5 Australian Property Tax Loopholes That Could Save You Thousands

In a nation where property is as much a cultural obsession as it is an investment strategy, the tax system holds secrets that could transform your financial landscape. Surprisingly, while many Australians grapple with rising costs, a handful of overlooked property tax loopholes quietly offer substantial savings. Why do these opportunities remain underutilized? Are they hidden in plain sight, or simply misunderstood? As we unravel these strategies, the broader question emerges: how can you turn the tax code into your greatest ally?

Foundations of Capital Gains Tax (CGT) in Australia

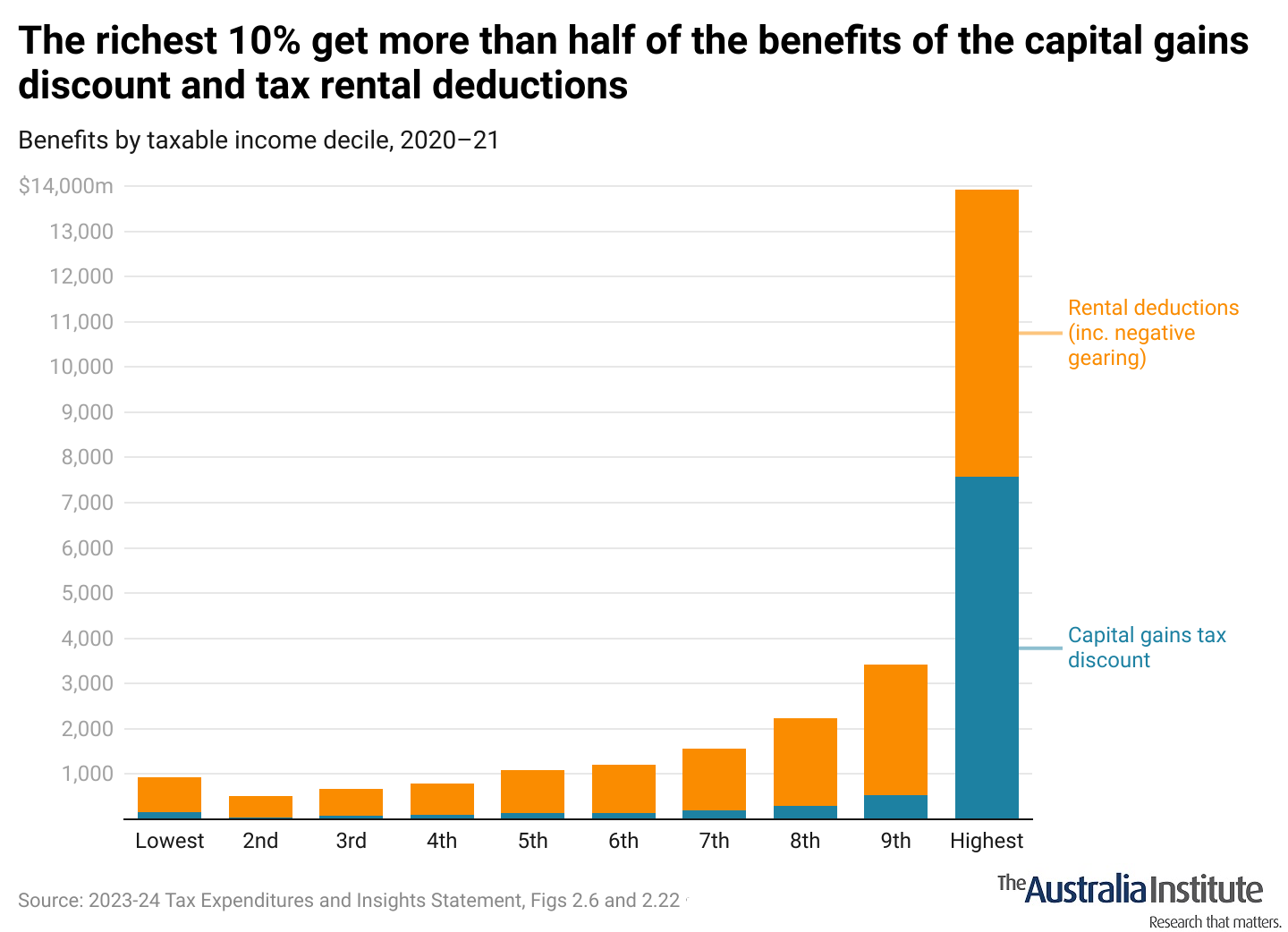

The true complexity of CGT lies in its interplay with ownership structures. For instance, holding property through a discretionary trust can redistribute gains to beneficiaries in lower tax brackets, significantly reducing liabilities. Yet, this strategy demands precision—missteps in trust deeds or timing can nullify benefits. Additionally, the 50% CGT discount for assets held over 12 months rewards long-term planning, but few consider how offsetting capital losses amplifies this advantage. These nuances redefine CGT as a tool, not a burden.

The Importance of Minimizing Property Tax Liabilities

Strategic use of negative gearing not only offsets rental property losses against taxable income but can also push investors into lower tax brackets, compounding savings. However, timing is critical—aligning deductions with high-income years maximises impact. Beyond this, leveraging state-specific exemptions, such as principal place of residence concessions, can significantly reduce liabilities. These approaches, when paired with meticulous record-keeping and proactive planning, highlight how property tax minimisation is less about avoidance and more about optimising financial outcomes for long-term growth.

The Main Residence Exemption

The main residence exemption offers a powerful shield against capital gains tax, but its nuances often go unnoticed. For instance, the six-year rule allows homeowners to rent out their property without forfeiting the exemption, provided they don’t claim another main residence. A case study revealed one investor saved over $50,000 by leveraging this rule strategically. Misconceptions, such as needing continuous occupancy, persist. By understanding these subtleties, homeowners can unlock significant savings while maintaining compliance with ATO regulations.

Qualifying Criteria and Key Benefits

A lesser-known factor influencing eligibility is the land size limit of 2 hectares. Properties exceeding this threshold may still qualify for a partial exemption, calculated proportionally. For example, a rural homeowner reduced their CGT liability by isolating the exempt portion of their land. Additionally, the exemption’s flexibility extends to properties used for income generation, such as Airbnb, provided meticulous records delineate personal and business use. These nuances underscore the importance of tailored strategies to maximise benefits while ensuring compliance.

Exploring the Extended Six-Year Rule

The six-year rule’s flexibility allows homeowners to reset the exemption clock by reoccupying their property, even briefly. For instance, an investor who rented out their home for five years returned for six months before relocating again, effectively restarting the six-year exemption period. This approach, while entirely legal, requires precise timing and documentation to avoid disputes with the ATO. By leveraging this strategy, property owners can extend tax benefits indefinitely, offering a dynamic tool for long-term financial planning.

The 12-Month Ownership Discount

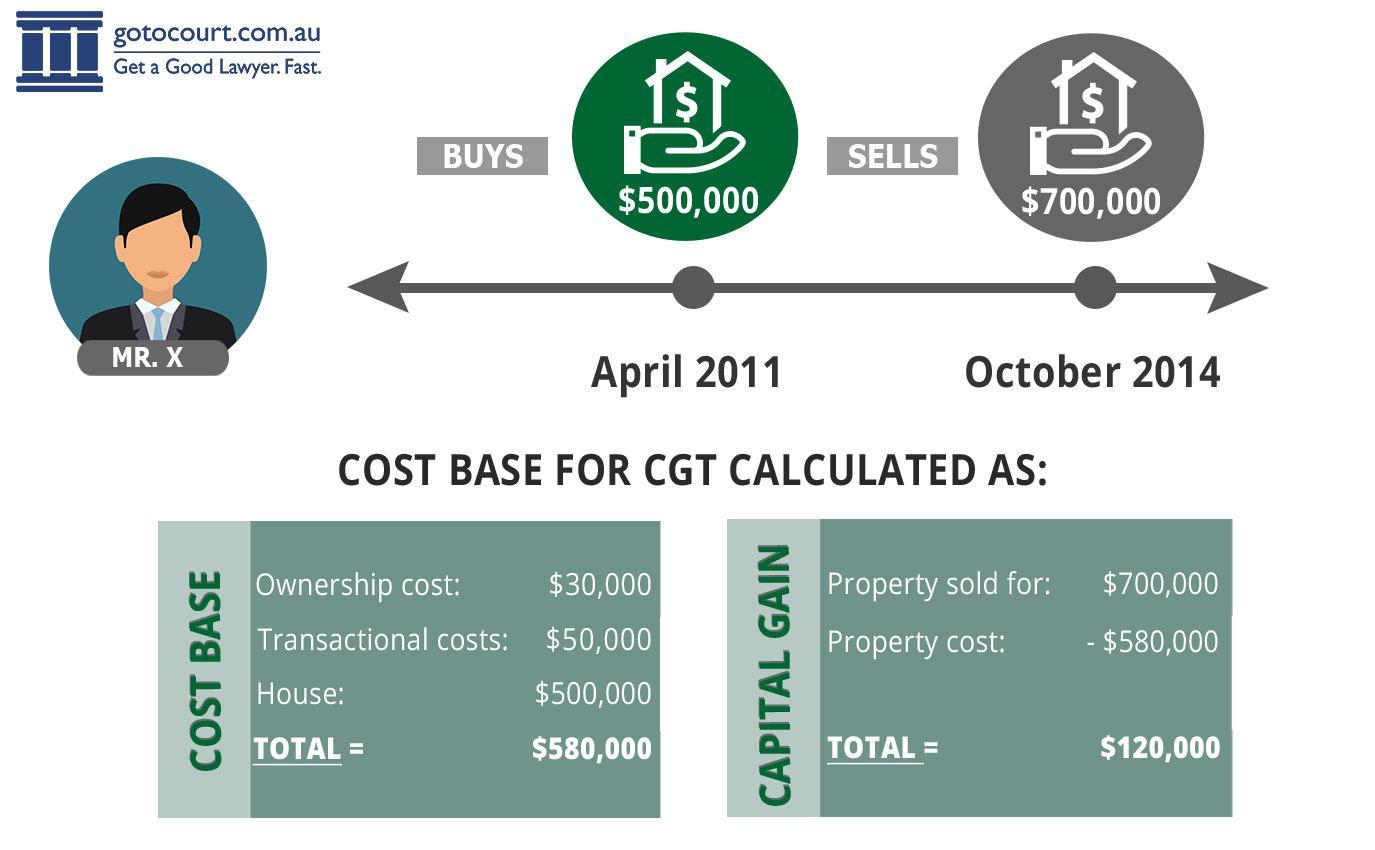

The 12-month ownership discount rewards long-term property investment by halving CGT liability for assets held over a year. Misunderstanding the timing—measured from contract dates, not settlement—can disqualify investors. For example, selling a property just days shy of the 12-month mark cost one investor $20,000 in additional tax. This rule also intersects with estate planning; inherited properties may qualify based on the deceased’s ownership period. Strategic timing and expert advice ensure maximum savings while avoiding costly errors.

Image source: gotocourt.com.au

Calculating Your Discounted CGT

Accurate CGT calculations hinge on understanding the cost base. Beyond purchase price, include expenses like legal fees, stamp duty, and capital improvements. For instance, a $10,000 renovation can significantly reduce taxable gains. Missteps, such as omitting deductible costs, inflate liabilities unnecessarily. Additionally, offsetting capital losses against gains before applying the 50% discount amplifies savings. Leveraging digital tools for meticulous record-keeping ensures compliance and precision. As property values rise, proactive planning transforms CGT from a burden into a strategic advantage.

Common Pitfalls and Best Practices

A frequent pitfall is misjudging the CGT event date, which is tied to contract signing, not settlement. For example, rushing a sale to meet financial deadlines can inadvertently disqualify the 12-month discount. Best practices include aligning sales with tax planning cycles and leveraging professional advice to navigate timing complexities. Additionally, consider the impact of joint ownership structures, as splitting gains between co-owners in different tax brackets can optimise outcomes. Precision and foresight are key to avoiding costly errors and maximising benefits.

Increasing the Cost Base

Expanding the cost base beyond the purchase price is a powerful yet underutilized strategy. Costs like legal fees, stamp duty, and renovations directly reduce taxable gains. For instance, a $15,000 kitchen upgrade not only boosts property value but also offsets CGT. Misconceptions arise when investors overlook holding costs, such as council rates, which may qualify under specific conditions. Expert advice ensures compliance while maximising deductions, transforming overlooked expenses into strategic tools for long-term tax efficiency and financial growth.

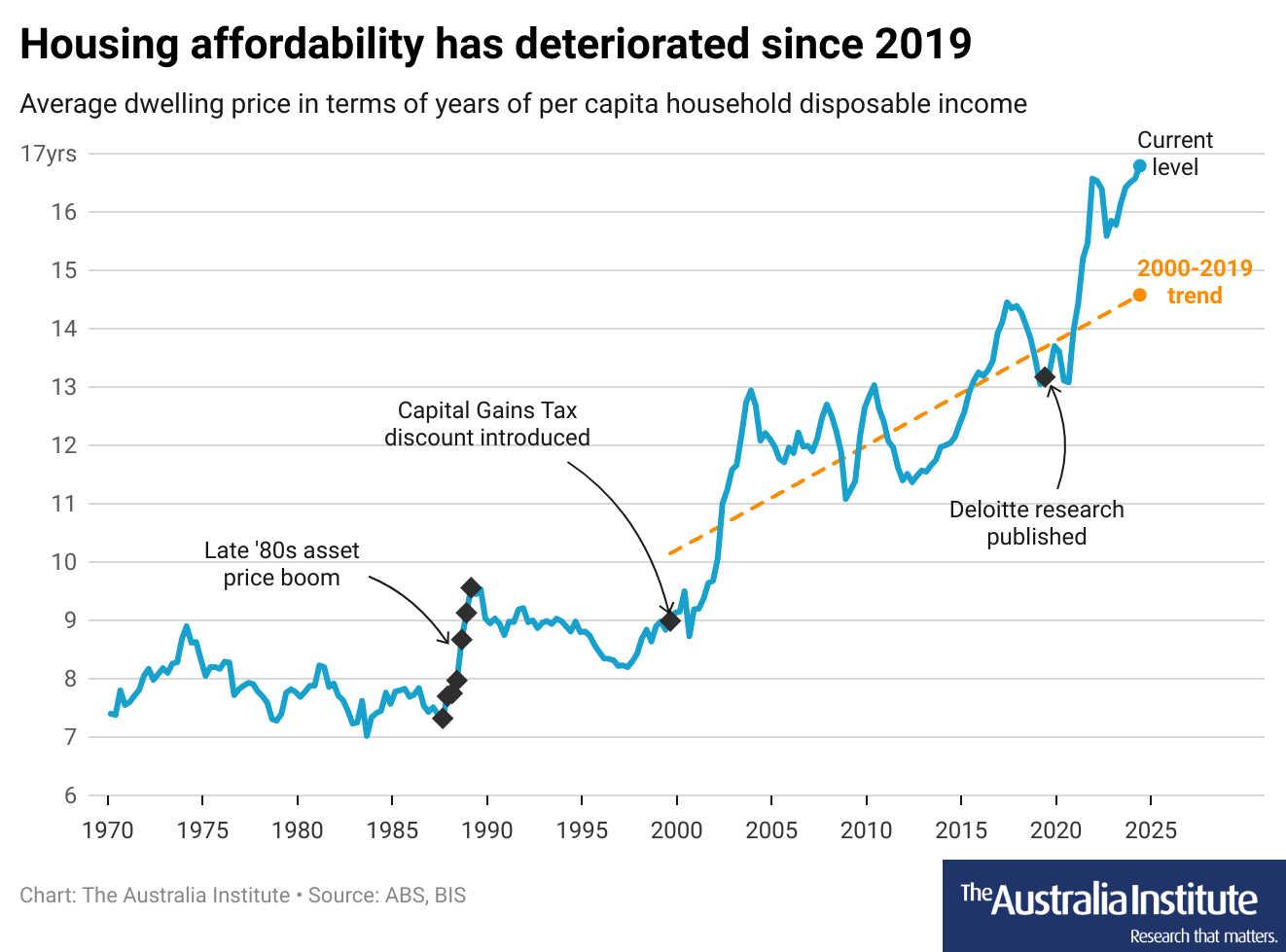

Image source: australiainstitute.org.au

Eligible Expenses and Adjustments

One overlooked adjustment is the inclusion of non-deductible ownership costs, such as council rates and loan interest during non-income-generating periods. For example, a property initially used as a main residence can have these costs added to its cost base when later rented. This nuanced approach reduces taxable gains significantly. Additionally, title defense costs, often ignored, can qualify if tied to ownership disputes. Leveraging these adjustments requires meticulous record-keeping, offering a proactive framework for optimising CGT outcomes while ensuring compliance.

Practical Examples of Cost Base Enhancement

Consider a property owner who added $20,000 in solar panels. While boosting market appeal, this expense also qualifies as a capital improvement, directly increasing the cost base and reducing CGT. Lesser-known factors, like reclassifying landscaping as a structural improvement, can further amplify benefits. Additionally, costs tied to rezoning applications—often dismissed—may qualify under title preservation. These strategies highlight the importance of expert guidance, ensuring every eligible expense is captured, transforming overlooked investments into measurable tax savings.

Partial Main Residence Exemption

The partial main residence exemption applies when a property serves dual purposes, such as being partially rented. For instance, renting out 30% of a home for three years on a five-year ownership timeline subjects only that portion to CGT. Misconceptions often arise around proportional calculations, but precise apportionment ensures compliance. Expert advice can uncover overlooked deductions, like shared utility costs. This exemption bridges personal and investment use, offering a tailored approach to minimise tax while maximising financial flexibility.

When Partial Exemptions Apply

Partial exemptions often hinge on accurate apportionment of income-generating use. For example, a homeowner renting out 40% of their property for two years on a six-year timeline must calculate CGT proportionally. Lesser-known factors, such as shared spaces like kitchens, can complicate calculations but also offer opportunities for nuanced deductions. Aligning these calculations with state-specific regulations ensures compliance while optimising outcomes. Leveraging digital tools for precise record-keeping and consulting tax professionals can transform complex scenarios into strategic tax advantages.

Proportional CGT Calculations

Proportional CGT calculations rely on meticulous tracking of both time and space. For instance, renting 25% of a home for four years on a 10-year ownership timeline requires precise apportionment of gains. Overlooked factors, like shared utilities or mixed-use areas, can skew results if not properly documented. Integrating these calculations with cost base adjustments, such as renovations, further refines outcomes. By combining detailed records with expert advice, property owners can uncover hidden savings while ensuring compliance with ATO standards.

Expert Perspectives and Emerging Trends

Experts highlight a growing trend in leveraging digital tools for precise tax tracking, enabling seamless integration of rental income, expenses, and apportionment calculations. For instance, platforms now automate CGT adjustments for mixed-use properties, reducing errors. Additionally, emerging data suggests that green property upgrades, like solar panels, not only enhance market value but also qualify for cost base adjustments, amplifying tax benefits. This shift underscores the importance of aligning tax strategies with sustainability trends, offering dual financial and environmental advantages.

Image source: australiainstitute.org.au

Professional Advice for Successful Tax Strategies

Tailored advice ensures tax strategies align with unique financial goals. For instance, structuring property ownership through self-managed super funds (SMSFs) can reduce tax liabilities while securing retirement benefits. However, compliance with strict ATO regulations is critical. Experts also recommend cost segregation studies to accelerate depreciation, boosting cash flow. Misconceptions, like assuming all expenses are deductible, often lead to errors. By integrating professional guidance with digital tools, investors can navigate complexities confidently, unlocking both immediate savings and long-term financial resilience.

Future Projections of Property Tax Regulations

Emerging trends suggest a shift towards recurrent property taxes to replace inefficient transfer duties, aligning with global practices. For example, Germany’s property tax reforms emphasize equity and affordability, offering a potential model for Australia. Additionally, the integration of sustainability incentives, such as tax credits for energy-efficient upgrades, could reshape compliance strategies. Policymakers may also adopt layered tax systems to balance revenue needs with housing affordability. Investors should anticipate these changes, leveraging expert advice to future-proof their portfolios against evolving regulations.

FAQ

What are the most overlooked property tax loopholes in Australia?

The most overlooked property tax loopholes include the six-year rule for main residence exemptions, strategic use of negative gearing, and cost base enhancements like adding non-deductible expenses. Leveraging capital losses and understanding state-specific exemptions further unlock savings. Expert advice ensures compliance while maximising these underutilised opportunities.

How can the six-year rule help reduce capital gains tax for property owners?

The six-year rule allows property owners to treat a former main residence as exempt from capital gains tax for up to six years while earning rental income. Reoccupying the property resets the exemption period, offering flexibility. Precise timing and documentation are essential to maximise this benefit and ensure compliance.

What strategies can investors use to maximise the 12-month ownership discount?

Investors can maximise the 12-month ownership discount by carefully timing property sales, ensuring the asset is held for at least 12 months from the contract date. Including eligible costs like renovations in the cost base and offsetting capital losses before applying the discount further amplifies tax savings while ensuring compliance.

How do partial main residence exemptions work for mixed-use properties?

Partial main residence exemptions apply when a property is used for both personal and income-generating purposes. The exemption is calculated proportionally based on the time and space used for income production. Accurate apportionment, meticulous record-keeping, and expert advice ensure compliance while optimising tax savings for mixed-use properties.

What are the key compliance requirements to leverage property tax benefits effectively?

Key compliance requirements include maintaining detailed records of expenses, adhering to ATO guidelines, and accurately apportioning costs for mixed-use properties. Timely reporting of income and deductions, aligning strategies with tax laws, and consulting professionals ensure proper utilisation of property tax benefits while avoiding penalties and maximising financial outcomes.

Disclaimer: The information provided here is general in nature and should not be considered as professional tax advice. For specific tax guidance, please consult a qualified tax professional or visit the ATO website.