From Renting to Owning: How Aussies Can Achieve Their First Home Dream

For many Australians, the dream of homeownership feels increasingly out of reach, yet here’s a surprising fact: in some cases, the cost of renting over a decade can exceed the upfront expenses of buying a home. This counterintuitive reality raises a critical question—why do so many remain renters when ownership could be within grasp?

The stakes couldn’t be higher. With rising property prices and shifting government policies, the window for first-time buyers to enter the market is narrowing. Yet, amidst these challenges lies an opportunity: a combination of strategic planning, financial literacy, and leveraging available incentives can turn the tide for aspiring homeowners.

But how do you navigate this complex landscape? What steps can transform the daunting process of buying a home into an achievable goal? This article explores not just the practicalities but also the broader implications of transitioning from renting to owning, offering a roadmap to secure your place in Australia’s housing market.

Image source: harcourts.net

The Australian Dream: Shifting from Renting to Owning

One of the most overlooked factors in transitioning from renting to owning is the role of lifecycle variables—key milestones like age, household structure, and income stability. Research by Roya and Garcia (2012) highlights how these variables significantly influence the timing and feasibility of homeownership. For instance, younger renters often face compounding challenges, such as lower savings rates and higher mobility, which delay their ability to build the necessary deposit.

However, city-specific factors, such as population growth and supply constraints, can either amplify or mitigate these barriers. In high-demand urban areas, innovative solutions like shared equity schemes or rent-to-buy models have emerged as viable pathways. These approaches reduce the upfront financial burden, allowing renters to gradually transition into ownership while still building equity.

To make this shift, aspiring homeowners should focus on actionable strategies: setting realistic savings goals, leveraging government incentives, and exploring alternative financing models. By aligning personal circumstances with market opportunities, renters can take meaningful steps toward achieving the Australian dream of homeownership.

Purpose and Scope of This Guide

A critical yet underexplored aspect of this guide is its emphasis on bridging the knowledge gap for first-time buyers. Many aspiring homeowners struggle not because of financial constraints alone, but due to a lack of understanding of the home-buying process. For example, terms like “offset accounts” or “LVR (Loan-to-Value Ratio)” can feel intimidating without proper context, leading to missed opportunities or costly mistakes.

This guide demystifies such concepts by breaking them into actionable steps. For instance, understanding how an offset account reduces interest payments can help buyers optimize their mortgage strategy. Similarly, knowing how to calculate LVR empowers buyers to assess their borrowing capacity and negotiate better loan terms.

By focusing on education and practical tools, this guide equips readers to make informed decisions. The broader implication is clear: knowledge is not just power—it’s a tangible asset that can directly impact financial outcomes.

Understanding the Current Housing Climate in Australia

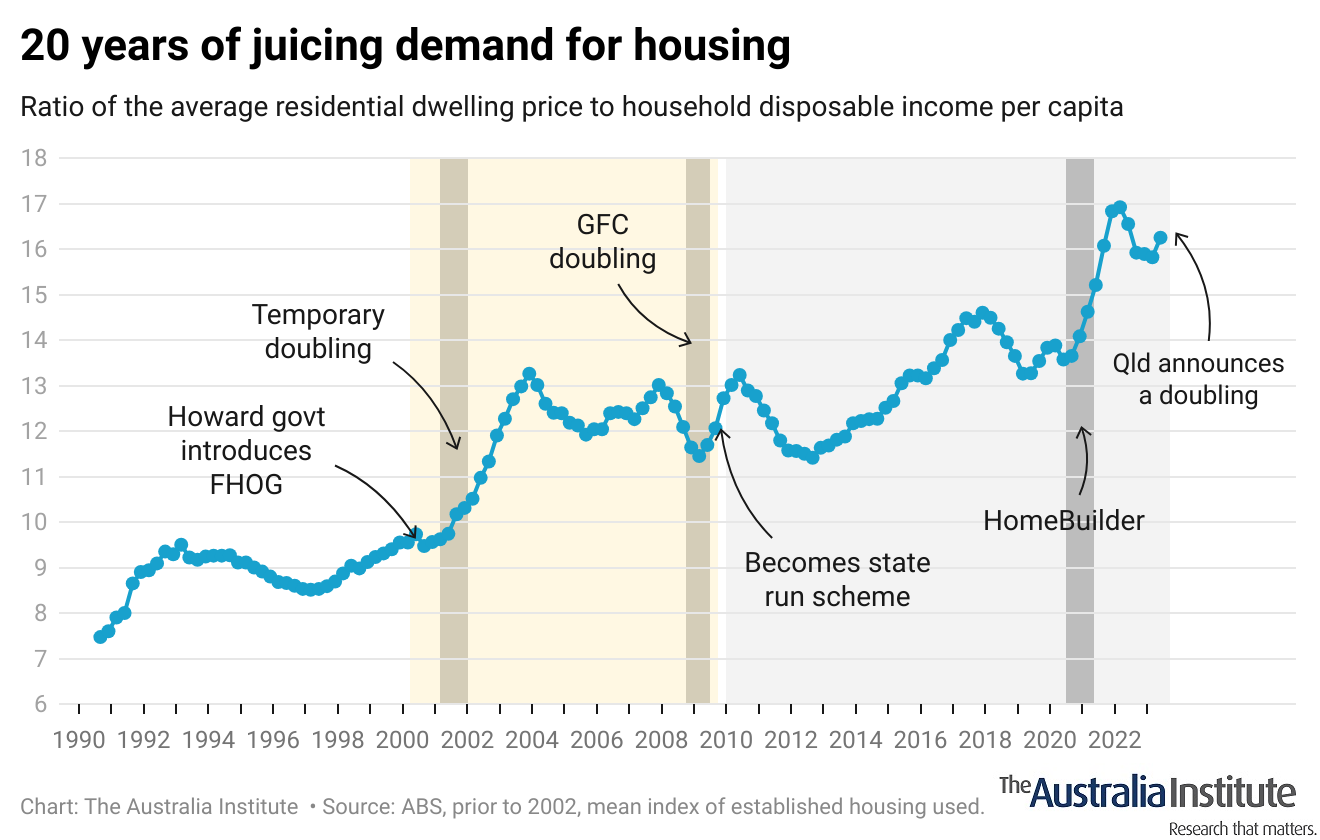

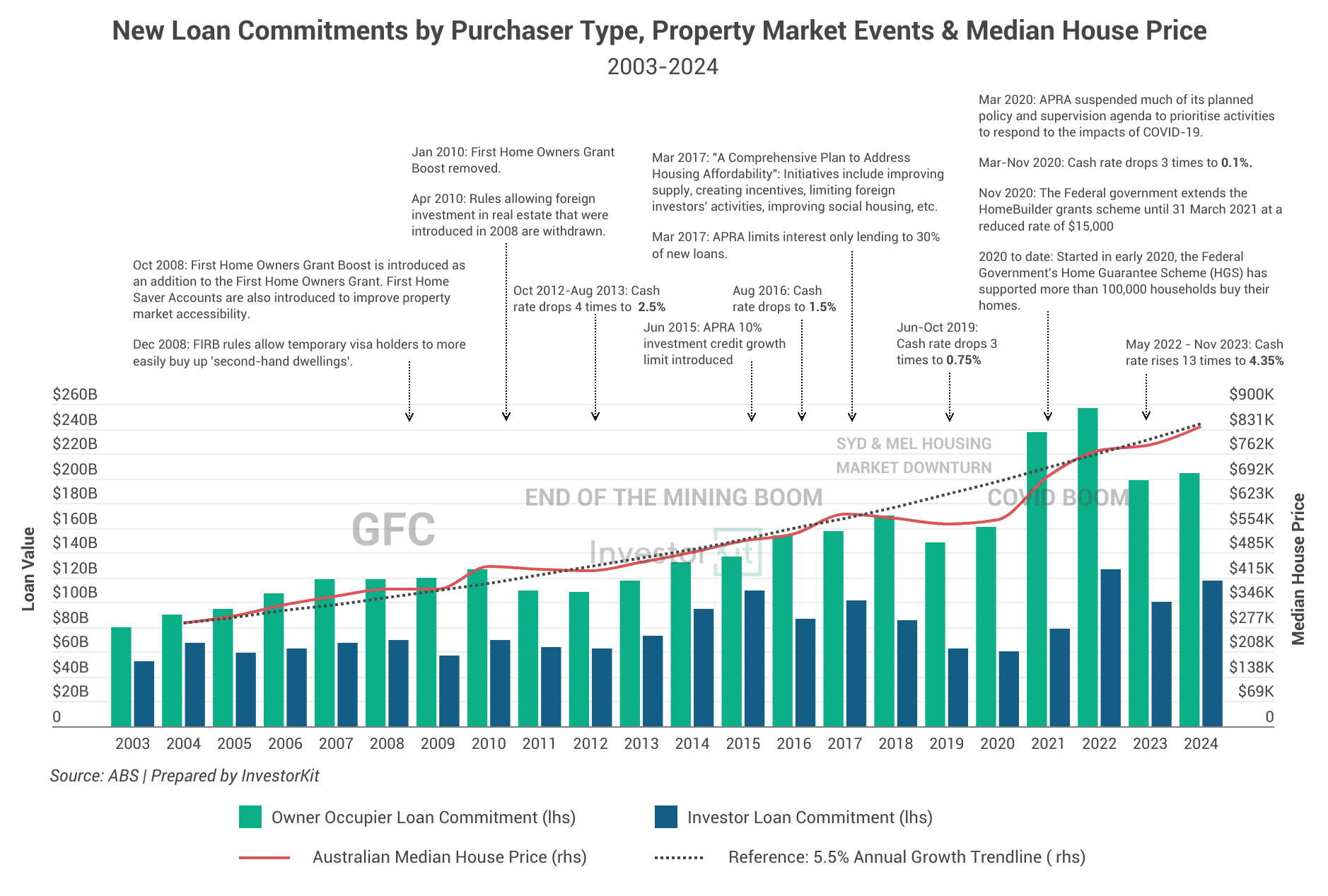

Australia’s housing market is at a critical juncture, shaped by a combination of economic, demographic, and policy-driven factors. For instance, the house price-to-income ratio has nearly doubled since 2002, with the average home now costing nine times the average household income. This stark imbalance highlights the growing challenge for first-time buyers, particularly younger Australians, who face record-low homeownership rates.

One unexpected connection lies in the role of rental market pressures. With rents more than doubling over the past two decades, many potential buyers struggle to save for a deposit. This creates a feedback loop where high rental costs delay homeownership, further driving demand for rental properties.

Experts suggest that targeted government interventions, such as shared equity schemes, could alleviate these pressures. By addressing both affordability and supply, such measures may help rebalance the market. Understanding these dynamics is essential for navigating today’s housing landscape effectively.

Image source: australiainstitute.org.au

Historical Property Market Trends

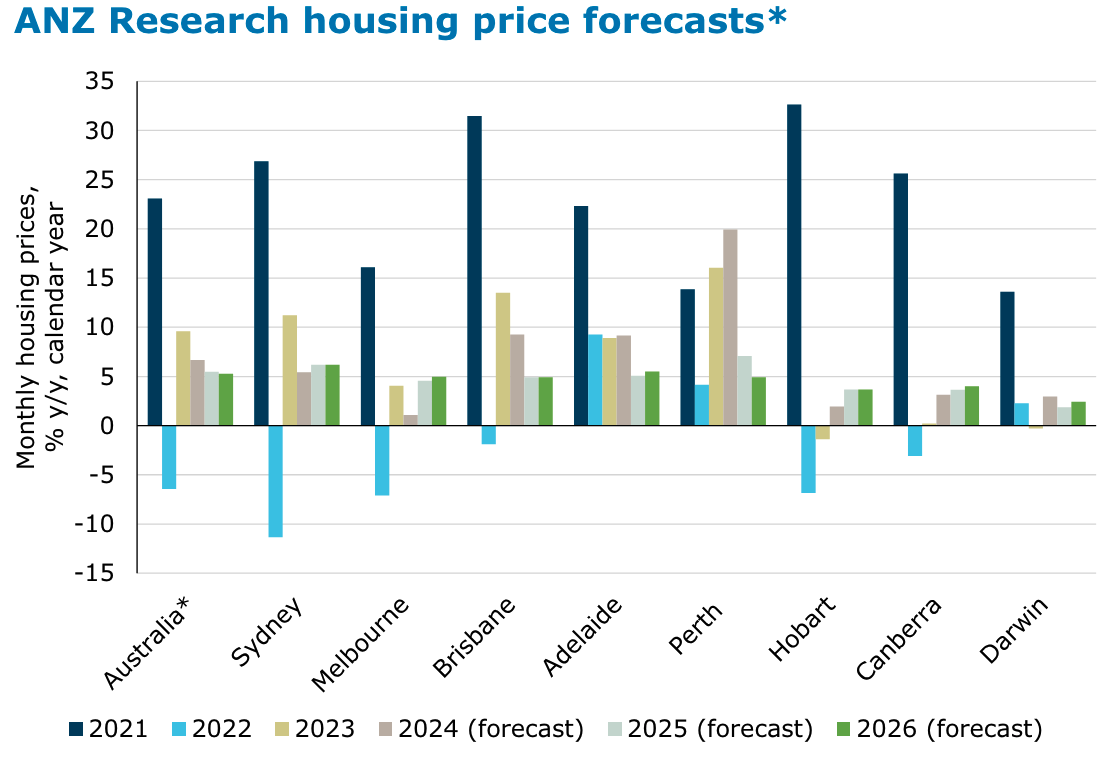

One pivotal trend in Australia’s property market history is the widening gap between house and unit values. Over the past decade, house prices have consistently outpaced unit prices, driven by shifting buyer preferences for larger living spaces, particularly during the pandemic. This divergence underscores how external factors, such as lifestyle changes and remote work, can reshape demand dynamics.

Interestingly, interest rate fluctuations have historically amplified these trends. For example, the rate hikes of the 1980s slowed market activity, but subsequent cuts in the 1990s spurred rapid growth. This cyclical behavior highlights the sensitivity of property markets to monetary policy, a factor often underestimated by first-time buyers.

To navigate these trends, aspiring homeowners can focus on timing their purchases during market corrections or exploring undervalued units in high-demand areas. By understanding these historical patterns, buyers can make more informed decisions and potentially capitalize on market shifts.

Factors Influencing Property Prices

A lesser-known yet critical factor influencing property prices is land supply elasticity. Unlike demand-side drivers such as population growth, land supply is constrained by zoning laws, infrastructure limitations, and environmental regulations. In cities like Sydney, where developable land is scarce, these constraints amplify price pressures, particularly in high-demand suburbs.

To illustrate, restrictive zoning policies can delay new housing developments, creating a bottleneck in supply. This not only inflates prices but also shifts demand toward existing properties, further driving up costs. By contrast, cities with more flexible land-use policies, such as Perth, have historically experienced more stable price growth.

For policymakers, addressing land supply elasticity requires balancing urban density with livability. For buyers, understanding these dynamics can guide decisions—such as targeting emerging suburbs where rezoning is likely. By aligning property investments with anticipated supply shifts, buyers can better position themselves in a competitive market.

The Impact of Economic Events on Housing

One specific aspect worth exploring is the role of interest rate fluctuations in shaping housing affordability and demand. Lower interest rates, as seen during periods of economic stimulus, reduce borrowing costs, making mortgages more accessible. This often triggers a surge in housing demand, which can outpace supply and drive up property prices.

However, the relationship is not linear. Prolonged low rates can encourage speculative investment, inflating housing bubbles. For instance, during the early 2000s, Australia experienced rapid price growth partly due to historically low rates, which incentivized investor-landlords to expand their portfolios.

To navigate this, aspiring homeowners should monitor interest rate trends and consider fixed-rate mortgages during periods of expected rate hikes. Additionally, policymakers could implement measures like macroprudential controls to curb speculative borrowing. By understanding these dynamics, buyers and regulators alike can better anticipate market shifts and mitigate risks associated with economic volatility.

Renting vs Owning: Evaluating Your Options

Deciding between renting and owning often feels like choosing between flexibility and stability, but the reality is more nuanced. Renting offers adaptability, especially for those in dynamic careers or uncertain financial situations. For instance, renters can adjust their living arrangements quickly in response to job relocations or income changes, a flexibility that homeowners lack.

On the other hand, owning a home builds equity over time, turning monthly payments into a long-term investment. A 2024 study by CoreLogic revealed that Australian homeowners saw an average annual property value increase of 6.8% over the past decade, underscoring the wealth-building potential of ownership. However, this comes with hidden costs like maintenance, insurance, and property taxes, which renters avoid.

A common misconception is that renting is “dead money.” In reality, renting can be a strategic choice when housing markets are overheated, allowing individuals to save for a deposit while avoiding inflated purchase prices.

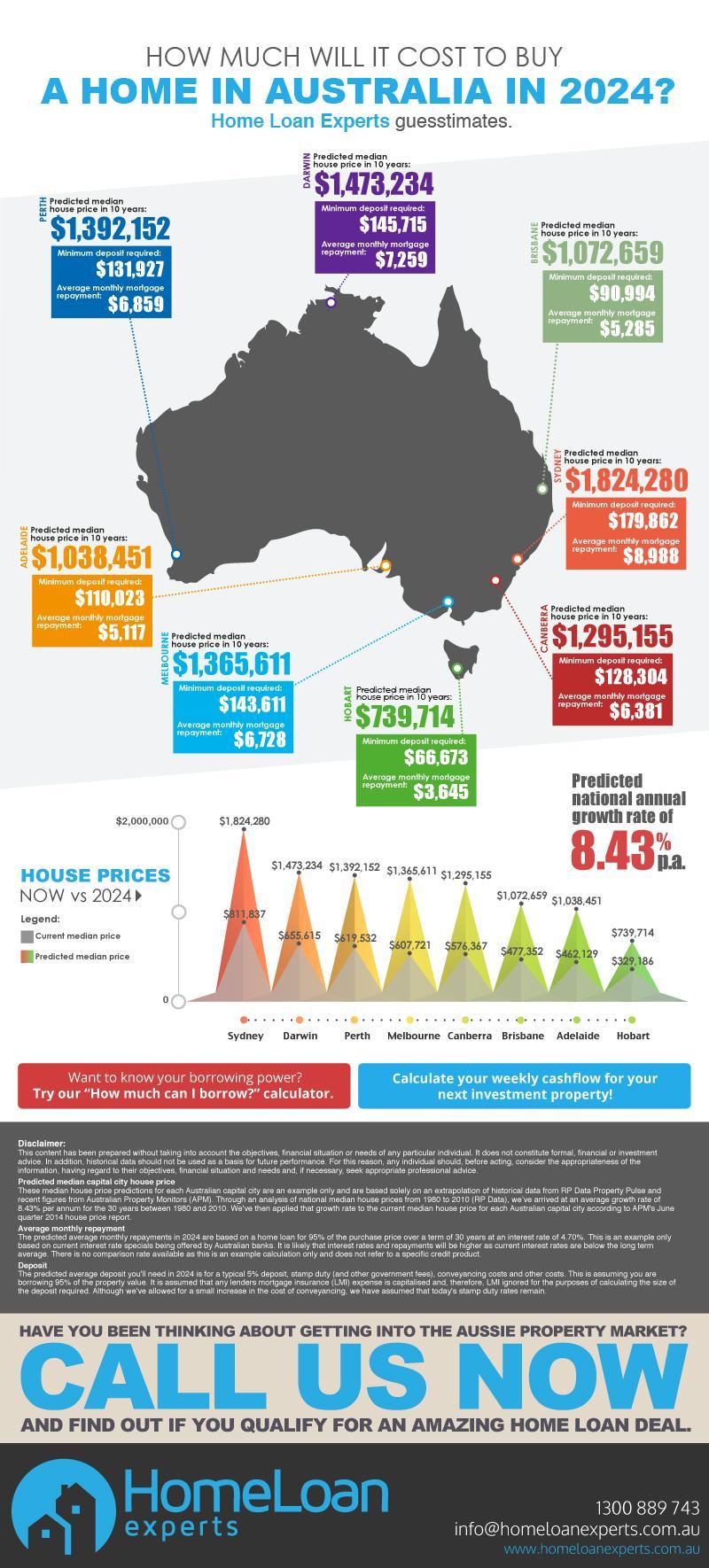

Image source: homeloanexperts.com.au

Financial Comparison Over Time

When comparing renting and owning over time, the concept of opportunity cost often goes unnoticed. For renters, the money saved by avoiding upfront costs—like deposits and stamp duty—can be invested elsewhere. For example, a renter who invests $50,000 in a diversified portfolio with a 7% annual return could see their investment grow to over $98,000 in 10 years, potentially outpacing property appreciation in some markets.

Conversely, homeowners benefit from forced savings through mortgage repayments, which gradually build equity. However, rising interest rates can significantly increase borrowing costs, as seen during Australia’s recent rate hikes. This underscores the importance of locking in favorable fixed rates or maintaining a financial buffer.

A lesser-known factor is inflation. Renters face periodic rent increases, while homeowners with fixed-rate loans effectively “freeze” a portion of their housing costs. Understanding these dynamics allows individuals to align their housing decisions with long-term financial goals.

Lifestyle and Flexibility Considerations

A critical yet underexplored aspect of lifestyle flexibility is the impact of career mobility. Renting allows individuals to adapt quickly to job opportunities in different cities or regions without the financial and logistical burden of selling a property. For instance, a professional in Australia’s tech sector may need to relocate from Sydney to Melbourne for a career advancement. Renting enables this transition with minimal disruption, preserving both time and resources.

On the other hand, homeownership offers stability but can limit flexibility. Selling a home involves transaction costs, potential capital gains tax, and market timing risks, which can deter quick moves. However, homeowners can mitigate this by leveraging rental income from their property if relocation is temporary, blending stability with adaptability.

A lesser-known factor is the psychological impact of flexibility. Studies suggest that renters often experience reduced stress when facing life changes, as their housing commitments are less rigid. Balancing these considerations is key to aligning housing choices with personal and professional goals.

Risk Assessment and Market Stability

One critical aspect of risk assessment is the volatility of property values. Homeownership ties your wealth to a single asset, making it vulnerable to market downturns. For example, during economic uncertainty, Australian property values can decline, leaving homeowners “upside down” on their mortgage—owing more than the property’s worth. This risk is amplified in regions with historically volatile markets, such as mining towns.

Renting, by contrast, offers insulation from such risks. Renters can adapt to market conditions by relocating to areas with lower costs or better opportunities, avoiding the financial strain of declining property values. However, renters face their own risks, such as rising rental prices, which can erode savings over time.

A lesser-known factor is the role of interest rate fluctuations. For homeowners, rising rates can significantly increase mortgage repayments, while renters may benefit from stable rental agreements. To mitigate these risks, homeowners should consider fixed-rate loans, and renters can negotiate longer-term leases for stability.

Financial Preparation for Home Ownership

Preparing financially for homeownership is like building a foundation for a house—it requires careful planning and attention to detail. Start by evaluating your borrowing power, which depends on your income, expenses, and credit score. For instance, a strong credit history can lower your interest rate, potentially saving tens of thousands over the life of a loan. Tools like online mortgage calculators can provide a realistic snapshot of what you can afford.

A common misconception is that saving for a deposit is the only hurdle. In reality, additional costs—such as stamp duty, legal fees, and insurance—can add up to 5-7% of the property price. For example, on a $500,000 home, these costs could exceed $25,000.

To mitigate risks, consider creating an emergency fund for unexpected expenses like repairs or rate hikes. Think of it as a financial buffer, ensuring stability even when surprises arise.

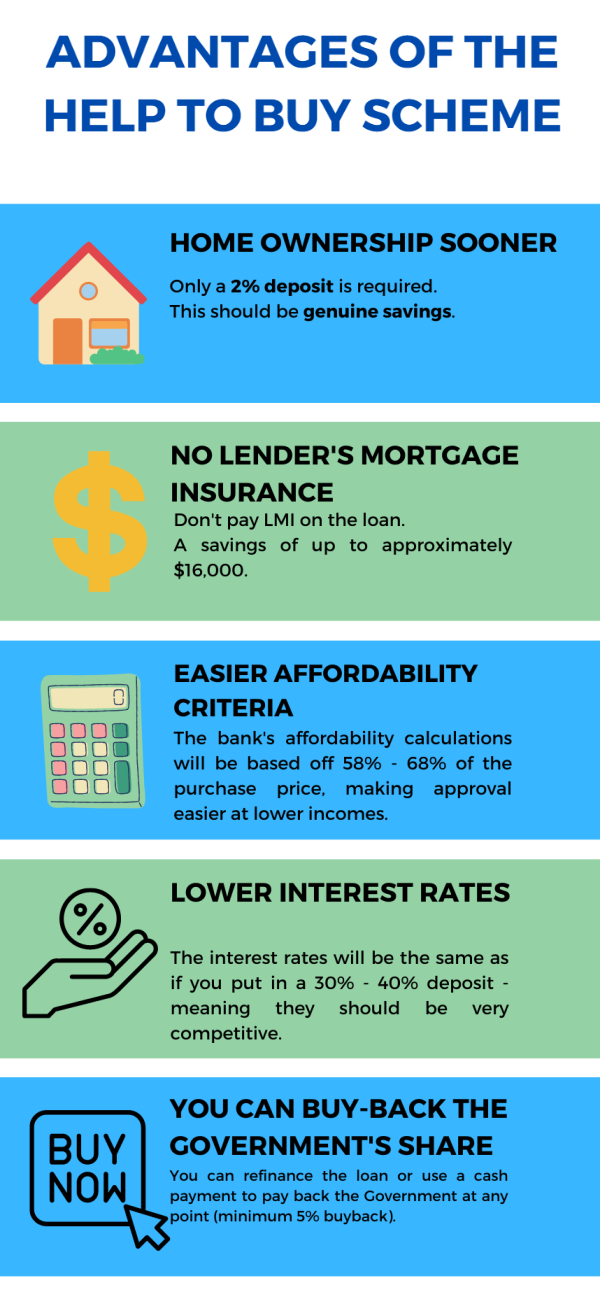

Image source: bluefoxfinance.com.au

Assessing Your Financial Health

Understanding your financial health goes beyond checking your savings account—it’s about evaluating your cash flow dynamics and debt-to-income ratio (DTI). A DTI below 30% is often considered ideal for securing favorable loan terms. For example, if your monthly income is $5,000, aim to keep total debt payments under $1,500. This metric helps lenders gauge your ability to manage mortgage repayments without financial strain.

One overlooked factor is the role of non-liquid assets, such as superannuation or investments. While these can’t directly fund a deposit, they signal long-term financial stability to lenders. Additionally, tracking discretionary spending can reveal opportunities to redirect funds toward your homeownership goals.

Think of this process as a financial health check-up. Just as a doctor identifies areas for improvement, analyzing your finances can uncover hidden inefficiencies. By addressing these, you’ll not only strengthen your loan application but also build a sustainable financial future.

Budgeting for Additional Costs of Ownership

One critical yet often underestimated aspect of homeownership is ongoing maintenance costs. These expenses, averaging 0.38% of a property’s value annually, can significantly impact your budget. For instance, on a $600,000 home, you might spend around $2,280 per year on repairs alone. Proactively setting aside funds for these costs ensures you’re prepared for unexpected issues, such as plumbing failures or roof repairs.

A practical approach is to create a sinking fund—a dedicated savings account for irregular expenses like maintenance, council rates, and insurance. By contributing a fixed amount monthly, you can smooth out financial shocks. For example, allocating $300 per month can cover most annual costs, including emergencies.

Interestingly, this concept parallels asset depreciation management in business finance, where regular reserves are set aside to maintain operational efficiency. Applying this mindset to personal finances not only safeguards your home but also fosters long-term financial stability.

Understanding Credit Scores and Loan Eligibility

A pivotal yet underexplored factor in loan eligibility is the credit utilization ratio—the percentage of your available credit currently in use. Lenders often view a ratio above 30% as a red flag, signaling potential financial strain. For example, if you have a $10,000 credit limit and consistently carry a $4,000 balance, your 40% utilization could negatively impact your credit score, even if payments are timely.

Reducing this ratio can significantly improve your creditworthiness. Strategies include paying down balances before the statement date or requesting a credit limit increase (while avoiding additional spending). These actions lower the ratio, demonstrating responsible credit management to lenders.

This concept aligns with risk assessment models in finance, where lower utilization indicates reduced default risk. By actively managing this metric, borrowers not only enhance their loan eligibility but also position themselves for more favorable interest rates, directly influencing long-term affordability.

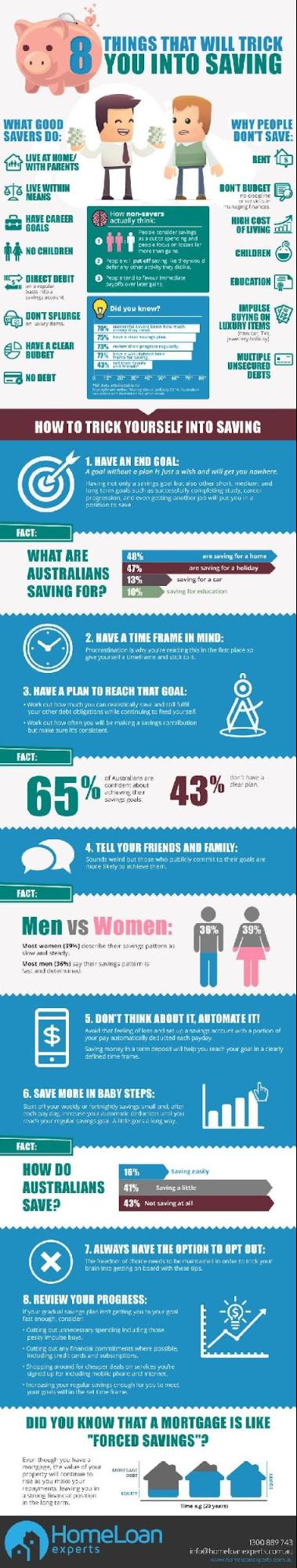

Saving Strategies for Your Home Deposit

Saving for a home deposit is often compared to running a marathon—it requires endurance, strategy, and incremental progress. One effective approach is to automate your savings. By setting up automatic transfers to a high-interest savings account, you remove the temptation to spend and allow compound interest to work in your favor. For instance, depositing $500 monthly into an account with a 4% annual interest rate could grow to over $6,200 in just one year.

Another overlooked strategy is lifestyle downsizing. Consider moving into a smaller rental or sharing accommodation temporarily. A case study from Sydney showed that a couple saved $12,000 in a year by moving in with family, redirecting rent savings toward their deposit.

Finally, challenge the misconception that small sacrifices don’t matter. Skipping a $4 daily coffee may seem trivial, but over a year, it adds up to nearly $1,500—enough to cover legal fees or inspections.

Image source: homeloanexperts.com.au

Effective Budgeting Techniques

A powerful yet underutilized budgeting technique is the 50/30/20 rule. This framework allocates 50% of your income to essentials (like rent and groceries), 30% to discretionary spending, and 20% to savings. By adhering to this structure, you create a disciplined yet flexible approach to managing finances. For example, reallocating just 5% from discretionary spending to savings could accelerate your deposit timeline by months.

To enhance this method, leverage budgeting apps like Pocketbook or MoneyBrilliant. These tools provide real-time insights into spending patterns, helping you identify “leaks” in your budget. A Melbourne-based saver discovered $200 in monthly savings simply by tracking unused subscriptions.

Another critical factor is psychological framing. Treat your savings like a non-negotiable expense—akin to paying rent. This mindset shift reduces the temptation to dip into your deposit fund and builds consistency over time. Ultimately, effective budgeting is less about restriction and more about intentionality.

Investment Options to Grow Your Savings

One often-overlooked strategy is leveraging exchange-traded funds (ETFs) to grow your deposit savings. ETFs offer a diversified portfolio of assets, reducing risk compared to investing in individual stocks. For instance, an ETF tracking the ASX 200 provides exposure to Australia’s top-performing companies, balancing growth potential with relative stability.

The key advantage lies in compounding returns. By reinvesting dividends, your investment grows exponentially over time. For example, a $10,000 investment in a high-dividend ETF with a 5% annual return could grow to over $12,700 in five years, assuming reinvestment. This approach aligns well with medium-term savings goals.

However, timing and risk tolerance are critical. Unlike high-interest savings accounts, ETFs are subject to market volatility. To mitigate this, consider dollar-cost averaging—investing fixed amounts regularly to smooth out price fluctuations. By combining ETFs with traditional savings methods, you can achieve a balanced, growth-oriented strategy tailored to your timeline.

Leveraging Superannuation for First Home Buyers

A focused strategy within the First Home Super Saver Scheme (FHSS) is making voluntary contributions to superannuation accounts. These contributions are taxed at a concessional rate of 15%, which is often lower than an individual’s marginal tax rate, allowing buyers to save more efficiently compared to traditional savings accounts.

For example, if you earn $80,000 annually and contribute $10,000 to your super, you could save up to $2,400 in taxes. Over time, these savings compound within the super fund, potentially accelerating deposit growth. However, funds not used for home purchases remain locked in super, which can deter some participants.

To maximize this approach, align contributions with your financial capacity and home-buying timeline. Additionally, consider the opportunity cost of locking funds in super versus other investments. By integrating the FHSS with broader financial planning, first home buyers can optimize both short-term goals and long-term retirement security.

Exploring Home Loan Options

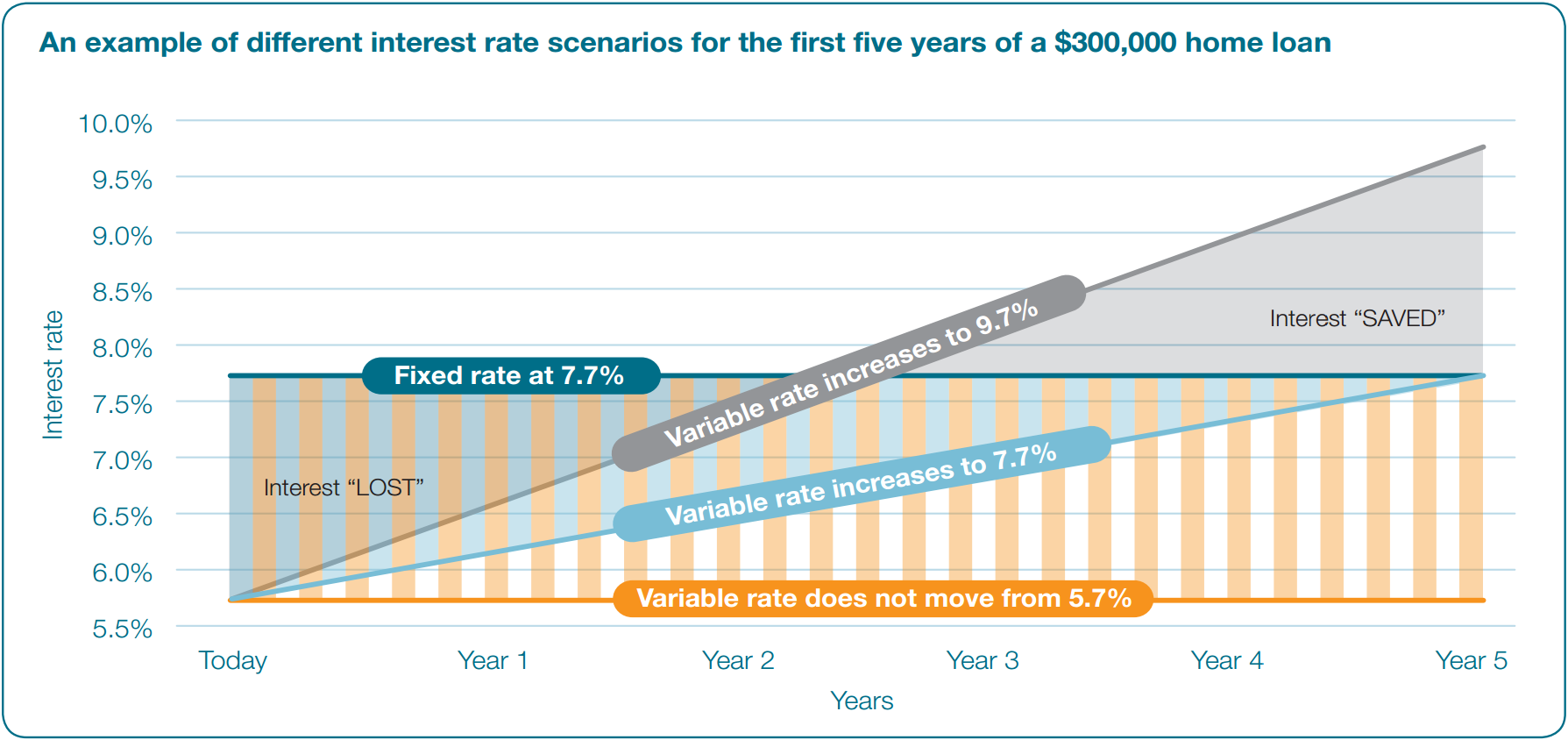

Choosing the right home loan is like tailoring a suit—it needs to fit your financial situation perfectly. Fixed-rate loans, for instance, offer stability by locking in interest rates, which can be ideal during periods of rising rates. However, they may limit flexibility if rates drop, much like committing to a fixed routine that doesn’t adapt to changing circumstances.

Variable-rate loans, on the other hand, fluctuate with market conditions, offering potential savings when rates fall but introducing unpredictability. A hybrid option, such as split-rate loans, combines the best of both worlds, allowing borrowers to hedge their bets by dividing the loan into fixed and variable portions.

Interestingly, many first-time buyers overlook offset accounts, which reduce interest by linking savings to the loan balance. For example, a $20,000 offset on a $400,000 loan could save thousands in interest over time. By understanding these nuances, buyers can align loan choices with both current needs and future goals.

Image source: mortgagechoice.com.au

Types of Mortgages: Fixed, Variable, and Interest-Only

One often-overlooked aspect of fixed-rate mortgages is their psychological benefit. Knowing your repayments won’t change for a set period can reduce financial stress, especially during volatile economic times. However, this stability comes at a cost—break fees for early repayment can be significant, making it crucial to assess your long-term plans before committing.

Variable-rate loans, while flexible, require careful budgeting. For instance, during the 2022–2023 rate hikes in Australia, many borrowers faced sudden repayment increases. A practical approach is to simulate higher repayment scenarios before choosing this option, ensuring you can weather potential rate rises.

Interest-only loans, popular among investors, can free up cash flow in the short term. Yet, they carry a hidden risk: the principal remains untouched, leading to higher long-term costs. Borrowers should consider pairing this option with a clear exit strategy, such as refinancing or selling, to avoid financial strain when repayments increase.

Comparing Lenders and Loan Features

A critical yet underappreciated factor when comparing lenders is the comparison rate. Unlike the advertised interest rate, the comparison rate includes most fees, offering a clearer picture of the loan’s true cost. For example, a loan with a lower advertised rate but high ongoing fees may end up costing more over time. Always prioritize this metric when evaluating options.

Another key consideration is the flexibility of loan features. Offset accounts, for instance, can significantly reduce interest costs by linking your savings to your loan balance. However, these features often come with higher fees. To decide if they’re worth it, calculate potential savings using your average savings balance and compare it to the added cost.

Finally, don’t overlook lesser-known factors like customer service quality. A lender with responsive support can save you time and stress, especially when navigating complex processes like refinancing or early repayments.

The Importance of Mortgage Pre-Approval

One often-overlooked benefit of mortgage pre-approval is its role in price negotiation. Sellers are more likely to favor buyers with pre-approval, as it signals financial readiness and reduces the risk of a deal falling through. This can give you leverage to negotiate better terms, such as a lower purchase price or favorable settlement conditions.

Pre-approval also helps you avoid emotional overspending. By clearly defining your borrowing capacity, it sets a financial boundary, ensuring you focus only on properties within your budget. This discipline is particularly valuable in competitive markets, where bidding wars can lead to overcommitment.

A lesser-known factor is the impact of pre-approval on your credit score. Multiple applications for pre-approval within a short period can negatively affect your credit rating. To mitigate this, research lenders thoroughly and apply selectively, focusing on those most likely to approve your application based on your financial profile.

Leveraging Government Assistance Programs

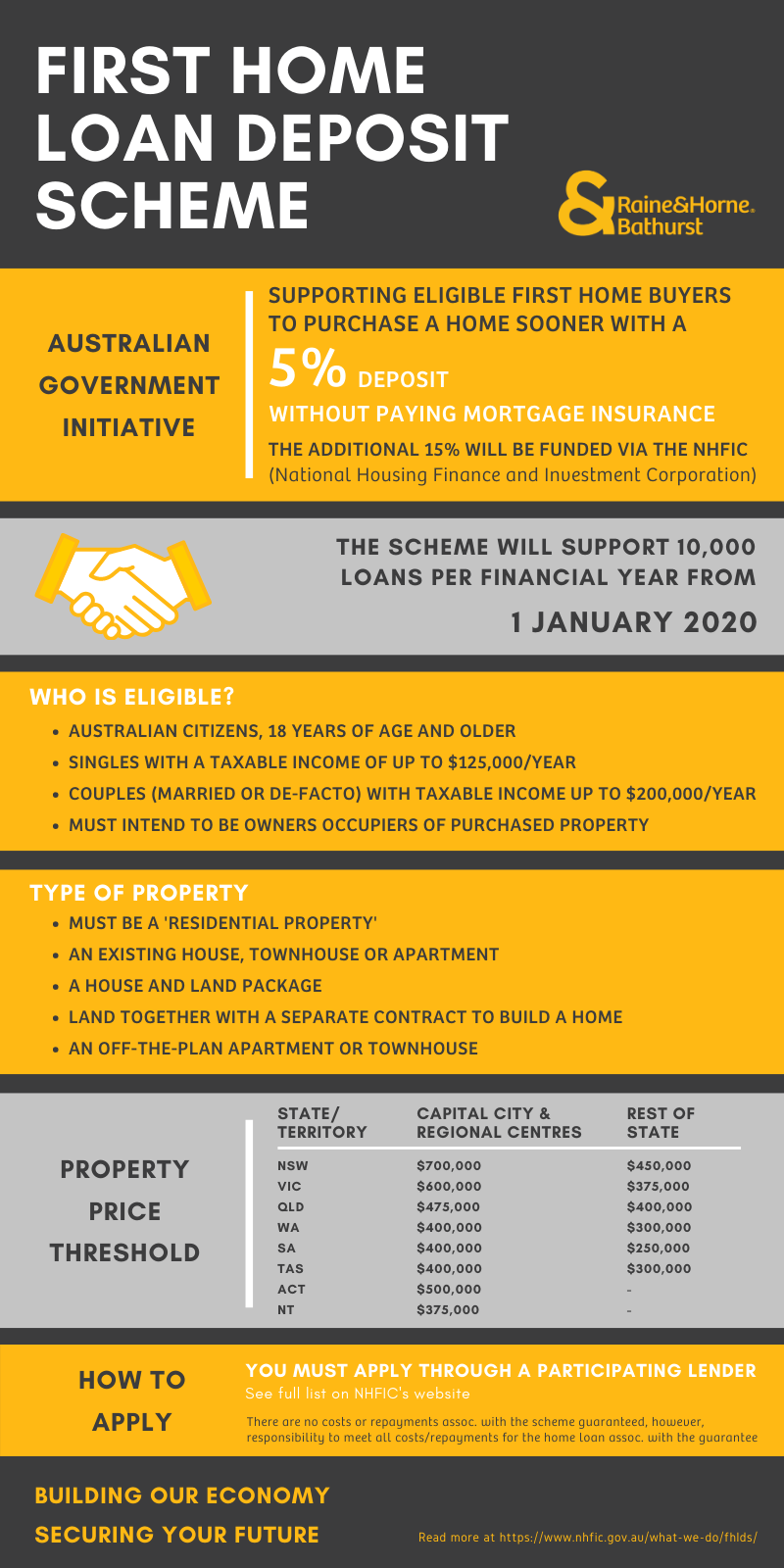

Government assistance programs can act as a springboard for first-time buyers, but their effectiveness depends on understanding how to use them strategically. For instance, the First Home Loan Deposit Scheme (FHLDS) allows eligible buyers to secure a home with as little as a 5% deposit, bypassing the need for costly lenders mortgage insurance (LMI). This can save thousands of dollars upfront, making homeownership more accessible.

However, a common misconception is that these programs guarantee affordability. In reality, demand-side initiatives like grants can inadvertently inflate property prices, particularly in high-demand areas. To counter this, buyers should focus on leveraging programs in emerging suburbs where price growth is steadier.

An unexpected connection lies in combining assistance schemes. For example, pairing the First Home Super Saver Scheme (FHSS) with the FHLDS can accelerate deposit savings while reducing borrowing costs. By layering these tools, buyers can optimize their financial position and enter the market more confidently.

Image source: raineandhorne.com.au

First Home Owner Grant (FHOG) Eligibility

Eligibility for the First Home Owner Grant (FHOG) hinges on nuanced criteria that vary by state, but one critical factor often overlooked is the newly-built home requirement. This stipulation not only narrows the pool of eligible properties but also channels demand into specific market segments, often in suburban or regional areas. For buyers, this means balancing the grant’s financial benefits against potential trade-offs, such as longer commutes or limited infrastructure.

Interestingly, the FHOG does not impose income caps, unlike many international counterparts. While this broadens access, it can inadvertently favor higher-income buyers who are better positioned to meet lending requirements. This dynamic underscores the importance of aligning grant use with personal financial capacity.

To maximize the FHOG, consider combining it with stamp duty concessions in your state. This dual approach can significantly reduce upfront costs, creating a more sustainable pathway to homeownership while mitigating financial strain.

First Home Super Saver Scheme Explained

A key feature of the First Home Super Saver Scheme (FHSS) is its concessional tax treatment, which allows voluntary contributions to be taxed at 15%, significantly lower than most individuals’ marginal tax rates. This creates a dual benefit: reducing taxable income while accelerating savings growth through compounding returns within the superannuation system. For example, a $10,000 pre-tax contribution could save up to $3,400 in taxes for someone in the 34% tax bracket, while simultaneously earning returns.

However, a lesser-known factor is the opportunity cost of locking funds in superannuation. Unlike traditional savings, FHSS contributions are less liquid, which may limit flexibility in responding to unexpected financial needs. This trade-off requires careful planning, particularly for those with variable income or short-term financial goals.

To optimize the FHSS, consider aligning contributions with annual tax planning. By timing contributions strategically, you can maximize tax savings while ensuring sufficient liquidity for other priorities.

Stamp Duty Exemptions and Concessions

One critical aspect of stamp duty exemptions and concessions is their ability to reduce upfront costs, which can otherwise be a significant barrier for first home buyers. For instance, in New South Wales, eligible buyers purchasing properties below a certain threshold can save up to $15,600 in stamp duty. This immediate cost reduction often enables buyers to allocate more funds toward their deposit, improving borrowing capacity and reducing loan-to-value ratios.

However, a lesser-known dynamic is the economic incidence of stamp duty. Research suggests that while buyers receive the legal benefit, sellers often adjust property prices upward in response to increased demand, partially offsetting the concession’s value. This highlights the importance of timing purchases in less competitive markets to maximize savings.

To navigate this, buyers should combine concessions with thorough market analysis. Tools like property value calculators and local market trends can help identify optimal purchase windows, ensuring financial benefits are fully realized.

Navigating the Home Buying Process

The home buying process can feel like solving a complex puzzle, but breaking it into manageable steps makes it far more approachable. Start by defining your financial boundaries—this includes not just your borrowing capacity but also factoring in hidden costs like legal fees, inspections, and moving expenses. For example, a 2023 study by CoreLogic found that first-time buyers often underestimate these additional costs by up to 15%, leading to budget shortfalls.

Next, research is your most powerful tool. Think of it as building a map before embarking on a journey. Use online property portals, attend open houses, and consult local agents to understand market trends. A surprising insight? Properties in emerging suburbs often offer better long-term value due to anticipated infrastructure developments.

Finally, don’t overlook the importance of pre-approval. It’s like having a boarding pass—it signals readiness and strengthens your negotiation position. With preparation, the process becomes less daunting and more empowering.

Image source: depositassure.com.au

Researching and Selecting the Right Property

When researching properties, one often-overlooked factor is the future potential of the area. Instead of focusing solely on current amenities, examine local council plans for infrastructure projects, such as new transport links or schools. For instance, suburbs near planned train stations have historically seen property value increases of up to 20% within five years, according to a 2022 report by Infrastructure Australia.

Another critical approach is to analyze property types in relation to your lifestyle and financial goals. Detached houses may offer long-term growth, but apartments often provide better rental yields. A balanced perspective can help you align your choice with both personal and investment objectives.

Finally, consider the psychological impact of your decision. Studies show that buyers who prioritize proximity to green spaces report higher satisfaction levels post-purchase. By combining data-driven research with personal priorities, you can make a choice that’s both financially and emotionally rewarding.

The Role of Real Estate Agents and Brokers

A critical yet underappreciated aspect of working with real estate agents is leveraging their local market expertise to identify undervalued properties. Agents often have access to “off-market” listings—properties not publicly advertised—that can provide buyers with unique opportunities. For example, in competitive markets like Sydney, off-market deals can help buyers avoid bidding wars, saving both time and money.

Mortgage brokers, on the other hand, excel in customizing loan solutions. By analyzing your financial profile, they can recommend niche loan products, such as those tailored for self-employed buyers or those with irregular income streams. This personalized approach often results in better loan terms than standard offerings.

To maximize these benefits, maintain open communication. Share your financial goals and constraints early, enabling agents and brokers to align their strategies with your needs. This collaborative approach not only streamlines the process but also enhances your chances of securing the ideal property.

Due Diligence: Inspections and Property Reports

One often-overlooked aspect of due diligence is assessing hidden environmental risks, such as flood zones or soil contamination. While structural inspections focus on visible issues, environmental factors can significantly impact long-term costs and insurability. For instance, properties in high-risk flood areas may face skyrocketing insurance premiums or even become uninsurable, as seen in parts of Queensland.

To address this, consult local council flood maps and request environmental reports. These tools provide data on historical flooding, soil quality, and even bushfire risks. By integrating this information with building and pest inspections, you gain a holistic view of the property’s viability.

Additionally, consider the opportunity cost of repairs. A property with minor structural issues but no environmental risks may be a better investment than one requiring costly flood mitigation. This layered approach ensures your decision is not only informed but also aligned with long-term financial and lifestyle goals.

Negotiation Strategies and Making an Offer

A critical yet underutilized strategy in negotiations is leveraging time-based pressure. Sellers often have specific timelines—whether due to financial constraints, relocation, or market conditions—that can influence their willingness to accept lower offers. Understanding these motivations allows you to craft offers that align with their urgency while securing favorable terms.

For example, if a property has been on the market for an extended period, the seller may prioritize a quick settlement over a higher price. By offering a shorter settlement period, you can create a win-win scenario without increasing your financial outlay. This approach works particularly well in slower markets or with properties listed for over 60 days.

Additionally, consider using anchoring techniques. Start with a well-researched but slightly lower offer to set the negotiation baseline. This psychological tactic often shifts the seller’s expectations, creating room for concessions. Combining these methods ensures a strategic, data-driven approach to securing your ideal property.

Understanding Contracts and Legal Obligations

One often-overlooked aspect of contracts is the inclusion of special conditions. These clauses allow buyers to protect themselves against unforeseen risks, such as failed financing or unsatisfactory property inspections. For instance, a “subject to finance” clause ensures you can withdraw from the contract without penalties if your loan application is denied.

The effectiveness of special conditions lies in their ability to shift risk. By clearly defining contingencies, you reduce the likelihood of financial loss while maintaining flexibility. However, poorly drafted clauses can lead to disputes, so consulting a legal professional is essential to ensure enforceability.

Another critical factor is understanding cooling-off periods, which vary by state. These provide a window to reconsider your purchase, but exercising this right may incur penalties. By combining well-crafted special conditions with a clear understanding of cooling-off rights, buyers can navigate legal obligations confidently, minimizing risks while securing their investment.

Settlement Process and Finalizing the Purchase

A critical yet underappreciated aspect of the settlement process is the timing and management of settlement funds. Ensuring these funds are available and correctly allocated can prevent costly delays or penalties. Buyers often choose between depositing funds into a solicitor’s trust account or directly into a lender-approved account. Each option has distinct advantages: trust accounts offer greater oversight, while lender accounts streamline disbursement.

The timing of fund transfers is equally crucial. For example, transferring funds too early may expose you to opportunity costs, while delays can breach contractual obligations. Leveraging tools like scheduled bank transfers or escrow services can mitigate these risks, ensuring funds are accessible precisely when needed.

This process also connects to broader financial disciplines, such as liquidity management. By aligning settlement fund strategies with your overall financial plan, you not only meet immediate obligations but also position yourself for long-term stability and growth.

Advanced Buying Strategies

One advanced strategy is leveraging market timing to maximize value. For instance, purchasing during a buyer’s market—when supply exceeds demand—can lead to significant savings. Data from CoreLogic Australia shows that property prices in Sydney dropped by 10% during the 2018 market correction, offering opportunities for well-prepared buyers. Monitoring economic indicators like interest rate trends and auction clearance rates can help identify these windows.

Another approach involves negotiating inclusions beyond the purchase price. For example, securing appliances or furniture as part of the deal can reduce post-purchase expenses. This tactic works particularly well in slower markets, where sellers are more flexible.

Finally, consider rentvesting—buying in an affordable area while renting where you live. This strategy balances lifestyle preferences with wealth-building. A 2022 study by the Australian Housing and Urban Research Institute found that rentvestors often achieve higher long-term returns by targeting high-growth suburbs.

By combining these strategies, buyers can optimize both financial and lifestyle outcomes.

Image source: mccrindle.com.au

Purchasing Off-the-Plan Properties

One critical aspect of purchasing off-the-plan properties is managing the time gap risk between signing the contract and settlement. This period, often spanning 12-24 months, exposes buyers to potential changes in financial circumstances or market conditions. For example, a 2020 report by the Reserve Bank of Australia highlighted that interest rate hikes during this window could significantly impact borrowing capacity, leaving buyers unable to secure financing.

To mitigate this, buyers should ensure financial buffers and pre-approval flexibility. Additionally, understanding valuation risks is essential. Banks may undervalue the property at settlement if market conditions shift, requiring buyers to cover the shortfall. Properties under 50 sqm or in commercially zoned areas are particularly vulnerable, as lenders often view them as higher risk.

A proactive approach includes consulting with mortgage brokers early and reviewing the developer’s track record. By aligning financial planning with these risks, buyers can navigate off-the-plan purchases with greater confidence.

Buying at Auction: Techniques and Etiquette

A key technique in auctions is mastering bid timing to influence the pace and psychology of the competition. Early bids can establish dominance, signaling serious intent to other buyers. However, late bidding—often referred to as “sniping”—can disrupt competitors’ strategies, forcing rushed decisions. Research from the University of Melbourne suggests that bidders who strategically delay their offers often secure properties at lower prices, as they avoid escalating bidding wars.

Equally important is understanding auctioneer cues. Subtle pauses or repeated calls for higher bids may indicate the reserve price is close to being met. Observing these signals allows buyers to adjust their strategy in real time.

Etiquette also plays a role. Maintaining composure and avoiding emotional bidding ensures financial discipline. For instance, setting a firm maximum bid beforehand and sticking to it prevents overextension. By combining timing, observation, and discipline, buyers can navigate auctions with confidence and precision.

Co-Ownership and Joint Ventures

A critical aspect of co-ownership is establishing a clear legal framework through a co-ownership agreement. This document outlines each party’s financial contributions, ownership percentages, and responsibilities, reducing the risk of disputes. For example, specifying how maintenance costs or future sale proceeds will be divided ensures transparency and protects all parties involved.

One lesser-known factor is the impact of credit profiles. If one co-owner defaults on their share of the mortgage, lenders may hold all parties accountable. To mitigate this, joint ventures often benefit from setting up a trust or company structure, which can shield individual credit ratings while offering tax advantages.

Co-ownership also intersects with lifestyle alignment. Partners with similar long-term goals—such as renting out the property versus living in it—tend to experience smoother collaborations. By combining legal safeguards, financial planning, and shared vision, co-ownership becomes a viable strategy for entering the property market collaboratively.

Utilizing Buyer’s Agents for Competitive Advantage

A key advantage of buyer’s agents lies in their ability to access off-market properties. These are homes not publicly listed, often sold discreetly to avoid market exposure. By leveraging their networks, buyer’s agents can present opportunities that reduce competition, enabling buyers to negotiate from a stronger position.

Another underappreciated benefit is their expertise in auction strategies. For instance, a buyer’s agent can analyze auctioneer behavior and competitor bids, helping clients time their offers effectively. This approach minimizes emotional decision-making, ensuring buyers stay within their financial limits while maximizing their chances of success.

Buyer’s agents also excel in property due diligence. They assess zoning changes, infrastructure developments, and market trends, providing insights that align with long-term investment goals. By combining these services with personalized negotiation tactics, buyer’s agents empower clients to secure properties that might otherwise be unattainable, offering a distinct edge in competitive markets.

Future Trends and Considerations

As the Australian housing market evolves, several trends are reshaping the path to homeownership. One notable shift is the growing demand for sustainable housing. Energy-efficient homes, equipped with solar panels and smart systems, are not only environmentally friendly but also reduce long-term utility costs. For example, properties with high energy ratings often command higher resale values, making them a dual investment in both lifestyle and financial security.

Another emerging trend is the rise of regional living. With remote work becoming mainstream, many Australians are moving to regional areas where property prices are lower, yet infrastructure and amenities are improving. This shift challenges the traditional focus on urban centers and opens new opportunities for first-time buyers.

Finally, technology-driven solutions like virtual property tours and AI-powered market analysis are streamlining the buying process. These tools empower buyers to make informed decisions, bridging the gap between aspiration and ownership in innovative ways.

Image source: anz.com.au

Technological Advancements in Property Buying

One transformative innovation in property buying is the integration of AI-powered market analysis. These systems analyze vast datasets—such as historical sales, neighborhood trends, and economic indicators—to predict property values and market shifts with remarkable accuracy. For instance, platforms like CoreLogic in Australia provide predictive insights that help buyers identify undervalued properties or anticipate price growth in emerging suburbs.

What makes this approach effective is its ability to process data at a scale and speed beyond human capability. By leveraging machine learning algorithms, these tools uncover patterns that might otherwise go unnoticed, such as the impact of upcoming infrastructure projects on local property demand.

However, it’s crucial to pair these insights with human judgment. While AI excels at identifying trends, it cannot account for subjective factors like a property’s emotional appeal or unique design features. Buyers should use these tools as a complement to traditional research, ensuring a balanced and informed decision-making process.

Sustainability and Environmental Factors in Housing

A critical yet underexplored aspect of sustainable housing is the role of energy-efficient retrofitting in existing properties. Retrofitting involves upgrading older homes with features like solar panels, insulation, and energy-efficient windows to reduce energy consumption and greenhouse gas emissions. For example, programs like Australia’s Green Loans have enabled low-income households to access retrofits, significantly lowering energy bills while improving thermal comfort.

The effectiveness of retrofitting lies in its dual impact: it reduces operational costs for homeowners and contributes to broader environmental goals. However, challenges such as upfront costs and limited awareness often deter homeowners from pursuing these upgrades. Addressing this requires targeted financial incentives, such as rebates or low-interest loans, paired with educational campaigns to highlight long-term benefits.

Interestingly, retrofitting also intersects with urban planning. Policies encouraging retrofits in high-density areas can amplify their impact, creating energy-efficient communities. This approach not only supports sustainability but also enhances property values over time.

Economic Policies Impacting Home Ownership

One pivotal yet under-discussed economic policy is the impact of negative gearing on housing affordability. Negative gearing allows property investors to offset rental losses against other taxable income, incentivizing investment in real estate. While this boosts housing supply in the rental market, it also intensifies competition for entry-level properties, often pricing out first-time buyers.

The mechanism works by making property investment more attractive, particularly in high-demand urban areas. However, this policy disproportionately benefits higher-income earners, as they can leverage tax deductions more effectively. For aspiring homeowners, this creates a structural disadvantage, as investor-driven demand inflates property prices.

A potential reform could involve capping negative gearing benefits or redirecting incentives toward first-time buyers. For instance, reallocating tax concessions to shared equity schemes could balance the scales, enabling broader access to homeownership. This approach not only addresses affordability but also aligns with equitable wealth distribution, fostering long-term economic stability.

Predicting Post-Pandemic Market Dynamics

A critical factor shaping post-pandemic housing markets is the shift in work-from-home (WFH) dynamics. The widespread adoption of remote work has redefined housing demand, with buyers prioritizing properties offering home office spaces and access to regional areas with lower costs of living. This trend has already led to increased demand in suburban and regional markets, as seen in Australia’s regional housing boom during 2021-2022.

The economic rationale is clear: WFH reduces the need for proximity to urban job centers, allowing buyers to seek affordability without sacrificing career opportunities. However, this shift also introduces risks, such as over-reliance on regional infrastructure and potential market corrections if companies revert to in-office policies.

To navigate these dynamics, buyers should evaluate long-term regional growth prospects, including infrastructure investments and employment diversification. Additionally, policymakers could incentivize regional development to sustain this trend, ensuring balanced growth and mitigating urban-rural disparities in housing accessibility.

FAQ

What are the key financial steps to transition from renting to owning a home in Australia?

To transition from renting to owning a home in Australia, aspiring homeowners should begin by evaluating their financial health. This includes assessing income stability, expenses, and credit scores to determine borrowing power. Setting a realistic savings goal for a home deposit is crucial, with a target of 10-20% of the property price to avoid Lender’s Mortgage Insurance (LMI). Automating savings into a high-interest account and reducing discretionary spending can accelerate deposit growth.

Next, prospective buyers should explore government grants and incentives, such as the First Home Owner Grant (FHOG) and stamp duty concessions, to reduce upfront costs. Leveraging the First Home Super Saver Scheme (FHSS) can also provide tax advantages and boost savings. Additionally, comparing home loan options, including fixed and variable rates, ensures alignment with financial stability and long-term goals.

Finally, creating a comprehensive budget that accounts for ongoing costs like council rates, insurance, and maintenance is essential. Consulting with financial advisors or mortgage brokers can provide tailored advice, ensuring a smooth transition from renting to homeownership.

How can first-time buyers leverage government grants and incentives effectively?

First-time buyers can leverage government grants and incentives effectively by thoroughly researching the programs available in their state or territory. Key options include the First Home Owner Grant (FHOG), which provides financial assistance for purchasing new or substantially renovated homes, and stamp duty concessions that reduce upfront costs. Understanding the eligibility criteria for these programs is essential, as they vary by location and property type.

The First Home Super Saver Scheme (FHSS) is another valuable tool, allowing buyers to save for a deposit through voluntary superannuation contributions with tax benefits. To maximize this scheme, buyers should calculate the potential tax savings and ensure contributions align with their financial goals.

Timing is also critical—applying for grants and incentives early in the buying process can streamline financial planning and reduce delays. Combining multiple programs, where possible, can further enhance affordability. Consulting with a mortgage broker or financial advisor ensures buyers make informed decisions and fully capitalize on available benefits.

What strategies can help renters save for a home deposit more efficiently?

Renters can save for a home deposit more efficiently by adopting a disciplined and strategic approach to their finances. Creating a detailed budget is the first step, tracking all income and expenses to identify areas where savings can be maximized. Prioritizing essential costs like rent, utilities, and groceries while cutting back on discretionary spending such as dining out, entertainment, and subscriptions can free up additional funds.

Automating savings into a dedicated high-interest account ensures consistent contributions and reduces the temptation to spend. Downsizing to a smaller rental property, moving to a more affordable area, or sharing accommodation with housemates or family can significantly lower living expenses, allowing renters to allocate more towards their deposit.

Exploring opportunities to earn extra income, such as taking on freelance work, part-time jobs, or monetizing hobbies, can also accelerate savings. Additionally, renters should take advantage of government schemes like the First Home Super Saver Scheme (FHSS) to boost their deposit through tax-effective savings. Staying focused on long-term goals and celebrating small milestones along the way can help maintain motivation throughout the saving journey.

How do market trends and interest rates impact the decision to buy a first home?

Market trends and interest rates play a pivotal role in shaping the decision to buy a first home. Declining interest rates can make mortgage financing more affordable, reducing monthly repayment costs and increasing the appeal of homeownership. However, lower interest rates often drive higher housing demand, which can push up property prices, particularly in entry-level market segments. This dynamic can narrow opportunities for first-time buyers, as rising prices may offset the benefits of reduced borrowing costs.

Conversely, when interest rates rise, housing affordability can decline due to higher mortgage repayments, potentially cooling demand and stabilizing or reducing property prices. Timing purchases during market corrections or periods of lower competition can provide first-time buyers with better value.

Monitoring broader market trends, such as shifts in housing supply, regional growth, and lifestyle preferences, is equally important. For instance, the rise of remote work has increased demand for suburban and regional properties, creating opportunities in these areas. Staying informed about these factors and consulting with financial experts can help buyers navigate market complexities and make well-timed, strategic decisions.

What are the common pitfalls to avoid when purchasing a first home in Australia?

Common pitfalls to avoid when purchasing a first home in Australia include underestimating the total costs involved. Beyond the property price, buyers must account for expenses such as stamp duty, legal fees, inspections, and ongoing costs like council rates and maintenance. Failing to budget for these can lead to financial strain post-purchase.

Another frequent mistake is neglecting thorough research on the property and its location. Overlooking factors like future infrastructure developments, neighborhood trends, or potential environmental risks can impact the property’s long-term value and suitability. Skipping professional inspections may also result in unexpected repair costs due to hidden structural or pest issues.

Rushing into a purchase without pre-approval for a mortgage is another common error. Pre-approval not only clarifies borrowing capacity but also strengthens negotiation power. Additionally, buyers should avoid overextending their finances by purchasing at the upper limit of their budget, leaving little room for unforeseen expenses or interest rate increases.

Lastly, failing to seek professional advice from conveyancers, mortgage brokers, or financial advisors can lead to costly oversights. Engaging experts ensures a smoother process and helps first-time buyers make informed, confident decisions.

Conclusion

Achieving the dream of homeownership in Australia is not merely about saving for a deposit or navigating the property market—it’s about understanding the interplay of financial discipline, market dynamics, and personal priorities. For instance, while many assume that buying during a market dip guarantees success, evidence shows that timing alone is insufficient without a clear financial plan and thorough property research. A 2023 study by the Grattan Institute revealed that buyers who combined strategic savings with government incentives like the First Home Super Saver Scheme saved up to 20% more on upfront costs compared to those who relied solely on market timing.

Think of the journey as assembling a puzzle: each piece—budgeting, market analysis, and professional advice—must fit together seamlessly. By addressing misconceptions, such as the belief that renting is always a financial setback, and leveraging expert insights, aspiring homeowners can transform challenges into opportunities, building a foundation for long-term financial stability.

Image source: investorkit.com.au

Recap of Key Steps to Home Ownership

One critical yet often overlooked step in the journey to homeownership is evaluating borrowing capacity with future-proofing in mind. While most buyers focus on current income and expenses, a forward-looking approach considers potential life changes—such as career shifts, family growth, or economic downturns—that could impact repayment ability. For example, a 2024 CoreLogic report highlighted that buyers who modeled scenarios like a 2% interest rate increase were 30% less likely to experience mortgage stress within the first five years.

To apply this, start by using online mortgage calculators that allow for stress-testing under different conditions. Then, integrate this analysis into your budget by allocating a buffer—typically 10-20% of your monthly income—for unexpected costs.

This approach not only safeguards financial stability but also aligns with broader risk management principles, ensuring that your home purchase remains a sustainable investment, even in uncertain times.

Encouragement for Aspiring First-Time Buyers

A powerful yet underutilized strategy for aspiring first-time buyers is leveraging micro-goals to build momentum. Instead of focusing solely on the daunting task of saving a full deposit, break it into smaller, achievable milestones—such as saving for the first $5,000 or reducing discretionary spending by 10% over three months. Behavioral finance research shows that achieving incremental goals boosts motivation and creates a positive feedback loop, making long-term objectives feel more attainable.

For instance, consider automating weekly transfers into a high-interest savings account. This not only simplifies the process but also reinforces discipline without requiring constant decision-making. Additionally, tracking progress visually—such as through a savings chart—can provide tangible evidence of growth, further enhancing commitment.

By reframing the journey as a series of manageable steps, buyers can reduce overwhelm and build confidence. This approach aligns with broader principles of habit formation, ensuring steady progress toward homeownership.

Looking Ahead: Your Journey Beyond the First Home

One critical yet often overlooked aspect of post-purchase planning is building equity strategically to unlock future opportunities. Equity—the difference between your home’s market value and the remaining loan balance—can serve as a powerful financial tool when managed effectively. By making additional repayments early or leveraging offset accounts, you can reduce interest costs and accelerate equity growth.

For example, consider using your equity to fund renovations that enhance your property’s value. A well-planned kitchen upgrade or energy-efficient retrofitting not only improves your living experience but also increases resale potential. This approach ties into broader investment principles, where reinvesting in appreciating assets compounds long-term gains.

Additionally, maintaining a proactive mindset about refinancing options can help you secure better loan terms as your financial situation evolves. By treating your first home as a stepping stone, you position yourself for future ventures, such as upgrading or diversifying into investment properties.