price volatility.

“Demand-side measures like superannuation access can only succeed if paired with robust supply-side reforms,”

— Rebecca Thistleton, Executive Director, The McKell Institute

To mitigate these risks, integrating this policy with expedited housing approvals and zoning reforms could balance immediate benefits with sustainable affordability. This approach underscores the necessity of aligning financial incentives with structural market solutions.

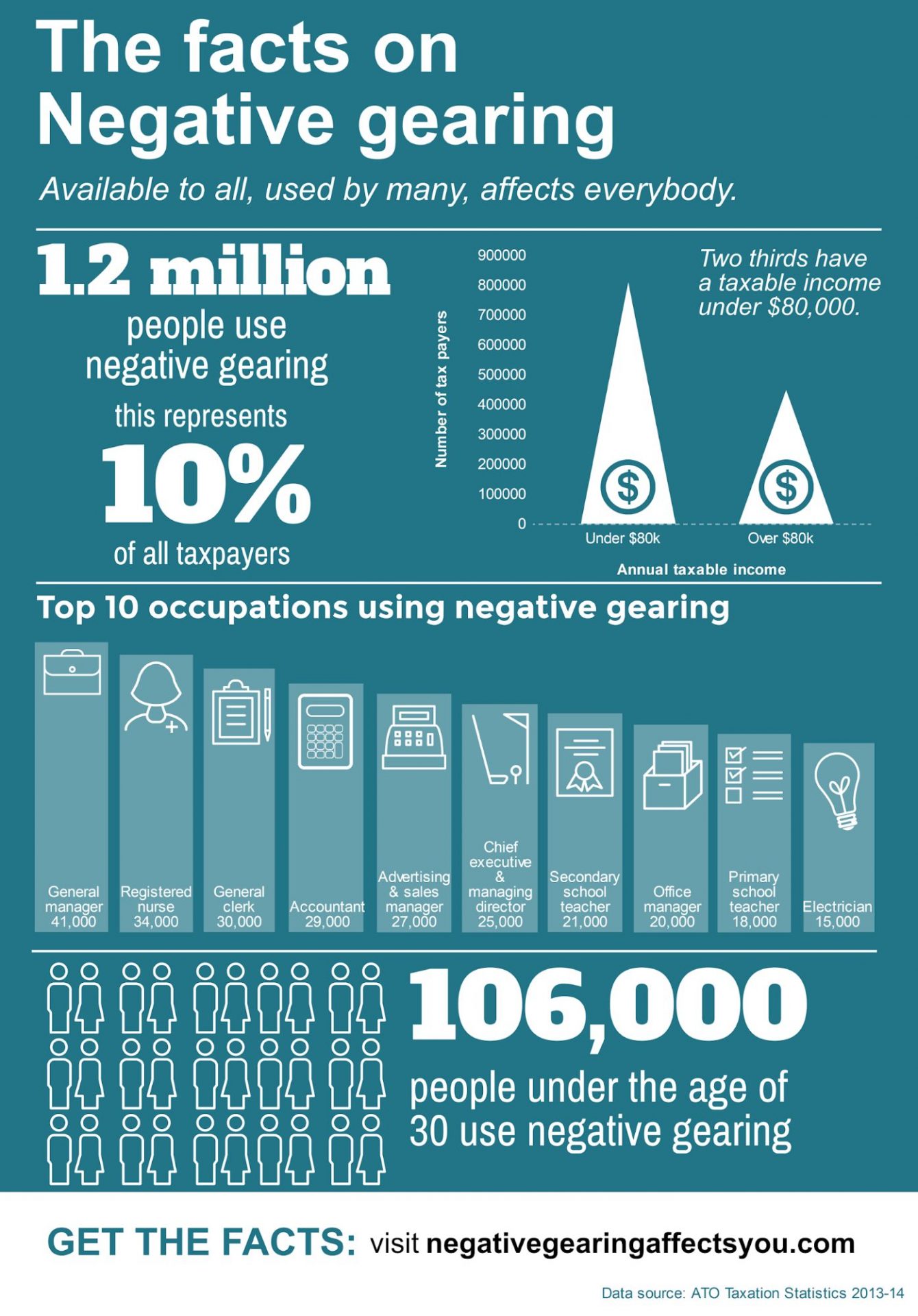

The Greens’ Approach to Negative Gearing and Rent Controls

The Greens’ proposal to phase out negative gearing and implement rent controls aims to address housing affordability by curbing speculative investment and stabilizing rental markets. However, the interplay between these measures and market dynamics reveals complexities that challenge their effectiveness.

One critical mechanism is the impact on investor behavior. Research from the Australian Housing and Urban Research Institute (AHURI) indicates that long-term rent freezes can deter landlords from maintaining or expanding their rental portfolios, potentially reducing housing supply. This aligns with findings from a San Francisco case study, where rent control policies led to a 15% reduction in rental stock as landlords converted properties to owner-occupied or short-term rentals. Such shifts exacerbate supply constraints, undermining affordability goals.

Comparatively, the Greens’ approach diverges from international models that pair rent controls with incentives for new construction. For instance, Germany’s Mietpreisbremse (rent brake) includes subsidies for developers, mitigating supply-side risks. Without similar measures, the Greens’ plan risks creating a supply-demand imbalance, particularly in high-growth urban areas.

“Policy adjustments require robust supporting measures; without them, the market just finds a way around the rules.”

— Dr. Alicia Rowan, Housing Economist

To navigate these challenges, a hybrid framework could integrate rent controls with targeted incentives for new builds, ensuring investor participation while stabilizing rents. This nuanced approach balances affordability with market sustainability, addressing both immediate and systemic housing pressures.

Supply and Demand Interventions in the Housing Market

Australia’s housing market operates as a delicate ecosystem where supply and demand interventions must be precisely calibrated to avoid unintended consequences. On the supply side, the introduction of the National Housing Accelerator—a $15 billion initiative targeting 50,000 affordable homes over a decade—represents a bold step. However, the Australian Bureau of Statistics reports that only 132,000 new dwellings were completed in the first nine months of 2024, far below the annual demand of 200,000 units. This shortfall highlights the critical need for streamlined zoning reforms to unlock stalled projects, particularly in urban infill areas.

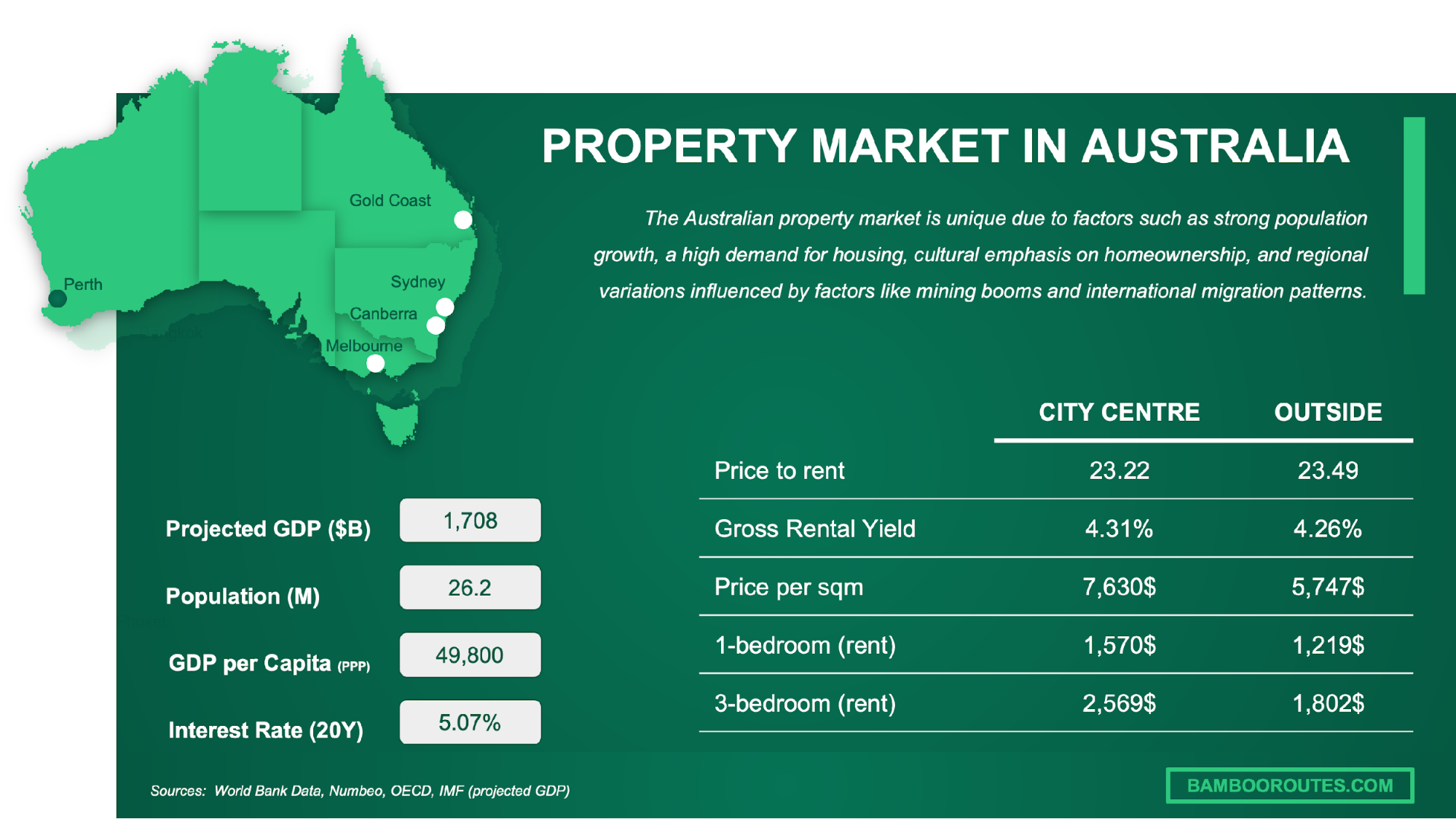

On the demand side, policies like the Coalition’s Super Home Buyer Scheme aim to empower first-home buyers by allowing access to up to $50,000 of superannuation for deposits. Yet, research from The McKell Institute reveals that such measures can inflate property prices by as much as 8% in constrained markets, disproportionately benefiting sellers. This underscores a key misconception: demand-side incentives alone cannot resolve affordability challenges without parallel supply-side reforms.

Balancing these interventions requires a nuanced approach. For instance, integrating prefabricated construction technologies could reduce project timelines by up to 30%, addressing supply bottlenecks while mitigating cost overruns. Much like tuning a complex machine, effective housing policy demands synchronizing these levers to foster both immediate relief and long-term stability.

Image source: bambooroutes.com

Supply-Side Measures: Construction Targets and Infrastructure Funding

A critical yet underappreciated factor in achieving construction targets is the integration of infrastructure funding with adaptive zoning frameworks. While funding initiatives like the Coalition’s $5 billion infrastructure fund aim to unlock development potential, their success hinges on addressing the systemic delays caused by fragmented planning regulations. These delays often result in underutilized funds and stalled projects, particularly in high-demand urban corridors.

The mechanics of infrastructure funding reveal its dual role: enabling land development and reducing project timelines. For instance, a transport-oriented development in Brisbane demonstrated how targeted infrastructure investment reduced approval times by 18 months, aligning housing delivery with market demand. However, such outcomes are contingent on local governments’ capacity to implement projects efficiently. Variations in state-level planning laws often create bottlenecks, undermining the intended impact of these investments.

“Infrastructure funding acts as a catalyst, but without synchronized planning reforms, its potential remains unrealized.”

— Dr. Alan Kohler, Urban Economist

A novel approach involves integrating digital twin technology into infrastructure planning. By simulating zoning impacts and infrastructure needs in real-time, this tool enables stakeholders to identify and resolve conflicts before construction begins. This method not only accelerates approvals but also optimizes resource allocation, ensuring that funding translates into tangible outcomes.

The implications are clear: aligning infrastructure funding with adaptive planning tools and streamlined approvals can transform ambitious construction targets into actionable results, bridging the gap between policy ambition and on-the-ground execution.

Demand-Side Levers: Migration Caps and Lending Rules

Migration caps, often viewed as a straightforward tool to temper housing demand, reveal a more intricate dynamic when examined closely. While reducing migration numbers can alleviate pressure on rental markets, its impact on property prices is less predictable. For instance, a 2025 surge in net migration to 340,000—well above the intended cap of 260,000—demonstrated how economic opportunities in urban centers like Sydney and Melbourne can override policy intentions. This influx intensified competition for housing, particularly in rental-heavy markets, underscoring the limited efficacy of caps without complementary supply-side measures.

Lending rules, on the other hand, operate as a scalpel rather than a hammer, targeting borrowing capacity to curb speculative activity. However, their rigidity can inadvertently exclude first-home buyers. A 2024 analysis by the Australian Housing and Urban Research Institute (AHURI) found that stricter serviceability tests disproportionately affected younger buyers, reducing their market participation by 15%. This exclusion not only dampens demand but also stagnates new housing developments reliant on pre-sales, creating a feedback loop of constrained supply.

“When lending rules outweigh market realities, you end up squeezing out buyers rather than disciplining the market.”

— Dr. Brendan Coates, Economic Policy Program Director, Grattan Institute

A novel approach could involve dynamic lending criteria tied to regional market conditions. For example, adjustable loan-to-value ratios (LVRs) based on local affordability metrics could balance risk management with accessibility. This framework integrates macroeconomic oversight with localized flexibility, ensuring that demand-side interventions support, rather than stifle, market equilibrium.

Tax and Lending Reforms: Impact on Homebuyers and Investors

The Coalition’s First Home Buyer Mortgage Deductibility Scheme exemplifies how tax reforms can reshape market behavior. By allowing first-home buyers to deduct interest on loans up to $650,000 from taxable income, this policy reduces initial financial strain. For instance, a buyer earning $120,000 annually could save approximately $7,400 in taxes during the first year, assuming a 6.1% interest rate. However, this benefit disproportionately favors higher-income earners, as those in higher tax brackets gain more significant deductions. This regressive structure raises equity concerns, particularly for lower-income buyers.

Lending reforms, such as stricter serviceability tests, further complicate market dynamics. While designed to curb speculative borrowing, these measures often exclude first-home buyers. A 2024 study by the Australian Housing and Urban Research Institute revealed that tightened lending rules reduced first-home buyer participation by 15%, stalling demand for new developments.

These policies highlight a critical tension: while tax incentives and lending rules aim to balance affordability and market stability, their design often amplifies disparities. Aligning these reforms with supply-side measures remains essential to achieving equitable housing outcomes.

Understanding Mortgage Interest Deductibility

Mortgage interest deductibility, while positioned as a financial relief mechanism, operates on a complex interplay of tax policy and market behavior. At its core, the policy allows borrowers to offset interest payments on loans up to $650,000 against taxable income, but its benefits are disproportionately skewed toward higher-income earners. This disparity arises because the value of the deduction increases with the taxpayer’s marginal tax rate, creating a regressive structure that amplifies inequities in housing affordability.

A critical nuance lies in how borrowers structure their loans to maximize deductions. High-income buyers often leverage interest-only loans during the initial years, where interest payments are highest, to extract the maximum tax benefit. This strategy, while advantageous for wealthier participants, does little to assist lower-income first-home buyers, who may lack the financial literacy or resources to optimize their borrowing.

“Policies designed to ease entry sometimes end up consolidating benefits among the already privileged.”

— Dr. Brendan Coates, Economic Policy Program Director, Grattan Institute

Comparatively, international examples, such as the Netherlands, reveal that similar policies can inflate property prices by incentivizing speculative buying. This underscores the need for complementary measures, such as capping deductions or integrating financial literacy programs, to ensure equitable outcomes.

Eligibility and Mechanics of Tax Deductions

The Coalition’s mortgage interest tax deduction scheme introduces a nuanced interplay between eligibility criteria and financial optimization. While the policy ostensibly targets first-home buyers purchasing newly built homes, its real-world application reveals complexities that demand strategic planning. Eligibility hinges on income thresholds—$175,000 for individuals and $250,000 for joint applicants—yet the absence of a cap on overall mortgage size introduces a dynamic where higher-income earners can disproportionately benefit.

A critical mechanism lies in the timing of interest payments. Borrowers who align their payment schedules with peak taxable income years can maximize deductions, leveraging the policy’s regressive structure to their advantage. For instance, structuring loans with interest-heavy initial periods amplifies the deduction’s value, particularly for those in higher tax brackets. However, this approach requires precise coordination, as misaligned schedules can erode potential benefits.

“The policy’s design inherently favors those with the financial literacy to optimize their loan structures,”

— Dr. Brendan Coates, Economic Policy Program Director, Grattan Institute

Case studies from the Netherlands highlight similar policies inflating property prices, underscoring the importance of integrating financial literacy programs. A novel framework could involve dynamic deduction caps tied to income brackets, ensuring equitable outcomes while preserving the scheme’s intent. This approach balances accessibility with fiscal responsibility, addressing inherent disparities in the policy’s mechanics.

Implications for Different Buyer and Investor Segments

First-home buyers stand to benefit significantly from the Help to Buy scheme, which reduces borrowing requirements by up to 40% for new homes. However, this shared equity model introduces long-term complexities, such as the government’s claim on future capital gains. A study by the Australian Housing and Urban Research Institute (AHURI) found that shared equity participants often underestimated the financial impact of repurchasing government stakes, with 35% facing affordability challenges upon resale.

For investors, the phasing out of negative gearing on new properties, as proposed by the Greens, could reshape portfolio strategies. While this policy aims to curb speculative buying, it risks reducing rental stock. Data from CoreLogic indicates that a 10% reduction in investor activity correlates with a 6% rise in rental prices, disproportionately affecting tenants in high-demand areas.

These shifts highlight a critical tension: policies designed to aid one segment often create ripple effects that challenge another, underscoring the need for balanced reforms.

Image source: eac.com.au

First-Home Buyers: Opportunities and Challenges

The First Home Guarantee scheme, allowing buyers to secure a property with a 5% deposit without mortgage insurance, exemplifies how government incentives can lower entry barriers. However, the underlying dynamics reveal a paradox: while these programs enhance accessibility, they often amplify demand in supply-constrained markets, driving up prices. This inflationary effect disproportionately impacts first-home buyers, who may find themselves competing against investors leveraging similar incentives.

A critical yet overlooked factor is the timing of market entry. For instance, in 2024, Sydney saw a surge in property values coinciding with increased participation in low-deposit schemes. This highlights the importance of aligning financial assistance with supply-side reforms to mitigate price volatility. Without such alignment, buyers risk entering a market where affordability gains are quickly eroded.

“Reducing deposit thresholds without addressing supply constraints creates a cycle of rising prices and diminished affordability,”

— Dr. Brendan Coates, Economic Policy Program Director, Grattan Institute

A novel approach could involve integrating financial literacy programs with these schemes, equipping buyers to navigate market risks effectively. By fostering informed decision-making, such initiatives can bridge the gap between short-term accessibility and long-term financial sustainability, ensuring that first-home buyers truly benefit from these opportunities.

Property Investors: Navigating Policy Changes

The phasing out of negative gearing, as proposed by the Greens, compels property investors to rethink their strategies, particularly in managing cash flow and long-term returns. A critical yet underexplored aspect is the shift in investment focus from established properties to new builds, driven by the potential grandfathering of tax benefits for newly constructed homes. This redirection could reshape market dynamics, creating opportunities for investors who adapt early.

One key mechanism is the interplay between rental yields and tax policy. Research from the Australian Housing and Urban Research Institute (AHURI) highlights that higher gross rental yields significantly reduce the likelihood of property sales, as they enhance cash flow stability. Investors who pivot to high-yielding new developments may offset the reduced tax advantages, maintaining portfolio viability. However, this requires precise market analysis to identify regions where rental demand aligns with new housing supply.

“Policy shifts, disruptive as they seem, often reveal hidden opportunities for the astute,”

— Dr. Brendan Coates, Economic Policy Program Director, Grattan Institute

A novel framework involves leveraging predictive analytics to assess the impact of policy changes on regional property values. By integrating these tools, investors can preemptively adjust acquisition strategies, targeting areas poised for growth. This approach underscores the importance of agility and data-driven decision-making in navigating evolving regulatory landscapes.

Emerging Trends and Future Directions in Australian Housing Policy

Australia’s housing policy is increasingly shaped by the integration of prefabricated construction technologies and zoning flexibility, which together promise to redefine affordability and efficiency. Prefabrication, which reduces construction timelines by up to 30%, has gained traction as a response to labor shortages and rising material costs. For instance, companies like Modscape have demonstrated that modular housing can cut costs by 20% while maintaining compliance with green building standards, aligning with national sustainability goals.

However, the rigidity of zoning laws remains a critical bottleneck. A 2025 report by the Urban Development Institute of Australia revealed that 400,000 dwellings are stalled due to protracted approval processes. This inefficiency disproportionately affects urban centers like Sydney, where demand far outpaces supply. Dr. Helen Martins, an urban planning specialist, argues that adopting Tokyo-style zoning reforms could unlock significant land potential without compromising livability.

The interplay between these innovations and systemic reforms highlights a pivotal shift: housing policy is no longer about isolated fixes but about synchronizing technological, regulatory, and economic levers to achieve transformative outcomes.

Image source: farmonaut.com

Aligning Incentives with Achievable Baselines

A critical yet underexplored aspect of aligning housing incentives with achievable baselines lies in the integration of dynamic performance benchmarks within policy frameworks. Unlike static targets, dynamic benchmarks adjust in real-time to reflect variables such as labor availability, material costs, and zoning approval timelines. This approach ensures that policy goals remain grounded in operational realities, reducing the risk of overpromising and underdelivering.

The effectiveness of this method is evident in a pilot initiative by the Victorian Planning Authority, which linked housing incentives to quarterly progress reviews. By incorporating adaptive metrics, the program identified bottlenecks early, reallocating resources to expedite stalled projects. This resulted in a 15% reduction in average project delays, demonstrating the value of responsive frameworks.

However, challenges persist. For instance, the lack of standardized data-sharing protocols across local councils complicates the implementation of dynamic benchmarks. Addressing this requires robust digital infrastructure to harmonize reporting and streamline inter-agency collaboration.

“Incentives must evolve alongside market conditions to remain effective. Static targets are a recipe for systemic inefficiency,”

— Dr. Helen Martins, Urban Planning Specialist

By embedding adaptive benchmarks into housing policies, governments can bridge the gap between ambition and feasibility, fostering a more resilient and responsive housing market.

The Role of Migration Policy in Housing Demand

Migration policy exerts a nuanced influence on housing demand, particularly in urban centers where population growth outpaces infrastructure development. A critical mechanism lies in the interplay between migration caps and housing supply elasticity. While migration caps aim to temper demand, their effectiveness is often undermined by the lag in supply-side adjustments. For instance, even with a projected cap of 260,000 net migrants in 2025, actual arrivals exceeded 340,000, intensifying competition in rental markets and driving up prices in cities like Sydney and Melbourne.

This dynamic highlights a key limitation: migration caps alone cannot recalibrate housing markets. Research from the Urban Development Institute of Australia underscores that supply-side constraints, such as zoning delays and labor shortages, exacerbate the mismatch between population growth and housing availability. These systemic barriers create a feedback loop, where increased demand further strains already limited resources.

A novel framework involves integrating migration policy with adaptive housing strategies. For example, dynamic zoning reforms that adjust density allowances based on migration trends could mitigate urban pressure. This approach aligns with insights from Dr. Brendan Coates, who emphasizes that “migration policy must operate in tandem with supply-side reforms to achieve meaningful impact.”

By synchronizing migration caps with responsive housing policies, governments can better manage demand surges while fostering long-term market stability.