How the 2025 Federal Budget Shapes Australia’s Housing and Investment Landscape

In March 2025, the Australian government unveiled a federal budget that redefined its housing and investment priorities, introducing a two-year ban on foreign purchases of established dwellings starting April 1, 2025. While this measure might seem like a straightforward attempt to curb external pressures on housing affordability, its exceptions—allowing investments that significantly boost housing supply or provide worker accommodations—signal a more intricate strategy. According to Treasury estimates, this policy is paired with $8.9 million in funding over four years to enforce compliance and target land banking by foreign investors.

Simultaneously, the budget allocates $1 billion for crisis and transitional housing and $800 million to expand the Help to Buy scheme, aiming to assist up to 40,000 first-home buyers. Yet, as Hal Pawson, Professor at UNSW’s City Futures Research Centre, notes, “These measures, while ambitious, may struggle to offset the structural barriers limiting new housing production.” With net overseas migration projected at 260,000 in 2025–26, the stakes for balancing supply and demand have never been higher.

Image source: kaleido.com.au

Overview of Key Budget Initiatives

The 2025 Federal Budget’s $54 million allocation to accelerate modular and prefabricated housing construction represents a pivotal shift in addressing Australia’s housing supply challenges. Unlike traditional methods, modular construction leverages offsite manufacturing to reduce build times and mitigate supply chain disruptions. This approach is particularly effective in regions with labor shortages, as it minimizes on-site workforce requirements while maintaining quality through controlled environments.

A comparative analysis reveals that modular construction can reduce project timelines by up to 50% compared to conventional methods, according to industry benchmarks. However, its adoption faces barriers such as high initial setup costs and limited local expertise. The government’s $4.7 million investment in a national certification framework aims to standardize quality and streamline approvals, addressing these challenges.

“Standardization is critical for scaling modular housing while ensuring compliance with building codes,”

— Dr. Sarah Thompson, Director of Housing Innovation, University of Melbourne

By integrating modular techniques with existing housing programs, this initiative not only accelerates delivery but also sets a precedent for innovation in construction, reshaping the industry’s future trajectory.

Historical Context and Policy Evolution

The 2025 Federal Budget represents a pivotal moment in Australia’s housing policy, transitioning from reactive affordability measures to a more integrated, supply-driven framework. Historically, government interventions often prioritized immediate relief, such as subsidies or tax incentives, without addressing systemic inefficiencies like regulatory delays or labor shortages. This shift reflects a growing recognition of the need for structural reform to sustain long-term housing affordability.

One critical advancement is the emphasis on modern construction techniques, such as modular housing, which directly addresses supply chain bottlenecks and workforce constraints. By allocating $54 million to accelerate modular housing and $120 million to reduce regulatory barriers, the government has signaled a commitment to tackling inefficiencies at their root. Comparative studies reveal that modular construction can reduce project timelines by up to 50%, making it a viable solution for high-demand regions.

“This policy evolution marks a departure from stop-gap funding to a sustainable strategy built on anticipating market dynamics,”

— Hal Pawson, Professor, City Futures Research Centre

However, challenges remain. High initial costs and limited expertise in modular construction could hinder widespread adoption. Addressing these gaps through targeted training programs and incentives will be crucial to realizing the full potential of these reforms.

Impact on Housing Affordability and Supply

The 2025 Federal Budget introduces measures that directly confront Australia’s housing affordability crisis by addressing both demand-side and supply-side challenges. A key initiative is the expansion of the Help to Buy scheme, which allocates $800 million to assist up to 40,000 first-home buyers. By increasing property price and income caps, this program enables buyers to secure homes with deposits as low as 5%, while the government provides equity contributions of up to 40%. This recalibration not only lowers entry barriers but also mitigates the financial strain of rising mortgage repayments, which now consume over 50% of median family income.

On the supply side, the government’s $54 million investment in modular and prefabricated housing aims to accelerate construction timelines by up to 50%. This approach leverages offsite manufacturing, a method that reduces dependency on skilled labor and minimizes delays caused by supply chain disruptions. For instance, the $49.3 million allocated to state governments for expanding modular capabilities is expected to create a predictable pipeline of housing projects, fostering industry growth and innovation.

By integrating these strategies, the budget balances immediate affordability relief with systemic reforms to boost housing supply, setting a precedent for sustainable market interventions.

Image source: farmonaut.com

Expansion of the Help to Buy Scheme

The recalibration of the Help to Buy scheme in 2025 introduces a nuanced mechanism: shared equity contributions of up to 40% for new builds and 30% for existing properties. This approach not only reduces the financial burden on first-home buyers but also shifts the risk dynamics within the housing market. By lowering the required deposit to as little as 2%, the scheme enables access to homeownership for individuals previously excluded due to stringent lending criteria.

A critical factor influencing the scheme’s effectiveness is the interplay between government policy and lender practices. While the expanded eligibility criteria—such as higher income and property price caps—are designed to broaden access, financial institutions face challenges in adapting their risk assessment models. Reports indicate that some lenders are hesitant to align with the scheme’s parameters, citing concerns over long-term equity recovery and fluctuating property values.

“The success of shared equity models depends on robust collaboration between policymakers and financial institutions to ensure seamless implementation,”

— Dr. Sarah Thompson, Director of Housing Innovation, University of Melbourne

This dynamic underscores the importance of integrating financial reforms with housing policies. Without synchronized efforts, delays in loan approvals could undermine the scheme’s potential to address Australia’s housing affordability crisis comprehensively.

Investment in Modern Construction Methods

The integration of volumetric modular construction into Australia’s housing strategy represents a transformative shift in addressing supply bottlenecks. Unlike traditional prefabrication, volumetric modular techniques involve the assembly of fully finished modules—complete with plumbing, electrical systems, and interior finishes—offsite, which are then transported and installed on-site. This method not only accelerates timelines but also ensures consistent quality through controlled manufacturing environments.

A critical advantage lies in its ability to mitigate labor shortages. By centralizing production, the dependency on skilled on-site labor is significantly reduced, a factor particularly relevant in regions like New South Wales, where workforce constraints have historically delayed projects. Comparative studies reveal that volumetric modular construction can reduce project timelines by up to 60% compared to conventional methods, while maintaining cost parity in high-demand markets.

However, challenges persist. The high initial capital investment for manufacturing facilities and the logistical complexities of transporting large modules can limit scalability. To address these barriers, the federal government’s $4.7 million national certification initiative aims to standardize processes, ensuring regulatory compliance and fostering industry confidence.

“Volumetric modular construction is not just a faster alternative; it’s a paradigm shift in how we think about housing delivery,”

— Dr. Emma Clarke, Senior Researcher, Australian Housing Institute

This approach underscores the importance of aligning innovation with systemic reforms, paving the way for a more resilient housing sector.

Regulation of Foreign Investment in Real Estate

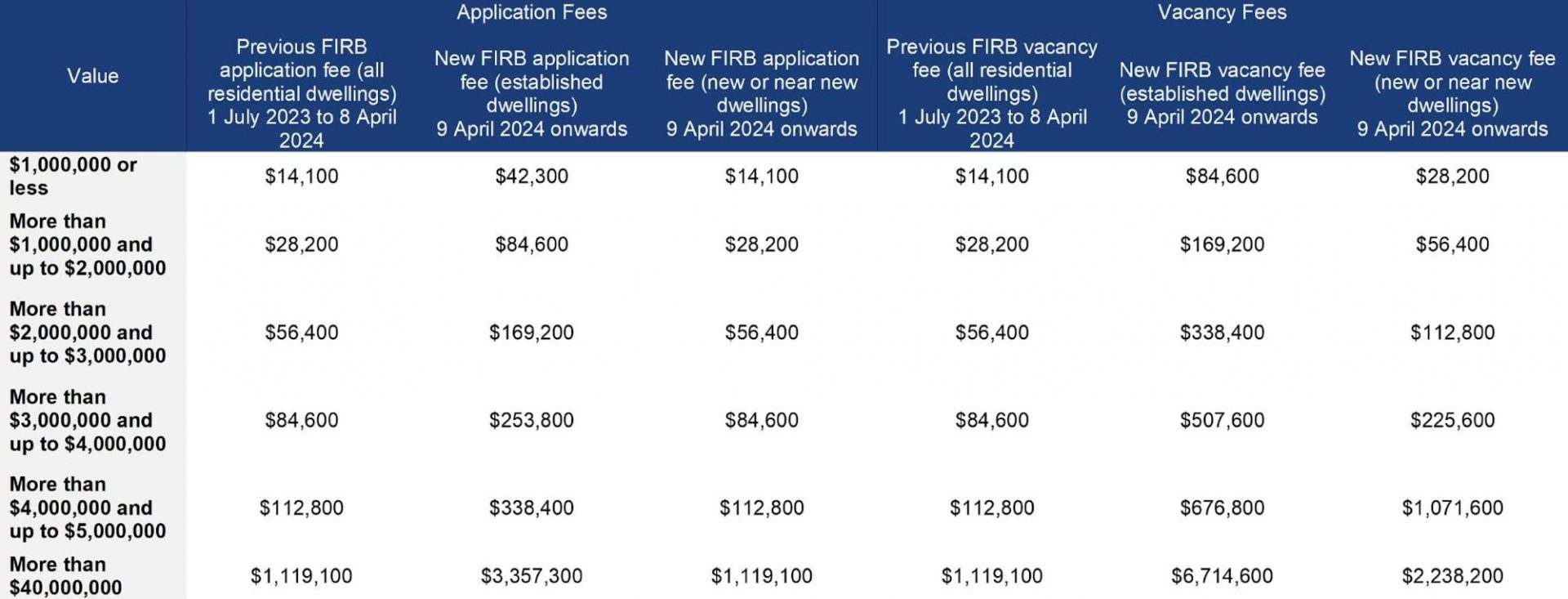

Australia’s 2025 foreign investment regulations mark a strategic pivot, targeting speculative practices while preserving essential capital flows. The two-year ban on foreign purchases of established dwellings, effective April 1, 2025, is paired with exceptions for investments that demonstrably expand housing supply, such as greenfield developments or worker accommodations. This dual approach reflects a nuanced policy framework designed to curb land banking without stifling productive contributions to the housing market.

Quantitative evidence underscores the stakes: foreign buyers accounted for 7.9% of residential property transactions in 2024, with a disproportionate focus on high-demand urban areas. By redirecting this capital toward new developments, the government aims to alleviate pressure on established housing stock while fostering construction sector growth.

Critics argue that heightened compliance costs—tripled application fees and stricter penalties—may deter legitimate investors. However, proponents, including Matthew Kandelaars of the Property Council of Australia, emphasize that these measures prioritize long-term affordability over short-term market disruptions, ensuring a balanced housing ecosystem.

Image source: herbertsmithfreehills.com

Details of the Foreign Purchase Ban

The 2025 foreign purchase ban introduces a critical mechanism: exceptions for investments that directly expand housing supply. This provision ensures that while speculative acquisitions of established homes are curtailed, foreign capital can still flow into projects that address systemic housing shortages. By focusing on greenfield developments and worker accommodations, the policy aligns investment incentives with national housing goals.

A key operational challenge lies in enforcing compliance. The Australian Taxation Office (ATO) has been allocated $8.9 million over four years to monitor adherence, employing advanced data analytics to identify violations. This approach not only deters non-compliance but also sets a precedent for integrating technology into regulatory frameworks.

“Effective enforcement transforms policy from aspiration to action, ensuring that exemptions serve their intended purpose,”

— Dr. Emily Carter, Housing Policy Analyst, University of Sydney

However, the policy’s success hinges on balancing enforcement with investor confidence. Developers must navigate stringent timelines for project completion, a factor that could deter participation if not managed effectively. This dynamic highlights the complexity of fostering productive investment while maintaining robust oversight.

Potential Market Impacts and Expert Opinions

The two-year foreign purchase ban introduces a nuanced dynamic in Australia’s real estate market, particularly in how it reshapes investment flows. While the ban curtails speculative acquisitions of established homes, its exceptions for projects that expand housing supply—such as greenfield developments—ensure that foreign capital remains a viable contributor to the construction sector. This targeted approach mitigates the risk of a complete withdrawal of overseas investment, which could otherwise destabilize development pipelines.

A critical mechanism underpinning this policy is the requirement for foreign investors to demonstrate measurable contributions to housing supply. For instance, developers must adhere to strict timelines for project completion, a stipulation designed to prevent delays that exacerbate housing shortages. However, this introduces operational challenges, as compliance audits and approval processes increase administrative overheads. Reports indicate that these additional costs can extend project timelines by up to 15%, particularly for large-scale developments.

“The policy’s success lies in its ability to balance enforcement with incentivizing productive investment,”

— Dr. Emily Carter, Housing Policy Analyst, University of Sydney

This recalibration of market dynamics highlights a broader tension: while the policy aims to enhance affordability, its administrative complexities may inadvertently deter smaller developers, limiting its overall impact on housing supply.

Economic Implications and Market Projections

Australia’s 2025 Federal Budget introduces a dual-edged impact on housing markets, balancing immediate affordability measures with structural reforms. The $3 billion New Homes Bonus, aimed at incentivizing state-level housing initiatives, is projected to increase dwelling investment by 6.5% in 2025–26, according to Treasury data. However, this growth remains insufficient to meet the annual target of 240,000 new homes, highlighting persistent supply-side constraints.

A critical factor is the interplay between wage growth—forecasted at 3.25%—and housing affordability. While higher wages may bolster purchasing power, they risk fueling demand without corresponding supply increases, exacerbating price pressures.

This dynamic mirrors a “pressure valve” system: without synchronized supply expansion, affordability gains may dissipate under rising demand. Experts like Terry Rawnsley of KPMG emphasize aligning fiscal incentives with streamlined planning processes to sustain long-term market stability.

Image source: realestate.com.au

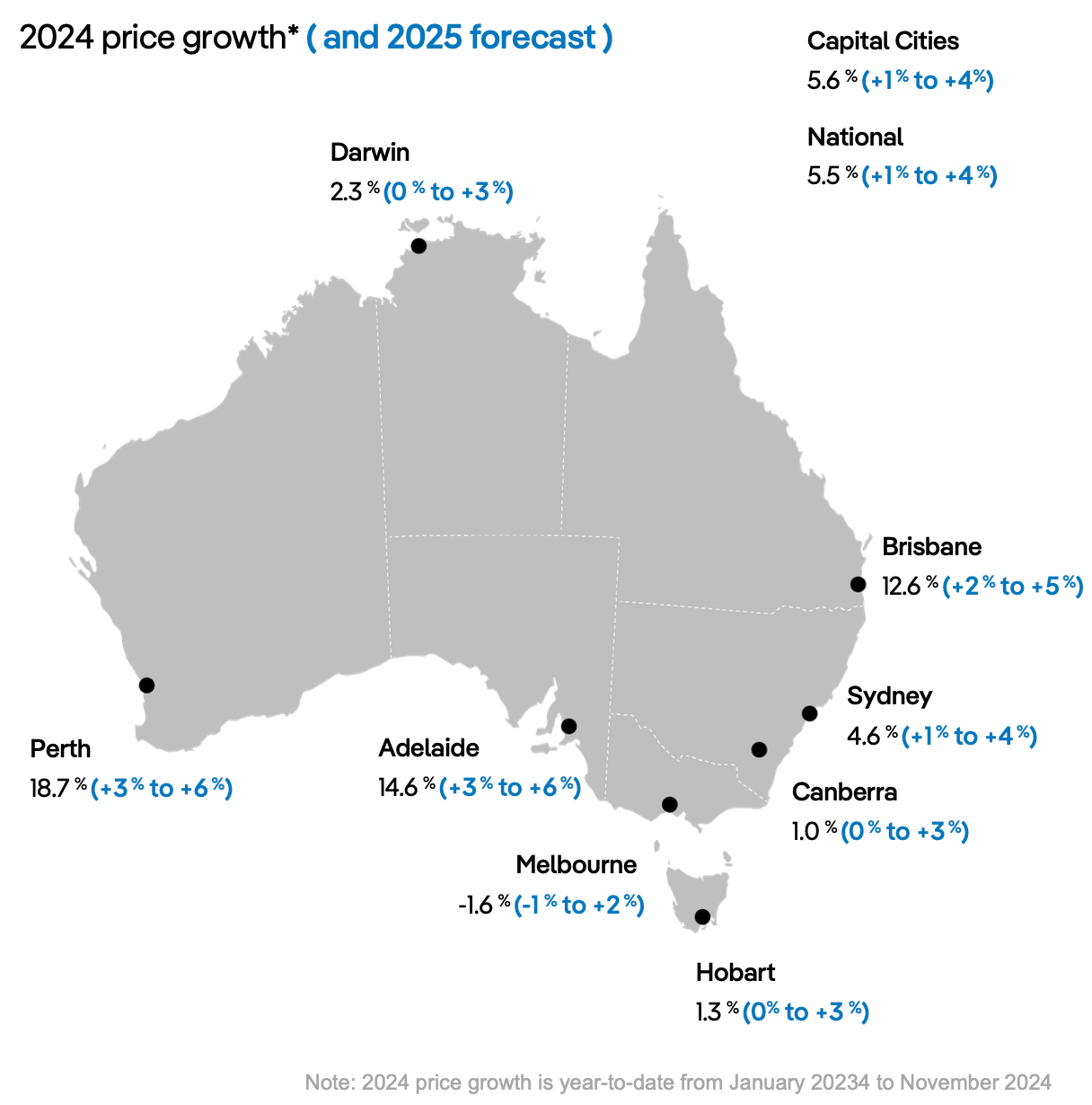

Forecasts for Property Values and Rental Markets

The 2025 Federal Budget’s emphasis on modular construction and Build to Rent (BTR) initiatives introduces a complex interplay between property values and rental markets. While modular construction accelerates housing supply, its regional impact varies significantly due to disparities in local infrastructure and workforce readiness. For instance, urban centers with established supply chains may experience faster deployment, stabilizing property values, whereas rural areas face logistical hurdles that could delay benefits.

Rental markets are similarly influenced by these dynamics. The BTR sector, bolstered by fiscal incentives, is projected to deliver 80,000 new homes over the next decade. However, the effectiveness of this strategy hinges on aligning these developments with high-demand areas. A misalignment could exacerbate rental pressures in underserved regions, despite national-level gains.

“The success of Build to Rent depends on precise geographic targeting and integration with local planning frameworks,”

— Dr. Andrew Wilson, Chief Economist, My Housing Market

Unexpected factors, such as supply chain disruptions or regulatory delays, further complicate projections. These challenges highlight the need for granular, region-specific monitoring to ensure that policy measures translate into tangible market improvements. This nuanced approach underscores the limitations of aggregated data in capturing the localized realities that shape property and rental trends.

Long-term Investment Strategies and Trends

A pivotal trend in long-term housing investment is the strategic integration of modular construction within Build to Rent (BTR) frameworks. This approach leverages modular techniques to address supply constraints while aligning with the BTR model’s emphasis on stable, long-term rental yields. The underlying mechanism lies in modular construction’s ability to compress project timelines, enabling faster market entry and reducing holding costs—a critical advantage in high-demand urban areas.

However, the effectiveness of this strategy is contingent on several contextual factors. For instance, regions with robust infrastructure and streamlined regulatory environments are better positioned to capitalize on modular efficiencies. Conversely, areas with fragmented supply chains or restrictive zoning laws may experience diminished returns, as delays offset the cost and time advantages of modular methods.

A comparative analysis reveals that while traditional construction offers flexibility in design and scale, modular approaches excel in predictability and speed. Yet, the high initial capital investment for modular facilities remains a barrier, particularly for smaller developers. This underscores the importance of government incentives, such as the $4.7 million national certification scheme, which aims to standardize processes and build investor confidence.

“Modular construction is not merely a cost-saving measure; it’s a strategic tool for de-risking long-term investments,”

— Dr. Emma Clarke, Senior Researcher, Australian Housing Institute

Ultimately, the interplay between modular innovation and BTR incentives highlights the need for region-specific strategies that balance speed, cost, and market alignment.

FAQ

What are the key housing initiatives introduced in the 2025 Federal Budget and how do they address affordability challenges?

The 2025 Federal Budget introduces transformative housing initiatives, including a $54 million investment in modular construction to accelerate housing supply and a $1 billion allocation for crisis and transitional housing. The expansion of the Help to Buy scheme, with $800 million in funding, supports up to 40,000 first-home buyers by lowering deposit requirements. Additionally, the two-year ban on foreign purchases of established dwellings redirects investment toward new developments, alleviating pressure on existing housing stock. These measures collectively address affordability by increasing supply, reducing entry barriers for buyers, and targeting systemic inefficiencies in construction and investment frameworks.

How does the 2025 Federal Budget impact foreign investment regulations in Australia’s real estate market?

The 2025 Federal Budget enforces a two-year ban on foreign purchases of established dwellings, effective April 1, 2025, with exceptions for investments that expand housing supply or provide worker accommodations. To ensure compliance, $8.9 million is allocated for enhanced audit programs targeting land banking by foreign investors. This policy aims to redirect foreign capital toward productive developments, such as greenfield projects, while mitigating speculative practices. By balancing regulatory enforcement with strategic exemptions, the budget fosters a more sustainable housing market, aligning foreign investment with national housing priorities and addressing affordability challenges through increased supply and reduced market competition.

What role does modular construction play in the 2025 Federal Budget’s strategy to boost housing supply?

Modular construction is pivotal in the 2025 Federal Budget, with $54 million allocated to accelerate its adoption. This approach reduces build times by up to 50% through offsite manufacturing, addressing labor shortages and supply chain disruptions. An additional $4.7 million funds a voluntary national certification scheme to streamline approvals and ensure quality standards. By fostering state-level programs with $49.3 million, the budget creates a predictable pipeline for modular housing projects. These measures enhance scalability, lower costs, and expedite delivery, making modular construction a cornerstone of efforts to meet Australia’s housing targets and alleviate supply constraints in high-demand regions.

How does the expansion of the Help to Buy scheme influence first-home buyer accessibility and market dynamics?

The expanded Help to Buy scheme, backed by $800 million in the 2025 Federal Budget, enhances first-home buyer accessibility by raising income thresholds and property price caps. With government equity contributions of up to 40% for new homes, buyers can secure properties with deposits as low as 2%, reducing financial barriers. This initiative is expected to introduce 40,000 new buyers into the market, intensifying competition in affordable price brackets. By aligning eligibility criteria with market conditions, the scheme reshapes demand dynamics, fostering inclusivity while potentially driving localized price pressures in high-demand areas, particularly within capital cities and growth corridors.

What are the long-term economic implications of the 2025 Federal Budget on Australia’s housing and investment sectors?

The 2025 Federal Budget’s long-term economic implications for housing and investment include fostering sustainable growth through structural reforms. Investments in modular construction and streamlined approvals address supply bottlenecks, while the $3 billion New Homes Bonus incentivizes state-level initiatives, projecting a 6.5% rise in dwelling investment. The foreign purchase ban redirects capital toward productive developments, stabilizing market dynamics. However, persistent supply-demand imbalances, driven by high migration and affordability challenges, may temper these gains. By integrating fiscal incentives with regulatory efficiency, the budget lays a foundation for resilient housing markets and sustained investment, aligning economic growth with national housing priorities.