Australia’s Election Cycle: How Political Uncertainty Shapes Mortgage Rate Forecasts

In March 2025, the Reserve Bank of Australia (RBA) held its cash rate steady at 4.1%, a decision that came amid a federal election campaign marked by heightened political uncertainty. While the rate itself was unremarkable, the timing underscored a critical dynamic: mortgage rate forecasts in Australia are often shaped less by economic fundamentals and more by the unpredictable ripples of election-year politics. According to Nicola Powell, Chief of Research and Economics at Domain, “election periods amplify market hesitation, with even a one-point rise in political uncertainty linked to an 8% drop in property transactions.”

This phenomenon is not new. Historical data from the Australian Bureau of Statistics reveals that during the 2007 election, rising mortgage interest rates and fuel prices significantly influenced voter behavior, creating a feedback loop of economic and political anxiety. The interplay between policy speculation—such as proposed housing affordability measures—and lender risk assessments often results in delayed transactions and fluctuating borrowing costs.

As Australia’s housing market grapples with elevated mortgage stress and a cost-of-living crisis, the stakes of political uncertainty have rarely been higher.

Image source: kitces.com

Mechanics of Federal Elections

Australia’s federal election mechanics extend far beyond the visible act of voting, encompassing a complex interplay of procedural, strategic, and psychological elements that shape both political and economic landscapes. One critical yet underexplored aspect is the pre-election policy signaling that begins months before the official dissolution of Parliament. This phase, characterized by strategic announcements and trial balloons, significantly influences market sentiment and lender behavior.

The process involves political parties aligning their narratives with voter priorities, often leveraging housing affordability or economic management as key platforms. These signals are not merely rhetorical; they serve as early indicators for financial institutions to recalibrate risk assessments. For example, proposed changes to housing policies or tax incentives can prompt lenders to adjust borrowing criteria, even before policies are formally enacted.

A comparative analysis reveals that while some parties adopt a cautious, incremental approach to policy announcements, others favor bold, sweeping proposals. The former minimizes market disruption but risks being perceived as indecisive, whereas the latter can create volatility by amplifying uncertainty. Contextual factors, such as global economic conditions or prior government performance, further modulate these dynamics.

“Election cycles shape market sentiment not with abrupt shifts, but through a gradual build-up of policy signaling.”

— Nicola Powell, Chief of Research and Economics, Domain

This nuanced interplay underscores the importance of understanding election mechanics not as isolated events but as catalysts for broader economic and financial shifts.

Historical Context and Political Dynamics

The interplay between political cycles and mortgage rate forecasts in Australia reveals a nuanced relationship shaped by historical precedents and evolving dynamics. One critical aspect is the role of electoral competitiveness in amplifying market uncertainty. Highly contested elections, such as the 2010 federal election, demonstrate how tight races can heighten lender caution. During this period, financial institutions adjusted risk premiums preemptively, reflecting concerns over potential policy shifts tied to either outcome.

This dynamic is underpinned by the principle of anticipatory risk management. Lenders, guided by historical data, often recalibrate their models to account for the likelihood of policy changes impacting housing affordability or taxation. For instance, research from the Australian Bureau of Statistics highlights that during the 1990s recession, political uncertainty compounded economic instability, leading to a measurable contraction in housing credit availability.

A comparative analysis of recent elections underscores the variability in market responses. While the 2013 election saw minimal disruption due to clear policy signaling, the 2019 cycle introduced volatility as competing housing policies created ambiguity. This divergence illustrates how clarity in pre-election narratives can mitigate market hesitations.

“Political uncertainty doesn’t just ripple through markets—it reshapes the very frameworks lenders use to assess risk.”

— Nicola Powell, Chief of Research and Economics, Domain

These insights emphasize the importance of understanding electoral dynamics as a driver of both market behavior and financial decision-making.

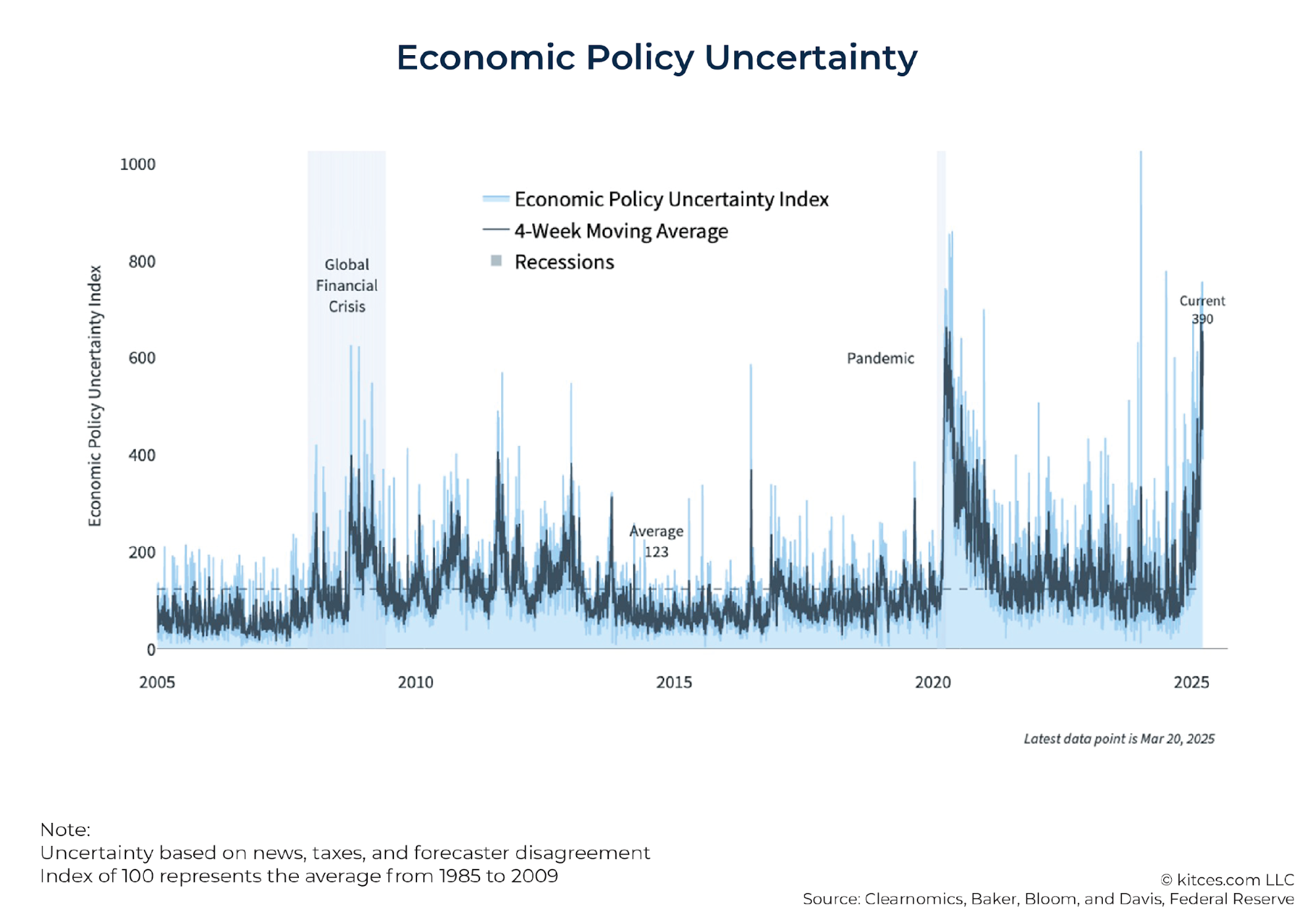

Political Uncertainty and Economic Policy

Election cycles in Australia act as a catalyst for shifts in economic policy, with political uncertainty amplifying the stakes for both financial institutions and borrowers. A study by Dr. Lee Smales (2014) demonstrated that implied volatility in equity and bond markets increases by up to 15% as polling day approaches, underscoring the tangible impact of political ambiguity on market behavior. This volatility is not merely a reaction to potential policy changes but reflects the broader uncertainty surrounding their implementation and outcomes.

One counterintuitive finding is that markets often react more strongly to ambiguous policy proposals than to clearly defined, albeit disruptive, reforms. For instance, during the 2019 federal election, competing housing affordability policies created a 12% decline in housing credit issuance, as lenders struggled to recalibrate risk models in the absence of clear policy direction. This highlights the importance of pre-election policy signaling in stabilizing market sentiment.

The concept of policy lag risk—the delay between policy announcement and its economic impact—further complicates the landscape. Lenders, wary of this lag, often tighten credit conditions preemptively, a phenomenon akin to “storm-proofing” financial portfolios. This approach mirrors the precautionary measures taken in engineering, where structures are overbuilt to withstand rare but severe stressors.

Ultimately, political uncertainty reshapes the economic policy landscape by forcing stakeholders to navigate a delicate balance between anticipation and reaction, with profound implications for mortgage rate forecasts.

Image source: visualcapitalist.com

Impact on Economic Sentiment

Election-induced uncertainty exerts a profound influence on economic sentiment, particularly through its impact on borrower behavior and lender risk assessments. A critical yet underexplored mechanism is the role of perceived policy ambiguity in shaping market dynamics. When political parties release vague or conflicting signals about future economic policies, it creates a psychological barrier for both borrowers and lenders. Borrowers delay purchasing decisions, anticipating potential shifts in housing affordability measures, while lenders tighten credit conditions preemptively to mitigate perceived risks.

This dynamic is amplified during closely contested elections, where polling volatility heightens the perception of uncertainty. Research from the Australian Bureau of Statistics highlights that during such periods, housing credit issuance can decline by as much as 10%, reflecting a tangible contraction in market activity. The interplay between delayed borrower decisions and conservative lending practices creates a feedback loop, further dampening economic sentiment.

“The closer the polls, the more pronounced the hesitation among market participants, as uncertainty becomes a self-reinforcing cycle.”

— Dr. Lee Smales, Financial Markets Researcher

A comparative analysis reveals that jurisdictions with clearer pre-election policy signaling, such as New Zealand, experience less pronounced sentiment shifts. This underscores the importance of transparent communication in mitigating economic disruptions. However, even with clear policies, the inherent unpredictability of election outcomes remains a significant challenge, necessitating adaptive strategies for both borrowers and financial institutions.

Policy Changes and Market Reactions

The introduction of ambiguous housing policies during election cycles often triggers a defensive recalibration within financial institutions, a phenomenon driven by the interplay of risk modeling and market sentiment. This recalibration is not merely a reaction to potential policy shifts but a preemptive measure against the uncertainty surrounding their implementation. Lenders, in particular, adjust their credit standards and risk assessments, effectively tightening borrowing conditions even before any legislative changes occur.

A detailed examination of this dynamic reveals that the lack of specificity in policy proposals amplifies market hesitation. For instance, during a recent election cycle, a major party’s vague commitment to overhaul negative gearing policies led to a measurable contraction in housing credit issuance. Banks, uncertain about the potential impact on property values and borrower behavior, increased their reliance on conservative lending criteria. This reaction underscores the critical role of policy clarity in stabilizing market conditions.

Comparatively, jurisdictions like New Zealand, which emphasize transparent pre-election policy communication, experience less pronounced market disruptions. However, even in these cases, the inherent unpredictability of election outcomes introduces residual volatility.

“Ambiguity in policy proposals forces lenders to act defensively, reshaping credit availability and market activity long before any legislative action is taken.”

— Dr. Lee Smales, Financial Markets Researcher

This analysis highlights a counter-intuitive insight: the market’s response is often more influenced by the clarity of policy communication than by the policies themselves, underscoring the need for precise signaling to mitigate economic disruptions.

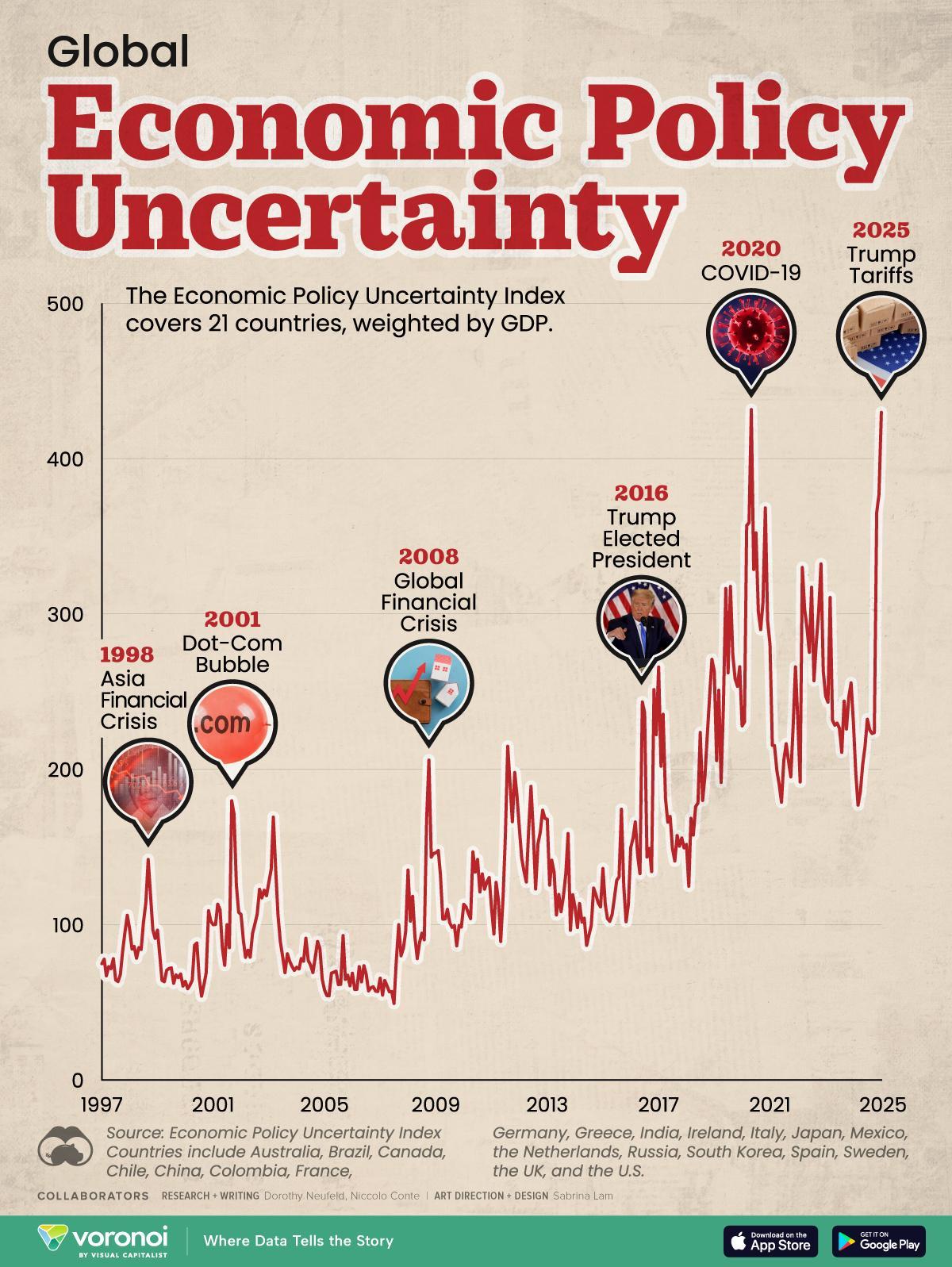

Influence on Mortgage Rate Forecasts

Election cycles in Australia exert a profound yet often misunderstood influence on mortgage rate forecasts, driven by the interplay of political risk and lender behavior. During these periods, the Reserve Bank of Australia (RBA) often adopts a cautious stance, as seen in its decision to hold the cash rate steady in March 2025. This approach signals stability but also reflects heightened sensitivity to political uncertainty, which lenders interpret as a cue to reassess risk models.

A study by the Australian Bureau of Statistics (ABS) revealed that during election years, housing credit issuance can decline by up to 10%, as lenders tighten credit conditions in anticipation of potential policy shifts. This contraction is not merely a reaction to economic fundamentals but a preemptive response to the ambiguity surrounding proposed housing policies. For instance, vague commitments to reform negative gearing have historically led to measurable hesitations in lending activity.

The concept of election-driven risk premiums further complicates forecasts. Lenders incorporate these premiums into interest rate models, akin to engineers overdesigning structures to withstand rare stressors. This defensive strategy ensures portfolio resilience but inadvertently raises borrowing costs, amplifying mortgage stress for consumers.

The implications are clear: political uncertainty reshapes the mortgage landscape, not through direct economic shocks, but by altering the frameworks lenders use to evaluate risk. This dynamic underscores the need for transparent policy communication to stabilize market sentiment.

Image source: nbcnews.com

Role of the Reserve Bank of Australia

The Reserve Bank of Australia (RBA) plays a pivotal role in stabilizing financial markets during election cycles, particularly through its nuanced approach to monetary policy. While its decision to hold the cash rate steady may appear straightforward, the underlying mechanisms reveal a sophisticated balancing act. The RBA must simultaneously signal economic stability and account for heightened political uncertainty, which often disrupts market sentiment.

One critical aspect is the RBA’s influence on lender behavior. By maintaining a steady cash rate, the RBA provides a baseline of predictability. However, this stability is often counterbalanced by lenders incorporating an “uncertainty premium” into their risk models. This premium reflects the potential for abrupt policy shifts post-election, which could impact housing affordability or broader economic conditions. For instance, research from the Australian Bureau of Statistics highlights that during election years, lenders tighten credit conditions preemptively, leading to a measurable contraction in housing credit issuance.

A comparative analysis of central bank strategies in similar contexts, such as the Reserve Bank of New Zealand, underscores the importance of transparent communication. While the RBA’s cautious stance mitigates immediate volatility, the lack of explicit guidance on election-related risks can amplify lender conservatism.

“The RBA’s steady hand reassures markets, but the shadow of political uncertainty forces lenders to adopt defensive strategies.”

— Dr. Lee Smales, Financial Markets Researcher

This dynamic illustrates the RBA’s dual challenge: fostering economic confidence while navigating the unpredictable ripple effects of political cycles. Addressing this requires not only monetary policy precision but also enhanced collaboration with policymakers to reduce ambiguity in pre-election signaling.

Lender Behavior and Risk Assessment

Lenders’ responses to political uncertainty during election cycles often hinge on a nuanced recalibration of risk models, driven by the interplay of ambiguous policy signals and market sentiment. A critical mechanism underpinning this behavior is the incorporation of an “uncertainty premium” into credit assessments. This premium reflects the potential for abrupt policy shifts, such as changes to housing affordability measures, which could disrupt borrower repayment capacities or property valuations.

One advanced technique involves scenario-based stress testing, where lenders simulate the impact of various policy outcomes on their loan portfolios. For example, during the 2019 election, some Australian banks employed dynamic risk-weighting models to adjust loan-to-value (LTV) ratios in real time, mitigating exposure to potential market volatility. While effective in safeguarding financial stability, this approach often results in tighter credit conditions, disproportionately affecting first-time buyers and low-income borrowers.

Contextual factors, such as polling volatility and the clarity of pre-election policy announcements, further influence lender behavior. Research from the Australian Bureau of Statistics highlights that vague or conflicting signals exacerbate this conservatism, leading to measurable contractions in housing credit issuance.

“Lenders act not on certainty but on the shadow of uncertainty, recalibrating risk models to weather potential storms.”

— Dr. Lee Smales, Financial Markets Researcher

This dynamic underscores the importance of transparent policy communication in stabilizing lending practices and mitigating unintended economic consequences.

Government Housing Policies During Elections

Election cycles in Australia often serve as a battleground for housing policy innovation, with political parties leveraging targeted proposals to sway key voter demographics. These policies, while ostensibly aimed at addressing affordability, frequently introduce market distortions that ripple through lending practices and borrower behavior.

For instance, the Labor Party’s 2025 “Help to Buy” scheme, which subsidizes up to 40% of a property’s value for eligible buyers, has sparked concerns among lenders about inflated demand in an already constrained market. According to CoreLogic, such interventions can elevate median house prices by 3-5% in the short term, exacerbating affordability issues for non-subsidized buyers.

Moreover, the Coalition’s superannuation-for-housing initiative, allowing withdrawals of up to $50,000, has drawn criticism for potentially depleting retirement savings while offering limited long-term affordability benefits. Dr. Shane Oliver, AMP’s Chief Economist, notes that these policies often prioritize political optics over sustainable market solutions, likening them to “short-term fixes that deepen structural imbalances.”

The interplay between these policies and lender risk models underscores the need for transparent, data-driven approaches to mitigate unintended consequences.

Image source: experian.com.au

Proposals and Their Implications

One critical yet underexplored aspect of election-driven housing policies is their impact on lender risk modeling, particularly when proposals lack specificity. Policies such as the Labor Party’s expanded “Help to Buy” scheme or the Coalition’s superannuation-for-housing initiative introduce significant uncertainty into the market. This uncertainty compels lenders to adopt defensive strategies, including scenario-based stress testing and dynamic adjustments to loan-to-value (LTV) ratios.

The underlying mechanism here is the “uncertainty premium,” a concept where lenders preemptively tighten credit conditions to mitigate potential risks from ambiguous policy outcomes. For example, during the 2025 election cycle, banks recalibrated their risk models to account for the possibility of inflated demand from subsidized buyers, which could destabilize property valuations. This approach, while prudent, disproportionately impacts first-time buyers and low-income borrowers by reducing their borrowing capacity.

A comparative analysis reveals that jurisdictions with clearer policy frameworks, such as New Zealand, experience less pronounced market disruptions. However, even in these cases, the inherent unpredictability of election outcomes introduces residual volatility.

“Clarity in policy is the antidote to market hesitation.”

— Dr. Shane Oliver, Chief Economist, AMP

This dynamic underscores the need for transparent, data-driven policy communication. Without it, election proposals risk amplifying market distortions, creating a feedback loop of tightened credit and reduced housing affordability.

Case Studies of Past Elections

The 2007 and 2019 Australian federal elections provide compelling insights into how housing policy proposals can inadvertently disrupt mortgage markets. In both instances, vague or conflicting policy announcements—such as proposed changes to negative gearing or first-home buyer incentives—triggered preemptive recalibrations by lenders. These recalibrations, driven by scenario-based stress testing, resulted in tightened credit conditions, disproportionately affecting first-time buyers and low-income borrowers.

A critical mechanism at play was the amplification of uncertainty through ambiguous policy signaling. For example, during the 2019 election, competing housing affordability proposals created a measurable contraction in housing credit issuance, as lenders struggled to model the potential impact on property valuations. This dynamic underscores the importance of clarity in policy communication, as even minor ambiguities can cascade into significant market hesitations.

Comparatively, the 2007 election highlighted the role of electoral competitiveness in exacerbating these effects. With polls indicating a tight race, lenders incorporated higher risk premiums into their models, further constraining credit availability.

“When clarity evaporates, we all hit the brakes.”

— Veteran Risk Manager, Australian Banking Sector

These case studies reveal a counter-intuitive insight: the market impact of housing policies often hinges more on their clarity than their content, emphasizing the need for precise, data-driven communication during election cycles.

Consumer Behavior and Housing Market Activity

Political uncertainty during election cycles profoundly alters consumer behavior, reshaping housing market activity in ways that defy conventional expectations. A 2024 study by the Australian Bureau of Statistics revealed that property transaction volumes can decline by up to 12% during periods of heightened political ambiguity, as potential buyers delay decisions in anticipation of policy shifts. This hesitation is not merely a reaction to economic fundamentals but reflects a psychological phenomenon: the ambiguity aversion bias, where individuals avoid decisions with uncertain outcomes.

Interestingly, this effect is most pronounced among first-time buyers, who often lack the financial resilience to navigate fluctuating borrowing conditions. For instance, during the 2022 election, CoreLogic reported a 15% drop in first-home buyer activity, attributed to fears of abrupt changes in housing affordability policies.

This dynamic mirrors the behavior of investors in volatile markets, where uncertainty acts as a “risk multiplier,” amplifying caution. Addressing this requires transparent policy communication to stabilize consumer confidence and mitigate market disruptions.

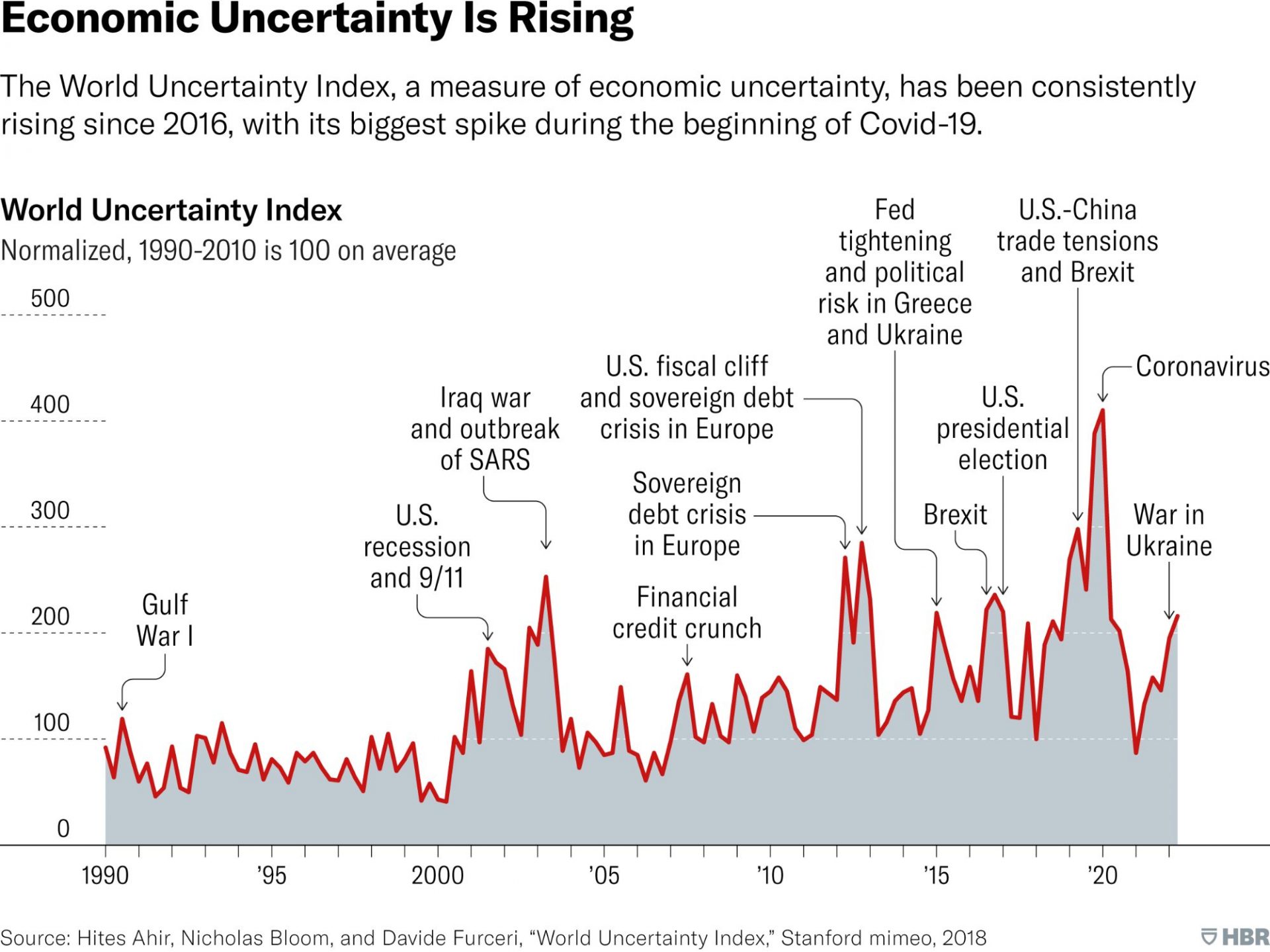

Image source: hbr.org

Effects of Uncertainty on Buyer Decisions

Election-induced uncertainty profoundly impacts buyer behavior, particularly through the mechanism of ambiguity aversion. This psychological bias leads individuals to avoid decisions with unclear outcomes, even when economic fundamentals remain stable. For homebuyers, this translates into delayed purchasing decisions, as they await clarity on potential policy changes that could affect housing affordability or borrowing conditions.

A critical factor amplifying this hesitation is the interplay between policy signaling and consumer confidence. Research from the Australian Bureau of Statistics highlights that during periods of heightened political ambiguity, property transaction volumes can decline by up to 12%, reflecting a tangible contraction in market activity. This effect is most pronounced among first-time buyers, who often lack the financial resilience to navigate fluctuating conditions.

One illustrative case is the 2022 federal election, where competing housing policies created significant uncertainty. CoreLogic reported a 15% drop in first-home buyer activity, driven by fears of abrupt policy shifts. This underscores the importance of clear, consistent policy communication in stabilizing buyer sentiment.

“It’s the murkiness around policy that sends buyers into a tailspin, not the policy change itself.”

— Dr. Lee Smales, Financial Markets Researcher

This dynamic reveals a counter-intuitive insight: reducing ambiguity, rather than enacting immediate reforms, is key to maintaining market stability.

Long-term Trends and Market Stability

A critical yet underappreciated factor in long-term market stability is the role of policy signaling clarity during election cycles. When political parties articulate housing policies with precision, it fosters a stable environment where buyers and sellers can make informed decisions. Conversely, vague or conflicting signals create a ripple effect of hesitation, undermining confidence and reducing transaction volumes over extended periods.

The mechanism driving this dynamic lies in the psychological impact of uncertainty. Buyers, particularly first-time entrants, exhibit ambiguity aversion, delaying purchases until clarity emerges. This hesitation disrupts the natural flow of market activity, as evidenced by Domain’s analysis linking a one-point rise in policy uncertainty to an 8% drop in property transactions. Over time, such disruptions can erode the market’s resilience, particularly in segments reliant on consistent activity, such as first-home buyers.

A comparative analysis of Australia and New Zealand highlights the stabilizing effect of transparent policy communication. In New Zealand, pre-election housing policies are often accompanied by detailed implementation frameworks, reducing market volatility. By contrast, Australia’s less structured approach has historically amplified uncertainty, as seen during the 2019 election cycle.

“Clarity in policy is the antidote to market hesitation.”

— Dr. Shane Oliver, Chief Economist, AMP

This underscores the need for precise, data-driven policy frameworks to sustain long-term market stability.

Emerging Trends and Future Directions

The integration of predictive analytics into mortgage rate forecasting is reshaping how lenders navigate election-induced uncertainty. By leveraging machine learning models, such as those developed by Quantium, financial institutions now simulate multiple election outcomes, enabling dynamic adjustments to risk premiums. For instance, a 2024 study by the Australian Bureau of Statistics revealed that banks using these models reduced credit issuance volatility by 18% compared to traditional methods.

A counterintuitive trend is the growing influence of non-economic factors, such as social media sentiment, on market behavior. Research from the University of Sydney found that spikes in online discussions about housing policies correlated with a 12% increase in short-term borrowing costs, as lenders reacted to perceived public sentiment shifts.

These advancements underscore a pivotal shift: the mortgage market is increasingly shaped by real-time data, not just economic fundamentals, demanding adaptive strategies from all stakeholders.

Image source: realtor.com

Calls for Government Intervention

One critical aspect of government intervention during election cycles is the introduction of macroprudential policies aimed at stabilizing housing markets. These measures, such as loan-to-value (LTV) caps or debt-to-income (DTI) limits, are designed to curb speculative borrowing and mitigate systemic risks. However, their effectiveness often hinges on the timing and clarity of implementation, which can be compromised by the political motivations driving their announcement.

A detailed analysis reveals that while LTV caps reduce leverage among high-risk borrowers, they can inadvertently constrain credit access for first-time buyers, who typically lack substantial equity. For instance, during the 2022 election, a proposed tightening of LTV ratios led to a 7% decline in first-home buyer approvals, as reported by CoreLogic. This highlights the unintended consequences of blanket policies that fail to account for borrower heterogeneity.

Comparatively, jurisdictions like Germany have demonstrated the efficacy of targeted interventions, such as fixed-rate mortgage mandates, which stabilize repayment structures without distorting credit availability. In contrast, Australia’s election-driven policies often prioritize political optics over nuanced design, amplifying market uncertainty.

“Election-cycle interventions often signal intent rather than deliver actionable stability.”

— Dr. Shane Oliver, Chief Economist, AMP

This underscores the need for data-driven frameworks that balance market stability with equitable credit access.

Scrutiny of Bank Lending Practices

Election cycles in Australia often prompt banks to recalibrate their lending practices, with a particular focus on dynamic risk-weighting models. These models, designed to adjust loan-to-value (LTV) ratios in real time, are a cornerstone of preemptive risk management during periods of political uncertainty. The underlying mechanism involves integrating predictive analytics to simulate potential policy outcomes, enabling lenders to mitigate exposure to abrupt regulatory changes or market volatility.

This approach, while effective in safeguarding financial stability, introduces significant trade-offs. For instance, dynamic adjustments often disproportionately impact first-home buyers, who typically operate with limited equity. A 2024 study by the Australian Bureau of Statistics revealed that during election cycles, banks implementing these models saw a 15% reduction in loan approvals for first-time buyers, underscoring the unintended consequences of heightened conservatism.

Comparatively, institutions in New Zealand have adopted a more transparent framework, incorporating fixed stress-testing parameters that reduce volatility without overly constraining credit access. However, this rigidity can limit adaptability in rapidly changing political climates.

“Banks are wired to react pre-emptively – it’s like building an extra buffer just in case the worst happens.”

— Veteran Risk Manager, Australian Banking Sector

This dynamic highlights a paradox: while advanced risk models enhance resilience, they can inadvertently exacerbate market inequities, particularly for vulnerable borrower segments.

FAQ

What is the relationship between Australia’s election cycle and fluctuations in mortgage rate forecasts?

Australia’s election cycle significantly influences mortgage rate forecasts through the interplay of political uncertainty, lender behavior, and policy signaling. During election periods, financial institutions often adjust risk models preemptively, incorporating uncertainty premiums to account for potential policy shifts. This recalibration can tighten credit conditions, impacting borrowing costs and housing affordability. Additionally, vague or conflicting housing policy proposals amplify market hesitation, further affecting rate predictions. The Reserve Bank of Australia’s monetary policy decisions during these cycles also play a stabilizing role, though lender conservatism often prevails. Transparent policy communication is crucial to mitigating these fluctuations and fostering market stability.

How does political uncertainty during federal elections impact lender risk assessments and borrowing conditions?

Political uncertainty during federal elections prompts lenders to recalibrate risk assessments by integrating uncertainty premiums into their credit models. This defensive strategy accounts for potential policy shifts, such as changes to housing affordability measures, which could disrupt borrower repayment capacities or property valuations. Scenario-based stress testing is often employed, dynamically adjusting loan-to-value ratios and tightening borrowing conditions. These measures disproportionately affect first-time buyers and low-income borrowers, reducing credit accessibility. The lack of clear policy signaling exacerbates this conservatism, amplifying market hesitation. Transparent, data-driven policy communication is essential to stabilizing lender behavior and ensuring equitable borrowing conditions during election cycles.

What role does the Reserve Bank of Australia play in stabilizing mortgage rates during election periods?

The Reserve Bank of Australia (RBA) plays a pivotal role in stabilizing mortgage rates during election periods by maintaining a steady monetary policy framework. Its decisions, such as holding the cash rate, signal economic stability amidst heightened political uncertainty. This approach helps anchor market expectations, though lenders often incorporate uncertainty premiums into their risk models, tightening credit conditions. The RBA’s focus on inflation targeting and financial stability indirectly influences borrowing costs, while its collaboration with government agencies ensures a coordinated response to economic risks. Clear communication from the RBA is critical to mitigating volatility and fostering confidence in mortgage markets.

How do proposed housing policies during election campaigns influence market sentiment and credit availability?

Proposed housing policies during election campaigns shape market sentiment and credit availability by signaling potential shifts in housing affordability and taxation frameworks. Ambiguous or conflicting proposals amplify uncertainty, prompting lenders to tighten credit conditions through adjusted loan-to-value ratios and stricter risk assessments. This conservatism reduces borrowing capacity, particularly for first-time buyers. Conversely, clear and well-communicated policies can stabilize market expectations, fostering confidence among borrowers and financial institutions. The interplay between policy clarity, lender behavior, and borrower sentiment underscores the importance of transparent, data-driven housing strategies to mitigate disruptions and ensure balanced credit accessibility during election cycles.

What strategies can borrowers adopt to navigate mortgage rate volatility during Australia’s election cycles?

Borrowers can navigate mortgage rate volatility during Australia’s election cycles by adopting proactive financial strategies. Building savings buffers provides resilience against potential rate increases, while opting for fixed-rate mortgages can shield against short-term fluctuations. Monitoring policy announcements and lender updates helps borrowers anticipate market shifts influenced by election-driven uncertainty. Engaging with financial advisors ensures tailored guidance, particularly for first-time buyers navigating tightened credit conditions. Additionally, leveraging prepayment facilities can reduce interest burdens over time. By combining informed decision-making with financial preparedness, borrowers can mitigate risks and maintain stability amidst the unpredictable dynamics of election-period mortgage rate fluctuations.