Do Federal Elections Really Move Australia’s Property Market? Data vs. Myths

In May 2022, as Australians cast their votes in a federal election, property auctions held on the same day defied expectations—achieving a clearance rate of 60.4%, higher than the Saturdays immediately before and after, according to Domain’s analysis. This anomaly challenges the entrenched belief that elections paralyze the property market, revealing instead a pattern of heightened buyer commitment amidst political uncertainty.

While political campaigns often spotlight housing affordability and tax policies, the data suggests these debates rarely translate into immediate market upheavals. Dr. Nicola Powell, Domain’s Chief of Research and Economics, underscores this complexity: “Elections can influence sentiment and policy, but they are just one factor in a much larger economic equation.” Her findings, based on seven election cycles, show no consistent advantage for either major party in driving property growth—house prices grew marginally faster under Liberal governments, while Labor periods saw stronger unit price increases and first-home buyer activity.

Ultimately, the forces shaping Australia’s property market—interest rates, supply shortages, and global economic trends—dwarf the fleeting impact of election-day jitters.

Image source: mrwilliamsburg.com

Fundamentals of the Australian Property Market

The Australian property market operates on a foundation of enduring economic principles, with supply-demand dynamics and macroeconomic indicators taking precedence over transient political events. A critical driver is the persistent housing supply shortage, particularly in urban centers like Sydney and Melbourne, where demand consistently outpaces new construction. This imbalance exerts upward pressure on prices, irrespective of election cycles.

Interest rates, set by the Reserve Bank of Australia (RBA), represent another cornerstone. Changes in the cash rate directly influence borrowing capacity and buyer sentiment. For instance, a 25-basis-point reduction can significantly enhance affordability, often overshadowing the impact of election-year policy announcements. Historical data underscores this: during periods of rate cuts, property markets have demonstrated resilience even amidst heightened political uncertainty.

“Elections create short-term noise, but the market’s trajectory is dictated by structural factors like interest rates and supply constraints.”

— Dr. Nicola Powell, Chief of Research and Economics, Domain

A nuanced understanding also reveals that demographic trends, such as population growth and migration patterns, sustain long-term demand. While election policies may tweak affordability schemes or tax incentives, their effects are typically incremental, absorbed into broader economic trends. This highlights the importance of focusing on enduring fundamentals rather than fleeting political narratives.

Overview of Federal Elections and Policy Changes

Federal elections often serve as a lens through which housing policies are scrutinized, yet their actual impact on market dynamics is frequently overstated. A critical aspect to examine is how proposed policy changes—such as adjustments to negative gearing or first-home buyer incentives—interact with entrenched economic forces like interest rates and supply-demand imbalances.

Policy announcements during campaigns can create temporary shifts in market sentiment. For instance, the 2019 election saw investor hesitation due to proposed changes to negative gearing, but the market rebounded swiftly once the status quo was maintained. This highlights a key dynamic: the market’s sensitivity to uncertainty rather than the policies themselves. Comparative analysis of past elections reveals that even when significant reforms are proposed, their implementation is often diluted or delayed, minimizing long-term disruption.

Contextual factors, such as the Reserve Bank of Australia’s monetary policy, further dilute the influence of election outcomes. For example, during periods of rate cuts, borrowing affordability often overshadows any policy-driven market hesitations. This interplay underscores the limited scope of elections in altering structural market drivers.

“Election promises often serve more to set the narrative than to reshape market fundamentals.”

— Dr. Nicola Powell, Chief of Research and Economics, Domain

Ultimately, while elections may shape short-term narratives, their influence is constrained by broader economic realities, emphasizing the need for investors to focus on enduring fundamentals rather than transient political cycles.

Short-Term Volatility and Market Sentiment During Elections

Election periods often amplify market uncertainty, but the relationship between this volatility and property market behavior is more nuanced than commonly assumed. For instance, Domain’s analysis highlights that a 1-point rise in Australia’s Economic Policy Uncertainty Index (EPU) correlates with 8.08 fewer property transactions, illustrating how sentiment shifts can directly impact activity. However, this effect is neither exclusive to elections nor uniformly disruptive.

A counterintuitive finding is that auction clearance rates on election days often outperform surrounding weekends. With auction volumes typically halving due to seller hesitancy, serious buyers face reduced competition, creating tighter bidding environments. This phenomenon underscores how perceived risks can generate unexpected opportunities.

Dr. Nicola Powell, Chief of Research and Economics at Domain, emphasizes that such volatility reflects broader economic forces rather than election outcomes alone. Interest rates, for example, exert a far greater influence, as evidenced by the RBA’s 2022-2023 rate hikes, which overshadowed political events entirely.

Image source: morningstar.com.au

Election Cycles and Their Immediate Impact on Property Prices

Election cycles often create a temporary distortion in property market dynamics, primarily driven by shifts in buyer and seller behavior rather than intrinsic value changes. A key mechanism at play is the reduction in property listings, as sellers delay decisions amidst political uncertainty. This contraction in supply, paradoxically, can stabilize or even elevate prices in the short term, as serious buyers compete for limited options.

Auction data provides a compelling lens into this phenomenon. On election days, clearance rates often remain robust despite lower transaction volumes. This suggests that committed buyers leverage reduced competition to secure properties, countering the narrative that elections inherently depress prices. The interplay between reduced supply and concentrated demand highlights the market’s adaptability during these periods.

Contextual factors further nuance this dynamic. For instance, the Reserve Bank of Australia’s monetary policy often exerts a stronger influence on immediate price movements than election outcomes. Historical data shows that rate cuts during election periods amplify buyer activity, mitigating any hesitation caused by political uncertainty.

“Elections create a momentary echo in market sentiment, but fundamentals like supply constraints and RBA policy drive long-term prices.”

— Dr. Nicola Powell, Chief of Research and Economics, Domain

This analysis underscores that while election cycles introduce short-term volatility, their impact on property prices is transient, with structural economic drivers ensuring market resilience.

Buyer and Seller Behavior in Uncertain Political Climates

During election periods, the interplay between buyer and seller behavior reveals a strategic recalibration rather than a market freeze. Sellers often delay listing properties, anticipating that political uncertainty will deter buyers. This reduction in inventory, however, creates a counterintuitive effect: committed buyers face less competition, leading to tighter bidding environments and, in some cases, higher clearance rates. This dynamic underscores the importance of understanding how perceived risks shape market activity.

A critical mechanism driving this behavior is the psychological impact of uncertainty. Buyers and sellers alike weigh potential policy shifts—such as changes to tax incentives or housing grants—against broader economic conditions. For instance, Domain’s analysis links a one-point rise in Australia’s Policy Uncertainty Index to a decline of approximately 8.08 property transactions. Yet, this hesitation is not uniform; experienced investors often exploit these periods to secure properties at favorable terms, leveraging reduced competition to their advantage.

Comparatively, first-home buyers exhibit a more cautious approach, often postponing decisions until post-election clarity emerges. This divergence highlights the varying risk tolerances across market segments. Additionally, regional factors, such as Canberra’s sensitivity to government employment changes, amplify these behaviors in specific locales.

“Political uncertainty can dampen activity, but it also creates opportunities for those prepared to act decisively.”

— Dr. Nicola Powell, Chief of Research and Economics, Domain

This nuanced behavior demonstrates that election-induced volatility is less about systemic disruption and more about strategic timing. For practitioners, aligning investment strategies with these behavioral patterns can unlock significant opportunities amidst perceived instability.

Analyzing Policy Proposals and Their Market Implications

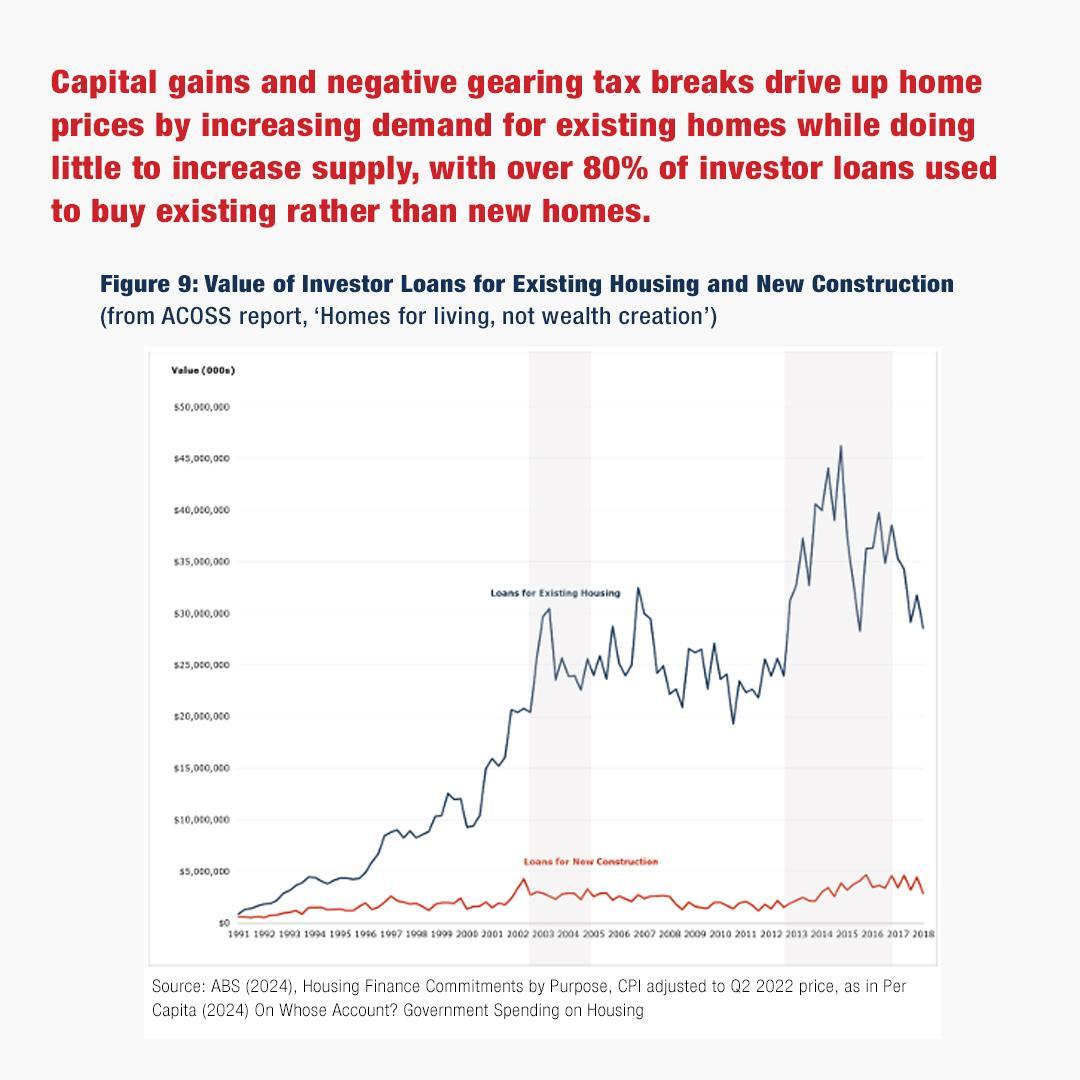

Election-driven policy proposals often generate significant attention, yet their actual market impact is frequently overstated. For instance, adjustments to negative gearing—a tax incentive allowing property investors to offset losses against other income—are often framed as transformative. However, historical data reveals that such changes typically influence investor behavior only marginally. A 2019 CoreLogic study found that proposed restrictions on negative gearing correlated with a temporary 6% decline in investor activity, but this effect dissipated within six months as broader economic conditions, such as interest rate cuts, took precedence.

Similarly, first-home buyer schemes, while politically popular, often fail to address systemic supply constraints. Labor’s 2022 initiative to increase first-home buyer grants by 20% led to a short-term spike in applications but had negligible long-term effects on affordability. This underscores a critical point: demand-side interventions, without corresponding supply-side measures, risk inflating prices rather than improving accessibility.

A key misconception is that policy clarity immediately stabilizes markets. In reality, the lag between policy implementation and tangible outcomes—often spanning 2-3 years—dilutes their immediate influence. For example, changes to capital gains tax in 1999 initially caused investor hesitation but ultimately aligned with broader market growth trends driven by population increases and urbanization.

By dissecting these dynamics, it becomes evident that structural fundamentals, not transient policy shifts, dictate Australia’s property market trajectory.

Image source: x.com

Impact of Negative Gearing and First-Home Buyer Schemes

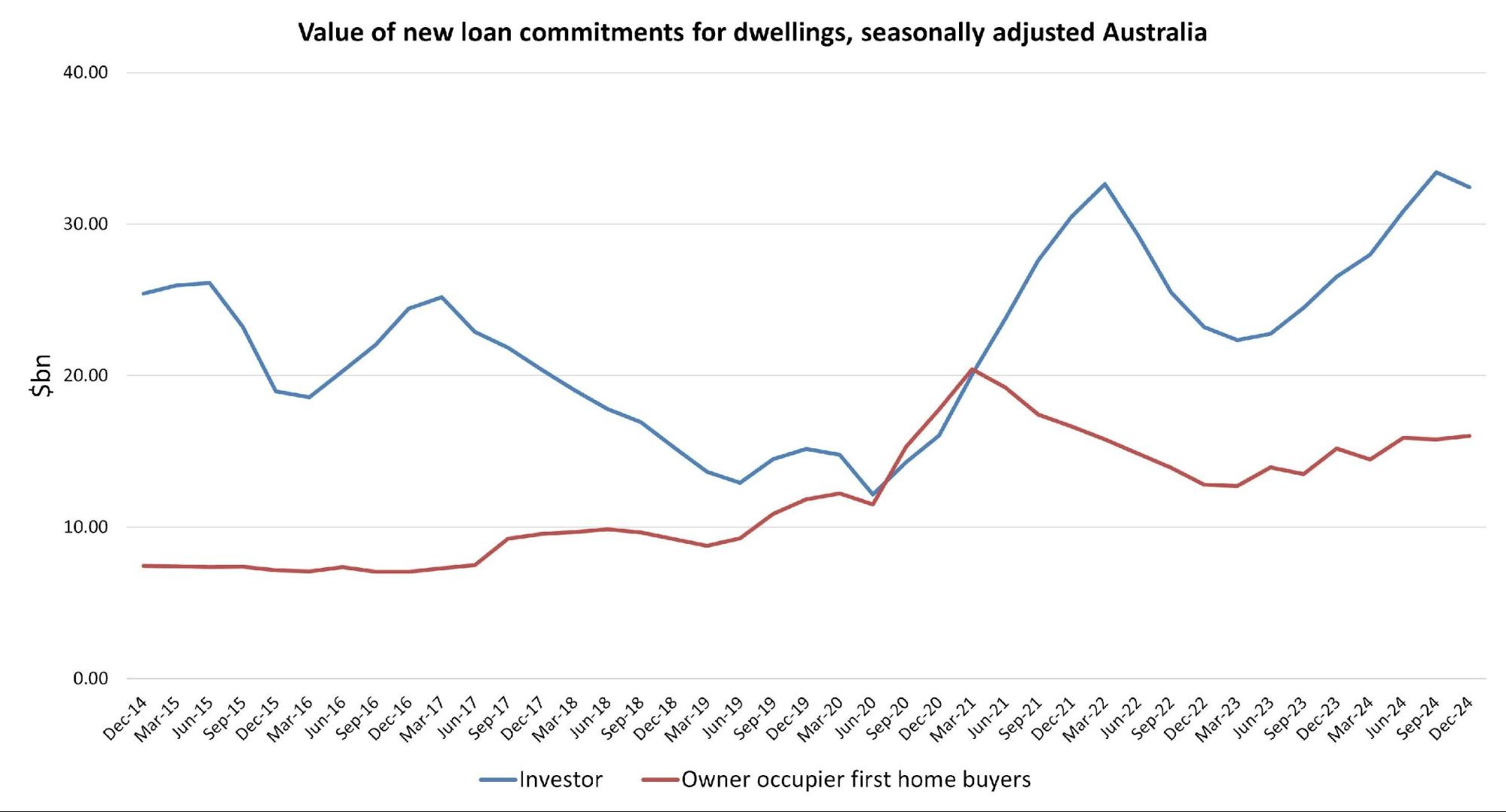

Negative gearing and first-home buyer schemes represent two pivotal yet contentious mechanisms in Australia’s housing policy landscape. While both aim to influence market dynamics, their real-world effects often diverge from their intended goals, revealing complexities that challenge conventional assumptions.

Negative gearing, designed to incentivize investment by allowing property losses to offset taxable income, disproportionately benefits high-income investors. This policy amplifies speculative behavior, as evidenced by its correlation with increased housing price volatility in Greater Sydney. A 2016 study by Daley and Wood highlighted that removing negative gearing could boost government revenue by $2 billion annually, yet its elimination risks exacerbating rental shortages due to reduced investor participation. This duality underscores the policy’s intricate balance between fostering investment and distorting affordability.

First-home buyer schemes, on the other hand, often create unintended market pressures. For instance, Labor’s 2022 initiative to increase grants by 20% led to a surge in applications but failed to address the underlying supply constraints. Without parallel measures to expand housing stock, such schemes inadvertently inflate demand, driving up prices and intensifying competition. This phenomenon disproportionately impacts lower-income buyers, who face heightened barriers despite increased financial support.

“While these policies aim to enhance accessibility, their structural limitations often reinforce existing inequities.”

— Dr. Nicola Powell, Chief of Research and Economics, Domain

A nuanced analysis reveals that both mechanisms are deeply influenced by external factors such as interest rates and population growth. Policymakers must therefore integrate supply-side strategies and macroeconomic considerations to ensure these tools achieve their intended outcomes. By aligning reforms with structural market realities, Australia can mitigate the unintended consequences of these well-intentioned policies.

Comparative Analysis of Party Policies on Housing

Labor and the Coalition’s housing policies diverge sharply in their approach to affordability, yet both face inherent limitations when applied to Australia’s entrenched market dynamics. Labor’s interventionist strategies, such as the Housing Accord and expanded first-home buyer schemes, aim to directly address supply shortages and affordability. Conversely, the Coalition’s market-driven solutions, including superannuation access for deposits and reduced migration targets, prioritize individual empowerment and easing regulatory barriers.

A critical examination reveals that Labor’s supply-side initiatives, while ambitious, are constrained by implementation bottlenecks. For instance, the Housing Accord’s target of 1.2 million homes over five years hinges on overcoming labor shortages and material costs—factors exacerbated by global supply chain disruptions. Meanwhile, the Coalition’s superannuation policy, though innovative, risks inflating demand without addressing the underlying supply deficit, potentially driving prices higher in competitive markets.

Contextual factors further complicate these policies. Labor’s focus on social housing aligns with urban affordability challenges but may struggle in regions where private investment dominates. The Coalition’s reduced migration targets, intended to ease housing demand, could inadvertently strain construction sector labor availability, undermining their supply-side goals.

“Policy effectiveness is often dictated by external economic forces, not political intent.”

— Dr. Nicola Powell, Chief of Research and Economics, Domain

This analysis underscores the need for integrated strategies that balance demand-side incentives with robust supply-side reforms. Without addressing systemic constraints, both parties’ policies risk perpetuating affordability challenges rather than resolving them.

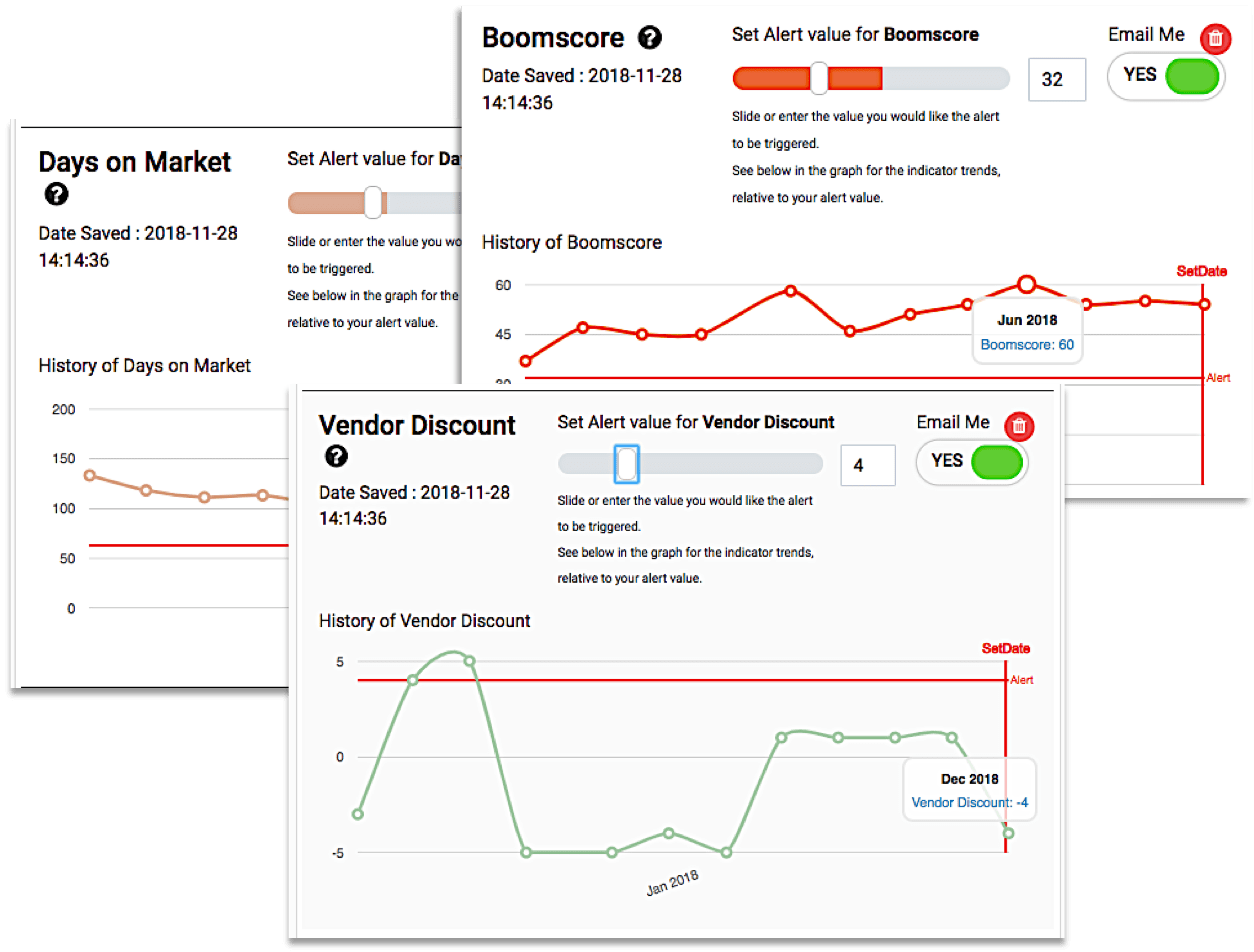

Data-Driven Insights vs. Common Myths

Contrary to the widespread belief that federal elections disrupt property markets, data consistently shows minimal long-term impact. For instance, Domain’s analysis of seven election cycles reveals that property transaction volumes remain broadly stable, with only a 1.2% average deviation during election months. This stability underscores the resilience of market fundamentals, such as interest rates and supply-demand dynamics, over transient political events.

One persistent myth is that auctions underperform on election days due to distracted buyers. However, auction clearance rates on election days often exceed surrounding weekends. A notable example is the 2022 federal election, where clearance rates reached 60.4%, outperforming the Saturdays before and after. This counterintuitive trend arises from reduced auction volumes, which create tighter competition among serious buyers.

Dr. Nicola Powell, Chief of Research and Economics at Domain, highlights a critical insight: “Elections influence sentiment, not structural drivers.” This distinction is vital, as it shifts focus from political cycles to enduring economic forces like housing supply shortages and monetary policy.

Ultimately, the data dismantles myths, revealing a market shaped by fundamentals rather than fleeting electoral narratives.

Image source: boomscore.com.au

Empirical Evidence on Election Outcomes and Market Trends

Election outcomes often generate speculation about their influence on property markets, yet empirical data reveals a more nuanced reality. A critical observation is the resilience of transaction volumes, which remain largely stable even during politically charged periods. This stability underscores the dominance of structural market drivers over transient political events.

One mechanism that illustrates this dynamic is the behavior of auction clearance rates. On election days, these rates frequently surpass those of adjacent weekends, driven by a unique interplay of reduced auction volumes and concentrated buyer activity. For instance, Domain’s analysis of past elections highlights a 60.4% clearance rate on election days, a figure that outperformed surrounding Saturdays. This phenomenon suggests that serious buyers capitalize on diminished competition, leveraging the temporary market lull to secure properties.

Contextual factors further reinforce this trend. Historical data indicates that macroeconomic variables, such as interest rate adjustments by the Reserve Bank of Australia, exert a far greater influence on property prices than election outcomes. As Dr. Nicola Powell, Chief of Research and Economics at Domain, notes:

“Elections influence sentiment, not structural drivers.”

This insight challenges the assumption that political cycles dictate market trends. Instead, it emphasizes the importance of aligning investment strategies with enduring fundamentals like supply-demand imbalances and monetary policy, rather than overreacting to election-time volatility.

Debunking Myths: Elections as Major Market Movers

The belief that elections significantly disrupt property markets often stems from a misinterpretation of short-term sentiment shifts as structural changes. A closer examination reveals that while political uncertainty can momentarily influence buyer behavior, the underlying market mechanisms remain largely unaffected.

One critical factor is the interplay between auction dynamics and buyer psychology. On election days, auction volumes typically decline by 50%, yet clearance rates often exceed those of surrounding weekends. This counterintuitive trend arises because serious buyers, undeterred by political noise, capitalize on reduced competition to secure properties. Domain’s data underscores this, showing a 60.4% clearance rate on election days compared to 59.5% the prior Saturday.

Contextual influences further dilute the perceived impact of elections. For instance, interest rate adjustments by the Reserve Bank of Australia (RBA) exert a far greater influence on market activity. Historical data consistently demonstrates that rate cuts amplify buyer participation, overshadowing any election-driven hesitations.

“Elections influence sentiment, not structural drivers.”

— Dr. Nicola Powell, Chief of Research and Economics, Domain

This analysis highlights a key insight: elections are not market movers but sentiment amplifiers. Investors who prioritize macroeconomic fundamentals over political cycles are better positioned to navigate these periods effectively.

FAQ

How do federal elections influence buyer and seller behavior in Australia’s property market?

Federal elections introduce a layer of uncertainty that can temporarily alter buyer and seller behavior. Sellers often delay listings, anticipating reduced demand, while buyers may adopt a cautious “wait-and-see” approach, particularly when potential policy changes could impact affordability or investment returns. However, serious buyers frequently leverage this reduced competition to secure properties, creating tighter bidding environments. Historical data shows that these behavioral shifts are short-lived, with market activity normalizing post-election. Broader economic factors, such as interest rates and housing supply-demand dynamics, consistently outweigh election-driven sentiment, underscoring the resilience of Australia’s property market amidst political cycles.

What role do interest rates and economic policies play compared to election outcomes in shaping property trends?

Interest rates and economic policies exert a far greater influence on property trends than election outcomes. Adjustments by the Reserve Bank of Australia (RBA), such as rate cuts or hikes, directly impact borrowing capacity and buyer sentiment, often overshadowing political events. Economic policies, including tax reforms and housing incentives, shape long-term market dynamics by addressing structural issues like affordability and supply shortages. While elections may create short-term sentiment shifts, the interplay between monetary policy and fiscal strategies consistently drives property market performance, highlighting the dominance of macroeconomic fundamentals over transient political cycles in Australia’s housing sector.

Are auction clearance rates affected by election day, and what does the data reveal about buyer competition?

Auction clearance rates on election day often outperform surrounding weekends, despite a 50% drop in auction volumes. This phenomenon is driven by reduced competition among sellers and the presence of highly motivated buyers who capitalize on the limited property pool. Data reveals that election day auctions achieve higher clearance rates, with serious buyers leveraging the quieter market to secure deals. This trend challenges the perception that elections deter property transactions, instead highlighting how buyer competition intensifies under constrained supply. These findings underscore the resilience of Australia’s property market, where structural dynamics outweigh short-term political sentiment.

Do changes in government policies during elections have a measurable impact on housing affordability and investment?

Changes in government policies during elections can influence housing affordability and investment, but their measurable impact often unfolds over years. Policies like adjustments to negative gearing or capital gains tax directly affect investor behavior, potentially altering demand in high-investor markets. Affordability measures, such as first-home buyer grants, may temporarily boost accessibility but risk inflating prices without addressing supply constraints. The lag between policy implementation and tangible outcomes highlights the dominance of structural factors, including interest rates and zoning reforms, in shaping long-term market trends. Election-driven policy shifts are impactful but secondary to broader economic and regulatory frameworks.

What myths about federal elections and property market performance are debunked by historical data?

Historical data debunks several myths about federal elections and property market performance. Contrary to popular belief, elections do not significantly disrupt transaction volumes or depress property prices. Auction clearance rates often exceed expectations on election days, driven by reduced competition among sellers and motivated buyers. Additionally, no major political party consistently outperforms in driving market growth, as broader economic factors like interest rates and supply-demand dynamics dominate. The notion that elections reshape buyer behavior is also overstated, with personal circumstances and macroeconomic conditions playing a more decisive role. These insights highlight the resilience of Australia’s property market amidst political cycles.