The 0.3% Rise: Why February 2025 Marks a Turning Point for Australian Housing

In February 2025, a modest 0.3% rise in Australian home values quietly disrupted a three-month downturn, signaling more than just a statistical rebound. For Melbourne, this marked the end of a ten-month slide, with prices climbing 0.4%, a shift mirrored in Hobart. These gains, though incremental, carried outsized significance: they emerged not from a surge in borrowing capacity but from a subtle yet palpable shift in buyer sentiment, fueled by the Reserve Bank of Australia’s recent rate cut.

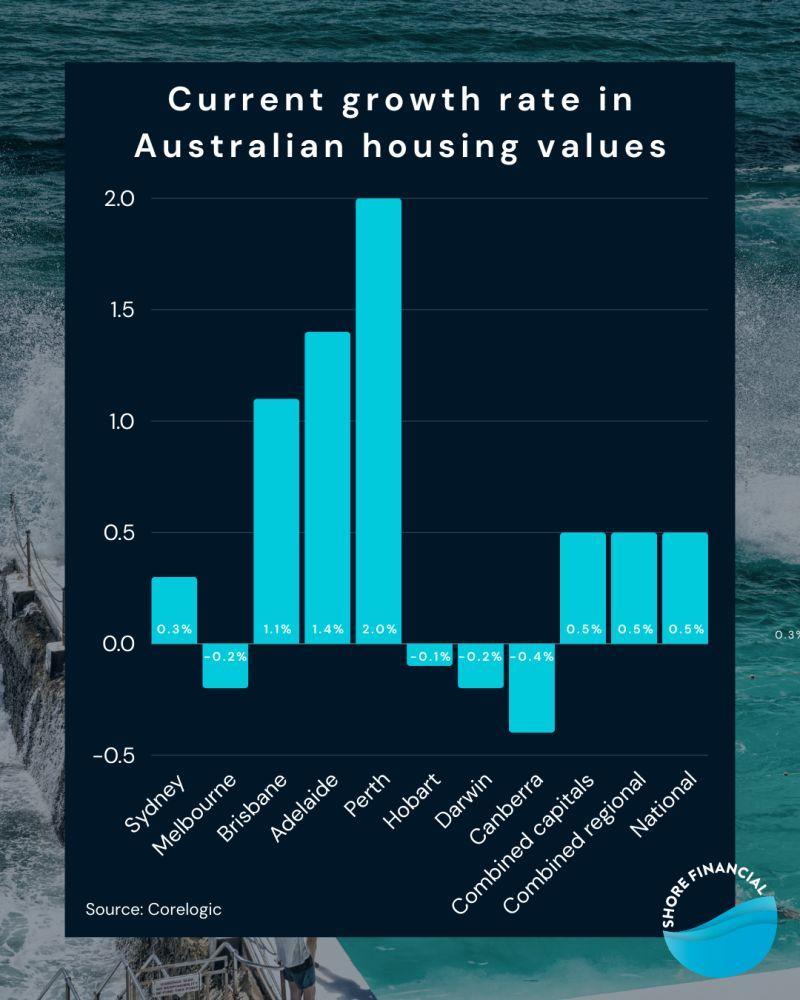

The CoreLogic Home Value Index revealed a nuanced picture. While premium markets in Sydney and Melbourne led the recovery, regional areas continued their steady ascent, outpacing capital cities with a 0.4% monthly rise. Yet, the story was far from uniform. Brisbane and Perth, once growth leaders, showed signs of cooling, while Darwin remained the outlier with a slight decline.

This fragmented recovery underscores the complexity of Australia’s housing market, where sentiment, affordability, and regional dynamics intersect in unexpected ways.

Image source: linkedin.com

Overview of the Australian Housing Market Pre-2025

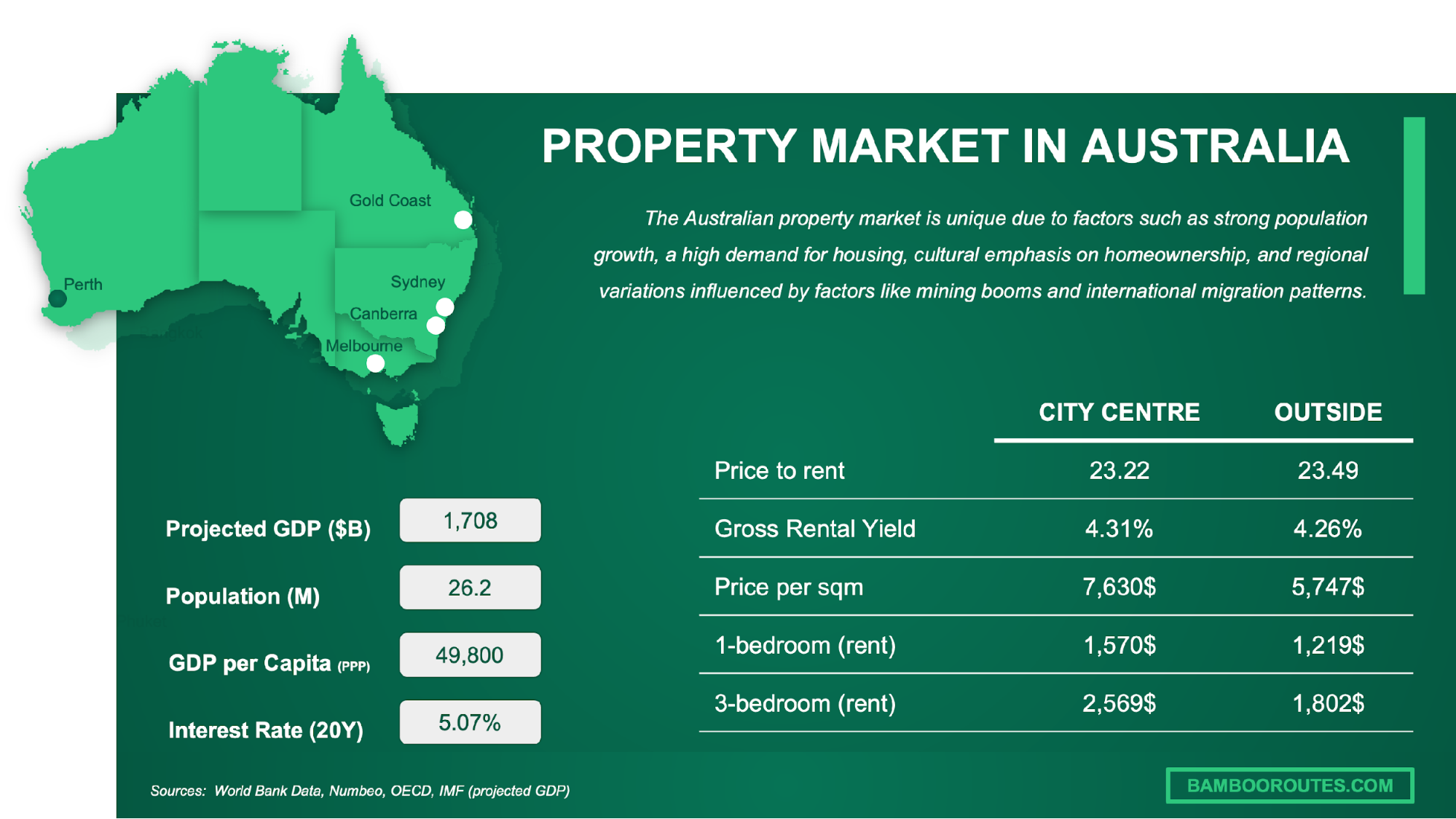

A critical yet underexplored factor shaping the Australian housing market pre-2025 was the interplay between demographic shifts and supply constraints. The net migration surge in 2024, adding approximately 250,000 urban residents, intensified demand in metropolitan areas. However, this demand collided with a 15% reduction in project completions due to labor shortages, particularly in Sydney and Melbourne, creating a supply-demand imbalance that drove up existing home values.

This dynamic highlights the elasticity of housing supply as a pivotal determinant of market behavior. Unlike other markets where supply can adjust rapidly, Australia’s construction sector faced structural bottlenecks, including a 12% workforce participation decline. These constraints not only delayed new developments but also amplified affordability challenges, particularly for first-time buyers.

Real-world implications of this imbalance are evident in the policy responses. For instance, the First Home Loan Deposit Scheme aimed to bridge the deposit gap, yet its impact was muted by escalating property prices. This underscores the need for integrated strategies that address both demand-side incentives and supply-side barriers.

Looking ahead, aligning immigration policies with infrastructure investments could mitigate such disparities, fostering a more resilient housing ecosystem while balancing urban growth with affordability.

Significance of the 0.3% Price Increase

The 0.3% price increase in February 2025, while modest, represents a pivotal shift in market dynamics, driven by a recalibration of buyer sentiment rather than traditional economic levers like borrowing capacity. This change underscores the psychological underpinnings of housing markets, where sentiment often precedes tangible economic shifts. The Reserve Bank of Australia’s recent rate cut played a catalytic role, not by directly enhancing affordability but by signaling stability, which encouraged hesitant buyers to re-enter the market.

A lesser-known factor amplifying this shift is the role of regional markets. With a 0.4% rise in regional home values, these areas outpaced capital cities, reflecting a growing preference for lifestyle-oriented living, fueled by remote work trends. This divergence highlights the importance of localized economic drivers, such as infrastructure investments and employment opportunities, which continue to attract buyers priced out of metropolitan areas.

Challenging conventional wisdom, this recovery suggests that incremental policy adjustments, like rate cuts, can have outsized psychological impacts even in a high-cost environment. Moving forward, stakeholders should focus on strategies that enhance market confidence, such as transparent policy communication and targeted regional investments, to sustain this momentum and address affordability challenges without exacerbating supply constraints.

Factors Driving the Market Turnaround

The February 2025 market turnaround was shaped by a confluence of psychological, economic, and structural factors, each playing a distinct yet interconnected role. At its core, the Reserve Bank of Australia’s (RBA) rate cut acted as a confidence catalyst. While the reduction did not significantly boost borrowing capacity, it signaled economic stability, nudging cautious buyers back into the market. This highlights the sentiment-driven nature of housing markets, where perception often precedes measurable financial shifts.

Unexpectedly, regional markets emerged as key drivers. For instance, areas like Geelong and the Sunshine Coast saw price increases outpacing capital cities, fueled by remote work trends and lifestyle preferences. This shift underscores the growing importance of localized economic factors, such as infrastructure upgrades and employment hubs, in shaping demand.

A common misconception is that affordability alone dictates market recovery. However, the February rebound illustrates how policy signaling and buyer psychology can outweigh traditional metrics. Moving forward, integrating targeted regional investments with transparent policy communication could sustain this momentum, offering a blueprint for balancing growth with affordability.

Image source: corelogic.com.au

Impact of Interest Rate Expectations

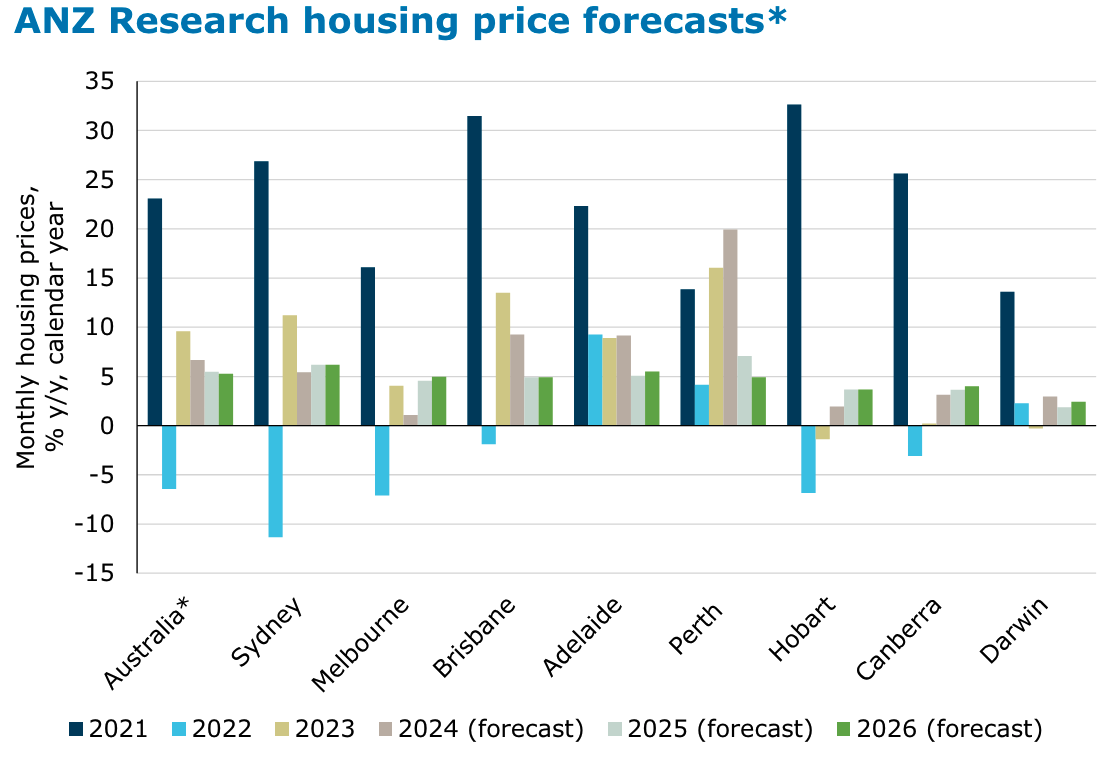

Interest rate expectations in early 2025 have proven to be a powerful psychological lever in shaping buyer behavior, even before tangible rate cuts fully materialize. The Reserve Bank of Australia’s anticipated reductions, projected to lower the cash rate from 4.1% to 3.35% by year-end, have already begun influencing market sentiment. This phenomenon demonstrates how expectations of change can drive action, often preceding actual policy implementation.

A key mechanism at play is the anchoring effect. Buyers recalibrate their financial strategies based on anticipated borrowing conditions, creating a ripple effect across the market. For instance, the February rate cut, though modest, spurred a noticeable uptick in buyer inquiries, particularly in lifestyle-driven regional markets like the Sunshine Coast. This aligns with findings from CoreLogic, which highlight a 0.4% rise in regional home values, outpacing capital cities.

Conventional wisdom suggests that rate cuts primarily enhance affordability. However, the February turnaround challenges this notion, emphasizing the role of market signaling. By fostering confidence, even incremental adjustments can unlock latent demand.

Looking ahead, policymakers and stakeholders should leverage this dynamic by coupling rate adjustments with clear, forward-looking communication strategies. Transparent signaling not only stabilizes sentiment but also mitigates volatility, creating a more predictable environment for both buyers and investors. This approach could serve as a blueprint for navigating future market cycles.

Improved Buyer Sentiment and Affordability

A pivotal yet underexplored driver of improved buyer sentiment in February 2025 is the psychological impact of perceived market stability. The Reserve Bank of Australia’s rate cut, while modest, acted as a signal of economic steadiness, encouraging hesitant buyers to re-enter the market. This shift highlights the behavioral economics principle that confidence often precedes affordability in influencing purchasing decisions.

Interestingly, affordability gains were not solely tied to borrowing capacity but also to regional market dynamics. For example, areas like Geelong and Newcastle experienced heightened activity as buyers sought alternatives to high-cost metropolitan markets. These regions benefited from infrastructure investments and employment hubs, which enhanced their appeal without the price pressures seen in Sydney or Melbourne.

A lesser-known factor is the role of government incentives, such as the First Home Loan Deposit Scheme, which, despite its limited reach, provided critical support for first-time buyers navigating affordability challenges. This underscores the importance of targeted policy measures in complementing broader economic shifts.

Challenging the conventional focus on interest rates alone, this recovery demonstrates that sentiment-driven demand can unlock market potential even in high-cost environments. Moving forward, integrating affordability-focused policies with transparent communication strategies could amplify this momentum. Stakeholders should prioritize regional investments and innovative housing solutions to sustain buyer confidence and address long-term affordability constraints.

Regional Variations in Market Performance

The February 2025 housing market recovery revealed striking regional disparities, underscoring the nuanced dynamics shaping Australia’s property landscape. While Sydney and Melbourne’s premium markets led the rebound with upper-quartile price gains, regional areas like Geelong and the Sunshine Coast outpaced capital cities, recording a 0.4% rise in values, according to CoreLogic. This divergence highlights the growing appeal of lifestyle-oriented regions, driven by remote work trends and infrastructure upgrades.

Unexpectedly, former growth leaders Brisbane and Perth showed signs of cooling, with inventory shortages in Perth (-28% below the five-year average) limiting buyer options. Meanwhile, Darwin remained an outlier, experiencing a slight decline, reflecting localized economic challenges.

A common misconception is that affordability alone dictates regional performance. However, the data suggests that localized economic drivers, such as employment hubs and transport investments, play a pivotal role. For instance, Newcastle’s market benefited from targeted infrastructure projects, enhancing its connectivity and livability.

This fragmented recovery challenges the notion of a uniform market rebound. Moving forward, stakeholders must adopt region-specific strategies, balancing affordability initiatives with investments in regional growth drivers to sustain momentum.

Image source: bambooroutes.com

Melbourne and Hobart: Leading the Gains

Melbourne and Hobart’s February 2025 performance, with a 0.4% rise in home values, underscores the resilience of premium markets when sentiment shifts. In Melbourne, the rebound was driven by upper-quartile properties, which historically respond most sensitively to rate cuts. CoreLogic’s Tim Lawless attributes this to improved buyer confidence rather than enhanced borrowing capacity, highlighting the psychological impact of the Reserve Bank of Australia’s recent rate cut.

Hobart’s gains, however, reveal a different dynamic. Despite a 25.2% increase in listings relative to the five-year average, demand for well-presented properties surged. This suggests that perceived value—rather than sheer affordability—plays a critical role in smaller markets. Buyers relocating from mainland cities, drawn by Hobart’s relative affordability and lifestyle appeal, further bolstered demand.

A lesser-known factor is the role of market liquidity. In both cities, reduced days on market for desirable properties indicate a shift toward faster transactions, reflecting renewed urgency among buyers.

Challenging the notion that affordability alone drives recovery, these gains highlight the interplay of sentiment, supply dynamics, and localized demand drivers. Moving forward, stakeholders should focus on enhancing market transparency and leveraging infrastructure investments to sustain momentum in these diverse urban contexts.

Slowing Growth in Traditionally Strong Markets

The deceleration in Brisbane and Perth, once growth leaders, highlights the constraints of inventory shortages and shifting buyer priorities. In Perth, where inventory levels are 28% below the five-year average, limited supply has tempered price growth despite strong demand. This scarcity underscores the inelasticity of housing supply in markets heavily reliant on construction pipelines, which remain hindered by labor shortages and rising material costs.

Brisbane’s cooling, on the other hand, reflects a nuanced interplay of affordability pressures and evolving buyer preferences. While the city has benefited from infrastructure investments tied to the 2032 Olympics, the rapid price escalation over the past five years—81% growth—has pushed some buyers toward more affordable regional alternatives. This shift aligns with the broader trend of lifestyle migration, where buyers prioritize value and quality of life over proximity to urban centers.

A lesser-known factor influencing these markets is the normalization of net overseas migration. As migration patterns stabilize, the demand surge that previously fueled growth in these cities has moderated, reducing upward pressure on prices.

To navigate these dynamics, stakeholders should adopt adaptive supply strategies, such as incentivizing mid-density developments, while leveraging regional infrastructure to balance demand across broader geographic areas. This approach could mitigate volatility and sustain long-term growth.

Divergence Between Houses and Units

The growing disparity between house and unit values reflects a structural shift in buyer behavior driven by affordability constraints and evolving lifestyle preferences. Since the onset of the pandemic, house prices have surged by 47.7%, compared to a modest 23.9% rise in unit values. This gap, temporarily narrowed during the rate-hiking cycle, has rebounded to record highs, underscoring the inelasticity of demand for detached homes.

A key driver is the psychological premium attached to houses, often seen as symbols of stability and long-term investment. However, escalating costs have pushed many buyers toward units, particularly in capital cities where affordability pressures are most acute. For instance, unit prices are forecasted to grow by 4.6% in 2025, outpacing houses in percentage terms.

This divergence challenges the misconception that houses universally outperform. Instead, it highlights the adaptive strategies of buyers, with units emerging as viable alternatives in high-cost markets, reshaping urban housing dynamics.

Understanding the Performance Gap

The performance gap between houses and units is increasingly shaped by affordability thresholds and the evolving economic landscape. A critical yet underappreciated factor is the replacement cost dynamic. With construction costs for new apartments rising over 40% in recent years, established units now offer substantial intrinsic equity, often priced well below their replacement cost. This creates a unique value proposition for buyers, particularly in markets like Melbourne, where new developments require a 40% price premium to be financially viable.

Additionally, regional price elasticity plays a pivotal role. In areas like Brisbane’s inner city, where units are priced at a 60% discount to houses, unit values have surged by nearly 16% over the past year, compared to just 2% growth in regions with narrower discounts. This highlights how steep price differentials can accelerate demand for units, especially among first-home buyers and investors constrained by borrowing capacity.

Challenging the traditional narrative that houses are always superior investments, these trends underscore the importance of contextual market dynamics. Moving forward, stakeholders should focus on leveraging these affordability-driven shifts by promoting mid-density developments and enhancing urban infrastructure, ensuring units remain a competitive and sustainable housing option in high-demand regions.

Future Trends in Housing Preferences

A significant emerging trend in housing preferences is the rise of multigenerational living and co-living arrangements, driven by affordability pressures and shifting family dynamics. These models are gaining traction in middle-ring suburbs, where larger properties can accommodate extended families or shared living setups. This shift reflects a growing need for adaptable housing solutions that balance cost efficiency with lifestyle needs.

One key driver is the economic synergy created by shared living. Multigenerational households can pool resources, reducing per capita housing costs while fostering intergenerational support. Similarly, co-living arrangements, often facilitated by purpose-built developments, cater to younger demographics seeking affordability without sacrificing proximity to urban centers.

Lesser-known factors, such as the influence of cultural norms and aging population trends, also play a role. For instance, in communities with strong familial ties, multigenerational living is not only practical but culturally resonant. Additionally, as baby boomers downsize, they increasingly opt for arrangements that allow proximity to family while maintaining independence.

To capitalize on these trends, developers should prioritize flexible floor plans and shared amenities in new projects. Policymakers, meanwhile, can incentivize such developments through zoning reforms and tax benefits, ensuring these evolving preferences are met sustainably and inclusively.

Economic and Policy Influences

The interplay between economic conditions and policy interventions has been pivotal in shaping the February 2025 housing market recovery. A key factor is the Reserve Bank of Australia’s (RBA) rate cut, which, while modest, acted as a psychological anchor, signaling stability and encouraging hesitant buyers to re-enter the market. This highlights the anchoring effect, where expectations of future affordability drive immediate action, even before tangible benefits materialize.

Unexpectedly, government initiatives like the First Home Loan Deposit Scheme have had mixed outcomes. While they bridged deposit gaps for some first-time buyers, escalating property prices in urban centers diluted their impact. This underscores a common misconception: demand-side incentives alone can resolve affordability challenges. Instead, the persistent supply bottlenecks, exacerbated by labor shortages and rising construction costs, remain a critical barrier.

A lesser-known yet influential factor is the alignment of infrastructure investments with regional housing policies. For instance, transport upgrades in areas like Newcastle have enhanced connectivity, driving demand in these lifestyle-oriented markets. Moving forward, integrating transparent policy communication with targeted regional investments could create a more balanced and resilient housing ecosystem, addressing both affordability and supply constraints effectively.

Image source: anz.com.au

Role of Government Policies and Economic Conditions

A critical yet underappreciated aspect of government policy in February 2025 is its focus on regional infrastructure alignment to address housing imbalances. By prioritizing transport upgrades, digital connectivity, and public amenities in areas like Newcastle and the Sunshine Coast, policymakers have created a ripple effect that extends beyond housing. These investments not only enhance regional livability but also stimulate local economies, attracting both buyers and businesses. For instance, Newcastle’s improved rail links have reduced commute times to Sydney, making it a viable alternative for urban professionals priced out of the capital.

However, a lesser-known factor influencing outcomes is the timing of policy implementation. Delays in zoning reforms and affordable housing incentives have often muted the impact of demand-side measures like the First Home Loan Deposit Scheme. This highlights the need for synchronized policy execution, where supply-side interventions, such as streamlined development approvals, complement buyer-focused initiatives.

Challenging conventional wisdom, evidence suggests that targeted regional investments outperform blanket affordability measures in fostering sustainable growth. For example, while urban incentives have struggled against escalating property prices, regional policies have unlocked latent demand, as seen in Geelong’s 0.4% price rise.

Moving forward, policymakers should adopt a systems-thinking approach, integrating housing, transport, and economic strategies to create resilient, interconnected markets that balance affordability with growth.

Global Economic Factors Affecting the Market

One pivotal yet underexplored global factor influencing Australia’s housing market in 2025 is the interdependence of commodity markets and housing costs. As a major exporter of raw materials, Australia’s economy is deeply tied to global demand for commodities like iron ore and coal. Fluctuations in these markets directly impact national income, employment, and, by extension, housing affordability. For instance, the recent slowdown in China’s industrial output has tempered demand for Australian exports, reducing economic growth projections and influencing consumer confidence in the housing sector.

A lesser-known dynamic is the spillover effect of international monetary policies. The U.S. Federal Reserve’s decision to maintain higher interest rates has strengthened the U.S. dollar, placing upward pressure on the Australian dollar’s exchange rate. This has increased the cost of imported construction materials, exacerbating already high building costs and further straining housing supply.

Challenging conventional wisdom, these global linkages demonstrate that domestic housing markets cannot be insulated from international economic currents. Policymakers must adopt adaptive risk management frameworks that account for external shocks. For example, diversifying trade partnerships and investing in local manufacturing could mitigate reliance on volatile global supply chains.

Looking ahead, integrating global economic forecasting into housing policy development will be essential. This approach can help stabilize market conditions and ensure resilience against external disruptions.

Real-World Implications and Future Outlook

The February 2025 housing market shift underscores the psychological elasticity of buyer behavior, where sentiment often outweighs traditional economic metrics. For example, the Reserve Bank of Australia’s modest rate cut acted as a confidence signal, spurring activity despite limited direct affordability gains. This highlights the untapped potential of policy signaling as a market lever.

Unexpectedly, regional markets like Geelong and the Sunshine Coast have emerged as growth leaders, driven by remote work trends and infrastructure upgrades. These areas illustrate how localized economic drivers can counteract broader affordability challenges, offering a blueprint for sustainable growth.

A common misconception is that affordability alone dictates recovery. However, the interplay of sentiment, infrastructure, and targeted policies reveals a more nuanced dynamic. Moving forward, stakeholders should prioritize integrated strategies—aligning regional investments with transparent policy communication—to sustain momentum. This approach not only stabilizes markets but also fosters resilience against future economic shocks.

Impact on Buyer Activity and Investment Strategies

The February 2025 market shift has redefined buyer activity, emphasizing the psychological premium of perceived stability over direct affordability gains. This is evident in the surge of inquiries in regional markets like Newcastle, where infrastructure upgrades have reduced commute times, making it a viable alternative for urban professionals. Such developments highlight the anchoring effect—buyers recalibrate expectations based on signals of economic steadiness, even before tangible benefits materialize.

For investors, this period underscores the value of adaptive diversification. Regional hotspots, driven by lifestyle migration and remote work trends, now rival traditional urban centers in growth potential. For instance, Geelong’s 0.4% price rise reflects how targeted infrastructure investments can unlock latent demand, offering a roadmap for strategic portfolio expansion.

A lesser-known factor influencing strategies is the replacement cost dynamic. Rising construction costs have elevated the intrinsic value of established properties, particularly units, which now offer significant equity advantages. This challenges the conventional preference for houses, urging investors to consider mid-density developments as a sustainable alternative.

Looking ahead, aligning investment strategies with localized economic drivers—such as employment hubs and transport connectivity—can mitigate risks while capitalizing on emerging opportunities. This approach ensures resilience in an increasingly fragmented market landscape.

Potential Changes in Housing Affordability and Rental Markets

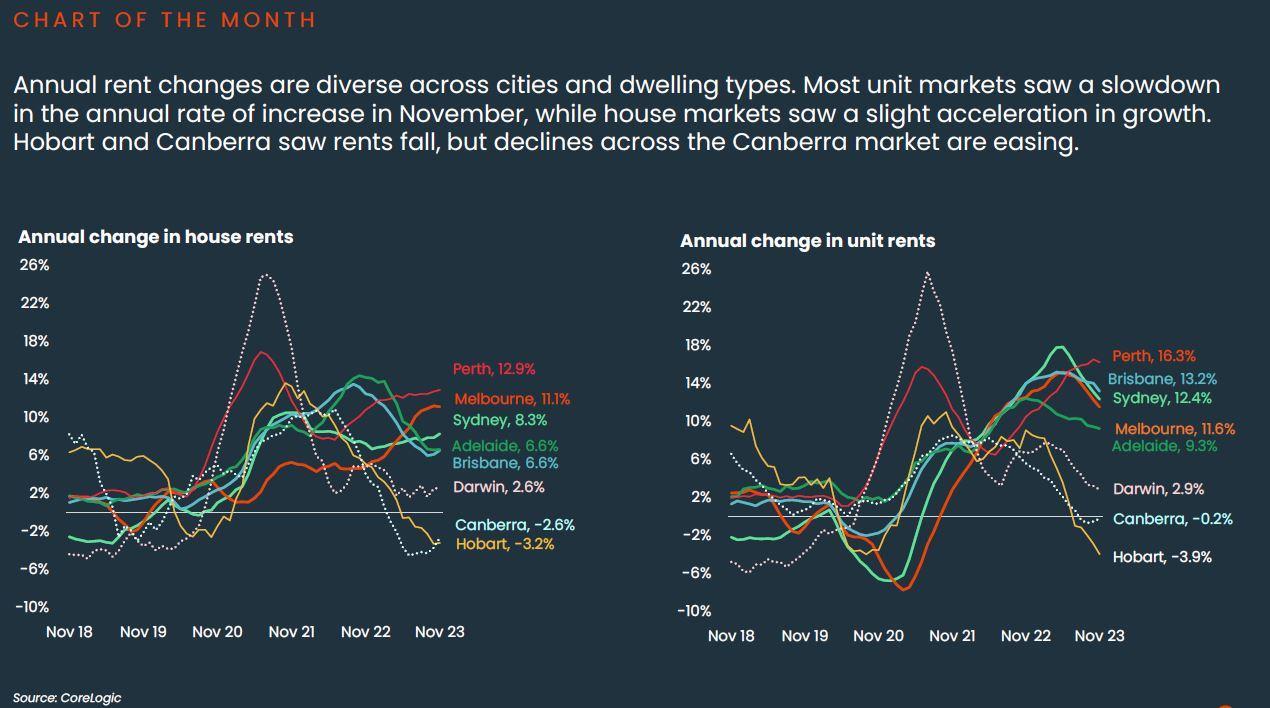

A critical yet underexplored factor in housing affordability is the interplay between rental market pressures and homeownership pathways. With median weekly rents climbing to $627 in 2024, many renters now face monthly costs comparable to mortgage repayments. This dynamic has prompted a shift in buyer behavior, where saving for a deposit remains the primary barrier rather than servicing a loan. Government initiatives, such as the First Home Loan Deposit Scheme, have provided limited relief, but escalating property prices continue to dilute their impact.

Interestingly, the rise of shared housing models offers a practical solution to affordability challenges. Co-living arrangements, particularly in high-demand urban areas, reduce per capita housing costs while fostering community-oriented living. These models align with broader trends in multigenerational housing, where pooled resources create economic synergies.

A lesser-known influence is the vacancy rate recovery. While rates improved to 1.8% by late 2024, they remain significantly below the pre-pandemic average of 3.3%, sustaining upward pressure on rents. This highlights the need for adaptive supply strategies, such as incentivizing build-to-rent developments.

Looking forward, integrating shared housing incentives with targeted rental market reforms could bridge the gap between renting and homeownership, fostering a more inclusive housing ecosystem.

FAQ

What factors contributed to the 0.3% rise in Australian home values in February 2025?

The 0.3% rise in Australian home values in February 2025 stemmed from a confluence of factors. The Reserve Bank of Australia’s rate cut acted as a psychological anchor, boosting buyer confidence despite limited direct affordability gains. Regional markets, such as Geelong and the Sunshine Coast, outpaced capital cities, driven by remote work trends and infrastructure upgrades. Additionally, constrained housing supply, exacerbated by labor shortages and rising construction costs, intensified competition for existing properties. This fragmented recovery highlights the interplay between sentiment, localized economic drivers, and structural supply-demand imbalances, underscoring the nuanced dynamics shaping Australia’s housing market during this period.

How does the Reserve Bank of Australia’s rate cut influence buyer sentiment and market stability?

The Reserve Bank of Australia’s rate cut in February 2025 significantly influenced buyer sentiment by signaling economic stability, encouraging hesitant buyers to re-enter the market. This psychological boost outweighed the modest direct impact on borrowing capacity, demonstrating the anchoring effect of policy signaling. Auction clearance rates returned to long-term averages, reflecting renewed market activity. Additionally, premium markets in Sydney and Melbourne, historically sensitive to rate changes, led the recovery. This strategic adjustment fostered confidence, stabilizing market conditions and mitigating volatility, while highlighting the critical role of transparent monetary policy in shaping both short-term sentiment and long-term housing market resilience.

What role do regional markets play in shaping the recovery of Australia’s housing sector?

Regional markets were pivotal in shaping the recovery of Australia’s housing sector during February 2025. Areas like Geelong and the Sunshine Coast outperformed capital cities, recording a 0.4% rise in values, driven by lifestyle migration and remote work trends. Infrastructure investments, such as transport upgrades, enhanced regional connectivity, attracting buyers priced out of metropolitan areas. These markets offered affordability advantages and strong yields, counterbalancing urban affordability constraints. The resilience of regional markets underscores their growing influence, as localized economic drivers and demographic shifts continue to redefine housing demand, fostering a more balanced and diversified recovery across Australia’s property landscape.

How does the February 2025 market shift impact housing affordability and rental market dynamics?

The February 2025 market shift highlighted the interplay between housing affordability and rental market dynamics. While the 0.3% rise in home values signaled renewed buyer confidence, affordability challenges persisted, with median property prices exceeding 7.5 times household income. Rental markets remained tight, with vacancy rates at 1.8%, sustaining upward pressure on rents. This dynamic pushed many renters toward homeownership, despite deposit barriers. Regional markets offered a reprieve, with lower entry costs and lifestyle appeal. The shift underscores the need for integrated policies addressing both rental supply constraints and affordability, fostering a balanced housing ecosystem amid evolving market conditions.

What are the long-term implications of the February 2025 housing market trends for investors and policymakers?

The February 2025 housing market trends carry significant long-term implications for investors and policymakers. For investors, the rise in regional market performance, driven by infrastructure upgrades and lifestyle migration, highlights opportunities in diversified portfolios, particularly in mid-density developments and units offering strong equity advantages. Policymakers face the challenge of addressing persistent supply bottlenecks and affordability constraints. Aligning infrastructure investments with housing policies and streamlining zoning reforms will be critical. These trends emphasize the importance of adaptive strategies, balancing growth with affordability, and fostering resilience in Australia’s housing ecosystem to navigate future economic cycles and demographic shifts effectively.