Australia’s Best Cities for Property Investment in 2025 – Where to Buy Now

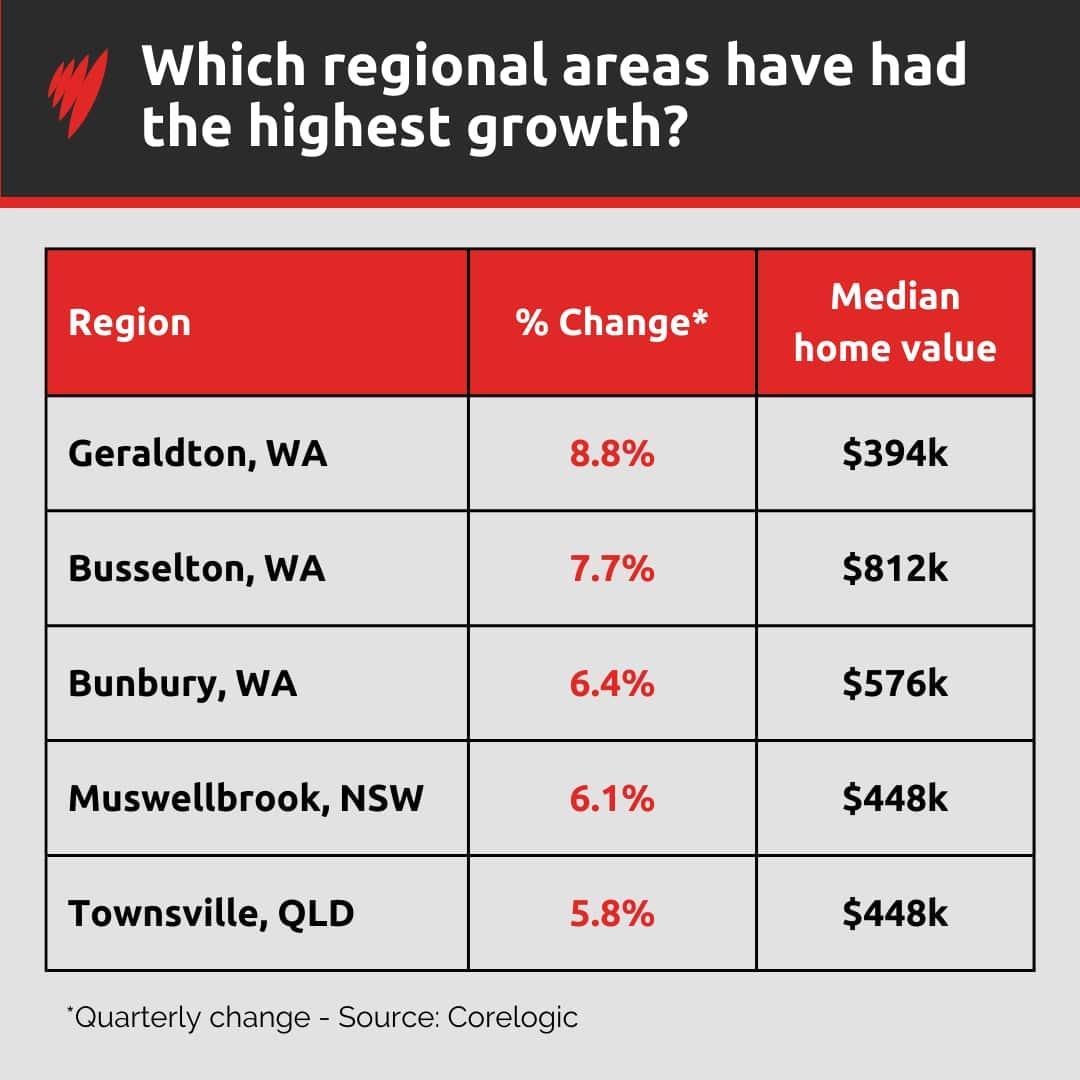

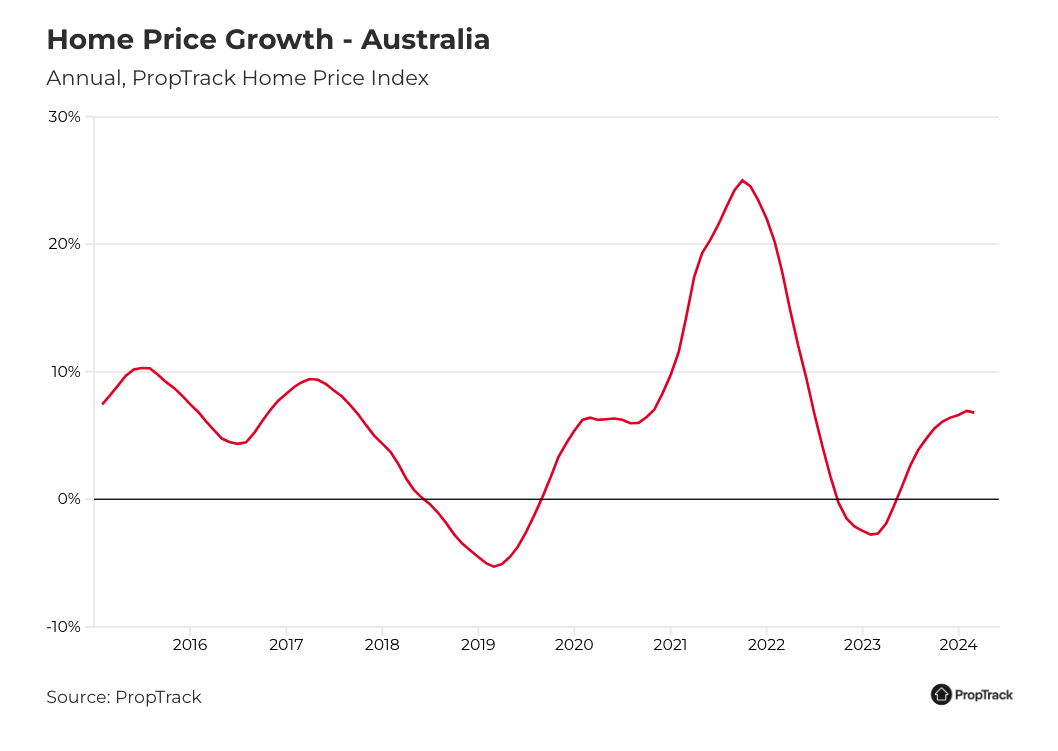

In 2024, Geraldton in Western Australia recorded an extraordinary 25% annual growth in property values, a figure that outpaced even the most optimistic forecasts. This surge wasn’t an isolated anomaly but part of a broader recalibration in Australia’s property market, where regional centers like Gladstone and Townsville are emerging as formidable contenders to traditional capital city dominance. The drivers are clear: infrastructure investments, lifestyle appeal, and affordability are drawing both investors and residents away from metropolitan hubs. Meanwhile, cities like Brisbane and Adelaide are leveraging their economic stability and relative affordability to attract a new wave of property buyers, positioning themselves as the next growth engines. These shifts are not just reshaping the market but redefining the criteria for what makes a city “investable.” For those looking to navigate this evolving landscape, understanding the interplay of local dynamics and national trends is no longer optional—it’s essential.

Image source: sbs.com.au

Understanding the Australian Property Market

A critical yet underexplored aspect of the Australian property market is the role of infrastructure-led growth in shaping investment hotspots. Cities like Perth and Brisbane exemplify how targeted infrastructure investments—such as the expansion of transport networks and urban renewal projects—can catalyze property value appreciation. For instance, Brisbane’s Cross River Rail project has not only enhanced connectivity but also spurred demand in previously overlooked suburbs, driving both rental yields and capital growth.

Moreover, the interplay between demographic shifts and housing demand deserves attention. Regional centers, bolstered by population growth and remote work trends, are increasingly outperforming traditional urban markets. Gladstone’s rise, fueled by its proximity to industrial hubs and lifestyle appeal, highlights how non-metropolitan areas can deliver robust returns when aligned with economic drivers.

Challenging conventional wisdom, the focus on affordability as the sole determinant of growth overlooks the nuanced impact of government policies. Investor-friendly tax incentives in Adelaide, for example, have created a balanced growth trajectory, even in a market with moderate price movements.

For investors, adopting a data-driven approach—analyzing infrastructure plans, demographic trends, and policy frameworks—offers a strategic edge. This framework not only mitigates risks but also positions portfolios to capitalize on emerging opportunities in 2025 and beyond.

Key Factors Influencing Property Investment

One pivotal yet often overlooked factor in property investment is the impact of employment hubs on long-term growth. Proximity to major employment centers not only drives demand for housing but also stabilizes rental yields. For example, the Sunshine Coast’s Maroochydore CBD development has transformed the area into a thriving economic zone, attracting both businesses and residents. This has led to a surge in property values and rental demand, showcasing how employment-driven infrastructure can anchor sustainable growth.

Another critical consideration is the role of environmental resilience. As climate change intensifies, properties in flood-prone or bushfire-affected areas face increased insurance costs and reduced buyer interest. Investors are now prioritizing locations with robust environmental planning, such as Brisbane’s flood mitigation projects, which enhance both safety and property appeal.

Challenging traditional metrics, lifestyle-driven migration is reshaping demand patterns. Regional areas like Ballarat and Toowoomba are benefiting from urban dwellers seeking affordability and quality of life, amplified by remote work trends. This shift underscores the importance of aligning investments with evolving demographic preferences.

To navigate these dynamics, investors should adopt a holistic evaluation framework that integrates economic, environmental, and social factors. This approach ensures adaptability to emerging trends, positioning portfolios for resilience and growth in 2025 and beyond.

Top Capital Cities for Investment

In 2025, Perth emerges as a standout among capital cities, driven by a robust mining sector, population growth, and a housing supply shortage. With forecasted growth of 14–19%, Perth’s resilience is further bolstered by urban renewal projects and strong employment figures. For instance, the city’s inner suburbs and coastal precincts are attracting investors due to gentrification potential and proximity to infrastructure upgrades.

Adelaide offers a more balanced growth trajectory, with expected increases of 8–13%. Its affordability and investor-friendly policies, such as tax incentives, make it an attractive option for those seeking stable returns. Notably, Adelaide’s consistent buyer activity since early 2024 underscores its growing appeal.

In contrast, Brisbane continues to capitalize on its infrastructure boom, including the Cross River Rail and Brisbane Metro projects. These developments are transforming connectivity and livability, driving 9–14% growth. Brisbane’s “Golden Arc,” stretching from the Gold Coast to the Sunshine Coast, exemplifies how strategic regional integration can amplify capital city performance.

These cities challenge the misconception that only Sydney and Melbourne dominate, proving that diversified economic drivers and infrastructure investments are key to sustainable growth.

Image source: starinvestment.com.au

Perth: Economic Growth and Affordability

Perth’s unique combination of economic growth and affordability positions it as a compelling investment destination in 2025. The city’s resource-driven economy, underpinned by a thriving mining sector, has catalyzed job creation and population growth. This economic momentum is further supported by government-backed infrastructure projects, such as the METRONET expansion, which enhances connectivity across key suburbs like Bayswater and Ellenbrook, driving demand for residential properties.

Affordability remains a critical factor distinguishing Perth from other capital cities. With a median house price of $797,184—significantly lower than Sydney or Melbourne—Perth offers an accessible entry point for investors. Suburbs like Scarborough and East Victoria Park exemplify areas where affordability intersects with high growth potential, thanks to proximity to employment hubs and lifestyle amenities.

A lesser-known driver of Perth’s appeal is its population growth rate, one of the highest among Australian capitals. This demographic expansion, projected to exceed 2 million by 2050, ensures sustained demand for housing. Additionally, investor-friendly policies, including stamp duty concessions for off-the-plan purchases, further incentivize market participation.

For investors, Perth’s affordability is not merely a cost advantage but a strategic opportunity to secure properties in a market poised for long-term growth. By targeting suburbs aligned with infrastructure upgrades and demographic trends, investors can maximize both rental yields and capital appreciation.

Adelaide: Infrastructure and Market Dynamics

Adelaide’s $21 billion infrastructure investment is redefining its property market by creating a synergy between urban development and economic growth. A standout feature is the integration of transport upgrades, such as the North-South Corridor project, which enhances connectivity across the city. This has spurred demand in suburbs like Tonsley and Bowden, where proximity to these upgrades is driving both residential and commercial interest.

A critical yet underappreciated factor is the role of Adelaide’s defense industry expansion, supported by infrastructure investments. The Osborne Naval Shipyard, a key hub for Australia’s defense projects, has catalyzed job creation and attracted skilled workers, increasing housing demand in nearby areas. This intersection of industrial growth and real estate underscores the importance of aligning property investments with economic drivers.

Challenging conventional wisdom, Adelaide’s market dynamics reveal that affordability alone does not dictate growth. Investor-friendly policies, such as tax incentives for new developments, have created a balanced trajectory, even in a market with moderate price movements. These policies, combined with low vacancy rates, ensure stable rental yields and long-term capital appreciation.

For investors, targeting suburbs near infrastructure projects and employment hubs offers a strategic edge. By leveraging Adelaide’s unique blend of affordability, policy support, and economic diversification, portfolios can achieve resilience and capitalize on emerging opportunities in 2025 and beyond.

Brisbane: Population Trends and Development

Brisbane’s record net interstate migration, with 84,000 new arrivals in the past year, is reshaping its property market by intensifying housing demand and driving suburban expansion. This influx, fueled by Queensland’s lifestyle appeal and employment opportunities, has particularly benefited growth corridors like North Lakes and Springfield, where infrastructure investments align with population growth. These areas are emerging as key residential hubs, offering a blend of affordability and accessibility.

A lesser-known yet pivotal factor is the role of remote work in accelerating migration trends. High-income earners from cities like Sydney and Melbourne are relocating to Brisbane, seeking larger homes and lifestyle-oriented suburbs. This shift has not only bolstered demand for premium properties but also increased rental yields in middle-ring suburbs such as Carindale and Chermside, which offer proximity to employment hubs and lifestyle amenities.

Challenging traditional urban-centric investment strategies, Brisbane’s suburban footprint is expanding rapidly, driven by infrastructure projects like the Cross River Rail and Brisbane Metro. These developments enhance connectivity, making outer suburbs more viable for long-term investment. Additionally, government incentives, such as the First Home Buyers Grant, are further stimulating market activity.

For investors, focusing on suburbs with strong infrastructure links and demographic growth offers a strategic advantage. This approach ensures alignment with Brisbane’s evolving urban dynamics, positioning portfolios for sustained growth through 2025 and beyond.

Emerging Regional Hotspots

Regional Australia is redefining property investment in 2025, with areas like Geelong, Ballarat, and the Sunshine Coast emerging as high-growth hotspots. These regions are benefiting from a confluence of affordability, infrastructure upgrades, and lifestyle-driven migration. For instance, Geelong’s proximity to Melbourne, coupled with its expanding transport links like the Geelong Fast Rail, has positioned it as a viable alternative for urban professionals seeking lower living costs without sacrificing connectivity.

A surprising driver of growth is the rise of remote work, which has amplified demand in lifestyle-centric areas such as the Sunshine Coast. Here, the Maroochydore CBD development is transforming the region into a thriving economic hub, attracting both businesses and residents. This shift challenges the misconception that regional areas lack employment opportunities, as these hubs increasingly rival metropolitan centers.

Additionally, Ballarat’s integration into Victoria’s regional rail network has spurred population growth, with rental yields climbing steadily. Investors targeting these regions can leverage their affordability and infrastructure-led growth to secure properties with strong long-term potential. By aligning investments with these emerging dynamics, portfolios can capitalize on the evolving regional landscape.

Image source: bluekeybuyersagents.com.au

Gold Coast and Sunshine Coast: Lifestyle Appeal

The Gold Coast and Sunshine Coast exemplify how lifestyle-driven migration is reshaping property markets, but their appeal extends beyond beaches and leisure. A critical yet underexplored factor is the role of infrastructure integration in enhancing liveability and investment potential. For example, the Gold Coast Light Rail extension has not only improved connectivity within the region but also linked it seamlessly to Brisbane, making it a viable option for commuters and remote workers alike. This infrastructure synergy drives demand for properties in suburbs like Southport and Broadbeach, where rental yields reach 4.8% and 3.9%, respectively.

On the Sunshine Coast, the Maroochydore CBD redevelopment is a game-changer, positioning the area as Australia’s newest urban hub. This project integrates commercial, residential, and technological spaces, attracting businesses and high-income professionals. Lesser-known but equally impactful is the Sunshine Coast Airport expansion, which enhances accessibility for both domestic and international markets, boosting tourism and short-term rental demand.

Challenging the notion that lifestyle regions lack economic diversity, both coasts benefit from robust healthcare, education, and technology sectors. For investors, targeting suburbs aligned with these developments—such as Robina on the Gold Coast or Caloundra on the Sunshine Coast—offers a strategic edge. By leveraging these regions’ unique blend of lifestyle and infrastructure, portfolios can achieve both stability and growth in 2025 and beyond.

Geraldton, Gladstone, and Townsville: High Growth Potential

A pivotal yet underappreciated driver of growth in Geraldton, Gladstone, and Townsville is the synergy between industrial expansion and housing demand. These regions are leveraging their proximity to resource-rich areas and infrastructure projects to create sustainable property market growth. For instance, Geraldton’s thriving mining sector, coupled with its port upgrades, has not only boosted employment but also driven a 32.2% annual increase in property values, as reported by CoreLogic.

In Gladstone, the LNG and renewable energy sectors are transforming the local economy. The city’s industrial diversification, including hydrogen production initiatives, is attracting skilled workers, increasing demand for housing. This aligns with the 27.2% annual growth in dwelling values, highlighting the interplay between economic drivers and real estate performance.

Townsville’s strategic focus on urban renewal, such as developments around the Townsville University Hospital and the Port of Townsville expansion, underscores the importance of aligning property investments with employment hubs. These projects enhance liveability and stabilize rental yields, with suburbs like Douglas offering yields of 5.5%.

Investors should adopt a sector-aligned strategy, targeting areas where industrial growth intersects with infrastructure upgrades. By focusing on suburbs near employment centers and transport links, portfolios can capitalize on these regions’ unique blend of affordability and economic momentum, ensuring resilience and long-term returns.

Investment Strategies and Considerations

A data-driven approach is essential for navigating Australia’s evolving property market in 2025. Investors should prioritize regions where infrastructure projects align with economic growth. For example, Brisbane’s Cross River Rail has catalyzed demand in suburbs like Woolloongabba, where property values rose by 12% in 2024, according to CoreLogic. This demonstrates how infrastructure can transform overlooked areas into high-growth zones.

Challenging the misconception that affordability alone drives returns, policy incentives play a critical role. Adelaide’s tax concessions for new developments have created stable rental yields, even in a market with moderate price growth. This highlights the importance of evaluating government policies alongside market fundamentals.

Investors often overlook the impact of environmental resilience. Properties in flood-mitigated areas of Brisbane, such as Milton, have seen increased buyer interest, reflecting a growing preference for climate-adaptive investments.

To maximize returns, adopt a holistic evaluation framework that integrates infrastructure, policy, and environmental factors. This strategy not only mitigates risks but also positions portfolios to capitalize on emerging opportunities, ensuring long-term resilience and growth.

Image source: realestate.com.au

Sustainability and Smart Homes

The integration of smart home technology with sustainable design is revolutionizing property investment by enhancing both environmental performance and market appeal. Features such as energy-efficient lighting, solar panels, and smart thermostats not only reduce operational costs but also align with growing consumer demand for eco-conscious living. According to the Australian Housing Outlook, energy-efficient homes are valued 5–10% higher than comparable properties, underscoring their financial viability.

A lesser-known factor driving this trend is the role of data analytics in optimizing energy use. Smart systems can monitor consumption patterns, enabling homeowners to reduce waste and lower utility bills. For instance, properties equipped with AI-driven energy management systems have reported up to 30% reductions in energy costs, making them attractive to both buyers and tenants.

Challenging traditional investment metrics, the resale value of smart homes is increasingly tied to their sustainability credentials. Green Star-certified properties, for example, command higher premiums due to their lower environmental impact and enhanced occupant well-being.

Investors should focus on developments incorporating these technologies, particularly in regions with government incentives for green upgrades. By targeting properties that combine sustainability with smart innovations, portfolios can achieve resilience while meeting the demands of a rapidly evolving market.

Impact of Government Policies

The zoning and planning regulations introduced by Australian governments are reshaping property investment strategies by directly influencing housing supply and market dynamics. For instance, fast-tracking approvals for high-density developments in urban centers like Brisbane has mitigated supply constraints, stabilizing property prices while accommodating population growth. This approach demonstrates how targeted regulatory interventions can balance affordability with market demand.

A lesser-known yet critical factor is the impact of foreign investment restrictions. Policies limiting foreign ownership of established dwellings have redirected overseas capital toward new developments, stimulating construction activity in regions like Melbourne’s outer suburbs. This has not only bolstered local economies but also created opportunities for investors to capitalize on emerging markets with high growth potential.

Challenging conventional wisdom, environmental and building standards mandated by government policies are increasingly seen as value drivers rather than cost burdens. Properties adhering to these standards, such as those incorporating energy-efficient designs, often command higher premiums and attract environmentally conscious buyers.

To navigate these complexities, investors should adopt a policy-aligned strategy, focusing on regions where regulatory frameworks support long-term growth. By leveraging insights into zoning changes, foreign investment trends, and sustainability mandates, portfolios can achieve resilience and capitalize on evolving market conditions.

Risk Management and Portfolio Diversification

A critical yet underutilized strategy in property investment is cross-sector diversification, which involves allocating capital across residential, commercial, and industrial properties. This approach mitigates sector-specific risks, such as economic downturns disproportionately affecting one asset class. For example, during the COVID-19 pandemic, industrial properties, particularly logistics hubs, outperformed other sectors due to the surge in e-commerce demand, highlighting the resilience of diversified portfolios.

A lesser-known but impactful factor is geographic diversification. By investing in properties across multiple states or regions, investors can shield their portfolios from localized economic shocks or policy changes. For instance, while Sydney faced stagnation in 2024 due to affordability constraints, regional markets like Ballarat and Geelong experienced robust growth driven by infrastructure upgrades and lifestyle migration.

Challenging conventional wisdom, dynamic asset allocation—adjusting portfolio composition based on market cycles—has proven effective in optimizing returns. Research from the Pacific Rim Property Research Journal demonstrates that portfolios incorporating industrial properties during economic expansions and residential assets during contractions achieve superior risk-adjusted performance.

To implement these strategies, investors should adopt a data-driven framework, leveraging tools like predictive analytics to identify emerging trends. This proactive approach ensures adaptability, enabling portfolios to capitalize on evolving market conditions while maintaining resilience.

FAQ

What are the top cities in Australia for property investment in 2025 and why?

Perth, Brisbane, and Adelaide stand out as top cities for property investment in 2025. Perth benefits from a thriving mining sector, population growth, and urban renewal projects, driving forecasted growth of 14–19%. Brisbane leverages major infrastructure developments like the Cross River Rail and Brisbane Metro, alongside strong interstate migration, to achieve 9–14% growth. Adelaide offers balanced growth (8–13%) through affordability, investor-friendly policies, and defense industry expansion. These cities exemplify how economic drivers, infrastructure upgrades, and demographic trends converge to create high-growth opportunities, challenging the dominance of Sydney and Melbourne in Australia’s property market.

How do infrastructure projects influence property values in Australian cities?

Infrastructure projects significantly enhance property values by improving connectivity, accessibility, and economic activity in Australian cities. Developments like Brisbane’s Cross River Rail and Perth’s METRONET expansion transform overlooked suburbs into high-demand areas, driving both rental yields and capital growth. Adelaide’s North-South Corridor project exemplifies how transport upgrades attract residential and commercial interest. Additionally, projects such as the Maroochydore CBD redevelopment on the Sunshine Coast integrate lifestyle and economic hubs, boosting regional appeal. These initiatives align with demographic shifts and employment growth, creating sustainable demand and positioning cities with robust infrastructure as prime investment destinations in 2025.

What role do government policies play in shaping property investment opportunities in 2025?

Government policies in 2025 are pivotal in shaping property investment opportunities by influencing affordability, supply, and market stability. Tax incentives, such as Adelaide’s concessions for new developments, attract investors by ensuring stable rental yields and balanced growth. Infrastructure funding, like Brisbane’s transport upgrades, enhances property values in key suburbs. Policies promoting sustainability, including green building incentives, increase demand for energy-efficient homes. Additionally, restrictions on foreign ownership redirect capital to new developments, stimulating construction in emerging areas. These measures align with demographic trends and economic drivers, creating a favorable environment for strategic property investments across Australia’s top cities.

Which suburbs within Australia’s best cities offer the highest growth potential for investors?

Suburbs like Scarborough and East Victoria Park in Perth offer high growth potential due to affordability and proximity to employment hubs. In Brisbane, Woolloongabba and North Lakes benefit from infrastructure projects like the Cross River Rail and suburban expansion driven by interstate migration. Adelaide’s Tonsley and Bowden stand out for their connectivity to transport upgrades and economic hubs like the Osborne Naval Shipyard. Additionally, emerging suburbs such as Joondalup in Perth and Salisbury in Adelaide are gaining traction due to infrastructure improvements and population growth. These areas align with economic, demographic, and lifestyle trends, making them prime investment opportunities in 2025.

How can investors mitigate risks and diversify their portfolios in the evolving Australian property market?

Investors can mitigate risks and diversify portfolios by adopting geographic, sectoral, and asset-type diversification strategies. Geographic diversification, such as investing across Perth, Brisbane, and Adelaide, reduces exposure to localized economic shocks. Sectoral diversification, including residential, commercial, and industrial properties, balances risk and return. Incorporating sustainable and smart home technologies enhances market appeal and resilience. Leveraging data-driven tools for market analysis and aligning investments with infrastructure projects, like Brisbane’s Cross River Rail, ensures strategic positioning. Additionally, monitoring government policies and engaging professional advisors helps navigate regulatory changes, creating a robust, adaptable portfolio in Australia’s evolving property market for 2025.