Australia’s Election Showdown: How Party Promises Could Reshape the Housing Market

In March 2025, Australia’s housing market reached a critical juncture: median property prices in Sydney surged past $1.5 million, a 12% increase from the previous year, according to CoreLogic data. Yet, as both major political parties unveiled their housing policies ahead of the federal election, economists warned that these measures could exacerbate the crisis. “Demand-side incentives like first home buyer grants are politically popular but economically disastrous in a constrained market,” said Dr. Brendan Coates, Economic Policy Program Director at the Grattan Institute. His analysis highlights how such policies, without corresponding supply-side reforms, inflate prices further—benefiting sellers while sidelining buyers.

The stakes are high. With over 30% of Australians now experiencing housing stress, per the 2024 Rental Affordability Index, the electorate is demanding action. However, entrenched tax concessions for investors and restrictive zoning laws continue to stymie meaningful progress, leaving the nation at a crossroads between short-term relief and systemic reform.

Image source: phys.org

Factors Contributing to the Crisis

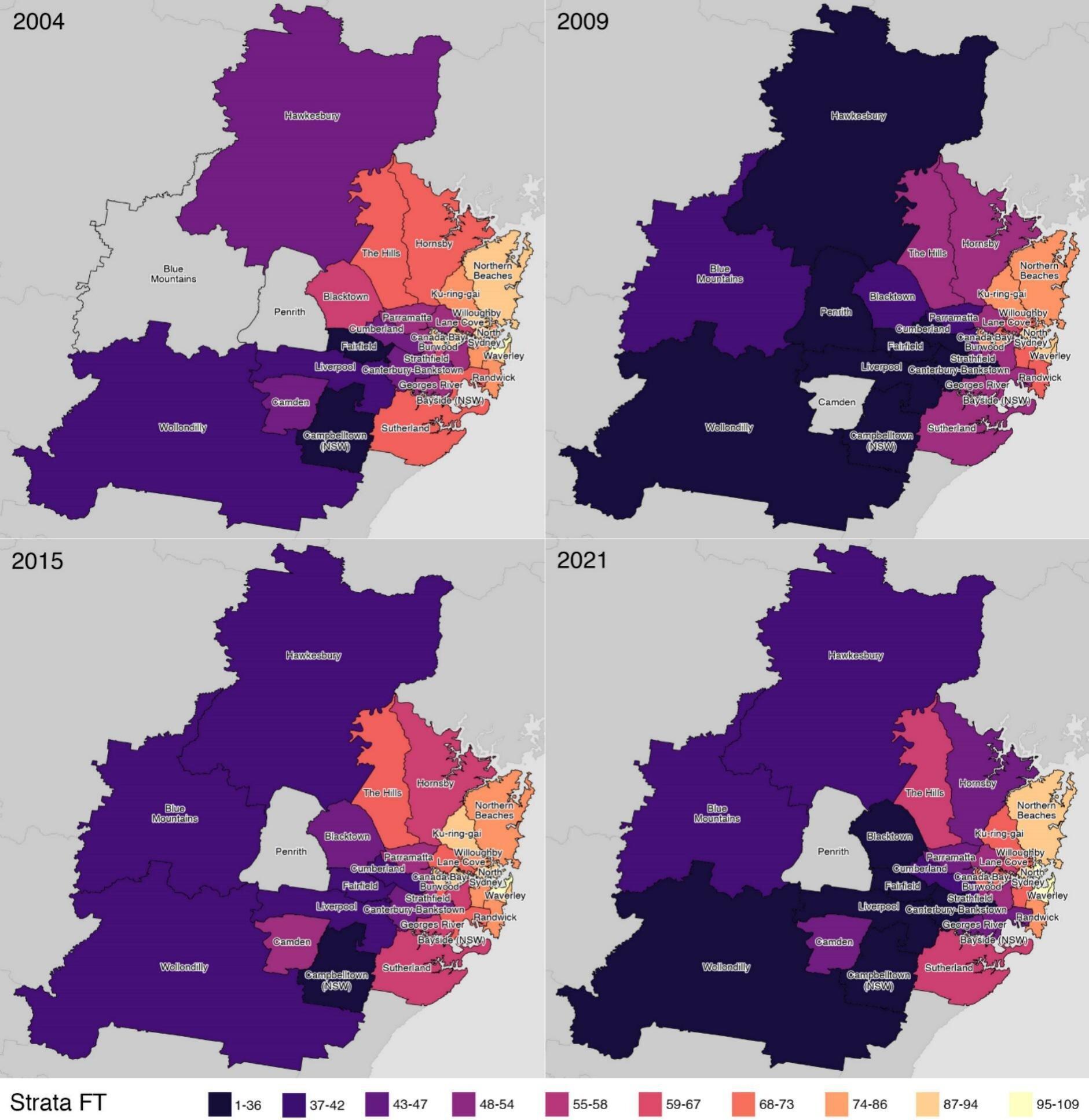

Restrictive zoning laws represent a pivotal yet underexplored driver of Australia’s housing affordability crisis. These regulations, often enacted at the local government level, limit the availability of land for residential development, particularly in high-demand urban areas. By constraining supply, zoning laws create artificial scarcity, inflating property values and exacerbating affordability challenges.

The impact of these restrictions is stark. A 2022 report by the NSW Productivity Commission revealed that zoning premiums—additional costs attributed to land-use constraints—added 37% to apartment prices in Sydney. This premium not only deters developers but also shifts the financial burden onto buyers, compounding housing stress. Comparative analysis shows that cities with more flexible zoning frameworks, such as Houston, Texas, experience significantly lower housing cost growth despite similar population pressures.

“The ability to speculate on property value relies on scarcity, and it’s the zoning that brings the scarcity,” noted Brendan Coates, Economic Policy Program Director at the Grattan Institute.

However, reforming zoning laws is fraught with political resistance, as local councils often prioritize preserving neighborhood character over increasing density. Addressing this requires a nuanced approach, balancing urban accessibility with streamlined approval processes. Without such reforms, the housing market will remain structurally misaligned with the needs of a growing and diverse population.

Impact on Australian Households

The housing affordability crisis has profoundly reshaped household financial dynamics, particularly through the mechanism of rental stress. With over 30% of Australians now spending more than a third of their income on housing, the private rental market has become a critical pressure point. This phenomenon is exacerbated by the limited availability of affordable rental properties, especially in urban centers, where demand far outstrips supply.

A key driver of this imbalance is the financialization of housing, where properties are increasingly treated as investment assets rather than homes. Tax policies such as negative gearing and capital gains tax concessions incentivize speculative investment, disproportionately benefiting wealthier individuals while sidelining low-income renters. According to the Anglicare report, only 0.2% of rental properties in Sydney are affordable for families relying on government assistance.

“The housing system increasingly serves investors’ interests, leaving vulnerable households behind,” notes Leonora Risse, University of Canberra.

Addressing this requires systemic reforms, including expanding social housing and revising tax incentives, to realign the market with the needs of everyday Australians.

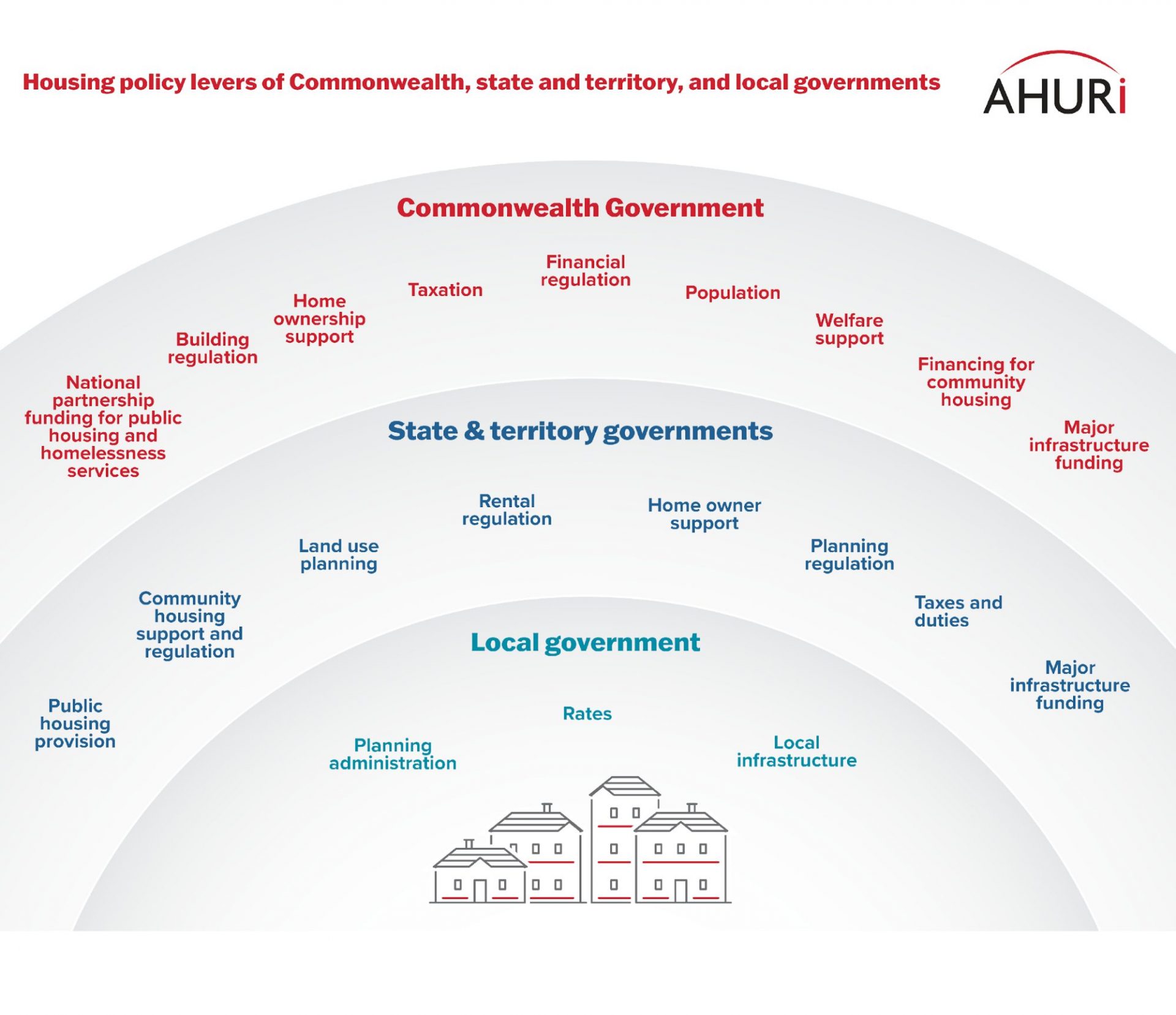

Labor’s Housing Policies and Their Implications

Labor’s housing strategy, centered on expanding the Home Guarantee Scheme and constructing 100,000 cost-price homes, reflects a dual focus on accessibility and supply. By removing income caps for first-home buyers and setting property price limits aligned with regional averages (e.g., $1.5 million in Sydney), the scheme aims to broaden eligibility. However, critics argue that such demand-side measures risk inflating prices unless paired with robust supply-side interventions.

The promise of 100,000 new homes exclusively for first-home buyers could reduce prices by up to 2.5%, according to housing economist Hal Pawson. Yet, this impact hinges on overcoming significant barriers, including labor shortages and restrictive planning laws. For instance, delays in high-density developments due to insufficient pre-sales have already slowed construction in urban centers.

A critical flaw lies in the potential overlap with state-planned housing projects, which could dilute the scheme’s additionality. Experts like Dr. Julie Collins emphasize that direct government intervention, akin to postwar housing programs, is essential to meet Australia’s 1.2 million homes target by 2029. Without systemic reforms, Labor’s policies may offer temporary relief but fail to address structural inefficiencies.

Image source: ahuri.edu.au

The First Home Guarantee Scheme

The First Home Guarantee Scheme (FHGS) reduces the deposit requirement for eligible buyers to as little as 5%, a seemingly transformative measure for first-home ownership. However, its real-world application reveals significant complexities. By lowering financial barriers, the scheme accelerates market entry for buyers, but this influx often outpaces housing supply, intensifying competition and inflating prices.

A critical analysis of regional implementation highlights this dynamic. In FY2023–24, regional hubs such as Newcastle and Geelong experienced a 15% increase in first-home buyer activity within months of the scheme’s expansion. Yet, construction pipelines in these areas lagged due to labor shortages and restrictive zoning laws, exacerbating supply-demand imbalances. This underscores the scheme’s dependency on parallel supply-side reforms to mitigate unintended price pressures.

“Demand-side subsidies like the FHGS are effective in theory but risk amplifying affordability challenges without concurrent supply expansion,”

— Dr. Brendan Coates, Economic Policy Program Director, Grattan Institute

To address these limitations, policymakers must integrate the FHGS with strategies such as fast-tracking approvals for high-density developments and incentivizing prefabricated housing. Without such measures, the scheme risks perpetuating the very affordability crisis it seeks to resolve, highlighting the necessity of a holistic approach to housing policy.

Supply-Side Pledges and Challenges

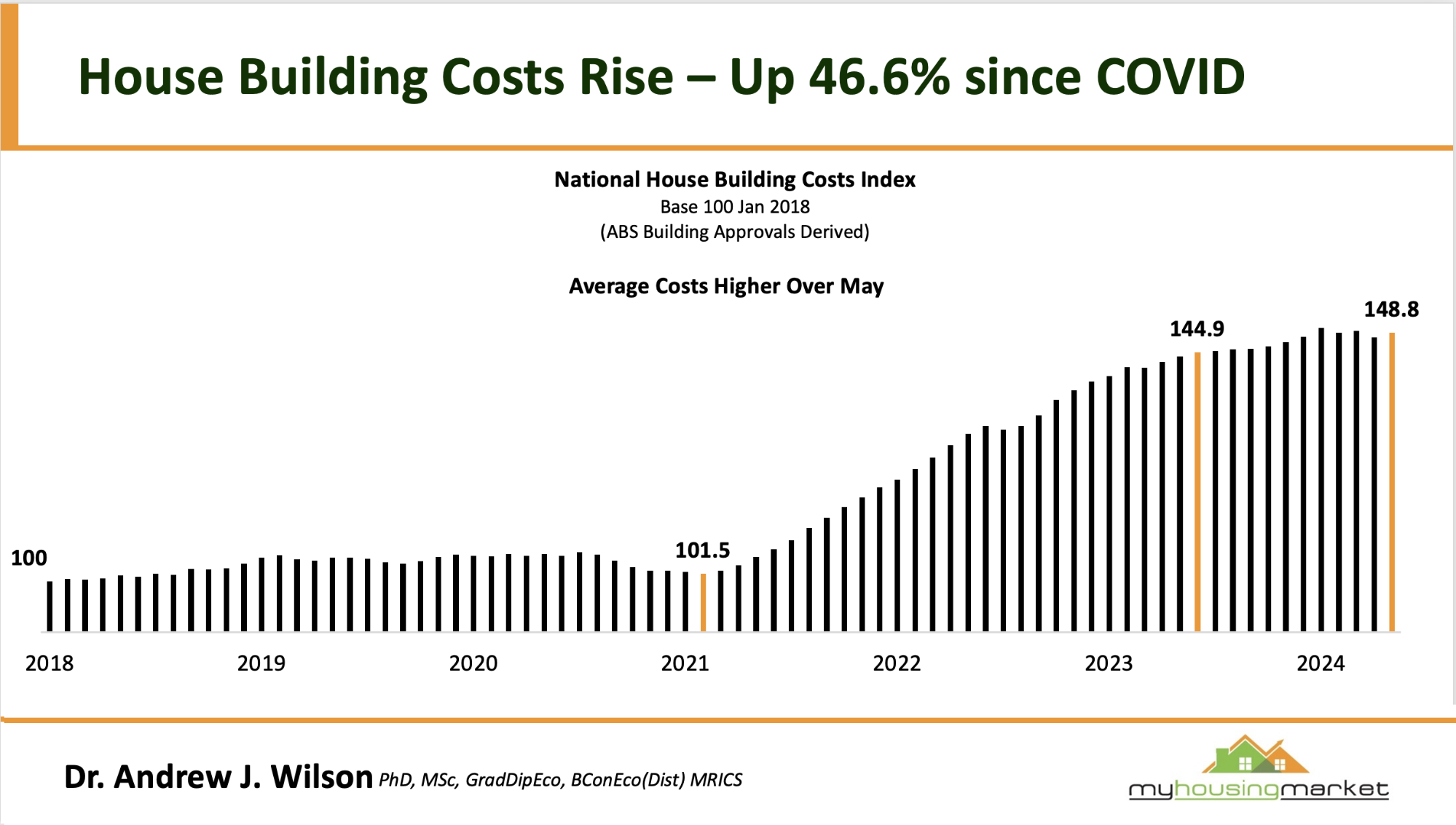

Labor’s commitment to constructing 100,000 cost-price homes hinges on overcoming entrenched supply-side barriers, particularly restrictive zoning laws and labor shortages. While the pledge signals a shift toward addressing systemic housing issues, its execution reveals significant complexities that extend beyond policy frameworks.

A critical challenge lies in aligning high-density housing projects with existing urban infrastructure. For instance, Transport Oriented Development (TOD) initiatives in New South Wales demonstrate the potential of integrating housing with transit hubs to reduce urban sprawl. However, such projects often face delays due to fragmented planning processes and resistance from local councils prioritizing neighborhood character over density. This misalignment underscores the need for cohesive intergovernmental collaboration to streamline approvals and incentivize compliance.

Labor shortages further complicate these efforts. According to the Urban Institute, the construction sector’s reliance on immigrant labor, coupled with insufficient domestic training programs, has created a persistent skills gap. Addressing this requires targeted investment in vocational education and upskilling initiatives, as well as fast-tracking immigration for skilled tradespeople.

“Without a robust workforce and streamlined planning, supply-side measures risk falling short of their potential,”

— Dr. Julie Collins, Housing Policy Expert

Ultimately, Labor’s housing strategy must integrate zoning reform, workforce development, and infrastructure alignment to achieve meaningful progress. This multifaceted approach is essential to bridging the gap between policy ambition and practical implementation.

Coalition’s Approach to Housing Market Reform

The Coalition’s housing strategy introduces a mortgage interest tax deduction, allowing individuals to offset interest payments on the first $650,000 of their mortgage against taxable income. This measure, applicable to single earners under $175,000 or couples under $250,000, aims to alleviate cost-of-living pressures. However, economic analyses, such as those by the Grattan Institute, suggest that such demand-side incentives risk exacerbating housing affordability issues by inflating buyer competition without addressing supply constraints. This policy, while politically appealing, may inadvertently deepen market imbalances, particularly in high-demand urban areas.

Complementing this, the Coalition has pledged targeted infrastructure funding to unlock development potential in underutilized regions. By prioritizing transport and utility upgrades, the initiative seeks to stimulate housing construction. Yet, historical precedents highlight a critical flaw: without concurrent zoning reforms, infrastructure investments often fail to translate into meaningful housing supply increases. For instance, delays in rezoning approvals have previously stalled projects despite available funding, underscoring the necessity of integrated policy frameworks.

These measures reflect a broader tension in the Coalition’s approach—balancing immediate relief with the structural reforms essential for long-term market stability.

Image source: housingaustralia.gov.au

Mortgage Tax Deductions Explained

The Coalition’s proposed mortgage interest tax deduction, allowing first-home buyers to offset interest on loans up to $650,000 against taxable income, operates on a principle of immediate financial relief. However, its structural implications reveal significant complexities. By reducing taxable income, this policy effectively lowers monthly financial burdens during the initial years of homeownership, when interest payments are highest. Yet, the mechanism inherently favors higher-income earners, as their marginal tax rates amplify the deduction’s value.

Comparatively, similar policies in the United States, such as the Mortgage Interest Deduction (MID), have demonstrated limited success in improving affordability. Research from the Tax Foundation highlights that high-income households disproportionately benefit, with 60% of MID advantages accruing to taxpayers earning over $200,000 annually. This raises concerns about equity and effectiveness in addressing affordability for lower-income groups.

Contextual factors further complicate implementation. In Australia’s constrained housing market, increased purchasing power may exacerbate demand-side pressures, inflating property prices. Without concurrent supply-side measures, such as zoning reforms or expedited construction pipelines, the policy risks perpetuating affordability challenges.

“Demand-side incentives like mortgage deductions often intensify competition without addressing supply bottlenecks,”

— Dr. Brendan Coates, Economic Policy Program Director, Grattan Institute

Ultimately, while the deduction offers short-term relief, its long-term efficacy hinges on integrated reforms targeting systemic supply constraints.

Infrastructure Funding and Its Potential Impact

Infrastructure funding under the Coalition’s housing reform strategy is most effective when it addresses the interplay between financial investment and regulatory frameworks. A critical observation is that funding alone cannot catalyze development unless paired with mechanisms that reduce bureaucratic inertia. For example, a 2023 infrastructure upgrade in Melbourne’s outer suburbs, aimed at improving transport connectivity, failed to accelerate housing projects due to protracted rezoning processes. This highlights the necessity of aligning financial inputs with streamlined planning approvals.

A comparative analysis of funding models reveals that fixed levies, while predictable, often lack the flexibility to adapt to site-specific challenges. Conversely, negotiated agreements between developers and local councils can better account for unique project constraints but risk delays due to extended negotiations. Both approaches underscore the importance of integrating funding strategies with zoning reforms to unlock development potential.

Contextual factors, such as labor shortages and fragmented governance, further complicate implementation. Without a skilled workforce and intergovernmental coordination, even well-funded projects face execution bottlenecks. Dr. Julie Collins, a housing policy expert, emphasizes,

“Infrastructure funding works best when paired with streamlined planning processes and workforce initiatives.”

This perspective underscores the need for synchronized action. By embedding funding within a broader framework of regulatory and capacity-building reforms, policymakers can ensure that infrastructure investments translate into tangible housing supply improvements.

Economic and Market Implications of Party Policies

The economic ramifications of party housing policies reveal a stark divergence in their potential market impacts. The Coalition’s mortgage interest tax deduction, for instance, disproportionately benefits higher-income earners due to its reliance on marginal tax rates, amplifying purchasing power for wealthier buyers. According to the Grattan Institute, such demand-side measures risk inflating property prices by up to 8% in constrained markets, exacerbating affordability challenges.

Conversely, Labor’s pledge to construct 100,000 cost-price homes addresses supply shortages but faces execution barriers. A 2024 report by the Urban Development Institute of Australia highlights that labor shortages and zoning delays could reduce planned housing output by 20%, undermining policy effectiveness.

A critical misconception is that demand-side incentives alone can stabilize the market. However, without synchronized supply-side reforms—such as streamlined zoning or prefabricated construction—these policies risk perpetuating systemic imbalances. This interplay underscores the necessity of integrated, multi-faceted housing strategies.

mage source: propertyupdate.com.au

Demand-Side Policies and Market Dynamics

Demand-side policies, such as first-home buyer grants and mortgage interest deductions, often create immediate surges in market activity, but their structural

implications reveal significant complexities. These measures enhance purchasing power, yet in supply-constrained markets, they frequently lead to price inflation rather than improved affordability. This dynamic is particularly evident in urban centers where housing supply struggles to keep pace with demand.

A critical mechanism at play is the acceleration of buyer competition. For instance, when New South Wales expanded its first-home buyer incentives in 2023, auction activity in Sydney’s outer suburbs increased by 18% within three months. However, the corresponding supply response was muted due to zoning delays and labor shortages, leaving prices elevated. This underscores a key limitation: demand-side policies often amplify short-term market pressures without addressing systemic supply bottlenecks.

“Demand-side interventions can be politically expedient but risk exacerbating affordability challenges unless paired with robust supply-side reforms,”

— Dr. Brendan Coates, Economic Policy Program Director, Grattan Institute

To mitigate these effects, policymakers must integrate demand-side measures with strategies that expedite land release and streamline construction approvals. Without such alignment, these policies risk perpetuating the affordability crisis, highlighting the necessity of a holistic approach to housing reform.

Addressing Structural Challenges in Housing Supply

Fragmented zoning regulations remain a critical bottleneck in addressing Australia’s housing supply crisis. These regulations, often inconsistent across local councils, create delays that ripple through the entire development pipeline. For instance, aligning zoning approvals with high-density housing needs can take years, particularly in urban centers where demand is most acute. This misalignment not only inflates costs but also discourages private sector investment in affordable housing projects.

A comparative analysis highlights the effectiveness of prefabricated construction as a countermeasure. In Melbourne, a 2024 pilot project integrating zoning reform with prefabricated housing reduced construction timelines by 40%, demonstrating the potential of streamlined processes. Prefabrication minimizes on-site labor requirements, addressing workforce shortages while maintaining quality standards. However, its scalability depends on regulatory frameworks that support modular designs and expedited approvals.

Contextual factors, such as labor market constraints, further complicate implementation. Only 5% of recent migrants to Australia work in construction, underscoring the need for targeted immigration policies to fill critical skill gaps. Without such measures, even innovative techniques like prefabrication face operational bottlenecks.

“Structural reform is the missing puzzle piece; without streamlining zoning and training programs for builders, even well-funded projects stall at the approval stage.”

— Dr. Julie Collins, Housing Policy Expert

Ultimately, addressing these structural challenges requires a cohesive strategy that integrates regulatory reform, workforce development, and technological innovation.

FAQ

What are the key differences between Labor and the Coalition’s housing policies in the 2025 election?

Labor emphasizes supply-side solutions, including constructing 100,000 cost-price homes and expanding the Help to Buy scheme, aiming to increase housing accessibility. Conversely, the Coalition focuses on demand-side measures, such as allowing first-home buyers to use superannuation for property purchases and introducing a mortgage interest tax deduction. Both parties propose a two-year ban on foreign residents buying existing homes. However, critics argue Labor’s plans face execution barriers like labor shortages, while the Coalition’s policies risk inflating prices without addressing supply constraints. These contrasting approaches highlight differing priorities: systemic reform versus immediate financial relief for aspiring homeowners.

How could the proposed housing policies impact first-home buyers in Australia’s major cities?

Labor’s expanded First Home Guarantee Scheme reduces deposit requirements to 5%, broadening access for first-home buyers in cities like Sydney and Melbourne. However, with property price caps set near city averages, affordability remains a challenge. The Coalition’s mortgage interest tax deduction offers financial relief but disproportionately benefits higher-income earners, potentially intensifying competition in urban markets. Both policies risk driving up prices in supply-constrained cities, as demand surges without sufficient new housing stock. Addressing systemic issues like restrictive zoning and labor shortages is critical to ensuring these measures provide meaningful benefits for first-home buyers in Australia’s major metropolitan areas.

What role do zoning laws and supply constraints play in the housing affordability crisis during this election?

Zoning laws and supply constraints are pivotal in Australia’s housing affordability crisis, particularly during the 2025 election. Restrictive zoning creates artificial scarcity, inflating property prices in urban centers like Sydney and Melbourne. Supply bottlenecks, exacerbated by labor shortages and slow planning approvals, hinder the construction of affordable housing. Both Labor and the Coalition acknowledge these barriers but differ in solutions. Labor emphasizes increasing housing stock through cost-price homes, while the Coalition focuses on infrastructure funding. Without significant zoning reform and streamlined approvals, these policies risk being undermined, leaving affordability challenges unresolved for voters in this critical election year.

How might Labor’s $10 billion housing fund and the Coalition’s superannuation access policy reshape the housing market?

Labor’s $10 billion housing fund aims to boost supply by constructing 100,000 homes, potentially easing affordability pressures if execution challenges like labor shortages are addressed. This supply-side approach targets systemic reform, focusing on long-term market stability. In contrast, the Coalition’s superannuation access policy empowers first-home buyers with immediate purchasing power but risks inflating prices in supply-constrained markets. By increasing demand without parallel supply expansion, the Coalition’s policy could exacerbate affordability issues. Together, these initiatives highlight a critical divide: Labor’s focus on structural solutions versus the Coalition’s emphasis on short-term financial accessibility for aspiring homeowners.

What are the long-term economic implications of demand-side versus supply-side housing reforms proposed by both parties?

Demand-side reforms, like the Coalition’s superannuation access policy and mortgage interest tax deductions, may provide short-term relief but risk inflating property prices, deepening affordability challenges in supply-constrained markets. Conversely, Labor’s supply-side focus, including its $10 billion housing fund, aims to address structural issues by increasing housing stock, fostering long-term market stability. However, execution barriers such as zoning restrictions and labor shortages could limit effectiveness. Economically, demand-side measures often exacerbate inequality by benefiting higher-income earners, while supply-side reforms promise broader affordability gains if implemented effectively. The election underscores the critical need for integrated strategies to balance immediate relief with systemic solutions.