Can You Really Retire Early With Property? Let’s Do the Math

Imagine this: renting could actually fast-track your path to early retirement, while owning your dream home might slow you down. Surprising, right? With Australia’s housing market in flux and interest rates shifting, now’s the time to rethink everything you thought you knew about property investment. Can the numbers really work in your favour? Let’s find out.

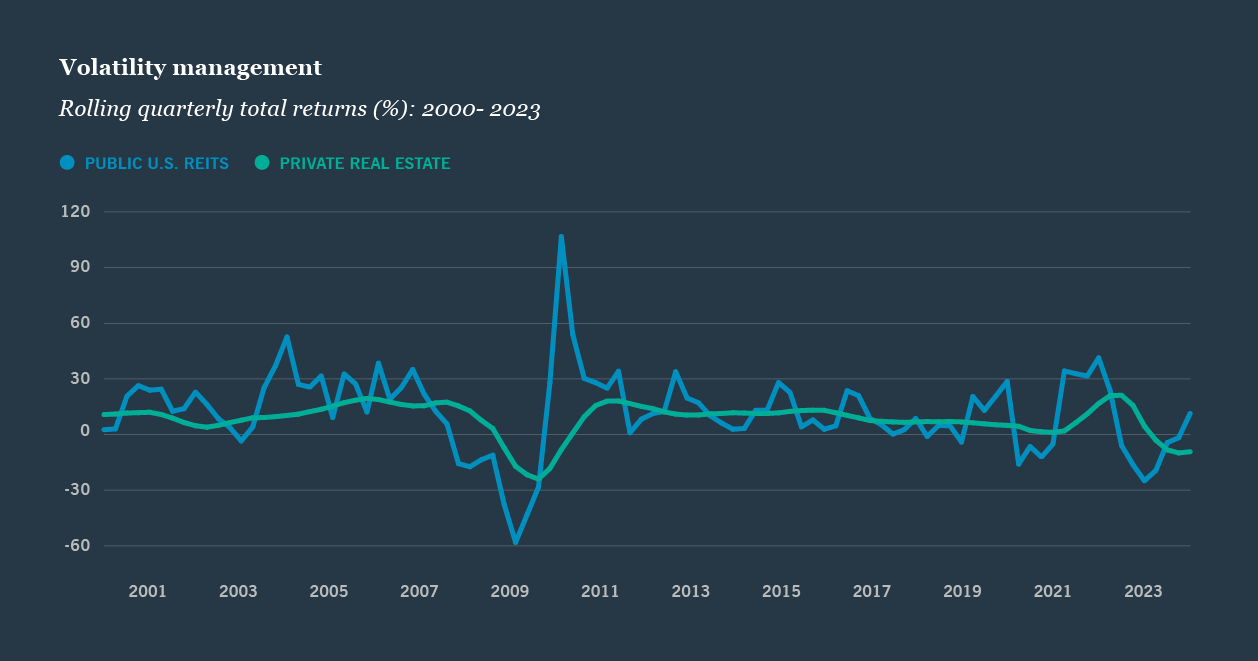

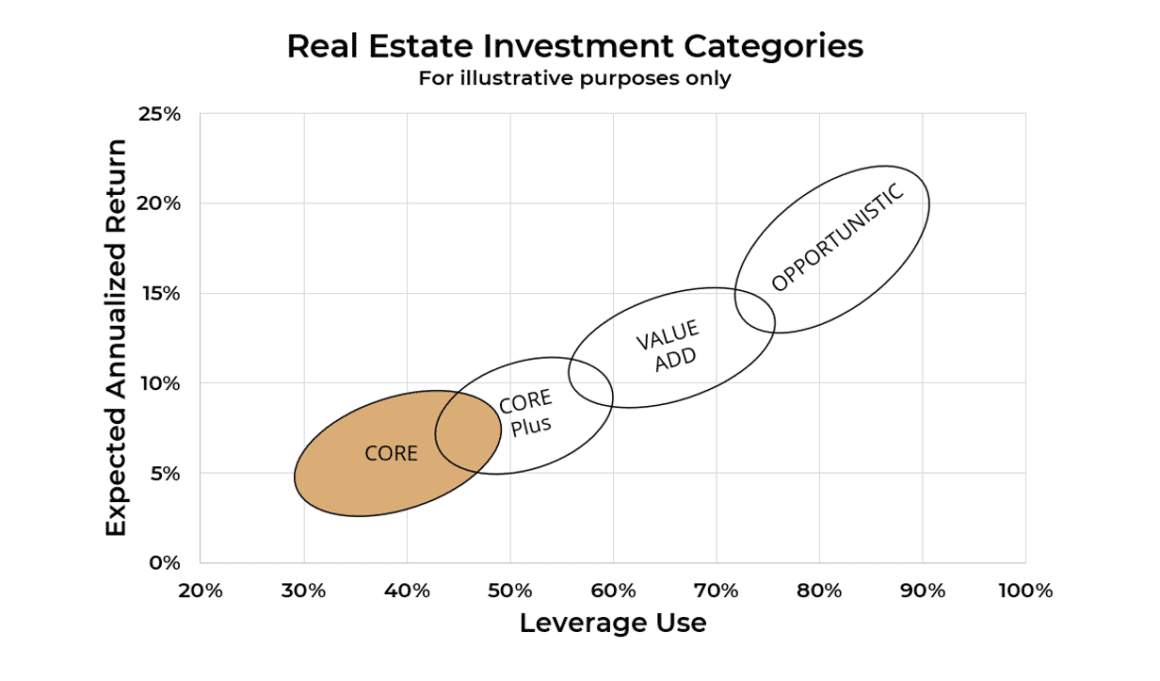

Image source: nuveen.com

The Appeal of Early Retirement Through Property Investment

The allure lies in control and predictability. Unlike volatile stocks, property offers steady rental income and tangible growth. For Australians, leveraging equity in high-demand suburbs can amplify returns. Lesser-known? Tax benefits like negative gearing can offset costs. But here’s the kicker: timing and location are everything—get them wrong, and profits vanish.

Objective of the Analysis and What to Expect

This analysis uncovers how property investment strategies align with financial independence goals. Expect a breakdown of cash flow dynamics, equity leverage, and tax advantages. We’ll challenge myths like “more properties equal faster retirement” and explore how factors like interest rates, market cycles, and lifestyle goals shape your roadmap to early retirement.

Understanding the Fundamentals of Property Investment

Property investment isn’t just about buying houses—it’s about strategic decision-making. For example, a positively geared property in a regional area might generate immediate cash flow, but urban properties often deliver stronger long-term growth. Misconception? Bigger portfolios guarantee success. Instead, focus on quality over quantity and leverage tax benefits like negative gearing wisely.

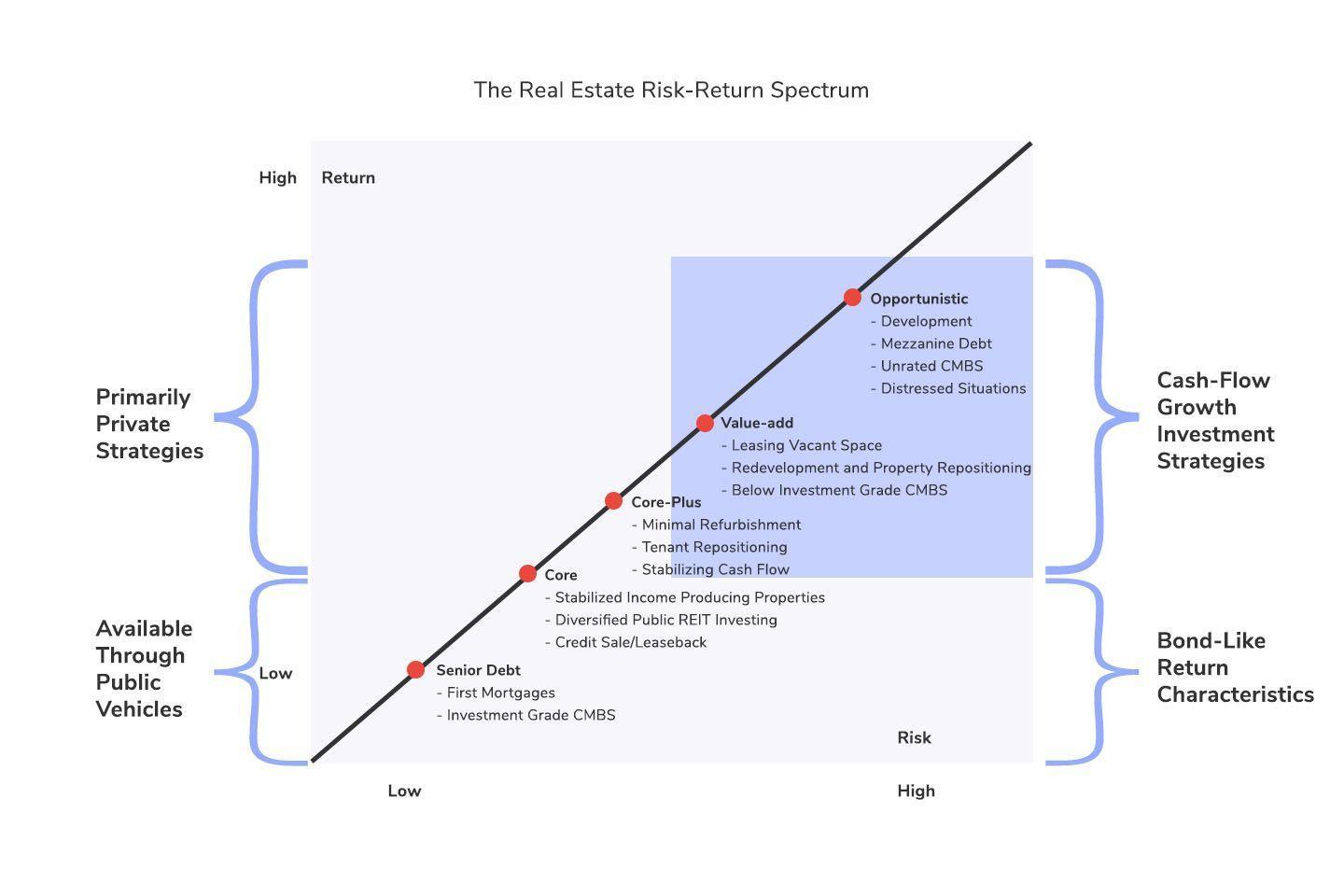

Image source: tenantcloud.com

How Property Generates Wealth Over Time

Wealth builds through equity growth and compounding returns. For instance, leveraging a $500k property appreciating at 5% annually creates $25k in equity each year. Add rental income and tax benefits like depreciation, and the gains multiply. Lesser-known? Forced appreciation—renovations can boost value faster than market trends, accelerating your wealth-building timeline.

Key Concepts: Equity, Cash Flow, and Appreciation

Equity isn’t just a passive gain—it’s a leveraging tool. For example, refinancing a property with $200k in equity can fund new investments, compounding returns. Lesser-known? Cash flow properties often attract better financing terms, reducing costs. Balancing equity growth with cash flow ensures both stability and long-term wealth creation.

Financial Foundations Before Investing

Before diving into property, know your numbers. For example, calculate your monthly surplus by subtracting expenses from income. Misstep? Overestimating affordability. A $500k loan at 6% interest means $30k/year in repayments—can your cash flow handle it? Build a buffer for unexpected costs, and remember: financial discipline is your strongest foundation.

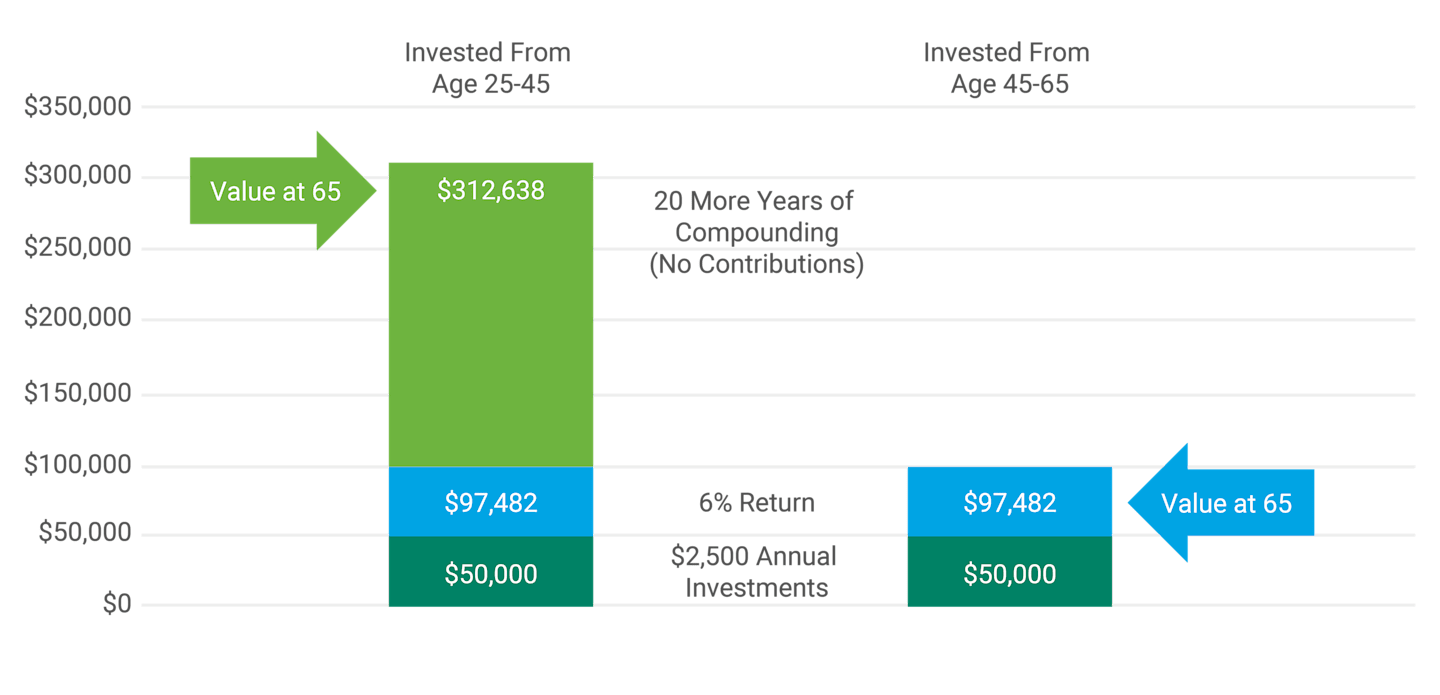

Image source: americancentury.com

Assessing Your Financial Readiness and Goals

Focus on time horizon. Short-term investors may prioritize cash flow, while long-term strategies hinge on capital growth. For instance, a Sydney property appreciating 6% annually doubles in value in 12 years. Misconception? Bigger loans mean faster gains—without stable income, risks outweigh rewards. Align goals with realistic timelines and market trends.

The Role of Credit Scores and Financing Options

Debt-to-income ratio is a game-changer. Lenders favour ratios below 30%, ensuring you can manage repayments. Lesser-known tip? Reducing credit card limits boosts borrowing power. Conventional wisdom says high scores guarantee loans, but without stable cash flow, approvals falter. Actionable step: consolidate debts to improve ratios and unlock better financing terms.

Budgeting for Upfront Costs and Ongoing Expenses

Don’t overlook hidden costs. Stamp duty, legal fees, and inspections can add 5-7% to your purchase price. Lesser-known factor? Vacancy periods—budget for 1-2 months of no rental income annually. Actionable tip: create a buffer fund covering six months of expenses to handle unexpected repairs or tenant turnover seamlessly.

Mathematical Modeling: Calculating Your Path to Early Retirement

Think of early retirement as solving a puzzle. Start with net passive income exceeding expenses. For example, owning three positively geared properties generating $3,000/month can replace a $36,000 annual salary. Misconception? More properties mean faster retirement—quality beats quantity. Use compound growth models to project equity gains and reinvest strategically.

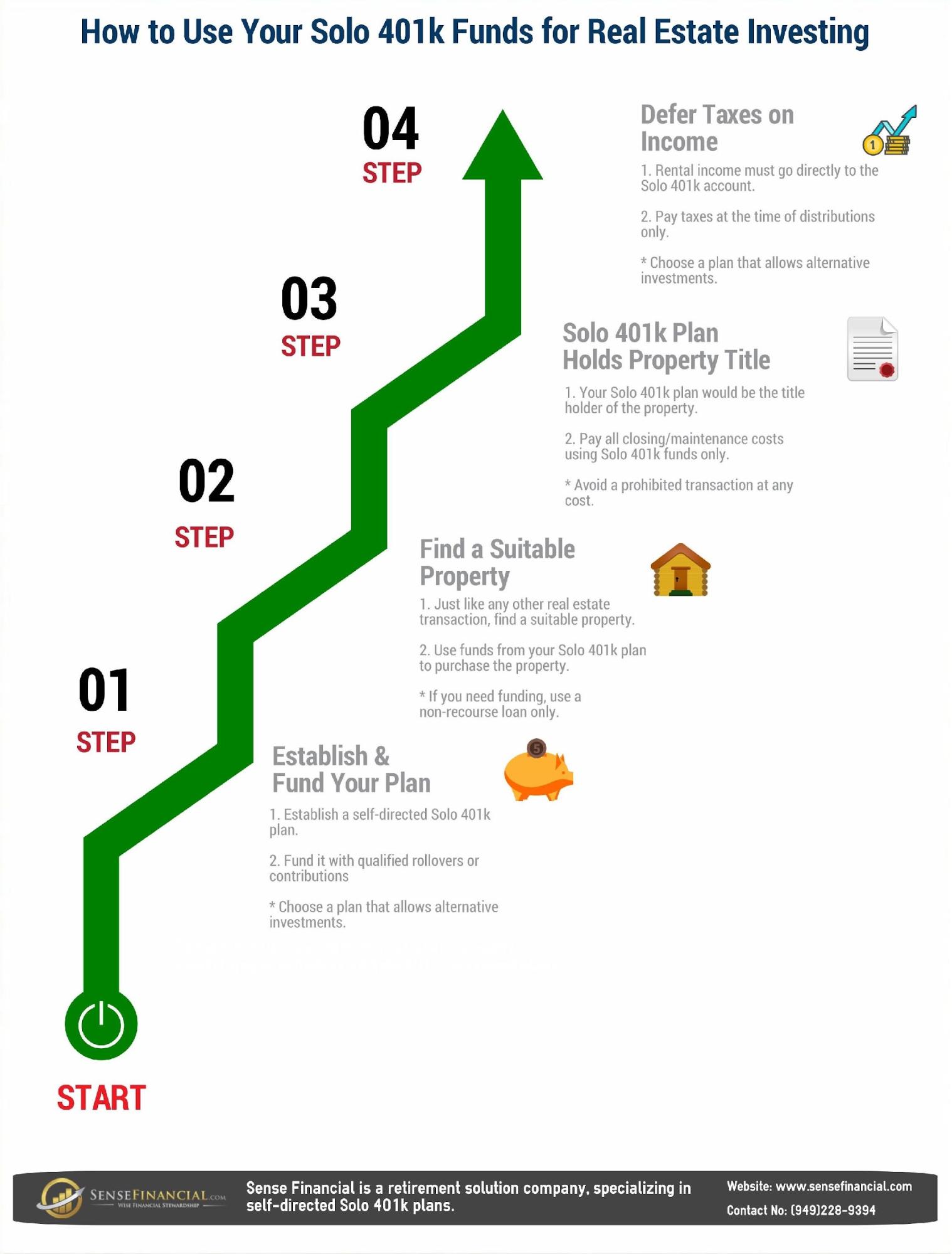

Image source: sensefinancial.com

Determining Your Retirement Income Needs

Start by calculating lifestyle-driven expenses. For instance, a $50,000 annual budget might require $1.25M in assets at a 4% withdrawal rate. Overlooked factor? Inflation—plan for rising costs by targeting properties with rental income growth. Actionable tip: use tools like retirement calculators to align income streams with future spending needs.

Projecting Rental Income and Cash Flow Analysis

Focus on market-driven rent increases. For example, a 3.3% annual rise (historical average) can significantly boost long-term cash flow. Lesser-known tip? Analyse tenant demographics—stable, high-income renters reduce vacancy risks. Actionable framework: combine rent estimators with expense forecasting tools to refine projections and ensure sustainable, inflation-adjusted income streams.

Understanding the Impact of Compound Growth and Leverage

Leverage amplifies returns by enabling control of higher-value assets with less capital. For instance, a 20% deposit on a $500k property allows gains on the full value. Lesser-known insight? Debt recycling can optimise tax benefits while compounding equity growth. Framework: reinvest equity strategically to accelerate wealth-building cycles.

Strategies for Building a Property Portfolio

Focus on diversification: mix high-growth urban properties with positively geared regional ones. Example: pairing a Sydney apartment for capital gains with a Brisbane duplex for cash flow. Misconception? More properties equal success—quality trumps quantity. Expert tip: leverage equity cyclically to scale sustainably while managing risk exposure.

Image source: caliberco.com

Identifying High-Potential Investment Properties

Look beyond price tags—focus on infrastructure growth. Properties near upcoming transport hubs or schools often outperform. Example: Melbourne’s western suburbs saw 15% growth post-rail upgrades. Lesser-known factor? Walkability scores influence tenant demand. Actionable tip: use tools like CoStar to map demographic shifts and predict future hotspots.

Diversification: Residential vs. Commercial Properties

Blend residential stability with commercial high yields. For instance, Sydney apartments offer steady demand, while Brisbane retail spaces can deliver 8%+ returns. Lesser-known insight? Commercial leases often include tenant-covered expenses, boosting net income. Actionable tip: balance portfolios by allocating 60% residential, 40% commercial for risk-adjusted growth.

Scaling Your Portfolio Sustainably

Leverage debt recycling to scale efficiently—convert non-deductible debt (e.g., home loans) into investment debt for tax benefits. Example: Melbourne investors use equity from appreciating properties to fund new purchases. Lesser-known tip? Avoid over-leveraging by maintaining a 70% loan-to-value ratio. Framework: reinvest profits into high-growth areas for compounding returns.

Risk Management and Mitigation

Think of property investment like driving—seatbelts (contingency funds) and airbags (insurance) are non-negotiable. For example, Brisbane investors mitigate vacancy risks by targeting high-demand suburbs. Misconception? Diversification alone isn’t enough; vet tenants rigorously. Expert tip: use sensitivity analysis to stress-test financial models against interest rate hikes.

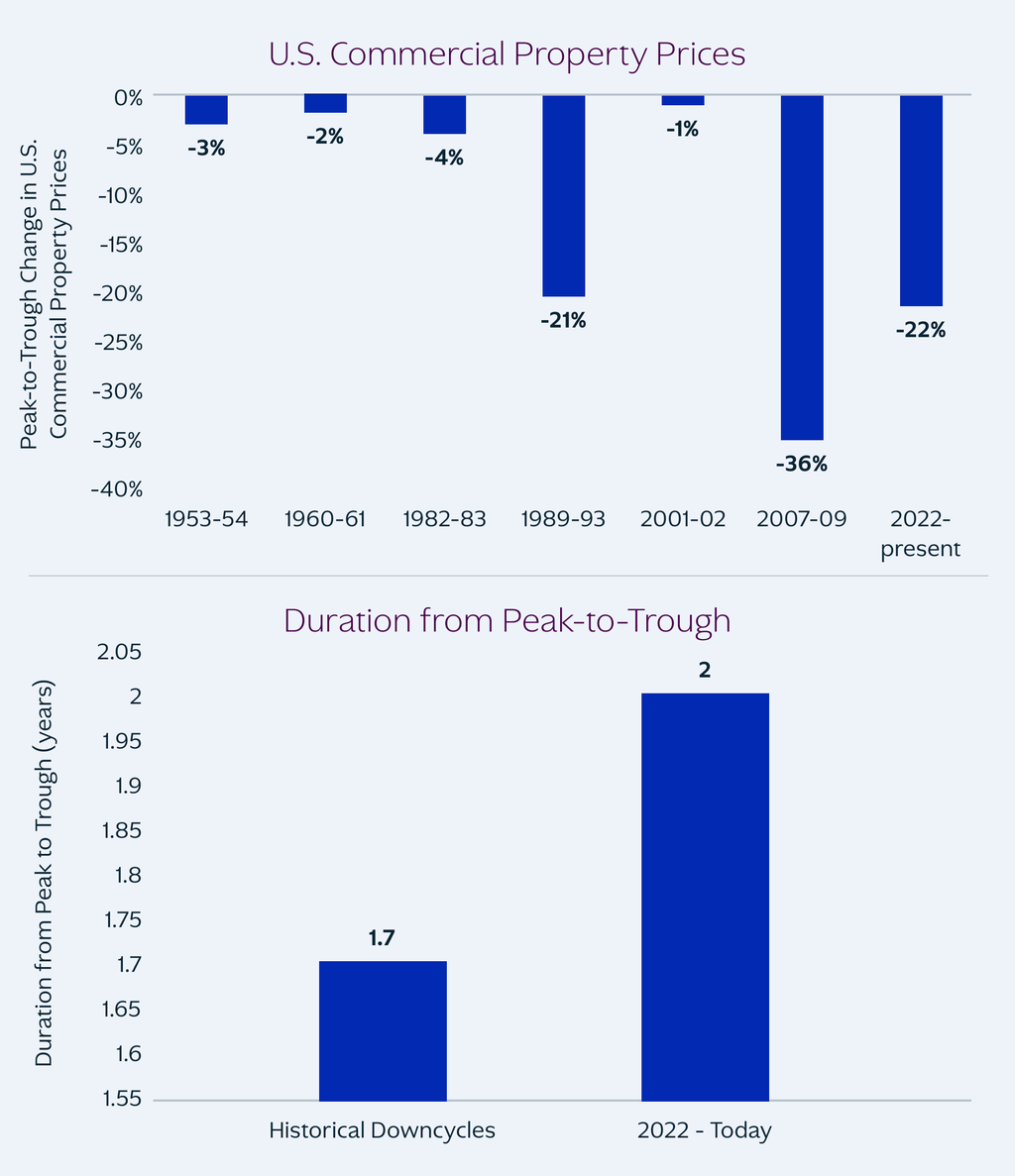

Image source: realvantage.co

Navigating Market Volatility and Economic Downturns

During downturns, liquidity is king. Savvy Sydney investors keep 6-12 months’ cash reserves, enabling them to seize undervalued properties. Lesser-known factor? Monitor local employment trends—areas with stable industries weather volatility better. Actionable tip: diversify into REITs for exposure without direct ownership risks, balancing stability with growth potential.

Legal and Regulatory Considerations

Zoning laws can make or break investments. For instance, Brisbane investors capitalise on rezoning for higher-density housing. Lesser-known tip? Track council development plans to anticipate changes. Challenge: Short-term rental laws, like in Melbourne, demand compliance. Actionable insight: Consult local property lawyers early to avoid costly missteps and maximise returns.

Insurance and Protection Strategies

Loss of rent insurance is a game-changer, especially in Sydney’s competitive market. It covers income gaps during tenant vacancies or defaults. Lesser-known factor? Policies often exclude unapproved subletting. Actionable tip: Regularly review coverage with insurers to adapt to market shifts, ensuring comprehensive protection and peace of mind for your portfolio.

Advanced Investment Techniques

Debt recycling transforms home loans into tax-deductible investment debt, boosting returns. For example, Melbourne investors leverage this to fund high-growth properties. Misconception? It’s risky—when managed with financial advice, it’s strategic. Think of it as turning everyday expenses into wealth-building tools, aligning tax benefits with long-term property appreciation.

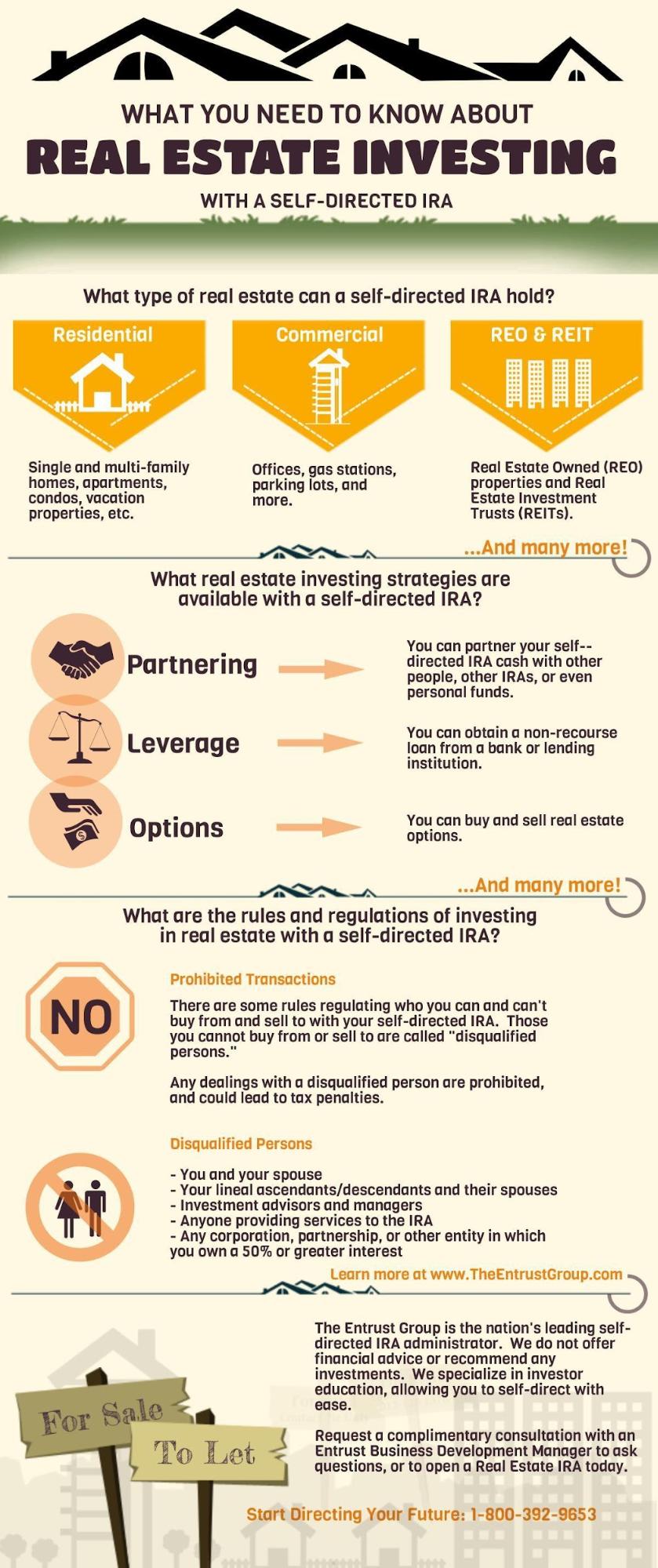

Image source: theentrustgroup.com

Utilizing Real Estate Investment Trusts (REITs)

Hybrid REITs blend equity and mortgage strategies, offering both rental income and interest returns. For instance, Australian investors use them to hedge against market volatility. Lesser-known insight? Rising interest rates can reduce profitability, but diversifying REIT types mitigates risks. Actionable tip: Monitor rate trends to optimise portfolio performance.

Exploring Property Crowdfunding and Syndication

Crowdfunding democratises property investment, allowing Australians to start with as little as $500. Platforms like Fundrise simplify due diligence, but here’s the catch: diversification is key. Avoid overexposure by spreading investments across regions and asset types. Framework: Assess platform transparency, historical returns, and alignment with your risk tolerance for smarter decisions.

Tax Strategies and Wealth Preservation

Leverage negative gearing to offset rental losses against taxable income—a popular strategy in Australia. Lesser-known tip? Use debt recycling to convert home loan debt into tax-deductible investment debt. Framework: Pair with a family trust to protect assets and optimise tax benefits. Always consult a tax advisor for tailored strategies.

Case Studies: Successes and Lessons Learned

A Sydney investor turned a $50k deposit into $1.2M equity in 10 years by targeting undervalued suburbs with upcoming infrastructure. Contrast: A Brisbane buyer over-leveraged in mining towns, losing 30% during a downturn. Lesson? Focus on long-term growth drivers, not short-term hype. Always balance risk with research.

Image source: kkr.com

Profiles of Investors Who Retired Early with Property

Meet Lisa, a Melbourne teacher who retired at 45 by leveraging positive cash flow properties in regional hubs. Her secret? Diversifying into dual-income homes, reducing vacancy risks. Insight: She reinvested rental surpluses into high-growth urban areas, compounding returns. Framework: Blend cash flow stability with strategic equity reinvestment.

Analyzing Failed Ventures and Common Pitfalls

Over-leveraging in mining towns during booms led many investors to financial ruin when demand plummeted. Why? Ignoring diversification and relying on speculative growth. Takeaway: Use sensitivity analysis to stress-test investments against downturns. Framework: Prioritise stable cash flow properties and avoid emotional decision-making tied to market hype.

Emerging Trends and Future Outlook

Sustainable housing is reshaping property investment, with green buildings offering long-term tenant appeal and reduced costs. Meanwhile, co-living spaces thrive among millennials seeking affordability and community. Unexpected twist? E-commerce growth fuels demand for logistics hubs. Actionable insight: Diversify into eco-friendly and tech-driven properties to future-proof your portfolio.

Image source: www2.deloitte.com

The Impact of Technology on Property Investment

Blockchain is revolutionising property transactions by enabling secure, tamper-proof records and fractional ownership. This opens doors for smaller investors while reducing fraud and costs. Unexpected link? AI-driven tools now predict market trends with precision, helping investors optimise portfolios. Pro tip: Leverage these tools to stay ahead in competitive markets.

Sustainability and Green Building Trends

Net Zero Energy Buildings are gaining traction, combining renewable energy with efficient designs to offset energy use. In Australia, government incentives like tax rebates make these projects financially viable. Surprising factor? Tenant demand for eco-friendly spaces drives higher rental yields. Takeaway: Invest in green retrofits to future-proof your properties.

Globalization and International Property Markets

Currency Arbitrage offers savvy Australian investors a chance to capitalise on weaker foreign currencies, boosting purchasing power in emerging markets. Key insight: Regions like Southeast Asia combine rapid urbanisation with low entry costs. Pro tip: Hedge against currency risks using forward contracts to protect returns and stabilise cash flow.

FAQ

What are the key financial metrics to calculate if property investment can fund early retirement?

Key financial metrics include:

- Cash Flow: Calculate net cash flow by subtracting expenses (mortgage, taxes, maintenance) from rental income. Positive cash flow ensures sustainability.

- Cash-on-Cash Return: Measures annual return on invested cash, factoring in debt service.

- Internal Rate of Return (IRR): Evaluates long-term profitability, considering cash flow and property appreciation.

- Loan-to-Value Ratio (LVR): Helps assess leverage and risk exposure.

- Break-Even Ratio: Determines the minimum occupancy rate needed to cover expenses.

These metrics provide a comprehensive view of financial viability for early retirement.

How does leveraging equity impact the timeline for achieving early retirement?

Leveraging equity accelerates the timeline by enabling investors to acquire additional properties without significant upfront capital. This amplifies wealth through compounding appreciation and rental income. However, careful management of loan-to-value ratios and debt servicing is crucial to avoid over-leveraging, which can delay retirement goals during market downturns or rising interest rates.

What role do rental income and cash flow play in sustaining early retirement through property?

Rental income and cash flow are the foundation of sustaining early retirement through property. Positive cash flow ensures that monthly expenses, including mortgage payments, taxes, and maintenance, are covered while generating surplus income for living costs. Over time, rental income typically increases due to inflation and market demand, further enhancing financial stability. Consistent cash flow reduces reliance on savings, making property investment a reliable source of passive income for long-term retirement sustainability.

How can market volatility and economic downturns affect property-based retirement plans?

Market volatility and economic downturns can disrupt property-based retirement plans by reducing property values and rental income. During downturns, higher vacancy rates and declining rents may strain cash flow, while tighter credit conditions can limit refinancing options. Over-leveraged investors face heightened risks, including potential foreclosure. However, maintaining liquidity reserves, diversifying property types and locations, and focusing on long-term growth can mitigate these impacts and preserve retirement goals.

What strategies can mitigate risks and ensure long-term success in property investment for early retirement?

Strategies include diversifying investments across property types and locations to reduce exposure to market-specific risks. Building a contingency fund ensures financial stability during vacancies or unexpected expenses. Conducting thorough tenant screening minimizes rental defaults, while opting for fixed-rate loans protects against interest rate hikes. Regularly reviewing market trends and maintaining conservative loan-to-value ratios further safeguard investments, ensuring long-term success and stability for early retirement plans.

Conclusion

Retiring early with property isn’t just a dream—it’s a calculated journey. By leveraging equity smartly, balancing cash flow with growth, and diversifying investments, you can create a sustainable income stream. Think of property as a “money tree”—nurtured with strategy, it grows steadily, weathering economic storms while bearing fruit for years to come.

Image source: wiseradvisor.com

Evaluating the Viability of Early Retirement Through Property

The key lies in scaling smartly. For instance, pairing positively geared properties with high-growth assets balances cash flow and equity. Lesser-known factors, like zoning changes or infrastructure projects, can skyrocket values. Expert tip: Use tools like cash flow calculators to model scenarios, ensuring your portfolio aligns with retirement goals and market trends.

Final Thoughts and Actionable Next Steps

Start by defining clear financial goals—whether it’s replacing your income or building a safety net. Leverage tools like property management software to streamline operations. Explore emerging trends like eco-friendly developments for future-proofing. Most importantly, consult experts regularly to adapt strategies, ensuring your portfolio thrives in Australia’s dynamic property market.