Australia’s Hottest Suburbs: Separating Hype from Smart Investment

In 2024, Melbourne’s property market recorded a rare seven-month streak of price declines, yet by early 2025, it emerged as one of Australia’s most promising investment landscapes. According to Hotspotting’s Top 10 National Best Buys report, the city’s resurgence is driven by a combination of affordability, urban renewal projects, and a population growth rate that outpaces national averages. “Melbourne faced significant challenges, but its recovery trajectory is undeniable,” notes Terry Ryder, director of Hotspotting.

This pattern of rebound isn’t unique to Melbourne. Suburbs like Broome, with rental yields of 7.2% for houses and 7.7% for units, exemplify how regional markets are outperforming traditional urban centers. PropTrack economists highlight that these shifts are underpinned by infrastructure investments and demographic shifts, rather than speculative booms.

As Australia’s property market recalibrates, the divergence between media-fueled hype and data-backed opportunities underscores the importance of scrutinizing long-term fundamentals over short-term trends.

Image source: brokernews.com.au

Defining Hot Suburbs and Key Metrics

Identifying “hot suburbs” requires a nuanced approach that transcends surface-level metrics like price spikes. A critical factor is the interplay between rental yields, vacancy rates, and demographic shifts, which collectively determine a suburb’s long-term viability. For instance, suburbs with consistent rental yields above 5% and vacancy rates below 2% often indicate robust demand and sustainable growth potential.

A comparative analysis of infrastructure-driven growth versus speculative booms reveals stark contrasts. Suburbs near new transport hubs or educational facilities, such as those benefiting from Sydney’s Metro West project, tend to exhibit stable appreciation. Conversely, areas experiencing speculative surges often lack the employment or amenity base to sustain growth, leading to eventual stagnation.

Contextual factors, such as zoning changes, further complicate assessments. Rezoning for higher-density housing can boost land values but may also strain local infrastructure, creating mixed outcomes. This underscores the importance of evaluating both immediate and long-term impacts.

“The most reliable indicators of a suburb’s potential are those tied to fundamental drivers like employment and infrastructure, not fleeting market trends.”

— Patrick O’Brien, Director and Home Loan Specialist

Ultimately, a data-driven framework that integrates these metrics with local insights enables investors to distinguish genuine opportunities from transient hype, ensuring strategic and sustainable investments.

The Role of Media and Market Perception

Media narratives wield significant influence over property markets, often amplifying trends that may not align with underlying fundamentals. A critical observation is that media coverage frequently lags behind on-the-ground developments, focusing on price surges or declines rather than the structural factors driving them. This delay can mislead investors into prioritizing short-term hype over sustainable growth indicators.

One mechanism through which media shapes perception is its emphasis on dramatic metrics, such as record-breaking sales or rapid price increases. These headlines often overshadow subtler, yet more critical, metrics like vacancy rates or infrastructure improvements. For instance, while a new transport hub may quietly boost demand in a suburb, media attention typically peaks only after prices have already risen, leaving latecomers vulnerable to speculative risks.

“Investors often mistake media buzz for market strength, ignoring sustained demand and employment growth as key drivers of long-term value.”

— Lisa Carver, Property Analyst

To counteract this, seasoned investors integrate local data and demographic trends with media reports. This approach ensures decisions are grounded in enduring fundamentals rather than transient narratives, fostering more resilient investment strategies.

Market Drivers and Investment Fundamentals

The interplay between infrastructure investment, employment growth, and demographic shifts forms the backbone of sustainable property market performance. According to the Australian Bureau of Statistics (ABS), suburbs with significant infrastructure upgrades, such as new transport links or educational facilities, experience property value increases of up to 15% within five years. This correlation underscores the importance of evaluating long-term utility over short-term price spikes.

Employment hubs further amplify this effect. For instance, areas within a 30-minute commute of major job centers consistently outperform others in capital growth, as confirmed by a 2023 PropTrack study. This proximity not only attracts renters but also stabilizes demand during economic downturns, creating a buffer against market volatility.

A common misconception is that population growth alone guarantees capital appreciation. However, without corresponding infrastructure and employment opportunities, this growth can strain local resources, leading to stagnation. As Terry Ryder, director of Hotspotting, emphasizes, “Population growth is a catalyst, but infrastructure and jobs are the engines.”

By integrating these metrics, investors can identify suburbs with genuine, enduring potential, avoiding the pitfalls of speculative hype.

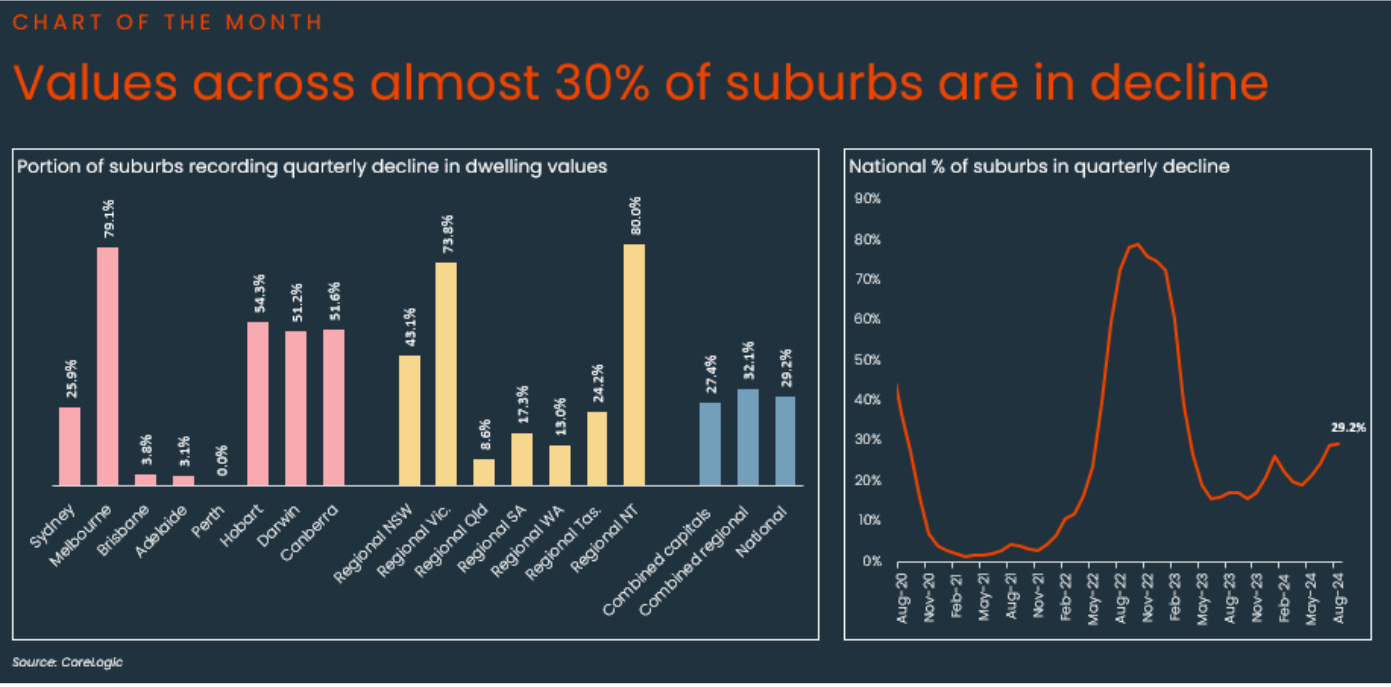

Image source: corelogic.com.au

Infrastructure and Employment as Key Drivers

The synergy between infrastructure development and employment growth is a cornerstone of sustainable suburb expansion. A critical yet often overlooked dynamic is how infrastructure projects, such as transport hubs or commercial precincts, act as catalysts for localized job creation. This relationship is not merely additive but symbiotic, where each element amplifies the other’s impact. For instance, the Parramatta Light Rail in Sydney has not only improved connectivity but also spurred the establishment of tech parks and coworking spaces, creating a self-reinforcing cycle of demand for both housing and employment.

A comparative analysis reveals that infrastructure investments without corresponding employment opportunities often fail to deliver long-term value. Suburbs with high commuter dependency, for example, may experience initial property value spikes but lack the resilience seen in areas with diversified local job markets. This underscores the importance of aligning infrastructure planning with economic development strategies.

“Infrastructure alone cannot sustain growth; it must be paired with robust employment ecosystems to ensure enduring benefits.”

— Dr. Sarah Hughes, Urban Economist

One challenge lies in measuring the true impact of these projects. Metrics like job density per square kilometer or commute time reductions provide valuable insights but often fail to capture qualitative factors, such as community engagement or workforce retention. Addressing these nuances enables investors and policymakers to identify suburbs with genuine, long-term potential.

Demographic Shifts and Government Policies

Targeted government policies often act as catalysts for demographic shifts, reshaping the economic and social fabric of suburbs. One critical mechanism is rezoning for higher-density housing, which not only increases housing supply but also attracts diverse population groups, including young professionals and immigrant families. This influx can transform previously stagnant areas into vibrant, economically active communities.

The effectiveness of such policies, however, hinges on their alignment with local demographic trends. For instance, rezoning without parallel investments in infrastructure—such as schools, healthcare facilities, and public transport—can lead to overcrowding and strain on resources, undermining long-term growth. Conversely, well-coordinated policies, like those seen in Melbourne’s outer suburbs, have demonstrated how integrated planning fosters sustainable development.

“Policy that encourages mixed-use developments coupled with a strong influx of young families can fundamentally alter a suburb’s economic landscape.”

— Dr. Sarah Hughes, Urban Economist

A comparative analysis reveals that suburbs benefiting from both demographic diversification and government-backed infrastructure projects consistently outperform those reliant on speculative growth. This underscores the importance of evaluating policy-driven changes not just for their immediate impact but for their capacity to sustain economic and social vitality over decades.

Distinguishing Between Hype and Sustainable Growth

Rapid price increases often captivate investors, but such surges can obscure critical vulnerabilities. According to CoreLogic, suburbs with annual price growth exceeding 20% frequently experience corrections within three years, as inflated values outpace local income growth. This phenomenon, termed “price decoupling,” highlights the importance of aligning property values with economic fundamentals like employment rates and infrastructure capacity.

A key misconception is that high demand alone signals sustainable growth. However, areas with vacancy rates below 1% may indicate a supply bottleneck rather than genuine market strength. For example, a 2024 study by PropTrack revealed that 60% of suburbs with ultra-low vacancy rates lacked sufficient infrastructure to support long-term population increases, leading to eventual stagnation.

To differentiate sustainable growth from hype, investors should evaluate metrics such as price-to-rent ratios and infrastructure spending per capita. Dr. Emily Carter, a property economist, emphasizes that “suburbs with balanced metrics and diversified economies consistently outperform speculative hotspots.” This approach ensures investments are grounded in resilience, not fleeting trends.

By integrating these insights, investors can navigate the tension between market excitement and enduring value, securing portfolios against volatility.

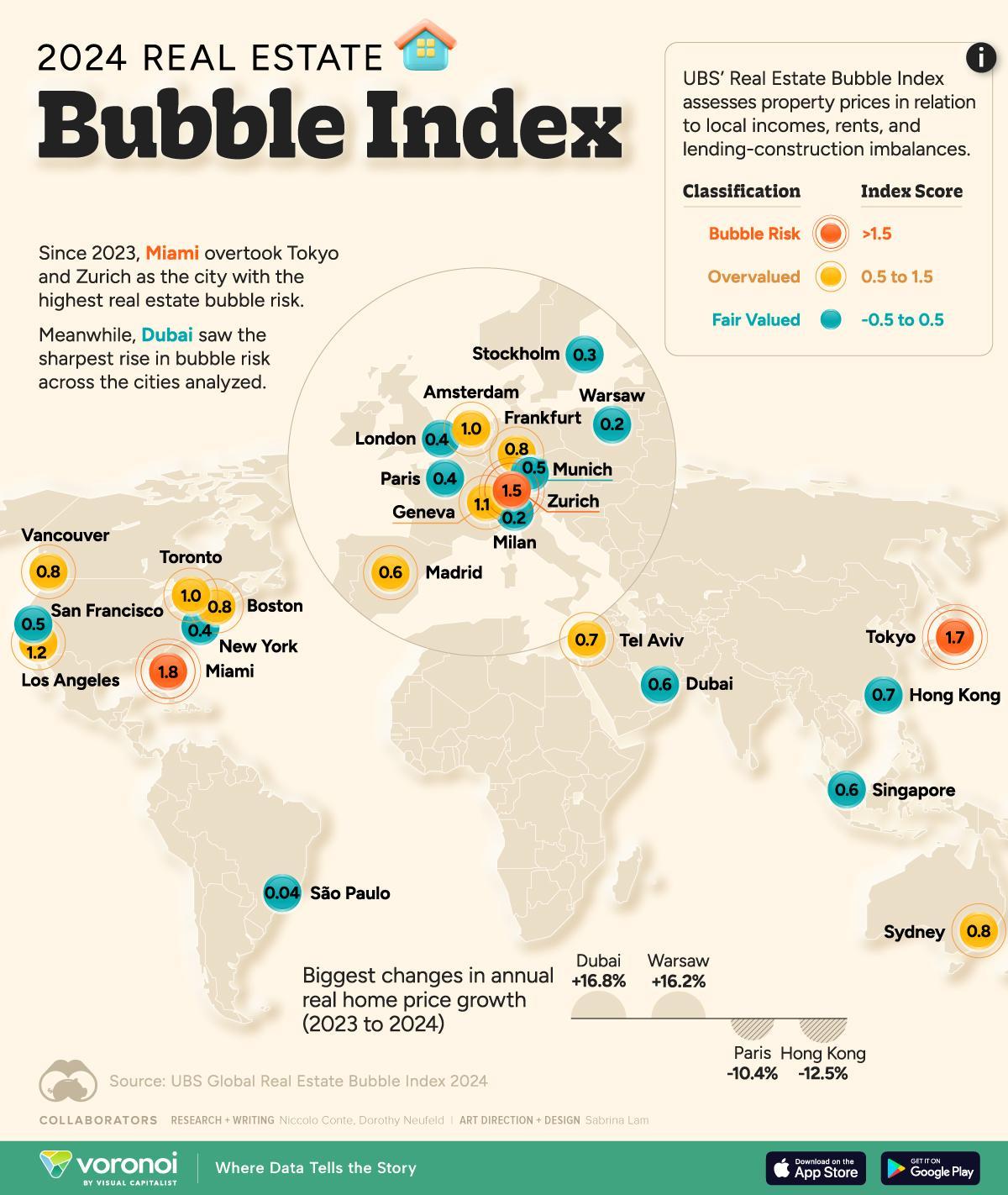

Image source: visualcapitalist.com

Identifying Speculative Bubbles

Speculative bubbles often manifest when property prices deviate significantly from underlying economic fundamentals, creating a precarious imbalance. A critical technique for identifying such bubbles is the log price-to-rent ratio analysis, which measures the disparity between property prices and rental income. This ratio, when abnormally high, signals that prices are driven more by speculative demand than by intrinsic value.

The methodology proposed by Shi (2017) refines this analysis by incorporating macroeconomic variables such as mortgage rates, disposable income, and housing supply growth. Unlike traditional models, this approach adjusts for external factors, offering a more precise detection of speculative activity. For instance, during the 2003–2005 period, this method identified speculative bubbles in six Australian capital cities, while also revealing that Canberra remained insulated due to its stable employment base and controlled housing supply.

“Speculative bubbles thrive in environments where market fundamentals are overshadowed by investor exuberance,” notes Dr. Shuping Shi, an economist specializing in housing markets.

However, limitations exist. The model’s reliance on historical data can delay real-time detection, and its effectiveness diminishes in markets with incomplete or inconsistent data. To mitigate these challenges, integrating real-time metrics like auction clearance rates and vacancy trends can enhance predictive accuracy, ensuring timely interventions and informed investment decisions.

Data-Driven Investment Strategies

A critical yet underexplored aspect of data-driven property investment is the integration of predictive analytics with localized market intelligence. While traditional metrics like rental yields and vacancy rates offer a snapshot of current conditions, predictive models excel in forecasting future trends by analyzing variables such as infrastructure developments, demographic shifts, and employment growth trajectories. This approach bridges the gap between static data and dynamic market realities.

The effectiveness of predictive analytics lies in its ability to identify leading indicators. For instance, a surge in building approvals or rezoning applications often precedes significant property value increases. However, these signals are context-dependent; their impact varies based on factors like regional economic stability and population density. A comparative analysis of Sydney’s outer suburbs versus regional hubs like Newcastle reveals that predictive models perform better in areas with consistent data availability and economic diversification.

“The true power of predictive analytics is unlocked when combined with granular, real-time local insights,” explains Dr. Emily Carter, a property economist. “This dual approach mitigates the risk of over-reliance on historical trends.”

Despite its potential, predictive analytics faces challenges, such as data quality inconsistencies and the difficulty of quantifying qualitative factors like community sentiment. Addressing these limitations requires blending algorithmic precision with human expertise, enabling investors to uncover nuanced opportunities while avoiding speculative pitfalls. This synthesis ensures decisions are both data-informed and contextually grounded.

Case Studies: Successes and Pitfalls

The contrasting trajectories of Melbourne’s Docklands and Brisbane’s Fortitude Valley illustrate the fine line between strategic investment and speculative missteps. Docklands, despite its $12 billion redevelopment, struggled with high vacancy rates and limited community engagement, highlighting the risks of prioritizing large-scale projects over organic demand. In contrast, Fortitude Valley leveraged targeted infrastructure upgrades, such as the $500 million transport hub, to attract tech startups and young professionals, achieving a 7.5% annual rental yield growth from 2020 to 2024.

A key misconception is that high population growth guarantees success. According to the Australian Bureau of Statistics, suburbs with a 3% annual population increase but inadequate infrastructure often face stagnation. This underscores the importance of aligning growth with local amenities and employment opportunities.

These examples reveal that sustainable investment hinges on integrating demand-driven planning with robust infrastructure, ensuring long-term resilience over fleeting market trends.

Image source: realtyai.com.au

Suburbs Benefiting from Infrastructure Projects

The transformative impact of infrastructure projects on suburban growth hinges on their ability to integrate connectivity with economic diversification. Suburbs like Box Hill in Melbourne, benefiting from the Suburban Rail Loop, exemplify how transport infrastructure can catalyze localized economic ecosystems. Enhanced accessibility attracts businesses, which in turn create employment opportunities, fostering a self-sustaining cycle of growth.

A critical mechanism driving this success is the alignment of infrastructure timelines with demographic and employment trends. For instance, the introduction of transport hubs often coincides with rezoning initiatives, enabling higher-density housing and commercial developments. However, the absence of complementary amenities—such as schools, healthcare facilities, and recreational spaces—can limit the long-term viability of these projects. This underscores the importance of holistic planning.

“Infrastructure investments yield dividends only when matched with economic diversification and community-centric planning.”

— Dr. Sarah Hughes, Urban Economist

Comparative analysis reveals that suburbs with integrated infrastructure and employment hubs outperform those reliant solely on transport upgrades. For example, while Box Hill thrives due to its mixed-use developments, other areas with similar transport projects but limited job creation face stagnation. This highlights the nuanced interplay between infrastructure, employment, and community development.

Lessons from Overhyped Markets

Overhyped property markets often expose a critical imbalance between rapid price growth and the structural elements required for sustainability. A key issue is the reliance on speculative demand, which inflates prices without corresponding improvements in infrastructure or employment opportunities. For instance, suburbs experiencing a 15% annual price surge often see corrections within three years when vacancy rates rise due to insufficient local amenities or job creation.

A comparative analysis highlights the pitfalls of focusing solely on price trends. Suburbs with high price-to-rent ratios frequently underperform in the long term, as rental yields fail to justify inflated valuations. This underscores the importance of evaluating metrics like infrastructure spending per capita and employment density, which provide a clearer picture of a suburb’s resilience.

“Sustainable growth stems from a balance of demand drivers, not speculative exuberance,” notes Dr. Emily Carter, Property Economist.

To mitigate risks, investors should integrate predictive analytics with qualitative assessments, such as community engagement and council planning. This dual approach uncovers hidden vulnerabilities, ensuring decisions are grounded in both data and real-world dynamics.

FAQ

What are the key factors that define Australia’s hottest suburbs for property investment in 2025?

Key factors include robust infrastructure development, such as transport hubs and educational facilities, which enhance connectivity and attract diverse demographics. Employment opportunities within or near the suburb significantly boost demand, ensuring long-term growth. Low vacancy rates and strong rental yields signal sustained interest from tenants, while balanced price-to-rent ratios indicate market stability. Government policies, including rezoning and urban renewal initiatives, further shape investment potential. Additionally, demographic trends, such as population growth aligned with local amenities, play a pivotal role. Evaluating these interconnected elements ensures a data-driven approach to identifying suburbs with genuine, enduring investment value.

How can investors differentiate between speculative hype and sustainable growth in emerging suburbs?

Investors can analyze metrics like infrastructure spending per capita, employment density, and demographic trends to identify sustainable growth. Suburbs with balanced price-to-rent ratios and low vacancy rates often indicate genuine demand. Reviewing government planning documents for upcoming projects, such as transport hubs or commercial precincts, provides insights into long-term viability. Avoiding areas with rapid, unsubstantiated price surges is crucial, as these often signal speculative bubbles. Additionally, integrating predictive analytics with local market intelligence ensures decisions are grounded in data and context. This approach helps distinguish between transient market excitement and suburbs with enduring investment potential.

What role do infrastructure projects and employment hubs play in driving property value in Australia’s top suburbs?

Infrastructure projects enhance connectivity, making suburbs more accessible and desirable, while employment hubs create localized job opportunities, driving demand for housing. Proximity to transport links, such as train stations or highways, significantly boosts property values by improving convenience and reducing commute times. Employment hubs attract a stable workforce, fostering economic activity and ensuring consistent rental demand. The synergy between these elements supports long-term growth, as seen in suburbs benefiting from projects like the Melbourne Suburban Rail Loop. Evaluating the alignment of infrastructure timelines with employment trends is essential for identifying suburbs with sustainable property value appreciation.

Which metrics should investors prioritize when evaluating the long-term potential of a suburb?

Investors should prioritize metrics such as rental yields, vacancy rates, and price-to-rent ratios to gauge market stability and demand. Infrastructure spending per capita and proximity to transport hubs or employment centers are critical indicators of future growth. Demographic trends, including population growth and income levels, reveal the suburb’s capacity to sustain demand. Additionally, tracking property turnover rates and planned rezoning initiatives provides insights into market activity and development potential. Combining these data points with predictive analytics ensures a comprehensive evaluation, enabling investors to identify suburbs with enduring value rather than short-term speculative appeal.

How do government policies and demographic shifts influence the performance of Australia’s property hotspots?

Government policies, such as rezoning for higher-density housing and infrastructure funding, directly enhance the appeal of property hotspots by improving amenities and accessibility. Incentives like first-home buyer grants stimulate demand, while urban renewal projects attract diverse demographics. Demographic shifts, including population growth and migration patterns, reshape housing demand, with younger professionals favoring urban centers and families migrating to regional hubs. Multi-generational living trends and an aging population further influence property types in demand. Aligning these policies and shifts with local infrastructure ensures sustainable growth, making these factors pivotal in identifying high-performing property hotspots with long-term investment potential.