How Australia’s Election Pledges Are Shaking Up the Property Market

In 2024, Australia’s housing market faced a supply shortfall of 11,600 homes, according to Forest & Wood Products Australia, marking the continuation of a deficit trend that has persisted since 2007. This chronic undersupply, compounded by surging demand, has left policymakers grappling with solutions that often exacerbate the very issues they aim to resolve.

Labor’s $10 billion Housing Australia Future Fund, promising 1.2 million new homes over five years, has been met with skepticism from industry experts, including the Urban Development Institute of Australia, which projects the target as unattainable. Meanwhile, the Coalition’s proposal to cut migration by 25% and invest $5 billion in infrastructure for greenfield developments has sparked debate over its potential to alleviate pressure on urban housing markets.

As Shane Oliver, AMP’s Chief Economist, notes, “Policies that boost purchasing power without addressing supply constraints risk inflating prices further.” The interplay of these pledges underscores the complexity of Australia’s housing crisis, where well-intentioned reforms often yield unintended consequences.

Image source: linkedin.com

Understanding the Housing Affordability Crisis

A critical yet underexplored dimension of Australia’s housing affordability crisis lies in the interplay between zoning regulations and urban density. Zoning laws, which dictate land use and development intensity, have historically favored low-density housing, particularly in suburban areas. This preference has constrained the supply of housing in high-demand urban centers, exacerbating affordability challenges.

The significance of zoning reform becomes evident when examining its impact on housing supply elasticity. Research from the Grattan Institute highlights that restrictive zoning policies in cities like Sydney and Melbourne have inflated land prices by up to 40%, directly contributing to higher housing costs. By contrast, cities with more flexible zoning frameworks, such as Houston in the United States, have demonstrated greater resilience in maintaining affordability despite population growth.

“Zoning reform is not just a technical adjustment; it’s a fundamental lever for unlocking housing supply in constrained markets,” notes Brendan Coates, Economic Policy Program Director at the Grattan Institute.

However, reforming zoning laws is fraught with political and social resistance, as communities often oppose higher-density developments due to concerns over congestion and changing neighborhood character. Addressing these barriers requires a coordinated approach that balances community engagement with the urgent need for increased housing supply, ensuring that policy changes translate into tangible affordability improvements.

Role of Government Policies in Shaping the Market

One pivotal mechanism through which government policies shape the property market is the regulation of foreign investment. These policies, designed to balance housing accessibility for domestic buyers with the economic benefits of foreign capital, have far-reaching implications. For instance, restrictions on foreign purchases of established homes, as implemented by the Albanese government, aim to curb speculative activity and stabilize housing prices. However, such measures can also reduce liquidity in high-demand markets, potentially deterring broader investment.

The effectiveness of these regulations hinges on their enforcement and the market’s response. A comparative analysis reveals that while Australia’s approach prioritizes domestic affordability, countries like Canada have adopted temporary bans on foreign buyers, yielding mixed results. Australia’s nuanced strategy, which includes additional taxes for foreign investors, has been more targeted but still faces challenges in addressing loopholes, such as proxy purchases through local entities.

“Foreign investment rules are a double-edged sword—they protect local buyers but can inadvertently stifle market dynamism,” notes Shane Oliver, Chief Economist at AMP.

The interplay between these policies and market sentiment underscores their complexity. While they may achieve short-term price stabilization, their long-term impact on housing supply and investor confidence remains a critical area for further evaluation.

Election Pledges and Their Impact on Housing Affordability

Labor’s Help to Buy scheme, which offers shared equity loans covering up to 40% of a home’s purchase price, exemplifies how election pledges can reshape affordability dynamics. While this initiative reduces upfront costs for buyers, it risks inflating property prices in competitive markets by increasing purchasing power without addressing supply constraints. According to the Productivity Commission, similar first-home buyer incentives have historically driven price increases of up to 8% in targeted segments, disproportionately benefiting sellers over buyers.

In contrast, the Coalition’s focus on infrastructure investment, including a $5 billion allocation for utilities at development sites, directly targets supply bottlenecks. By reducing the high costs of land preparation, this approach could unlock significant housing stock over time. However, experts like Dr. Nicola Powell, Chief of Research at Domain, caution that such measures require years to materialize, leaving short-term affordability largely unaddressed.

A critical yet underexplored factor is the demographic mismatch in housing stock. With 75.4% of couple-only households occupying homes with two or more spare bedrooms, policies incentivizing downsizing could free up larger properties, easing pressure on family-sized housing. This highlights the need for multifaceted strategies that balance immediate relief with structural reform.

Image source: grattan.edu.au

Comparing Party Policies on Housing

Labor’s shared equity scheme and the Coalition’s superannuation withdrawal policy represent fundamentally different approaches to housing affordability, yet both share a critical limitation: their reliance on demand-side stimulation in markets constrained by supply. Labor’s model, which allows the government to co-own up to 40% of a property, reduces upfront costs for buyers but inadvertently intensifies competition in high-demand areas. This dynamic is particularly pronounced in cities like Sydney, where limited housing stock amplifies price pressures.

The Coalition’s proposal to permit first-home buyers to withdraw up to $50,000 from their superannuation similarly boosts purchasing power but risks inflating prices by increasing demand without addressing supply bottlenecks. According to Dr. Brendan Coates, Economic Policy Program Director at the Grattan Institute, “Policies that enhance borrowing capacity often exacerbate affordability issues unless paired with significant supply-side reforms.”

A comparative analysis reveals that while Labor’s scheme targets affordability through equity sharing, the Coalition’s approach prioritizes liquidity. However, both strategies falter in markets with entrenched supply constraints, where even marginal demand increases can lead to disproportionate price surges.

This underscores a critical insight: affordability reforms must integrate supply-side measures to mitigate unintended consequences. Without such integration, these policies risk perpetuating the very challenges they aim to resolve, particularly in Australia’s most competitive housing markets.

First-Home Buyer Incentives and Market Reactions

The effectiveness of first-home buyer incentives hinges on their interaction with local market dynamics, a factor often overlooked in broader policy discussions. These measures, such as shared equity schemes or deposit guarantees, aim to lower entry barriers but frequently amplify demand in supply-constrained regions, leading to price inflation rather than affordability gains.

A critical mechanism at play is the elasticity of housing supply. In markets with rigid planning regulations, such as Sydney, increased purchasing power from incentives often translates directly into higher property prices. Sellers, aware of buyers’ enhanced capacity, adjust their pricing strategies accordingly. This phenomenon is supported by a 2021 Reserve Bank of Australia study, which found that house prices rose by up to 8% following the introduction of the First Home Loan Deposit Scheme.

“Policies that increase demand without addressing supply bottlenecks risk entrenching affordability challenges,”

— Dr. Brendan Coates, Economic Policy Program Director, Grattan Institute

Regional disparities further complicate outcomes. While suburban areas may experience moderate price adjustments, urban hotspots face significant surges, exacerbating inequality. This underscores the necessity of pairing demand-side incentives with robust supply-side reforms, such as streamlined zoning laws, to achieve sustainable affordability improvements.

Supply and Demand: Regional Variations and Market Segmentation

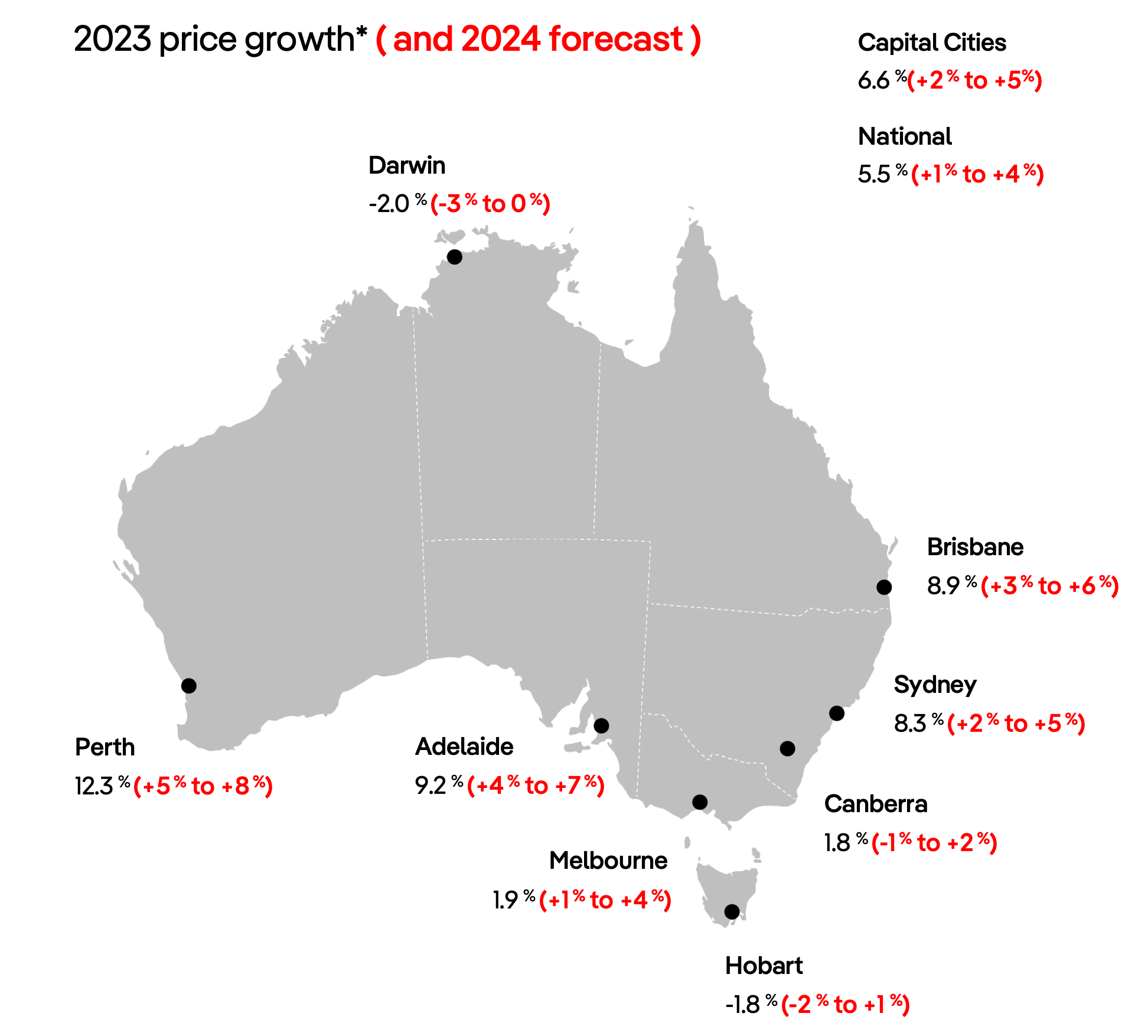

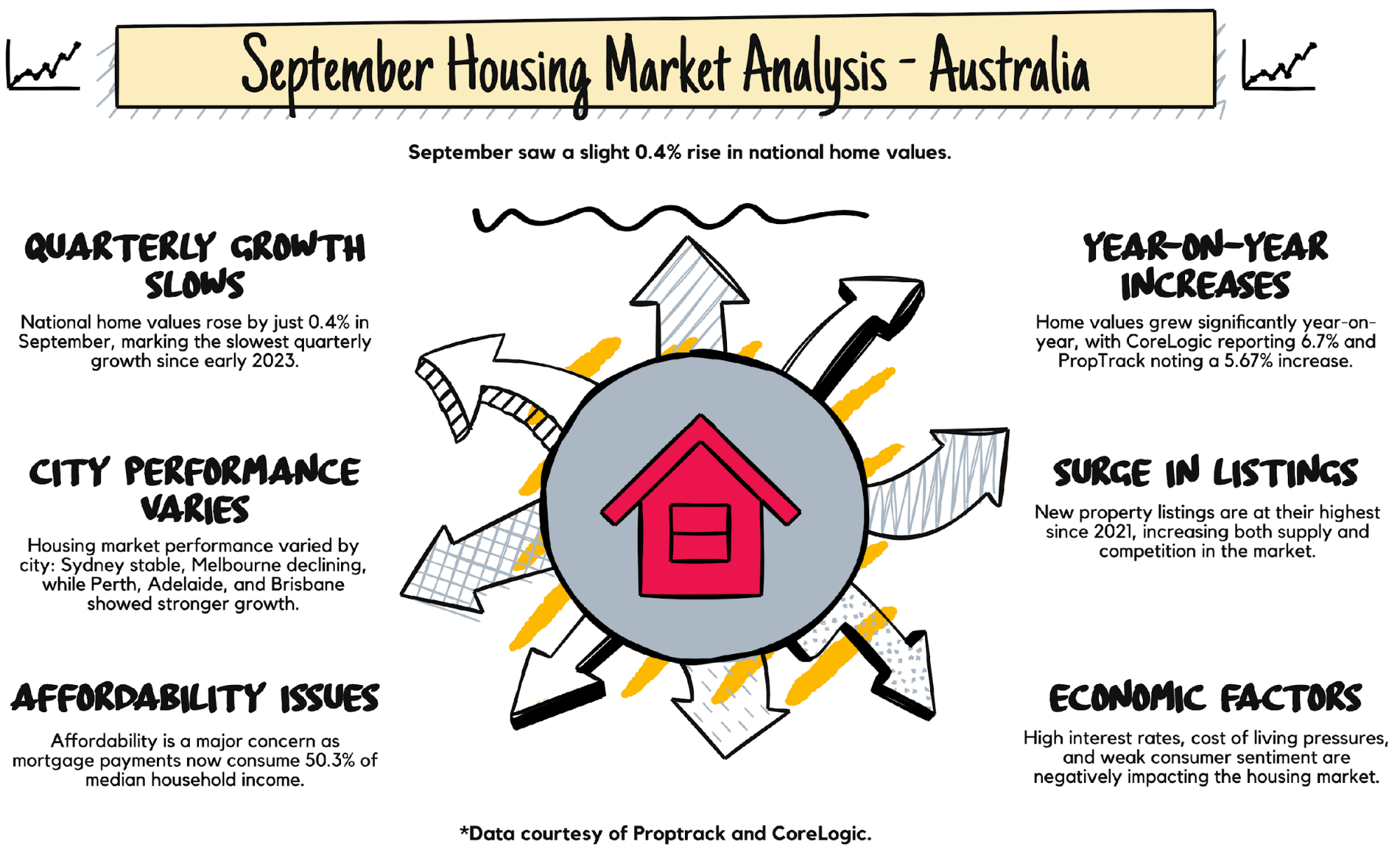

Australia’s housing market is a mosaic of regional disparities, where supply-demand imbalances manifest uniquely across states and cities. For instance, Brisbane and Perth have experienced annual price growth of 5.0-8.0% in 2025, driven by limited housing supply and robust population inflows. In contrast, Sydney and Melbourne, despite their economic prominence, face slower growth due to higher baseline prices and stricter planning regulations, which constrain new developments.

A critical factor shaping these variations is the concept of housing market elasticity. Regions with flexible zoning laws, such as parts of Queensland, can respond more dynamically to demand surges, mitigating price inflation. Conversely, areas like Sydney, where zoning restrictions inflate land costs by up to 40%, struggle to adapt, exacerbating affordability issues.

Misconceptions about uniform market behavior often overlook these nuances. For example, while foreign investment restrictions aim to stabilize urban markets, their impact is muted in regional areas where domestic demand dominates. This segmentation underscores the need for tailored policies that address localized drivers rather than applying blanket solutions.

Image source: realestate.com.au

Effects of Foreign Investment Restrictions

Foreign investment restrictions in Australia have introduced a nuanced dynamic in housing market elasticity, particularly in regions with varying regulatory frameworks. These measures, such as the prohibition on purchasing established dwellings, aim to prioritize local buyers and stabilize prices. However, their impact is far from uniform across the country, revealing complexities that challenge conventional assumptions.

One critical mechanism is the redistribution of speculative activity. In high-demand cities like Sydney, where zoning laws already constrain supply, the absence of foreign buyers has not significantly alleviated affordability pressures. Instead, speculative interest often migrates to less regulated markets, such as Brisbane, where domestic demand quickly absorbs the gap. This phenomenon underscores the importance of understanding how restrictions interact with local supply elasticity.

A comparative analysis highlights that while restrictions reduce foreign competition, they can inadvertently tighten markets in regions with limited housing stock. For example, Brisbane experienced a 5.0% price increase in 2025, partially attributed to redirected demand.

“Restricting foreign investment without addressing supply bottlenecks risks amplifying regional disparities,”

— Dr. Brendan Coates, Economic Policy Program Director, Grattan Institute

This interplay between policy intent and market behavior demonstrates the need for integrated strategies that balance regulatory measures with supply-side reforms, ensuring equitable outcomes across diverse housing markets.

Regional Disparities in Property Market Growth

A critical yet underappreciated factor driving regional disparities in Australia’s property market growth is the interplay between infrastructure readiness and zoning adaptability. Regions like Brisbane and Perth have demonstrated a capacity to rapidly scale housing supply in response to demand surges, leveraging flexible zoning laws and pre-existing infrastructure investments. In contrast, cities such as Sydney face entrenched bottlenecks, where restrictive zoning inflates land costs and delays development timelines.

The effectiveness of infrastructure as a growth enabler is evident in Brisbane’s recent pivot to high-density developments. According to a 2024 report by the Urban Development Institute of Australia, Brisbane’s streamlined approval processes for multi-unit projects have reduced average construction lead times by 18%, directly contributing to a 5.0% annual price growth. Conversely, Sydney’s rigid planning frameworks have limited similar adaptability, exacerbating affordability challenges despite comparable demand pressures.

“Infrastructure investments must align with zoning reforms to unlock regional growth potential,”

— Dr. Nicola Powell, Chief of Research, Domain

However, this approach is not without limitations. Smaller regional markets, while more agile, often lack the capital and workforce to sustain large-scale developments, creating uneven growth trajectories. This highlights the need for a hybrid strategy: combining targeted infrastructure funding with zoning flexibility to address both urban and regional disparities effectively. Such tailored interventions could mitigate the systemic imbalances that currently define Australia’s property market.

Advanced Implications of Tax and Superannuation Policies

The interplay between tax incentives and superannuation access is reshaping Australia’s property market in ways that defy conventional expectations. For instance, the Coalition’s proposal to allow up to $50,000 of superannuation for home deposits could increase homeownership rates by up to 4%, as estimated by the Centre for Independent Studies. However, this liquidity boost risks inflating prices in supply-constrained markets, where demand elasticity is limited.

Negative gearing reforms, often framed as a solution to affordability, reveal a paradox: while reducing investor activity may ease competition for first-home buyers, it could also shrink rental supply, driving up rents. According to the Grattan Institute, such changes could reduce investor participation by 15%, disproportionately affecting lower-income renters.

These policies highlight a critical tension: short-term affordability gains often come at the expense of long-term market stability. Addressing this requires integrating tax reforms with supply-side strategies, ensuring that fiscal tools complement structural housing solutions.

Image source: eliteagent.com

Tax Policy Changes and Their Market Implications

One underexplored dimension of tax policy changes is their impact on investor behavior and market segmentation. Adjustments to negative gearing and capital gains tax (CGT) discounts, for instance, do not merely influence affordability but also recalibrate the risk-reward calculus for property investors. This dynamic is particularly pronounced in markets like Sydney and Melbourne, where investor activity constitutes a significant share of transactions.

A critical mechanism at play is the redistribution of capital. When tax incentives are reduced, investors often pivot toward alternative asset classes such as equities or bonds, as highlighted by a 2025 Austaxpolicy report. This shift can depress demand for existing properties, potentially stabilizing prices in the short term. However, the same policies may inadvertently discourage investment in new housing developments, exacerbating supply shortages over time.

“Tax reforms targeting investors must balance affordability goals with the need to sustain housing supply,”

— Dr. Hassan Gholipour Fereidouni, Property Economist

An illustrative case is Brisbane, where recent CGT adjustments led to a 12% decline in investor-driven purchases but also delayed several multi-unit projects. This underscores the necessity of integrating tax reforms with incentives for new construction, ensuring that affordability gains do not come at the expense of long-term market stability.

Superannuation Access for Home Purchases: A Double-Edged Sword

Allowing superannuation access for home purchases introduces a complex interplay between liquidity and market dynamics. While this policy lowers entry barriers for first-home buyers by addressing deposit constraints, it simultaneously risks inflating property prices in supply-constrained markets. The mechanism is straightforward: increased purchasing power enables buyers to bid higher, but in markets with limited housing stock, this liquidity often translates into price escalation rather than affordability gains.

A critical factor influencing this outcome is the elasticity of housing supply. In regions with rigid planning regulations, such as Sydney, the injection of superannuation funds amplifies demand without a corresponding increase in supply. This dynamic is supported by findings from the Centre for Independent Studies, which highlight that using superannuation for deposits could reduce retirement savings by $53,600 at age 65, while offering only marginal affordability improvements in competitive markets.

“Policies that enhance liquidity without addressing supply constraints risk exacerbating affordability challenges,”

— Dr. Brendan Coates, Economic Policy Program Director, Grattan Institute

To mitigate these risks, policymakers must integrate superannuation access with supply-side reforms, such as streamlined zoning laws and infrastructure investments. Without such measures, the policy may inadvertently deepen the affordability crisis, particularly in urban hotspots.

FAQ

What are the key housing policies proposed by major political parties in Australia’s 2025 federal election?

The 2025 federal election has seen major parties propose transformative housing policies. Labor focuses on expanding the $10 billion Housing Australia Future Fund and building 1.2 million homes over five years, including 30,000 social and affordable units. The Coalition emphasizes supply-side solutions, such as a $5 billion infrastructure fund for greenfield developments and allowing up to $50,000 of superannuation for home deposits. The Greens advocate for structural reforms, including rent caps, a public property developer to construct 360,000 homes, and limits on negative gearing and capital gains tax discounts. These pledges aim to address affordability, supply, and market stability.

How do election-driven housing policies impact property market trends and affordability in Australia?

Election-driven housing policies significantly influence property market trends and affordability by altering supply-demand dynamics. Policies like Labor’s shared equity scheme and the Coalition’s superannuation access proposal increase buyer capacity, often driving up prices in supply-constrained markets. Infrastructure investments and zoning reforms, such as those targeting greenfield developments, aim to boost housing stock but require years to materialize. Additionally, measures like rent caps and foreign investment restrictions shape market behavior, impacting investor confidence and regional disparities. These policies, while addressing affordability in theory, often create unintended consequences, underscoring the need for integrated supply-side and demand-side strategies to stabilize the housing market.

What role does foreign investment regulation play in shaping Australia’s property market during election cycles?

Foreign investment regulation plays a pivotal role in shaping Australia’s property market during election cycles by influencing demand and market accessibility. Restrictions, such as surcharges on foreign buyers and limits on purchasing established dwellings, aim to prioritize local affordability while channeling foreign capital into new housing developments. Policies like annual vacancy fees and mandatory development timelines for vacant land deter speculative holdings, ensuring properties contribute to housing stock. However, these measures can redirect speculative activity to less regulated regions, creating uneven market impacts. Election cycles often amplify scrutiny of these regulations, reflecting public concerns over housing affordability and market equity.

How do infrastructure investments and zoning reforms proposed in election pledges address housing supply challenges?

Infrastructure investments and zoning reforms in election pledges tackle housing supply challenges by unlocking development potential and reducing bottlenecks. Proposals like the Coalition’s $5 billion infrastructure fund aim to finance essential utilities—water, power, and sewerage—at greenfield sites, expediting new housing projects. Zoning reforms, such as increasing density along transport corridors, optimize land use in urban areas, enabling higher housing yields. These measures address high land costs and regulatory delays, which are key barriers to supply. By aligning infrastructure readiness with flexible zoning policies, these pledges aim to create a sustainable pipeline of housing stock to meet growing demand.

What are the long-term implications of superannuation access and tax reforms on Australia’s housing market post-election?

Superannuation access and tax reforms carry profound long-term implications for Australia’s housing market post-election. Allowing superannuation withdrawals for home deposits boosts liquidity but risks inflating prices in supply-constrained areas, potentially reducing retirement savings. Tax reforms, such as limiting negative gearing and halving capital gains tax discounts, aim to curb speculative investment, stabilizing prices and reallocating capital toward new developments. However, these changes may shrink rental supply, driving up rents. The interplay between these policies highlights the need for balanced strategies that address affordability while ensuring market stability, fostering sustainable growth in both housing availability and economic equity.