Self-Managed Super Funds: The Do’s and Don’ts for Aussie Property Investors

In 2024, the Australian Taxation Office reported a surge in property investments through Self-Managed Super Funds (SMSFs), with over $135 billion allocated to real estate. This trend reflects a growing appetite among Australians to leverage their retirement savings for tangible, long-term assets. Yet, behind the allure of control and potential tax advantages lies a labyrinth of regulations, risks, and responsibilities. For instance, a Melbourne couple recently faced severe penalties after unknowingly breaching the “sole purpose test” by renting their SMSF-owned property to a relative. Such cases underscore the delicate balance between opportunity and compliance in SMSF property investment. As more Australians turn to SMSFs for property ventures, understanding the precise do’s and don’ts becomes not just prudent but essential for safeguarding both financial growth and legal standing.

Image source: assuredsupport.com.au

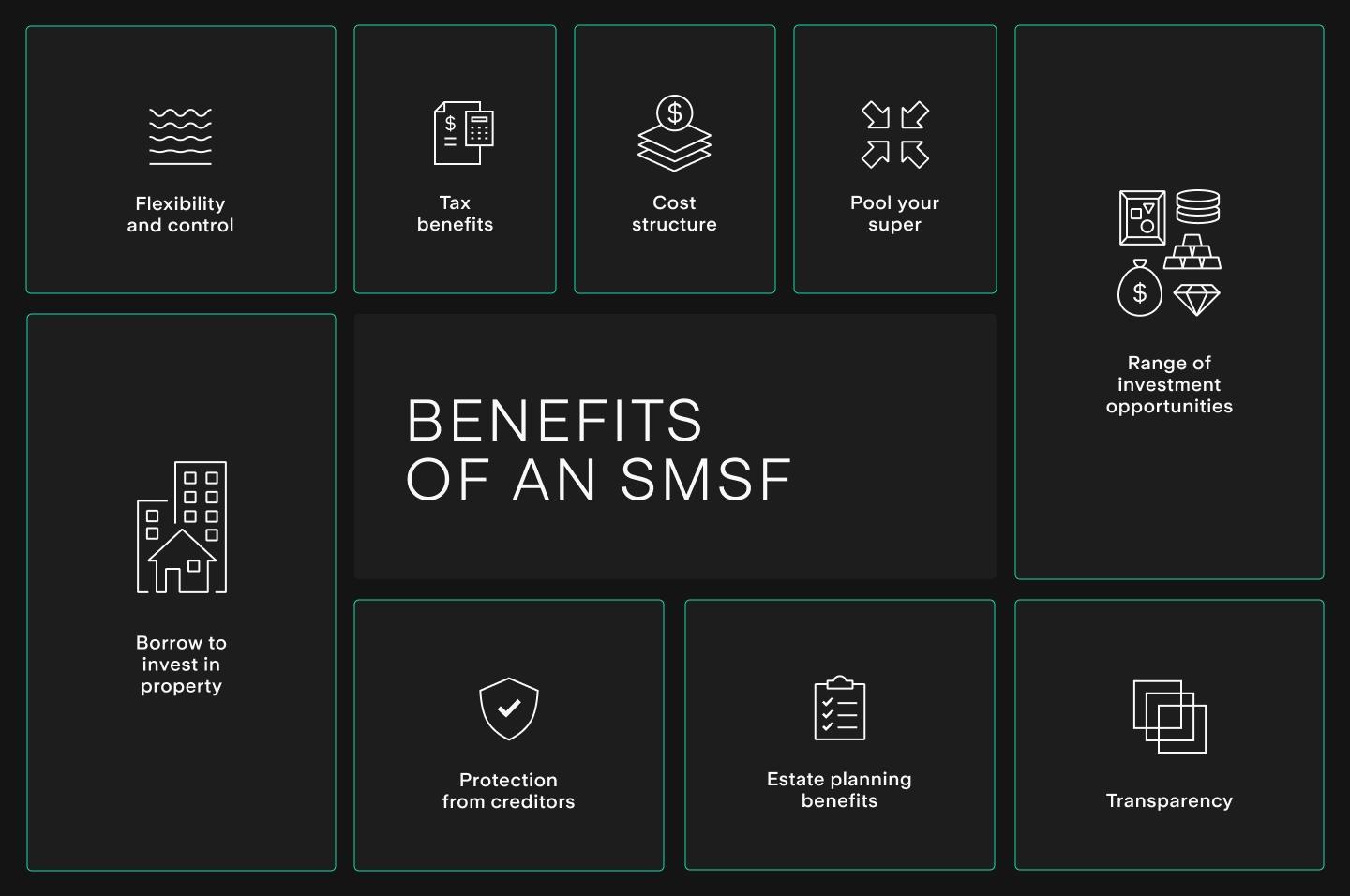

Why SMSFs Matter for Property Investors

A critical yet underexplored aspect of SMSF property investment is the strategic use of Limited Recourse Borrowing Arrangements (LRBAs). These arrangements allow SMSFs to borrow funds for property acquisition while limiting the lender’s claim to the purchased asset, safeguarding other fund assets. This mechanism not only amplifies purchasing power but also aligns with the long-term growth objectives of retirement savings.

For instance, consider a scenario where an SMSF acquires a $600,000 commercial property using $300,000 in fund assets and an LRBA for the remaining $300,000. The rental income generated can directly service the loan, creating a self-sustaining investment cycle. Additionally, commercial properties leased to related businesses at market rates offer dual benefits: stable income for the SMSF and operational cost efficiency for the business.

However, trustees must navigate compliance intricacies, such as ensuring the property adheres to the sole purpose test and avoiding over-leverage, which could strain liquidity. By integrating professional advice and robust financial modeling, investors can optimize returns while mitigating risks, setting a precedent for disciplined, growth-oriented SMSF strategies.

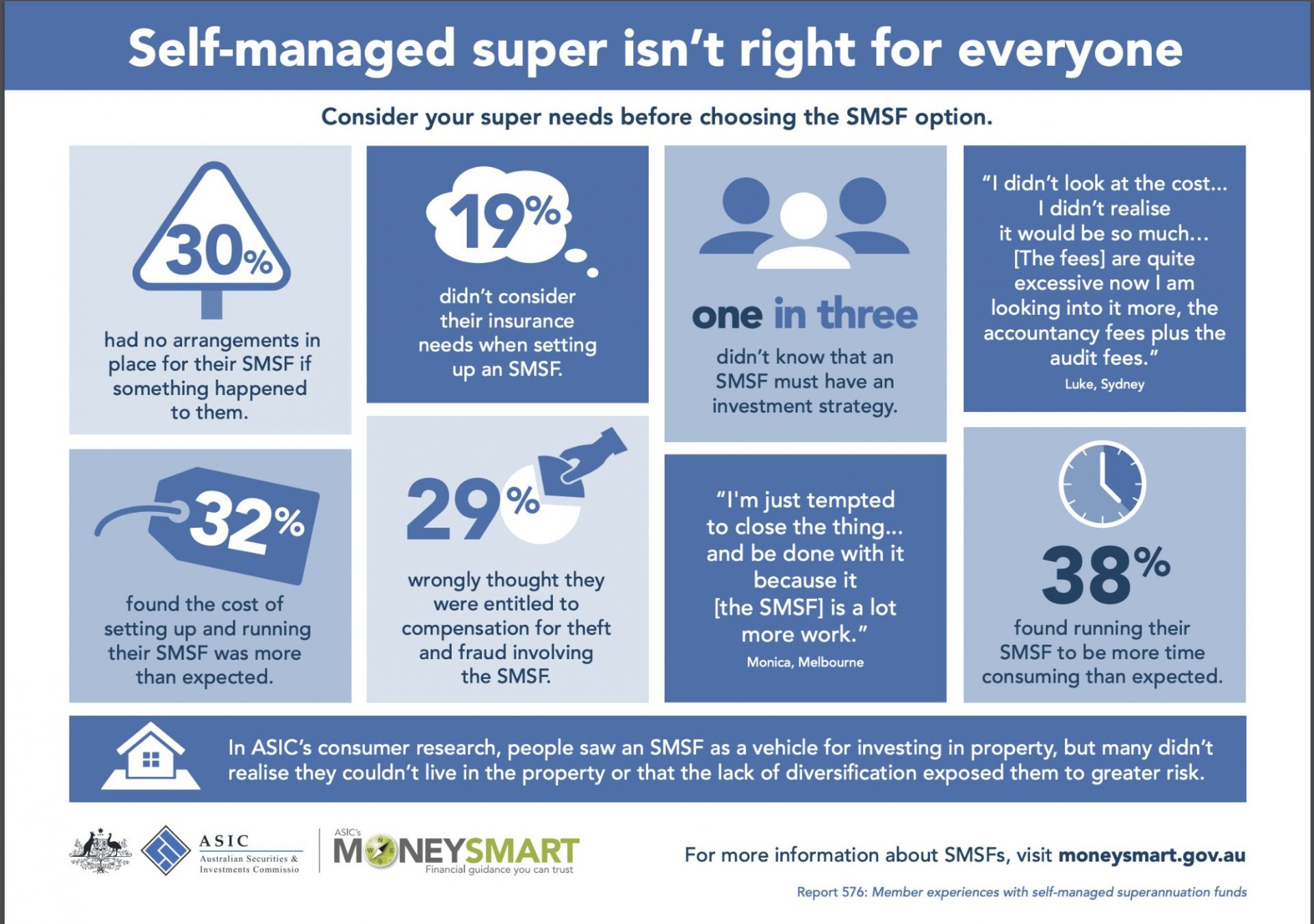

Common Misconceptions About SMSFs

One persistent misconception about SMSFs is that they are exclusively suited for high-net-worth individuals. While larger balances can enhance cost efficiency, SMSFs can also be viable for moderate balances when managed strategically. For example, pooling resources among up to four members allows for shared costs and increased investment capacity, making property acquisition more accessible.

Another overlooked factor is the flexibility SMSFs offer in tailoring investment strategies. Unlike retail funds, SMSFs enable trustees to diversify into alternative assets, such as direct property, which can provide stable, long-term returns. However, this flexibility requires trustees to possess or seek financial literacy and professional guidance to avoid compliance pitfalls.

Additionally, the belief that SMSFs are overly complex often stems from a lack of understanding of available support systems. Engaging specialized advisors, such as accountants or SMSF consultants, can simplify administrative burdens and ensure adherence to regulations like the sole purpose test.

By dispelling these myths, potential investors can better evaluate SMSFs as a tool for achieving personalized retirement goals while leveraging property investments effectively.

Key Components of an SMSF

An SMSF operates on three foundational pillars: trusteeship, compliance, and investment strategy. Each demands precision and foresight to ensure the fund’s success.

- Trusteeship: Trustees are both decision-makers and custodians, bearing full responsibility for the fund’s operations. For instance, selecting a corporate trustee structure can streamline compliance and reduce personal liability, a choice often overlooked by individual trustees.

- Compliance: Adhering to the sole purpose test is non-negotiable. A breach, such as renting a property to a relative, can result in severe penalties. Trustees must also navigate tax laws and superannuation regulations, which evolve frequently. Engaging a licensed SMSF advisor ensures alignment with these requirements.

- Investment Strategy: A robust strategy balances risk and return while meeting retirement objectives. For example, leveraging Limited Recourse Borrowing Arrangements (LRBAs) for property acquisition can amplify growth but requires careful liquidity management to avoid over-leverage.

By mastering these components, trustees can transform their SMSF into a disciplined, growth-oriented vehicle for retirement planning.

Image source: coastaladvicegroup.com.au

Trust Structures and Trustees

The choice between individual trustees and a corporate trustee structure significantly impacts an SMSF’s flexibility, compliance, and long-term viability. While individual trustees may appeal due to lower setup costs, they often introduce administrative complexities. For example, when a member exits or joins the fund, the trust deed and asset ownership records must be updated—a time-consuming and costly process.

In contrast, a corporate trustee structure offers streamlined administration. Since the company remains the trustee regardless of membership changes, asset ownership remains consistent. This structure also reduces personal liability, as legal responsibility is limited to the corporate entity. Notably, corporate trustees are particularly advantageous for SMSFs investing in property, where clear asset separation is critical to avoid compliance breaches.

A lesser-known benefit of corporate trustees is their ability to enhance audit readiness. By maintaining centralized records and consistent governance, they simplify compliance with the sole purpose test and other regulations, ensuring smoother operations and reduced risk of penalties.

Funding and Setup Costs

A critical yet underappreciated factor in SMSF setup is the initial fund balance threshold. While conventional wisdom suggests a minimum of $200,000 for cost efficiency, recent studies reveal that strategic planning can make lower balances viable. For instance, pooling resources among up to four members not only reduces individual contributions but also spreads setup and ongoing costs, enhancing affordability.

Another overlooked aspect is the non-deductibility of setup costs. As these are classified as capital expenses by the ATO, trustees must ensure sufficient liquidity to cover these upfront fees without compromising the fund’s investment capacity. This is particularly relevant when acquiring property, where additional costs like stamp duty and legal fees can strain initial resources.

To mitigate these challenges, trustees can adopt a phased funding approach, gradually increasing contributions post-setup. This strategy aligns with long-term growth objectives while maintaining compliance. Ultimately, balancing cost efficiency with robust financial planning ensures the SMSF remains a sustainable vehicle for wealth accumulation.

Crafting an Investment Strategy for Property

An effective SMSF property investment strategy hinges on aligning asset selection with retirement objectives while managing risks. A key insight is the importance of investment horizon. For instance, commercial properties often offer higher yields and longer lease terms, but they may require a longer holding period to offset initial costs like stamp duty and fit-out expenses. This contrasts with residential properties, which may provide quicker liquidity but are more susceptible to market fluctuations.

A lesser-known yet impactful approach is leveraging regional property trends. With the rise of remote work, SMSFs investing in regional areas can capitalize on lower entry costs and higher rental yields. For example, a trustee acquiring a $400,000 property in a growing regional hub could achieve a rental yield of 6%, compared to 3-4% in metropolitan areas.

To mitigate risks, trustees should integrate scenario modeling into their strategy, evaluating factors like vacancy rates and interest rate changes. This disciplined approach ensures sustainable growth while maintaining compliance.

Image source: emoneyhomeloans.com.au

Understanding Limited Recourse Borrowing Arrangements

A critical yet underexplored dimension of Limited Recourse Borrowing Arrangements (LRBAs) is their role in mitigating risk while expanding investment capacity. Unlike traditional loans, LRBAs isolate the lender’s claim to the purchased asset, safeguarding the SMSF’s remaining portfolio. This structure is particularly advantageous during market downturns, where asset devaluation could otherwise jeopardize the fund’s broader stability.

For example, an SMSF acquiring a $500,000 commercial property through an LRBA ensures that, in the event of loan default, only the property itself is at risk—not other fund assets. This protective mechanism aligns with the sole purpose test by preserving retirement savings while enabling strategic growth.

However, trustees must navigate nuanced compliance requirements. For instance, the property must qualify as a “single acquirable asset,” and any improvements must not alter its fundamental character. A common pitfall involves misclassifying repairs as improvements, potentially breaching superannuation law.

To optimize outcomes, trustees should integrate cash flow forecasting into their strategy. By projecting rental income against loan obligations, they can preempt liquidity shortfalls. Additionally, leveraging professional advice ensures alignment with both regulatory standards and long-term objectives, transforming LRBAs into a disciplined tool for sustainable property investment.

Choosing Residential vs. Commercial Property

A pivotal consideration when selecting between residential and commercial property for an SMSF is the income stability versus growth potential trade-off. Commercial properties often provide higher, more predictable rental yields due to long-term leases, typically ranging from 5-10 years. For instance, leasing a warehouse to a logistics company at market rates ensures steady cash flow, aligning with SMSF liquidity needs. Conversely, residential properties may offer stronger capital growth over time but are subject to shorter lease terms and higher tenant turnover, increasing management demands.

A lesser-known factor influencing this decision is tenant quality and market resilience. Commercial tenants, such as established businesses, often bear maintenance costs and are less likely to default compared to residential tenants. However, economic downturns can disproportionately impact commercial sectors, leaving properties vacant for extended periods.

To navigate these dynamics, trustees should employ sector-specific risk assessments. For example, investing in residential properties in high-demand urban areas may mitigate vacancy risks, while diversifying commercial investments across industries can reduce exposure to sector-specific downturns.

Ultimately, integrating these insights into a tailored investment strategy allows trustees to balance income stability with long-term growth, ensuring alignment with retirement objectives and regulatory compliance.

Compliance, Regulations, and Risk Management

Navigating SMSF compliance requires precision, as breaches can lead to severe penalties, including fund disqualification. A key challenge lies in adhering to the sole purpose test, which mandates that all investments serve retirement benefits exclusively. For example, a trustee renting an SMSF-owned property to a relative below market rates risks significant fines, as seen in recent ATO enforcement cases.

Unexpectedly, even well-intentioned actions, such as property improvements, can breach regulations if they alter the asset’s fundamental character. Trustees must distinguish between allowable repairs and prohibited enhancements, often requiring professional guidance.

Risk management extends beyond compliance to include liquidity planning. Over-concentration in property can strain cash flow, especially during market downturns. Scenario modeling—projecting rental income against potential vacancies—offers a proactive solution.

Engaging SMSF specialists ensures alignment with evolving regulations while mitigating risks. This disciplined approach transforms compliance from a burden into a framework for sustainable growth, safeguarding both financial and legal standing.

Image source: youtube.com

Audit and Reporting Obligations

A critical yet underappreciated aspect of SMSF audits is their dual role in ensuring compliance and uncovering operational inefficiencies. The annual audit, mandated by the Superannuation Industry (Supervision) Act 1993 (SISA), comprises two components: a financial audit and a compliance audit. While the former verifies the fund’s financial statements, the latter ensures adherence to superannuation laws, such as the sole purpose test.

One overlooked factor is the importance of maintaining a robust audit trail. For instance, trustees must retain records of all transactions, meeting minutes, and investment decisions for at least five years. Failure to do so can complicate audits and attract penalties. Engaging a qualified SMSF auditor early in the financial year can preemptively identify compliance gaps, reducing the risk of costly errors.

Additionally, trustees often underestimate the value of integrating technology, such as cloud-based accounting platforms, to streamline reporting. These tools not only simplify record-keeping but also enhance transparency, enabling auditors to efficiently verify data.

By viewing audits as a strategic tool rather than a regulatory burden, trustees can foster better governance, ensuring both compliance and long-term fund sustainability.

Strategies to Mitigate Investment Risks

A focused strategy to mitigate SMSF investment risks involves dynamic scenario modeling. This approach evaluates potential outcomes under varying market conditions, enabling trustees to anticipate and address vulnerabilities. For example, modeling the impact of a 2% interest rate hike on cash flow can reveal liquidity gaps, prompting adjustments such as increasing rental yields or diversifying income streams.

Another effective tactic is sectoral diversification. While property investments dominate many SMSFs, integrating assets like exchange-traded funds (ETFs) or fixed-income products can buffer against property market downturns. For instance, allocating 20% of the fund to high-yield bonds can stabilize returns during periods of property vacancy.

A lesser-known yet impactful method is stress testing. By simulating extreme scenarios—such as prolonged tenant vacancies or sudden regulatory changes—trustees can identify weaknesses in their investment strategy. This proactive approach ensures the fund remains resilient under adverse conditions.

Finally, leveraging professional risk assessments from SMSF advisors provides tailored insights. These experts can align risk mitigation strategies with the fund’s long-term objectives, ensuring compliance while optimizing growth potential. Adopting these frameworks positions trustees for sustainable, risk-adjusted returns.

Advanced Tax and Estate Planning Considerations

Integrating tax efficiency with estate planning in SMSFs requires a nuanced approach. For instance, the introduction of the 15% additional tax on earnings above $3 million (effective 2025-26) necessitates proactive strategies like segregating high-growth assets into lower-taxed structures. This ensures compliance while preserving wealth.

A critical yet overlooked aspect is the binding death benefit nomination (BDBN). Without a valid BDBN, trustees risk disputes over fund distribution, as seen in high-profile legal cases. Regularly reviewing BDBNs ensures alignment with evolving family dynamics and tax laws.

Unexpectedly, intergenerational wealth transfer can trigger unintended tax liabilities. For example, transferring property to non-dependent beneficiaries may incur capital gains tax (CGT). Structuring assets through testamentary trusts mitigates this risk, offering both tax efficiency and asset protection.

By combining expert advice with tailored strategies, trustees can harmonize tax obligations with long-term estate goals, safeguarding both compliance and legacy.

Image source: hellostake.com

Leveraging Tax Concessions and Franking Credits

A strategic yet underutilized approach in SMSFs involves optimizing franking credits to reduce tax liabilities and enhance cash flow. Franking credits, representing tax already paid by companies on distributed profits, can offset SMSF tax obligations or even result in refunds when credits exceed the fund’s taxable income. This is particularly advantageous during the pension phase, where the SMSF tax rate drops to 0%, allowing the full value of franking credits to be refunded.

For example, an SMSF holding $500,000 in fully franked Australian shares could receive $21,429 in dividends with $9,184 in franking credits. If the fund has no other taxable income, the ATO refunds the full $9,184, effectively boosting returns.

A lesser-known factor is the timing of asset sales to align with concessional tax rates. Selling shares during the pension phase can eliminate capital gains tax (CGT), amplifying the benefits of franking credits. However, trustees must navigate the 45-day holding rule to qualify for credits, ensuring compliance.

Integrating franking credits with broader tax strategies, such as offsetting rental income or concessional contributions tax, creates a compounding effect. By leveraging professional advice, trustees can unlock these benefits, transforming tax concessions into a cornerstone of sustainable SMSF growth.

Ensuring Smooth Estate Transfers

A critical yet underexplored aspect of estate transfers in SMSFs is the use of non-lapsing binding death benefit nominations (BDBNs) to ensure assets are distributed according to the member’s wishes. Unlike standard wills, SMSF assets are not automatically covered under estate law, making a valid BDBN essential for avoiding disputes and delays.

For instance, a trustee with a $1.2 million SMSF portfolio can direct specific allocations to dependents through a BDBN, bypassing potential legal challenges. However, trustees must ensure the nomination complies with the SMSF trust deed and is regularly reviewed to reflect changes in family dynamics or tax laws.

A lesser-known yet impactful strategy involves integrating reversionary pensions. By nominating a spouse as the reversionary beneficiary, the pension continues seamlessly upon the member’s death, preserving tax advantages and avoiding the need for asset liquidation. This approach is particularly effective for property-heavy SMSFs, where selling assets could trigger capital gains tax (CGT) liabilities.

To mitigate risks, trustees should combine these tools with professional estate planning advice, ensuring compliance and alignment with long-term objectives. By proactively addressing these complexities, SMSF members can safeguard their legacy while minimizing tax and legal complications for beneficiaries.

FAQ

What are the key compliance requirements for property investment through a Self-Managed Super Fund (SMSF)?

SMSF property investments must strictly adhere to the sole purpose test, ensuring all assets serve retirement benefits exclusively. Transactions must comply with arm’s length rules, prohibiting personal use or below-market dealings with related parties. Trustees must maintain accurate records, including financial statements and investment decisions, to meet annual audit and ATO reporting obligations. Property acquisitions must align with the SMSF’s investment strategy, balancing risk and return. Additionally, improvements to properties must not alter their fundamental character, avoiding breaches of superannuation law. Engaging SMSF specialists ensures compliance with the Superannuation Industry (Supervision) Act 1993 and related regulations.

How does the sole purpose test impact SMSF property investment strategies?

The sole purpose test mandates that SMSF property investments exclusively provide retirement benefits, prohibiting personal or related-party use. This requirement shapes strategies by ensuring properties generate market-rate income or long-term capital growth. Trustees must avoid conflicts of interest, such as renting to relatives, and document all decisions to demonstrate compliance. Investment strategies must align with fund objectives, balancing liquidity and risk while adhering to superannuation laws. Breaching the test can result in severe penalties, including fund disqualification. Professional advice helps trustees navigate these regulations, ensuring property investments remain compliant and aligned with retirement-focused goals.

What are the advantages and risks of using Limited Recourse Borrowing Arrangements (LRBAs) for SMSF property purchases?

LRBAs enable SMSFs to acquire high-value properties while protecting other fund assets, as lenders can only claim the purchased asset in case of default. This structure enhances diversification and accelerates portfolio growth, aligning with long-term retirement goals. Additionally, holding properties for over 12 months unlocks capital gains tax concessions. However, LRBAs carry risks, including higher interest rates, strict lending criteria, and potential liquidity strain if rental income falls short. Trustees must ensure compliance with superannuation laws, such as the single acquirable asset rule, and integrate cash flow forecasting to mitigate risks. Professional guidance ensures strategic and compliant implementation.

How can SMSF trustees balance liquidity needs with long-term property investment goals?

Trustees can balance liquidity and long-term goals by integrating diversified assets, such as cash or fixed-income products, alongside property investments. Scenario modeling helps anticipate cash flow needs for expenses like loan repayments, taxes, and pension payments. Adopting a phased funding approach ensures sufficient liquidity during property acquisition while maintaining compliance with SMSF regulations. Rental income should align with loan obligations to create a self-sustaining investment cycle. Regularly reviewing the investment strategy ensures adaptability to market changes or member transitions. Engaging SMSF advisors provides tailored solutions, optimizing liquidity management while achieving sustainable growth aligned with retirement objectives.

What are the tax implications and estate planning considerations for SMSF-owned properties?

SMSF-owned properties benefit from concessional tax rates, with rental income taxed at 15% and capital gains at 10% if held over 12 months. In the pension phase, both become tax-free, maximizing retirement income. Estate planning requires binding death benefit nominations (BDBNs) to ensure assets bypass disputes and align with member wishes. Reversionary pensions preserve tax advantages and prevent forced asset liquidation, particularly for property-heavy funds. Trustees must consider potential capital gains tax liabilities when transferring properties to non-dependents. Professional advice ensures compliance with tax laws and optimizes estate strategies, safeguarding both financial legacy and fund integrity.