Why the Smartest Aussies Are Buying Property Instead of Saving in the Bank

Australia’s savviest investors are rewriting the rules of wealth-building, ditching the comfort of savings accounts for the dynamic world of property investment. Here’s the twist: while bank interest rates hover at historic lows, property values in key markets are surging, creating a stark contrast between stagnant savings and thriving real estate portfolios.

In a time when inflation quietly erodes the purchasing power of cash, the allure of bricks and mortar has never been stronger. But this isn’t just about numbers—it’s about strategy. Why park your money in a bank when it could be working harder, generating rental income and capital growth simultaneously?

This shift raises a compelling question: is saving in the bank still a safe bet, or has it become a missed opportunity? As we explore this tension, a broader truth emerges—wealth favours the bold.

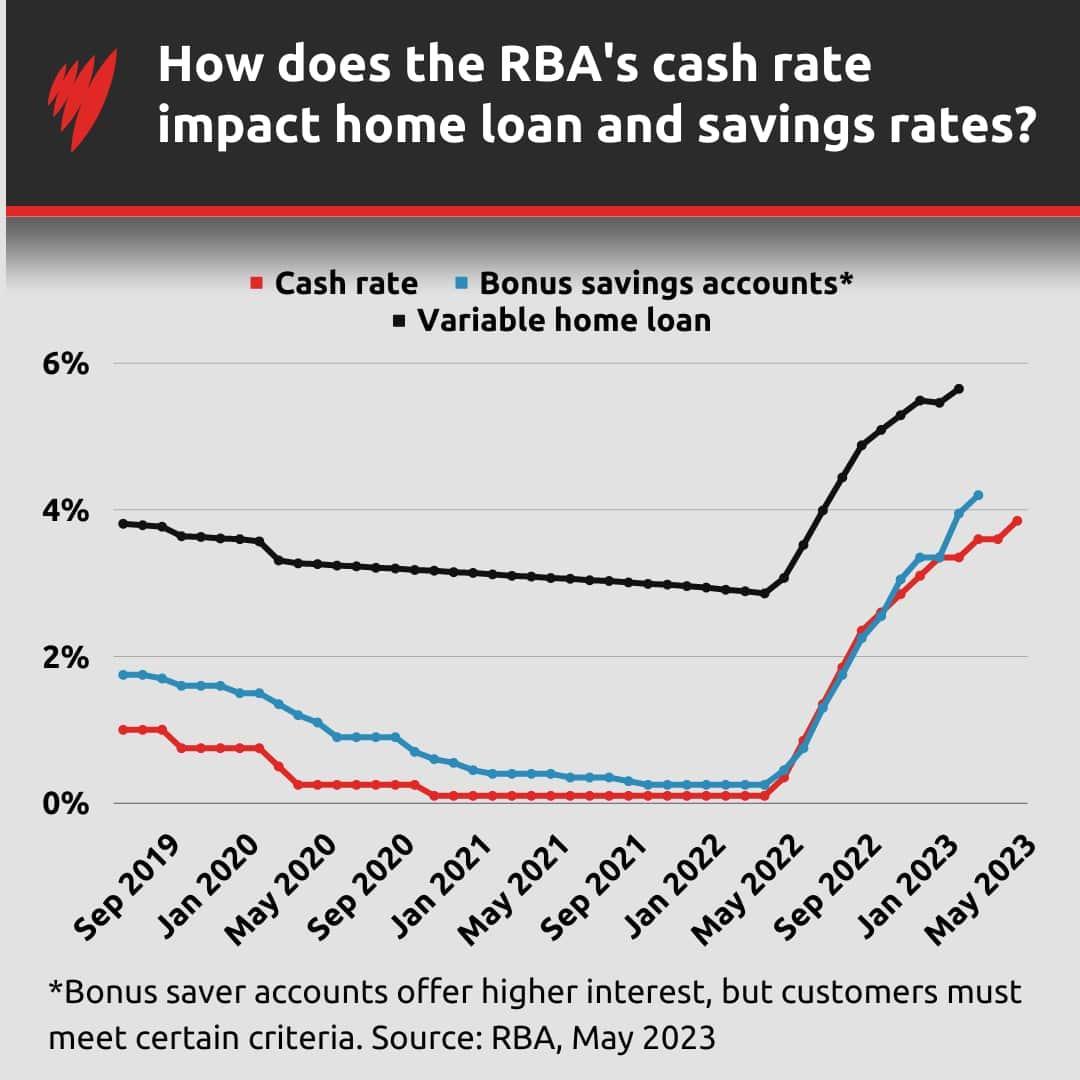

Image source: sbs.com.au

Context of Australia’s Financial Landscape

Australia’s financial ecosystem is undergoing a quiet but profound transformation, driven by a combination of low interest rates, rising inflation, and shifting consumer priorities. While traditional savings accounts once symbolised financial security, they now struggle to keep pace with inflation, effectively diminishing the real value of cash over time. This creates a paradox: the very act of “saving” can erode wealth.

At the same time, the property market has emerged as a dynamic counterbalance. For instance, the Reserve Bank of Australia’s sustained low cash rate policy has made borrowing more affordable, fuelling demand for real estate. This demand, coupled with limited housing supply in urban centres, has driven property values upward, offering investors both capital growth and rental income potential.

Interestingly, younger Australians are leveraging technology—like AI-driven market analysis and virtual property tours—to identify undervalued opportunities in regional areas. These tools not only democratise access to property investment but also challenge the conventional wisdom that success lies solely in metropolitan markets.

Looking ahead, the interplay between inflation, interest rates, and technological innovation will likely redefine how Australians perceive and pursue financial stability.

Shifting Consumer Mindset

A fascinating shift in the Australian consumer mindset is the growing preference for value-driven investments over traditional savings. This change is fuelled by a combination of economic pressures and evolving lifestyle priorities. With inflation steadily eroding the purchasing power of cash, many Australians are questioning the long-held belief that savings accounts are the cornerstone of financial security.

Instead, consumers are embracing property investment as a way to achieve both financial growth and lifestyle alignment. For example, younger buyers are prioritising properties in regional areas that offer affordability and a better quality of life, thanks to the rise of remote work. This trend is supported by tools like AI-powered property analysis, which helps identify undervalued opportunities, making the process more accessible and less intimidating.

Interestingly, the mindset shift also reflects a deeper understanding of opportunity cost. Savvy investors recognise that leaving money idle in a bank account means missing out on potential rental income and capital appreciation. Moving forward, this mindset will likely drive innovation in property investment strategies, encouraging Australians to explore creative ways to build wealth.

Common Motivations for Property Investment

One key motivation driving Australians toward property investment is the desire for financial independence. Unlike traditional savings, which often fail to outpace inflation, property offers a dual advantage: capital growth and passive income. This combination allows investors to build wealth while creating a steady cash flow through rental yields.

A lesser-known factor is the emotional security tied to owning tangible assets. Real estate provides a sense of stability that stocks or bonds often lack. For instance, a property can serve as a fallback residence or even a legacy for future generations, making it a deeply personal investment choice.

Additionally, government incentives like tax deductions on investment properties and grants for first-time buyers amplify the appeal. These policies not only reduce upfront costs but also improve long-term profitability, especially when paired with strategic planning.

Looking ahead, the rise of sustainable and tech-enabled properties is reshaping motivations. Investors are increasingly drawn to energy-efficient homes and smart technologies, which attract higher-quality tenants and command premium rents. This shift highlights the growing intersection of financial goals and lifestyle aspirations in property investment.

Foundational Financial Concepts

Understanding foundational financial concepts is crucial for making smarter investment decisions. One key idea is the time value of money—a dollar today is worth more than a dollar tomorrow due to its earning potential. For example, investing $50,000 in property now could generate rental income and capital growth, while the same amount in a savings account might barely keep up with inflation.

Another critical concept is leverage. Property investment allows you to use borrowed funds to amplify returns. For instance, with a 20% deposit on a $500,000 property, you control a high-value asset while only committing $100,000 upfront. If the property appreciates by 10%, your return on investment is effectively 50%.

A common misconception is that debt is inherently bad. In reality, strategic debt, like a mortgage on an income-generating property, can be a powerful wealth-building tool.

By combining these principles with disciplined budgeting and market research, Aussies can turn property into a dynamic financial asset rather than letting cash stagnate in savings.

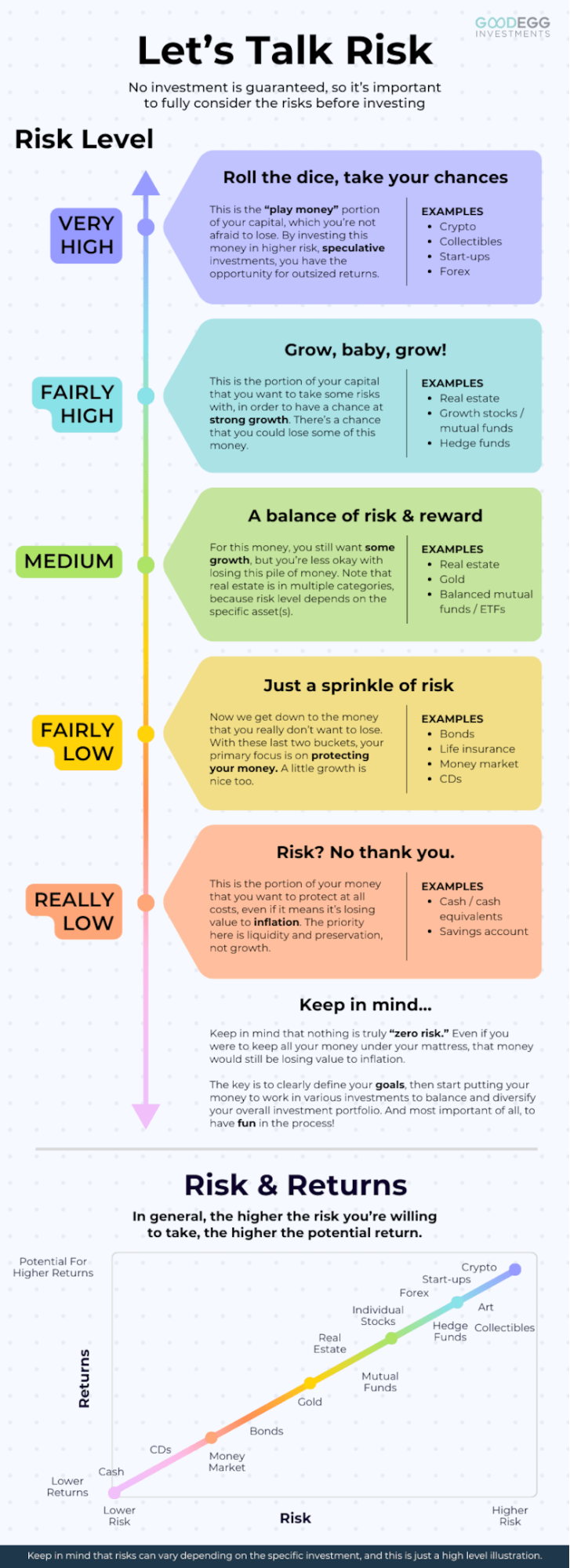

Image source: goodegginvestments.com

Understanding Risk Tolerance

Risk tolerance is more than just a buzzword—it’s the backbone of smart property investment. It’s about knowing how much uncertainty you can handle without losing sleep. For instance, a conservative investor might focus on low-risk properties in stable markets, while an aggressive investor could target high-growth areas with greater volatility.

What’s often overlooked is how life stages and financial goals shape risk tolerance. A young professional with decades to recover from market dips might embrace riskier investments, while a retiree prioritises steady income over capital growth. Factors like income stability, family responsibilities, and even personality traits play a role too.

Here’s the kicker: risk tolerance isn’t static. It evolves with your circumstances. Regularly reassessing your comfort level ensures your strategy stays aligned with your goals.

Actionable tip? Use tools like risk tolerance surveys or consult a financial advisor to pinpoint your sweet spot. By understanding your limits, you can confidently navigate the property market and make decisions that balance ambition with peace of mind.

Role of Long-Term Financial Goals

Long-term financial goals act as a compass, steering property investment strategies toward sustainable wealth creation. A critical yet underappreciated aspect is the power of compounding. By reinvesting rental income or leveraging equity growth, investors can exponentially increase their portfolio’s value over time. For example, using equity from an appreciating property to fund the purchase of another creates a snowball effect, amplifying returns.

Interestingly, aligning long-term goals with lifestyle aspirations can unlock unique opportunities. Consider the growing trend of investing in regional properties that offer both affordability and lifestyle benefits. These investments not only provide financial growth but also align with personal values, such as work-life balance or environmental sustainability.

A lesser-known factor? Tax efficiency. Long-term property investments often benefit from reduced capital gains tax rates, making them more profitable than short-term flips.

Actionable framework: Define SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound) and regularly review them. Pair this with disciplined reinvestment strategies to maximise compounding benefits. By staying focused on the bigger picture, Aussies can build a resilient financial future while adapting to life’s inevitable changes.

Mechanics of Property Investment

At its core, property investment is about turning bricks and mortar into a wealth-building machine. The leverage effect is a standout feature—by using borrowed funds, you can control a high-value asset with a relatively small upfront investment. For instance, a 20% deposit on a $600,000 property means you’re leveraging $120,000 to own an asset worth six times that amount. If the property appreciates by just 5%, your return on equity skyrockets to 25%.

But here’s where it gets interesting: cash flow vs. capital growth. Many investors mistakenly chase high rental yields without considering long-term growth potential. A regional property might offer 7% rental returns, but a well-located urban property with 3% yield could double in value over a decade.

Expert tip? Balance both. Use tools like AI-driven market analysis to identify suburbs with rising infrastructure and population growth. And don’t forget the hidden costs—maintenance, vacancies, and taxes can erode profits if overlooked.

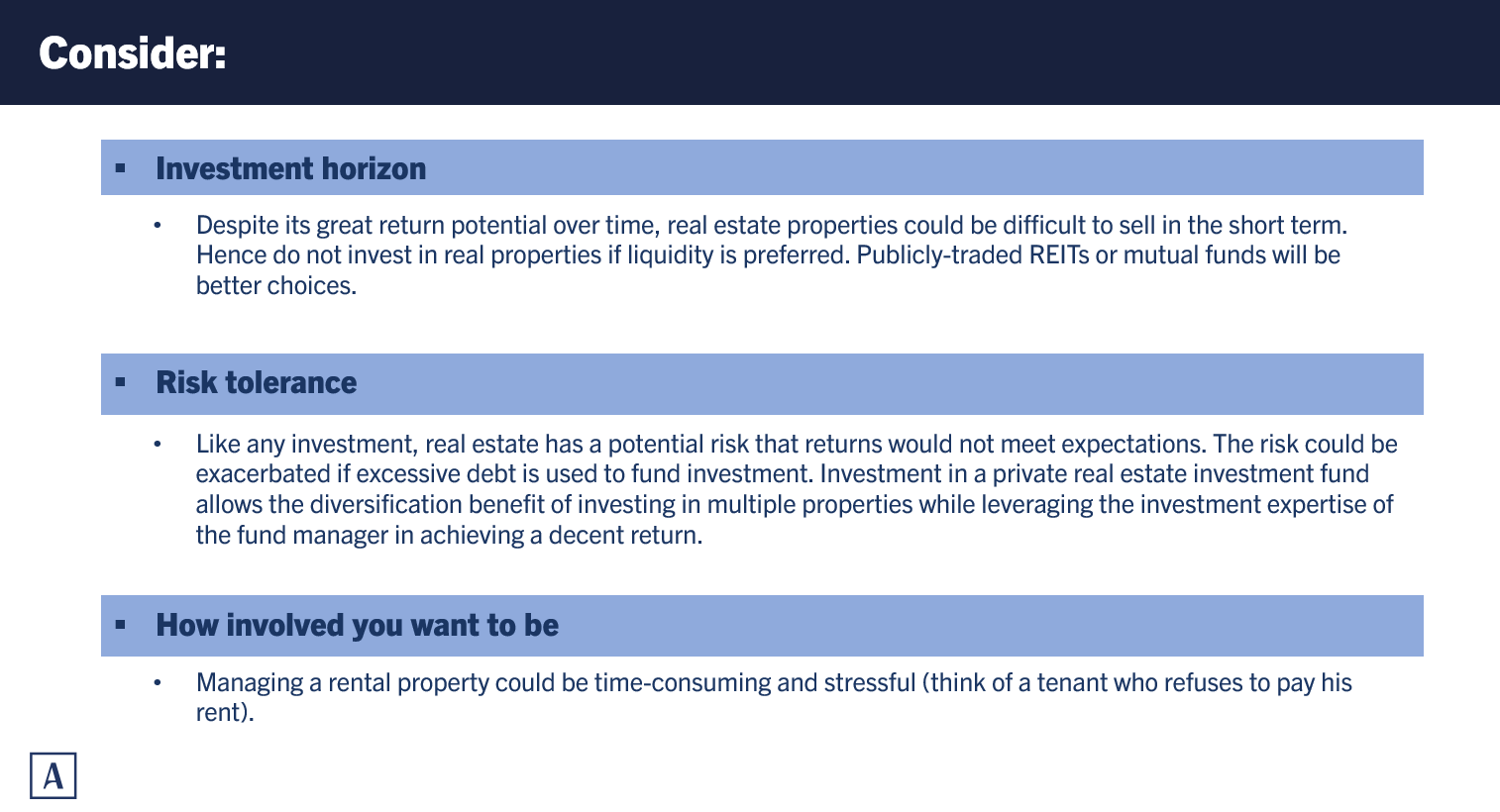

Image source: altfest.com

Leveraging Capital and Mortgage Structures

Smart investors know that the right mortgage structure can make or break a property investment. One powerful approach is offset accounts, which reduce interest payments while keeping funds accessible. For example, parking $50,000 in an offset account linked to a $500,000 loan can save thousands in interest over the loan’s life—money that can be reinvested or used for renovations.

Another game-changer? Interest-only loans. While often misunderstood, these loans free up cash flow in the short term, allowing investors to direct funds toward high-growth opportunities or additional properties. However, timing is key—switching to principal-and-interest repayments before market conditions shift ensures long-term stability.

A lesser-known strategy involves loan splitting. By dividing debt into fixed and variable portions, investors can hedge against rate hikes while still benefiting from market dips.

Actionable insight: Regularly review your mortgage with a broker to adapt to changing goals and market conditions. The right structure isn’t just about saving—it’s about unlocking growth potential.

Tax Advantages and Obligations

One standout tax advantage for property investors is depreciation deductions. Many overlook how powerful this can be in reducing taxable income. Depreciation applies to the wear and tear of assets like appliances, fixtures, and even the building itself. For instance, a $5,000 air conditioner could yield $1,500 in deductions over five years, while structural depreciation on a property built after 1987 can add thousands annually. These deductions directly improve cash flow without requiring out-of-pocket expenses.

A lesser-known factor? Green upgrades. Installing solar panels or energy-efficient systems not only attracts eco-conscious tenants but also qualifies for additional deductions. This dual benefit enhances rental demand while reducing tax liabilities.

However, investors must also navigate obligations like Capital Gains Tax (CGT). Properties held for over 12 months qualify for a 50% CGT discount, but timing the sale strategically—such as during a lower-income year—can further minimise tax impact.

Actionable tip: Work with a tax specialist to create a tailored depreciation schedule and explore green initiatives. Staying proactive ensures you maximise benefits while staying compliant with evolving tax laws.

Evaluating Bank Savings in Today’s Economy

In today’s economy, parking money in a savings account feels like leaving your car idling—it’s safe, but it’s not going anywhere. With inflation in Australia hovering around 4%, even high-interest savings accounts offering 5% barely keep up, leaving little room for real growth. Essentially, your money is working hard just to stand still.

Take this example: a $50,000 deposit in a savings account might earn $2,500 in interest annually before taxes. Meanwhile, inflation quietly erodes purchasing power, meaning that $50,000 buys less each year. Compare this to property investment, where the same $50,000 could serve as a deposit on a $500,000 property, leveraging capital for both rental income and potential appreciation.

A common misconception is that savings accounts are “risk-free.” While they avoid market volatility, they carry the hidden risk of stagnation. Savvy Aussies are recognising this and shifting focus to assets like property, which offer dynamic growth opportunities in a changing financial landscape.

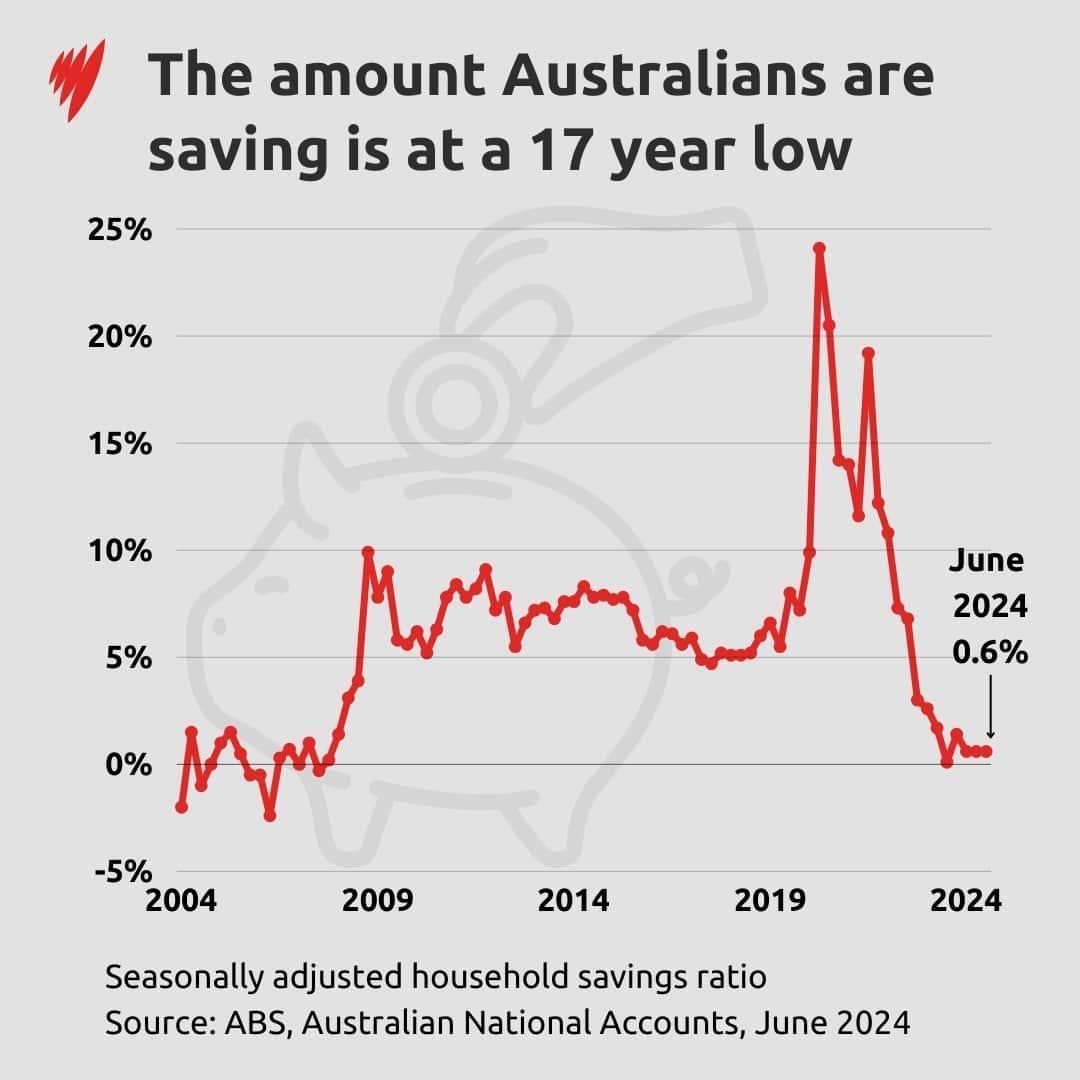

Image source: sbs.com.au

Interest Rates and Inflation Impact

Interest rates and inflation are like two sides of the same coin, constantly shaping the value of your money. When inflation outpaces interest rates, as it often does in Australia, savings accounts lose their shine. For example, with inflation at 4% and average savings rates hovering around 5%, the real return is a meagre 1%—and that’s before taxes.

Here’s the kicker: rising interest rates don’t just impact savings; they ripple through the economy. Higher rates make borrowing more expensive, cooling property demand temporarily. But savvy investors see this as an opportunity. Why? Property prices often stabilise during these periods, creating a window to buy at more reasonable prices before the next growth cycle.

A lesser-known factor? Inflation can actually work for property investors. As property values and rental income rise with inflation, fixed mortgage repayments stay the same, effectively shrinking debt in real terms.

Actionable insight: Use inflation to your advantage by locking in low fixed rates and focusing on high-growth areas. It’s about playing the long game, not just surviving the short-term squeeze.

Liquidity and Security Benefits

Bank savings accounts shine when it comes to liquidity—your money is just a tap away, perfect for emergencies or seizing sudden opportunities. But here’s the twist: this convenience comes at a cost. While your funds are accessible, they’re also stagnant, barely keeping pace with inflation.

On the flip side, property investments are often criticised for being illiquid, but this “drawback” can actually be a hidden strength. Illiquidity discourages impulsive decisions, fostering a disciplined, long-term approach to wealth building. Plus, property offers a unique form of security: it’s a tangible asset that doesn’t vanish with market volatility, unlike shares.

A lesser-known angle? Pairing property with a line of credit can bridge liquidity gaps. For instance, an investor can tap into their property’s equity to access funds without selling, maintaining both the asset and its growth potential.

Actionable tip: Balance liquidity and security by diversifying. Keep a portion of your wealth in liquid assets like savings or shares, while leveraging property for stability and growth. This hybrid strategy ensures you’re prepared for both short-term needs and long-term goals.

Assessing Risks and Diversification Strategies

Investing in property isn’t without its risks, but smart diversification can act as your financial safety net. Think of it like a balanced diet—too much of one thing, and you’re vulnerable. By spreading investments across property types (residential, commercial, industrial) and locations, you reduce the impact of market downturns in any single area.

For example, a Melbourne investor who paired CBD apartments with regional homes in Ballarat saw consistent returns, even when urban rental demand dipped. Diversification also shields against risks like tenant vacancies or local economic slumps.

A common misconception? That diversification is only for large portfolios. Even first-time investors can diversify by exploring fractional property ownership platforms, which allow partial investments in multiple properties.

Expert tip: Conduct thorough due diligence. Research growth trends, infrastructure projects, and population shifts. Tools like AI-driven market analysis can uncover hidden gems.

Actionable insight: Regularly review your portfolio’s performance and adjust as needed. Diversification isn’t a one-time task—it’s an ongoing strategy for long-term stability and growth.

Image source: cornerstonepm.net

Comparing Property Volatility to Other Assets

Property’s stability shines when compared to the rollercoaster ride of stocks or cryptocurrencies. While shares can swing wildly based on market sentiment or global events, property values tend to move at a steadier pace, driven by fundamentals like population growth and infrastructure development. For instance, during the 2008 financial crisis, Australian property values dipped only 3.5% before rebounding within months, while global equities plummeted by 36%.

A lesser-known factor? The illiquid nature of property actually acts as a buffer against panic selling. Unlike shares, which can be offloaded in seconds during a downturn, property’s slower transaction process encourages a more measured, long-term approach.

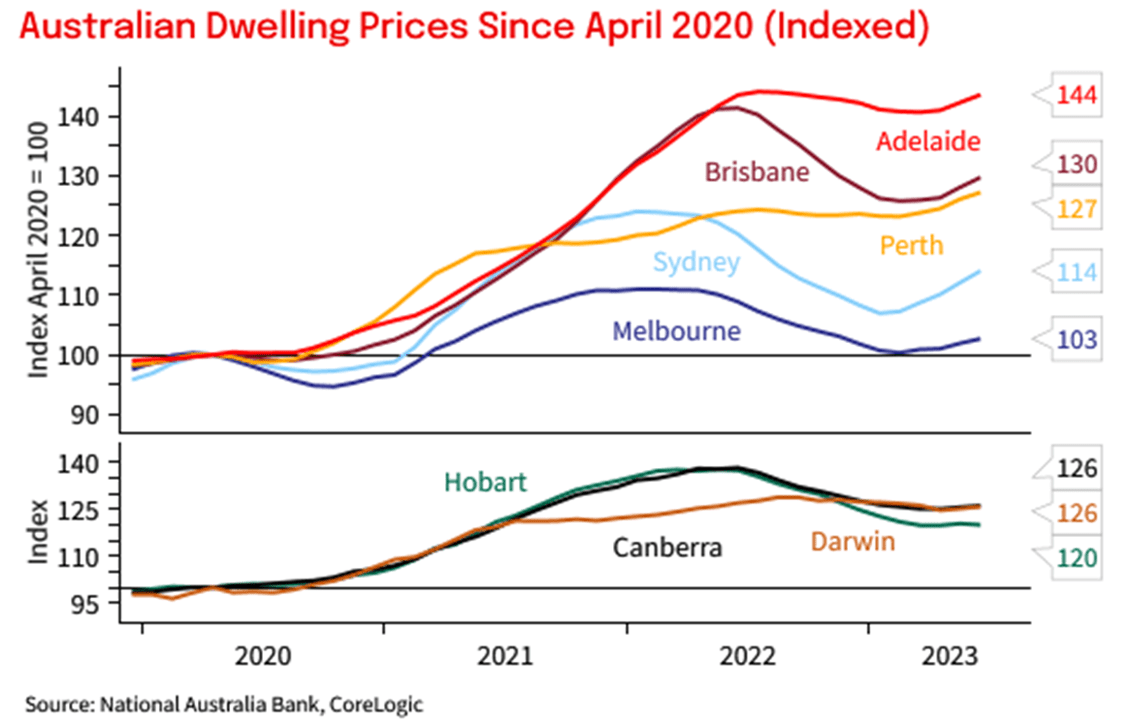

Interestingly, property also benefits from localized volatility. A downturn in one region doesn’t necessarily impact another. For example, while Sydney’s market cooled in 2022, Brisbane saw a 10% surge due to tech-sector job growth.

Actionable insight: Use tools like AI-driven market analysis to identify regions with stable demand and growth potential. This approach minimizes risk while capitalizing on property’s inherent resilience.

Building a Balanced Portfolio

A key aspect of building a balanced portfolio is strategic asset allocation. While many investors focus on property type or location, balancing cash flow and capital growth properties is often overlooked. For example, pairing a high-yield regional property with a capital-growth-focused urban property creates a portfolio that generates steady income while appreciating over time.

A lesser-known approach is incorporating fractional property ownership. Platforms offering shared ownership allow investors to diversify across multiple properties with smaller capital outlays. This not only spreads risk but also provides exposure to different markets, such as combining Brisbane real estate with Melbourne’s commercial sector.

Interestingly, behavioral economics highlights how emotional biases, like overvaluing familiar markets, can skew portfolio decisions. Data-driven tools, such as AI-powered market analysis, help counteract these biases by identifying undervalued opportunities.

Actionable framework: Start by defining your financial goals—whether it’s income stability, long-term growth, or both. Then, allocate assets accordingly, ensuring a mix of property types and geographic locations. Regularly review and rebalance your portfolio to adapt to market shifts, ensuring resilience and consistent returns.

Market Analysis and Future Outlook

The Australian property market is like a living organism—constantly evolving and shaped by a mix of economic, social, and technological forces. One standout trend is the growing appeal of emerging suburbs and regional areas. For instance, areas like Geelong and Ballarat are seeing a surge in demand due to improved infrastructure and affordability, offering investors both rental yields and long-term growth potential.

A common misconception is that property markets move uniformly. In reality, localized factors like job growth or new transport links can create micro-booms. Take Brisbane’s tech sector expansion—it’s driving a 10% rise in property values, even as other markets cool.

Interestingly, technology is reshaping how investors approach market analysis. AI tools now predict growth hotspots by analyzing data like population trends and infrastructure projects, giving savvy Aussies a competitive edge.

Looking ahead, sustainability will play a bigger role. Energy-efficient homes are not just eco-friendly—they’re becoming a must-have for tenants, ensuring higher demand and premium rents.

Image source: ironfish.com.au

Current Trends in Australian Real Estate

One fascinating trend reshaping Australian real estate is the rise of fractional property ownership. This approach allows investors to buy shares in properties rather than owning them outright, significantly lowering the entry barrier. Platforms like Bricklet are making this possible, attracting younger, tech-savvy Aussies who want exposure to property without needing a massive deposit. It’s a game-changer for those priced out of traditional markets.

Another shift? The growing demand for regional properties. With remote work becoming the norm, areas like Toowoomba and Bendigo are booming. These locations offer affordability, lifestyle perks, and solid rental yields, making them attractive alternatives to capital cities. For example, a three-bedroom home in Ballarat can cost less than half of a similar property in Melbourne, while still delivering competitive returns.

Interestingly, sustainability is becoming a key factor. Energy-efficient homes with solar panels or smart tech are commanding higher rents and attracting quality tenants.

Actionable insight: Combine fractional ownership with regional investments to diversify your portfolio while keeping costs manageable. Look for properties with eco-friendly features to future-proof your investment.

Long-Term Projections and Economic Indicators

A key factor shaping long-term property projections is the interplay between population growth and infrastructure development. Australia’s population is expected to grow by over 1.5 million by 2030, with much of this concentrated in regional hubs and outer suburbs. This shift is driven by affordability pressures in major cities and the rise of remote work. Areas like Geelong and Newcastle are already benefiting from government-backed infrastructure projects, such as improved transport links, which boost property values and rental demand.

Interestingly, inflation plays a dual role. While it raises construction costs, it also increases the value of existing properties, especially in high-demand areas. Savvy investors are leveraging inflation by locking in fixed-rate mortgages, effectively reducing their debt burden in real terms as property values climb.

A lesser-known factor? Global economic trends. For instance, foreign investment from Asia is expected to rise, particularly in sustainable developments, as international buyers seek stable markets.

Actionable insight: Focus on regions with planned infrastructure upgrades and growing populations. Pair this with fixed-rate loans to hedge against inflation and position yourself for long-term capital growth.

Case Studies and Best Practices

One standout example of strategic property investment comes from a couple in Geelong, Victoria, who purchased a house-and-land package in the early stages of a master-planned community. By investing $319,000 in 2014, they secured a 550m² block. Fast forward to 2018, the property was valued at $525,000, allowing them to draw equity for other ventures. This highlights the power of early entry into well-researched developments.

Another case involves a Brisbane investor leveraging AI-driven tools to identify a high-growth suburb. By purchasing a $500,000 property in 2020, they capitalized on infrastructure upgrades and population growth, achieving a 15% value increase within three years. This underscores the importance of data-driven decisions.

A common misconception is that property success requires massive capital. Platforms like fractional ownership now allow smaller investors to diversify across multiple properties, reducing risk while gaining exposure to growth markets.

Actionable takeaway: Combine thorough research, emerging tech, and strategic timing to unlock property’s full potential.

Image source: sydneyrealtor.com.au

Success Stories of Savvy Investors

One fascinating approach savvy investors are using is rentvesting—renting where they want to live while investing in high-growth areas. Take the example of a Sydney-based professional who rented in Bondi but purchased an investment property in Newcastle for $450,000 in 2019. By targeting a suburb with rising infrastructure and job opportunities, the property appreciated by 20% in just four years, while delivering a 6% rental yield. This strategy allowed them to enjoy their preferred lifestyle while building wealth elsewhere.

Another lesser-known tactic is leveraging green upgrades to boost property value and tenant appeal. A Melbourne investor installed solar panels and energy-efficient appliances in a regional rental property. Not only did this attract eco-conscious tenants willing to pay premium rents, but it also qualified for tax deductions, improving cash flow.

Actionable insight: Combine lifestyle flexibility with strategic investments. Use tools like AI-driven market analysis to identify growth suburbs and consider sustainable upgrades to future-proof your portfolio while maximising returns.

Common Pitfalls and How to Avoid Them

One major pitfall is overestimating rental income, which can lead to financial strain if the property doesn’t perform as expected. Many investors rely on optimistic rental projections without accounting for potential vacancies or market fluctuations. For instance, a Brisbane investor purchased a property expecting a 6% yield, only to face a 3-month vacancy due to oversupply in the area, significantly impacting cash flow.

To avoid this, focus on conservative estimates. Research historical rental data and vacancy rates in the area. Tools like AI-driven rental analysis can provide realistic projections based on current market trends. Additionally, always budget for at least 2-3 months of potential vacancy to ensure financial stability.

A lesser-known factor? Tenant quality. Poor screening can result in unpaid rent or property damage, further eroding returns. Implementing thorough vetting processes, such as credit checks and rental history reviews, can mitigate these risks.

Actionable insight: Pair conservative rental estimates with a robust tenant screening process. This dual approach ensures steady cash flow and protects your investment from unexpected setbacks, setting the stage for long-term success.

FAQ

What are the key financial advantages of investing in property over traditional savings accounts?

Investing in property offers capital growth, passive rental income, and protection against inflation, unlike savings accounts that often fail to outpace inflation. Property also allows leveraging borrowed funds for higher returns and provides tax benefits like depreciation and negative gearing, making it a dynamic tool for long-term wealth creation.

How does inflation impact the value of savings compared to property investments?

Inflation erodes the purchasing power of savings, often outpacing interest rates in bank accounts. In contrast, property values and rental income typically rise with inflation, preserving and even enhancing wealth. This makes property a more resilient and growth-oriented option for Australians seeking to safeguard their financial future.

What role do tax benefits like negative gearing and capital gains concessions play in property investment?

Tax benefits like negative gearing allow investors to offset property losses against taxable income, reducing overall tax liability. Capital gains concessions, such as the 50% discount for properties held over 12 months, significantly enhance post-sale profits. These incentives make property investment a financially strategic choice for wealth-building Australians.

How can Australians leverage technology to identify high-growth property markets?

Australians can use AI-driven tools to analyze market trends, population growth, and infrastructure projects, identifying high-growth areas with precision. Virtual reality tours streamline property inspections, while blockchain ensures secure transactions. These technologies empower smarter, data-driven decisions, giving investors a competitive edge in uncovering lucrative property opportunities.

What are the risks associated with property investment, and how can they be mitigated effectively?

Risks include tenant vacancies, market volatility, and maintenance costs. Mitigation strategies involve diversifying across property types and locations, conducting thorough due diligence, and maintaining cash reserves. Leveraging professional advice and securing insurance further safeguards investments, ensuring a balanced approach to managing uncertainties while maximizing long-term returns.