The Great Australian Dream on the Ballot: Election Impact on Housing and Property Prices

In May 2019, Australian property auctions saw an unexpected surge in clearance rates—60.4% on election day, compared to the usual 50% average for the preceding months. This anomaly, reported by Domain, defied the typical pre-election market slowdown, suggesting that political uncertainty doesn’t always suppress buyer activity. Instead, it can concentrate demand among the most committed participants, reshaping short-term market dynamics.

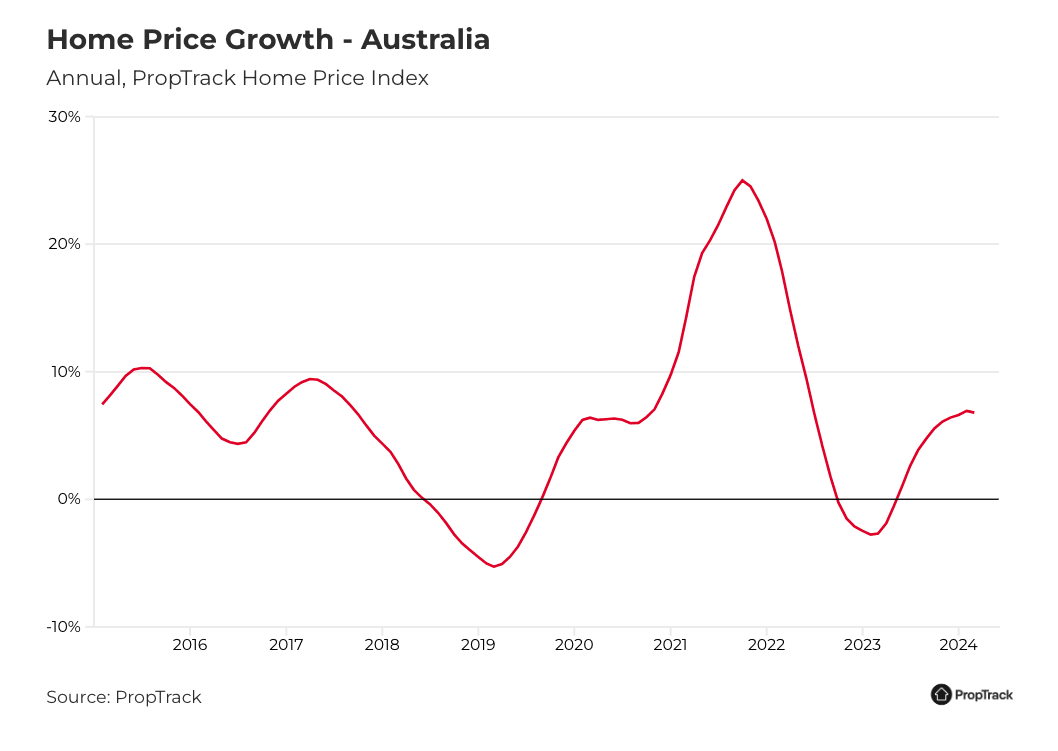

The interplay between elections and property markets is far from straightforward. While political campaigns often spotlight housing affordability and tax policies, the real drivers of market behavior—interest rates, global economic conditions, and immigration trends—frequently overshadow legislative promises. For instance, the Reserve Bank of Australia’s rate hikes in 2022 had a more pronounced effect on property prices than any single policy announcement.

Yet, elections remain pivotal moments. As Dr. Nicola Powell, Chief of Research at Domain, notes, “Political uncertainty can dampen activity, but it’s the broader economic context that ultimately dictates market trajectories.”

Image source: realestate.com.au

Historical Roots and Cultural Significance

The Great Australian Dream is deeply intertwined with the nation’s post-war reconstruction, where home ownership was championed as a cornerstone of societal stability and personal achievement. This vision was not merely economic but symbolic, reflecting a collective aspiration for security and belonging. What is often overlooked, however, is how this ethos was deliberately cultivated through government policies and cultural narratives, embedding home ownership into the national identity.

One pivotal mechanism was the introduction of the Commonwealth Housing Commission in 1943, which prioritized affordable housing as a public good. This initiative laid the groundwork for decades of policy favoring detached suburban homes, reinforced by tax incentives and urban planning frameworks. Yet, these policies also entrenched socio-economic divides, as access to ownership became increasingly unequal.

“The Australian Dream is not just about property—it’s about identity and legacy,” explains Dr. Michael Fotheringham, Executive Director of the Australian Housing and Urban Research Institute.

— Dr. Michael Fotheringham, AHURI

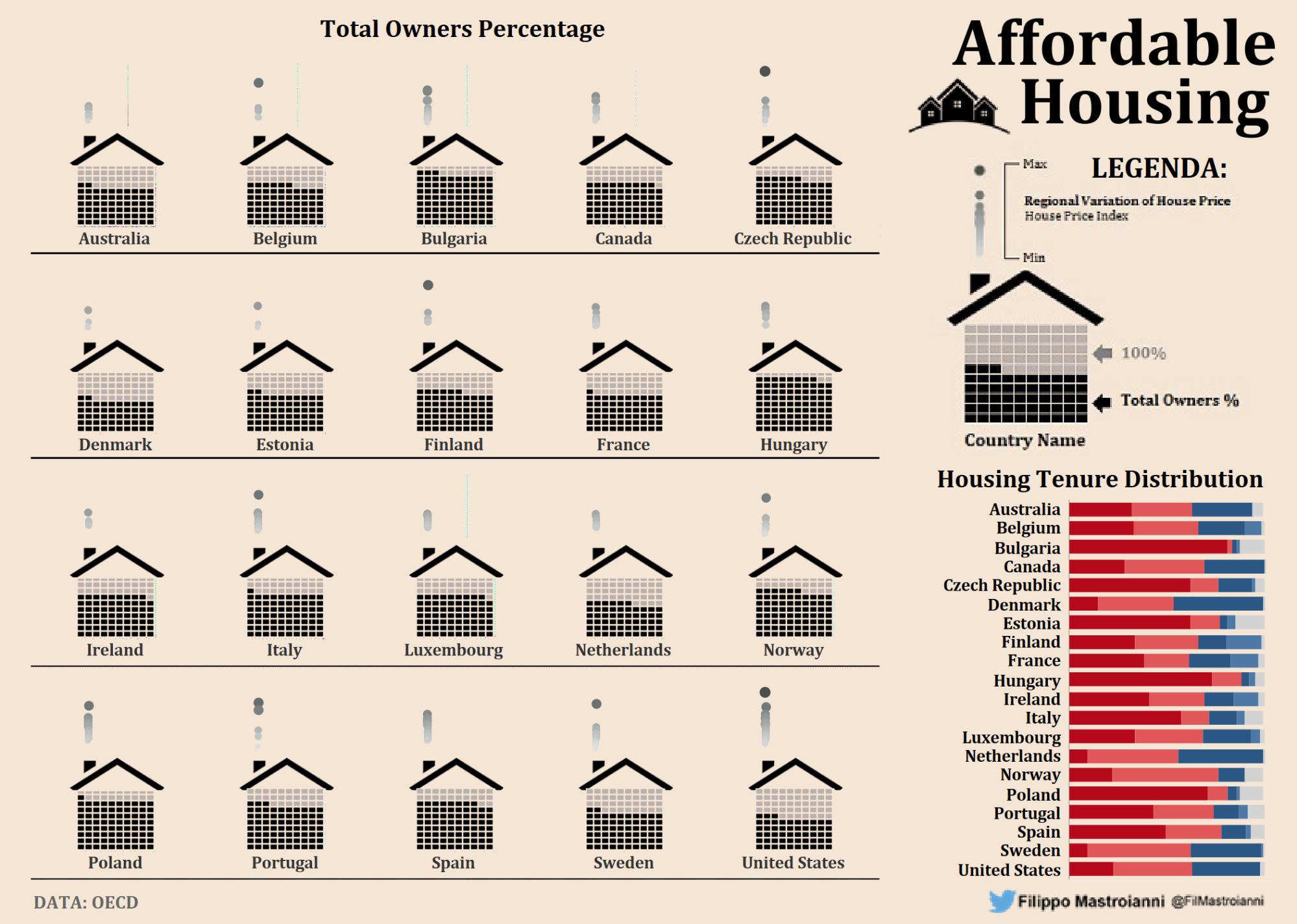

Comparatively, nations like Germany emphasize long-term rental stability over ownership, challenging the assumption that home ownership is universally ideal. This contrast highlights the cultural specificity of Australia’s housing aspirations and underscores the need for nuanced policy approaches that balance tradition with modern realities.

Current Challenges in Housing Affordability

One critical yet underexplored challenge in housing affordability lies in the interplay between restrictive zoning laws and urban density. These regulations, often designed to preserve neighborhood character, inadvertently limit the construction of medium- and high-density housing, exacerbating supply shortages in urban centers. This dynamic is particularly pronounced in cities like Sydney and Melbourne, where demand far outstrips available housing stock.

The significance of this issue extends beyond supply constraints. Restrictive zoning inflates land values, making it economically unfeasible for developers to prioritize affordable housing projects. Comparative studies reveal that cities with more flexible zoning frameworks, such as Tokyo, achieve greater housing affordability by enabling higher-density developments. However, in Australia, political resistance and community opposition frequently stall such reforms, perpetuating the crisis.

“Zoning reform is essential, but it must be paired with incentives for affordable housing to ensure equitable outcomes,” explains Eliza Owen, Head of Research at CoreLogic Australia.

A nuanced approach could involve inclusionary zoning policies, which mandate affordable housing quotas in new developments. While promising, these policies face implementation challenges, including balancing developer profitability with affordability goals. Addressing these complexities requires coordinated efforts across federal, state, and local governments, alongside robust public engagement to overcome resistance and align stakeholder interests.

Political Party Platforms and Housing Policies

Labor and the Coalition have unveiled housing policies that, while ambitious, reveal critical gaps when scrutinized against market realities. Labor’s pledge to construct 1.2 million homes by 2029, including 100,000 reserved for first-home buyers, is a bold target. However, the 2025 State of the Land report by the Urban Development Institute of Australia projects a shortfall of nearly 400,000 homes, highlighting the disconnect between political promises and feasible outcomes. Similarly, the Coalition’s plan to unlock 500,000 homes through reduced immigration and streamlined approvals risks exacerbating labor shortages in construction, a sector already strained by a 13% workforce deficit.

Experts like Brendan Coates, Economic Policy Program Director at the Grattan Institute, argue that both platforms focus excessively on demand-side measures, such as first-home buyer assistance, which inadvertently inflate prices. Coates emphasizes that supply-side interventions, including zoning reforms and public housing investment, are essential to address structural imbalances.

This divergence between political rhetoric and actionable solutions underscores the need for policies that prioritize sustainable, long-term affordability over short-term electoral gains.

Image source: informationisbeautifulawards.com

Major Party Proposals and Their Implications

Labor’s expanded shared-equity scheme, allowing first-home buyers to purchase with a 5% deposit, exemplifies a demand-side intervention aimed at improving accessibility. However, such measures often inflate prices by increasing purchasing power without addressing supply constraints. This dynamic is particularly evident in urban centers like Sydney, where demand consistently outpaces housing availability.

The Coalition’s proposal to unlock 500,000 homes through streamlined approvals and reduced immigration introduces a contrasting approach. While reducing migration may alleviate short-term rental pressures, it risks exacerbating labor shortages in the construction sector, already strained by a 13% workforce deficit. This limitation highlights the interconnectedness of housing supply and broader economic policies.

“Demand-side policies alone are insufficient; without significant supply-side reforms, affordability will remain elusive,” explains Brendan Coates, Economic Policy Program Director at the Grattan Institute.

A critical yet underexplored factor is the role of enabling infrastructure. The Coalition’s $5 billion fund for streets and sewage in greenfield developments could accelerate housing delivery but may disproportionately benefit outer suburban areas, raising concerns about urban sprawl and environmental impact. Comparative studies suggest that integrating inclusionary zoning policies with infrastructure investment could yield more balanced outcomes, fostering both affordability and sustainability.

Ultimately, the effectiveness of these proposals hinges on their ability to address systemic barriers, such as restrictive zoning laws and construction capacity, rather than relying solely on politically expedient solutions.

Case Study: Labor’s ‘Help to Buy’ Scheme

Labor’s ‘Help to Buy’ scheme exemplifies the complexities of demand-side housing policies, particularly in markets with constrained supply. By allowing buyers to enter the market with as little as a 2% deposit and government equity stakes of up to 40% for new homes, the scheme aims to reduce barriers to homeownership. However, its implementation reveals significant unintended consequences.

One critical dynamic is the scheme’s impact on property prices. Research from the English Help to Buy Equity Loan Scheme, which shares structural similarities, indicates that such policies often trigger localized price increases. A study published in ScienceDirect found that in supply-inelastic areas like London, led to price surges without corresponding increases in housing supply. This underscores the importance of supply elasticity in determining policy outcomes.

“Demand-side subsidies without supply-side reforms risk inflating prices, benefiting sellers more than buyers,” explains Brendan Coates, Economic Policy Program Director at the Grattan Institute.

Additionally, the scheme’s design raises equity concerns. Critics argue that income and price caps exclude many low-income households, while benefiting those already closer to market entry. This highlights the need for complementary supply-side measures, such as zoning reforms, to ensure broader affordability and mitigate inflationary pressures.

Impact of Elections on Property Prices

Elections introduce a unique interplay of short-term market sentiment and long-term policy implications, often misunderstood by stakeholders. Contrary to the belief that elections directly dictate property prices, evidence suggests their influence is more nuanced. For instance, Domain’s statistical modeling links a one-point rise in Australia’s Policy Uncertainty Index to an 8.08 decline in property sales, illustrating how political ambiguity can suppress immediate market activity without altering underlying price trends.

However, the broader economic context often overshadows electoral effects. CoreLogic data reveals that Australia’s $11.1 trillion residential real estate market—nearly three times the size of national superannuation investments—remains resilient due to its structural depth. This resilience explains why post-election recoveries are swift, as seen in the 2019 federal election when market confidence rebounded immediately after policy clarity emerged.

A critical yet overlooked factor is the lag between policy announcements and their tangible impact. For example, changes to negative gearing or capital gains tax may take years to influence supply-demand dynamics, underscoring the importance of long-term economic fundamentals over transient political cycles.

Image source: costar.com

Market Reactions to Election Outcomes

Election outcomes often create short-term volatility in property markets, but the underlying mechanisms reveal a more intricate dynamic. One critical factor is the role of policy uncertainty in shaping buyer and investor behavior. Research indicates that heightened uncertainty during close elections can delay high-stakes decisions, such as property purchases, as stakeholders await clarity on potential policy shifts. This phenomenon is particularly pronounced in competitive urban markets like Sydney, where even minor regulatory changes can significantly impact buyer confidence.

A comparative analysis of past elections highlights the nuanced interplay between political outcomes and market sentiment. For instance, while the 2019 Coalition victory restored confidence in property stocks due to the dismissal of proposed tax reforms, the 2022 election saw mixed reactions. Affordable housing initiatives buoyed optimism, but concerns over stricter regulations for real estate investment trusts tempered enthusiasm. These contrasting responses underscore the sector-specific sensitivities to electoral outcomes.

“Markets respond not just to who wins, but to the clarity and feasibility of their policies,” explains Dr. Nicola Powell, Chief of Research at Domain.

Ultimately, while elections can influence short-term sentiment, the broader economic context—interest rates, supply constraints, and demographic trends—remains the dominant force shaping property prices. This highlights the importance of focusing on structural fundamentals over transient political cycles.

Long-term Effects of Policy Changes

Policy changes in the housing market often exhibit delayed impacts, with their full effects materializing over extended periods. This lag arises from the intricate interplay between regulatory adjustments, market sentiment, and structural constraints. For instance, modifications to capital gains tax or negative gearing policies initially create minimal disruption, as stakeholders require time to interpret and adapt to the new landscape. However, over two to three years, these changes can significantly influence investment patterns, housing supply, and price stability.

A critical factor in this delayed response is the alignment—or lack thereof—between policy objectives and market realities. For example, while tax incentives may aim to stimulate affordable housing, their success depends on complementary measures such as zoning reforms and infrastructure investment. Without these, the intended benefits may be diluted, as developers face persistent barriers to increasing supply.

“The effectiveness of housing policies hinges on their integration with broader economic frameworks,” explains Brendan Coates, Economic Policy Program Director at the Grattan Institute.

A case study of Japan’s flexible zoning laws highlights the potential for long-term stabilization. By enabling high-density developments, Japan mitigated housing shortages despite population pressures. In contrast, Australia’s restrictive zoning has often counteracted policy goals, prolonging affordability crises. This underscores the importance of cohesive, multi-faceted strategies that address both immediate and systemic challenges.

Social Equity and the Evolving Dream

The notion of homeownership as a universal benchmark of success is increasingly misaligned with Australia’s socio-economic realities. According to the Australian Bureau of Statistics, 32% of households now rent, a figure that has risen steadily over the past two decades. This shift reflects not only affordability challenges but also evolving lifestyle preferences, particularly among younger demographics and urban dwellers.

Critically, the traditional “Great Australian Dream” of owning a detached suburban home has perpetuated systemic inequities. Research by the Australian Housing and Urban Research Institute (AHURI) reveals that tax policies like negative gearing disproportionately benefit high-income investors, exacerbating wealth gaps. Meanwhile, low-income households face mounting barriers, with 43% of renters experiencing housing stress, defined as spending more than 30% of income on rent.

To address these disparities, innovative housing models such as build-to-rent and co-housing are gaining traction. These approaches prioritize affordability and community, challenging entrenched norms while fostering inclusivity.

Image source: linkedin.com

Redefining Success in Home Ownership

Redefining success in home ownership requires a paradigm shift from asset accumulation to fostering long-term affordability and community stability. This shift is particularly relevant in Australia, where traditional ownership models have exacerbated socio-economic divides. Shared equity programs, such as those piloted by the Western Australian government, illustrate how co-ownership frameworks can mitigate these disparities by reducing entry costs while retaining affordability for future buyers.

The mechanics of shared equity hinge on balancing individual and collective benefits. For instance, subsidy retention models, like community land trusts (CLTs), ensure perpetual affordability by embedding resale restrictions into legal agreements. These mechanisms prevent speculative price inflation, a common pitfall of demand-side policies. However, implementation challenges persist, including limited public awareness and resistance from financial institutions reluctant to underwrite unconventional mortgages.

Comparatively, build-to-rent developments offer an alternative by prioritizing rental stability over ownership. A case study from Sydney demonstrates how these projects, supported by tax incentives, have provided affordable housing options for middle-income earners while reducing urban sprawl. Yet, critics argue that such models lack the wealth-building potential of ownership, underscoring the need for hybrid approaches.

“Sustainable housing solutions must balance affordability with equity, ensuring long-term benefits for diverse demographics.”

— Dr. Louise Crabtree, Housing Researcher

This evolving definition of success emphasizes inclusivity, challenging policymakers to integrate innovative tenure models with systemic reforms.

Innovative Models for Inclusive Housing

A critical yet underexplored dimension of inclusive housing lies in the integration of community land trusts (CLTs) with shared equity frameworks. CLTs, which separate land ownership from property ownership, ensure perpetual affordability by embedding resale restrictions into legal agreements. This mechanism prevents speculative price inflation, a recurring issue in demand-driven housing markets, while fostering long-term community stability.

The effectiveness of CLTs depends on their ability to balance affordability with autonomy. Unlike traditional shared equity models, CLTs allow residents to build equity while maintaining affordability for future buyers. However, implementation challenges persist, particularly in urban areas where high land values complicate initial funding. Comparative studies reveal that CLTs in the United States, such as the Champlain Housing Trust in Vermont, have successfully retained affordability across multiple resale cycles, offering a blueprint for Australian adoption.

Contextual factors, including regulatory frameworks and public awareness, significantly influence the scalability of CLTs. In Australia, limited familiarity with this model has hindered its adoption, despite its potential to address systemic affordability issues.

“Community land trusts offer a pathway to equitable housing, but their success hinges on robust governance and public engagement.”

— Dr. Louise Crabtree, Housing Researcher

By integrating CLTs with broader housing strategies, policymakers can create a sustainable model that prioritizes both equity and accessibility.

FAQ

How do Australian elections influence housing affordability and property market trends?

Australian elections shape housing affordability and property market trends through policy shifts, economic signals, and market sentiment. Proposed changes to tax incentives, such as negative gearing or capital gains tax, directly impact investor behavior and housing supply. Political uncertainty often delays major financial decisions, temporarily reducing market activity. Additionally, affordability measures like first-home buyer grants can drive demand, influencing price dynamics. Broader economic factors, including interest rates and immigration policies, often intersect with election-driven housing strategies, amplifying their effects. These interconnected elements highlight the critical role of elections in defining short- and long-term housing market trajectories.

What are the key housing policies proposed by major political parties in the upcoming election?

Labor has pledged to build 1.2 million homes by 2029, expand shared-equity schemes with 5% deposit options, and allocate 100,000 homes exclusively for first-home buyers. The Coalition proposes unlocking 500,000 homes by reducing immigration, streamlining approvals, and allowing first-home buyers to access up to $50,000 from superannuation. Both parties support a two-year ban on foreign investment in existing properties. While these policies aim to address affordability, experts highlight gaps in supply-side measures, such as zoning reforms and infrastructure investment, which are critical for sustainable housing solutions. These proposals reflect differing approaches to balancing demand stimulation and structural reforms.

How does political uncertainty during elections affect property prices and buyer behavior?

Political uncertainty during elections often leads to “poll paralysis,” where buyers and sellers delay decisions due to unclear policy outcomes. This hesitation can temporarily reduce transaction volumes, particularly in competitive urban markets. However, committed buyers may capitalize on reduced competition, stabilizing overall activity. Policy debates, such as changes to negative gearing or capital gains tax, amplify uncertainty, influencing investor confidence and price trends. Additionally, fluctuations in Australia’s Economic Policy Uncertainty Index correlate with declines in property sales, underscoring the sensitivity of market behavior to political ambiguity. Despite short-term impacts, long-term property values remain driven by broader economic fundamentals.

What role do tax incentives and zoning reforms play in shaping the Australian housing market during election cycles?

Tax incentives like negative gearing and capital gains tax concessions significantly influence investor activity, often driving up property prices and sidelining first-home buyers. During election cycles, proposed reforms to these incentives become focal points, shaping market expectations and voter sentiment. Zoning reforms, meanwhile, directly impact housing supply by determining land use and development density. Restrictive zoning inflates land values and limits affordable housing projects, while flexible policies can boost supply in high-demand areas. Together, these factors create a dynamic interplay where election-driven policy debates on tax and zoning reforms critically shape affordability, investment patterns, and long-term market stability.

How might election outcomes impact first-home buyers and long-term property investors in Australia?

Election outcomes influence first-home buyers through policies like shared-equity schemes, deposit assistance, and grants, which enhance accessibility but may inflate prices by increasing demand. For long-term property investors, changes to tax incentives, such as negative gearing or capital gains tax, directly affect profitability and investment strategies. Additionally, infrastructure funding and zoning reforms can shape market opportunities by altering supply dynamics. Broader economic policies tied to immigration and interest rates further intersect with election-driven housing strategies, impacting both demographics. These outcomes underscore the dual significance of election policies in addressing immediate affordability concerns and fostering sustainable investment environments.