Australia’s Housing Market in the Spotlight: Election Policies and What They Mean for You

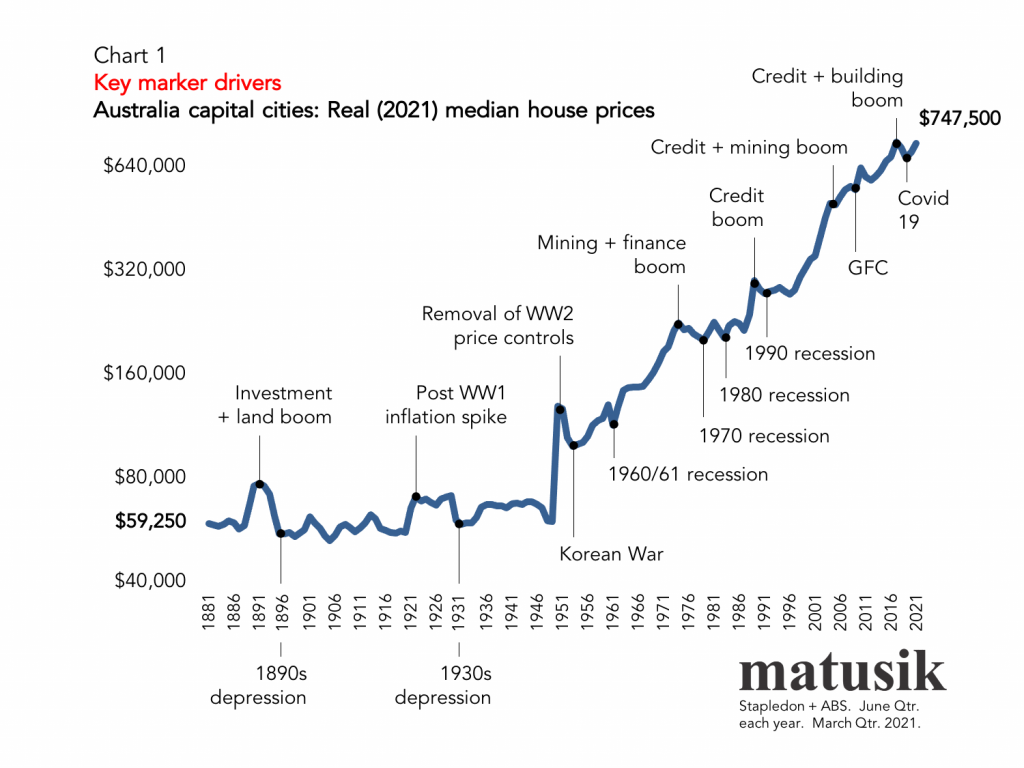

In 2025, Australia’s housing market faces a paradox: despite a decade of record-low interest rates and government incentives, homeownership remains out of reach for many. According to the Australian Bureau of Statistics, the national homeownership rate has fallen to 63.5%, its lowest since the 1950s. This decline coincides with a surge in housing prices—up 28% nationally since 2020—driven by constrained supply and speculative investment.

The upcoming federal election has thrust this crisis into the political spotlight. Prime Minister Anthony Albanese’s Labor government has proposed expanding shared equity schemes, while Opposition Leader Peter Dutton’s Coalition advocates for tax incentives and migration cuts. Yet, experts like Dr. Katrina Raynor of Per Capita argue these measures fail to address the core issue: a chronic undersupply of new housing. “Without systemic reform, these policies risk exacerbating the problem,” she warns.

As voters prepare to head to the polls, the stakes for Australia’s housing future have never been higher.

Image source: matusik.com.au

Historical Trends in Home Ownership

The trajectory of home ownership in Australia reflects a profound shift influenced by structural, financial, and demographic transformations. In the mid-20th century, home ownership was bolstered by affordable housing prices, government-backed loans, and a relatively stable economic environment. However, the introduction of financial deregulation in the 1980s marked a turning point, enabling easier access to credit but simultaneously driving up property values through increased leveraging and speculative investment.

A critical yet underexplored factor is the role of policy frameworks that have inadvertently favored investors over first-time buyers. Tax incentives such as negative gearing and capital gains tax discounts have amplified demand for investment properties, creating competition that disproportionately impacts younger buyers. This dynamic is compounded by demographic shifts, including delayed household formation and an aging population, which have altered housing preferences and mobility patterns.

“The erosion of fundamental affordability isn’t just about price hikes; it’s about decades of policy missteps that have skewed supply and demand.”

— Dr. Katrina Raynor, Housing Policy Expert

These trends underscore that declining home ownership is not merely a cyclical phenomenon but a structural issue. Addressing this requires rethinking entrenched policies and aligning housing supply with evolving demographic and economic realities.

Current Housing Crisis: Causes and Effects

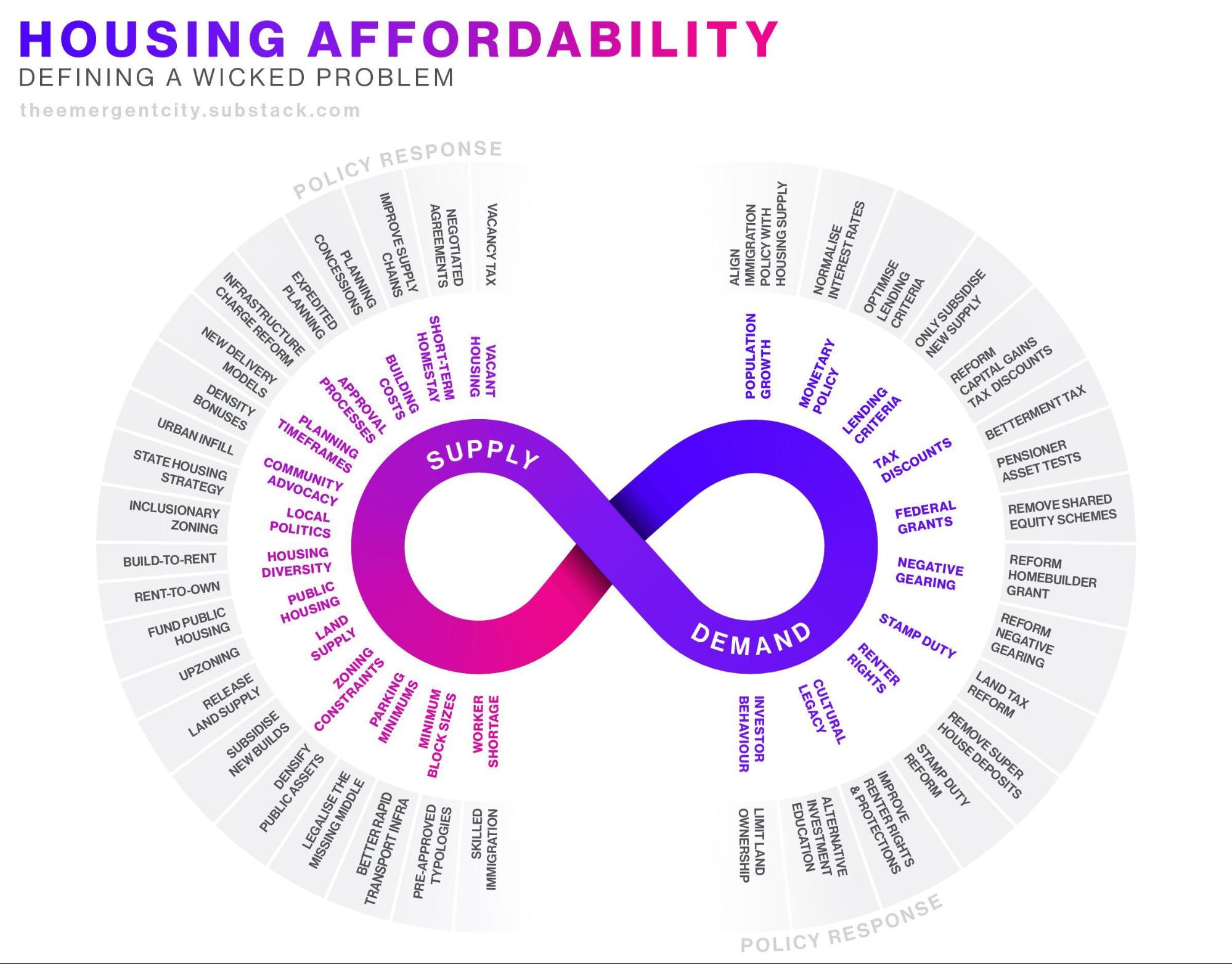

A critical yet underexamined driver of Australia’s housing crisis is the misalignment between housing supply responsiveness and population growth. While demand-side interventions, such as first-home buyer grants, dominate policy discussions, the underlying issue lies in structural barriers that hinder the timely expansion of housing stock. These barriers include restrictive planning regulations, high material costs, and labor shortages, which collectively stifle the construction sector’s ability to meet demand surges.

The supply inelasticity is particularly evident in urban centers like Sydney and Melbourne, where topographical constraints and infrastructure deficits exacerbate the problem. Research from the Australian Housing and Urban Research Institute (AHURI) highlights that even significant price increases result in only marginal growth in housing stock, underscoring the need for systemic reform. This dynamic creates a feedback loop where rising prices further incentivize speculative investment, intensifying affordability challenges for first-time buyers.

“Policy measures that fail to address supply constraints risk perpetuating housing inequities, as they disproportionately benefit investors over low-income renters.”

— Dr. Hugh Sibly, Housing Economist

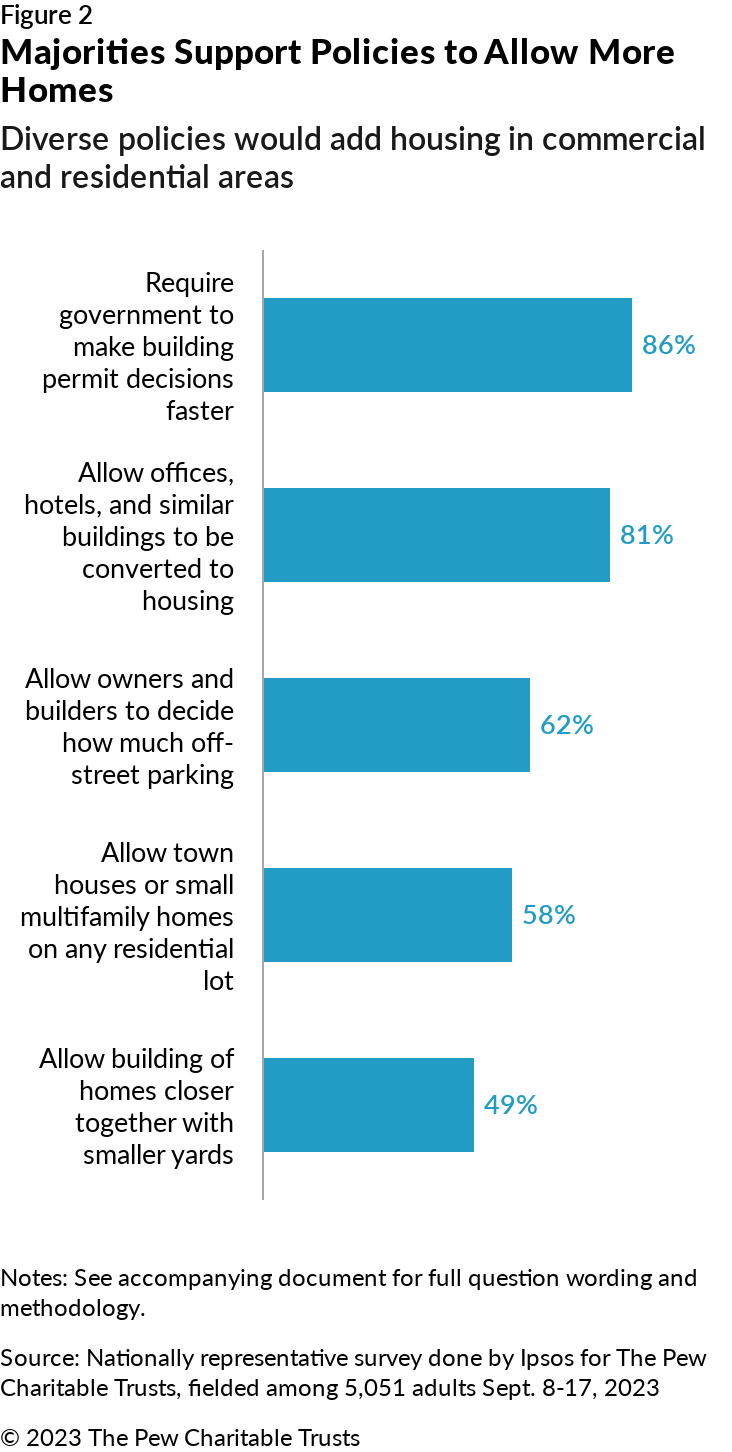

A promising yet underutilized approach involves fast-tracking prefabricated housing, which can reduce construction timelines and costs. However, its adoption remains limited due to regulatory hurdles and market skepticism. Addressing these challenges requires coordinated efforts across federal, state, and local governments to streamline planning processes and incentivize innovative construction methods. Without such reforms, the crisis will likely persist, disproportionately affecting vulnerable populations.

Election Policies: A Comparative Analysis

Labor’s housing strategy emphasizes direct government intervention, pledging $10 billion to construct 100,000 homes for first-time buyers over a decade. This approach aims to mitigate affordability issues by increasing supply, yet experts like Brendan Coates of the Grattan Institute argue that such measures risk underperformance without addressing systemic bottlenecks, such as restrictive zoning laws and labor shortages. Notably, the Housing Australia Future Fund, a cornerstone of Labor’s plan, has faced criticism for its slow rollout, with only 30% of promised developments initiated by 2025.

In contrast, the Coalition’s policy framework leans on market-driven mechanisms, including a two-year ban on foreign investment in existing properties and allowing first-home buyers to access superannuation savings. While these measures aim to curb speculative demand and empower buyers, critics highlight potential unintended consequences. For instance, Saul Eslake, a prominent economist, warns that superannuation withdrawals could inflate prices further, disproportionately benefiting sellers over buyers.

These divergent strategies underscore a critical tension: Labor’s supply-focused model seeks long-term stability, whereas the Coalition’s demand-side incentives prioritize immediate market access. However, without addressing core supply constraints—such as land banking by developers and infrastructure deficits—neither approach fully resolves Australia’s housing crisis.

Image source: theemergentcity.substack.com

Labor’s Housing Policy Proposals

Labor’s $10 billion commitment to construct 100,000 homes exclusively for first-time buyers represents a significant supply-side intervention. However, the success of this initiative hinges on overcoming entrenched systemic barriers, particularly in planning and construction. A critical yet underexplored aspect is the interplay between federal funding and local regulatory frameworks, which often dictate the pace and feasibility of housing projects.

One of the primary challenges lies in restrictive zoning laws and protracted approval processes. Research from the Grattan Institute highlights that even well-funded projects face delays averaging 18-24 months due to inconsistent local regulations. This misalignment between federal ambitions and municipal execution creates a bottleneck that undermines the intended impact of large-scale investments.

“Even with substantial funding, systemic inefficiencies in planning and approvals can derail housing initiatives,”

— Dr. Katrina Raynor, Housing Policy Expert

A comparative analysis of similar programs, such as New Zealand’s KiwiBuild, reveals that without streamlined permitting and robust coordination across government levels, ambitious targets often fall short. Labor’s proposal could benefit from integrating prefabricated construction techniques, which have demonstrated potential to reduce timelines by up to 30%. However, adoption remains limited due to market skepticism and regulatory inertia, underscoring the need for comprehensive reform alongside financial investment.

Coalition’s Housing Policy Proposals

The Coalition’s proposal to allow first-home buyers to access up to $50,000 from their superannuation for a home deposit exemplifies a demand-side intervention with immediate appeal but complex ramifications. This policy, while designed to empower buyers, operates within a market constrained by supply shortages, creating a dynamic where increased purchasing power may inadvertently drive up property prices.

A critical mechanism at play is the interaction between liquidity injection and market elasticity. According to Saul Eslake, a leading economist, “Policies that boost demand without addressing supply constraints often result in price inflation, benefiting sellers more than buyers.” Historical data from New Zealand’s KiwiSaver scheme supports this, showing a decline in homeownership rates despite similar measures, as sellers capitalized on heightened demand in a supply-limited environment.

The Coalition’s approach also includes a two-year ban on foreign investment in existing properties, aimed at reducing speculative pressures. However, this measure risks unintended consequences, such as deterring foreign capital that supports new developments. Balancing these policies with robust supply-side reforms, such as infrastructure investment and streamlined planning processes, is essential to mitigate inflationary risks and ensure sustainable market growth. Without such alignment, the policies may exacerbate existing inequities rather than resolve them.

Third-Party Perspectives and Critiques

Independent analyses of Australia’s housing policies often highlight a critical oversight: the disconnect between policy ambitions and the operational realities of housing supply. Economic think tanks, such as the Grattan Institute, emphasize that while demand-side measures like first-home buyer grants generate political appeal, they fail to address systemic supply bottlenecks. These include restrictive zoning laws, protracted approval timelines, and labor shortages, which collectively stymie the construction sector’s responsiveness.

A comparative review of international housing markets reveals that nations with integrated planning frameworks, such as Germany, achieve higher supply elasticity. In contrast, Australia’s fragmented regulatory environment exacerbates inefficiencies. For instance, the dissolution of the National Housing Supply Council (NHSC) has left policymakers without a centralized mechanism to monitor and respond to market trends effectively.

“Without robust data and streamlined planning processes, even well-funded initiatives risk underperformance,”

— Dr. Katrina Raynor, Housing Policy Expert

This critique underscores the need for a coordinated, data-driven approach that aligns federal funding with local execution. Addressing these structural barriers is essential to achieving sustainable affordability rather than perpetuating short-term market distortions.

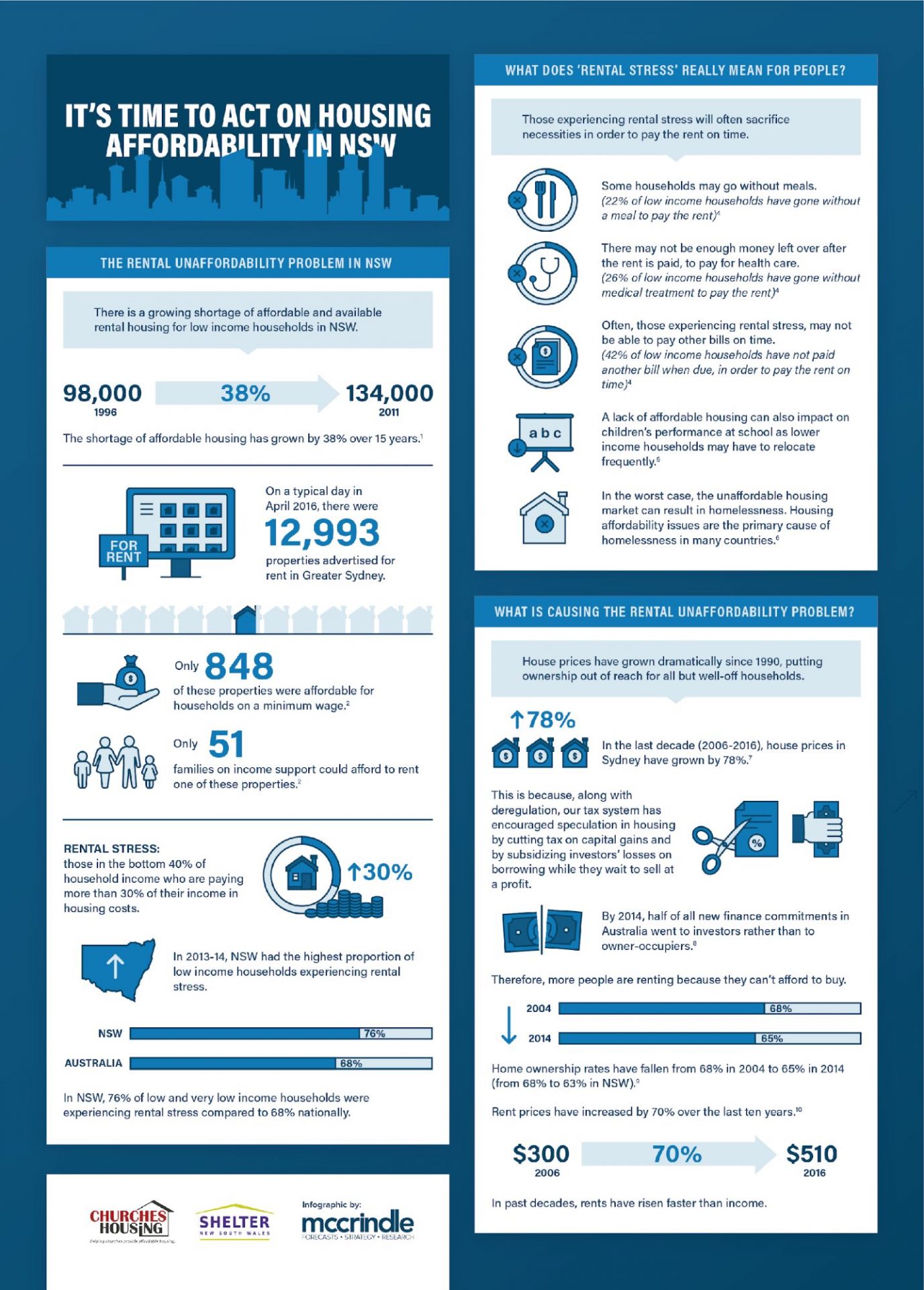

Impact on Buyers and Renters

Australia’s housing market policies create a dual-edged impact, with buyers and renters often experiencing opposing pressures. For first-home buyers, demand-side incentives like grants and superannuation access have increased purchasing power. However, CoreLogic data reveals that such measures contributed to a 65% surge in first-home buyer transactions between May 2020 and February 2021, inadvertently inflating property prices in supply-constrained markets. This dynamic disproportionately benefits sellers, leaving many aspiring buyers priced out.

Renters face a different but equally challenging landscape. The Australian Housing and Urban Research Institute (AHURI) highlights that rental supply stagnation, exacerbated by restrictive planning laws and investor-driven market dynamics, has driven rents up by 18% in regional areas over two years to Q4 2021. This trend reflects a broader shift toward non-metropolitan markets, where affordability pressures are intensifying.

The interplay between these sectors underscores the need for policies that harmonize buyer incentives with robust rental supply strategies, ensuring equitable outcomes across the housing spectrum.

Image source: mccrindle.com.au

First Home Buyer Schemes: Opportunities and Challenges

First Home Buyer (FHB) schemes in Australia, while designed to enhance accessibility, often create unintended market distortions due to their demand-centric focus. These programs, such as grants and low-deposit mortgages, temporarily boost purchasing power but fail to address the structural supply constraints that underpin housing affordability issues. This misalignment between policy intent and market dynamics is a critical challenge.

A key mechanism driving these distortions is the inelasticity of housing supply. Research from the Australian Housing and Urban Research Institute (AHURI) highlights that even significant price increases result in only marginal growth in housing stock. This supply rigidity amplifies the inflationary effects of FHB schemes, as increased demand outpaces the market’s ability to respond. For instance, the 2020–2021 HomeBuilder scheme saw a surge in demand but exacerbated delays in construction due to labor and material shortages.

“Without concurrent supply reforms, FHB schemes merely boost short-term demand, inadvertently driving prices higher,”

— Dr. Katrina Raynor, Housing Policy Expert

To mitigate these challenges, integrating FHB initiatives with supply-side reforms is essential. Streamlined zoning laws, prefabricated construction techniques, and incentivized land releases could enhance supply responsiveness. Such measures would ensure that FHB schemes contribute to sustainable affordability rather than perpetuating cyclical price inflation.

Rental Market Implications

The rental market faces significant strain when housing policies prioritize first-home buyers without addressing rental supply. A critical dynamic emerges as developers, incentivized by higher profit margins, shift focus toward high-end projects or owner-occupied housing, leaving the rental sector underserved. This imbalance exacerbates affordability challenges, particularly in urban centers where demand for rental properties remains high.

One overlooked mechanism is the “filtering” process, where new housing stock is expected to alleviate pressure on lower-income rental markets. However, research from the Australian Housing and Urban Research Institute (AHURI) indicates that this process often fails in practice, as new developments cater to higher-income segments, bypassing the affordable rental market entirely. This misalignment underscores the need for targeted interventions.

“Rental markets suffer when policy measures favor buyers without parallel supply-side reforms,”

— Dr. Hugh Sibly, Housing Economist

A promising approach involves expanding the Build-to-Rent sector, supported by tax concessions and streamlined planning approvals. This model, already gaining traction in countries like the UK, could stabilize rental supply while addressing affordability gaps. However, its success hinges on overcoming regulatory inertia and ensuring equitable geographic distribution.

Evaluating the Effectiveness of Proposed Solutions

Proposed housing policies often falter due to their inability to address entrenched supply-side inefficiencies. For instance, while Labor’s $10 billion housing fund aims to construct 100,000 homes, only 30% of projects have commenced by 2025, reflecting systemic delays in planning approvals and labor shortages. This highlights a critical flaw: funding alone cannot overcome regulatory bottlenecks.

Similarly, the Coalition’s superannuation withdrawal policy risks inflating prices in supply-constrained markets. According to Saul Eslake, increased liquidity without parallel supply expansion exacerbates affordability issues, benefiting sellers disproportionately.

A more effective approach would integrate prefabricated construction, which reduces build times by up to 30%. However, adoption remains limited due to regulatory inertia. Addressing these barriers requires coordinated reforms that align federal funding with streamlined local planning, ensuring policies translate into tangible, equitable outcomes.

Image source: pewtrusts.org

Supply-Side vs. Demand-Side Interventions

A critical yet underappreciated distinction between supply-side and demand-side interventions lies in their long-term market impacts. Supply-side measures, such as easing planning restrictions and promoting prefabricated construction, directly address housing stock shortages, while demand-side policies, like first-home buyer grants, often exacerbate price inflation in constrained markets. This divergence underscores the importance of aligning policy mechanisms with market realities.

The effectiveness of supply-side strategies hinges on their ability to overcome entrenched structural barriers. For instance, prefabricated housing offers a compelling solution by reducing construction timelines by up to 30%. However, regulatory inertia and fragmented local planning frameworks frequently delay implementation. A case study from Melbourne revealed that a prefabricated housing project, despite its efficiency, faced a 24-month delay due to zoning disputes, highlighting the disconnect between innovation and regulatory adaptability.

“Policies that fail to address supply bottlenecks risk perpetuating affordability challenges, as they merely redistribute demand without expanding capacity.”

— Dr. Hugh Sibly, Housing Economist

Comparatively, demand-side interventions often yield immediate but unsustainable results. For example, first-home buyer grants temporarily boost purchasing power but inflate prices in supply-inelastic markets. This dynamic disproportionately benefits sellers, leaving affordability issues unresolved. A balanced approach, integrating supply-side reforms with targeted demand-side measures, is essential to achieving equitable and sustainable housing outcomes.

Long-Term Sustainability and Economic Impacts

Achieving long-term sustainability in Australia’s housing market requires addressing the structural inefficiencies that hinder supply responsiveness. A critical factor is the integration of advanced construction techniques, such as prefabricated housing, with streamlined regulatory processes. Prefabrication can reduce construction timelines by up to 30%, yet its potential remains underutilized due to fragmented local planning frameworks and inconsistent zoning regulations.

The economic implications of these inefficiencies are profound. Delays in housing production exacerbate affordability issues, as demand continues to outpace supply. For instance, research from the Australian Housing and Urban Research Institute (AHURI) highlights that even significant price increases fail to stimulate proportional growth in housing stock, underscoring the rigidity of the current system.

“Without systemic reforms to planning and approval processes, even innovative solutions like prefabrication cannot achieve their full potential,”

— Dr. Katrina Raynor, Housing Policy Expert

A promising approach involves aligning federal funding initiatives with local execution through coordinated governance models. This would ensure that financial investments translate into tangible outcomes. Additionally, adopting performance-based metrics to evaluate housing policies could provide a clearer understanding of their long-term economic impacts, fostering a more adaptive and resilient housing market

FAQ

What are the key differences between Labor and Coalition housing policies in the 2025 federal election?

Labor’s housing policies focus on increasing supply through a $10 billion investment to build 100,000 homes for first-time buyers, emphasizing high-density urban developments and planning reform. In contrast, the Coalition prioritizes demand-side measures, such as allowing first-home buyers to withdraw up to $50,000 from superannuation and implementing a two-year ban on foreign investment in existing properties. While Labor targets systemic supply issues, the Coalition aims to empower buyers and reduce speculative pressures. Both approaches face criticism for not adequately addressing labor shortages, material costs, and regulatory barriers, which are pivotal to resolving Australia’s housing affordability crisis comprehensively.

How do shared equity schemes and superannuation access impact first-home buyers in Australia?

Shared equity schemes reduce financial barriers for first-home buyers by allowing partial property ownership alongside government or institutional partners, lowering deposit requirements and monthly repayments. This model mitigates inflationary pressures compared to direct grants. Conversely, superannuation access provides immediate liquidity for deposits but risks inflating property prices in supply-constrained markets, disproportionately benefiting sellers. Research, including Saul Eslake’s analysis, highlights that superannuation withdrawals may favor wealthier individuals while leaving low-income buyers marginalized. Both approaches require complementary supply-side reforms, such as streamlined zoning laws and increased housing stock, to ensure equitable and sustainable outcomes for aspiring homeowners in Australia.

What role do zoning laws and planning regulations play in Australia’s housing affordability crisis?

Zoning laws and planning regulations significantly influence housing affordability by dictating land use, density, and development timelines. Restrictive zoning often limits high-density housing, inflating prices by constraining supply. Studies reveal that in cities like Sydney, zoning restrictions have raised housing costs by up to 73%. Additionally, protracted approval processes delay construction, increasing costs for developers and buyers. Reforming these regulations, such as easing height limits and rezoning underutilized land, can unlock supply and reduce prices. Coordinated efforts across federal, state, and local governments are essential to streamline planning systems and address Australia’s housing affordability crisis effectively.

How might the proposed housing policies affect rental markets and long-term property investment strategies?

Proposed housing policies could reshape rental markets by influencing supply and investor behavior. Labor’s focus on increasing housing stock may alleviate rental shortages over time, stabilizing rents. However, delays in construction due to regulatory bottlenecks could prolong current pressures. The Coalition’s superannuation access policy may drive up property prices, indirectly increasing rents in supply-constrained areas. Additionally, measures like foreign investment bans could deter speculative activity, potentially redirecting capital toward long-term rental developments. For investors, tax reforms targeting negative gearing and capital gains concessions may shift strategies, encouraging diversified portfolios and Build-to-Rent projects to meet evolving market demands.

What innovative construction methods, like prefabricated housing, are being considered to address supply shortages?

Innovative construction methods, such as prefabricated and modular housing, are gaining traction to address supply shortages. Prefabrication involves off-site assembly of building components, reducing construction timelines by up to 70% and minimizing labor costs. Modular homes, offered by companies like Modscape, combine efficiency with customization, delivering eco-friendly and cost-effective solutions. Emerging technologies like 3D printing further enhance affordability by streamlining material usage and accelerating build times. However, regulatory hurdles and industry resistance remain barriers to widespread adoption. Government incentives, updated building codes, and public-private partnerships are critical to scaling these methods and alleviating Australia’s housing supply constraints.