Government Grants and Hidden Gems: Australia’s First Home Buying Tips You’ll Thank Us For

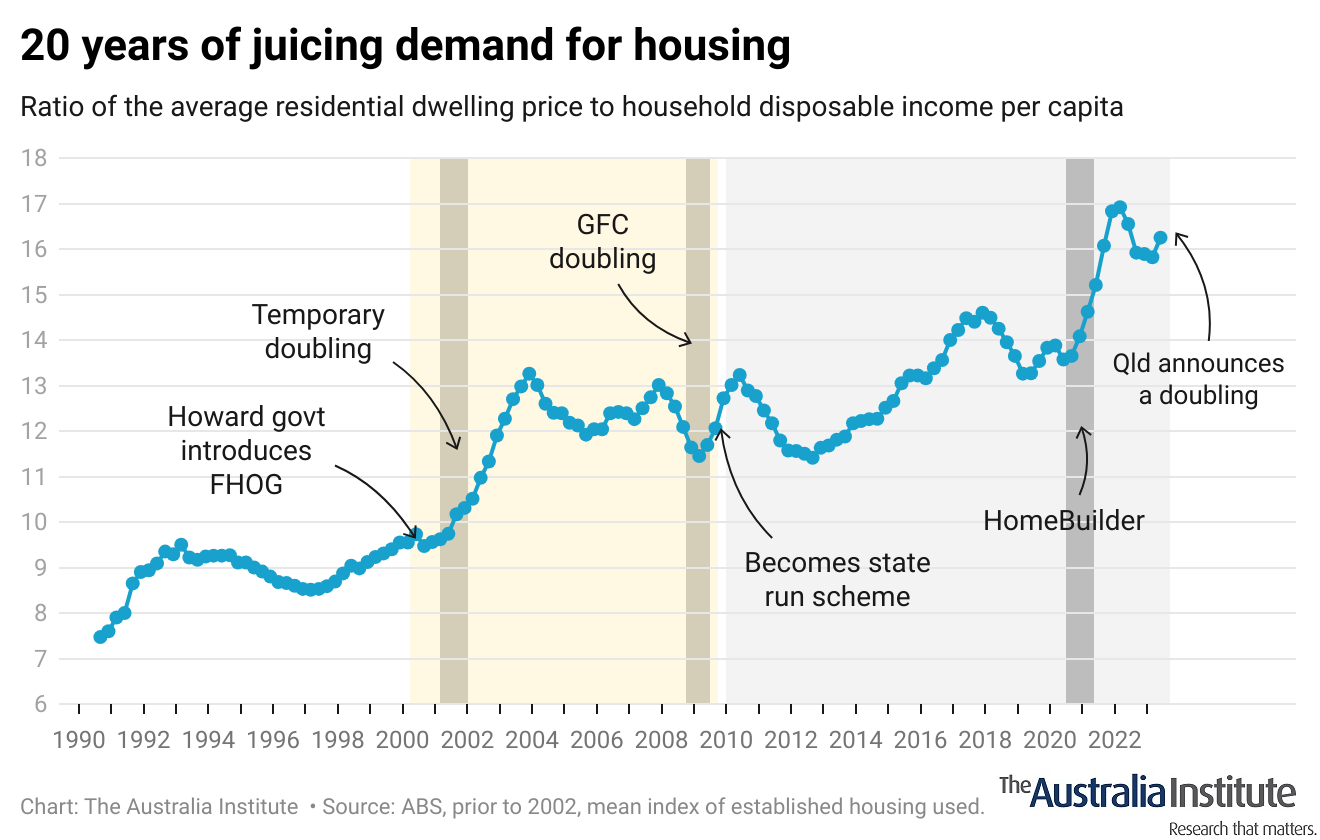

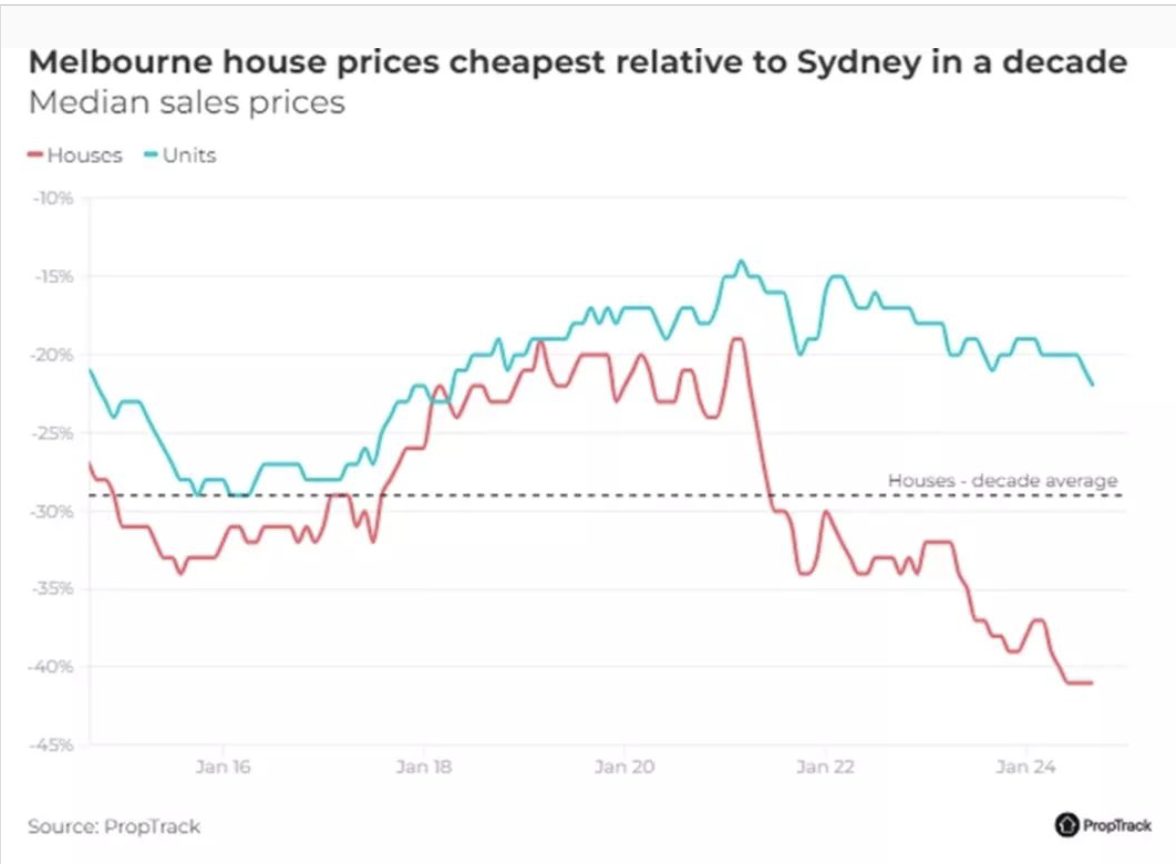

Australia’s housing market is a paradox: while government grants promise affordability, they often fuel demand, driving prices higher. Can first-home buyers truly win in this cycle, or is there a smarter way forward?

Image source: australiainstitute.org.au

Embarking on Your First Home Buying Journey

Understanding the trade-offs between location, size, and amenities is crucial. For instance, opting for a larger home further from employment hubs may save costs but increase commuting expenses. Balancing these factors requires strategic planning.

Why Knowing All Your Options Matters

Exploring emerging suburbs with planned infrastructure growth can unlock lower entry prices and long-term value. Tools like CoreLogic help analyze trends, ensuring investments align with future urban development and lifestyle needs.

Demystifying Government Grants and Schemes

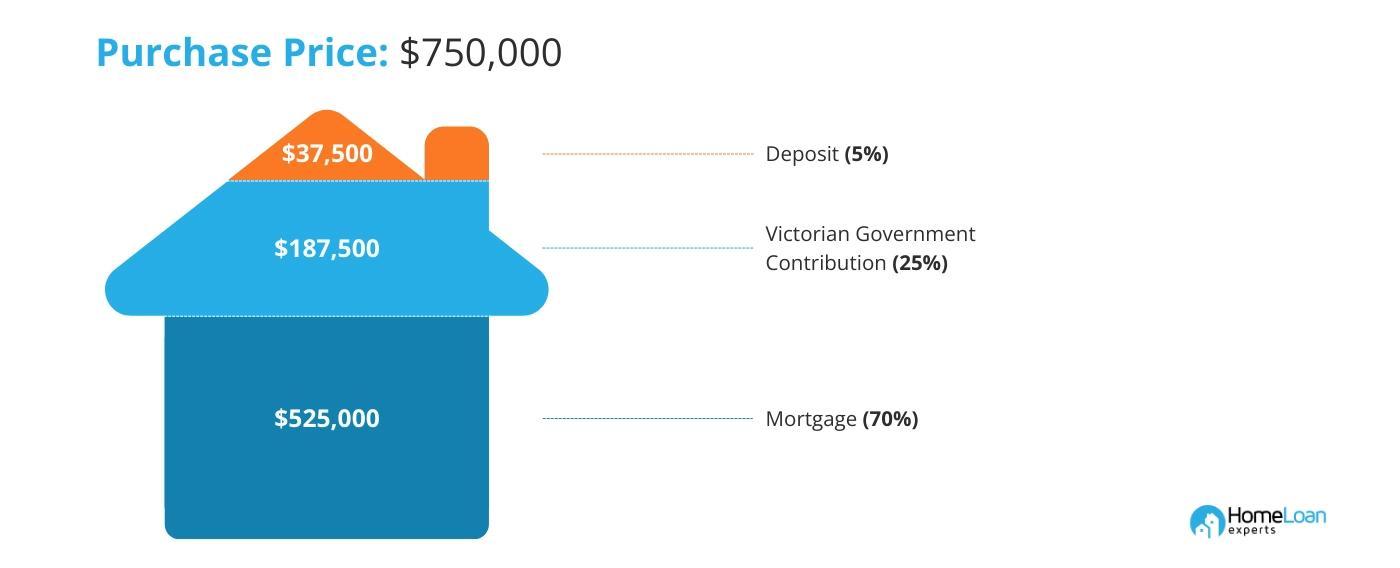

Government grants, like the First Home Guarantee, reduce deposit barriers but can inflate demand. Shared equity schemes, such as Help to Buy, balance affordability with market stability, offering innovative pathways for first-home buyers in high-cost regions.

Image source: 7mortgages.com.au

Understanding the First Home Owner Grant (FHOG)

The FHOG incentivizes new builds, fostering construction growth. However, eligibility caps, like the $750,000 property limit, ensure accessibility while curbing speculative purchases. Strategic use alongside other grants maximizes affordability for first-time buyers.

Exploring the First Home Loan Deposit Scheme

By reducing deposit requirements to 5%, the scheme eliminates Lenders Mortgage Insurance costs. However, higher loan-to-value ratios increase interest risks, urging buyers to balance short-term affordability with long-term financial resilience.

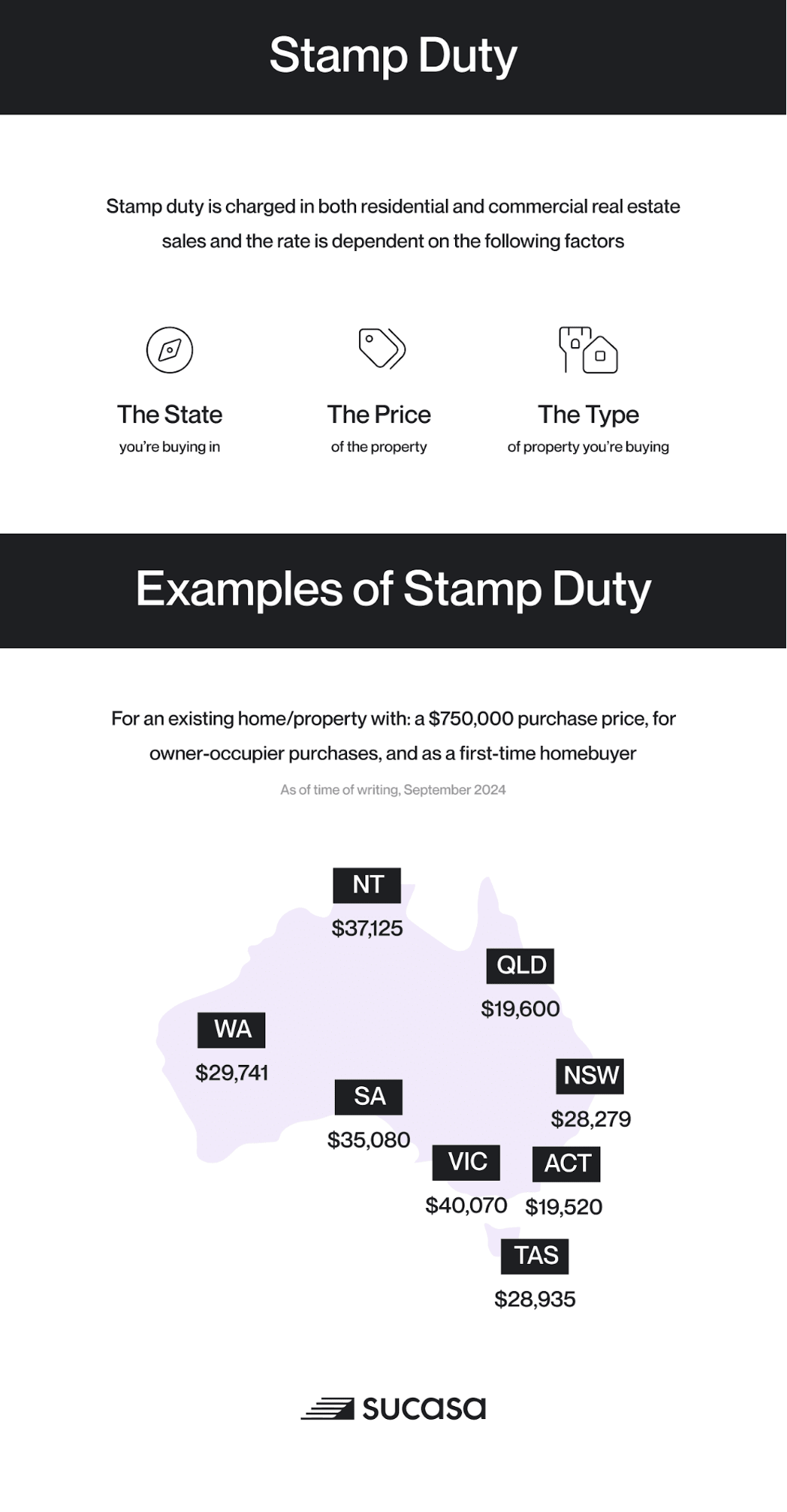

State and Territory Incentives: What’s Available

Stamp duty concessions, like Victoria’s $31,000 savings, reduce upfront costs. However, regional disparities in eligibility highlight the need for integrated infrastructure investments to ensure equitable access and long-term housing affordability.

Eligibility Requirements Simplified

Income thresholds often exclude middle-income earners. Introducing dynamic caps tied to regional cost-of-living indices could improve inclusivity, ensuring grants reach diverse demographics while aligning with localized housing market conditions.

Maximising Government Assistance

Layering grants, like combining the First Home Owner Grant with stamp duty concessions, can slash upfront costs. Pro tip: Use tools like CoreLogic to target suburbs with planned infrastructure for long-term value growth.

Image source: abrealtywa.com

Strategically Combining Grants and Concessions

Pairing the First Home Owner Grant with regional stamp duty exemptions can unlock significant savings. Example: In Victoria, combining these reduces upfront costs by over $20,000, enabling faster market entry and financial flexibility.

Timing Your Application for Optimal Benefit

Submit grant applications alongside pre-approved home loans to streamline processes. Why it works: Lenders often assist with compliance, reducing delays. Aligning with market cycles can also secure better property prices and maximize grant impact.

Navigating the Application Process Successfully

Leverage digital platforms for faster grant approvals. Pro tip: Pre-organize documents like income proof and property details. This minimizes errors, accelerates processing, and ensures compliance, giving you a competitive edge in high-demand markets.

Uncovering Hidden Gems in Home Buying

Explore emerging suburbs with planned infrastructure projects. Example: Areas near future transport hubs often see value spikes. Use AI-driven tools to identify these opportunities early, blending affordability with long-term growth potential for savvy investments.

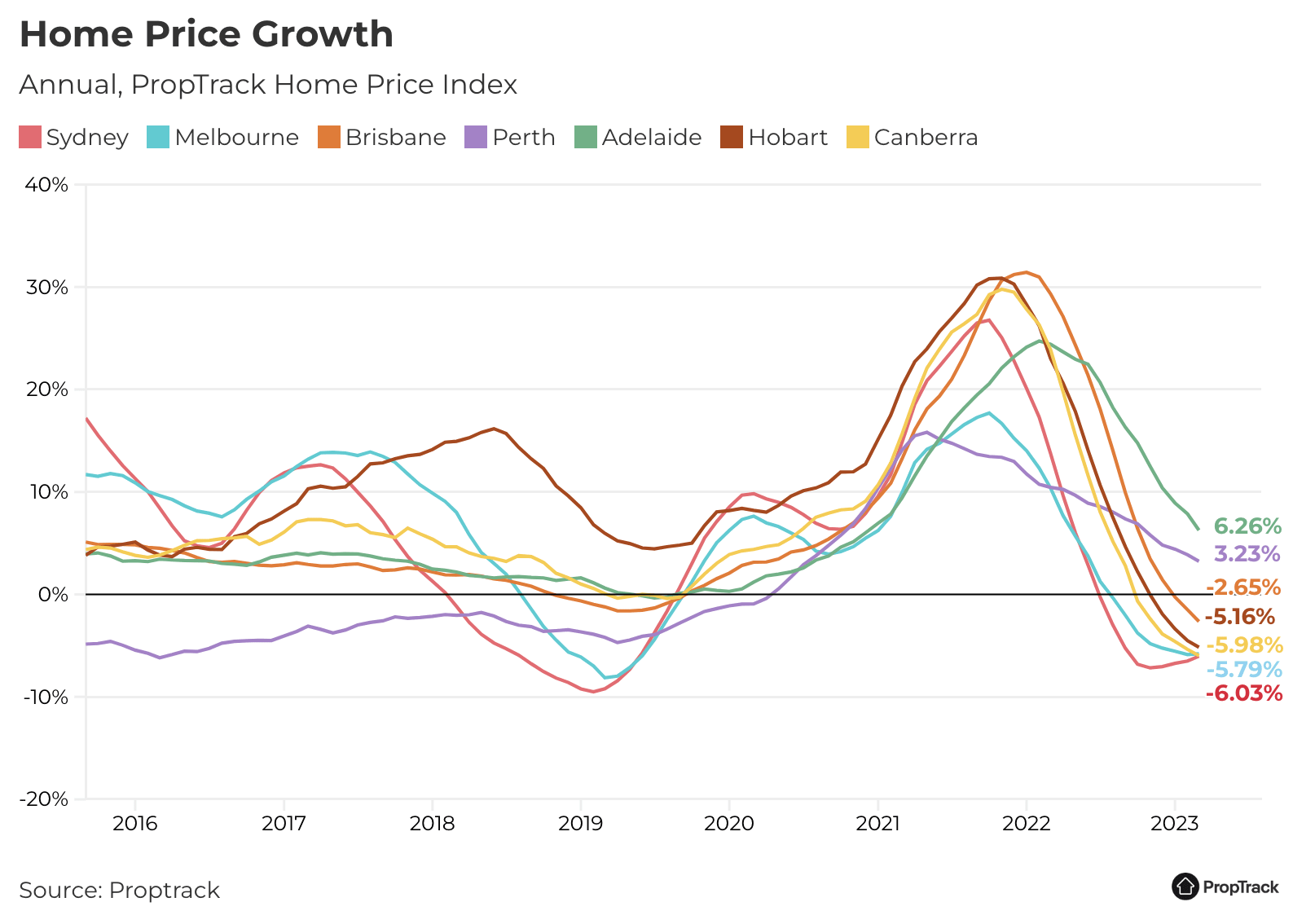

Image source: realestate.com.au

Lesser-Known Grants and Programs

Investigate regional-specific grants like the Regional First Home Buyer Guarantee. These programs promote growth in overlooked areas, offering lower entry costs. Pairing them with local incentives maximizes affordability while fostering community-driven investment opportunities.

Taking Advantage of Stamp Duty Exemptions

Leverage exemptions strategically by targeting properties below threshold limits. Example: In NSW, homes under $650k qualify for full exemptions, saving thousands upfront. Combine with grants to reduce financial barriers and accelerate homeownership goals.

Shared Equity and Co-Ownership Opportunities

Shared equity reduces upfront costs by splitting ownership. Example: Government schemes like “Help to Buy” allow gradual equity buyback, aligning affordability with market growth. This fosters accessibility while mitigating financial risks for first-time buyers.

Community and Employer Assistance Programs

Employer-backed housing loans or subsidies ease affordability challenges. Example: Mining companies in remote areas offer housing incentives, boosting employee retention. Integrating such programs with government grants amplifies impact, fostering sustainable homeownership and community development.

Financial Strategies for First-Time Buyers

Prioritize tax-effective savings tools like the First Home Super Saver Scheme. Example: A $15,000 annual contribution taxed at 15% grows faster than traditional savings, accelerating homeownership. Align budgeting with grants to avoid over-leveraging risks.

Image source: huntergalloway.com.au

Utilising the First Home Super Saver Scheme

Maximize salary sacrifice contributions under the scheme to reduce taxable income while boosting savings. Example: A $20,000 contribution taxed at 15% saves $3,400 annually compared to standard income tax rates, accelerating deposit growth.

Alternative Financing Options

Explore shared equity schemes to reduce upfront costs. Example: A 30% government equity share lowers mortgage size, easing repayments. Lesser-known benefit: gradual buyback flexibility minimizes financial strain, offering stability even during economic downturns or rising interest rates.

Budgeting and Saving Hacks

Leverage micro-saving apps to automate daily savings. Example: Rounding up transactions builds deposits effortlessly. Lesser-known factor: linking these apps to high-interest accounts amplifies growth, aligning short-term habits with long-term financial goals for first-home buyers.

Navigating the Property Market with Confidence

Think of the property market as a puzzle—CoreLogic tools act like a map, revealing undervalued suburbs. Example: Emerging areas with planned infrastructure often outperform expectations, blending affordability with future growth potential.

Image source: propertyupdate.com.au

Researching Suburbs and Property Trends

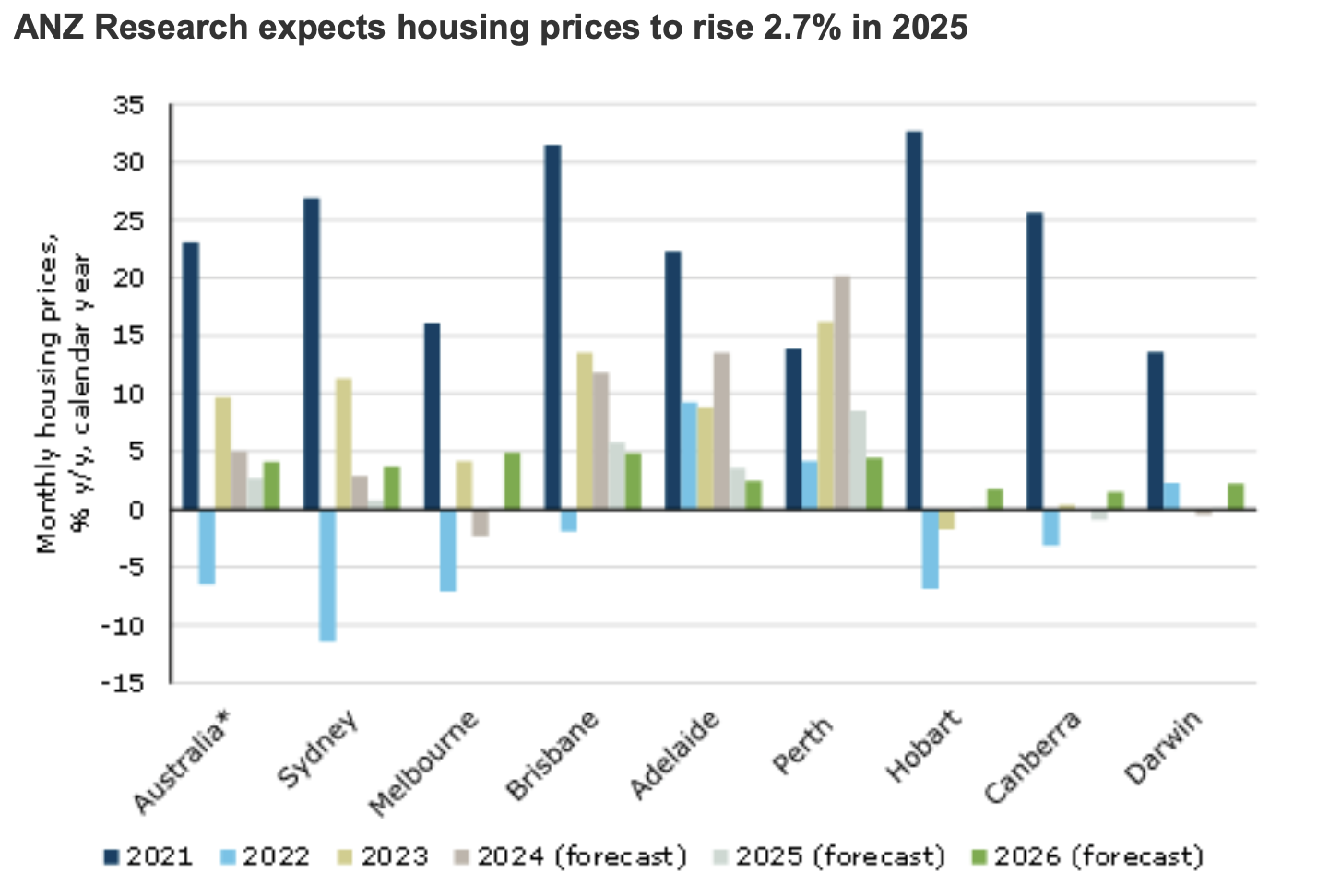

Focus on suburbs near planned transport hubs. Example: Sydney’s outer west saw 20% growth post-infrastructure announcements. Lesser-known tip: Analyze council development plans to uncover hidden opportunities before market demand spikes.

Assessing Property Value and Potential

Leverage market assessment valuations to gauge fair pricing. Example: Properties near rezoned areas often see 15% value jumps. Lesser-known factor: Historical sales trends reveal hidden growth patterns, offering a smarter investment framework.

Negotiation Tactics for First-Time Buyers

Use pre-settlement inspections as leverage. Example: Identifying minor defects can justify price reductions. Lesser-known tactic: Offer flexible settlement terms to appeal to sellers, creating win-win scenarios and boosting your negotiation power.

Learning from Real-Life Success Stories

A couple in Melbourne combined the First Home Owner Grant with stamp duty concessions, saving $25,000. Their strategy? Targeting an emerging suburb with planned infrastructure, ensuring both affordability and long-term growth potential.

Image source: homeloanexperts.com.au

Case Study: Leveraging Multiple Grants

A Brisbane buyer combined the First Home Guarantee with regional stamp duty exemptions, reducing upfront costs by 30%. Key insight: Aligning grants with low-interest periods amplifies affordability and long-term financial stability.

Case Study: Finding Hidden Opportunities

A Sydney buyer identified undervalued properties near future transport hubs using CoreLogic analytics. This approach secured a 15% lower entry price, proving that early infrastructure insights unlock both affordability and long-term growth.

Key Takeaways from Successful Buyers

Successful buyers prioritized pre-approval timing to lock in favorable rates before market shifts. This strategy, paired with leveraging regional grants, minimized financial risks and maximized opportunities in emerging, high-growth suburbs.

Staying Informed: Emerging Trends and Updates

AI-driven platforms now predict suburb growth by analyzing infrastructure plans and demographic shifts. For example, buyers using AI tools identified undervalued Melbourne suburbs, achieving 20% equity growth within three years—outpacing traditional methods.

Image source: propertyupdate.com.au

Recent Policy Changes Impacting Buyers

Stricter foreign investment taxes, like Victoria’s 7% surcharge, reduced competition for locals. However, zoning law shifts enabling higher-density housing could counteract supply shortages, offering buyers more affordable options in previously inaccessible areas.

Technology and Tools for Modern Home Buying

Blockchain-based platforms now ensure fraud-proof transactions, streamlining property purchases. Coupled with AI-driven analytics, buyers can identify undervalued properties faster, reducing risks and maximizing returns—revolutionizing how first-home buyers navigate competitive markets.

Future Predictions for the Housing Market

AI-driven forecasting models predict regional market cooling as immigration policies shift. However, emerging infrastructure projects could stabilize demand, creating opportunities for buyers to capitalize on undervalued areas before prices rebound.

FAQ

What are the key government grants available for first-home buyers in Australia?

Key government grants for first-home buyers in Australia include the First Home Owner Grant (FHOG), offering up to $30,000 for new builds, and the First Home Guarantee, enabling purchases with a 5% deposit without Lenders Mortgage Insurance. Additionally, the Family Home Guarantee supports single parents with a 2% deposit, while the Regional First Home Buyer Guarantee promotes regional growth with similar benefits. These programs aim to reduce financial barriers and improve accessibility for first-time buyers.

How can first-home buyers strategically combine grants to maximize savings?

First-home buyers can strategically combine grants by layering the First Home Owner Grant (FHOG) with stamp duty concessions, significantly reducing upfront costs. Pairing the First Home Guarantee with the First Home Super Saver Scheme accelerates deposit savings while minimizing Lenders Mortgage Insurance. In regional areas, combining the Regional First Home Buyer Guarantee with state-specific grants enhances affordability. Consulting financial advisors ensures eligibility alignment and maximizes benefits across programs.

What factors should be considered when exploring emerging suburbs as hidden gems?

When exploring emerging suburbs as hidden gems, consider planned infrastructure developments, such as new transport links or schools, which can boost long-term property value. Analyze historical sales data and growth trends using tools like CoreLogic to identify undervalued areas. Evaluate proximity to employment hubs and amenities to balance affordability with convenience. Additionally, review local council development plans to uncover future opportunities and ensure the suburb aligns with lifestyle and investment goals.

Are there any risks associated with using shared equity schemes for first-home buyers?

Risks associated with using shared equity schemes for first-home buyers include the potential for entering negative equity if property values decline, as borrowers may owe more than the home’s worth. Additionally, shared equity arrangements require sharing profits with the equity partner upon sale, which could limit financial gains. Eligibility criteria, such as income thresholds, may also restrict flexibility. Rising interest rates and repayment obligations can further strain finances, making it essential to assess long-term implications and seek professional advice before committing.

How do eligibility criteria for government grants vary across different states and territories?

Eligibility criteria for government grants vary across states and territories in several key areas. Property value caps differ significantly, with urban limits often exceeding $800,000, while regional caps are lower. Residency requirements may mandate living in the property for a minimum period, typically 6 to 12 months. Grant amounts also vary, such as Queensland offering up to $30,000 for new builds, while other states provide less. Income thresholds and property types further influence eligibility, with some grants focusing exclusively on new constructions or significantly renovated homes. Consulting state-specific guidelines ensures compliance and maximizes benefits.

Conclusion

Navigating Australia’s first-home buying landscape is like piecing together a puzzle where every grant, scheme, and suburb insight adds value. For instance, combining the First Home Owner Grant (FHOG) with stamp duty exemptions in regional areas has saved buyers up to $40,000 upfront, as seen in a Brisbane couple’s success story. Yet, misconceptions persist—many assume shared equity schemes are risk-free, overlooking potential profit-sharing downsides. Expert advice, like leveraging tools such as CoreLogic, reveals hidden gems in suburbs poised for growth, turning overlooked areas into investment goldmines. By aligning grants with strategic planning, first-home buyers can unlock opportunities that balance affordability with future potential.

Image source: sucasa.com.au

Charting Your Path to Home Ownership

Focusing on emerging suburbs with planned infrastructure can redefine affordability. For example, Sydney’s Marsden Park saw a 15% value increase post-railway expansion. Pairing this with First Home Super Saver Scheme contributions accelerates deposit growth.

Final Tips and Encouragement

Leverage AI-driven property platforms to uncover undervalued suburbs. For instance, buyers using predictive analytics identified growth hotspots like Melbourne’s Wyndham Vale, achieving 20% equity gains within three years. Stay adaptable to evolving market trends.