Housing Affordability Map: Which Australian Cities Offer the Best Value in 2025

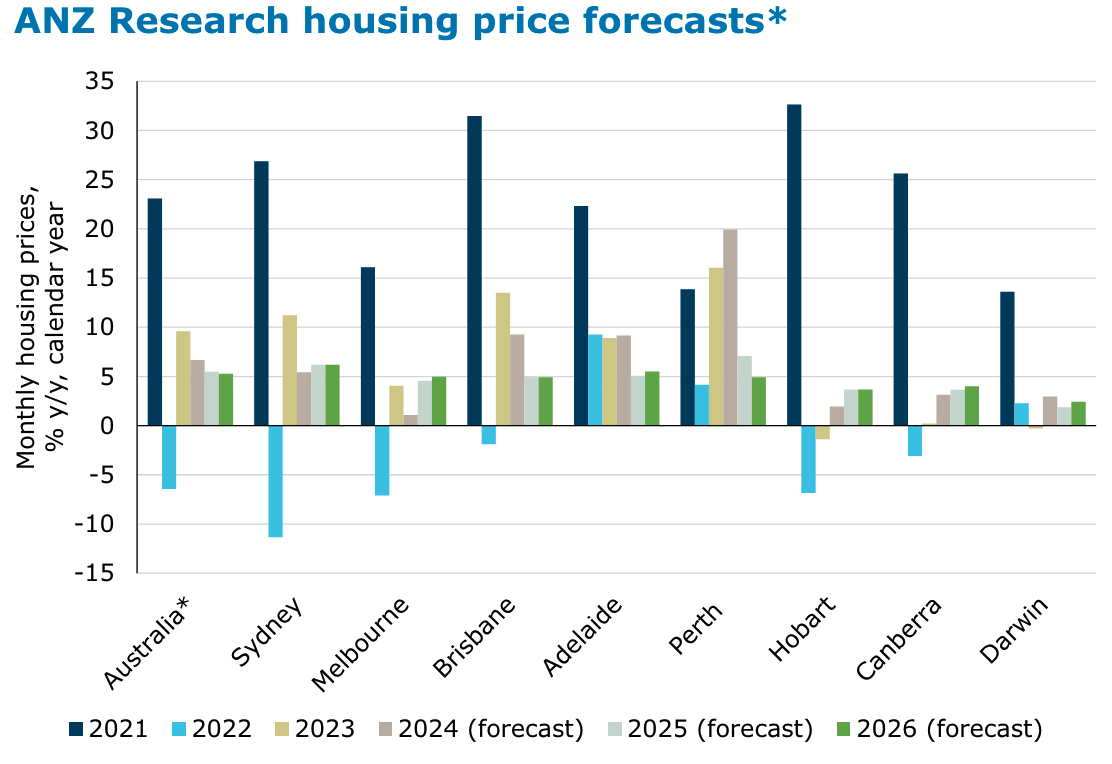

In January 2025, Sydney’s median house price dipped below $1.2 million for the first time in three years, a stark reversal for a city long synonymous with skyrocketing property values. Meanwhile, Brisbane’s inner-city apartment market, once oversaturated, has seen rents stagnate and prices fall, offering rare opportunities for first-time buyers. These shifts are not isolated anomalies but part of a broader recalibration in Australia’s housing market, driven by a confluence of factors: sustained high-density construction, regional migration trends, and the Reserve Bank of Australia’s anticipated interest rate cuts.

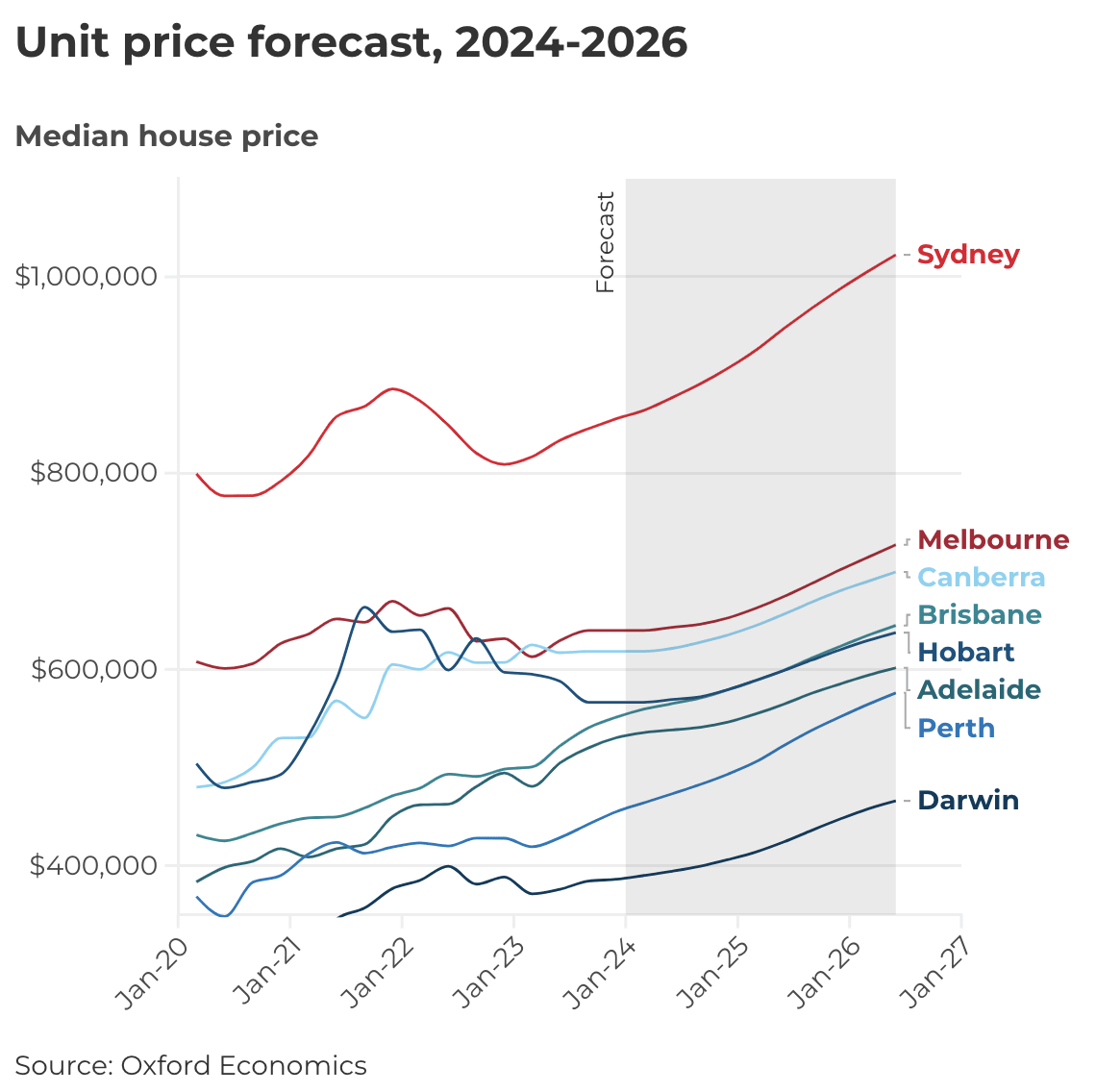

Yet, the picture is far from uniform. While Melbourne’s apartment prices have slowed in growth compared to houses, Perth and Adelaide have maintained steady momentum, buoyed by localized economic resilience. Coastal regions like the Sunshine Coast are drawing buyers with lifestyle appeal, even as affordability challenges persist nationwide.

This article maps the evolving affordability landscape, city by city, revealing where value truly lies in 2025.

Image source: realestate.com.au

Understanding Housing Affordability Metrics

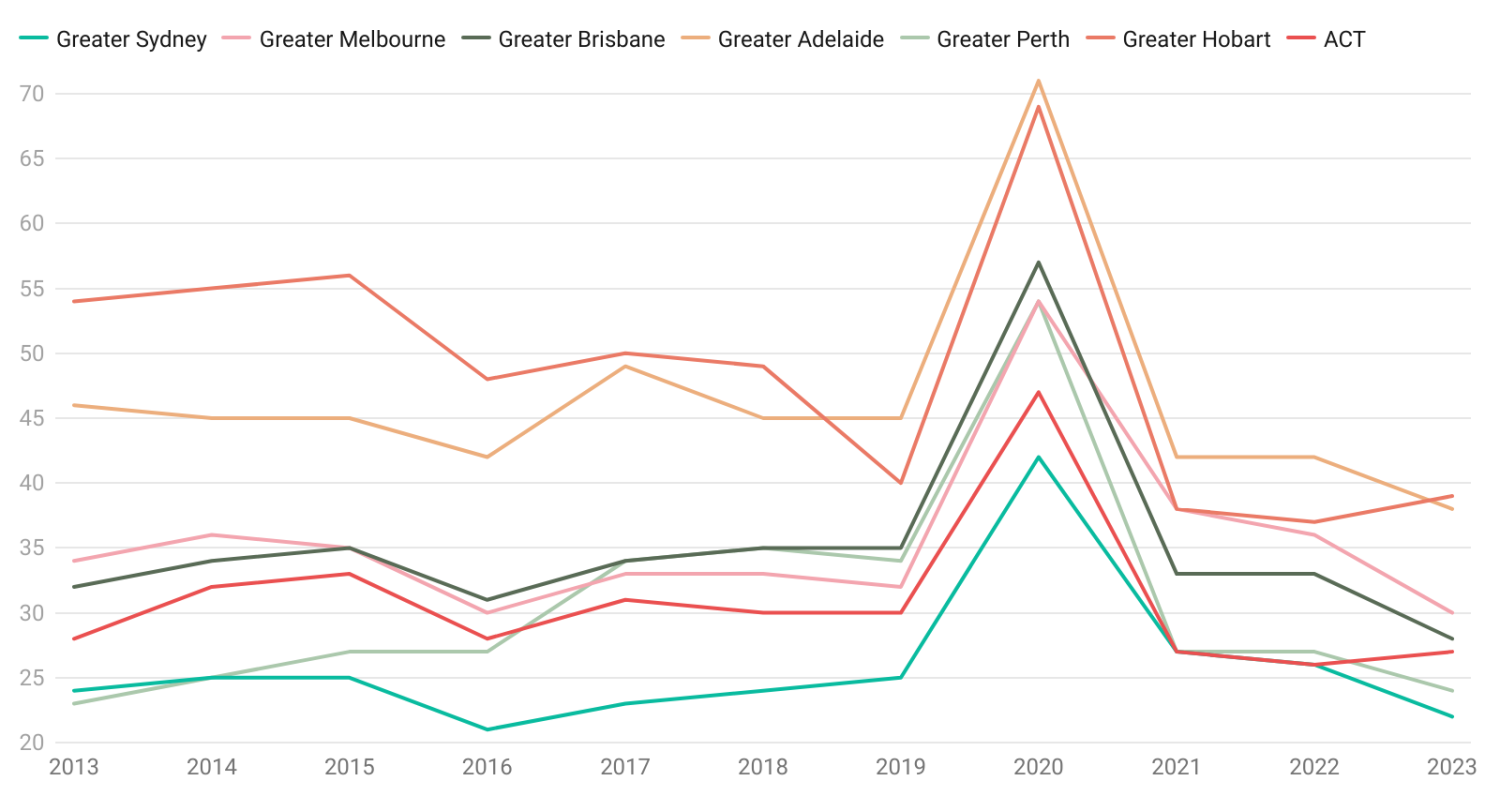

Housing affordability in Australia is often measured using the price-to-income ratio, but this metric alone fails to capture the full complexity of the issue. A more nuanced approach incorporates additional factors such as rental yields, cost-to-income ratios, and regional economic conditions. For instance, CoreLogic’s 2024 Affordability Report revealed that the cost-to-income ratio in Sydney exceeded 7.5 times the median household income, underscoring the city’s persistent affordability challenges despite recent price declines.

In contrast, Brisbane’s inner-city apartment market demonstrates how localized metrics can reveal hidden opportunities. With rental yields stabilizing at 5.2% and median apartment prices falling by 3.8% over the past year, first-time buyers are finding entry points previously unavailable. This shift is attributed to sustained high-density construction and a cooling rental market, as noted by CoreLogic analysts.

Emerging trends also highlight the importance of lifestyle-driven metrics. Coastal regions like the Sunshine Coast, where remote work has spurred demand, show a unique affordability dynamic. Here, the balance between property prices and quality-of-life factors has drawn both investors and long-term residents.

By integrating these diverse metrics, policymakers and buyers can better navigate the evolving housing landscape, identifying value beyond traditional affordability measures.

The Importance of Affordability in Urban Planning

Urban planning plays a pivotal role in shaping housing affordability by influencing land use, density, and infrastructure development. Restrictive land use regulations, as highlighted in Brisbane City Council’s City Plan 2014, often limit the availability of land for multi-dwelling developments, driving up prices in established suburbs. Conversely, reforms that streamline planning processes have demonstrated measurable success. For example, Brisbane’s high-density construction initiatives have contributed to a 3.8% drop in median apartment prices, creating opportunities for first-time buyers.

A critical yet underexplored factor is the geographic mismatch between housing and employment hubs. In Sydney and Melbourne, fringe suburbs increasingly house low-income residents, exacerbating commuting costs and reducing access to economic opportunities. Addressing this requires integrating transport infrastructure with housing policies, as seen in Perth, where transit-oriented developments have maintained steady housing momentum.

Emerging trends suggest that affordability metrics must incorporate lifestyle factors, such as proximity to amenities and remote work potential. Policymakers should prioritize mixed-use zoning and adaptive reuse of underutilized spaces to balance affordability with urban growth. By aligning planning reforms with evolving demographic and economic needs, cities can foster equitable and sustainable housing solutions.

Current State of Housing Affordability in Major Australian Cities

Housing affordability in Australia’s major cities reveals a fragmented landscape shaped by economic, demographic, and policy-driven forces. Sydney, long emblematic of high property prices, has seen its median house price fall below $1.2 million for the first time in three years, yet affordability remains elusive with a cost-to-income ratio exceeding 7.5 times the median household income. This underscores the persistent challenges despite recent price corrections.

In contrast, Brisbane’s inner-city apartment market offers a rare bright spot. Sustained high-density construction has driven a 3.8% decline in median apartment prices, while rental yields stabilize at 5.2%, creating entry points for first-time buyers. Similarly, Perth’s steady growth, bolstered by transit-oriented developments, has positioned it as the best-performing capital city with a 21% annual price increase.

Unexpectedly, Adelaide has overtaken Melbourne in median house prices, reflecting localized economic resilience. However, misconceptions persist that regional markets like the Sunshine Coast are universally affordable; lifestyle-driven demand has inflated prices, challenging this narrative. Policymakers must address these disparities to foster equitable housing solutions.

Image source: sgsep.com.au

Affordability in Capital Cities: A Comparative Analysis

A comparative analysis of Australia’s capital cities reveals stark contrasts in housing affordability, driven by unique economic, demographic, and policy factors. Sydney, despite its recent price dip, remains a global outlier with a price-to-income ratio exceeding 7.5, reflecting entrenched affordability challenges. In contrast, Brisbane’s inner-city apartment market has emerged as a case study in effective urban planning. High-density construction initiatives, supported by Brisbane City Council’s streamlined zoning reforms, have reduced median apartment prices by 3.8% while stabilizing rental yields at 5.2%. This approach demonstrates how targeted policies can create entry points for first-time buyers.

Perth’s transit-oriented developments offer another compelling example. By integrating housing with transport infrastructure, the city has maintained steady price growth, achieving a 21% annual increase in median house prices without sacrificing affordability. Adelaide, meanwhile, has overtaken Melbourne in median house prices, a shift attributed to localized economic resilience and lower regulatory barriers.

A lesser-known factor influencing affordability is the role of lifestyle-driven demand in regional markets like the Sunshine Coast. While often perceived as affordable, rising demand from remote workers has inflated prices, challenging this assumption.

Looking ahead, cities must adopt adaptive frameworks that balance affordability with growth. Mixed-use zoning, infrastructure investment, and data-driven policy reforms will be critical in addressing disparities and fostering sustainable housing solutions.

Regional Centers: Emerging Trends and Opportunities

Regional centers in Australia are increasingly becoming focal points for housing affordability and lifestyle-driven migration. The Sunshine Coast, for instance, has seen a surge in demand due to remote work flexibility, with property prices rising by 12% in 2024. This trend underscores the importance of balancing affordability with infrastructure development to sustain growth.

A key driver of regional appeal is the integration of economic hubs with housing supply. For example, the Gold Coast has leveraged its tourism and service industries to attract both investors and residents. The Regional Movers Index (RMI) reported a 27% increase in migration to regional areas in mid-2024, highlighting the shift away from urban centers. However, this influx has strained local housing markets, with rental prices climbing by 8.5% year-on-year.

To address these challenges, innovative models like mixed-use developments are gaining traction. Koala Invest, a property investment firm, has piloted projects combining residential, commercial, and recreational spaces, reducing commute times and enhancing community engagement.

Looking forward, regional centers must adopt adaptive zoning policies and invest in transport connectivity to manage growth sustainably. Policymakers should also explore public-private partnerships to expand housing supply while preserving affordability, ensuring these regions remain viable alternatives to capital cities.

Economic and Policy Factors Influencing Housing Affordability

Economic and policy dynamics are pivotal in shaping housing affordability across Australian cities. A key factor is the Reserve Bank of Australia’s anticipated interest rate cuts in mid-2025, which could lower mortgage costs but risk inflating property prices. Historically, such monetary easing has disproportionately benefited high-income buyers, exacerbating affordability challenges for low-income households.

Policy interventions also play a critical role. For instance, Brisbane’s streamlined zoning reforms have facilitated high-density construction, leading to a 3.8% drop in median apartment prices. In contrast, restrictive land-use regulations in Sydney continue to constrain supply, keeping the cost-to-income ratio above 7.5 times the median household income.

Unexpectedly, regional migration incentives have revealed mixed outcomes. While they alleviate urban housing pressures, they strain infrastructure in regional centers like the Sunshine Coast, where property prices surged by 12% in 2024.

“Effective housing policy must balance supply-side reforms with demand management,” notes CoreLogic analyst Sarah Thompson, emphasizing the need for integrated solutions.

Policymakers must adopt adaptive frameworks, combining transport investment, mixed-use zoning, and innovative construction methods to address affordability disparities sustainably.

Image source: empire8property.com.au

Impact of Economic Indicators on Housing Costs

Economic indicators such as interest rates, employment trends, and inflation significantly influence housing costs, shaping both demand and affordability. The Reserve Bank of Australia’s anticipated interest rate cuts in mid-2025 exemplify this dynamic. While lower rates reduce borrowing costs, they often drive up property prices by increasing buyer competition, disproportionately benefiting higher-income households. This creates a paradox where affordability improves for some but worsens for others.

Employment trends further complicate this landscape. Cities like Perth, with steady job growth in mining and technology sectors, have seen housing demand rise, sustaining a 21% annual increase in median house prices. Conversely, regions with stagnant employment, such as parts of regional New South Wales, experience slower price growth but face affordability challenges due to limited economic opportunities.

A case study of Brisbane highlights the interplay of economic and policy factors. High-density construction initiatives, supported by zoning reforms, have stabilized rental yields at 5.2% and reduced median apartment prices by 3.8%. This demonstrates how aligning economic indicators with targeted policies can mitigate affordability pressures.

Emerging trends also reveal the impact of inflation on ancillary housing costs, such as energy and maintenance. Rising energy prices, for instance, exacerbate financial stress for low-income households, a factor often overlooked in traditional affordability metrics.

Looking ahead, policymakers must integrate economic forecasting with adaptive housing strategies. By combining transport investment, mixed-use zoning, and inflation-indexed subsidies, cities can create resilient housing markets that balance growth with affordability.

Government Policies and Their Role in Affordability

Targeted government policies play a pivotal role in addressing housing affordability, particularly through supply-side interventions. A notable example is Brisbane’s zoning reforms, which streamlined approval processes for high-density developments. This initiative led to a 3.8% reduction in median apartment prices and stabilized rental yields at 5.2%, creating accessible entry points for first-time buyers. Such policies demonstrate how reducing regulatory bottlenecks can directly impact affordability.

Tax reforms also hold transformative potential. Replacing stamp duty with an annual land tax, as proposed in New South Wales, could lower upfront costs for buyers, making homeownership more attainable. Similarly, reducing capital gains tax concessions and abolishing negative gearing could curb speculative investment, cooling property markets without destabilizing them. However, these measures require careful calibration to balance investor and buyer interests.

Emerging trends highlight the importance of integrating social housing initiatives. For instance, the Victorian Government’s $5.3 billion Big Housing Build aims to deliver 12,000 new homes by 2027, addressing both affordability and housing stress for low-income households. This underscores the value of public-private partnerships in expanding affordable housing stock.

Looking forward, governments must adopt adaptive frameworks that combine zoning reforms, tax restructuring, and social housing investments. By aligning these strategies with population growth and economic trends, policymakers can foster equitable and sustainable housing markets, ensuring affordability for diverse demographics.

Future Projections and Emerging Trends in Housing Affordability

Australia’s housing affordability in 2025 is poised for significant shifts, driven by economic, demographic, and policy dynamics. The anticipated mid-2025 interest rate cuts by the Reserve Bank of Australia could lower borrowing costs, yet paradoxically inflate property prices, benefiting high-income buyers while marginalizing low-income households. This underscores the need for targeted interventions to mitigate inequities.

Regional markets, such as the Sunshine Coast, are expected to see continued demand fueled by remote work trends. However, rising property prices—up 12% in 2024—challenge the perception of universal affordability in these areas. Policymakers must address infrastructure gaps to sustain growth without exacerbating housing stress.

Innovative models like mixed-use developments are gaining traction. For example, Koala Invest’s projects integrating residential and commercial spaces have reduced commute times and enhanced community engagement, offering a blueprint for sustainable urban growth.

Looking ahead, adaptive zoning policies and public-private partnerships will be critical in balancing affordability with economic and lifestyle demands.

Image source: brokernews.com.au

Population Growth and Infrastructure Development

Population growth in Australia’s urban and regional centers is reshaping housing affordability, with infrastructure development emerging as a critical determinant of success. Cities like Perth have demonstrated the value of transit-oriented developments (TODs), where integrating housing with transport hubs has sustained a 21% annual increase in median house prices without sacrificing accessibility. This model reduces commuting costs and enhances economic opportunities, offering a replicable framework for other cities.

In contrast, Sydney’s fringe suburbs highlight the risks of inadequate infrastructure planning. The geographic mismatch between housing and employment hubs has exacerbated commuting costs, reducing affordability despite recent price corrections. Addressing this requires a shift toward mixed-use zoning and adaptive reuse of underutilized spaces.

Emerging trends suggest that infrastructure investment must align with demographic shifts. For instance, the Sunshine Coast’s population surge, driven by remote work, has strained local transport and utilities. Public-private partnerships, such as Koala Invest’s mixed-use developments, provide a scalable solution by integrating residential, commercial, and recreational spaces.

Looking forward, policymakers must prioritize infrastructure that supports decentralized growth. Scenario analyses indicate that combining TODs with digital infrastructure for remote work could balance population pressures while fostering sustainable housing markets. This approach ensures affordability without compromising quality of life.

The Rise of Remote Work and Its Impact on Housing Preferences

Remote work has redefined housing preferences, with demand surging for suburban and rural properties offering larger living spaces and enhanced home office setups. This shift is exemplified by Brisbane’s outer suburbs, where property prices have risen by 8% in 2024 due to increased interest from remote workers seeking affordability and space. Developers like Koala Invest have capitalized on this trend by integrating dedicated home offices and high-speed internet infrastructure into new housing projects, meeting the needs of remote professionals.

A unique metric, the Remote Work Housing Index (RWHI), could quantify this trend by combining factors such as home office availability, internet speed, and proximity to lifestyle amenities. Early applications of such metrics reveal that regions like the Sunshine Coast score highly, driven by a 12% rise in property values in 2024, attributed to remote work migration.

However, challenges persist. Limited infrastructure in regional areas strains utilities and transport systems, highlighting the need for public-private partnerships. For instance, Koala Invest’s mixed-use developments have successfully reduced commute times while enhancing community engagement.

Looking ahead, policymakers must prioritize zoning reforms and digital infrastructure to sustain this shift. Scenario analyses suggest that integrating remote work-friendly features into urban planning could balance affordability with lifestyle demands.

FAQ

What factors determine housing affordability in Australian cities for 2025?

Housing affordability in Australian cities for 2025 is shaped by a combination of economic, demographic, and policy-driven factors. Key determinants include the price-to-income ratio, rental yields, and cost-to-income metrics, alongside regional economic conditions like employment growth and infrastructure development. Interest rate movements, such as the Reserve Bank of Australia’s anticipated mid-2025 cuts, also play a pivotal role. Urban planning policies, including zoning reforms and high-density construction initiatives, influence supply dynamics. Additionally, lifestyle-driven demand, particularly in coastal and regional areas, impacts affordability. These interconnected factors highlight the importance of localized metrics and adaptive strategies in evaluating housing value across cities.

Which Australian cities offer the best value for first-time homebuyers in 2025?

Brisbane and Perth stand out as the best-value cities for first-time homebuyers in 2025. Brisbane’s inner-city apartment market offers affordability through a 3.8% decline in median prices and stable rental yields of 5.2%, driven by high-density construction. Perth, supported by transit-oriented developments and economic growth in mining, has maintained steady price momentum with a 21% annual increase, yet remains relatively affordable compared to Sydney and Melbourne. Regional centers like Adelaide also present opportunities, with balanced growth and investor-friendly policies. These cities combine economic resilience, infrastructure investment, and lifestyle appeal, making them ideal for first-time buyers seeking value.

How do regional migration trends impact housing affordability in 2025?

Regional migration trends in 2025 have reshaped housing affordability by increasing demand in areas like the Sunshine Coast and Gold Coast, where property prices rose by 12% and rental costs climbed 8.5% year-on-year. This shift, driven by remote work flexibility and lifestyle appeal, has strained local infrastructure and housing supply, challenging affordability. Conversely, migration alleviates pressure on urban markets like Sydney and Melbourne, where prices have stabilized. Policymakers must address these dynamics through adaptive zoning, transport investment, and public-private partnerships to balance regional growth with affordability, ensuring sustainable housing solutions across Australia’s evolving demographic landscape.

What role do government policies play in shaping housing affordability across Australian cities?

Government policies significantly influence housing affordability across Australian cities by addressing supply, demand, and infrastructure challenges. Zoning reforms, such as Brisbane’s high-density initiatives, have reduced apartment prices by 3.8%, creating entry points for first-time buyers. Tax reforms, including replacing stamp duties with land taxes, lower upfront costs and encourage institutional investment in rental housing. Policies like the National Housing and Homelessness Agreement aim to boost greenfield land supply, while transport infrastructure investments improve access to affordable housing. However, restrictive land-use regulations in cities like Sydney continue to constrain supply, underscoring the need for coordinated, adaptive policy frameworks to ensure affordability.

How does remote work influence housing preferences and affordability in 2025?

Remote work in 2025 has redefined housing preferences, driving demand for suburban and regional properties with larger living spaces, home offices, and outdoor amenities. Cities like Brisbane’s outer suburbs and the Sunshine Coast have seen property values rise by 8% and 12%, respectively, as remote workers prioritize affordability and lifestyle over proximity to urban centers. This shift has cooled demand in metropolitan areas like Sydney, easing price pressures. However, regional infrastructure challenges, such as limited transport and utilities, strain affordability. Policymakers must integrate digital infrastructure and adaptive zoning to balance remote work-driven migration with sustainable housing affordability.