Can’t Save a 20% Deposit? Aussie First Home Buyer Hacks to Get in Faster

In Australia’s housing market, where saving for a 20% deposit feels as achievable as winning the lottery, the dream of homeownership is slipping further out of reach for many. But what if the 20% rule isn’t the unbreakable law it’s made out to be? While skyrocketing property prices and stagnant wages dominate headlines, a quiet revolution is reshaping how first-home buyers approach the game.

Could the key to owning your first home lie in strategies that challenge conventional wisdom? Let’s explore the hacks, loopholes, and fresh opportunities that might just fast-track your way to the front door.

Image source: bankrate.com

The Rising Challenge of Home Deposits

As property prices outpace wage growth, the traditional 20% deposit feels increasingly unattainable. In 2024, Australian property prices surged by 7.5%, while wages lagged behind, creating a widening affordability gap. Yet, focusing solely on saving more may be a flawed strategy.

Consider this: buyers who acted during market dips saved up to 10% on property prices, proving that timing can trump prolonged savings. Additionally, leveraging government schemes like the First Home Guarantee Scheme can slash deposit requirements by 15%, opening doors faster.

The real challenge isn’t just saving—it’s knowing when and how to act in a volatile market.

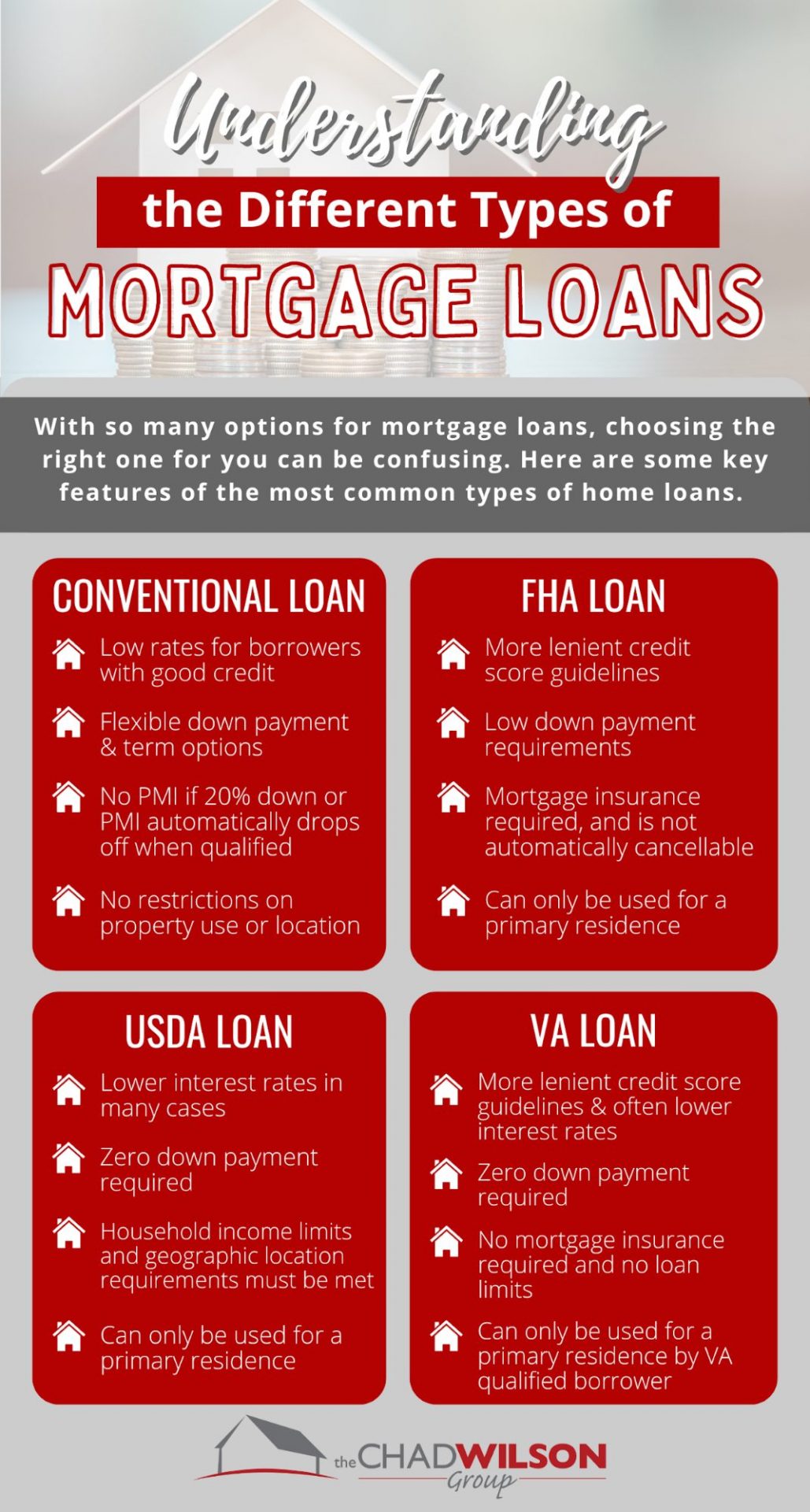

Breaking Down the 20% Myth

The 20% deposit rule is more tradition than necessity, and modern lending options prove it. For instance, government-backed loans like the First Home Guarantee allow buyers to secure a property with as little as 5% deposit, bypassing Lenders Mortgage Insurance (LMI) entirely. This not only reduces upfront costs but also accelerates entry into the market.

Interestingly, smaller deposits can even work strategically in rising markets, where property appreciation outpaces savings growth. By acting sooner, buyers build equity faster. The key? Understanding your eligibility and leveraging tools like deposit calculators to map out a clear, actionable path to ownership.

Government Schemes and Grants

Government schemes like the First Home Guarantee (FHBG) are game-changers, letting eligible buyers secure a home with just a 5% deposit—no Lenders Mortgage Insurance (LMI) needed. For example, in FY2024-25, 35,000 FHBG places are available, helping Australians fast-track homeownership.

But here’s the twist: these schemes aren’t just for first-timers. Some, like the Family Home Guarantee, support single parents re-entering the market with as little as 2% deposit. Misconception? Many think these programs are cash handouts—they’re not. Instead, they reduce barriers, making ownership realistic. The takeaway? Explore eligibility early and act fast—places fill quickly!

Image source: soho.com.au

Understanding the First Home Guarantee Scheme

The First Home Guarantee Scheme (FHBG) isn’t just about smaller deposits—it’s about strategic timing. By guaranteeing up to 15% of a loan, it eliminates the need for LMI, saving buyers thousands. For instance, skipping LMI on a $500,000 home could save over $10,000 upfront.

Here’s the kicker: FHBG also works in tandem with other grants, like the First Home Owner Grant, amplifying benefits. But beware—eligibility hinges on factors like income caps and property price limits. The smart move? Use tools like the Property Price Cap Tool to pinpoint opportunities and act before the 35,000 spots vanish!

Maximizing the First Home Owner Grant

The First Home Owner Grant (FHOG) shines when paired with strategic property choices. Opting for new builds under $600,000 not only qualifies for the $10,000 grant but also unlocks potential stamp duty exemptions, slashing upfront costs. Lesser-known tip? Combine FHOG with regional incentives—some states offer additional grants for rural areas, boosting affordability.

Timing matters too. Builders often offer discounts during off-peak seasons, stretching your grant further. Challenge the norm: instead of focusing solely on urban hotspots, explore growth corridors where property values are rising. Actionable insight? Research local council plans to identify areas primed for future development.

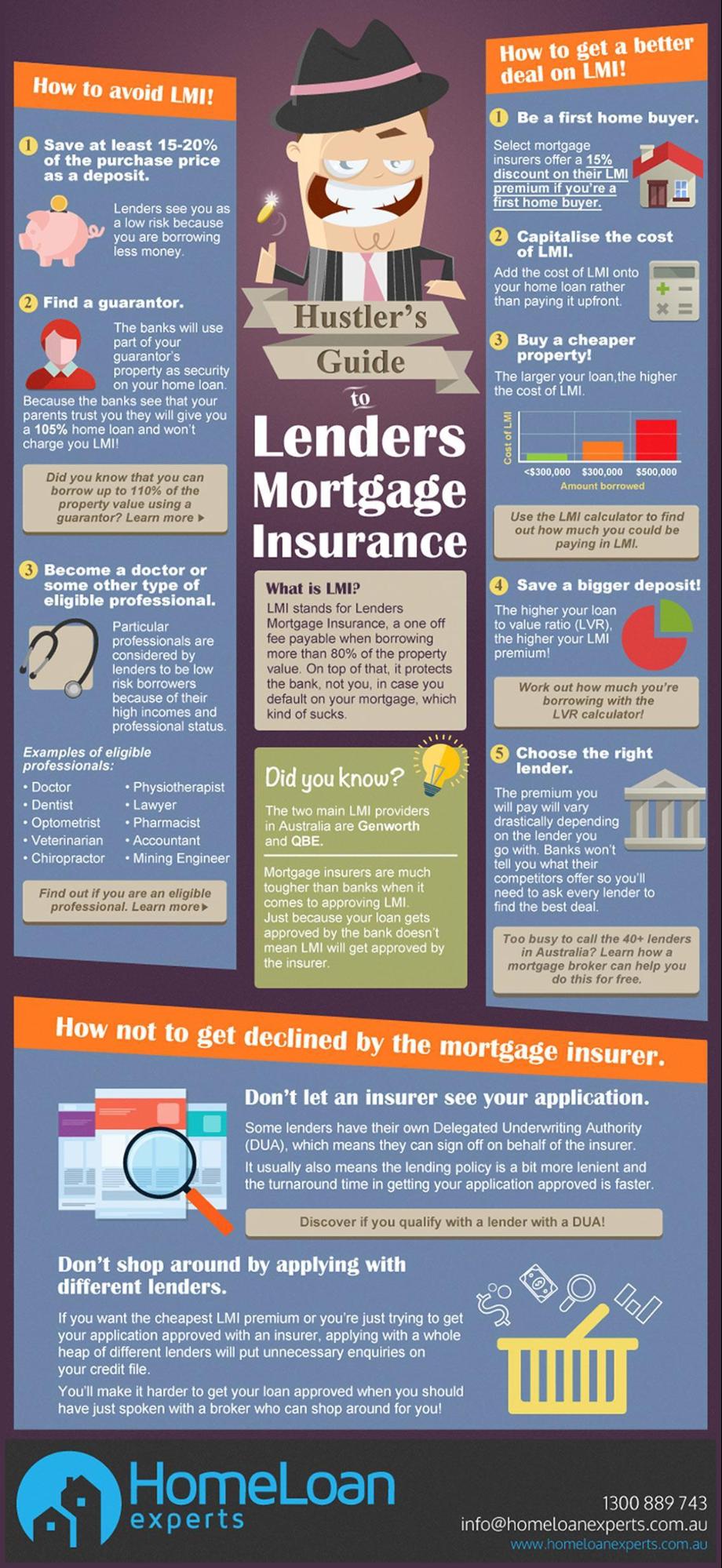

Navigating Lenders Mortgage Insurance and Brokers

Lenders Mortgage Insurance (LMI) often feels like a roadblock, but it can be a stepping stone with the right strategy. For instance, government-backed schemes like the First Home Guarantee eliminate LMI entirely, saving buyers thousands. Alternatively, some lenders offer LMI waivers for professionals in fields like medicine or law—an often-overlooked perk.

Here’s where brokers shine: they compare hundreds of loan options, uncovering hidden gems like shared-equity schemes or state-funded low-deposit loans. Think of brokers as your GPS in a maze of options—they don’t just save you money; they save you time and stress.

Image source: infogrades.com

Why LMI Exists and How to Avoid It

LMI exists to protect lenders from the risks of high loan-to-value ratios (LVRs), but savvy buyers can sidestep it. For example, state-backed programs like Keystart in WA allow deposits as low as 2% without LMI, though higher interest rates may apply. Another option? Family guarantees, where a relative’s property secures your loan, bypassing LMI entirely.

Surprisingly, some lenders waive LMI for professionals in medicine or law, leveraging their stable income profiles. Actionable tip: Work with a broker to uncover these niche opportunities and weigh trade-offs like interest rates or eligibility criteria. The key? Tailor strategies to your situation.

Role of Mortgage Brokers in Low-Deposit Loans

Mortgage brokers excel at unlocking low-deposit loan options by leveraging their extensive lender networks. Beyond mainstream banks, they access specialist lenders offering flexible terms for buyers with smaller deposits. Brokers also identify hidden perks, like LMI waivers for certain professions or regional incentives tied to government schemes.

A lesser-known advantage? Brokers can negotiate interest rate discounts even on low-deposit loans, reducing long-term costs. They also streamline complex applications, ensuring compliance with strict eligibility criteria. Pro tip: Use a broker to combine low-deposit loans with grants like the First Home Guarantee for maximum savings and faster market entry.

Alternative Deposit Options and Financial Planning

Think outside the 20% deposit box! Shared equity schemes, like WA’s Keystart, let buyers co-own with the government, slashing upfront costs. Another game-changer? Family guarantees, where a relative’s property secures your loan, bypassing LMI entirely.

Surprisingly, crowdfunding is gaining traction—platforms like GoFundMe have helped buyers raise thousands. Misconception? It’s not just about asking for money; sharing your story can inspire support.

Expert tip: Diversify savings with low-risk ETFs, which often outperform traditional accounts. Picture it as planting seeds in a garden—each strategy grows your deposit faster. The key? Mix creativity with solid financial planning!

Image source: thechadwilsongroup.com

Personal Saving Strategies and Budgeting

Rethink your budget with the 50/30/20 rule, but supercharge it—shift 30% (wants) into savings temporarily. For example, cutting $200/month on dining out adds $2,400 annually to your deposit fund.

Micro-saving apps like Raiz or Up round up purchases, turning spare change into investments. Over a year, this can quietly grow into a few thousand dollars.

Lesser-known hack? Windfall redirection—tax refunds or bonuses go straight to savings. Behavioral finance shows this reduces the temptation to splurge.

Actionable insight: Treat savings like a subscription—automate it. This consistency builds momentum, bringing you closer to your first home faster!

Using Family Guarantees and Other Creative Approaches

Family guarantees can fast-track homeownership by leveraging a relative’s property as security, bypassing LMI and reducing upfront costs. But here’s the twist: partial guarantees are an underutilised option. Instead of securing the entire loan, guarantors can limit their liability to a specific portion, minimising risk.

Real-world example? A parent guarantees 15% of a $500,000 loan, reducing exposure to $75,000. This flexibility protects their assets while still helping you enter the market sooner.

Pro tip: Pair family guarantees with shared equity schemes to further reduce borrowing needs. The result? A tailored, low-risk pathway to homeownership that balances family dynamics and financial goals.

Market Strategies and Negotiation

Timing is everything in real estate. Buyers who acted during market dips in 2024 saved up to 10% on property prices—proof that market awareness beats endless saving. Misconception? Negotiation is just about price. In reality, terms like settlement periods or inclusions (e.g., appliances) can add value without extra cost.

Expert tip: Use predictive analytics tools to track local trends, like inventory spikes signaling price stabilization. Think of it like surfing—catching the right wave (market conditions) propels you forward.

Actionable insight: Partner with an agent skilled in competitive markets to craft offers that balance assertiveness with flexibility.

Image source: innovativemtgbrokers.com

Property Research and Timing

Understanding micro-market trends can be a game-changer. For instance, suburbs with upcoming infrastructure projects often see property values rise post-completion. A 2024 case study in Sydney’s west showed a 12% price jump after a new train line opened.

Lesser-known tip? Track days on market (DOM)—properties sitting longer may signal motivated sellers, opening doors for negotiation.

Actionable framework: Use tools like CoreLogic or local council plans to identify growth zones early. Combine this with seasonal timing—spring listings often flood the market, creating buyer leverage. The takeaway? Research isn’t just about data; it’s about spotting opportunities before they’re obvious.

Securing Deals with Low Deposits

Creative financing can unlock deals with low deposits. For example, vendor finance agreements allow buyers to negotiate directly with sellers, spreading deposit payments over time. This works well in slower markets where sellers are motivated to close quickly.

Lesser-known factor? Deposit bonds—a guarantee instead of cash—can secure properties without upfront funds, ideal for buyers awaiting liquidity events like asset sales.

Actionable insight: Pair low-deposit strategies with off-market opportunities, where competition is lower, and sellers may accept flexible terms. The key? Collaborate with a broker to identify lenders or sellers open to unconventional arrangements, accelerating your path to ownership.

FAQ

What are the most effective government schemes for first-home buyers with low deposits?

The First Home Guarantee Scheme allows eligible buyers to purchase with just a 5% deposit, avoiding LMI. The First Home Owner Grant offers $10,000 for new builds, while the Family Home Guarantee supports single parents with as little as 2% deposit. Act fast—places fill quickly!

How can I avoid Lenders Mortgage Insurance (LMI) when my deposit is below 20%?

Leverage the First Home Guarantee Scheme to bypass LMI with a 5% deposit. Alternatively, explore family guarantees, where a relative’s property secures your loan. Certain professions, like doctors or lawyers, may qualify for LMI waivers. A mortgage broker can uncover these options tailored to your situation.

What role do mortgage brokers play in securing low-deposit home loans?

Mortgage brokers simplify the process by accessing a wide lender network, uncovering low-deposit options like government-backed loans or LMI waivers. They tailor solutions to your financial needs, negotiate better terms, and streamline applications, saving time and stress while maximizing your chances of securing a suitable low-deposit home loan.

Are there alternative financing options for buyers struggling to save a 20% deposit?

Alternative options include shared equity schemes, where buyers co-own with the government, reducing upfront costs. Vendor finance agreements allow deposit payments over time, while deposit bonds act as guarantees instead of cash. Crowdfunding platforms and family guarantees also provide creative pathways for buyers with limited savings to enter the market.

How can timing and market trends impact the success of buying with a smaller deposit?

Acting during market dips can save buyers up to 10% on property prices, outpacing prolonged savings. Monitor local trends like inventory spikes, signaling price stabilization. Leverage predictive analytics tools to identify opportunities, and align purchases with favorable conditions to maximize affordability and equity growth, even with a smaller deposit.