What Every Australian Needs To Know Before Refinancing In 2025

In 2025, Australian homeowners face a paradox: while interest rates are poised to drop, offering a lifeline to those burdened by high repayments, the competitive lending market could quietly erode borrowing safeguards. This duality—relief on one hand, risk on the other—makes refinancing not just an option but a strategic imperative.

As lenders vie for market share, underwriting standards may loosen, creating opportunities for some but potential pitfalls for others. Will the promise of lower rates outweigh the hidden costs of rushed decisions?

Refinancing in 2025 isn’t merely about securing a better deal; it’s about navigating a shifting financial landscape where every choice reverberates through household budgets and long-term stability. The question isn’t just how to refinance but when and why—a tension that underscores the stakes for every Australian borrower.

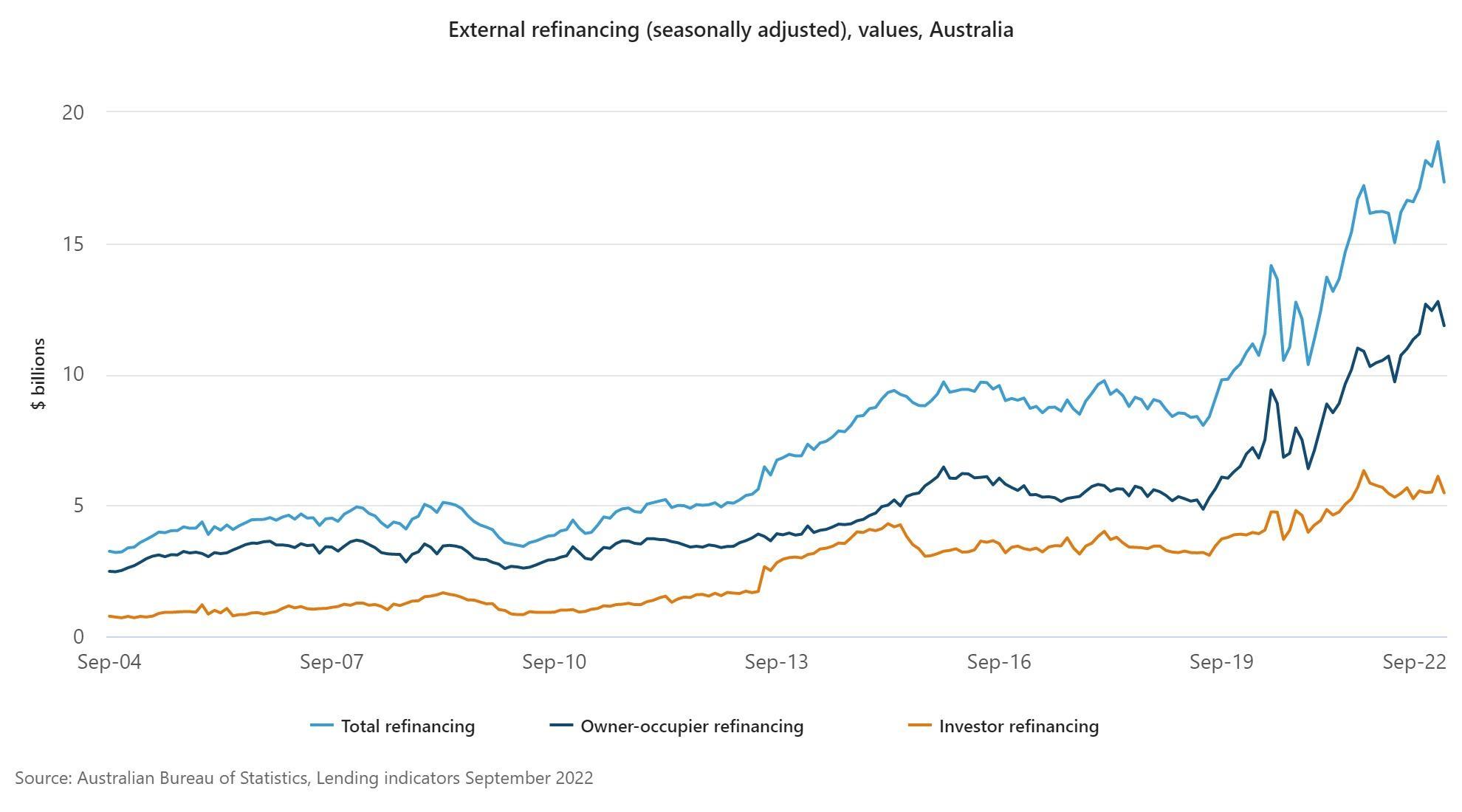

Image source: brokernews.com.au

The Basics Of Refinancing

Refinancing may seem straightforward—replacing an existing loan with a new one—but its nuances often go unnoticed. One critical yet underappreciated factor is the comparison rate. While many borrowers fixate on the advertised interest rate, the comparison rate reveals the true cost of a loan by incorporating fees, charges, and other hidden expenses. Ignoring this metric can lead to costly miscalculations, especially in a market where lenders compete aggressively with seemingly low rates.

Another overlooked aspect is the timing of refinancing. For instance, refinancing too early in a loan term can negate potential savings due to exit fees or break costs, particularly for fixed-rate loans. Conversely, waiting too long may erode equity gains, limiting access to better terms or features like offset accounts and redraw facilities.

Borrowers should also consider the broader economic context. In 2025, with interest rates expected to decline, locking into a fixed-rate loan prematurely could mean missing out on future rate cuts. Strategic timing, paired with a thorough cost-benefit analysis, ensures refinancing aligns with both immediate needs and long-term financial goals.

Why 2025 Is A Pivotal Year

In 2025, the convergence of declining interest rates and evolving lending standards creates a unique refinancing landscape. A lesser-known but critical factor is the anticipated reduction in mortgage serviceability buffers. Traditionally, these buffers—set by lenders to ensure borrowers can handle rate increases—have limited borrowing capacity. With potential adjustments, borrowers may qualify for larger loans or more favorable terms. However, this shift demands caution, as over-leveraging could jeopardize long-term financial stability.

Another pivotal aspect is the interplay between refinancing and equity access. Falling rates can boost property values, increasing home equity. This equity can be leveraged for renovations, investments, or debt consolidation. For example, a homeowner with $100,000 in equity might refinance to fund energy-efficient upgrades, reducing utility costs while increasing property value.

Borrowers must also navigate the competitive lending market. While aggressive offers may seem attractive, hidden fees or restrictive terms can erode benefits. By combining expert advice with a forward-looking strategy, homeowners can capitalize on 2025’s opportunities while mitigating risks.

Navigating Key Eligibility And Preparatory Steps

Refinancing in 2025 requires a meticulous approach to eligibility and preparation, as lenders increasingly scrutinize financial profiles. A critical yet overlooked step is ensuring your credit score is robust. For instance, reducing credit card limits—even if unused—can improve your debt-to-income ratio, a key metric lenders assess. This small adjustment can significantly enhance borrowing capacity.

Another essential preparatory step is organizing comprehensive documentation. Beyond income and asset details, lenders may request evidence of consistent savings habits. A borrower with a history of disciplined financial behavior is more likely to secure favorable terms. For example, maintaining a six-month emergency fund demonstrates financial resilience, a trait lenders value.

Unexpectedly, property valuation plays a pivotal role. Preparing your home for appraisal—such as addressing minor repairs—can boost its market value, increasing equity. This equity not only improves loan terms but also opens opportunities for strategic investments. By aligning these steps with expert advice, borrowers can navigate refinancing with confidence and precision.

Image source: quantumfinance.com.au

Assessing Your Financial Health

A thorough assessment of your financial health is the cornerstone of a successful refinancing strategy. One critical yet underappreciated factor is the debt-to-income (DTI) ratio. While many borrowers focus solely on income, lenders evaluate how much of it is already committed to existing debts. For example, a DTI ratio exceeding 30% may signal financial strain, reducing your chances of securing favorable terms. To improve this metric, consider paying down high-interest debts or consolidating smaller loans before applying.

Another key aspect is liquidity. Beyond emergency savings, maintaining accessible funds equivalent to three months of repayments can demonstrate financial stability. This liquidity reassures lenders of your ability to manage unforeseen expenses, such as sudden rate adjustments or property maintenance costs.

Additionally, borrowers often overlook the impact of discretionary spending patterns. Lenders may scrutinize bank statements for excessive non-essential expenditures. Reducing such outflows months before refinancing not only improves your financial profile but also signals fiscal discipline.

By addressing these nuanced factors, borrowers can position themselves as low-risk candidates, unlocking better refinancing opportunities while safeguarding long-term financial resilience.

Optimizing Your Loan-To-Value Ratio

A strategic yet underutilized approach to optimizing your Loan-To-Value (LTV) ratio is leveraging targeted property enhancements. Unlike broad renovations, focused upgrades—such as energy-efficient installations or modernizing key areas like kitchens and bathrooms—can significantly increase property value without excessive costs. For instance, adding solar panels not only boosts valuation but may also qualify for green loan incentives, further improving refinancing terms.

Another critical tactic is timing your refinancing to coincide with favorable market conditions. Rising property values in a competitive housing market can naturally lower your LTV ratio, enhancing your eligibility for better rates. Monitoring local real estate trends and aligning refinancing efforts with peak valuation periods can yield substantial benefits.

Lesser-known factors, such as addressing minor property defects before valuation, can also influence outcomes. For example, repairing structural issues or improving curb appeal can positively sway appraisers, increasing equity.

By combining these strategies with disciplined debt management, borrowers can achieve a lower LTV ratio, unlocking more favorable refinancing options. This proactive approach not only reduces borrowing costs but also strengthens long-term financial resilience.

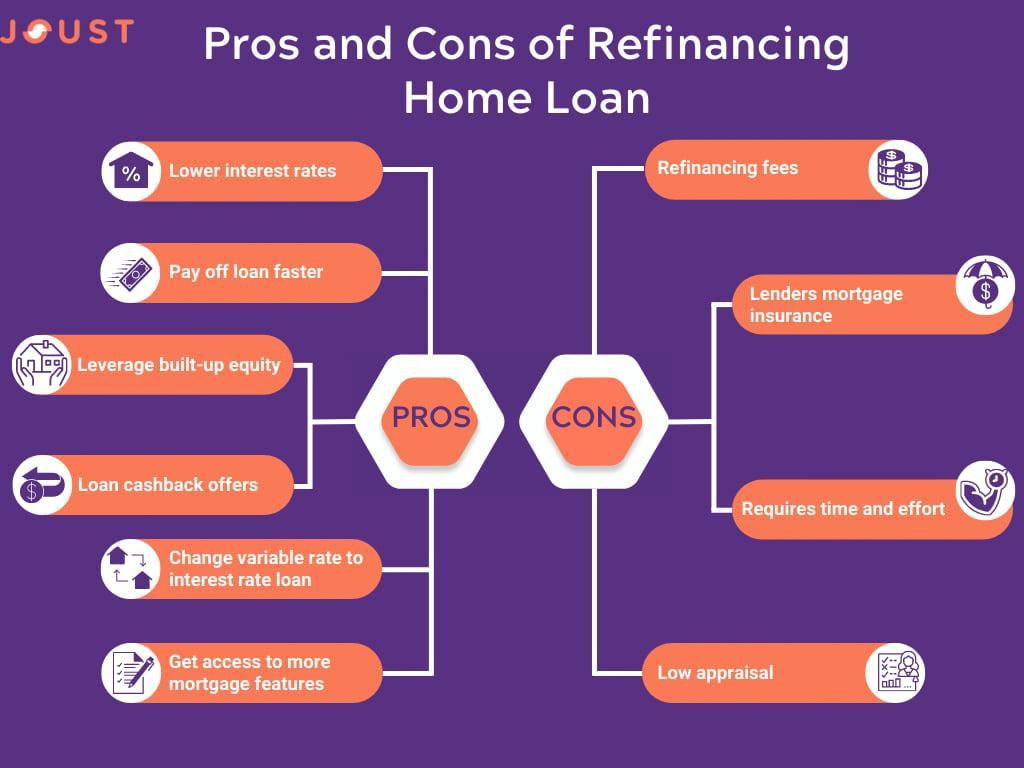

Financial Benefits And Considerations

Refinancing in 2025 offers a dual-edged financial opportunity: the potential for significant savings and the risk of unforeseen costs. For instance, transitioning from a 6% to a 5.5% interest rate on a $500,000 loan could save over $15,000 across a 30-year term. However, borrowers often overlook associated costs like exit fees, valuation charges, and legal expenses, which can erode these savings if not carefully calculated.

A lesser-known benefit is the ability to consolidate high-interest debts, such as credit cards, into a lower-rate mortgage. This strategy reduces monthly outflows but requires disciplined repayment to avoid reaccumulating debt. Additionally, leveraging equity for investments or renovations can amplify long-term financial gains, provided the returns outweigh borrowing costs.

Expert advice is crucial to navigate these complexities. A mortgage broker, for example, can identify hidden fees or tax implications, ensuring refinancing aligns with both immediate needs and broader financial goals.

Image source: joust.com.au

Calculating Potential Savings

Accurately calculating potential savings from refinancing requires more than comparing interest rates—it demands a holistic evaluation of both upfront and long-term costs. A critical yet often overlooked factor is the break-even point, which determines how long it will take for savings from lower repayments to offset refinancing costs. For example, if refinancing costs total $5,000 and monthly savings are $200, the break-even point is 25 months. Borrowers planning to sell or move before this period may find refinancing less advantageous.

Another nuanced consideration is the impact of loan term extension. While extending a 20-year loan back to 30 years reduces monthly repayments, it can increase total interest paid over the life of the loan. Borrowers should use tools like refinance calculators (e.g., Koalify’s Refinance Savings Calculator) to model scenarios and assess trade-offs.

Additionally, hidden fees such as discharge costs, valuation charges, and application fees can erode savings. Borrowers should request a detailed cost breakdown from lenders to avoid surprises.

By integrating these factors into a comprehensive cost-benefit analysis, borrowers can make informed decisions, ensuring refinancing aligns with both short-term goals and long-term financial stability.

Balancing Fees And Long-Term Gains

A critical yet underexplored aspect of balancing fees and long-term gains is the opportunity cost of refinancing. While upfront fees such as application, valuation, and discharge costs are tangible, the potential financial trade-offs of reallocating these funds elsewhere often go unnoticed. For instance, a borrower with $5,000 in refinancing costs might instead invest this amount in a high-yield savings account or diversified portfolio, potentially generating returns that rival or exceed the savings from refinancing.

Another nuanced factor is the time value of money. Borrowers extending their loan term to reduce monthly repayments may inadvertently increase the total cost of borrowing due to prolonged interest accrual. For example, refinancing a 15-year loan into a 30-year term might lower immediate outflows but could result in tens of thousands of dollars in additional interest over time. Using amortization schedules to model these scenarios can clarify the true financial impact.

Additionally, borrowers should evaluate non-monetary benefits such as improved loan features. Access to offset accounts or redraw facilities can enhance liquidity and reduce interest costs, offering long-term value beyond immediate savings.

By weighing these factors through a structured cost-benefit framework, borrowers can align refinancing decisions with both financial goals and broader wealth-building strategies.

Emerging Strategies And Market Insights

In 2025, dynamic refinancing strategies are reshaping how Australians approach their mortgages. One emerging trend is the integration of green financing options. For instance, lenders now offer incentives like reduced rates for energy-efficient upgrades, such as solar panel installations. This not only lowers borrowing costs but also aligns with broader sustainability goals, creating a dual financial and environmental benefit.

Another strategy gaining traction is leveraging data-driven tools. Advanced mortgage calculators, such as those for split loans or offset accounts, enable borrowers to simulate complex scenarios. For example, combining an offset account with a variable-rate loan can significantly reduce interest payments while maintaining liquidity.

A surprising insight is the growing role of non-traditional lenders. These institutions often provide more flexible terms, but borrowers must scrutinize hidden fees and regulatory compliance. By blending these strategies with expert advice, homeowners can unlock tailored solutions that maximize both savings and stability.

Image source: linkedin.com

Leveraging Digital Tools And Brokers

The rise of AI-driven platforms and digital tools is revolutionizing the refinancing process in 2025, offering borrowers unprecedented precision and efficiency. These tools analyze vast datasets, including market trends, borrower profiles, and lender policies, to deliver tailored refinancing options in real time. For example, platforms like Lendi’s dual-interface system allow brokers and clients to collaborate seamlessly, optimizing loan searches and applications with live data.

A key advantage of digital tools is their ability to uncover hidden opportunities. Advanced algorithms can identify niche products, such as green loans or split-rate mortgages, that align with specific borrower goals. For instance, a borrower seeking to reduce environmental impact might be matched with lenders offering rate discounts for energy-efficient upgrades.

However, the human element remains critical. Brokers equipped with digital tools can interpret complex outputs, contextualize recommendations, and advocate for clients during negotiations. This synergy between technology and expertise ensures borrowers avoid pitfalls like hidden fees or restrictive terms.

Lesser-known factors, such as behavioral analytics, are also gaining traction. By analyzing spending patterns, digital platforms can predict financial resilience, helping brokers craft more sustainable refinancing strategies.

Looking ahead, the integration of blockchain for secure transactions and AI for predictive modeling will further streamline refinancing, empowering borrowers to make data-driven, future-proof decisions.

Anticipating Regulatory And Interest Rate Trends

A critical yet underexplored aspect of 2025’s refinancing landscape is the anticipated reduction in mortgage serviceability buffers. Traditionally, these buffers have required borrowers to demonstrate repayment capacity at rates significantly higher than their loan’s actual interest rate. While this has safeguarded against financial shocks, the expected easing of these buffers could expand borrowing capacity for many Australians. However, this shift demands caution, as it may inadvertently encourage over-leveraging.

For example, a borrower previously limited to a $600,000 loan might now qualify for $650,000 under reduced buffer requirements. While this increases purchasing power, it also raises the risk of financial strain if interest rates rise unexpectedly or household income decreases. Borrowers must weigh this flexibility against long-term stability, using tools like debt-to-income (DTI) ratio calculators to ensure sustainable borrowing.

Another regulatory trend to monitor is the growing scrutiny of non-traditional lenders. As these institutions expand into niche markets, their less stringent lending criteria may attract borrowers unable to meet major banks’ requirements. However, hidden fees and variable compliance standards can offset perceived benefits, making due diligence essential.

Looking forward, borrowers should adopt a proactive approach by consulting brokers who track regulatory changes and leveraging predictive tools to align refinancing decisions with evolving policies and rate trends.

FAQ

What are the key factors to consider before refinancing in 2025?

Key factors include evaluating the comparison rate to uncover true loan costs, assessing the timing to avoid exit fees or missed rate cuts, and understanding the impact of reduced serviceability buffers. Additionally, borrowers should ensure a strong credit profile, prepare comprehensive documentation, and consider property valuation to optimize refinancing outcomes.

How will declining interest rates impact refinancing opportunities this year?

Declining interest rates in 2025 will lower monthly repayments, enhance borrowing capacity, and increase home equity. This creates opportunities for debt consolidation, renovations, or investments. However, borrowers must navigate competitive offers carefully, considering hidden fees and timing to secure the most favorable terms while avoiding rushed decisions.

What role do mortgage serviceability buffers play in refinancing decisions?

Mortgage serviceability buffers ensure borrowers can manage repayments if rates rise. In 2025, reduced buffers expand refinancing eligibility, allowing more Australians to access better terms. However, this flexibility requires caution, as over-leveraging could lead to financial strain if interest rates increase or personal circumstances change unexpectedly.

How can borrowers identify and avoid hidden fees during the refinancing process?

Borrowers can identify hidden fees by scrutinizing the comparison rate, which includes interest rates and additional costs. Reviewing lender terms for charges like exit, application, and valuation fees is essential. Consulting a mortgage broker and requesting a detailed cost breakdown ensures transparency, helping borrowers avoid unexpected expenses during refinancing.

What strategies can homeowners use to maximize savings when refinancing in 2025?

Homeowners can maximize savings by timing refinancing after market adjustments to secure competitive rates, leveraging equity for debt consolidation or investments, and using tools like refinance calculators to assess costs. Enhancing credit scores, reducing discretionary spending, and consulting brokers for tailored advice further optimize financial outcomes in 2025.