Brisbane’s Property Boom: Where ‘Fixer-Upper’ Means ‘Bring Your Own Demolition Crew’

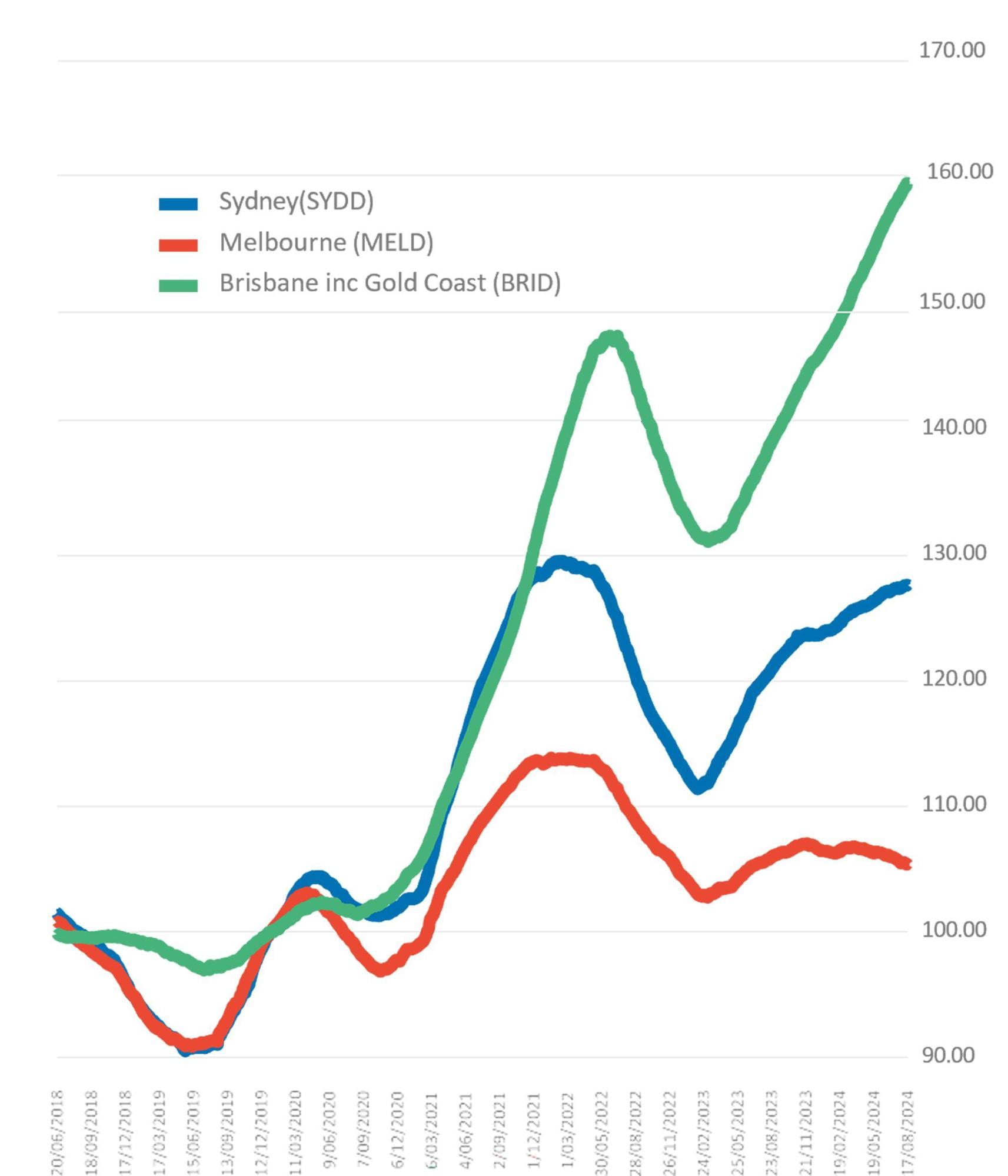

In Brisbane’s inner suburbs, properties requiring complete demolition are commanding prices that would have seemed unthinkable a decade ago. A three-bedroom, one-bathroom house in Newmarket, listed between $850,000 and $885,000, exemplifies this trend—despite its need for extensive work, its proximity to the CBD and inclusion in the Kelvin Grove school catchment area have made it a coveted asset. According to CoreLogic, Brisbane’s median house price rose by 5% in 2023, and the momentum shows no signs of slowing, driven by infrastructure projects like the Cross River Rail and preparations for the 2032 Olympics.

This surge in demand for dilapidated properties reflects a broader shift in investor strategy. Michael Yardney, Director of Metropole Property Strategists, notes that “savvy buyers are targeting land value and location over immediate livability.” With government incentives such as the First Home Buyers Grant now reaching $30,000, even first-time buyers are entering this high-stakes market, reshaping Brisbane’s real estate landscape.

mage source: fticonsulting.com

Factors Driving the Demand for Fixer-Uppers

The demand for fixer-uppers in Brisbane is deeply rooted in the interplay between land scarcity and strategic redevelopment opportunities. As inner-city land becomes increasingly limited, buyers are prioritizing location over the condition of existing structures. This shift is particularly evident in suburbs undergoing infrastructure upgrades, where proximity to new amenities significantly enhances long-term property value.

One critical factor is the economic advantage of acquiring properties with high land-to-asset ratios. Investors often target older homes on larger blocks, leveraging the potential for subdivision or redevelopment. For instance, a case study in Coorparoo revealed that a dilapidated property purchased for $950,000 was transformed into two modern dwellings, yielding a combined resale value of $2.1 million. This approach underscores the importance of land value as a driver of demand.

However, the process is not without challenges. Renovation costs, council regulations, and market volatility can complicate these investments. Yet, government incentives, such as renovation grants, mitigate financial risks, making these projects more accessible.

“The true value lies in the land and its future potential, not the structure itself.”

— Dr. Nicola Powell, Chief of Research & Economics, Domain

This nuanced strategy highlights how informed buyers capitalize on Brisbane’s evolving urban landscape to maximize returns.

The Role of Government Incentives in the Market

Government incentives in Brisbane’s property market serve as critical enablers for transforming underutilized properties into high-value assets. Programs such as the Queensland First Home Buyers Grant and targeted renovation subsidies reduce financial barriers, allowing investors to redirect resources toward strategic upgrades. These measures are particularly impactful in mitigating the risks associated with extensive renovations, such as cost overruns or unforeseen structural issues.

A comparative analysis reveals that Brisbane’s incentives are uniquely structured to prioritize accessibility and long-term value creation. For instance, while similar grants in other states focus narrowly on new builds, Brisbane’s policies extend to substantial renovations, broadening their applicability. This flexibility encourages investment in older properties, particularly in high-demand inner suburbs, where land value often outweighs the cost of redevelopment.

However, the effectiveness of these incentives is context-dependent. Properties in areas with restrictive zoning or complex permitting processes may still face delays, limiting the immediate utility of government support. Addressing these systemic challenges could further amplify the transformative potential of such programs.

“These incentives are not just financial tools; they are catalysts for urban renewal.”

— Dr. Nicola Powell, Chief of Research & Economics, Domain

By aligning financial support with strategic urban planning, Brisbane’s approach exemplifies how targeted incentives can drive both individual and community-level growth.

Renovation Hotspots and Investment Strategies

Brisbane’s inner and middle-ring suburbs are emerging as prime renovation hotspots, driven by their proximity to infrastructure projects and demographic shifts. According to CoreLogic, suburbs like Stafford Heights and Greenslopes have seen property values rise by over 7% annually, fueled by demand for homes with redevelopment potential. These areas offer large blocks suitable for subdivision, a critical factor for investors aiming to maximize land value.

A key strategy involves targeting properties with high land-to-asset ratios. For example, a 2024 case study in Camp Hill demonstrated how a $1.1 million purchase of a weathered home on a 900m² block yielded a 40% return after subdivision and resale. This underscores the importance of leveraging Brisbane’s zoning laws, which often permit dual-occupancy developments in gentrifying neighborhoods.

Misconceptions persist that extensive renovations guarantee higher returns. However, experts like Michael Yardney, Director of Metropole Property Strategists, emphasize that aligning upgrades with buyer demand—such as adding outdoor living spaces or modern kitchens—delivers superior results. This approach balances cost efficiency with market appeal, ensuring sustainable growth in Brisbane’s competitive property landscape.

Image source: northbrisbanehomeloans.com.au

Identifying Key Suburbs for Investment

Strategically identifying Brisbane suburbs with high investment potential requires a nuanced understanding of zoning laws and infrastructure dynamics. Suburbs like Woolloongabba and Chermside exemplify areas where zoning flexibility intersects with planned infrastructure upgrades, creating fertile ground for high-yield investments. These locations benefit from urban renewal projects, such as the Cross River Rail and major commercial developments, which significantly enhance property values.

A critical technique involves leveraging Brisbane’s zoning allowances for dual-occupancy or multi-dwelling developments. For instance, Woolloongabba’s zoning permits medium-density housing, enabling investors to transform single-dwelling lots into multi-unit properties. This approach not only maximizes land use but also aligns with the increasing demand for rental properties near employment hubs and transport links.

However, success hinges on precise execution. Comparative analysis reveals that suburbs with restrictive zoning or delayed infrastructure timelines often underperform, despite initial promise. Investors must also navigate challenges like fluctuating construction costs and council approval delays, which can erode profit margins.

“The interplay between zoning flexibility and infrastructure upgrades is the linchpin of successful property investment in Brisbane.”

— Dr. Nicola Powell, Chief of Research & Economics, Domain

By combining granular local research with strategic foresight, investors can unlock the hidden potential of Brisbane’s evolving property landscape.

Strategic Approaches to Maximizing Returns

Maximizing returns in Brisbane’s renovation hotspots requires a focus on value engineering—a methodology that prioritizes cost-effective design and construction strategies to enhance profitability. This approach is particularly effective in areas where zoning laws permit high-density developments, such as dual-occupancy or multi-dwelling projects. By integrating zoning flexibility into the planning phase, investors can unlock significant value beyond standard renovation practices.

A critical component of this strategy involves conducting a feasibility analysis to assess the financial viability of potential upgrades. This includes evaluating land-to-asset ratios, projected rental yields, and resale values. For instance, properties near infrastructure projects like the Cross River Rail often present opportunities for substantial appreciation, provided the timing aligns with market demand. Comparative studies reveal that projects incorporating energy-efficient designs and sustainable materials not only reduce operational costs but also attract premium buyers and tenants.

However, challenges such as fluctuating material costs and regulatory delays can undermine profitability. To mitigate these risks, investors are increasingly adopting modular construction techniques, which offer faster build times and lower labor costs.

“The key to maximizing returns lies in aligning renovation strategies with both market trends and regulatory frameworks.”

— Dr. Nicola Powell, Chief of Research & Economics, Domain

By combining rigorous planning with innovative construction methods, investors can achieve superior outcomes, transforming underutilized properties into high-performing assets. This nuanced approach underscores the importance of adaptability in Brisbane’s dynamic property market.

Navigating the Challenges of Major Renovations

The complexity of major renovations in Brisbane lies in the interplay between escalating construction costs and stringent regulatory frameworks. According to Rider Levett Bucknall’s Oceania Tender Price Index, Brisbane experienced a 7.2% rise in construction costs in 2024, the highest among Australian capitals. This surge, compounded by labor shortages, often forces investors to reassess project feasibility mid-renovation, leading to delays and budget overruns.

A critical yet underappreciated challenge is navigating Brisbane’s evolving zoning laws. For instance, while medium-density zoning in suburbs like Woolloongabba enables lucrative multi-dwelling developments, compliance with council requirements can extend approval timelines by up to six months. This delay not only inflates holding costs but also risks missing market peaks.

To mitigate these risks, experts recommend adopting critical path scheduling, a project management technique that identifies essential tasks and their dependencies to optimize timelines. Dr. Nicola Powell, Chief of Research at Domain, emphasizes that “proactive engagement with council and contractors during the planning phase is pivotal to avoiding costly disruptions.”

Ultimately, success hinges on balancing meticulous planning with adaptive execution, ensuring projects remain both financially viable and operationally efficient.

Image source: cmaa.org

Understanding Renovation Costs and Timelines

Accurately estimating renovation costs and timelines in Brisbane requires a nuanced understanding of both market dynamics and project-specific variables. A critical yet often overlooked factor is the impact of regulatory compliance on project schedules. Securing council permits for structural changes or extensions can extend timelines by several months, particularly in areas with complex zoning requirements. This delay not only inflates holding costs but also disrupts contractor scheduling, compounding financial strain.

A comparative analysis of project management techniques reveals that critical path scheduling offers a significant advantage in mitigating such delays. By mapping task dependencies and prioritizing high-impact activities, this method ensures efficient resource allocation. However, its effectiveness is contingent on accurate pre-construction assessments, which must account for potential site-specific challenges like asbestos removal or soil instability.

For instance, a 2024 renovation in Brisbane’s Camp Hill faced a 20% cost overrun due to unforeseen structural issues, highlighting the importance of contingency planning. According to Dr. Nicola Powell, Chief of Research at Domain, “Detailed upfront assessments and proactive stakeholder engagement are essential to maintaining both budget and timeline integrity.”

Ultimately, integrating advanced planning methodologies with local regulatory expertise enables investors to navigate Brisbane’s renovation landscape more effectively, minimizing risks while optimizing outcomes.

Managing Large-Scale Renovations On-Site

Effective on-site management of large-scale renovations in Brisbane requires a dynamic approach that integrates real-time problem-solving with structured methodologies. One critical yet underexplored aspect is the implementation of just-in-time resource allocation. This technique minimizes material storage on-site, reducing clutter and improving workflow efficiency. However, its success depends on precise coordination with suppliers and contractors, as any delay in deliveries can disrupt the entire project timeline.

A comparative analysis of resource management strategies reveals that while traditional bulk ordering reduces per-unit costs, it often leads to inefficiencies such as material damage or misplacement. In contrast, just-in-time allocation aligns with Brisbane’s space-constrained urban sites, where storage is often limited. For instance, a renovation project in Newstead successfully reduced material waste by 15% through this method, demonstrating its practical benefits.

Contextual factors, such as Brisbane’s unpredictable weather, further complicate on-site logistics. Sudden rain can halt outdoor work, necessitating contingency plans like temporary shelters or rescheduling. These adjustments highlight the importance of adaptive scheduling tools, such as critical path method (CPM) software, which allows project managers to re-prioritize tasks dynamically.

“The ability to adapt resource allocation and scheduling in real-time is what separates successful projects from costly overruns.”

— Dr. Nicola Powell, Chief of Research & Economics, Domain

By combining advanced planning tools with flexible execution strategies, on-site managers can navigate the complexities of Brisbane’s renovation landscape while maintaining efficiency and cost control.

FAQ

What factors are driving Brisbane’s property boom and the rising demand for fixer-upper homes?

Brisbane’s property boom is fueled by a combination of infrastructure investments, such as the Cross River Rail and Brisbane Metro, and the city’s preparation for the 2032 Olympics, which enhance connectivity and urban appeal. Population growth, driven by interstate migration and international arrivals, intensifies housing demand, particularly in inner and middle-ring suburbs. Rising land values make fixer-uppers attractive for redevelopment, as buyers prioritize location over structure. Government incentives, including grants for first-home buyers and renovation subsidies, further stimulate this trend. Additionally, Brisbane’s affordability compared to Sydney and Melbourne positions it as a prime market for investors seeking high-growth opportunities.

How do Brisbane’s zoning laws and demolition control precincts impact the feasibility of renovating or rebuilding?

Brisbane’s zoning laws and demolition control precincts significantly influence renovation and rebuilding feasibility by dictating land use, density, and heritage preservation. Medium-density zoning in areas like Woolloongabba enables lucrative multi-dwelling developments, while heritage overlays in suburbs such as Tarragindi impose restrictions on structural changes. Compliance with demolition control regulations, including waste management and asbestos removal, adds complexity and cost. However, these frameworks also create opportunities for strategic redevelopment, particularly in growth corridors aligned with infrastructure upgrades. Navigating these regulations effectively requires collaboration with experienced builders and planners familiar with Brisbane’s local council requirements and urban planning objectives.

What are the key considerations when purchasing a fixer-upper property in Brisbane’s competitive market?

Key considerations include evaluating the property’s land-to-asset ratio, as land value often outweighs structural costs in Brisbane’s booming market. Buyers should assess zoning regulations to determine redevelopment potential, such as allowances for dual-occupancy or subdivision. Proximity to infrastructure projects, like the Cross River Rail, enhances long-term value. Conducting thorough inspections for issues like asbestos or structural instability is crucial to avoid unforeseen expenses. Additionally, understanding local council requirements for permits and demolition control precincts ensures compliance. Partnering with experienced builders and leveraging government incentives can further optimize investment outcomes in Brisbane’s competitive fixer-upper landscape.

How can government incentives and grants support buyers investing in demolition and redevelopment projects in Brisbane?

Government incentives and grants, such as Queensland’s First Home Buyers Grant of $30,000 for eligible purchases under $750,000, reduce financial barriers for buyers targeting demolition and redevelopment projects. Stamp duty concessions on properties below $700,000 further enhance affordability. These programs enable buyers to allocate more resources toward redevelopment, including structural upgrades or dual-occupancy conversions. Additionally, renovation subsidies mitigate risks associated with unforeseen costs, such as asbestos removal or compliance with demolition control regulations. By aligning financial support with urban renewal goals, these incentives empower buyers to capitalize on Brisbane’s property boom while contributing to the city’s evolving real estate landscape.

Which Brisbane suburbs offer the best opportunities for high-return investments in fixer-upper properties?

Suburbs like Woolloongabba and Greenslopes stand out for high-return fixer-upper investments due to their proximity to infrastructure projects like the Cross River Rail and urban renewal initiatives. Middle-ring areas such as Stafford Heights and Camp Hill offer large blocks with subdivision potential, aligning with zoning flexibility for dual-occupancy developments. Coastal suburbs like Wynnum attract lifestyle-driven buyers, enhancing resale value. Additionally, Chermside and Bowen Hills provide strong rental demand, supported by nearby employment hubs and transport links. These locations combine strategic redevelopment opportunities with rising land values, making them prime targets for investors seeking to maximize returns in Brisbane’s competitive market.