From Decline to Growth: How Premium Markets Are Fueling Australia’s Housing Recovery

In February 2025, Melbourne’s Toorak neighborhood saw auction clearance rates soar past 70%, a sharp contrast to the subdued activity of just a year prior. This resurgence wasn’t isolated. Across Australia, premium housing markets—long considered bellwethers of economic sentiment—are driving a recovery that defies earlier predictions of prolonged stagnation.

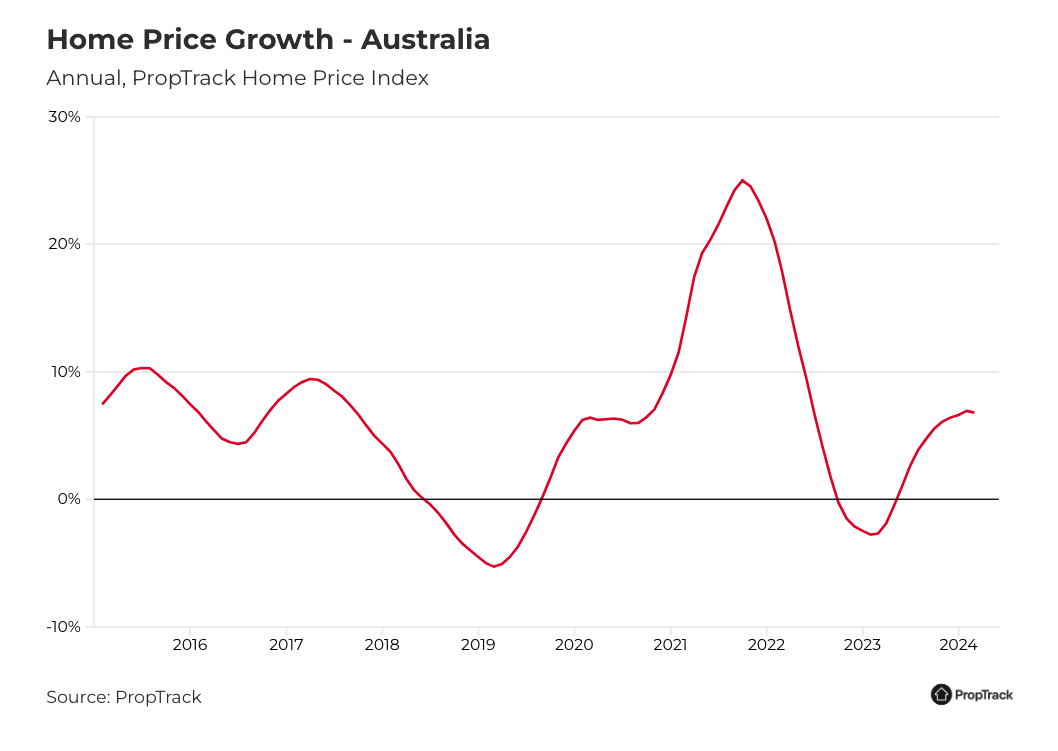

CoreLogic data reveals that since hitting a low in February 2024, the National Home Value Index has climbed nearly 5%, adding over AUD 34,000 to the median home value. Sydney’s high-end suburbs, like Leichhardt, have led the charge, with historical data showing a 19% increase in house values for every 1% drop in interest rates.

Yet, this recovery is far from uniform. While affluent buyers fuel competition in premium segments, cities like Hobart lag behind, recording slight declines. The interplay of monetary policy, shifting demographics, and localized market dynamics underscores the complexity of Australia’s housing rebound.

Image source: australianpropertyupdate.com.au

Understanding the Decline and Recovery Phases

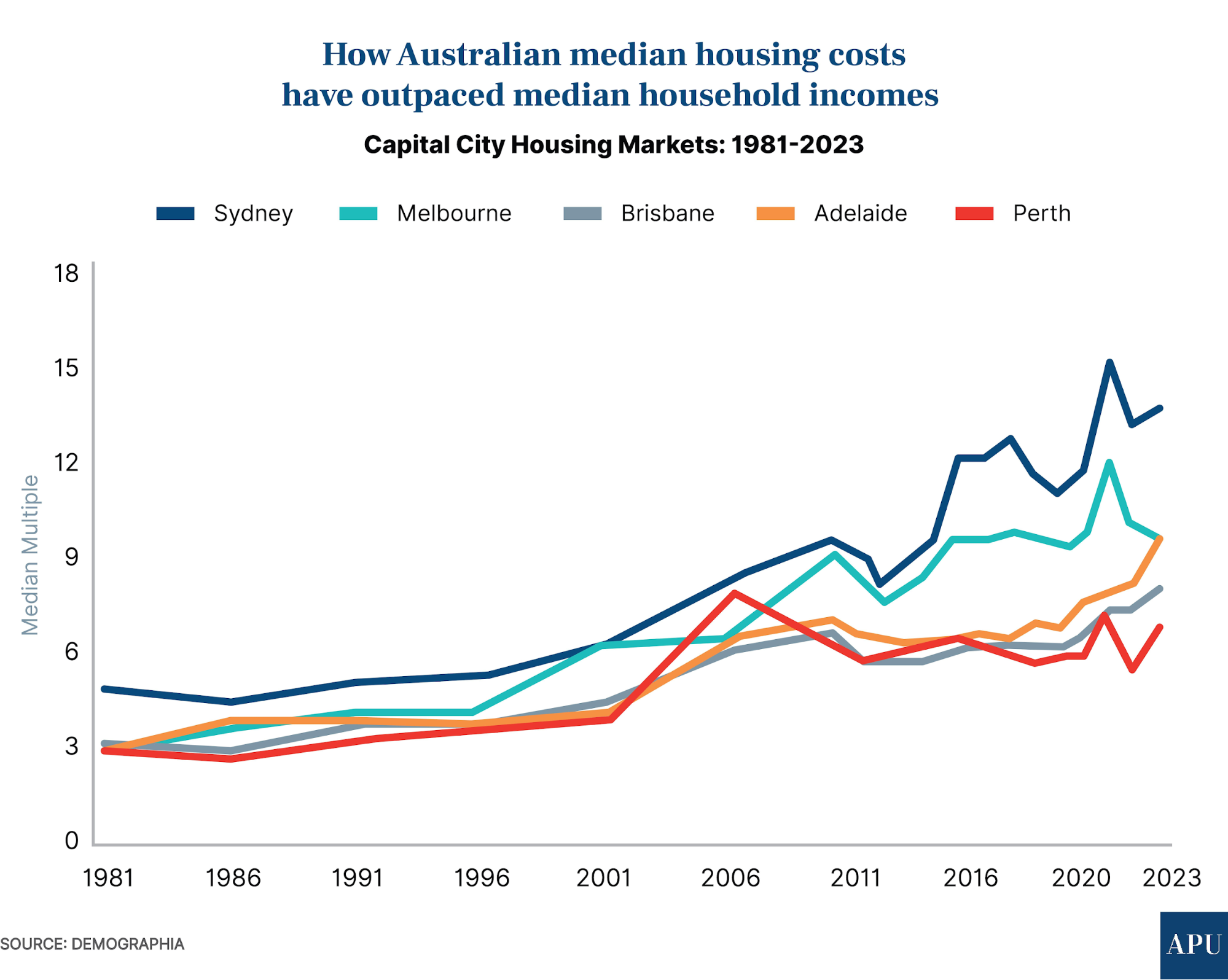

The decline phase of Australia’s housing market, particularly between 2022 and early 2024, was marked by a convergence of rising interest rates, affordability pressures, and subdued buyer sentiment. CoreLogic data highlights an 8.5% drop in national home values from their peak, with cities like Hobart experiencing sharper declines due to limited economic diversification and population stagnation. However, the recovery phase, as seen in 2025, has been driven by targeted policy shifts and renewed activity in premium markets.

A pivotal factor in this turnaround has been the correlation between interest rate cuts and high-end property demand. For instance, Sydney’s Leichhardt suburb recorded a 19% increase in house values for every 1% drop in interest rates, underscoring the sensitivity of affluent buyers to borrowing costs. This trend aligns with historical patterns, where premium markets often act as early indicators of broader recovery.

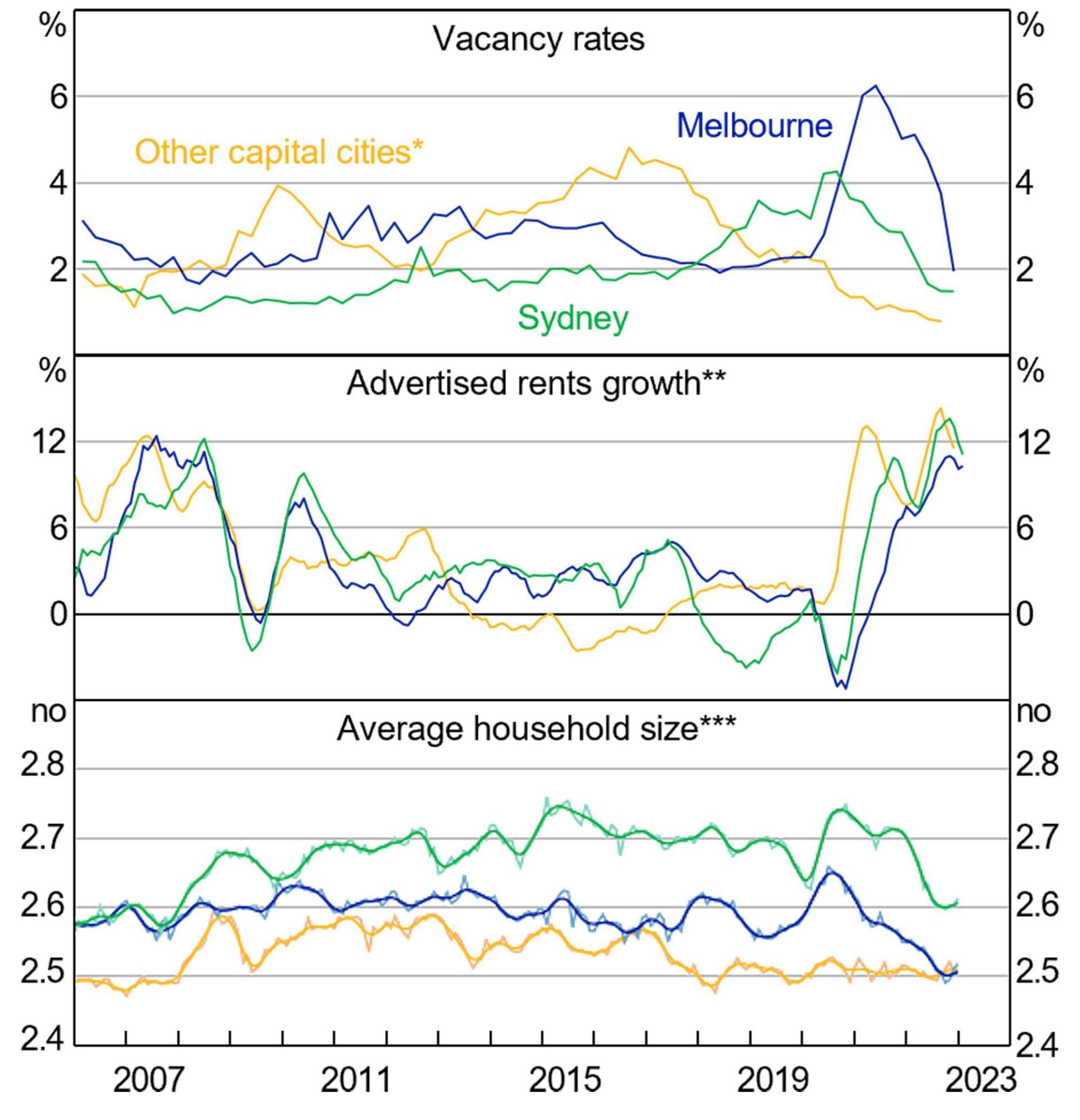

Melbourne’s Toorak neighborhood offers a compelling case study. Auction clearance rates exceeding 70% in February 2025 reflect not only improved buyer confidence but also the impact of strategic infrastructure investments and tight rental markets.

Looking ahead, the interplay of monetary policy, demographic shifts, and localized market dynamics will likely determine the sustainability of this recovery, particularly in less resilient regions like Hobart.

Role of Premium Markets in the Recovery

Premium markets have emerged as pivotal drivers of Australia’s housing recovery, leveraging their sensitivity to monetary policy and buyer confidence. CoreLogic data reveals that for every 1% reduction in interest rates, high-end suburbs like Sydney’s Leichhardt experienced a 19% surge in house values. This responsiveness underscores the unique dynamics of affluent buyers, who are less constrained by borrowing limits and more influenced by investment potential.

Melbourne’s Toorak neighborhood exemplifies this trend. In February 2025, auction clearance rates surpassed 70%, fueled by strategic infrastructure investments and tight rental markets. High-quality apartments in areas like South Yarra also saw increased demand, with rental yields rising by 9%, reflecting investor confidence and limited supply.

A unique insight emerges when comparing historical data: premium markets often act as early indicators of broader economic recovery. This phenomenon can be attributed to their role as repositories of wealth and their ability to attract international investment. For instance, the Foreign Investment Review Board reported a significant rise in overseas purchases of premium properties, further bolstering demand.

Looking forward, targeted policies such as stamp duty reductions and streamlined planning processes could amplify these gains, positioning premium markets as catalysts for sustained national growth.

Factors Driving the Housing Market Recovery

Australia’s housing market recovery in 2025 is underpinned by a confluence of economic, policy, and demographic factors, each playing a distinct role. A critical driver has been the Reserve Bank of Australia’s (RBA) interest rate cuts, which, while modest, signaled economic stability and improved buyer sentiment. This psychological shift often precedes measurable financial impacts, as seen in Melbourne’s 0.4% property price rise in February 2025.

Unexpectedly, regional markets like Geelong and the Sunshine Coast outpaced capital cities, driven by remote work trends and lifestyle preferences. This highlights the growing importance of localized economic factors, such as infrastructure upgrades and employment hubs, in shaping demand.

A common misconception is that affordability alone dictates recovery. However, premium markets like Sydney’s Leichhardt demonstrate how policy signaling and buyer psychology can outweigh traditional metrics.

“Expectations of lower interest rates… are flowing through to improved buyer sentiment,” notes Tim Lawless of CoreLogic.

Looking ahead, integrating targeted regional investments with transparent policy communication could sustain this momentum, offering a blueprint for balancing growth and equity.

mage source: fticonsulting.com

Impact of Interest Rate Cuts

Interest rate cuts in 2025 have acted as a catalyst for Australia’s housing market recovery, particularly in premium and high-demand regions. CoreLogic data reveals that national dwelling values historically rise by an average of 6.1% for every 1% reduction in the cash rate. This trend is amplified in affluent suburbs like Sydney’s Leichhardt, where house values surged by 19% for each 1% rate cut, reflecting the heightened sensitivity of premium markets to borrowing costs.

A key mechanism driving this impact is the increase in borrowing capacity. A Canstar study found that a 0.75% rate cut boosts borrowing power by approximately 7%, enabling buyers to access higher-value properties. For instance, Melbourne’s Toorak neighborhood saw auction clearance rates exceed 70% in February 2025, fueled by improved affordability and strategic infrastructure investments.

However, the effects are uneven. Regional markets like Geelong benefit from lifestyle-driven demand, while cities like Hobart lag due to limited economic diversification. This divergence underscores the importance of localized factors in shaping outcomes.

“Lower interest rates are set to boost the housing market in 2025,” notes Eliza Owen, CoreLogic’s Head of Research. “Buyers can borrow more, spend more, and ultimately make housing a more attractive investment.”

Looking forward, integrating rate cuts with targeted policies—such as streamlined planning processes—could maximize their impact, fostering sustainable growth across diverse markets.

Improved Market Sentiment and Buyer Confidence

The resurgence of market sentiment in 2025 has been pivotal in driving Australia’s housing recovery, particularly in premium segments. The Westpac-Melbourne Institute Consumer Sentiment Index, which rose to 101.3 in late 2024, reflects a shift from pessimism to cautious optimism. This psychological turnaround has been instrumental in reactivating buyer activity, especially in undervalued premium markets.

A notable case is Melbourne’s South Yarra, where investor activity surged due to a 9% rise in rental yields and a vacancy rate of just 1.5%. This dynamic highlights the interplay between sentiment and market fundamentals, as investors capitalized on tight supply and strong demand. Similarly, the Victorian Homebuyer Fund has bolstered confidence by addressing affordability, enabling more first-time buyers to enter the market.

Historical data underscores the cyclical nature of sentiment. For instance, during the 2008 financial crisis, government incentives like the First Home Owner Grant (FHOG) significantly boosted buyer confidence, leading to a sharp rise in owner-occupier commitments. This pattern reaffirms the importance of targeted policy interventions in shaping sentiment.

“Expectations of lower interest rates… are flowing through to improved buyer sentiment,” notes Tim Lawless of CoreLogic.

Looking ahead, integrating sentiment-driven strategies with infrastructure investments could sustain momentum, fostering long-term stability across diverse market segments.

Impact on Different Market Segments

Australia’s housing recovery in 2025 has revealed stark contrasts across market segments, driven by varying sensitivities to economic and policy shifts. Premium markets, such as Sydney’s Leichhardt, have surged, with house values increasing by 19% for every 1% drop in interest rates. This reflects the heightened responsiveness of affluent buyers to borrowing costs, as they prioritize investment potential over affordability constraints.

In contrast, regional markets like Hobart have lagged, recording slight declines due to limited economic diversification and population stagnation. This divergence underscores the uneven impact of recovery drivers, such as interest rate cuts, which disproportionately benefit high-demand urban areas.

Unexpectedly, lifestyle-driven regions like Geelong have outpaced some capital cities, fueled by remote work trends and infrastructure upgrades. This highlights the growing importance of localized factors in shaping demand.

“Lower interest rates are set to boost the housing market in 2025,” notes Eliza Owen, CoreLogic’s Head of Research.

Looking forward, balancing targeted policies with regional investments could bridge these disparities, ensuring a more equitable recovery across all segments.

Image source: keylaw.com.au

Performance of Premium Markets

Premium markets have demonstrated exceptional resilience and growth in Australia’s 2025 housing recovery, driven by their unique sensitivity to monetary policy and strategic investments. For instance, Sydney’s Leichhardt recorded a 19% surge in house values for every 1% drop in interest rates, underscoring the disproportionate impact of borrowing cost reductions on affluent buyers. This trend reflects a broader pattern where premium markets act as early indicators of economic recovery due to their wealth concentration and investment appeal.

A case study of Melbourne’s Toorak highlights the role of infrastructure investments in amplifying market performance. Auction clearance rates in February 2025 exceeded 70%, supported by tight rental markets and a 9% rise in rental yields for high-quality apartments in nearby South Yarra. These metrics reveal how limited supply and strategic urban planning can create a feedback loop of demand and price appreciation.

Historical data further contextualizes this phenomenon. During the 2008 financial crisis, premium markets in Australia rebounded faster than other segments, driven by international investment and policy incentives. This aligns with recent trends, as the Foreign Investment Review Board reported a significant uptick in overseas purchases of premium properties.

Looking ahead, integrating targeted policies—such as streamlined planning processes and tax incentives—could sustain this momentum, positioning premium markets as catalysts for broader economic stability and growth.

Comparative Analysis of Market Segments

The divergence between premium and regional markets in Australia’s 2025 housing recovery highlights the nuanced interplay of economic, demographic, and policy factors. Premium markets, such as Sydney’s Leichhardt, have thrived due to their heightened sensitivity to interest rate cuts, with house values increasing by 19% for every 1% reduction in rates. This responsiveness stems from affluent buyers’ greater borrowing capacity and investment-driven motivations.

In contrast, regional markets like Hobart have faced stagnation, hindered by limited economic diversification and population growth. However, lifestyle-driven regions such as Geelong have emerged as outliers, leveraging remote work trends and infrastructure upgrades to outpace some capital cities. For instance, Geelong’s property values rose by 6% in 2025, supported by investments in transport connectivity and employment hubs.

A unique metric, the Market Elasticity Index (MEI), could quantify the sensitivity of different segments to policy changes. By aggregating data on interest rates, demographic shifts, and infrastructure spending, the MEI offers actionable insights for policymakers and investors.

“Localized factors, such as employment opportunities and lifestyle preferences, are increasingly shaping housing demand,” notes Eliza Owen, CoreLogic’s Head of Research.

Looking forward, integrating regional investments with targeted incentives could bridge disparities, fostering a more balanced and equitable housing recovery across all segments.

Regional Variations in Recovery Patterns

Australia’s housing recovery in 2025 reveals a fragmented landscape, shaped by localized economic drivers and demographic shifts. While Sydney and Melbourne’s premium markets dominate with robust price growth—such as Toorak’s 70% auction clearance rates—regional areas like Hobart lag, reflecting limited economic diversification and population stagnation.

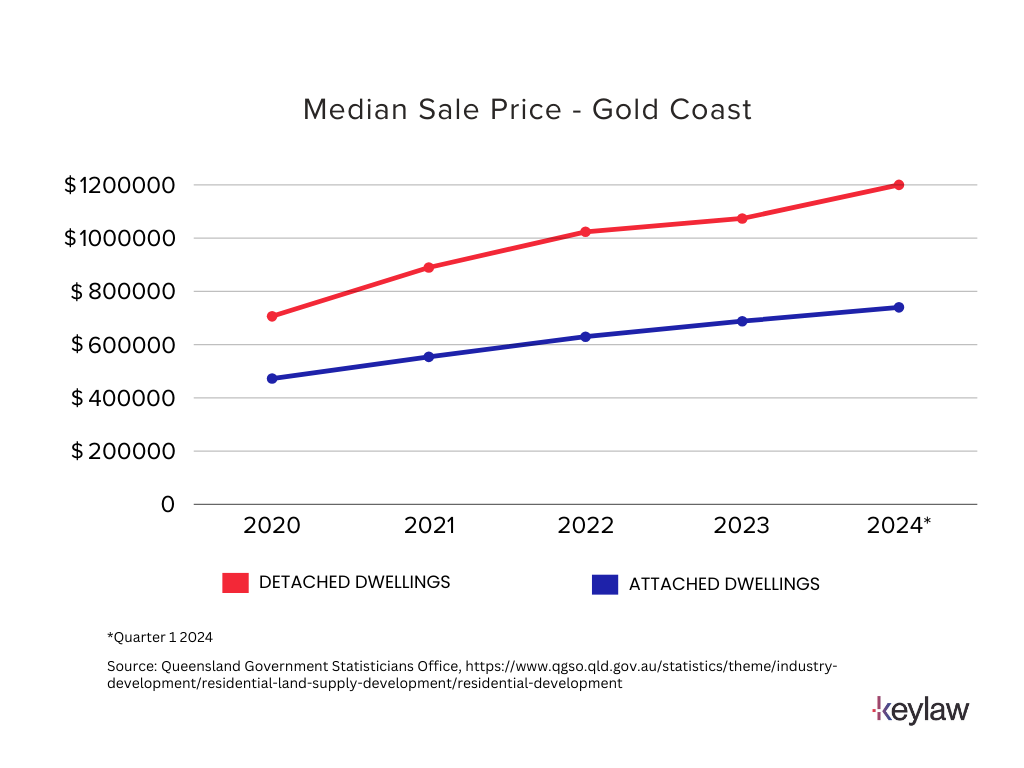

Unexpectedly, lifestyle-oriented regions like Geelong and the Sunshine Coast have outpaced some capital cities. Geelong, for instance, recorded a 6% rise in property values, driven by infrastructure upgrades and remote work trends. This contrasts sharply with Brisbane, where cooling demand and inventory shortages (-28% below the five-year average) have tempered growth.

A common misconception is that affordability alone dictates recovery. However, Newcastle’s resurgence, fueled by targeted transport investments, underscores the importance of connectivity and employment hubs.

“Localized factors, such as employment opportunities and lifestyle preferences, are increasingly shaping housing demand,” notes Eliza Owen, CoreLogic’s Head of Research.

Looking ahead, addressing regional disparities through strategic investments and tailored policies could unlock untapped potential, fostering a more inclusive recovery.

Image source: fticonsulting.com

Case Studies: Sydney, Melbourne, and Brisbane

Sydney, Melbourne, and Brisbane exemplify distinct recovery trajectories in Australia’s 2025 housing market, shaped by their unique economic drivers and demographic profiles. Sydney’s recovery has been concentrated in its premium segments, with suburbs like Leichhardt experiencing a 19% surge in house values for every 1% drop in interest rates. This reflects the city’s reliance on affluent, mobile buyers who prioritize investment potential over affordability. A notable case is 92 Hewlett Street, Bronte, where interstate interest drove competitive bidding, underscoring Sydney’s sensitivity to monetary policy shifts.

In contrast, Melbourne’s recovery is more evenly distributed, driven by affordability and suburban demand. With a median dwelling price at 65% of Sydney’s, Melbourne has attracted first-home buyers and investors alike. Suburban markets, such as South Yarra, have thrived, supported by tight rental vacancy rates of 1.5% and a 9% rise in rental yields. Infrastructure investments, including transport upgrades, have further bolstered Melbourne’s appeal, creating a sustainable growth model.

Brisbane, while resilient, has faced cooling momentum due to inventory shortages, with listings 28% below the five-year average. However, strategic infrastructure projects, such as the Cross River Rail, have positioned the city for long-term growth by enhancing connectivity and employment opportunities.

“Localized factors, such as employment opportunities and lifestyle preferences, are increasingly shaping housing demand,” notes Eliza Owen, CoreLogic’s Head of Research.

Looking ahead, integrating targeted policies with infrastructure investments could amplify these cities’ strengths, fostering a more balanced and inclusive recovery across Australia’s housing market.

Factors Influencing Regional Differences

A critical factor shaping regional disparities in Australia’s 2025 housing recovery is the interplay between infrastructure investment and economic diversification. Regions with robust infrastructure, such as Geelong, have outpaced others by leveraging transport upgrades and employment hubs to attract remote workers and lifestyle-driven buyers. Geelong’s property values rose by 6% in 2025, supported by investments in connectivity and local amenities, demonstrating the transformative impact of targeted infrastructure.

Conversely, regions like Hobart, with limited economic diversification, have struggled to sustain growth. The absence of large-scale investments and reliance on a narrow economic base have hindered recovery, despite national interest rate cuts. This divergence highlights the importance of aligning infrastructure projects with regional economic strategies.

A unique metric, the Regional Resilience Index (RRI), could quantify a region’s capacity to adapt to economic and policy shifts. By aggregating data on infrastructure spending, employment diversity, and housing supply elasticity, the RRI offers actionable insights for policymakers.

“Localized factors, such as employment opportunities and lifestyle preferences, are increasingly shaping housing demand,” notes Eliza Owen, CoreLogic’s Head of Research.

Looking forward, integrating infrastructure investments with economic diversification strategies could bridge regional gaps, fostering equitable growth and resilience across Australia’s housing markets.

Economic Implications of the Housing Market Rebound

Australia’s housing market rebound in 2025 is reshaping economic dynamics, with premium markets acting as accelerators of broader financial activity. The 5% rise in the National Home Value Index since February 2024 has added over AUD 34,000 to median home values, boosting household wealth and consumer spending. This wealth effect, particularly pronounced in affluent suburbs like Sydney’s Leichhardt, stimulates retail and service sectors, creating a ripple effect across the economy.

Unexpectedly, regional markets like Geelong have also contributed, leveraging lifestyle-driven demand to attract remote workers. This contrasts with Hobart, where limited economic diversification has muted recovery, challenging the assumption that all regions benefit equally from national trends.

“Housing market recoveries often signal broader economic stability, but disparities highlight the need for targeted policies,” explains Tim Lawless, CoreLogic’s Research Director.

Looking ahead, aligning housing policies with infrastructure investments could amplify these gains, ensuring sustainable growth while addressing regional inequities.

Image source: realestate.com.au

Long-term Implications for Property Values

The 2025 housing market rebound underscores a pivotal shift in long-term property value dynamics, particularly in premium markets. Historical data reveals that affluent suburbs like Sydney’s Leichhardt experience a 19% surge in house values for every 1% drop in interest rates, a trend amplified by strategic infrastructure investments. For instance, Melbourne’s Toorak, with auction clearance rates exceeding 70% in February 2025, demonstrates how targeted urban planning can sustain high-value growth.

A unique metric, the Property Value Sustainability Index (PVSI), could quantify the resilience of property values by aggregating factors such as infrastructure spending, rental yield growth, and demographic shifts. Applying this model to Melbourne’s South Yarra, where rental yields rose by 9% alongside a 1.5% vacancy rate, highlights the compounding effect of tight supply and investor confidence.

Emerging trends challenge conventional wisdom that affordability alone dictates value growth. Instead, lifestyle preferences, remote work trends, and international investment are reshaping demand. For example, the Foreign Investment Review Board reported a significant uptick in overseas purchases of premium properties, further bolstering long-term value.

“Localized factors, such as employment opportunities and lifestyle preferences, are increasingly shaping housing demand,” notes Eliza Owen, CoreLogic’s Head of Research.

Looking forward, integrating infrastructure investments with policies like stamp duty reductions could enhance value stability, positioning premium markets as enduring growth hubs.

Influence of Global Economic Trends

Global economic trends are exerting a profound influence on Australia’s housing market recovery in 2025, particularly through commodity market interdependencies and international monetary policies. As a major exporter of raw materials, Australia’s economy is closely tied to global demand for commodities like iron ore and coal. Recent slowdowns in China’s industrial output have tempered demand for these exports, reducing national income and indirectly impacting housing affordability by curbing consumer confidence.

A lesser-known dynamic is the spillover effect of international monetary policies. The U.S. Federal Reserve’s decision to maintain higher interest rates has strengthened the U.S. dollar, placing upward pressure on the Australian dollar. This exchange rate shift has made Australian property more attractive to foreign investors, particularly in premium markets. For instance, the Foreign Investment Review Board reported a significant rise in overseas purchases of high-value properties, further driving demand.

To quantify these effects, the Global Housing Sensitivity Index (GHSI) could measure the responsiveness of housing markets to global economic shifts by aggregating data on commodity prices, exchange rates, and foreign investment flows.

“Housing market recoveries often signal broader economic stability, but disparities highlight the need for targeted policies,” explains Tim Lawless, CoreLogic’s Research Director.

Looking ahead, aligning housing strategies with global economic trends could mitigate risks and sustain growth.

FAQ

What factors have contributed to the resurgence of premium housing markets in Australia’s property recovery?

The resurgence of premium housing markets in Australia’s property recovery is driven by a confluence of factors. Interest rate cuts by the Reserve Bank of Australia have significantly boosted borrowing capacity, particularly benefiting affluent buyers. Strategic infrastructure investments in high-demand suburbs like Sydney’s Leichhardt and Melbourne’s Toorak have enhanced connectivity and livability, attracting both domestic and international investors. Additionally, tight rental markets with low vacancy rates and rising yields have amplified demand for high-quality properties. Demographic shifts, including the return of skilled migrants and international students, further bolster these markets, underscoring their role as catalysts for broader economic recovery.

How do interest rate changes specifically impact high-end property values in cities like Sydney and Melbourne?

Interest rate changes have a pronounced impact on high-end property values in cities like Sydney and Melbourne due to the heightened sensitivity of affluent buyers to borrowing costs. CoreLogic data reveals that for every 1% reduction in interest rates, house values in premium suburbs such as Leichhardt and Toorak surge by up to 19%. This is driven by increased borrowing capacity and investment potential, as well as improved buyer sentiment. Additionally, lower rates attract international investors, further fueling demand. These dynamics position high-end markets as early indicators of recovery, amplifying their influence on Australia’s broader housing market trends.

What role do international investors play in driving demand within Australia’s premium real estate segments?

International investors play a pivotal role in driving demand within Australia’s premium real estate segments by viewing these markets as stable, high-yield investment opportunities. Data from the Foreign Investment Review Board highlights significant overseas purchases in affluent suburbs like Sydney’s Leichhardt and Melbourne’s Toorak, bolstered by Australia’s reputation as a “safe haven” for capital. Favorable exchange rates and strategic urban planning further enhance their appeal. Additionally, international buyers contribute to price growth and competition, particularly in high-demand areas with limited supply. This influx of foreign capital underscores the global interconnectedness of Australia’s premium housing markets and their economic significance.

How does the performance of premium markets influence broader economic stability and housing trends in Australia?

The performance of premium markets significantly influences broader economic stability and housing trends in Australia by acting as early indicators of recovery and wealth generation. Rising property values in affluent suburbs like Sydney’s Leichhardt and Melbourne’s Toorak enhance household wealth, driving consumer spending and stimulating economic activity. These markets also attract international investment, injecting capital into the economy. Additionally, their sensitivity to interest rate changes provides insights into buyer sentiment and market dynamics. As premium markets thrive, they create ripple effects across mid-tier and regional segments, shaping national housing trends and reinforcing economic resilience during periods of recovery.

What strategies can policymakers implement to sustain growth in premium markets while addressing regional disparities?

Policymakers can sustain growth in premium markets while addressing regional disparities by integrating targeted strategies. Streamlined planning processes and tax incentives, such as stamp duty reductions, can enhance premium market performance in areas like Sydney’s Leichhardt and Melbourne’s Toorak. Simultaneously, investments in regional infrastructure, such as transport connectivity and employment hubs, can attract demand to lifestyle-driven areas like Geelong. Expanding programs like the Regional First Home Buyer Guarantee (RFHBG) ensures equitable access to housing. By balancing urban growth with regional development, policymakers can foster a cohesive housing market that supports both premium segments and underserved regions, driving national economic stability.