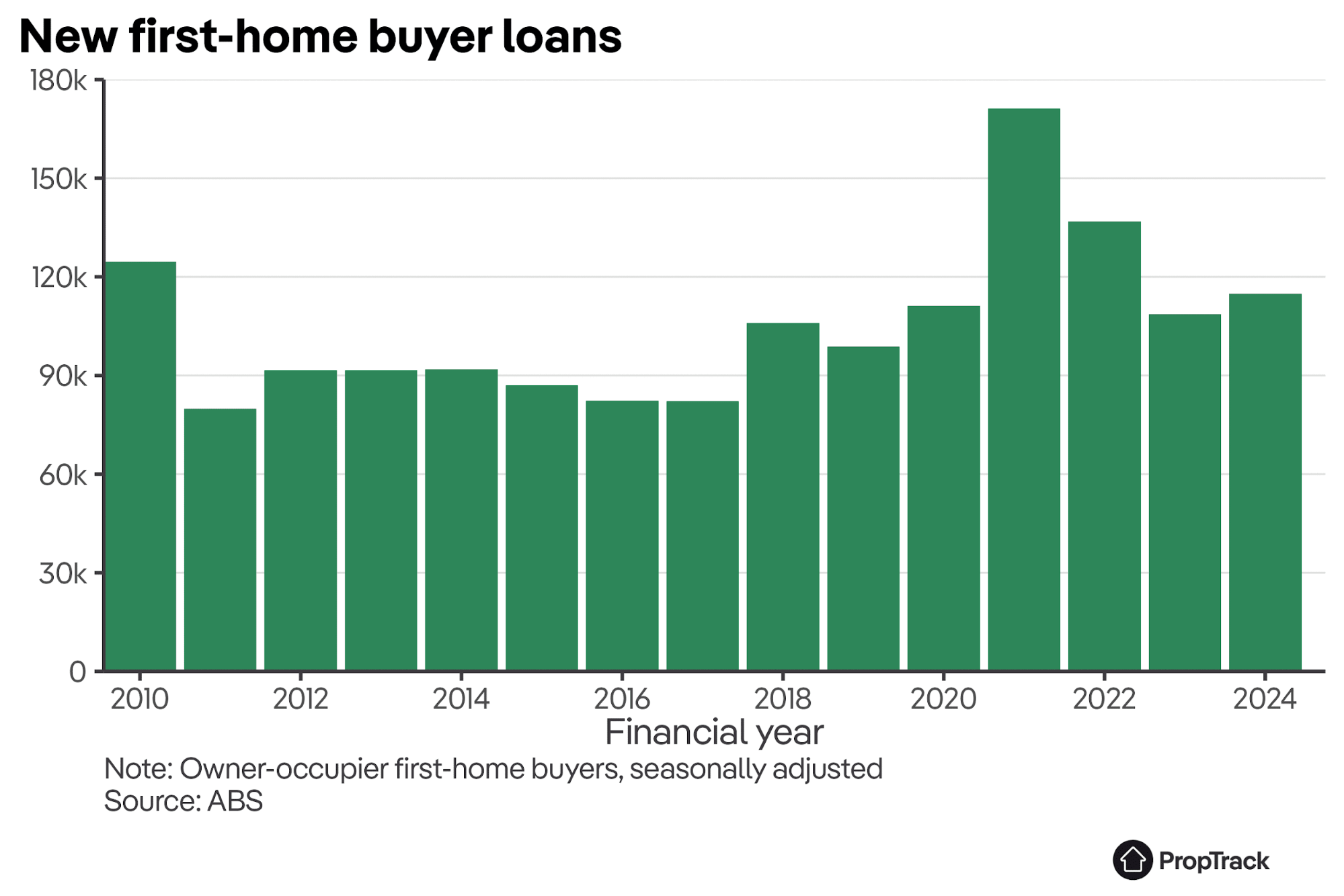

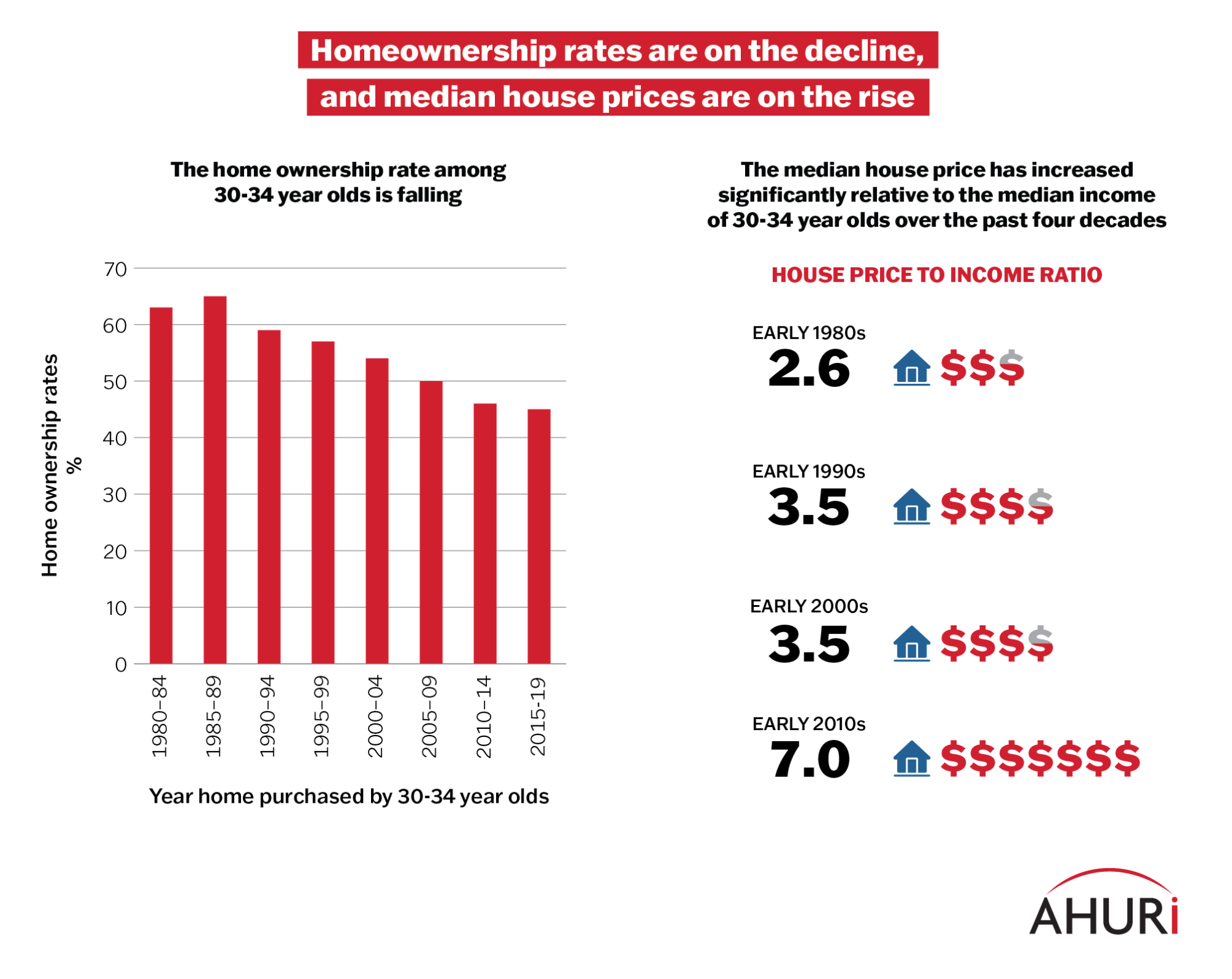

In 2022, Australian first-home buyers accounted for just 26% of new housing loans, a sharp decline from the 30-year average of 35%, according to the Australian Bureau of Statistics. Yet, in the lead-up to the 2025 federal election, both major political parties have unveiled aggressive policies aimed at reversing this trend. Labor’s promise to build 1.2 million homes by 2029 and expand shared-equity schemes with 5% deposit options stands in stark contrast to the Coalition’s plan to unlock 500,000 homes by reducing immigration and allowing first-home buyers to access $50,000 from their superannuation.

However, experts like Steven Rowley, a property professor at Curtin University, warn that such measures often exacerbate affordability issues. “These policies are only going to increase demand, which will push up prices,” he notes. Historical data supports this: similar initiatives, such as the First Home Owner Boost in 2008, temporarily spiked home purchases but also inflated property values by 13.6% in major cities.

This interplay between political strategy and market dynamics underscores a critical tension—election-driven incentives may offer short-term relief but risk entrenching long-term inequities in Australia’s housing market.

Image source: realestate.com.au

Historical Context of First Home Buyer Incentives

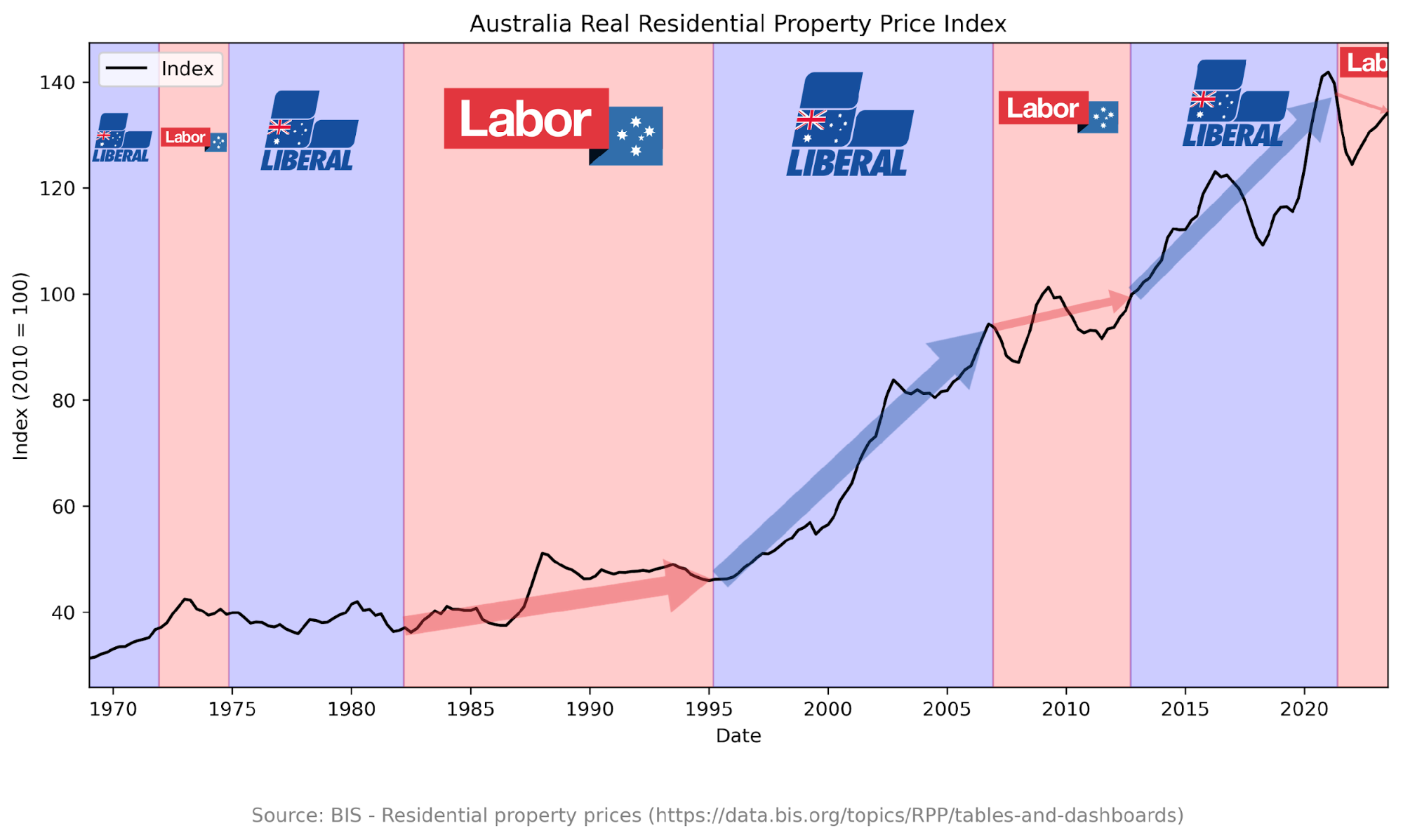

The evolution of first home buyer (FHB) incentives in Australia highlights a critical interplay between economic cycles and policy design. Initially introduced as modest post-war measures, these programs aimed to stabilize housing access for young families. However, their role has since expanded, becoming tools for economic stimulus during downturns and politically strategic instruments during election cycles. This shift underscores a nuanced dynamic: incentives often reflect broader economic conditions rather than purely electoral motives.

A key insight lies in the timing of these policies. Historical data reveals that incentives introduced during recovery phases, such as the 1980s adjustments, often triggered temporary surges in home purchases. Yet, these surges frequently led to unintended price inflation, particularly in lower-tier markets. This phenomenon challenges the assumption that such measures inherently improve affordability.

“The real impact of FHB incentives lies not in their magnitude but in their timing and market context,” notes Michael McKenzie, a housing policy analyst.

Comparative analysis with international counterparts, such as the UK’s time-limited stamp duty exemptions, further illustrates how targeted, temporary measures can mitigate distortions. These examples emphasize the importance of aligning policy design with market conditions, a principle often overlooked in domestic implementations. Understanding these temporal and contextual factors is essential for crafting effective, sustainable FHB policies.

Political Strategies and Their Impact on Housing

Election-driven housing policies often prioritize immediate voter appeal over structural market stability, a dynamic that significantly influences first-home buyer (FHB) behavior. A critical mechanism at play is the strategic timing of demand-side incentives, such as grants or tax deductions, which are frequently announced in the months leading up to elections. These measures create a perception of urgency, spurring short-term market activity but often exacerbating affordability challenges.

The effectiveness of such strategies hinges on their alignment with market conditions. For example, when New South Wales expanded FHB incentives in 2023, auction activity in Sydney’s outer suburbs surged by 18% within three months. However, supply constraints, including restrictive zoning and labor shortages, muted the intended benefits, leaving prices elevated. This underscores a key limitation: demand-side policies amplify competition without addressing underlying supply bottlenecks.

“Election-driven schemes tend to be stop-gap measures that only stimulate demand in a contained period, leaving fundamental supply issues unaddressed.”

— Michael McKenzie, Property Economist

A more sustainable approach would integrate supply-side reforms, such as streamlined planning approvals or inclusionary zoning policies. These measures, while politically less expedient, offer the potential to stabilize prices and improve long-term affordability, addressing systemic imbalances rather than perpetuating cyclical volatility.

Mechanisms of First Home Buyer Incentives

First-home buyer (FHB) incentives in Australia operate as finely tuned levers within the housing market, designed to influence buyer behavior and market dynamics. These mechanisms, while appearing straightforward, are deeply interwoven with economic and political strategies. For instance, the First Home Owner Grant (FHOG), introduced in 2000, provided up to $7,000 to eligible buyers. However, its impact extended beyond financial relief; studies reveal that 60% of recipients accelerated their purchase decisions, amplifying short-term demand.

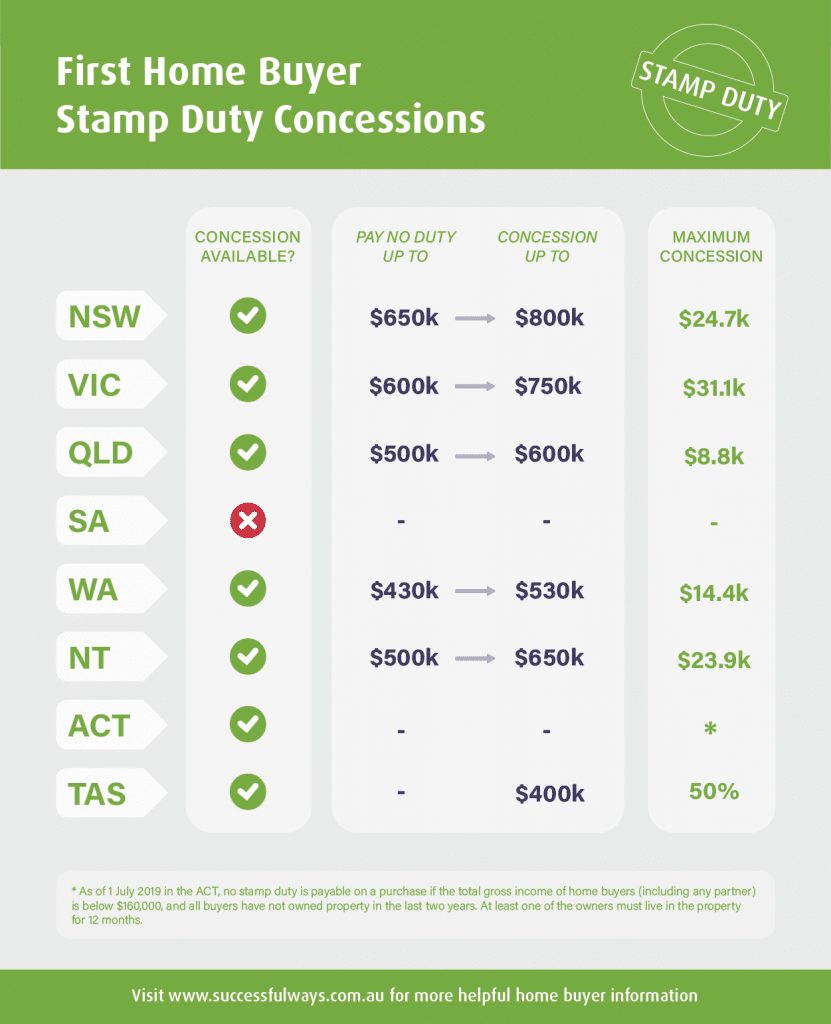

A critical yet underappreciated mechanism is stamp duty concessions, which reduce upfront costs for buyers. In Victoria, for example, FHBs purchasing properties under $600,000 are exempt from stamp duty, saving up to $31,000. This policy not only lowers entry barriers but also signals affordability, often driving competition in lower-tier markets. However, experts like Dr. Hal Pawson of UNSW argue that such measures disproportionately benefit higher-income buyers, inadvertently sidelining those most in need.

These incentives, while politically expedient, often fail to address systemic supply constraints, underscoring the need for integrated reforms that balance demand stimulation with sustainable housing development.

Image source: successfulways.com.au

Understanding First Home Owner Grants and Schemes

The First Home Owner Grant (FHOG) operates as a dual-purpose mechanism: reducing financial barriers for first-time buyers while indirectly influencing market dynamics. At its core, the grant offsets initial deposit requirements, enabling faster entry into homeownership. However, its broader implications reveal complexities that extend beyond its immediate financial relief.

One critical dynamic is the grant’s interaction with market pricing. Research indicates that FHOGs often lead to localized price inflation, particularly in lower-tier markets where first-home buyers are most active. This occurs because the increased purchasing power intensifies competition for limited housing stock, driving up prices. A study by Wood et al. (2006) highlighted that many recipients would have purchased homes without the grant, suggesting its primary effect is to accelerate demand rather than expand access.

Comparatively, jurisdictions like Western Australia, which offer reduced grants for established homes, demonstrate a nuanced approach. By incentivizing new construction over existing properties, these schemes aim to alleviate supply constraints. However, implementation challenges persist, such as ensuring adequate land availability and addressing labor shortages in the construction sector.

“The FHOG’s untargeted nature often exacerbates affordability issues, particularly for low-income buyers,” notes Dr. Hal Pawson, housing policy expert at UNSW.

Ultimately, while FHOGs provide short-term benefits, their long-term efficacy depends on integration with supply-side reforms, such as streamlined zoning policies and infrastructure investment, to mitigate unintended market distortions.

The Role of Stamp Duty Concessions

Stamp duty concessions serve as a pivotal mechanism in reducing the financial barriers for first-home buyers, yet their impact extends far beyond immediate cost relief. These concessions, often tied to property value thresholds, influence buyer behavior and market dynamics in nuanced ways. For instance, in New South Wales, exemptions on properties up to $650,000 have spurred significant activity in this price bracket, creating localized demand surges.

A critical factor shaping the effectiveness of these concessions is their interaction with market supply. In constrained markets, such as metropolitan Sydney, the increased purchasing power granted by concessions often intensifies competition, leading to price inflation. This phenomenon disproportionately affects lower-income buyers, who may find themselves priced out despite the intended affordability benefits.

Comparative analysis reveals that jurisdictions like Tasmania, which allow staggered stamp duty payments, mitigate some of these pressures by spreading financial obligations over time. However, such approaches are less effective in high-demand areas where supply bottlenecks persist.

“Stamp duty concessions are a short-term lever; their real challenge lies in addressing systemic supply issues,” notes Dr. Hal Pawson, housing policy expert at UNSW.

Ultimately, while these concessions provide immediate relief, their long-term efficacy depends on integration with broader supply-side reforms, such as zoning adjustments and infrastructure investments.

Economic and Political Implications

Election-driven first-home buyer incentives often act as dual-edged swords, simultaneously stimulating market activity and exacerbating structural inefficiencies. A 2023 report by the Grattan Institute revealed that demand-side policies, such as grants and shared-equity schemes, increased first-home buyer participation by 12% within six months of implementation. However, in supply-constrained markets like Sydney, this surge contributed to a 7% rise in median property prices, disproportionately benefiting sellers over buyers.

The political timing of these measures is critical. Governments frequently introduce incentives during election cycles to appeal to younger voters, yet these policies often fail to address systemic supply shortages. For instance, while Labor’s $10 billion Housing Australia Future Fund aims to build 100,000 homes, experts like Brendan Coates argue that such initiatives require years to impact affordability meaningfully, leaving short-term demand pressures unchecked.

This dynamic mirrors a “balloon effect,” where squeezing one area of the market inflates another. Without concurrent supply-side reforms—such as zoning deregulation or infrastructure investment—these policies risk perpetuating affordability crises, undermining their intended benefits.

Image source: reddit.com

Economic Impact of Election-Driven Incentives

Election-driven housing incentives often create a paradoxical dynamic: while designed to enhance affordability, they frequently exacerbate market imbalances. A critical mechanism underpinning this phenomenon is the interaction between demand-side subsidies and supply elasticity. In markets with inelastic supply, such as Sydney, increased purchasing power from grants or shared-equity schemes intensifies competition for limited housing stock, driving prices higher. This effect disproportionately benefits sellers and entrenched investors, sidelining first-home buyers despite the policy’s intent.

A comparative analysis of Australia’s First Home Owner Grant (FHOG) and the UK’s Help to Buy Equity Loan Scheme reveals key differences in implementation. The FHOG, untethered to new construction, often inflates prices in existing property markets. Conversely, the UK scheme ties subsidies to new builds, partially mitigating supply constraints. However, even in the UK, localized price surges occurred in areas with restrictive zoning, underscoring the critical role of regulatory frameworks.

“Demand-side incentives without concurrent supply-side reforms risk inflating prices, benefiting sellers more than buyers,” explains Brendan Coates, Economic Policy Program Director at the Grattan Institute.

To address these limitations, policymakers must integrate zoning reforms and infrastructure investments with demand-side measures. For instance, expedited planning approvals in Melbourne’s growth corridors have shown promise in aligning supply with surging demand, offering a potential blueprint for sustainable implementation. This highlights the necessity of systemic reforms to ensure election-driven incentives achieve their intended outcomes.

Political Cycles and Housing Market Dynamics

Election cycles act as pivotal moments that reshape housing market behavior, leveraging political incentives to influence buyer activity. A key mechanism is the strategic timing of demand-side measures, such as grants or tax concessions, which are often announced in the months preceding elections. These policies create a sense of urgency among first-home buyers, fostering a “fear of missing out” that accelerates purchasing decisions. This phenomenon is particularly pronounced in supply-constrained markets like Sydney, where limited housing stock amplifies competition.

The interplay between political timing and market dynamics reveals a critical flaw: while these measures temporarily boost transaction volumes, they often exacerbate affordability challenges. For instance, a study of the 2008 First Home Owner Boost (FHOB) demonstrated that the policy spurred a 13.6% rise in property values in major cities, disproportionately benefiting sellers over buyers. This underscores the unintended consequence of election-driven incentives—price inflation that outlasts the policy’s immediate effects.

“Election-timed incentives often prioritize short-term voter appeal over sustainable market solutions,” notes Dr. Hal Pawson, housing policy expert at UNSW.

To mitigate these distortions, experts advocate for integrating supply-side reforms, such as streamlined zoning and infrastructure investment, alongside demand-side measures. This dual approach could stabilize prices while addressing systemic imbalances, ensuring policies achieve their intended outcomes.

Challenges and Controversies

Election-driven housing incentives often face criticism for exacerbating the very issues they aim to resolve. A 2023 Grattan Institute report revealed that demand-side measures, such as first-home buyer grants, increased buyer activity by 12% within six months but contributed to a 7% rise in median property prices in supply-constrained markets like Sydney. This dynamic disproportionately benefits existing homeowners and investors, sidelining low-income buyers.

A key controversy lies in the misalignment between policy intent and market realities. For instance, while shared-equity schemes lower entry barriers, they inadvertently inflate demand without addressing supply bottlenecks. Dr. Nicola Powell, Chief of Research at Domain, highlights that restrictive zoning laws and labor shortages further compound these challenges, creating a “supply chokehold” that amplifies price pressures.

This interplay mirrors a hydraulic system: increasing pressure (demand) without expanding capacity (supply) risks rupturing affordability. Addressing these systemic flaws requires integrating zoning reforms and infrastructure investments into election policies.

Image source: ahuri.edu.au

Affordability vs. Price Inflation

The paradox of affordability incentives lies in their unintended inflationary effects, particularly in supply-constrained markets. When first-home buyer grants increase purchasing power, they often intensify competition for limited housing stock, driving prices higher. This dynamic is especially pronounced in metropolitan areas like Sydney, where supply elasticity is minimal due to zoning restrictions and prolonged development timelines.

A critical mechanism at play is the interaction between liquidity and market psychology. Grants inject immediate liquidity into the market, but this surge often triggers speculative behavior among sellers, who adjust prices upward in anticipation of heightened demand. According to the Reserve Bank of Australia (RBA), “policy measures aimed at boosting housing demand can lead to higher prices if supply is constrained” (Statement on Monetary Policy, February 2023). This creates a feedback loop where affordability gains are eroded almost as quickly as they are introduced.

Comparatively, jurisdictions like the UK mitigate this effect by tying incentives to new construction, ensuring that increased demand is met with proportional supply. However, even these measures face challenges in areas with restrictive planning laws, highlighting the importance of aligning demand-side policies with robust supply-side reforms.

“Demand-side measures without concurrent supply-side adjustments risk inflating prices, benefiting sellers more than buyers.”

— Brendan Coates, Economic Policy Program Director, Grattan Institute

This underscores the necessity of integrated approaches that balance immediate relief with systemic market stability.

Effectiveness of Incentives in Long-Term Housing Policy

Election-driven housing incentives often falter in achieving sustained affordability due to their reliance on demand-side mechanisms without addressing systemic supply constraints. A critical aspect is the temporal mismatch between immediate market reactions and the protracted timelines required for supply-side adjustments. For instance, first-home buyer grants typically accelerate purchasing decisions, but in supply-constrained markets, this surge in demand inflates prices, eroding affordability gains.

A comparative analysis highlights the divergent outcomes of demand-focused versus integrated approaches. In Japan, flexible zoning laws have enabled high-density developments, mitigating price pressures despite population growth. Conversely, Australia’s restrictive zoning policies exacerbate supply bottlenecks, amplifying the inflationary effects of grants. This underscores the importance of aligning incentives with structural reforms to ensure long-term efficacy.

“Demand-side policies alone often intensify competition, benefiting sellers more than buyers,”

— Dr. Brendan Coates, Economic Policy Program Director, Grattan Institute

A novel framework for evaluating these policies involves assessing their “affordability retention rate” over a decade, factoring in price stability and accessibility metrics. This approach reveals that without concurrent supply-side measures, such as expedited planning approvals or infrastructure investments, election-timed incentives risk perpetuating cyclical affordability crises rather than resolving them.

FAQ

What are the key election-driven incentives for first-home buyers in Australia in 2025?

In 2025, election-driven incentives for first-home buyers in Australia include Labor’s expanded shared-equity scheme, allowing purchases with a 5% deposit, and a pledge to construct 1.2 million homes by 2029, with 100,000 reserved for first-home buyers. The Coalition offers tax-deductible interest payments on the first $650,000 of a mortgage for new homes, access to $50,000 from superannuation for deposits, and streamlined approvals to unlock 500,000 homes. Both parties propose a two-year ban on foreign purchases of existing properties, reflecting a focus on affordability. These measures aim to address accessibility but risk inflating prices without concurrent supply-side reforms.

How do political cycles impact housing affordability and first-home buyer activity in Australia?

Political cycles significantly influence housing affordability and first-home buyer activity in Australia by introducing demand-side incentives, such as grants and tax benefits, often timed to sway voter sentiment. These measures temporarily boost market participation but frequently exacerbate affordability challenges by inflating prices in supply-constrained areas. Policy uncertainty during elections, including debates on negative gearing or capital gains tax, can delay buyer decisions, creating short-term market stagnation. Additionally, election-driven promises, like shared-equity schemes or superannuation access, enhance accessibility but intensify competition. Without parallel supply-side reforms, such as zoning adjustments or infrastructure investment, these cycles risk perpetuating affordability crises.

What role do tax policies and zoning reforms play in shaping first-home buyer incentives during elections?

Tax policies and zoning reforms are pivotal in shaping first-home buyer incentives during elections by influencing both demand and supply dynamics. Generous tax concessions, such as negative gearing and capital gains tax discounts, often favor investors, sidelining first-home buyers. Election proposals to reform these policies aim to rebalance market accessibility but face political resistance. Zoning reforms, meanwhile, directly impact housing supply by dictating land use and development density. Restrictive zoning inflates land values, limiting affordable housing projects, while flexible policies can boost supply in high-demand areas. Together, these factors critically shape affordability, investment patterns, and market stability during election cycles.

How do supply constraints influence the effectiveness of first-home buyer grants and shared-equity schemes?

Supply constraints significantly limit the effectiveness of first-home buyer grants and shared-equity schemes by intensifying competition for limited housing stock. In markets with restrictive zoning or labor shortages, increased purchasing power from these incentives often drives up property prices, eroding affordability gains. Shared-equity schemes, while addressing deposit and repayment barriers, face challenges in areas with insufficient new housing supply, reducing their impact. Without concurrent supply-side reforms, such as streamlined planning approvals or infrastructure investments, these demand-side measures risk inflating prices further, benefiting sellers and investors over first-home buyers and perpetuating systemic affordability issues in Australia’s housing market.

What are the long-term implications of election-driven housing policies on Australia’s property market?

Election-driven housing policies have profound long-term implications for Australia’s property market, often amplifying systemic imbalances. Demand-side measures, such as grants and shared-equity schemes, temporarily boost first-home buyer activity but frequently inflate prices in supply-constrained markets, benefiting sellers over buyers. Over time, these policies can entrench affordability challenges, particularly if unaccompanied by supply-side reforms like zoning adjustments or infrastructure investments. Additionally, political cycles create market volatility, with policy uncertainty delaying investment and development decisions. Without cohesive, multi-faceted strategies addressing both demand and supply, election-driven policies risk perpetuating cyclical affordability crises and undermining sustainable market stability.