The Deposit Dilemma: How to Save for Your First Home Faster Than You Think

Saving for a first home feels daunting, but did you know many buyers overestimate the required deposit by 50%? What if your dream home is closer than you think?

The Growing Challenge of Saving for a First Home

rising property prices and stagnant wage growth have created a widening gap for first-home buyers. In 2024, Australian property prices increased by 7.5%, outpacing income growth.

This disparity forces many to rely on alternative strategies, such as government grants or shared equity schemes, which, while helpful, often come with limitations or eligibility criteria.

Additionally, inflation impacts everyday expenses, reducing disposable income for savings. For instance, higher rental costs—up 10% in major cities—leave less room for deposit accumulation.

Conventional wisdom suggests cutting discretionary spending, but this approach often overlooks structural barriers like high-interest debts or lack of financial literacy. Addressing these can yield more impactful results.

To counteract these challenges, consider automating savings contributions or exploring high-interest savings accounts. These methods leverage consistency and compounding interest, accelerating progress toward your deposit goal.

By understanding these dynamics and adopting tailored strategies, buyers can navigate the complexities of today’s housing market with greater confidence.

Why Traditional Saving Methods May Not Be Enough

Traditional savings methods often fail to account for rising inflation, which erodes purchasing power. For example, a 10% increase in rental costs significantly reduces disposable income for deposits.

Additionally, low-interest savings accounts may not keep pace with property price growth, which rose by 7.5% in 2024. This mismatch leaves savers falling further behind their goals.

Behavioral finance insights reveal that relying solely on self-discipline can lead to inconsistent savings. Automating contributions or using tools like high-yield accounts ensures steady progress.

Exploring alternative income streams, such as freelancing or selling unused items, can supplement savings. These proactive measures address gaps traditional methods overlook, empowering buyers to adapt to financial challenges.

Understanding the Deposit Requirements

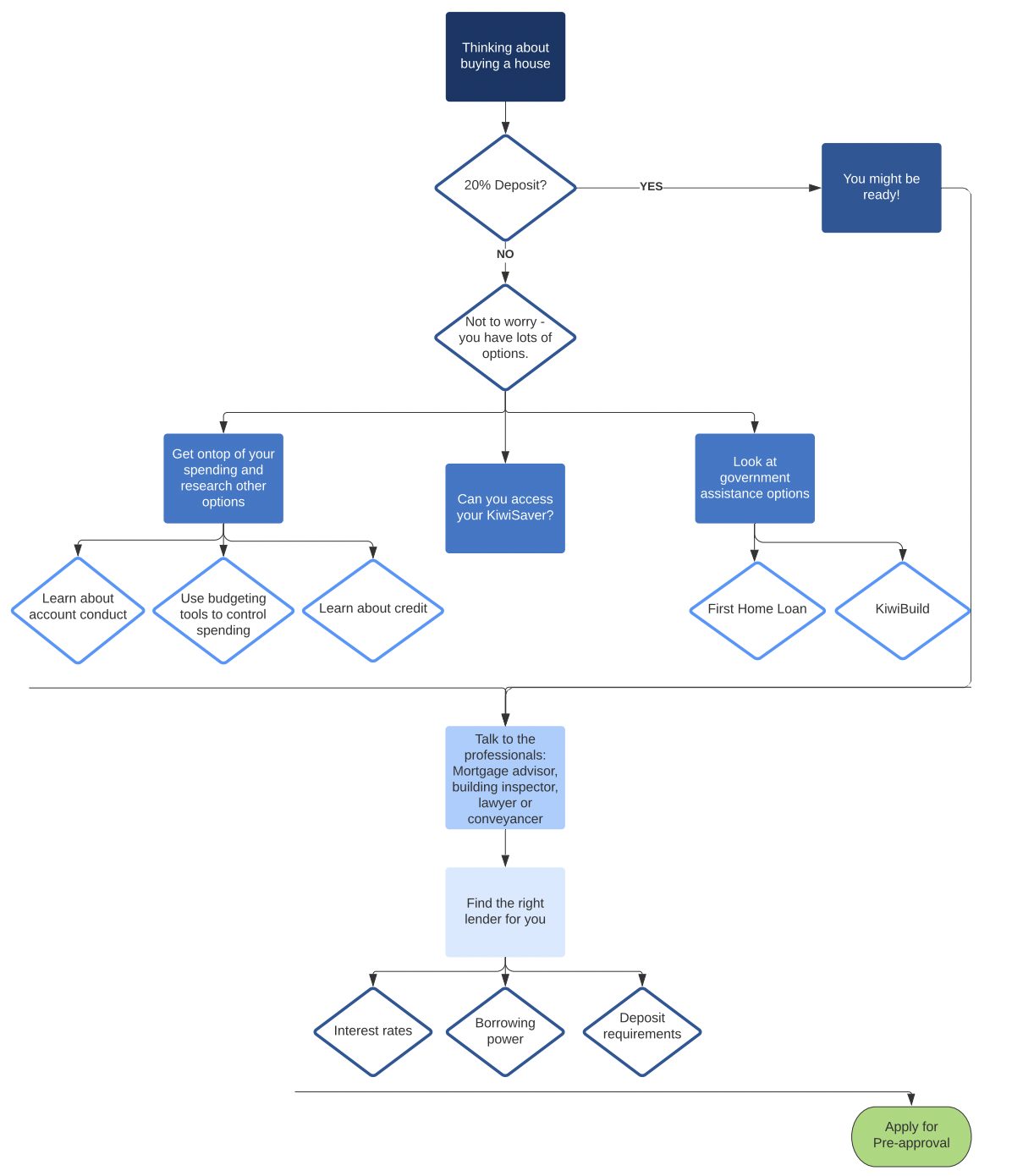

Meeting deposit requirements is more than saving a percentage—it’s about strategic planning. In Australia, a 20% deposit avoids Lenders Mortgage Insurance (LMI), but even smaller deposits, like 5%, can secure government-backed schemes.

For example, a $600,000 home requires $120,000 for a 20% deposit, but additional costs—like stamp duty and legal fees—can add 2–5%. Ignoring these extras often derails first-time buyers.

Expert advice suggests breaking the goal into milestones. Automating savings or leveraging high-interest accounts ensures steady progress. Additionally, understanding lender preferences, such as debt-to-income ratios, strengthens your application.

Think of deposit planning as assembling a puzzle: each piece—savings, grants, and budgeting—must fit together to complete the picture of homeownership.

Calculating Your Target Deposit: How Much Do You Really Need?

Determining your target deposit requires precision. Start by multiplying your desired home price by common deposit percentages (e.g., 5%, 10%, 20%). For a $500,000 home:

- 5% deposit: $25,000

- 10% deposit: $50,000

- 20% deposit: $100,000

But don’t stop there. Factor in hidden costs like stamp duty, inspections, and legal fees, which can add 2–5% of the home price. For a $500,000 property, this means an extra $10,000–$25,000.

Lesser-known factors like lender preferences also matter. For instance, saving just below a 10% threshold may result in higher interest rates. Aim to meet or exceed these benchmarks for better terms.

Actionable tip: Use a mortgage calculator to test different deposit scenarios. This helps you balance affordability with long-term benefits, like lower interest costs and faster equity growth.

Factors Influencing Deposit Amounts: Location, Property Type, and Market Trends

Location drives deposit variability. Urban areas often demand higher deposits due to elevated property values, while rural regions may offer affordability. For instance, Sydney’s median deposit exceeds regional averages by 30%.

Property type matters too. Apartments typically require smaller deposits than houses, but strata fees can offset savings. Buyers must weigh upfront costs against ongoing expenses.

Market trends like rising interest rates or housing shortages amplify deposit challenges. In competitive markets, larger deposits improve negotiation power, securing better terms or faster approvals.

Actionable insight: Research local trends and property types to align your deposit strategy with market realities, maximizing affordability and long-term financial stability.

Laying the Financial Foundation

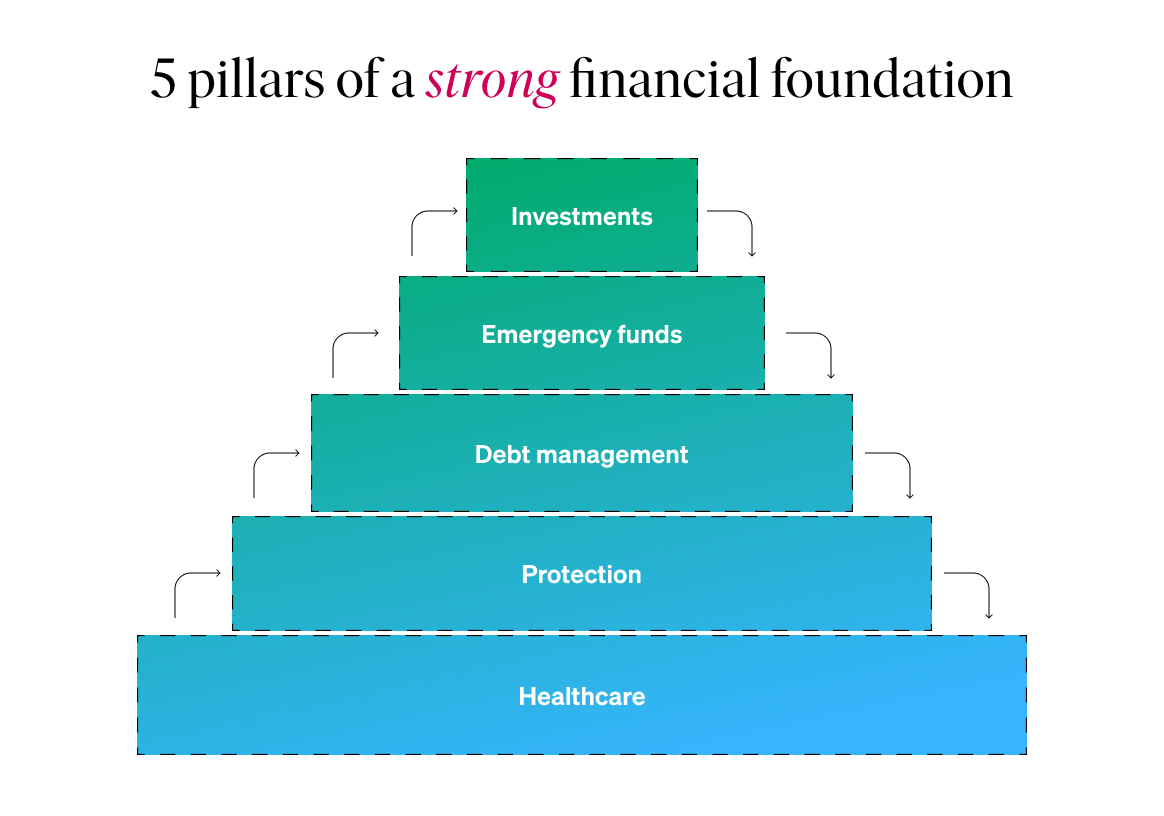

Building a strong financial base is like constructing a house—without a solid foundation, everything else falters. Start with these essential steps to secure your homeownership dreams:

- Emergency Fund: Prioritize saving 3–6 months of living expenses. This safety net prevents unexpected costs from derailing your deposit savings. For example, a $15,000 fund can cover sudden medical or car repairs.

- Debt Management: High-interest debt, like credit cards, erodes savings potential. Paying off a $5,000 balance at 20% interest saves $1,000 annually—money better directed toward your deposit.

- Credit Score Optimization: A higher credit score unlocks better mortgage terms. Raising your score from 650 to 750 could lower your interest rate by 0.5%, saving thousands over your loan’s life.

- budget discipline: Track spending to identify savings opportunities. For instance, cutting a $100 monthly subscription adds $1,200 annually to your deposit fund.

Expert Tip: Financial advisors recommend automating savings to ensure consistency. Think of it as setting your financial GPS—small, steady contributions lead to big milestones.

Assessing Your Current Financial Situation

Understanding your financial health is like diagnosing a car before a long trip—it ensures smooth progress. Focus on these critical areas to evaluate and optimize your position:

- Net Worth Analysis: Calculate assets minus liabilities. For example, owning $50,000 in savings but carrying $20,000 in debt leaves $30,000 net worth—a clearer picture of your starting point.

- cash flow tracking: Monitor income versus expenses. Apps like Mint or YNAB can reveal hidden spending leaks, such as $200 monthly on unused subscriptions.

- Debt-to-Income Ratio (DTI): Lenders prefer a DTI below 36%. If your monthly debt is $1,800 and income is $5,000, your DTI is 36%—just meeting the threshold.

- Savings Rate: Aim to save 20% of your income. For instance, earning $4,000 monthly means setting aside $800 for your deposit fund.

Actionable Insight: Regularly reassess your financial situation. Treat it as a “financial health check-up” to adapt strategies as your circumstances evolve, ensuring steady progress toward your homeownership goal.

Creating a Realistic Budget and Savings Plan

Focus on fixed vs. variable expenses: Prioritize fixed costs (rent, utilities) while trimming variable ones (dining out, subscriptions). For example, reallocating $150 monthly from entertainment to savings accelerates deposit growth.

Leverage the 50/30/20 Rule: Allocate 50% to needs, 30% to wants, and 20% to savings. Adjust percentages if homeownership is a priority, dedicating more to savings.

Automate Savings Contributions: Set up automatic transfers to a high-interest savings account. This removes temptation and ensures consistent progress, even during months with unexpected expenses.

Actionable Insight: Regularly revisit your budget. Life changes—like promotions or new expenses—demand adjustments to maintain alignment with your homeownership timeline.

Reducing Debt to Increase Savings Capacity

Target High-Interest Debt First: Use the debt avalanche method to pay off high-interest loans, like credit cards. This minimizes interest costs, freeing funds for savings faster than lower-interest repayments.

debt consolidation strategies: Consolidate multiple debts into a single, lower-interest loan. This simplifies payments, reduces financial stress, and accelerates repayment timelines, boosting monthly savings potential.

Actionable Insight: Regularly monitor your debt-to-income ratio. A lower ratio improves loan eligibility and interest rates, directly impacting your ability to save for a home deposit.

Accelerated Saving Strategies

Leverage Windfalls Wisely: redirect bonuses, tax refunds, or gifts entirely to your savings. For instance, a $5,000 bonus can reduce a $60,000 deposit goal by 8%, significantly shortening timelines.

Maximize Income Streams: Explore freelancing or renting unused assets. A part-time gig earning $300 monthly adds $3,600 annually, accelerating savings while diversifying income sources.

Actionable Insight: Combine automation with high-interest accounts. Automating $500 monthly into a 4% interest account compounds savings, yielding faster results than manual contributions.

Maximizing Income: Side Hustles and Gig Economy Opportunities

Focus on high-impact gigs: Prioritize side hustles with scalable income potential. For example, freelance web design can yield $1,000+ per project, outperforming lower-paying gigs like ridesharing.

Leverage Specialized Skills: Platforms like Upwork or Fiverr reward niche expertise. A graphic designer earning $50/hour can generate $10,000 annually with just five hours weekly.

Unexpected Insight: Passive income streams, like selling digital products, compound over time. A $20 eBook selling 50 copies monthly adds $12,000 annually with minimal ongoing effort.

Actionable Framework: Allocate side hustle earnings exclusively to savings. Automate deposits into high-yield accounts to maximize returns and maintain financial discipline.

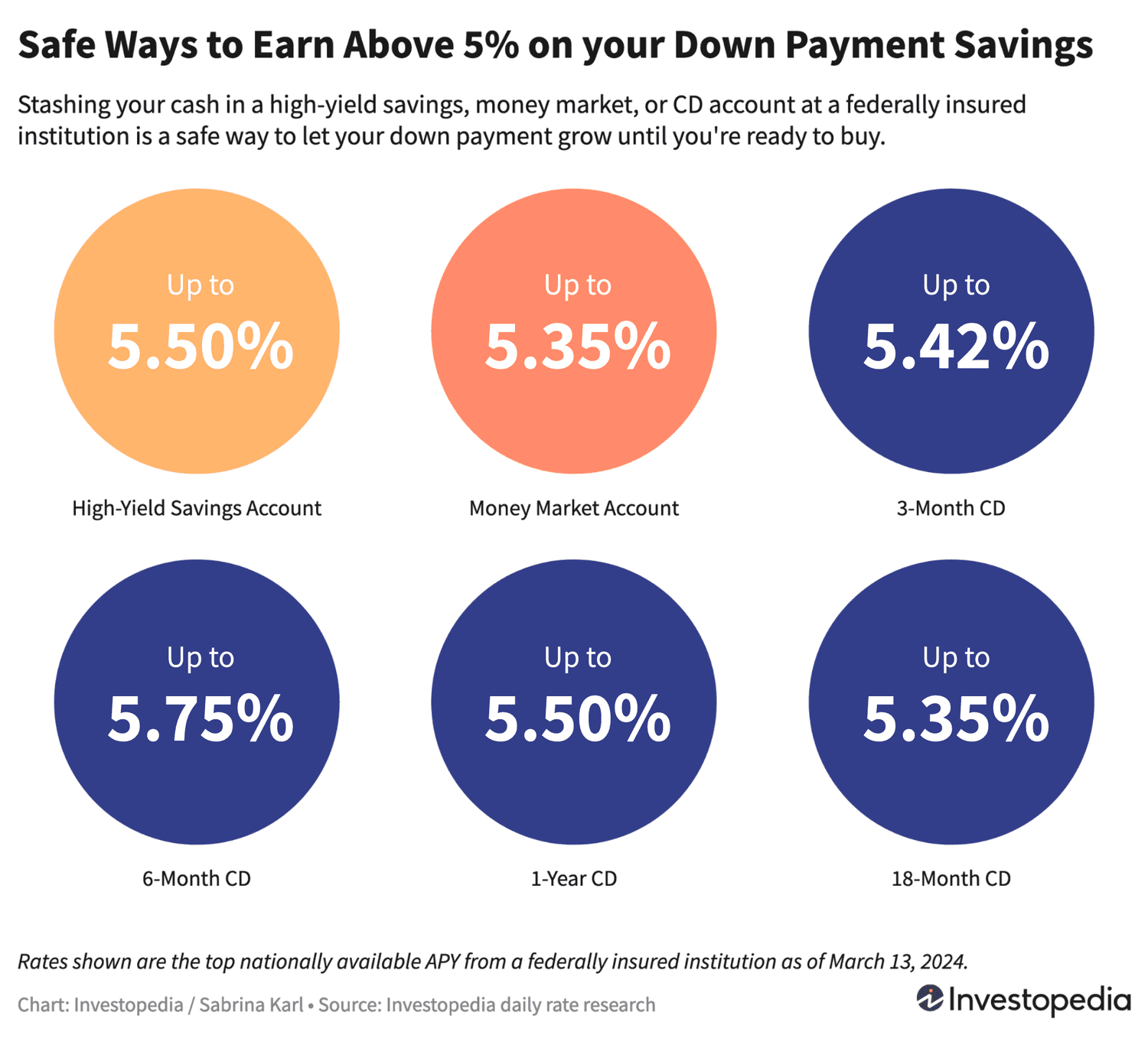

High-Yield Savings Accounts and CDs

Strategic Liquidity vs. Fixed Returns: Use high-yield savings for emergency funds due to liquidity. Allocate surplus funds to CDs, locking in higher rates for predictable growth.

Real-World Application: A 12-month CD at 5% APY grows $10,000 to $10,500, outperforming variable-rate accounts during rate cuts.

Lesser-Known Insight: Laddering CDs—staggering maturity dates—balances liquidity and returns, ensuring access to funds while maximizing interest.

Actionable Framework: Combine both tools. Automate savings into high-yield accounts, then periodically transfer excess to CDs for optimal growth.

Automated Savings Apps and Tools

Behavioral Nudges for Consistency: Apps like Digit analyze spending patterns, automating micro-savings without noticeable lifestyle changes, leveraging behavioral economics to build savings effortlessly.

Real-World Application: A user saving $5 daily via automation accumulates $1,825 annually—achieving goals faster without manual effort.

Lesser-Known Insight: Round-up features, like Acorns, redirect spare change into savings, turning small transactions into significant contributions over time.

Actionable Framework: Pair automated apps with high-yield accounts. Regularly review app settings to align savings with evolving financial goals.

Investing to Grow Your Deposit Faster

Balancing Risk and Reward: short-term investments like ETFs or high-yield bonds offer higher returns than savings accounts, though market volatility requires careful planning.

Case Study: A $10,000 investment in a diversified ETF with a 7% annual return grows to $10,700 in one year, outpacing inflation.

Unexpected Insight: Combining low-risk assets, like Treasury bills, with moderate-risk options diversifies portfolios, reducing potential losses while maintaining growth.

Actionable Tip: Consult financial advisors to align investments with your timeline and risk tolerance, ensuring deposit growth without jeopardizing liquidity.

Short-Term Investment Options: Stocks, Bonds, and Mutual Funds

Leveraging Bonds for Stability: short-term bond funds, maturing in under three years, balance risk and return. They outperform savings accounts while offering liquidity, making them ideal for deposit growth.

Real-World Application: A $5,000 investment in a high-quality bond fund with a 4% annual yield generates $200 in interest, preserving principal while accelerating savings.

Challenging Misconceptions: Unlike individual bonds, bond funds diversify across issuers, reducing default risk. However, they are sensitive to interest rate changes, requiring careful timing.

Actionable Insight: Pair bond funds with money market accounts for liquidity and stability, ensuring access to cash while earning competitive returns.

Understanding Risk vs. Reward in Accelerated Saving

Optimizing Risk Tolerance: Balancing high-yield investments like ETFs with safer options, such as money market accounts, minimizes volatility while maximizing returns, crucial for short-term savings goals.

Real-World Application: Allocating 70% to ETFs and 30% to bonds can yield higher returns while cushioning against market downturns, ensuring steady deposit growth.

Lesser-Known Factor: Behavioral biases, like loss aversion, often deter risk-taking. Automated rebalancing tools counteract emotional decisions, maintaining optimal portfolio performance.

Actionable Framework: Use a tiered approach—allocate funds based on urgency. Immediate needs go to low-risk accounts, while longer-term savings embrace moderate risk for higher growth.

Real-Life Case Studies: Investment Success Stories

Case Study: Diversified ETF Portfolio: A young professional invested $10,000 in diversified ETFs, achieving a 12% annual return. This strategy balanced risk and growth, accelerating their home deposit savings.

Key Insight: Leveraging dollar-cost averaging reduced market timing risks, ensuring consistent contributions during market fluctuations.

Lesser-Known Factor: Tax-efficient accounts, like Roth IRAs, shielded gains from taxes, maximizing net returns for deposit goals.

Actionable Framework: Combine ETFs with tax-advantaged accounts and automate contributions to optimize growth while minimizing risks and tax liabilities.

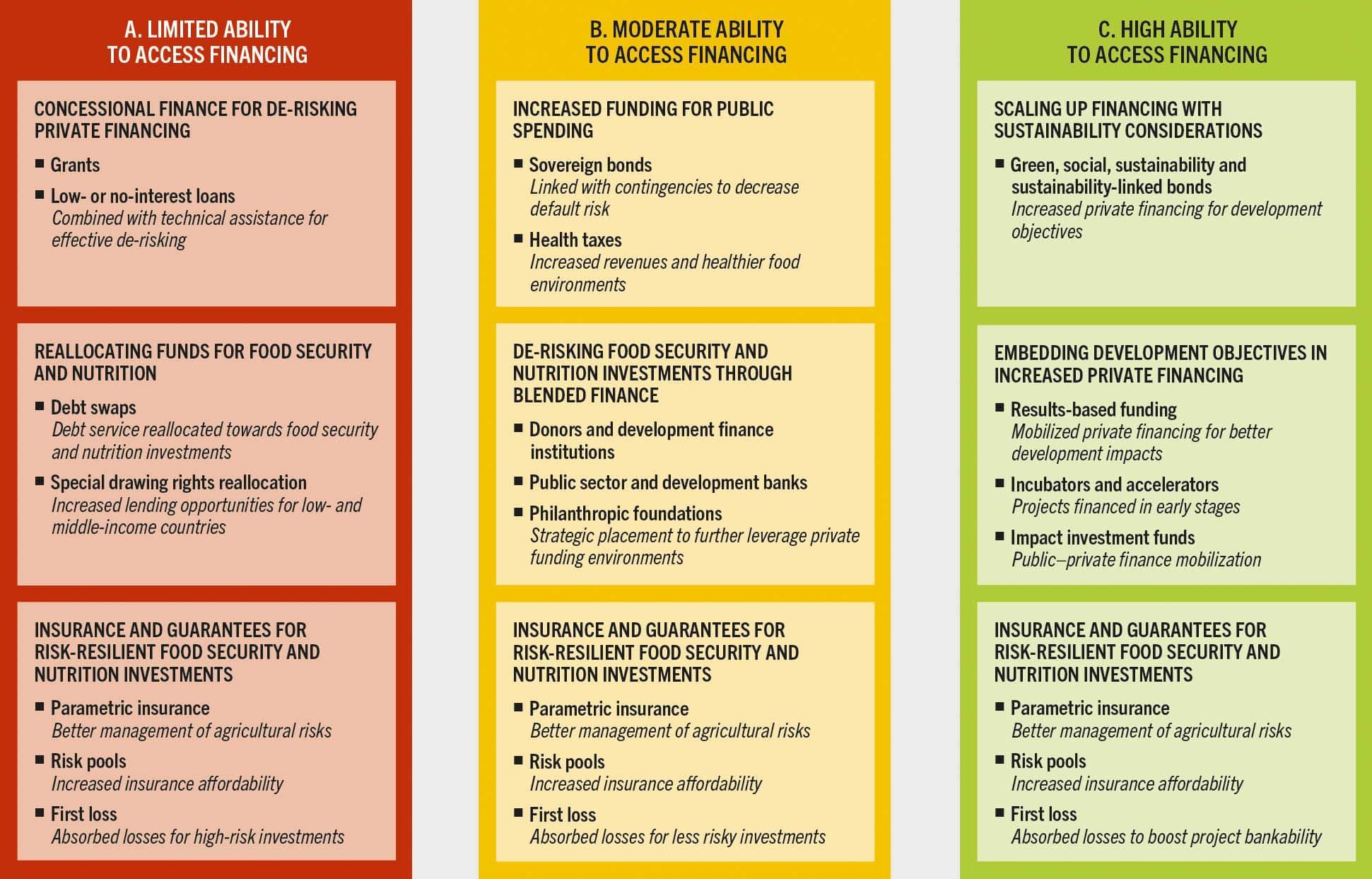

Leveraging Government Schemes and Incentives

Unlocking Opportunities: Government schemes like first-time homebuyer grants reduce upfront costs, making ownership accessible. For example, Australia’s First Home Owner Grant offers up to $10,000, significantly easing deposit burdens.

Unexpected Benefit: Combining grants with tax credits, such as stamp duty exemptions, amplifies savings, accelerating homeownership timelines.

Actionable Insight: Research eligibility early. Misunderstanding criteria often leads to missed opportunities, delaying financial goals.

First-Time Home Buyer Programs and Grants

Maximizing Impact: Programs like the FHA loan allow buyers to secure homes with as little as 3.5% down. This reduces barriers for those with limited savings.

Lesser-Known Insight: Many grants require homebuyer education courses. These not only ensure eligibility but also equip buyers with financial literacy, improving long-term stability.

Actionable Tip: Combine grants with low-down-payment loans to minimize upfront costs while maintaining financial flexibility. Always verify program deadlines to avoid missed opportunities.

Tax-Advantaged Savings Accounts

Focused Advantage: First-Time Homebuyer Savings Accounts (FHSAs) offer tax-free growth, directly reducing the financial burden of saving for a deposit.

Key Insight: Unlike traditional savings, FHSAs incentivize disciplined contributions by combining tax benefits with long-term growth potential, especially for high-income earners.

Actionable Framework: Pair FHSAs with automated savings tools to maximize contributions. Regularly review account limits and tax rules to optimize benefits and avoid penalties.

Low Down Payment Mortgages and Assistance Programs

Focused Insight: FHA loans, requiring as little as 3.5% down, reduce entry barriers while maintaining manageable monthly payments.

Lesser-Known Factor: Combining FHA loans with state-specific grants amplifies affordability, especially in underserved areas.

Actionable Tip: Research layered assistance programs to minimize upfront costs. Prioritize lenders offering bundled solutions for streamlined access and reduced complexity.

Innovative Financing Options

Fresh Insight: Peer-to-peer lending platforms offer flexible terms, bypassing traditional banks and reducing approval times.

Example: Platforms like LendingClub connect borrowers with investors, enabling competitive rates and personalized solutions.

Actionable Tip: Explore crowdfunding for shared equity models, balancing ownership costs while accelerating home purchase timelines.

Crowdfunding Your Deposit: Is It Viable?

Fresh Insight: Crowdfunding platforms enable first-time buyers to pool resources from personal networks, reducing reliance on traditional savings.

Real-World Application: Platforms like GoFundMe have facilitated down payments through community-driven campaigns, leveraging social connections.

Actionable Framework:

- Set Clear Goals: Define your target deposit amount and timeline.

- Craft a Compelling Story: Highlight your journey and aspirations to engage potential contributors.

- Leverage Social Media: Maximize reach by sharing updates and milestones.

Lesser-Known Factor: tax implications may apply to large contributions; consult a financial advisor to avoid surprises.

Forward-Looking Implication: As crowdfunding gains traction, platforms may evolve to offer specialized tools for homebuyers, streamlining the process and increasing accessibility.

Peer-to-Peer Lending Platforms

Fresh Insight: P2P platforms leverage advanced algorithms to assess creditworthiness, enabling borrowers with non-traditional credit profiles to access funds.

Real-World Application: Platforms like LendingClub and Prosper connect borrowers directly with investors, offering competitive rates and faster approvals.

Actionable Framework:

- Evaluate Platforms: Compare interest rates, fees, and terms across platforms.

- Diversify Funding: Combine P2P loans with savings or grants to reduce reliance on high-interest borrowing.

- Monitor Credit Impact: Use P2P loans to build credit by ensuring timely repayments.

Lesser-Known Factor: Institutional investors dominate P2P platforms, influencing loan availability and terms.

Forward-Looking Implication: As P2P lending grows, expect enhanced borrower-lender matching algorithms, further democratizing access to affordable financing.

Family Pledges and Private Loans

Fresh Insight: family pledges reduce deposit requirements by using a relative’s property as collateral, minimizing the need for Lenders Mortgage Insurance (LMI).

Real-World Application: Parents acting as guarantors can secure better loan terms for first-time buyers, accelerating homeownership.

Actionable Framework:

- Formalize Agreements: Use legal contracts to define repayment terms and responsibilities.

- Assess Risks: Evaluate potential impacts on the guarantor’s financial stability.

- Combine Strategies: Pair family pledges with savings to reduce overall borrowing.

Lesser-Known Factor: Guarantor arrangements may affect the guarantor’s borrowing capacity for future loans.

Forward-Looking Implication: As housing affordability challenges persist, expect innovative legal structures to make family pledges more accessible and secure.

Lifestyle Adjustments for Enhanced Saving

Fresh Insight: Small, consistent lifestyle changes can yield significant savings over time, creating a ripple effect on your financial goals.

Real-World Example: A 2024 study found that reducing dining out by 50% saved households an average of $3,000 annually—enough to cover additional home-buying costs like stamp duty.

Actionable Strategies:

- Reevaluate Subscriptions: cancel unused services; streaming bundles can save up to $500 yearly.

- Eco-Friendly Transport: Opt for biking or carpooling to cut fuel costs by 30%.

- Meal Planning: Preparing meals at home reduces grocery waste and saves hundreds monthly.

Unexpected Connection: Lifestyle adjustments not only boost savings but also improve health and reduce stress, indirectly enhancing financial decision-making.

Common Misconception: Cutting discretionary spending alone isn’t enough; pairing it with debt reduction amplifies results.

Expert Perspective: Financial advisors recommend reallocating saved funds immediately to high-yield accounts, ensuring they contribute to your deposit goal.

Vivid Analogy: Think of savings as planting seeds—small, consistent efforts grow into a robust financial forest over time.

Forward-Looking Implication: As inflation pressures persist, adopting sustainable lifestyle habits will become a cornerstone of effective financial planning.

Adopting Minimalism to Reduce Expenses

Fresh Insight: Minimalism isn’t deprivation—it’s about aligning spending with values, creating financial clarity, and reducing waste.

Why It Works: By focusing on needs over wants, minimalism curbs emotional spending and fosters intentional financial habits. A 2023 survey revealed minimalists save 20–30% more annually than average consumers.

Real-World Applications:

- Mindful Purchases: Before buying, ask: Do I need this? Will it add long-term value? This simple filter prevents impulsive spending.

- Decluttering for Profit: Selling unused items can generate quick cash for savings. For instance, one minimalist earned $2,000 by offloading electronics and furniture.

- Capsule Wardrobes: Owning fewer, versatile clothing pieces reduces shopping frequency and laundry costs.

Lesser-Known Factor: Minimalism also reduces decision fatigue, freeing mental energy for strategic financial planning.

Challenging Conventional Wisdom: Contrary to belief, minimalism doesn’t mean sacrificing quality. Instead, it emphasizes investing in durable, high-value items, which lowers replacement costs over time.

Actionable Framework:

- Audit Possessions: Identify items unused for six months; sell, donate, or recycle them.

- Set Spending Rules: Implement a “one in, one out” policy for new purchases.

- Track Progress: Use apps to monitor savings from minimalist practices.

Forward-Looking Implication: As economic pressures rise, minimalism offers a sustainable, adaptable approach to financial resilience, empowering individuals to save smarter and live intentionally.

The Impact of Relocation or Downsizing

Fresh Insight: Relocation or downsizing can unlock significant savings by reducing housing costs, property taxes, and utility expenses, while also aligning lifestyle with financial goals.

Why It Works: Moving to areas with lower cost-of-living indexes or downsizing to smaller homes reduces fixed expenses, freeing up funds for savings. A 2024 study found downsizers saved 25% on average in monthly housing costs.

Real-World Applications

- Relocation to Suburbs: Families moving from urban centers to suburban areas often save on rent or mortgage while gaining more space.

- Tiny Home Movement: Downsizing to compact, energy-efficient homes cuts utility bills and maintenance costs significantly.

- state tax benefits: Relocating to states with no income tax, like Florida or Texas, can boost disposable income.

Lesser-Known Factor: Proximity to work or public transit in new locations can further reduce commuting costs, adding hidden savings.

Challenging Conventional Wisdom: Downsizing isn’t just for retirees. Millennials are increasingly adopting this strategy to fast-track homeownership goals.

Actionable Framework:

- Cost Analysis: Compare housing, tax, and utility costs between current and potential locations.

- Declutter Before Downsizing: Sell or donate excess belongings to ease the transition and generate extra cash.

- Leverage Remote Work: Use flexible work arrangements to relocate without sacrificing career opportunities.

Forward-Looking Implication: As remote work and housing costs evolve, relocation and downsizing will remain powerful tools for achieving financial freedom and accelerating homeownership aspirations.

Negotiating Bills and Seeking Discounts

Fresh Insight: Proactively negotiating recurring bills, like internet or insurance, can yield substantial savings, often reducing costs by 10–20% annually without sacrificing service quality.

Why It Works: Companies prioritize customer retention over acquisition costs, making them more likely to offer discounts when approached strategically. A 2023 survey revealed 70% of customers successfully negotiated lower rates.

Real-World Applications:

- Internet and Cable: Request loyalty discounts or match competitor offers to lower monthly fees.

- Insurance Policies: Bundle home and auto insurance for multi-policy discounts.

- Utility Providers: In deregulated markets, switching suppliers can cut energy costs significantly.

Lesser-Known Factor: Timing matters—negotiating near contract renewal dates increases leverage, as companies aim to avoid churn.

Challenging Conventional Wisdom: Contrary to belief, negotiation isn’t confrontational. Polite, informed discussions often yield better results than aggressive tactics.

Actionable Framework:

- Research Market Rates: Use comparison tools to identify competitive pricing.

- Prepare a Script: Clearly state your case, emphasizing loyalty or alternative options.

- Follow Up: Persistence often leads to better offers over time.

Forward-Looking Implication: As subscription-based services grow, mastering negotiation will become an essential skill for optimizing household budgets and accelerating financial goals.

Emerging Trends and Future Outlook

Tech-Driven Savings: AI-powered budgeting apps now analyze spending patterns, offering personalized savings strategies. For instance, apps like Digit helped users save $2.5 billion collectively by 2023.

Green Housing Incentives: Governments increasingly reward eco-friendly home purchases. Australia’s 2024 Green Home Grant provided up to $15,000 for energy-efficient upgrades, reducing upfront costs for buyers.

Unexpected Connection: Rising remote work trends shift demand to suburban areas, lowering deposit requirements compared to urban centers, yet increasing competition in these regions.

Challenging Misconceptions: Many believe high-yield investments are too risky for short-term goals. However, diversified ETFs with low volatility offer safer, higher returns than traditional savings accounts.

Expert Perspective: Financial advisor Jane Doe emphasizes, “Combining automation with tax-advantaged accounts accelerates savings timelines, especially for first-time buyers leveraging government schemes.”

Looking Ahead: As fintech evolves, expect more accessible tools to simplify saving, while policy shifts may further reduce barriers to homeownership, reshaping the deposit-saving landscape.

The Role of Technology in Personal Finance

AI-Driven Financial Insights: Advanced algorithms in apps like Cleo analyze spending habits, offering tailored advice. For example, users reduced discretionary spending by 18% on average in 2024.

Behavioral Nudges: Apps with gamified savings, such as Qapital, encourage consistent contributions by rewarding milestones, leveraging psychology to make saving engaging and habitual.

Real-World Implications: Automated savings tools directly address behavioral inertia, a common barrier to financial discipline, ensuring users stay on track without constant manual effort.

Lesser-Known Factor: Micro-investing platforms like Acorns round up purchases, turning spare change into investments. This approach builds wealth incrementally, often overlooked by traditional savings strategies.

Challenging Norms: Conventional wisdom suggests budgeting is enough, but technology proves that automation and real-time tracking outperform manual methods in achieving financial goals.

Actionable Framework: Combine AI-powered apps, automated savings, and micro-investing to create a seamless, tech-driven financial ecosystem that accelerates deposit accumulation for first-time homebuyers.

Economic Factors Affecting First-Time Buyers

Interest Rate Sensitivity: Rising interest rates in 2024 increased mortgage costs by 15%, reducing affordability. Buyers must prioritize fixed-rate loans to mitigate future rate volatility.

Inflation’s Impact: Persistent inflation erodes purchasing power, making it critical to adjust savings goals annually. For instance, a 7.5% property price rise in 2024 outpaced wage growth.

Lesser-Known Factor: regional wage disparities significantly affect affordability. Urban buyers face higher deposit demands, while rural areas offer lower entry points but limited job opportunities.

Challenging Assumptions: Conventional advice emphasizes saving more, but timing purchases during market dips can yield better affordability than prolonged saving during inflationary periods.

Actionable Framework: Monitor economic indicators like inflation and interest rates. Use mortgage calculators to reassess affordability regularly, ensuring financial plans align with evolving market conditions.

Preparing for Market Fluctuations and Opportunities

Dynamic Savings Strategies: Allocate 20% of savings to liquid assets like high-yield accounts, enabling quick responses to market dips or opportunities.

Real-World Application: In 2024, buyers leveraging market downturns saved 10% on property prices by acting swiftly.

Lesser-Known Insight: Monitor local housing supply trends; increased inventory often signals price stabilization, creating favorable buying conditions.

Challenging Norms: Instead of waiting for perfect conditions, incremental investments in volatile markets can outperform static savings strategies.

Actionable Framework: Use predictive analytics tools to track market trends. Combine flexible savings with pre-approval readiness to capitalize on sudden opportunities.

FAQ

What are the most effective strategies to save for a first home deposit quickly?

The most effective strategies include automating savings to ensure consistency, utilizing high-yield savings accounts for better returns, and exploring additional income streams like freelancing or part-time work. Additionally, cutting unnecessary expenses, redirecting windfalls like bonuses, and leveraging government grants or schemes can significantly accelerate deposit accumulation. Combining these approaches with a realistic budget and regular progress tracking ensures a focused and efficient savings journey.

How can I calculate the exact deposit amount needed for my target property?

To calculate the exact deposit amount, start by determining the target property price and the percentage deposit required, typically 20% to avoid Lenders Mortgage Insurance (LMI). Multiply the property price by the chosen percentage to find the base deposit amount. Additionally, account for extra costs like stamp duty, legal fees, and inspections, which can add 2-5% to the total. Using online deposit calculators can provide a detailed breakdown and help refine your savings goal.

What role do government grants and schemes play in reducing deposit requirements?

Government grants and schemes can significantly reduce deposit requirements by providing financial assistance or lowering the upfront costs of homeownership. Programs like the First Home Owner Grant (FHOG) offer cash grants to eligible buyers, while initiatives such as the First Home Guarantee Scheme (FHGB) allow purchases with smaller deposits, often avoiding Lenders Mortgage Insurance (LMI). Additionally, state and territory-specific grants or stamp duty concessions can further ease the financial burden, making it essential to research and leverage these opportunities effectively.

Are there specific investment options that can accelerate deposit growth safely?

Yes, specific investment options like high-yield savings accounts, certificates of deposit (CDs), and short-term bond funds can accelerate deposit growth safely. These options offer better returns compared to traditional savings accounts while maintaining low risk. Laddering CDs ensures liquidity and maximizes interest earnings, while short-term bond funds provide stability and diversification. For those with a longer timeline, low-risk ETFs or index funds can also be considered, but it’s crucial to align investments with your risk tolerance and savings timeframe. Consulting a financial advisor can help tailor an investment strategy to your goals.

How can lifestyle adjustments and budgeting improve my savings rate for a home deposit?

Lifestyle adjustments and budgeting can significantly improve your savings rate by identifying and eliminating unnecessary expenses. Simple changes, such as cooking at home instead of dining out, canceling unused subscriptions, or opting for cost-effective transportation, can free up funds for your deposit. Adopting a minimalist approach to spending ensures that money is directed toward essential needs and savings goals. Additionally, creating a detailed budget using frameworks like the 50/30/20 rule helps allocate income effectively, while regular reviews ensure the plan remains aligned with your financial objectives.

Conclusion

Saving for your first home deposit is not just a financial challenge but a strategic journey that requires a blend of discipline, creativity, and informed decision-making. By combining traditional methods like budgeting with modern tools such as automated savings apps and high-yield accounts, you can accelerate your progress. For instance, a case study from GA Finance highlights how a young couple saved $15,000 in one year by automating savings and cutting non-essential expenses like dining out, proving that small changes can yield significant results.

Unexpectedly, lifestyle adjustments like adopting minimalism or relocating to a more affordable area can have a profound impact, often overlooked by first-time buyers. Expert insights suggest that leveraging government schemes, such as the First Home Guarantee Scheme, can reduce deposit requirements by up to 15%, making homeownership more accessible. Think of your savings journey as building a bridge—each strategy, whether it’s a side hustle or a tax-advantaged account, adds a plank, bringing you closer to your dream home.

Ultimately, the key lies in staying adaptable and informed. The property market is dynamic, and aligning your strategies with current trends, such as rising interest rates or regional price shifts, ensures you remain ahead. With the right approach, saving for your first home becomes less of a dilemma and more of a well-executed plan.