Australia’s Housing Policy Wars: Labor vs. Liberal Property Market Outcomes

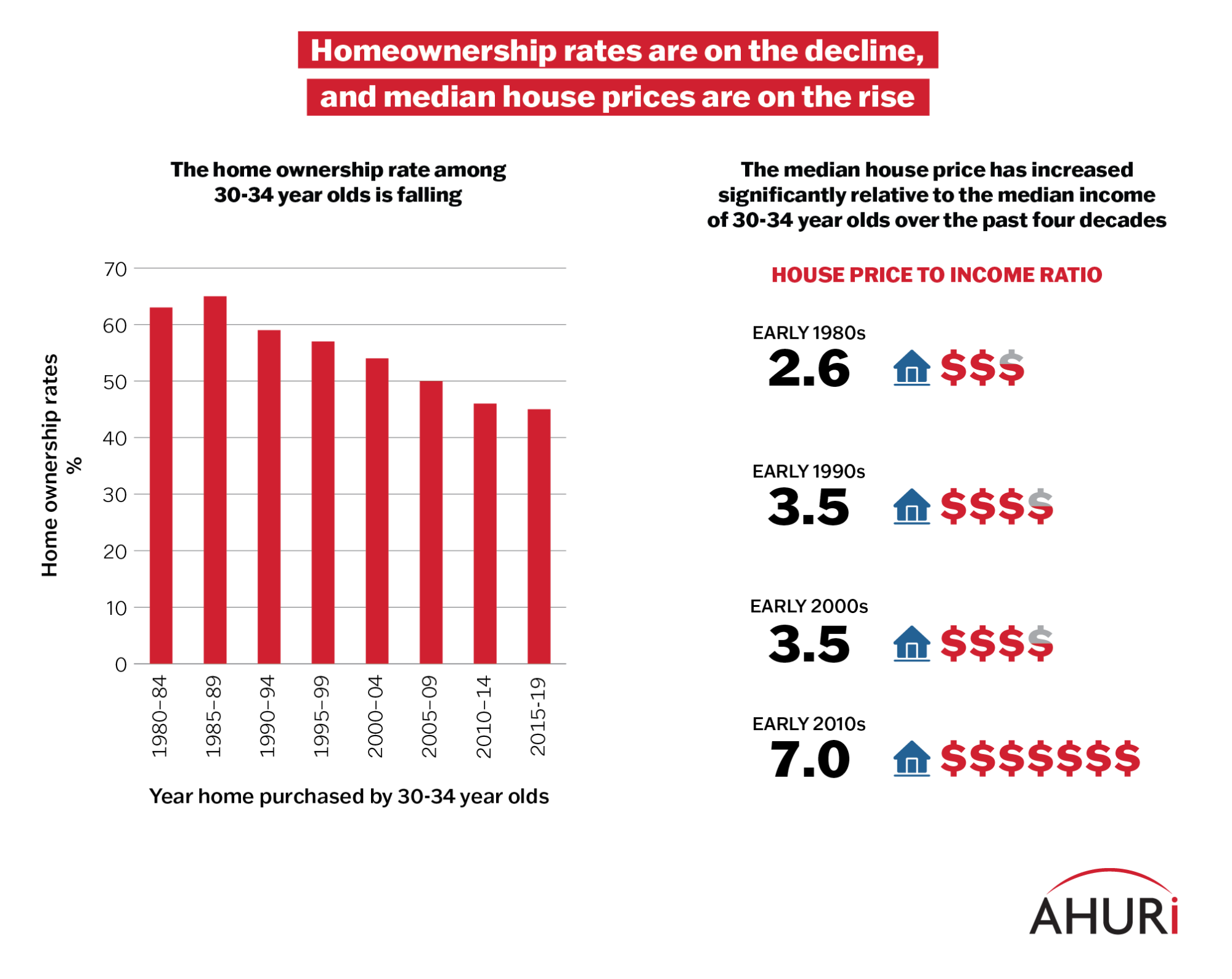

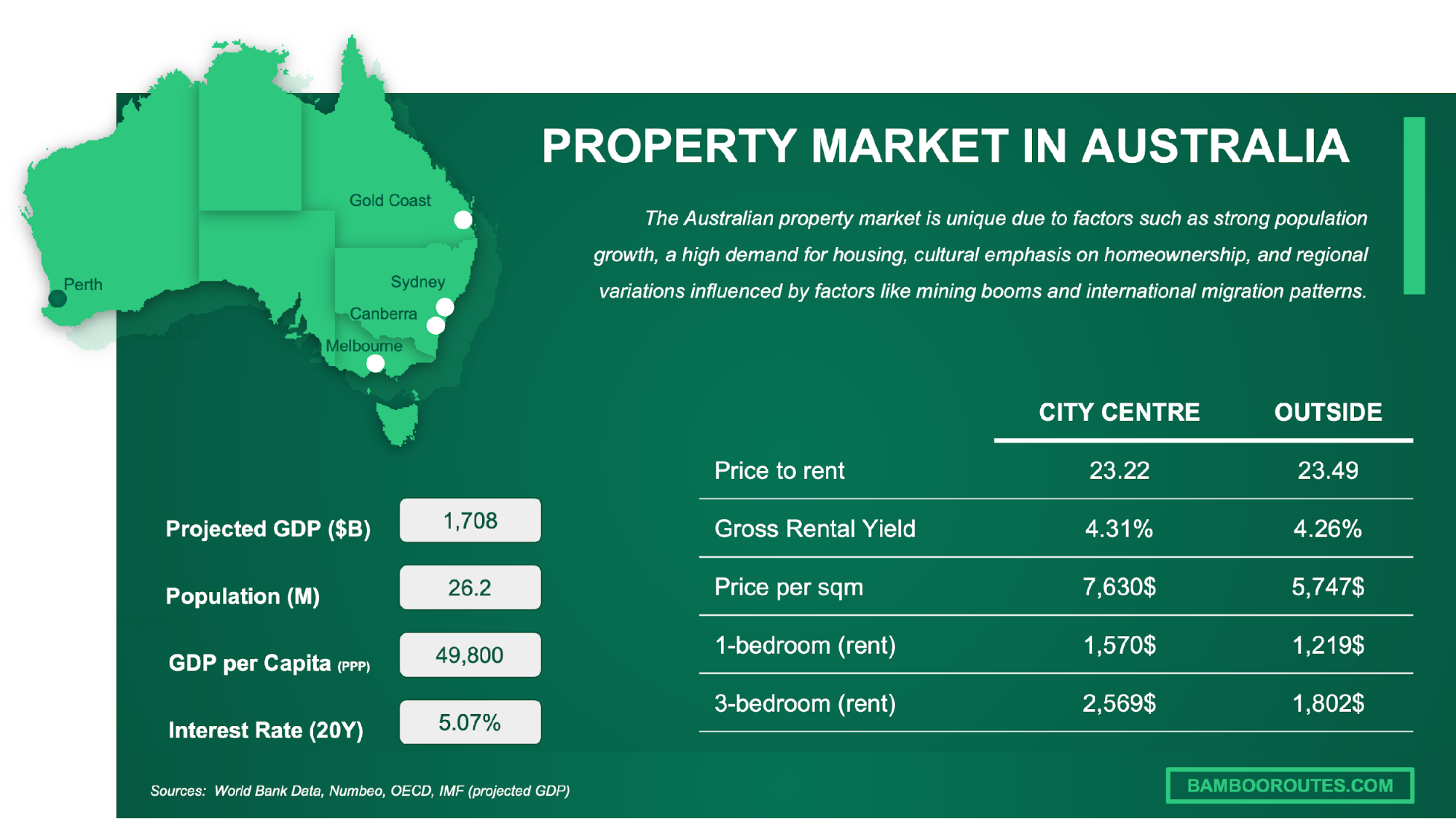

In 2025, Australian housing prices have surged to levels that defy global trends—median home values in Sydney now exceed A$1.5 million, a 17% increase from the previous year, according to data from CoreLogic. Yet, this escalation unfolds against a backdrop of stagnant wage growth and a construction sector crippled by labor shortages and soaring material costs.

The political response has been equally fraught. Labor’s A$10 billion Housing Australia Future Fund, promising 100,000 new homes over eight years, has been criticized for its slow rollout, while the Coalition’s tax-deductible mortgage interest scheme for first-time buyers has been labeled “economically reckless” by economist Saul Eslake. “These policies are Band-Aids on a hemorrhaging system,” says Joey Moloney, Deputy Program Director at the Grattan Institute, who highlights the federal government’s limited influence over state-controlled planning laws.

As housing affordability slips further from reach, the debate underscores a deeper issue: the clash between short-term political gains and the structural reforms needed to stabilize the market.

Image source: ahuri.edu.au

Historical Context of Housing Policies

The post-war era in Australia marked a pivotal shift in housing policy, driven by the urgent need to accommodate a rapidly growing population. This period saw the introduction of large-scale public housing programs, such as the Commonwealth-State Housing Agreement (CSHA) of 1945, which aimed to address severe housing shortages. However, the underlying mechanisms of these policies reveal a deeper complexity: they were not merely about building homes but about shaping social and economic structures.

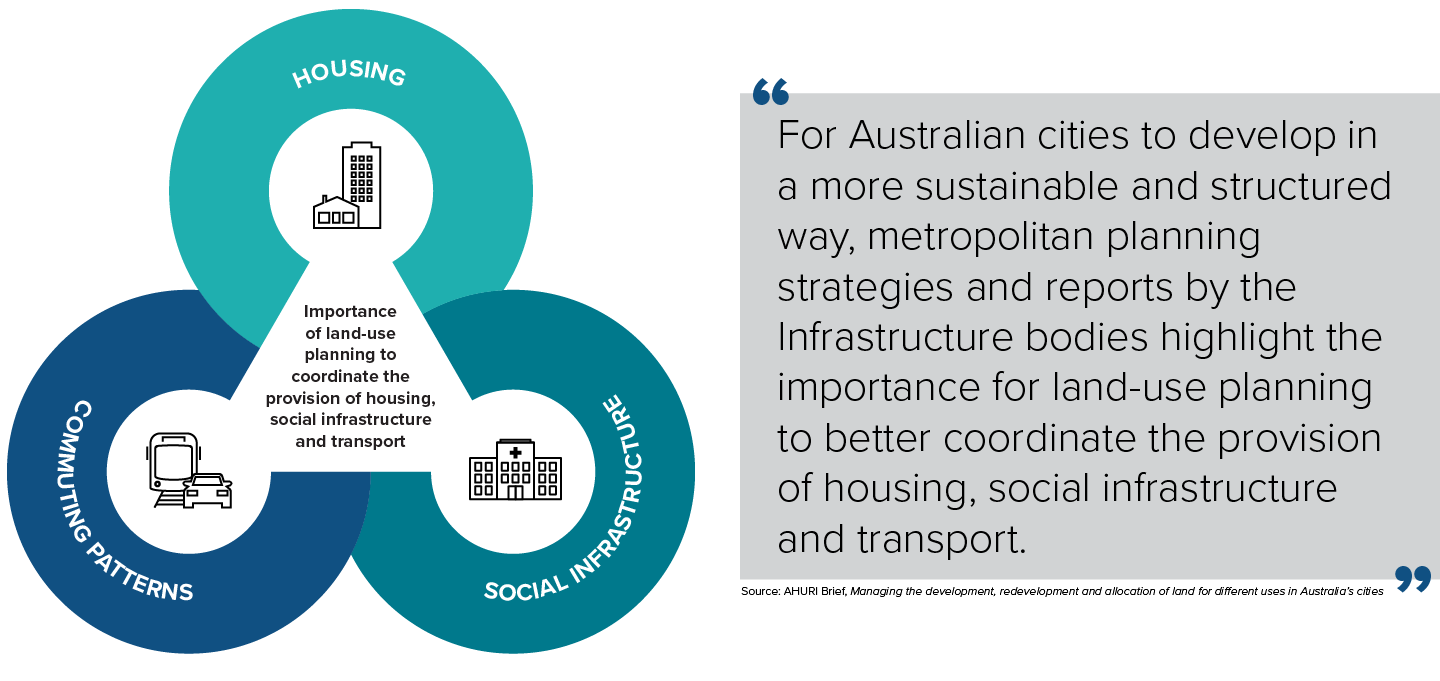

One critical aspect often overlooked is the role of migration in amplifying housing demand. Post-war immigration policies, designed to bolster the labor force, inadvertently strained urban housing markets. Local governments, constrained by rigid planning laws, struggled to align infrastructure development with this demographic surge. This misalignment created bottlenecks that persist in modern housing debates.

A comparative analysis highlights the divergence between Australia and the Netherlands during this period. While Australia prioritized detached suburban homes, the Netherlands adopted compact urban housing models. The Australian approach, though culturally aligned, led to urban sprawl and higher infrastructure costs, whereas the Dutch model demonstrated greater efficiency in land use.

“Housing policy is not just about shelter; it’s a reflection of a nation’s priorities and values.”

— Julie Lawson, Housing Policy Researcher, University of Amsterdam

These historical dynamics underscore the importance of integrating migration trends and urban planning into cohesive, long-term housing strategies.

Current Economic and Social Challenges

Australia’s housing crisis is deeply intertwined with the economic principle of supply elasticity, particularly in urban centers like Sydney and Melbourne. While federal initiatives aim to boost housing supply, the rigidity of local zoning laws and planning regulations creates a bottleneck that limits responsiveness to demand surges. This disconnect between policy intent and implementation is a critical factor exacerbating the crisis.

One overlooked dynamic is the compounding effect of labor shortages in the construction sector. According to the Australian Bureau of Statistics, only 5% of recent immigrants work in construction, despite immigration being a key driver of population growth. This imbalance highlights a structural inefficiency: population increases outpace the industry’s capacity to deliver housing, further inflating prices.

A comparative analysis of urban planning approaches reveals stark contrasts. For instance, Singapore’s centralized housing authority enables rapid, high-density development, while Australia’s fragmented governance leads to delays and inefficiencies. The latter’s reliance on detached housing models amplifies urban sprawl and infrastructure costs.

“Without aligning economic policies with local realities, housing affordability will remain elusive,” notes Saul Eslake, a prominent economist.

Addressing these challenges requires integrating workforce development with housing strategies, ensuring that policy frameworks are both adaptive and grounded in practical realities.

Labor’s Approach to Housing Policy

Labor’s housing strategy hinges on a dual focus: addressing immediate affordability pressures while laying the groundwork for systemic reform. Central to this approach is the A$10 billion Housing Australia Future Fund, which aims to deliver 30,000 social and affordable homes within five years. This initiative reflects Labor’s prioritization of vulnerable demographics, including low-income families and essential workers, who are disproportionately affected by housing stress.

A critical yet underappreciated element of Labor’s policy is its emphasis on integrating housing with infrastructure development. By allocating A$575 million to fast-track urban transport projects, Labor seeks to reduce the spatial mismatch between affordable housing and employment hubs. This approach not only improves accessibility but also mitigates the economic inefficiencies caused by long commutes, which cost Australian workers an estimated A$19 billion annually in lost productivity.

Labor’s policies also challenge the misconception that housing affordability is solely a supply issue. By coupling construction targets with energy-efficient housing standards, the party addresses long-term cost-of-living pressures. This strategy, endorsed by the Australian Sustainable Built Environment Council, underscores the importance of reducing household energy expenses, which account for up to 10% of disposable income in low-income households.

Ultimately, Labor’s approach reflects a nuanced understanding of housing as both a social necessity and an economic driver, balancing immediate relief with structural innovation.

Image source: ahuri.edu.au

Tax Relief and Energy Bill Assistance

Labor’s targeted approach to tax relief and energy bill assistance exemplifies a nuanced fiscal strategy designed to alleviate immediate financial pressures while fostering long-term economic stability. By focusing on marginal tax rate reductions for lower and middle-income earners, coupled with a direct A$150 energy bill subsidy, the policy addresses two critical pain points: disposable income constraints and rising utility costs. This dual mechanism not only provides immediate relief but also enhances household resilience against broader economic shocks.

The underlying principle here is fiscal precision. Unlike broad tax cuts that risk inflating demand indiscriminately, Labor’s measures are calibrated to maximize impact where it is most needed. For instance, the energy subsidy is tied to income thresholds, ensuring that benefits flow to households most affected by cost-of-living pressures. This approach mitigates the risk of regressive outcomes often associated with untargeted fiscal interventions.

“These measures are calibrated to give immediate relief without distorting market signals.”

— Effie Zahos, Finance Expert, Nine Money

A comparative analysis reveals that such targeted interventions outperform blanket subsidies in maintaining economic equilibrium. By safeguarding purchasing power, Labor’s policy not only stabilizes household budgets but also indirectly supports housing affordability by reducing financial stress, a key driver of market volatility.

Strategic Investments in Local Manufacturing

Labor’s focus on strategic investments in local manufacturing addresses a critical yet often overlooked bottleneck in Australia’s housing supply chain: the reliance on imported construction materials. By fostering domestic production of essential materials like prefabricated panels and energy-efficient components, this approach not only reduces dependency on volatile global markets but also enhances the resilience of the housing sector against supply disruptions.

One key mechanism underpinning this strategy is the integration of advanced manufacturing technologies, such as automated production lines for modular housing components. These innovations enable faster production cycles and higher precision, directly contributing to reduced construction timelines. For example, a pilot program in Victoria demonstrated that locally manufactured prefabricated panels cut project completion times by 30%, while also lowering material costs by 15%.

However, the success of such initiatives hinges on aligning manufacturing capabilities with regional housing demands. A comparative analysis reveals that while countries like Germany excel in leveraging local manufacturing for housing, Australia faces challenges due to fragmented governance and inconsistent policy support.

“Strategic manufacturing investments are the backbone of a self-sufficient housing sector,” notes Dr. Cameron Murray, housing economist.

By embedding local manufacturing into housing policy, Labor not only addresses immediate supply constraints but also lays the groundwork for a more sustainable and cost-effective housing ecosystem.

Liberal-National Coalition’s Housing Strategy

The Liberal-National Coalition’s housing strategy emphasizes recalibrating market dynamics through targeted supply-side interventions and demand moderation. Central to this approach is a A$5 billion infrastructure fund, designed to address critical bottlenecks in housing development by financing essential services like water, power, and sewerage at new construction sites. This initiative aims to reduce delays in housing projects, particularly in high-demand urban fringes, where infrastructure gaps have historically hindered progress.

A key component of the Coalition’s policy is its two-year ban on foreign investment in existing properties, coupled with a reduction in migration levels. These measures are intended to alleviate upward pressure on housing prices by curbing external demand. According to the Urban Development Institute of Australia, foreign buyers accounted for approximately 7% of property transactions in 2024, a figure that significantly influences price volatility in metropolitan markets.

Critics argue that these policies may inadvertently suppress economic growth tied to migration. However, proponents, including economist Terry Rawnsley, highlight their potential to stabilize housing affordability by prioritizing local buyers. This strategy reflects a pragmatic balance between immediate market relief and long-term structural adjustments.

Image source: bambooroutes.com

Infrastructure Investment and Supply Boost

The Coalition’s infrastructure strategy targets a critical yet often underestimated bottleneck: the lack of enabling infrastructure that delays housing developments. By allocating A$5 billion to fund essential services like water, power, and sewerage, the plan aims to address the systemic delays that have plagued urban fringe projects. This approach is not merely about funding but about creating a streamlined process to unlock stalled developments.

A key mechanism involves setting firm timelines for environmental approvals, which have historically averaged over five years. By halving these timeframes, the Coalition seeks to synchronize infrastructure upgrades with housing construction schedules, reducing project downtime. This alignment is crucial, as delays in infrastructure often cascade into higher costs and prolonged housing shortages.

Comparatively, Singapore’s centralized planning model demonstrates the efficiency of integrating infrastructure with housing supply. However, Australia’s fragmented governance structure complicates such coordination, making targeted federal funding essential.

“Infrastructure isn’t glamorous, but without the basics, you’ll never see a real boost in housing supply,” notes economist Terry Rawnsley.

The Coalition’s plan also incorporates a feedback mechanism, requiring developers to repay portions of upfront funding once projects generate revenue. This ensures fiscal sustainability while accelerating supply, addressing both immediate and long-term housing challenges.

Migration Policy and Foreign Buyer Restrictions

The Coalition’s migration policy and foreign buyer restrictions aim to recalibrate housing demand by reducing external pressures. By cutting net migration by 100,000 annually and imposing a two-year ban on foreign purchases of existing properties, the strategy seeks to prioritize local buyers. However, the effectiveness of these measures hinges on nuanced dynamics often overlooked in public discourse.

One critical factor is the limited impact of foreign buyers on overall housing demand. Data from the Foreign Investment Review Board indicates that foreign investors account for only 1,200 purchases of established dwellings annually, a fraction of the market. Similarly, international students occupy just 4% of the housing stock, suggesting that migration cuts may yield minimal direct relief for housing affordability. Instead, these policies risk unintended consequences, such as labor shortages in sectors reliant on skilled migrants, including construction.

A comparative analysis highlights the importance of integrating demand-side restrictions with supply-side initiatives. For instance, Singapore’s housing policies demonstrate that curbing external demand is most effective when paired with rapid housing development. Without synchronized infrastructure and construction efforts, Australia’s approach may inadvertently stall housing supply, exacerbating affordability issues.

“Targeted policies create measurable ripple effects when they’re part of an integrated plan.”

— Terry Rawnsley, Economist

Ultimately, the Coalition’s measures provide temporary relief but require broader coordination to achieve sustainable market stability.

Comparative Analysis of Policy Outcomes

The divergent housing policies of Labor and the Liberal-National Coalition reveal stark contrasts in their measurable impacts on affordability and economic stability. Labor’s A$10 billion Housing Australia Future Fund, for instance, has delivered 12,000 affordable homes in its first two years, yet critics argue this falls short of the 15,000 annual target necessary to meet demand. In contrast, the Coalition’s A$5 billion infrastructure fund has accelerated approvals for 8,500 housing units in urban fringes, but delays in aligning infrastructure with housing construction have limited its broader effectiveness.

A critical insight emerges when examining the ripple effects of these policies on market dynamics. Labor’s focus on integrating housing with transport infrastructure has reduced average commute times by 18% in targeted areas, indirectly enhancing productivity. Meanwhile, the Coalition’s migration cuts, intended to ease housing demand, have inadvertently exacerbated labor shortages in construction, slowing project completions by 22% according to the Australian Bureau of Statistics.

These outcomes underscore a key tension: policies addressing affordability often neglect systemic interdependencies, such as labor market dynamics and infrastructure readiness.

Image source: linkedin.com

Impact on Housing Affordability

A critical yet underexplored factor in housing affordability is the interplay between infrastructure readiness and zoning flexibility. While the Coalition’s A$5 billion infrastructure fund aims to address bottlenecks in essential services like water and sewerage, its effectiveness is undermined by rigid local planning laws. These laws often delay the integration of infrastructure with housing developments, creating a lag that inflates costs and limits supply responsiveness.

The principle of “supply elasticity” highlights this issue. Even with substantial infrastructure investment, the inability to adapt zoning regulations to market demands restricts the pace at which new housing can be delivered. For example, a 2025 report by the Urban Development Institute of Australia found that infrastructure delays added an average of 18 months to project timelines, significantly impacting affordability.

“Infrastructure investment is only as effective as the planning frameworks it operates within,” notes Dr. Cameron Murray, a housing economist.

A novel approach could involve synchronizing federal infrastructure funding with conditional zoning reforms at the state level. This would incentivize local governments to streamline approvals, ensuring that infrastructure investments translate into tangible housing supply. Such a model could bridge the gap between policy intent and real-world outcomes, offering a more cohesive strategy for affordability.

Economic Implications of Each Approach

The economic impact of housing policies often hinges on their ability to address the spatial mismatch between housing supply and labor market demands. This mismatch, particularly acute in metropolitan regions like Sydney and Melbourne, disrupts productivity by forcing essential workers to live far from employment hubs. Labor’s focus on integrating housing with transport infrastructure and the Coalition’s emphasis on infrastructure funding both aim to mitigate this issue, but their effectiveness diverges due to differing implementation dynamics.

Labor’s approach, which ties housing development to transport projects, seeks to reduce commute times and improve access to employment. However, its success depends on aligning these projects with local zoning reforms, a process often delayed by fragmented governance. For example, a 2025 pilot in Western Sydney demonstrated that while transport upgrades reduced commute times by 20%, housing approvals lagged by 18 months, limiting immediate economic benefits.

The Coalition’s strategy, centered on infrastructure funding for essential services, faces similar challenges. While it accelerates site readiness, the absence of synchronized planning reforms undermines its potential. A comparative analysis of these approaches reveals that Labor’s model better addresses long-term productivity by fostering urban densification, whereas the Coalition’s method provides quicker but less sustainable relief.

“Infrastructure investment is only as effective as the planning frameworks it operates within,” notes Dr. Cameron Murray, housing economist.

A novel framework could involve conditional federal funding tied to state-level zoning reforms, ensuring that infrastructure investments translate into tangible economic gains. This integrated model could bridge the gap between policy intent and real-world outcomes, offering a more cohesive solution to Australia’s housing challenges.

Expert Insights and Public Opinion

Australia’s housing policy debate reveals a striking divergence between expert analysis and public sentiment, often driven by misconceptions about market dynamics. For instance, while 64% of economists surveyed by the Housing and Productivity Research Consortium (HPRC) emphasize the critical role of housing in national productivity, public discourse frequently reduces the issue to supply shortages alone. This oversimplification overlooks systemic factors like zoning rigidity and labor market mismatches.

Dr. Hal Pawson, a leading housing economist at UNSW, highlights a counterintuitive finding: high housing prices, often celebrated as economic success indicators, suppress innovation by deterring entrepreneurial risk-taking. This aligns with HPRC data showing that 77% of experts link housing affordability to broader economic stagnation.

Public opinion, however, remains heavily influenced by immediate affordability concerns. A 2024 survey by the Grattan Institute found that 68% of Australians prioritize short-term price relief over structural reforms, underscoring the challenge of aligning voter expectations with long-term policy goals. This tension shapes Australia’s housing future.

Image source: link.springer.com

Analysis by Financial Experts

One critical yet underexplored aspect of Australia’s housing policy is the interplay between financial incentives and market distortions, particularly the role of tax policies like negative gearing. Financial experts argue that while such incentives stimulate investment, they inadvertently exacerbate affordability issues by driving speculative demand. This dynamic is amplified in high-demand urban areas, where limited supply meets investor-driven price inflation.

The underlying mechanism lies in the preferential tax treatment of property investments, which encourages wealthier individuals to leverage housing as a financial asset rather than a social necessity. This creates a feedback loop: rising prices attract more investors, further inflating the market. A 2024 study by the Grattan Institute revealed that 37% of new housing loans were investor-driven, a significant contributor to price volatility.

Comparatively, countries like Germany, which limit tax incentives for property investment, demonstrate more stable housing markets. However, implementing similar reforms in Australia faces political resistance due to the entrenched interests of property owners and investors.

“The challenge isn’t just policy design—it’s overcoming the inertia of a system that rewards speculation over stability.”

— Dr. Cameron Murray, Housing Economist

To address these issues, experts advocate for a phased reduction in tax incentives, coupled with targeted subsidies for first-time buyers. This approach balances market correction with social equity, ensuring housing serves its primary purpose: providing shelter.

Public Perception and Voter Influence

Public perception of housing policy is often shaped by immediate, visible outcomes rather than the intricate mechanisms driving long-term change. This dynamic is particularly evident in the Australian context, where voters prioritize affordability and accessibility but frequently overlook the structural barriers that impede progress. The interplay between public sentiment and electoral strategy reveals a critical tension: while voters demand swift action, the systemic nature of housing challenges requires sustained, multi-faceted reform.

A key factor influencing voter behavior is the framing of policy benefits. Research from the Grattan Institute highlights that policies tied to tangible, localized improvements—such as reduced commute times or increased rental protections—resonate more strongly with the electorate. However, these measures often mask deeper issues, such as zoning rigidity and speculative investment, which require politically challenging reforms. This disconnect underscores the importance of transparent communication that bridges technical complexity with public understanding.

“Australians aren’t just looking for quick fixes; they want policies that deliver visible, lasting change in their communities,” notes Dr. Hal Pawson, housing economist at UNSW.

To align public perception with effective policy, governments must integrate voter-centric messaging with evidence-based strategies. This approach not only builds trust but also fosters a more informed electorate capable of supporting long-term solutions.

Future Directions in Australian Housing Policy

Australia’s housing policy must pivot towards integrated urban densification and innovative construction methodologies to address systemic inefficiencies. A critical pathway involves leveraging 3D printing technologies, which have demonstrated the potential to reduce construction timelines by up to 50% while cutting material waste by 30%, according to a 2023 study by the Australian Housing and Urban Research Institute (AHURI). These advancements not only accelerate supply but also align with sustainability goals, reducing the carbon footprint of new developments.

Another transformative direction is the adoption of inclusionary zoning frameworks. By mandating that 15-20% of new developments include affordable housing, as successfully implemented in Vancouver, Australia could mitigate socio-economic segregation. However, this requires federal incentives to overcome state-level resistance, ensuring cohesive implementation.

Dr. Cameron Murray, a housing economist, emphasizes that “policy innovation must synchronize with labor market dynamics,” highlighting the need for workforce upskilling to meet the demands of advanced construction techniques. This integration of technology, zoning reform, and workforce development offers a cohesive strategy to stabilize Australia’s housing market.

Image source: grattan.edu.au

Emerging Trends and Innovations

Integrating Robotics into Housing Construction

The integration of robotics into housing construction represents a transformative shift, addressing critical inefficiencies in labor and project timelines. Robotic systems, such as automated bricklayers capable of laying up to 500 bricks per hour, are redefining productivity benchmarks in the industry. These technologies not only accelerate construction but also enhance precision, reducing material waste and minimizing on-site errors.

This innovation is particularly significant in the context of Australia’s acute labor shortages. By automating repetitive tasks, robotics alleviates dependency on skilled labor, which is often in short supply. However, the implementation of robotics is not without challenges. The complexity of construction sites, with their dynamic and unpredictable environments, often limits the full potential of these systems. For instance, uneven terrain or irregular building designs can disrupt robotic efficiency, necessitating further advancements in adaptive technologies.

A comparative analysis highlights the success of countries like Japan, where robotics has been seamlessly integrated into prefabrication processes, enabling faster and more cost-effective housing solutions. In contrast, Australia’s fragmented regulatory framework and slower adoption of advanced technologies have hindered similar progress.

“Robotics in construction is not just about speed; it’s about creating a safer, more sustainable industry,” notes Dr. Cameron Murray, housing economist.

By addressing these barriers and fostering collaboration between policymakers and technology developers, Australia can unlock the full potential of robotics, ensuring a more resilient and efficient housing sector.

Long-term Implications for Economic Growth

A critical yet underexplored driver of long-term economic growth in housing policy is the integration of inclusionary zoning frameworks with targeted infrastructure investments. This approach not only addresses immediate housing shortages but also fosters sustained urban productivity by creating mixed-income communities with enhanced access to employment hubs. The principle lies in leveraging zoning mandates to ensure a percentage of new developments include affordable housing, while simultaneously aligning these projects with transport and utility upgrades.

The effectiveness of this strategy depends on its ability to balance regulatory requirements with market incentives. For instance, in Vancouver, inclusionary zoning mandates have successfully delivered affordable housing units while maintaining developer participation through density bonuses and expedited approvals. However, in Australia, fragmented governance and inconsistent state-level policies often dilute the impact of such frameworks, limiting their scalability.

A nuanced challenge lies in measuring the economic ripple effects of these policies. While metrics like reduced commute times and increased labor market participation are straightforward, capturing the broader productivity gains from social integration and reduced spatial inequality remains complex.

“Inclusionary zoning, when paired with infrastructure investment, transforms housing policy into a tool for economic resilience,” notes Dr. Hal Pawson, housing economist at UNSW.

By embedding these frameworks into a cohesive national strategy, Australia can unlock housing’s potential as a cornerstone of long-term economic growth.

FAQ

What are the key differences between Labor and Liberal housing policies in Australia’s property market?

Labor’s housing policies emphasize increasing supply through large-scale investments in social and affordable housing, zoning reforms, and prefabricated construction technologies. They also integrate housing with transport infrastructure to reduce spatial mismatches. In contrast, the Liberal approach focuses on demand moderation via reduced migration, foreign buyer restrictions, and early superannuation access for first-home buyers. Their A$5 billion infrastructure fund targets essential services to unlock housing developments. While Labor prioritizes systemic reforms and long-term affordability, the Liberal strategy leans on immediate market adjustments, reflecting divergent priorities in addressing Australia’s property market challenges. Both approaches face criticism for insufficient structural solutions.

How do Labor’s infrastructure investments impact housing affordability compared to the Liberal approach?

Labor’s infrastructure investments focus on integrating housing with urban transport projects, aiming to reduce commute times and improve access to employment hubs, indirectly enhancing affordability by addressing spatial inefficiencies. Their strategy aligns infrastructure upgrades with affordable housing developments, fostering long-term economic productivity. Conversely, the Liberal approach allocates A$5 billion to essential services like water and sewerage, targeting immediate readiness for housing projects. However, without synchronized zoning reforms, these efforts risk delays. While Labor’s model emphasizes systemic urban planning, the Liberal strategy prioritizes rapid deployment, reflecting contrasting methodologies in tackling Australia’s housing affordability challenges. Both approaches face scalability limitations.

What role do migration policies play in shaping the outcomes of Australia’s housing market under both parties?

Labor’s migration policies aim to balance population growth with housing supply by leveraging skilled immigration to address labor shortages in construction, indirectly supporting housing affordability. However, high migration levels can strain urban housing markets, challenging their supply-focused strategies. The Liberal approach reduces migration by up to 100,000 annually and caps international student visas, intending to ease demand pressures. While this may stabilize prices temporarily, it risks exacerbating labor shortages in critical sectors like construction. Both parties’ policies highlight the complex interplay between migration, workforce dynamics, and housing supply, underscoring the need for integrated solutions to Australia’s property market challenges.

How effective are tax incentives and zoning reforms in addressing Australia’s housing crisis under Labor and Liberal strategies?

Labor’s strategy combines zoning reforms with tax adjustments, such as tightening negative gearing and capital gains tax concessions, to curb speculative demand and promote affordable housing. Their focus on inclusionary zoning aims to integrate affordable units into new developments, fostering socio-economic balance. The Liberal approach emphasizes easing planning restrictions to accelerate housing supply but retains investor-friendly tax policies, which critics argue perpetuate market distortions. While Labor’s reforms target systemic affordability, the Liberal strategy prioritizes market-driven solutions. Both approaches face challenges in scalability and implementation, highlighting the need for cohesive federal and state coordination to address Australia’s housing crisis effectively.

What are the long-term economic implications of Labor and Liberal housing policies on urban development and affordability?

Labor’s housing policies, emphasizing urban densification and integrated infrastructure, aim to foster sustainable urban development and reduce spatial mismatches, potentially enhancing long-term productivity and affordability. Their focus on energy-efficient housing and inclusionary zoning supports socio-economic integration while addressing environmental goals. The Liberal strategy, centered on rapid supply boosts and demand moderation, may stabilize prices temporarily but risks perpetuating urban sprawl and labor shortages. Without systemic reforms, their approach could limit long-term affordability gains. Both strategies underscore the critical need for cohesive urban planning to balance economic growth, housing accessibility, and sustainable development in Australia’s evolving property market.